- US Equity Index Funds now manage more money than actively managed equity funds.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Electric Cars

- Fascinating to see Daimler abandon the development of internal combustion engines.

- They have just introduced a new generation which could be the last.

- Daimler are seen as the industry leader in many respects.

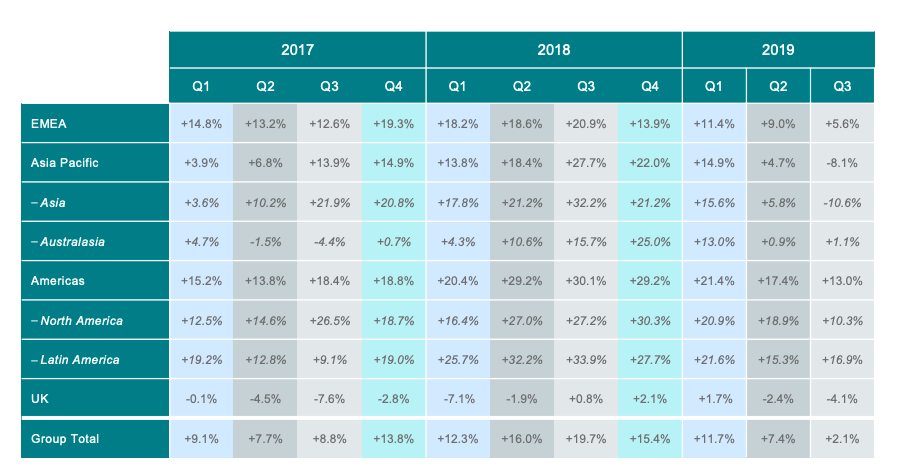

Page Group

- Profit warning from Page Group is a red flag.

- “Looking ahead, the deterioration in trading conditions seen during Q3 across the majority of our regions is anticipated to continue. In the UK, heightened Brexit related uncertainty is expected to remain as we approach and go beyond 31 October. With worsening macro-economic indicators in Continental Europe, particularly in Germany, and in the US, there are signs that growth in these markets may slow. In Greater China, confidence in Mainland China continues to be affected by trade tariff uncertainty and the social unrest in Hong Kong is increasing.” Q3 Trading Update.

- There was a slowdown across the board. Group slowed from +2.1% growth from +7.4% last quarter with UK and Asia negative.

Pizza Express

- Pizza Express is running 14x Debt to EBITDA.

- According to this article that is £1.6m of debt per restaurant!

- Rather amazing, as they point out, given it is largely a leasehold company.

- Be very careful with companies that have been held by private equity.

- Bad balance sheets end businesses.

Uber

- Reality sets in at Uber.

- Uber is “turning [into] an operations company — not a product/tech company” said one former senior employee.

- All of the perks seem to be disappearing.

- But morale suffered as the company seemed to crack down. It stopped letting people anonymously ask questions at all-hands meetings. Starbucks showed up in coffee dispensers, and craft coffee from Stumptown, a roaster based in Portland, Ore., went away. Office supplies like giant sticky notes dried up, and the company no longer hands out “Uberversary” balloons. (from WP article).

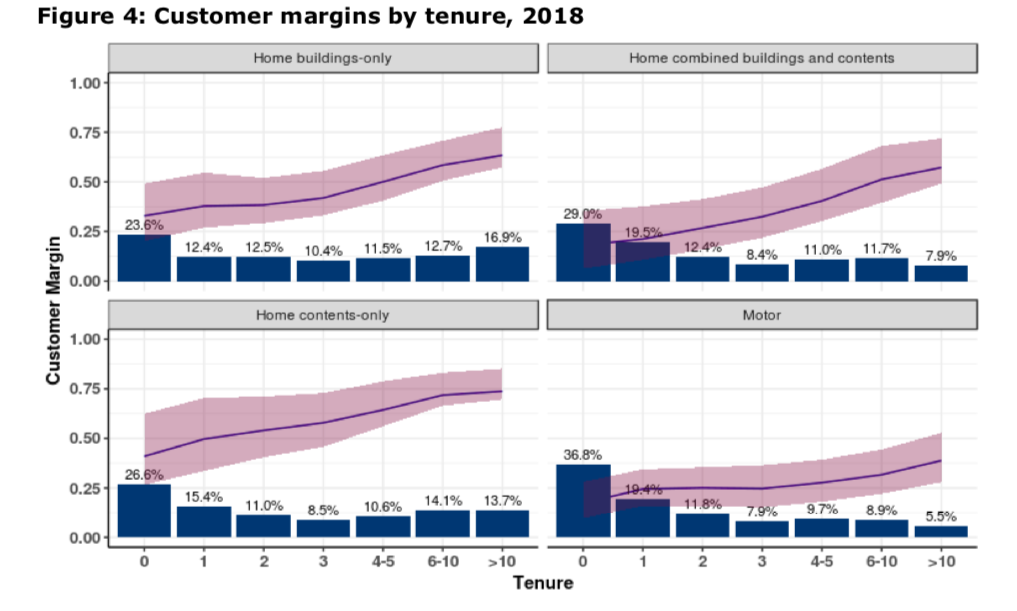

FCA on Insurance Pricing

- The FCA is out with their report on insurance pricing in the UK.

- Key chart – the blue line is customer margin against length a policy is held (tenure). The bars show dispersion of margin at each tenure.

- What this tells you is that customer margin is correlated with tenure (but that there is dispersion so it is not the only variable).

- In other words – the longer you are a customer the more margin you pay …

- “The difference in average customer margin between a front book customer (tenure 0) and a longstanding customer (tenure >10) is 31 percentage points for buildings-only policies, 39 percentage points for combined building and contents policies, 33 percentage points for contents-only policies and 21 percentage points for motor policies“

- This is something the FCA is taking action on – calculating £1.2bn could be saved (in a total market of £18bn).

Quantum Supremacy

- We don’t pretend to understand all the science behind this.

- However, some experts are claiming that something important has just happened in the field of Quantum Computing.

- The analogy used is the Wright Brother’s first flight and how it took the world another 5 years to realise what had happened.

- h/t The Browser.

SPX

- Interesting to see the S&P 500 poised on its 50 day moving average just as earning season is about to start.

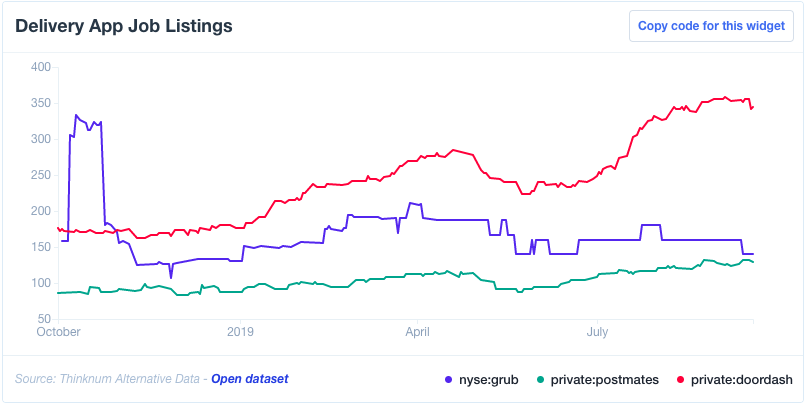

Doordash

- At Snippet we are huge fans of alternative data sources.

- Thinknum is a website that uses numbers to tell stories.

- It is very useful in terms of tracking investments.

- For example this article shows that using online data sources Doordash (the food delivery service) has started beating its rivals.

- This gap opened up in 2019 and is consistent across data sources.

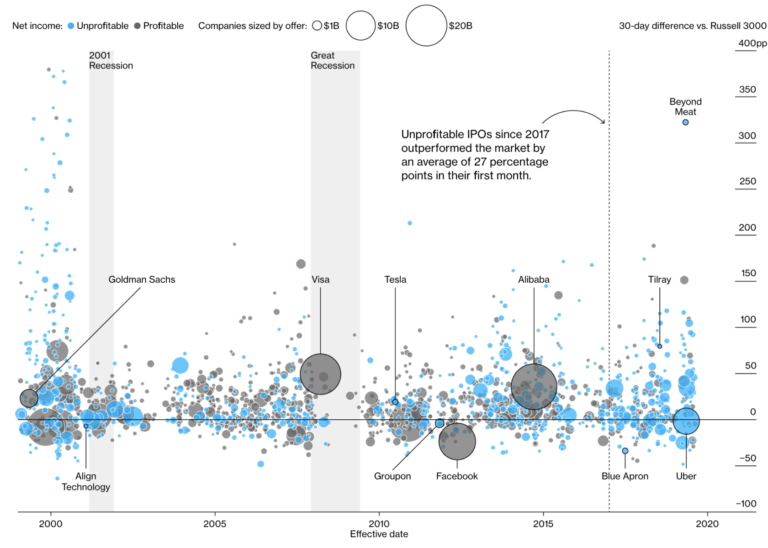

IPOs

- Who needs profitability any way?

- Good chart from Bloomberg.

RIT Capital (RCP.LON)

- An interesting investment trust we have come across is RIT Capital.

- It is run by the Rothschild family.

- It trades at a small premium to NAV (Net Asset Value) – so it is down to NAV growth and dividends to deliver returns.

- They are invested in a broad range of assets – from hedge funds, to real estate, to gold.

- Their goal is steady, long term wealth compounding.

- Disclosure. We owns shares in RCP.LON

Forever 21

- Interesting to see Forever 21 file for bankruptcy.

- They experienced huge growth that was perhaps too much to swallow.

- “We went from seven countries to 47 countries within a less-than-six-year time frame and with that came a lot of complexity” EVP Linda Chang.

- Clearly online competition and declining mall traffic (F21 was big in malls) were the key culprits.

- Full story here from NYT.

Apple’s U-1 Chip

- Always interesting to see what Apple are putting in the iPhone chipset

- This article from Wired suggests some interesting things to come.

- UWB (ultra wide band) can locate position down to 30cm and is much faster than Bluetooth without interference.

- This opens up lots of interesting technology applications.

Blackstone

- Interview with Schwarzman, founder of Blackstone worth a listen

- Skip the first 4 min.

- h/t The Browser.

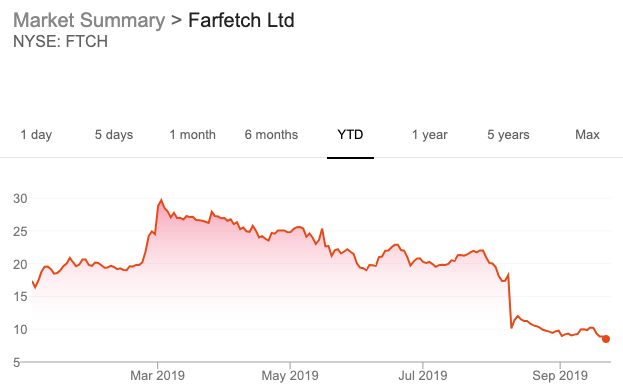

FTCH

- Shares of Farfetch (luxury online clothing retailer) have collapsed.

- Looks like a huge over-reaction to slowing GMV and an acquisition.

- In fact, GMV only slowed a tiny bit and the deal looks interesting (a vertical integration).

- More concerning is the departure of the COO (online retail is an operationally heavy business).

- FTCH trades below 1x GMV – attractive if 40%+ growth can continue.

Common Sense Disclaimer. We plan to ponder about stocks and other investments here on Snippet. Some will look attractive and some we might recommend. Some we are buying/own ourselves (always disclosed). You should always do your own work, use common sense and invest responsibly!

Private Equity

- Last week shares in private equity firm EQT saw a 25% pop on the first day of trading.

- Interesting to see private equity listing again – something that marked the top of the last cycle (except Carlyle/Oaktree both listing in 2012).

- EQT raised 5.3bn SEK of new money and 13.5bn of sales by shareholders – a telling sign.

- In the meantime over the last year the existing listed players have also started to convert their shares from limited partnerships to common stock – widening investor bases.

Zero-click Searches

- June was a milestone.

- For the first time, since the advent of the modern search engine, more than 50% of Google searches resulted in zero-clicks.

- In other words, people searched on google and didn’t click on an ad or an organic search result.

- This trend has been steadily building and has profound implications for businesses around the world.

How things change

Boeing

- A fascinating article on Boeing and where it all went wrong.

- In 1997 Boeing was pushed to merge with MacDonnell Douglass.

- This turned into a reverse take-over – “McDonnell Douglas bought Boeing with Boeing’s money” – corrupting the engineering-first culture.

- The results of this are only now being felt.

- It is important to always look at the long-term history of a company.

- There is an even longer read on the topic over at The New Republic.

Gold Miners

- Despite the gold price at a six year high, miners are showing restraint at the latest industry conference, preferring mergers instead.

- “A general theme of this conference has been the need to maintain discipline” CEO of Agnico Eagle Mines.

- This should be taken as a positive (looking past the fact that gold isn’t actually ever consumed).

- Read about it here.