- We have posted Snippets about GrubHub before here and here.

- This is another interesting and long article on how online takeout is turning out to be bad for restaurants as well.

- The article is rather sensational (and we aren’t convinced the Online Travel analogy is apt).

- Regardless it is full of interesting stats and analysis.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

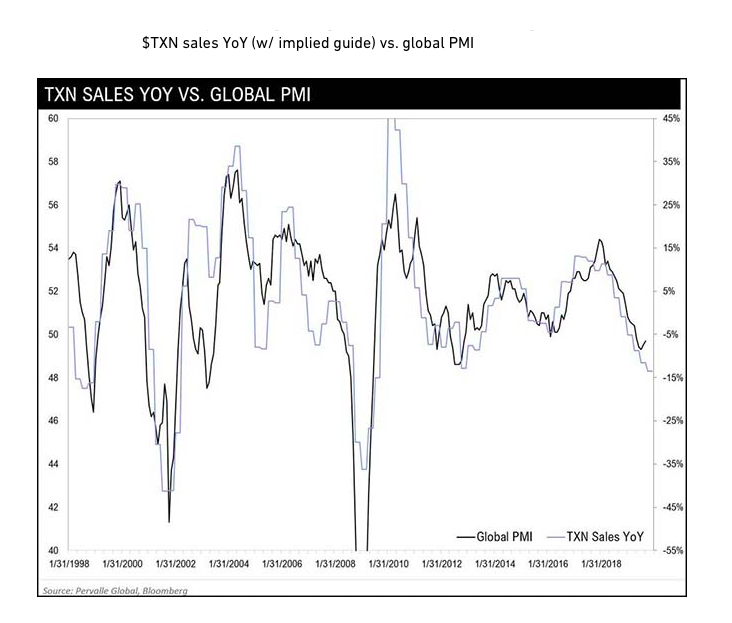

Texas Instruments is the World

- Texas Instruments, the semiconductor company, is very diverse (largest product is just 0.8% of revenue).

- Their sales growth therefore largely follows global PMIs.

- It makes them a great barometer of what is going on.

- They have now experienced four quarters of revenue decline and are guiding for a fifth (typical semi-cycle is 4-5 quarters).

- From their recent conference call:

- “Revenue decreased 11% from a year ago and came in below the midpoint of our guidance as we saw most end markets continue to weaken further … the weakness we’ve seen in the third quarter was broad-based across all markets and most sectors … We saw weakness across all major customers, regions and technologies … our sense is that customers are just far more cautious than they were certainly a year ago, but even 90 days ago.”

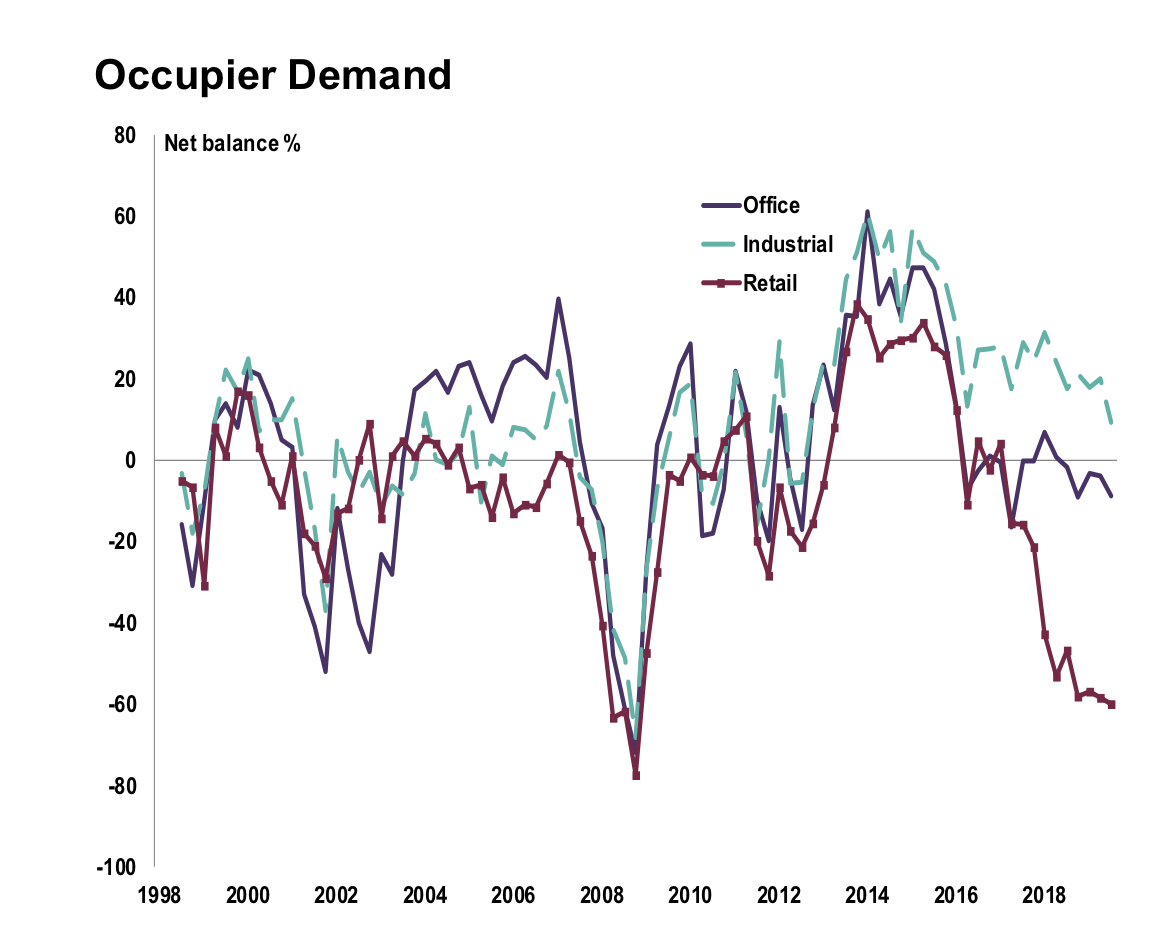

RICS Survey

- Royal Institution of Chartered Surveyors (RICS) Q3 survey of UK commercial property is out this week.

- “The Q3 Survey results point to a deterioration in sentiment over the period, with 62% of respondents now sensing the market is in the downturn phase of the property cycle.“

- A lot of this due to Brexit fears.

Grubhub

- Grub Investor Letter after their recent profit warning (and -43% fall in the shares) is worth a read.

- We have previously pointed out how alternative data was suggesting competitors were beating Grub.

- The letter points out how the online takeout market is getting a lot more competitive.

- “Furthermore, we believe online diners are becoming more promiscuous … our newer diners are increasingly coming to us already having ordered on a competing online platform, and our existing diners are increasingly ordering from multiple platforms … the easy wins in the market are disappearing a little more quickly than we thought.”

- Well done Chanos on shorting the stock.

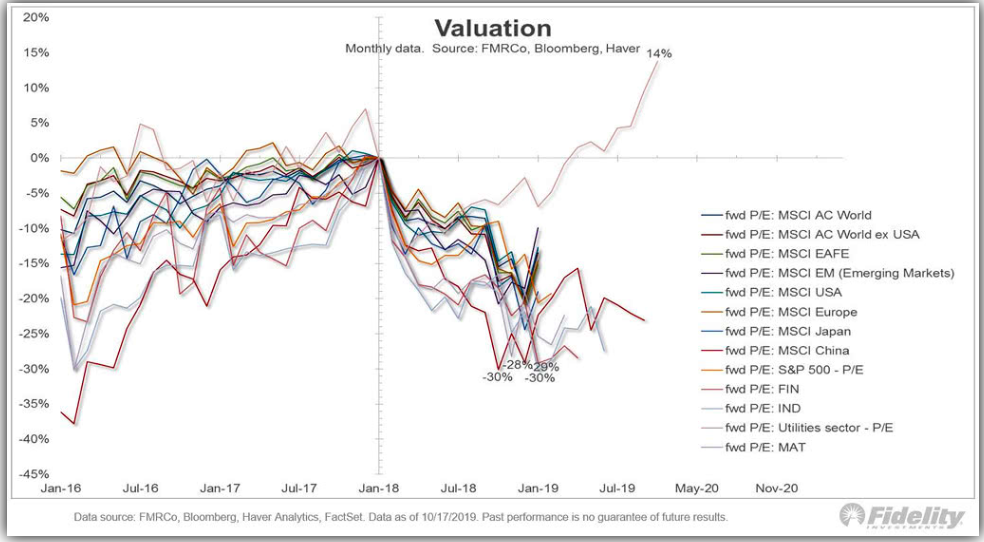

Valuation

- Forward P/E ratio of various equity sectors/countries.

- All bar one have de-rated since the peak in Jan 2018 by 20-30%.

- Source: Fidelity via Isabelnet.

Vodafone Idea in India

- Indian supreme court, after 10 years deliberation, hands a real shocker for Vodafone’s merged entity in the country (Vodafone Idea).

- Essentially the court is forcing all companies to pay levies for spectrum on total revenue (not just telecoms revenue).

- Vodafone Idea are forced to pay $4bn.

- This is likely to put Vodafone Idea under (It has net debt of $14bn or 20x Net Debt/EBITDA).

- Hard to see in the share price chart but that last drop was 35%.

- Upstart Jio, which has been waging the mother of all price wars (it gave services away for free!), is unscathed by this ruling.

Third Point

- Latest Investment Letter for Q3 from Third Point is out.

- It contains their view on activism and their edge in this strategy.

- They review of the successful Sotheby’s (BID) investment (acquired recently at a 61% premium).

- It also has an analysis of their new big holding in EssilorLuxottica (EL) and why they like it (mostly the merger synergies).

Spotify

- SPOT have reported Q3 and there are lots of interesting points.

- The latest initiative, Podcasts, is seeing exponential growth (+39% Q/Q)

- They are also launching paid recommendations.

- On competition – “We continue to feel very good about our competitive position in the market. Relative to Apple, the publicly available data shows that we are adding roughly twice as many subscribers per month as they are. Additionally, we believe that our monthly engagement is roughly 2x as high and our churn is at half the rate. Elsewhere, our estimates imply that we continue to add more users on an absolute basis than Amazon. Our data also suggests that Amazon’s user base skews significantly more to ‘Ad-Supported’ than ‘Premium’, and that average engagement on our platform is approximately 3x.“

Nokia

- Big profit warning from Nokia last week.

- They are seeing margin pressure from competition, and are having to make bigger investments into next generation mobile networks (5G).

- As a result they are also cutting the dividend.

- This competitor driven intensity ahead of a new investment cycle (5G) is very typical of the telecoms equipment industry.

- Their customers merging is not helping as they likely standardise on one supplier. They are also delaying 5G roll outs as a result.

Biogen (cont.)

Cigarette Filters

- The press are making another push to ban cigarette filters on the grounds they are toxic for the environment and aren’t safer.

- Essentra (ESNT.L) is a leading independent provider of these filters.

- This scientific review article makes sober reading.

- Evidence is presented that, not only are discarded filters not biodegradable, toxic chemicals actually leak from them such as arsenic, nicotine, PAHs, and heavy metals such as cadmium and lead.

- They are not safer for smokers either – The National Cancer Institute’s comprehensive review of light and low-tar cigarettes concluded that “Epidemiological and other scientific evidence, including patterns of mortality from smoking-caused diseases, does not indicate a benefit to public health from changes in cigarette design and manufacturing over the last 50 years.”

- “The yellow discolouration was an innovation deliberately created to reassure smokers that the filter was working, and comes from a change in pH rather than an accumulation of tar.”

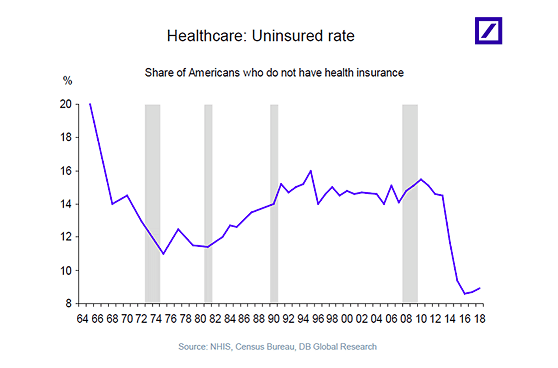

Health Insurance

- Say what you like about Obama but this is an achievement.

- 6% or 18m people now have health insurance that didn’t before.

- Source: Deutsche Bank Research via Isabelnet.

Quantum Supremacy (cont)

Sohn San Fran Notes

- Market Folly is a great site.

- They often have insightful investment conference write ups.

- At these conferences leading managers around the world pitch their ideas. Be critical though – they are obviously talking their own book.

- Here and here are the latest from Ira Sohn San Fransisco.

- Common sense disclaimer. Just because a hedge fund is buying a stock doesn’t mean you should. One never knows what offsetting hedges or positions they hold. Be smart, do your own work, use common sense and invest responsibly.

Anti-Portfolio

- Mistakes are only useful if you remember and learn from them.

- This is a great example of learning from one’s mistakes.

- Bessemer have put together their anti-portfolio.

- It is a list of all the missed opportunities they had as VC Investors.

- A gem – “David Cownan’s college friend rented her garage to Sergey and Larry for their first year. In 1999 and 2000 she tried to introduce Cowan to “these two really smart Stanford students writing a search engine.” Students? A new search engine? In the most important moment ever for Bessemer’s anti-portfolio, Cowan asked her, “How can I get out of this house without going anywhere near your garage?”

Biogen

- Biogen have just announced they will be going ahead and filing Aducanumab (their treatment for Alzheimer’s Disease).

- Shares are +40% as a result.

- This is extremely odd considering just in March the studies were discontinued due to futility (i.e. they didn’t show an effect).

- The company is saying new analysis of a larger dataset has led to, in communication with the FDA, the filing decision (NB. approval is uncertain still).

- There is a huge unmet need [100% of drugs have failed, the disease affects 5.8m people in America (50m worldwide) and costs $290bn per year in direct and care costs] so perhaps there was pressure for a win.

VC Customer Subsidy

- So many start-ups offer big consumer subsidies to attract users.

- This article argues this is all unsustainable and presents some even crazier examples in the US.

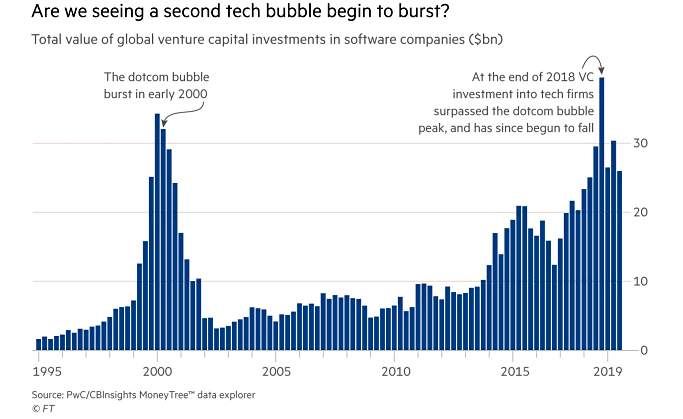

- We agree the beginning of the end has started, in fact VC funding peaked last year (see chart), but with rates so low will it end soon?

Market Timing

- Many investors are on the sidelines right now.

- It brings to mind this market timing game.

- Try see if you can beat the market by buying and selling (once each) in any given randomly selected 10-year period from 1978.

- A more sophisticated version, but with worse UI, covering 1950-2018 is found here. You can buy/sell several times and decide to use history or a random selection of daily historic returns (Monte-Carlo).

Uber (cont.)

- More problems for Uber.

- First, if Uber is deemed a Transport provider in the UK it might owe 20% VAT on gross bookings (ca. £1bn historically) and going forward.

- This could also apply in the EU as well.

- Second, it seems one of Uber’s insurer panel has quit – not a great sign and likely will lead to rising costs.

Bezos

- Great long read about Jeff Bezos and his plan.

- Worth reading – after all this is the man in charge of nearly 40% of US eCommerce as well as AWS (Amazon Web Services) – the infrastructure most start-ups run on.

- A gem – Bezos has given $42m of funding for a clock – The Clock of the Long Now – on his ranch that will tell time accurately for 10,000 years.