- Mining companies across metals aren’t spending nearly enough to get us where we need to go on the energy transition.

- Source.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

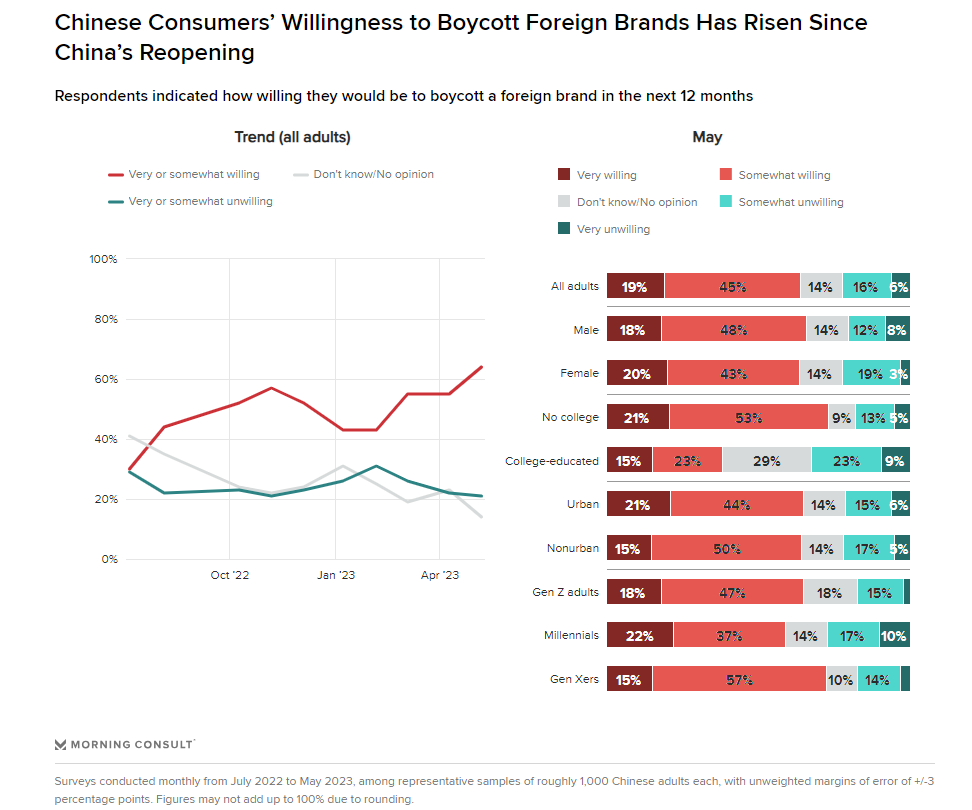

Chinese Boycott Foreign Brands

- Since the reopening earlier this year the willingness of Chinese consumers, according to this survey, to boycott foreign brands has risen.

- Source.

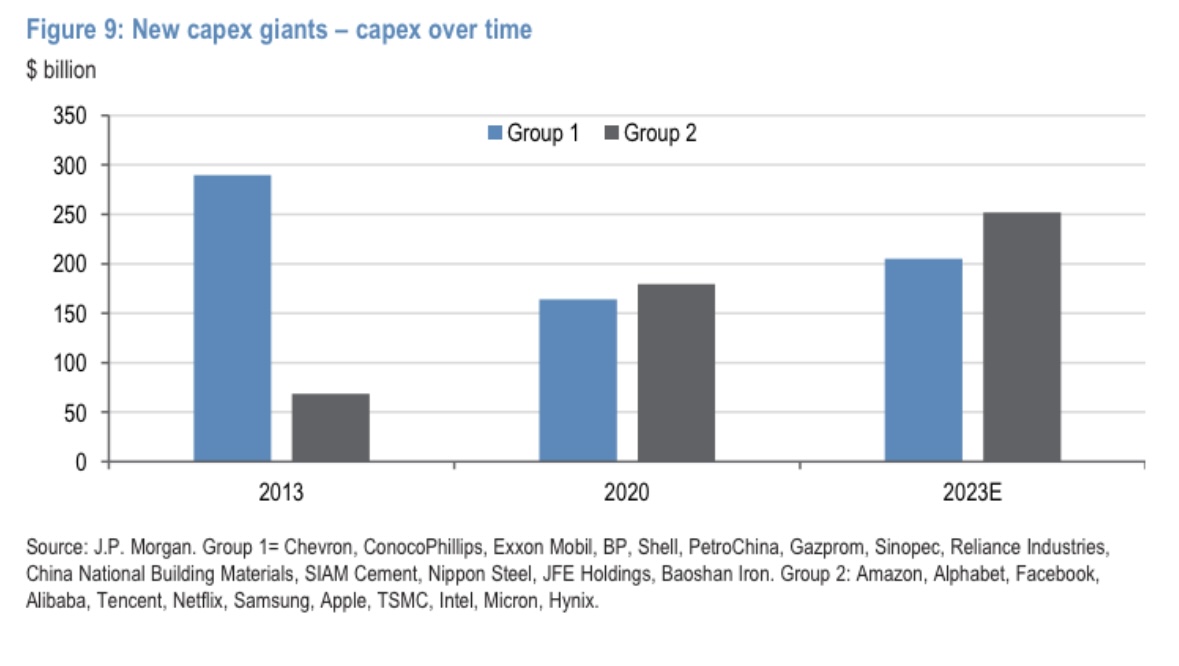

The Capex Shift

- A remarkable change in who the giants of capex spending are.

Tesla Production System

- “Engineers at Tesla Inc. have developed a new process that they claim will reduce EV production costs by 50 percent, while reducing factory space by 40 percent.“

- The so-called “unboxed” system – “focuses on eliminating linear assembly lines and producing more subassemblies out of large castings“.

- That is a remarkable goal, and huge if achieved.

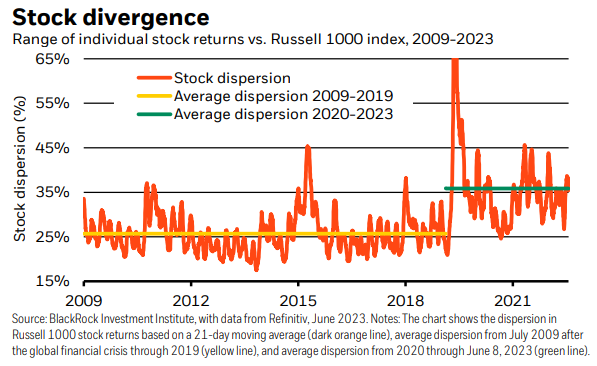

Stock Return Dispersion

- Looks like a step change – should be positive for active management.

- Source: Blackrock.

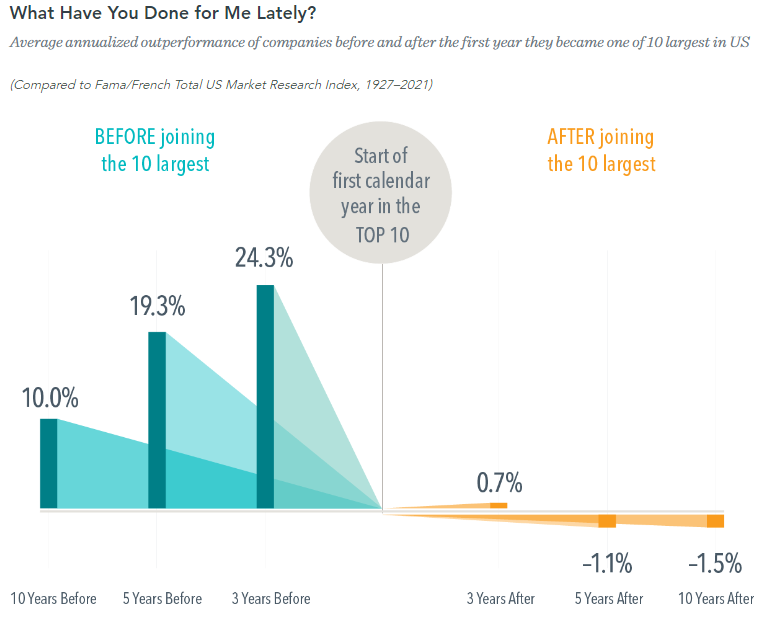

Concentration Risks

- This chart “shows the average annualized outperformance of stocks after they’ve become one of the largest top 10 in the S&P 500.”

- “As you can see, the top 10 largest companies underperform by an average of -1.5% over the subsequent 10 years.”

- Source.

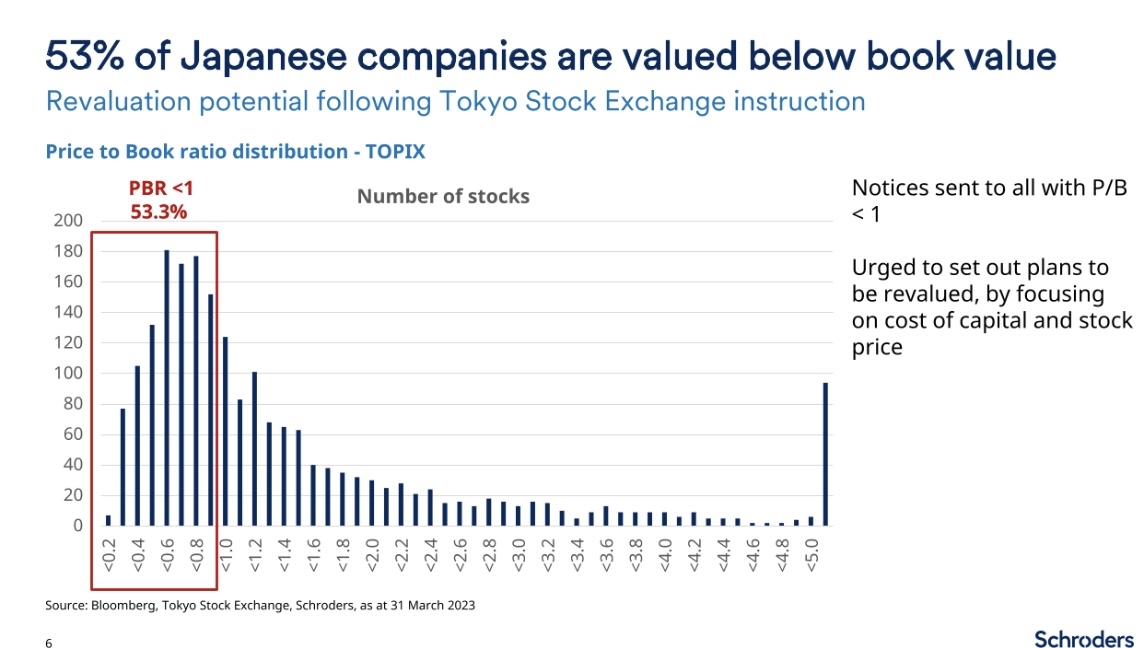

Japanese Market

Tesla and Service

- Interesting analysis of Tesla’s purported business model compared to other automotive manufacturers – make cars that don’t break vs. the razor/razor blade (i.e. zero margin cars with high margin service and parts) typically adopted by others.

- “Tesla does not have an existing fleet and that the auto industry, the reason incumbents succeed and newcomers fail, the biggest reason is that the incumbents have a large fleet, and they’re able to sell new cars at close to 0 margin and then sell spare parts at a very high margin, sort of razors and blades type thing.“

- NB to access all the transcripts you can try Stream for free for two weeks.

Disintermediation of Credit

- The private equity giants, who have raised $bns in credit funds, are looking to work with regional banks to take assets off their balance sheets.

- “The banking system wants the client, but not the asset”

Third Point Letter

- In case you missed it – Loeb’s latest missive from Q1.

- His purchase of UBS is interesting – though CS will undoubtedly have more skeletons (see here) and lose more AuM (as clients diversify), the uplift to UBS book value (74% accretive, putting UBS post deal on 0.74x P/TBV), state loss guarantees (CHF 9bn post first 5bn), and liquidity provision (CHF 100bn) are all positives.

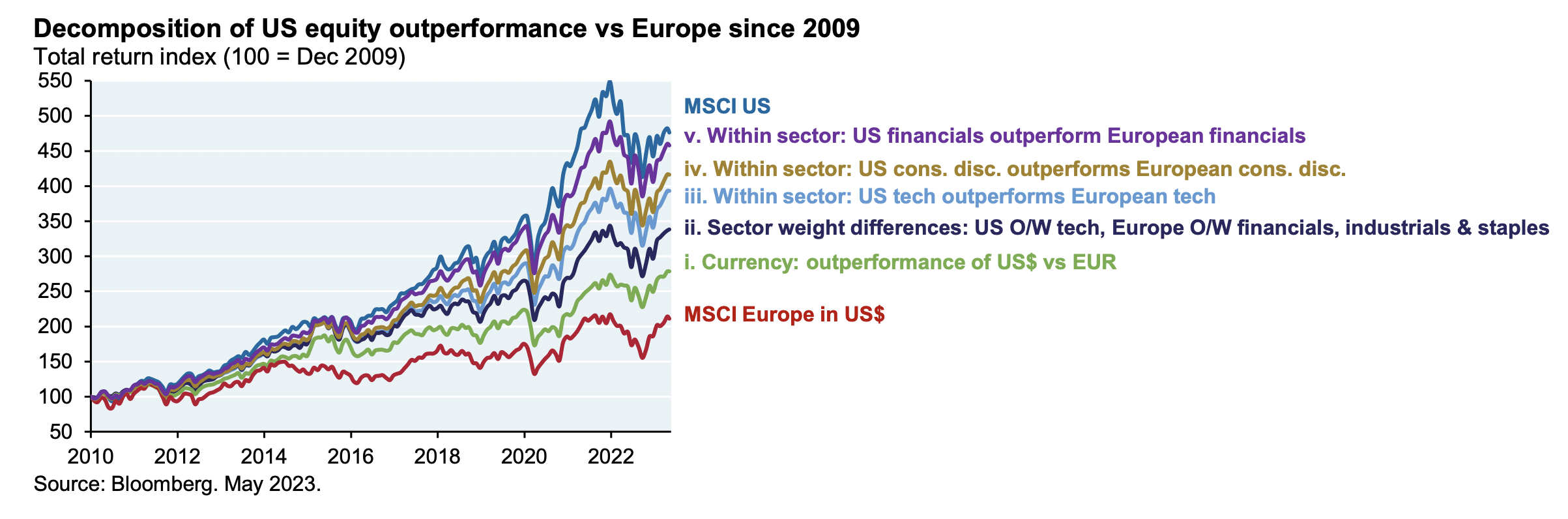

What explains US outperformance vs. EU

- Chart decomposing the outperformance of MSCI US vs. MSCI EU from 2010 until last year.

- Source.

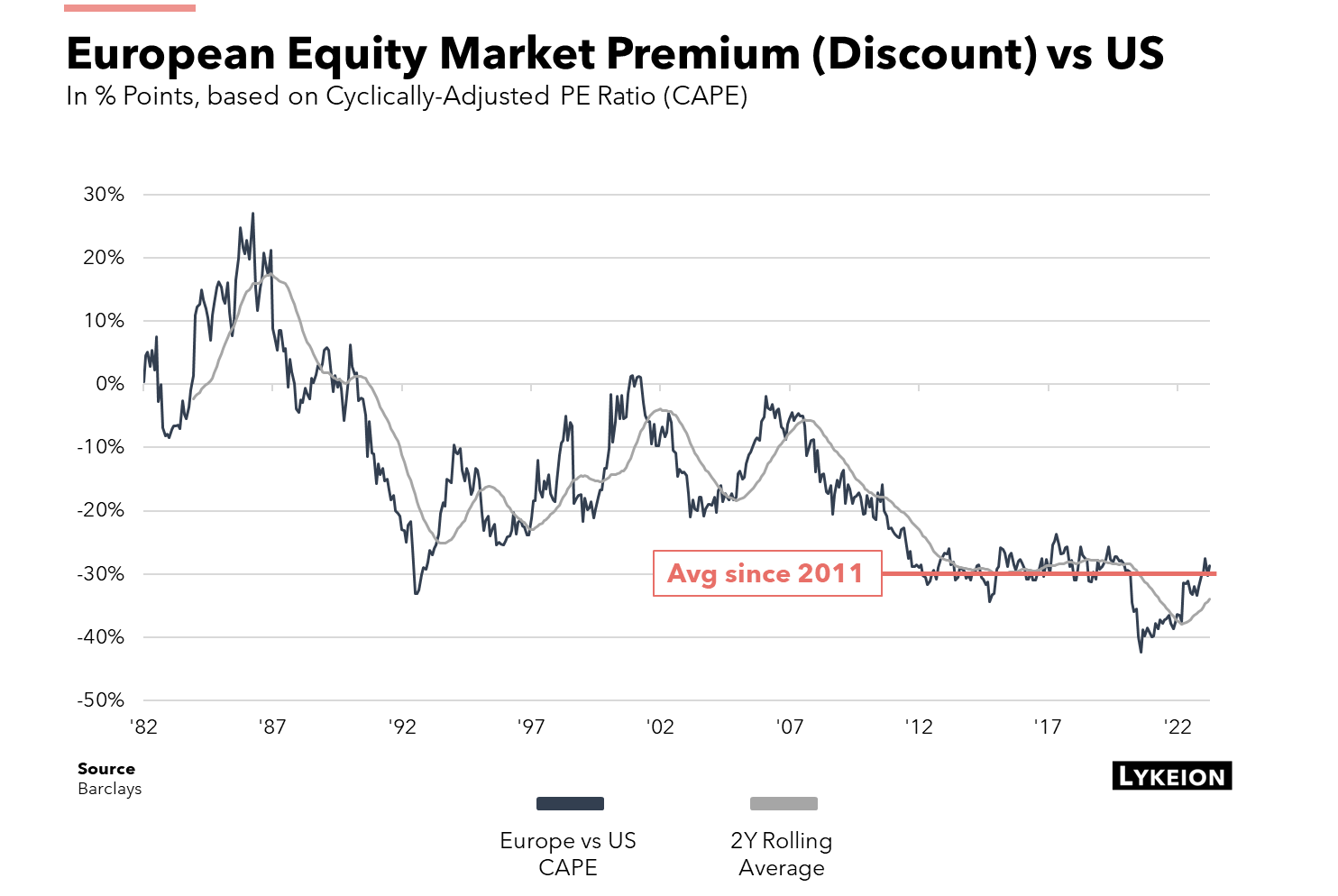

European Equity Valuations vs. US

- After a recent rally, the discount is back to its post-2011 average.

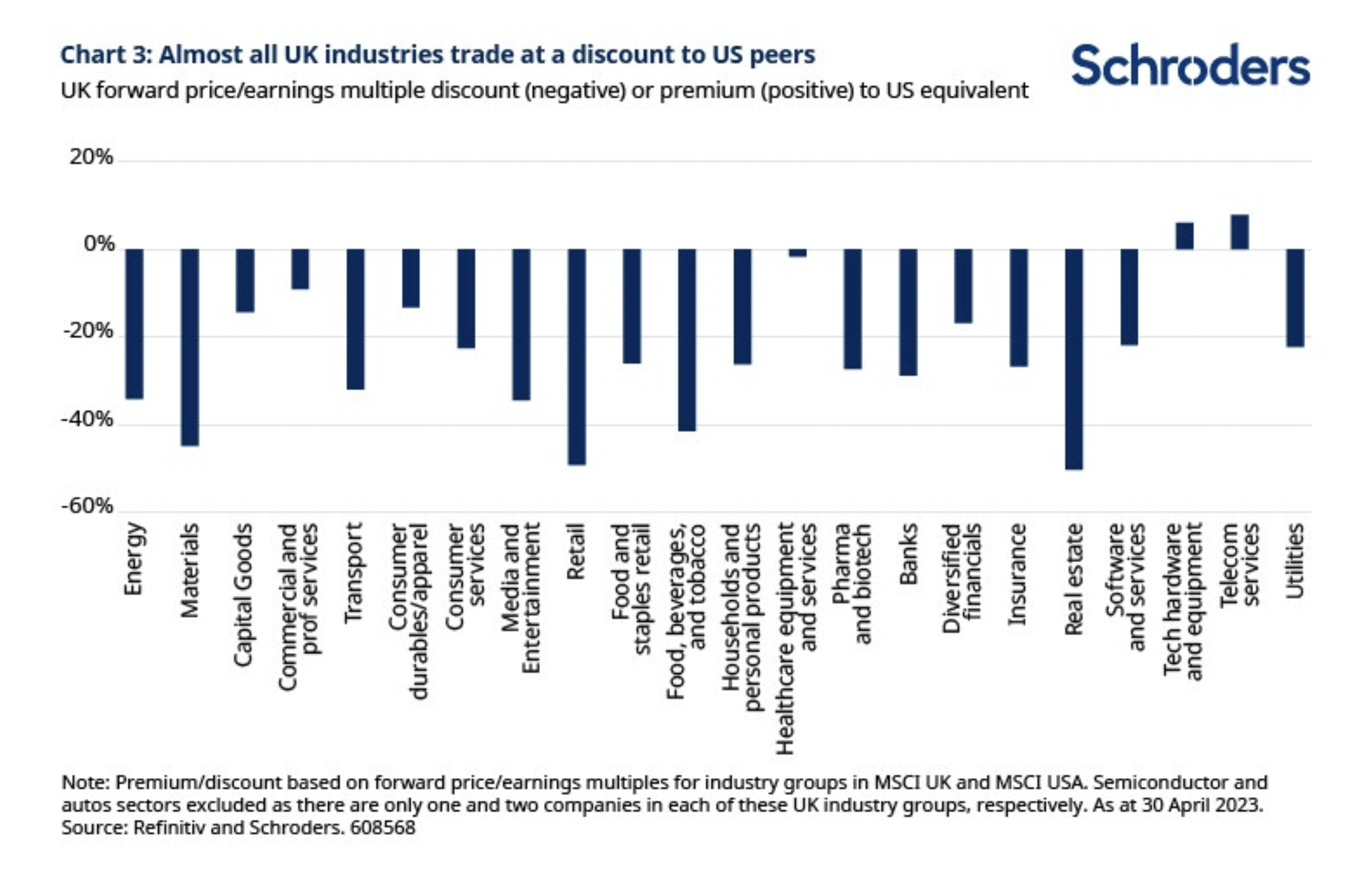

UK Valuations

- A nice set of six charts showing how cheap the UK is.

- The UK trades at a near-record 40% forward P/E discount to the US and 20% vs the EU.

- Almost every industry, as seen in the chart, is cheaper than the US.

Nike DTC

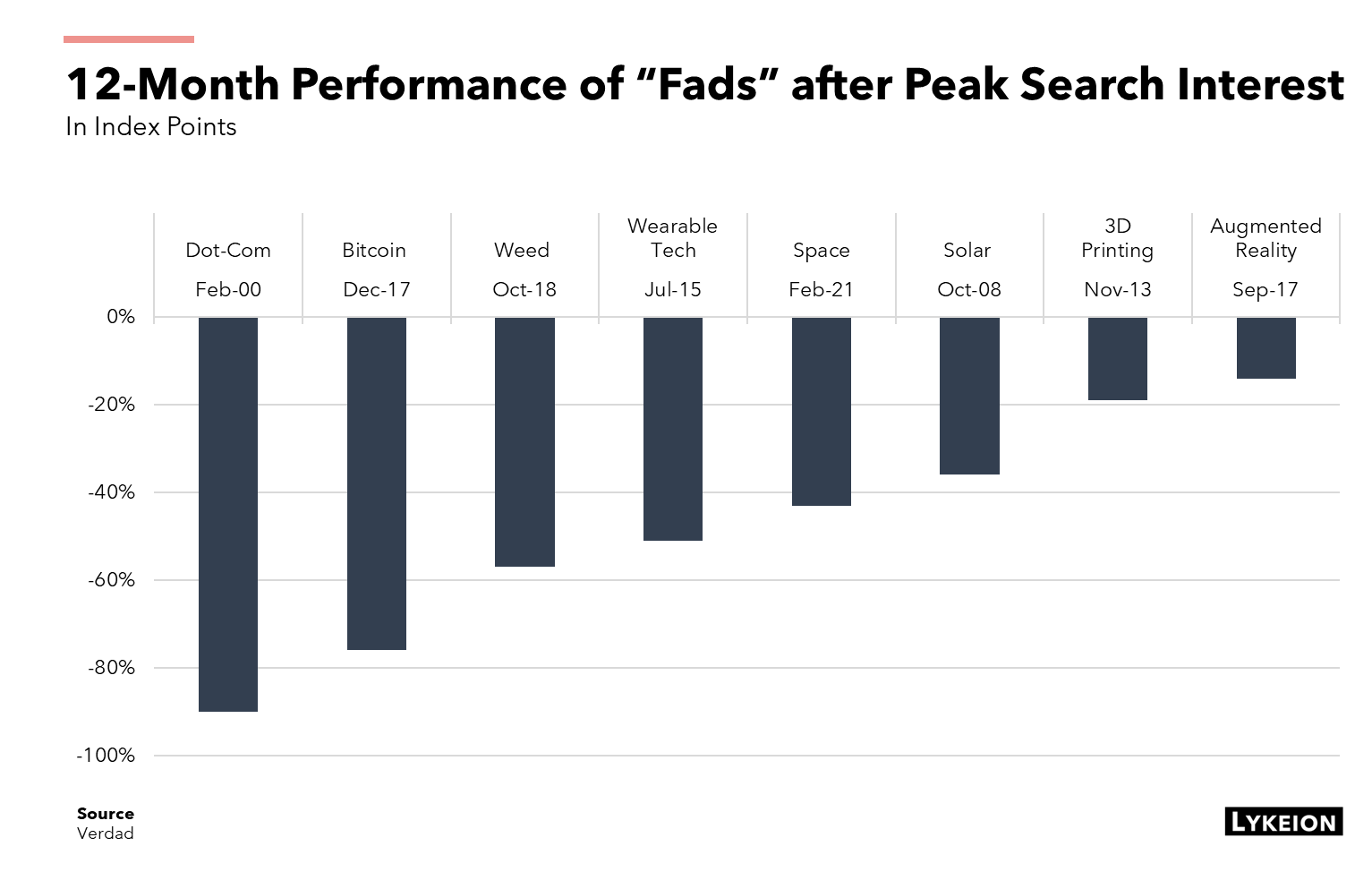

Investing in Fads

- Nice chart showing performance of fads, 12 months after search interest peaks.

- Source: Lykeion excellent Markets Update newsletter.

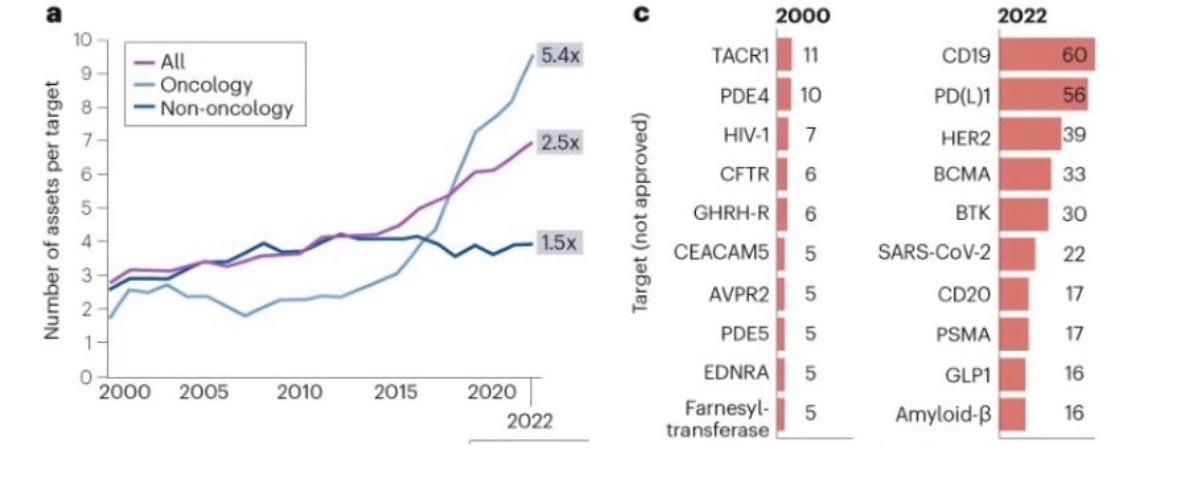

Crowding in Biotech Development

- “An analysis of biopharma pipelines shows that the average number of assets per target investigated has more than doubled: 3 assets/target in 2000 to 7/target today. The number of assets in clinical development is outpacing the number of biological approaches, particularly in oncology.”

- Source.

Bioprocessing

- EC merger control does a lot of in-depth work on industries and often it is some of the best analysis one can read.

- Here for example is their work on the bioprocessing industry in their decision on DHR’s acquisition of GE Biopharma.

AI Moat

- This leaked memo from Google has been doing the rounds last two weeks.

- The jist is that no one has a moat in AI.

- The arguments boil down to the idea that there has been so much innovation that open source will win.

- Ben Thompson lists a few counterarguments about why this might not be true.

- The other point, mentioned by a friend, is having intellectual property infringement experience as a key competitive advantage.

Sohn Conference Summary

- Genreally a good source of new stock ideas (with the usual pinch of “talking your own book”).

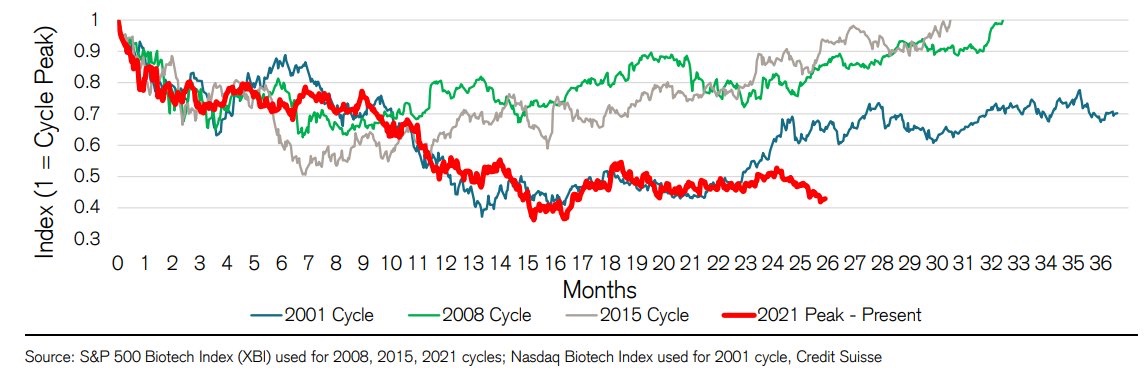

Biotech Downcycle

- Tracking worse than previous sell-offs.