- Major firms badly lag international peers in terms of patents.

- Source.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

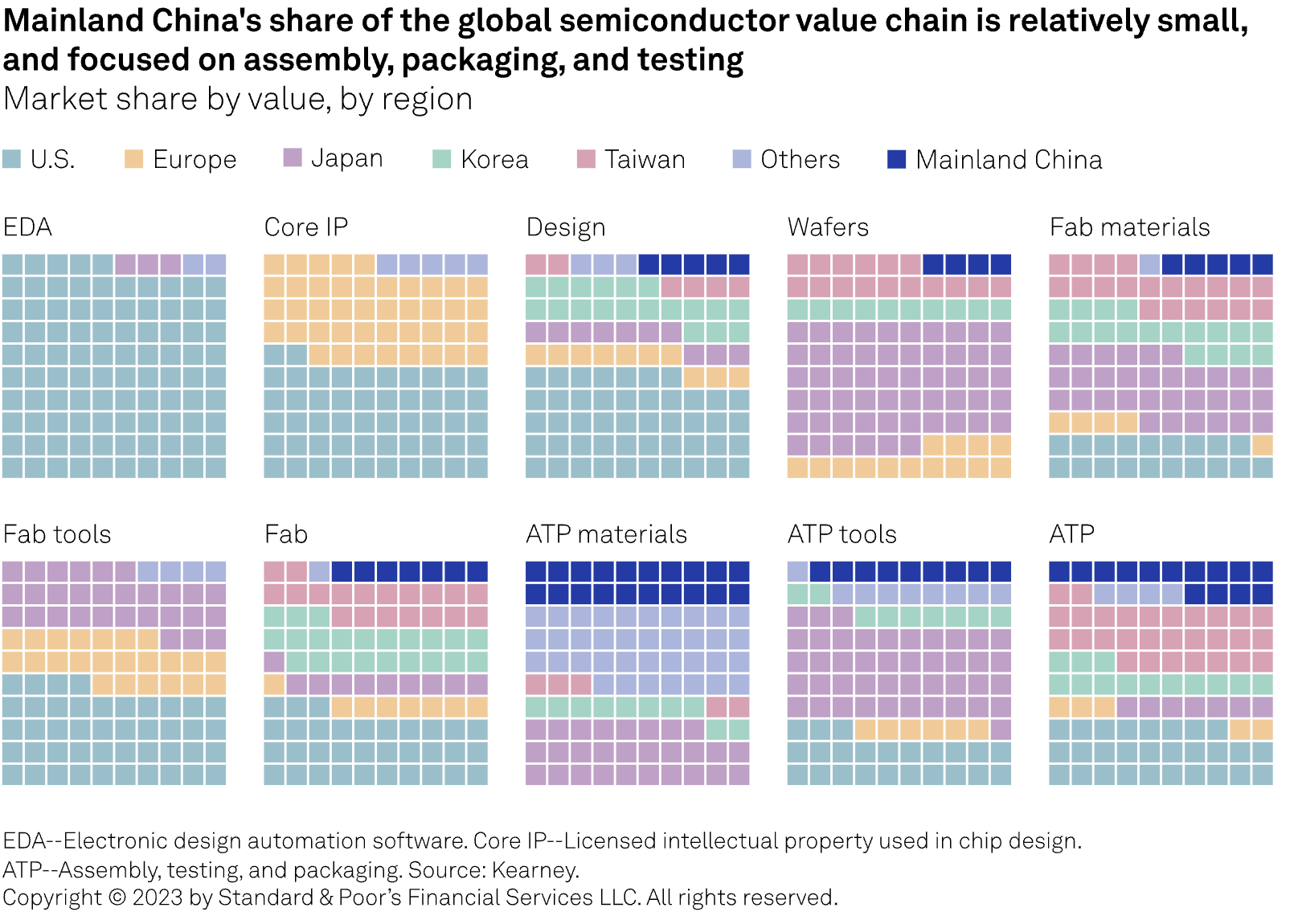

China’s Position in Semis

- Source: S&P Global.

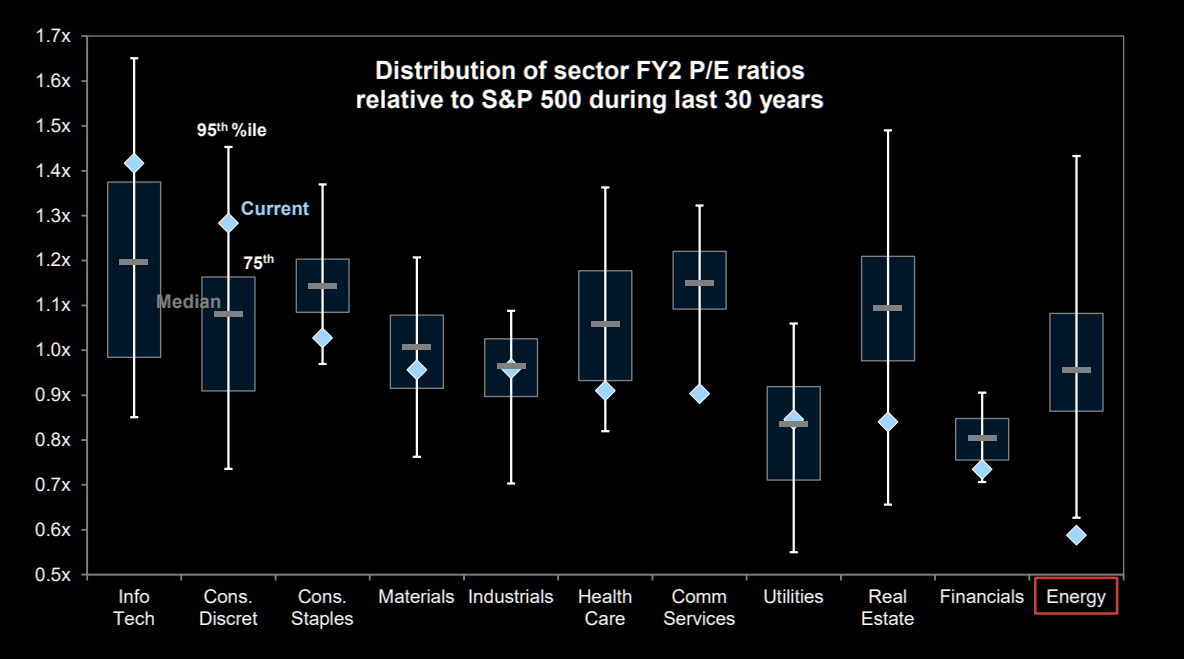

Sector Valuations

- Chart of SPX sector P/E ratios vs their own history.

Coatue AI Revolution Deck

- Interesting deck that has been doing the rounds.

- To be taken with the usual “bottom left to top right charts” pinch of salt.

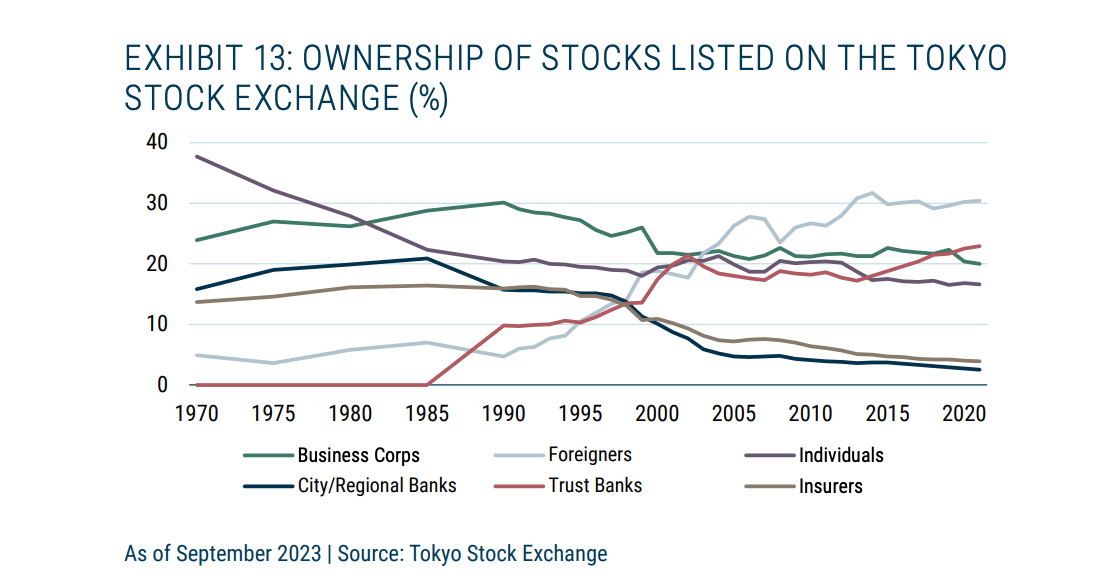

Japanese Stock Ownership

- Dramatic transformation over the past 20 years.

- If you split it up into insiders (financial/corporate) and outsiders (everyone else), the former ownership peaked at 70% during the bubble years and has come down to 20%.

- Source: GMO

IRA and Pharma

- Interesting set of company quotes on views about the impact of IRA on Medicare negotiating drug prices.

- Most of the industry has launched multi-pronged lawsuits (including constitutional challenges) against this.

- To read more transcripts from AlphaSense Expert Insights get a free two-week trial here [use work email].

Activate TMT Outlook 2024

- Handy report on everything technology and media with useful stats.

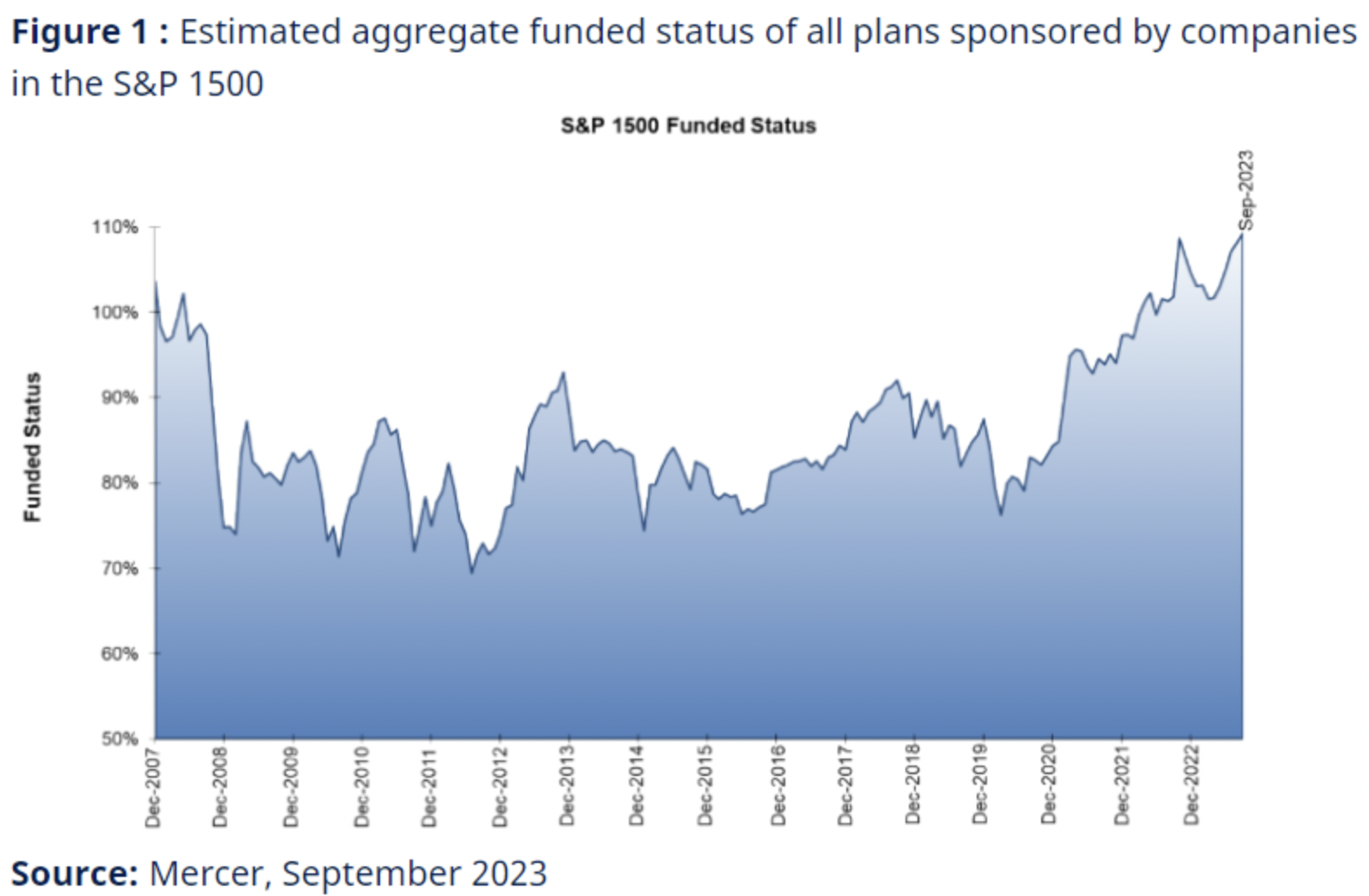

Pension Plans

- One upside of rising bond yields is pension plan liabilities. These are pricing downwards pushing many pension plans into surplus relieving the cash flow pressure on sponsor companies.

AI and Healthcare

- Healthcare is one area where the application of AI, in its LLM and other forms, could be enormous.

- This nice article from AlphaSense Expert Insights explores the topic, mirroring the huge rise in expert calls in the sector mentioning the term.

- It is not all areas that can be bent to the will of ML. As this piece argues, academic literature and the correspondent knowledge graph is both difficult and not that useful to program.

- If you want to read some of these transcripts, you can grab a two-week free trial.

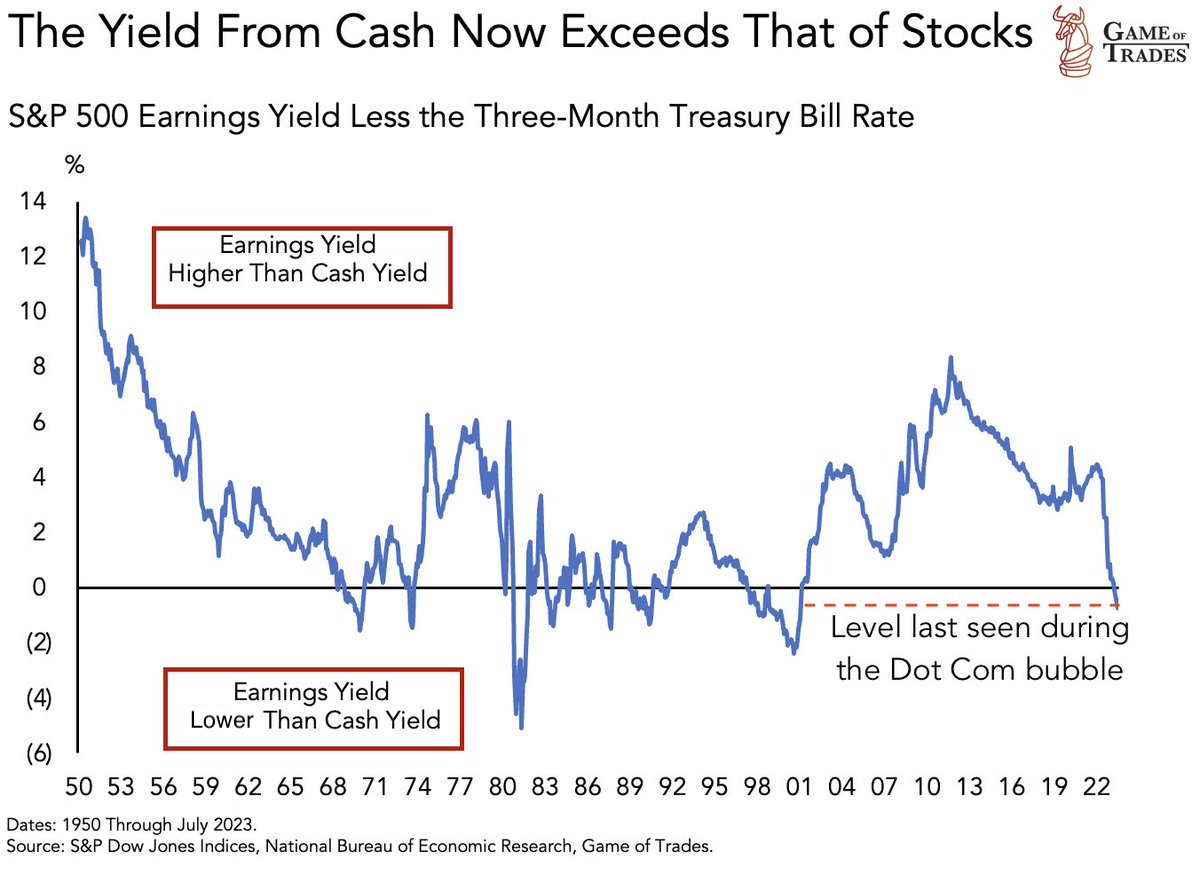

Earnings Yield vs. Cash Yield

- Rare to see S&P earnings yields go far below cash yields.

Regulatory Capture

- Bill Gurley’s September 2023 talk “2,851 Miles.” is a very interesting read on this very important topic in economics and investing.

- As a rule, regulation is acquired by the industry and is designed and operated primarily for its benefit.” I like to say, “Regulation is the friend of the incumbent.”

Gen AI Retention

- Is a serious problem when compared to pretty much any internet service.

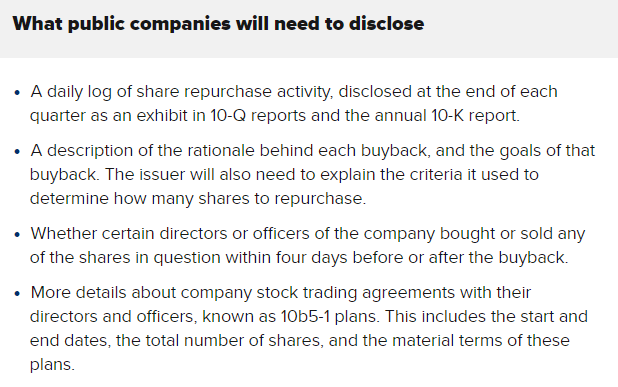

SEC New Short Disclosure Rules

- SEC is increasing disclosure around shorts.

- Investment managers that carry large short positions in equity securities will be required, within two weeks after each month, to report those positions and related short sale activity to the Commission. The threshold for reporting will be met when an investment manager’s short position in a particular equity security of a reporting issuer is at least $10 million or the equivalent of 2.5 percent or more of the total shares outstanding on average during a month.

- Based upon the filings to the Commission, the Commission will make public, within four weeks after the end of each month, aggregated, anonymized data about the gross, end-of-month large short positions. The Commission also will publish the net aggregated daily activity data for each settlement day.

- The UK (and EU) have good disclosures on shorts >0.5% of shares outstanding.

Google Antitrust Trial Exhibits

- Court cases always provide an interesting look inside companies.

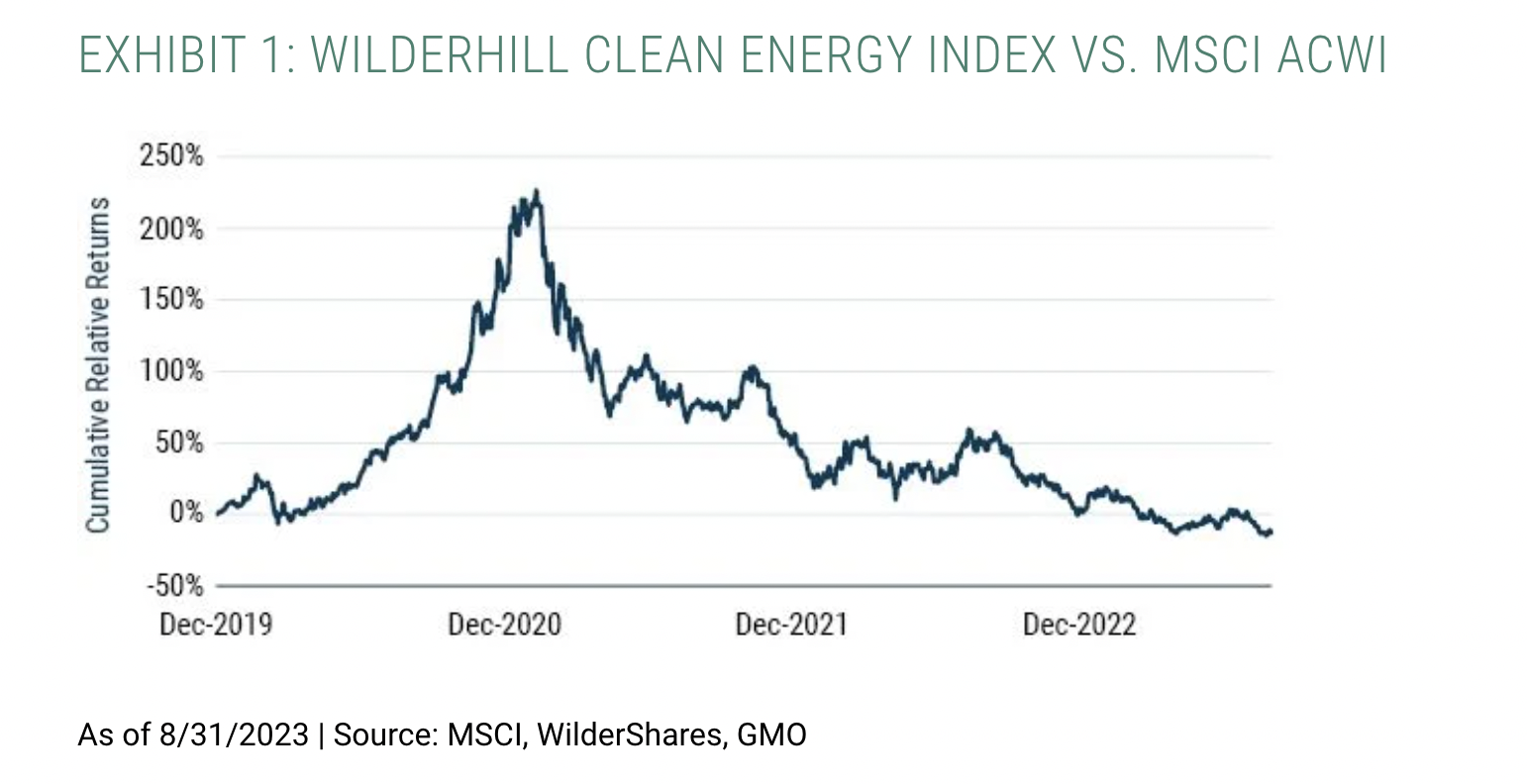

Clean Energy Cycle

- As GMO points out – clean energy has gone through a classic hype cycle.

- All the relative outperformance blow out has come off.

- Yet, change could be afoot – especially as firms focus on profitability – as described in this excellent analysis from AlphaSense (need to sign up).

- Government policy is helping – here is what GE said about the big incentives offered by the Inflation Reduction Act (IRA).

- “I know the IRA has created an eight year incentive, an incentive through 2030. That was enough of a long-term incentive for a few of the manufacturers that I know of that were making big decisions on supply chain changes, onshoring things, changing from China sources. In the absence of IRA incentives they would not happen. They would be small changes.“

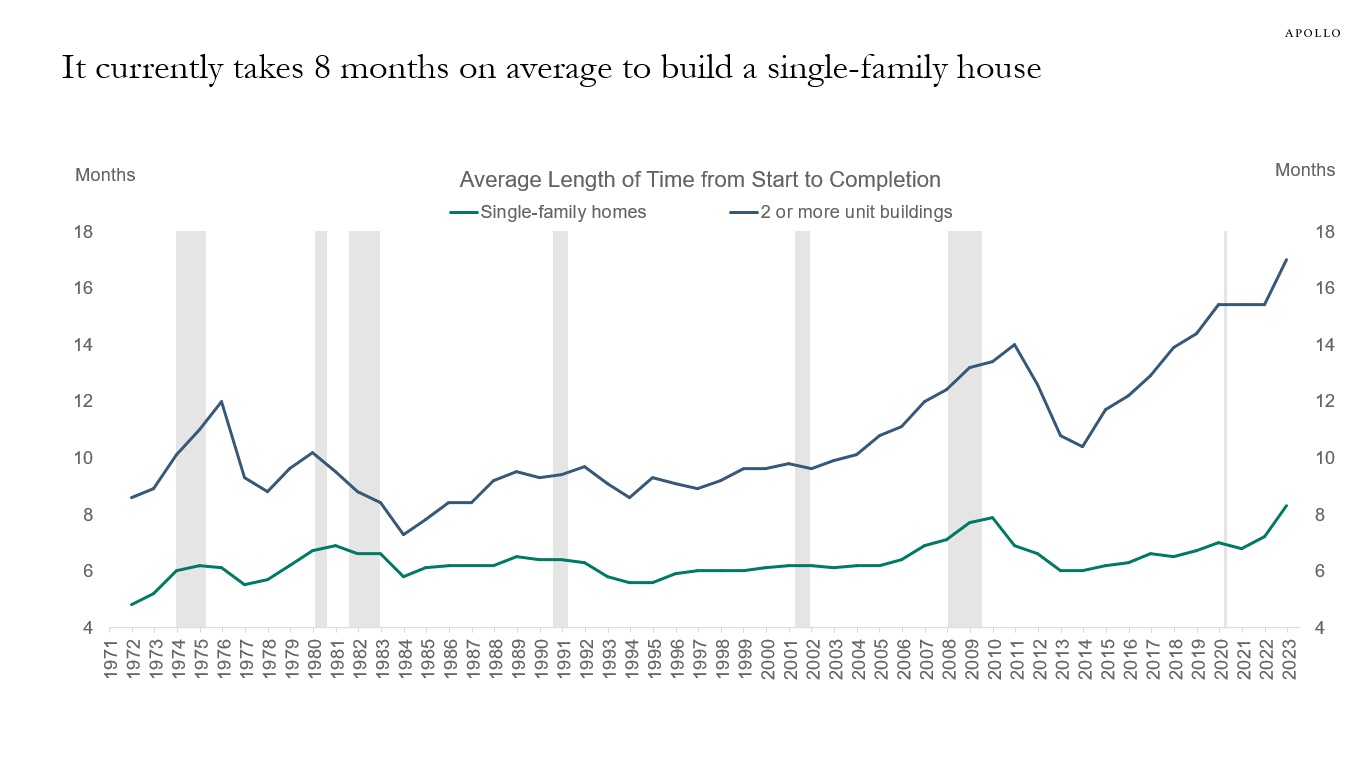

Time to Build a Home

- Interestingly, at least in terms of time, there has been no productivity improvement in residential construction.

- Median home size has risen modestly in the last two decades.

Buyback Popularity

- The popularity of buybacks is rising everywhere.

- Source: Schroders.

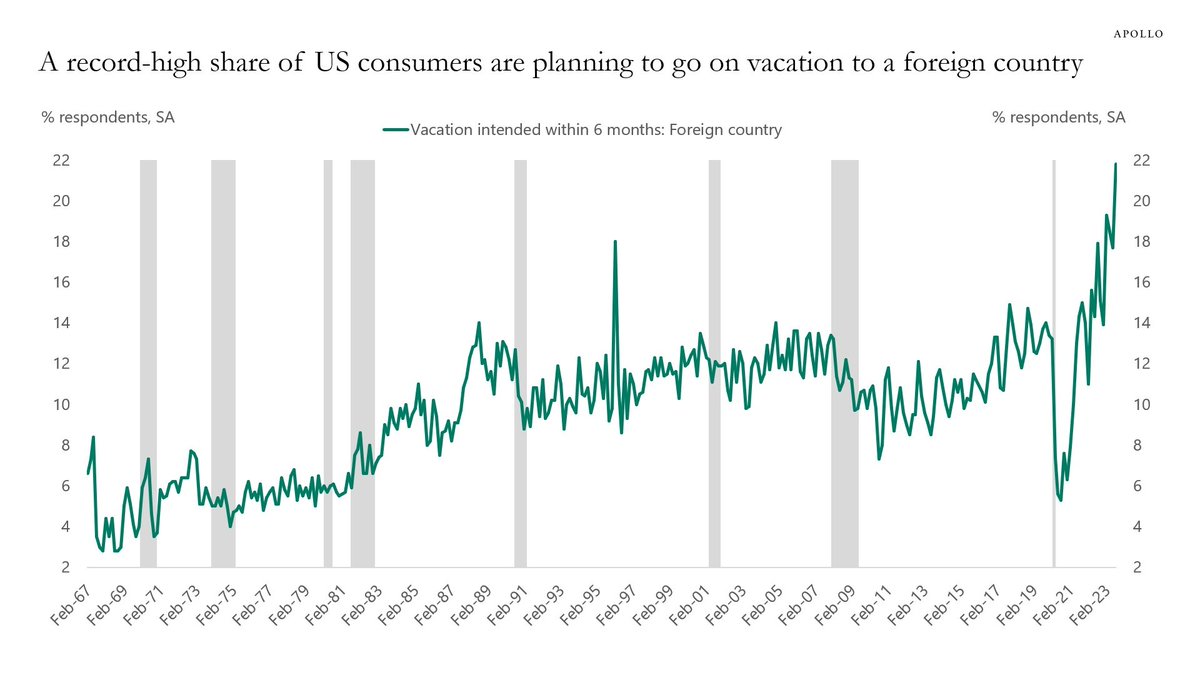

Bull Market in Foreign Vacations

- US consumers want to go abroad.

- Source: Apollo.

Razor and Razor Blades Strategy Was a Myth!

- It is business lore now that Gillette originated the business strategy of selling cheap razor handles to lock in customers to relatively more expensive razor blades, or so the story goes, recreated in board rooms and strategy meetings around the world today.

- However, as this paper shows, Gillette never actually pursued this strategy – even when patent protection meant their handles couldn’t be used with any other blade.

- h/t The Diff.