- Another wonderful list from KK (the previous one is here).

- A few of my favourites:

- Half the skill of being educated is learning what you can ignore.

- Ask funders for money, and they’ll give you advice; but ask for advice and they’ll give you money.

- It is the duty of a student to get everything out of a teacher, and the duty of a teacher to get everything out of a student.

Tools

Evergreen resources and for the voracious learner.

Charting

- Many fundamental investors don’t believe stock charts hold any value.

- Yet technical analysis does have useful signals even for bottom up investors.

- This was a pretty good basic introduction to charting – especially understanding the dynamics of participants and the so called “tug of war”.

ImportYeti

- Ever wondered what suppliers or manufacturers a company or product uses.

- ImportYeti is a search engine that uses bill of landings data for all US imports.

- Useful for investment or other types of research.

UK Short Positions

- We previously discussed how in Europe any short position over 0.5% has to be disclosed, daily.

- ShortTracker+ takes the underlying data for U.K. stocks and puts it in a much more useful form (by stock, by fund etc).

Pershing Square 2021

- Annual investor presentation from the famous fund.

- They grew NAV (26.9%) just below S&P 500 index in 2021 (+28.7%) but well above hedge fund indices.

- Interesting analysis of their UMG investing, the new SPARC, interest rate hedges and new investment in NFLX.

Biotech Resources

- For those interested in the biotech sector this was a great set of resources.

- Biopharm Catalyst – tracks catalysts/readouts by company.

- Derek Lowe’s blog – a brilliant read.

- For those looking for more of an introductory guide – this was great.

Analysts Resources

- Great set of mostly free resources for investment analysts.

- A few choice examples:

- iBorrowDesk – Borrow rates and short availability data.

- Shortsqueeze – data on short interest.

- OpenInsider – track insider stock transactions.

- Dataroma – famous hedge fund portfolios.

- 10x – collection of activist position presentations.

- CamelCamelCamel – Amazon product price tracker.

- The Tools section of our site has many more analyst resources.

The 12 Best Financial Blogs

Below is a list of the twelve best financial blogs.

- Abnormal Returns – going since 2005 this daily email contains a delightful smorgasbord of links to articles, podcasts and posts across the financial web. Always a gem to be found for those who like to dig.

- The Browser – arguably the only non-finance resource you will ever need. A daily curation of the best five articles from the man who reads 1,000 per day. The resource is paid but worth every penny for those looking to broaden their horizons (something all investors should do).

- 361 Capital Weekly Research Briefings – a weekly tour of the US financial markets with charts, articles and more. Always something to ponder.

- FT Alphaville – the godfather of financial blogs and what got me interested in finance in the first place. The writers always deliver the most interesting and contrarian morsels of analysis on the major financial topics of the day. The further reading posts are also a rich seam of fascinating articles.

- Daily Shot – They say a picture paints a thousand words, so can you imagine what 80-120 charts a day can do*. This is a paid daily email that consist of charts covering global markets and economic trends. The broad coverage is a great way to survey everything, as certain markets (e.g. credit) or geographies (e.g. Asia) tend to see trends unfold faster than others. [*for the geeks out there a weeks worth of Daily Shot will get you just about a War and Peace worth of words].

- The Bear Cave – written by fintwit powerhouse Edwin Dorsey this letter is full of useful analyst resources and short ideas. The free version has a great list of management resignations and short reports.

- TheMarketEar – As market structures have changed, paying attention to technicals is becoming even more important. This site provides a supercharged twitter-like feed of charts, indicators and snippets from sell-side that does a pretty good job of surveying the short term market direction (and calling it at that). Although the service is now paid you can still get a free daily email.

- SITAL Week – written weekly by Brad Slingerlend of NZS Capital this site has been my favourite recent discovery. Like Snippet, Brad finds interesting topics/articles, especially from non run-of-the-mill sources (like academia) and adds a lot of fascinating insights when discussing them.

- Marginal Revolution – another old kid on the block this site, written by professor Tyler Cowen, is regarded as the best economics blog out there. Yet it is so much more than that. Like Snippet, I feel the interests are very broad and there is always something insightful to be found. Their assorted links posts are also some of the best out there.

- The Diff – reading Byrne Hobart just makes you automatically smarter. His real magic is akin to mathematics – he observes businesses, generalises their features as concepts, and then works with these concepts to build useful theories. It is a paid newsletter but the return on investment is outstanding.

- Glimpse – I look forward to this monthly most of all. Glimpse gives you exploding trends before everyone else discovers them (not boring ones; think alcohol gummies, limb extension surgery and veneers). The way they are described is my favourite part – I always learn something new and surprising. If you sign up you get a few glimpses for free but their value, especially for investors, makes it worth paying.

- Snippet Finance – That is this blog. What I do is read all the above and a lot more. I then curate the best bits (a decade of investing really sharpens one’s information processing skills) into short easy to digest Snippets. So save yourself time and subscribe – two emails per week, 3-4 snippets. There will always be something to inform and inspire.

Machine Learning

- For those inclined to learn about Machine Learning this is a great and free introduction/crash course from Google.

Christmas Holiday Break

- Snippet Finance is taking a holiday break, returning on Monday 3rd of January 2022.

- For those of you that entered last year’s Christmas competition, the results will be tallied up and winner announced in the new year.

- Wishing everyone Happy Holidays.

Share Snippet Finance

- Snippet Finance launched just over two years ago.

- The problem: Investors’ voracious appetite for insights on a limited time budget.

- The mission: Use my experience as an investor to curate the most interesting snippets of information and deliver them in a short easy to digest way.

- I think I’d curate snippet even if no one read it, and use it as a sort of living notebook. However, I am so grateful for so many of you for subscribing and for all your feedback.

- I NEED YOUR HELP: Please forward Snippet Finance to anyone you think will find these nuggets valuable. This is the best way to help support the site.

- Thank you!

Podcast Search Engine

- Another useful tool for researching companies – a podcast search engine.

- Just put in company name or the name of any of the key management.

- Source: Adam Keesling (a few more interesting research tools here).

Stock Research Tool

- A useful tool when researching a company.

- Head to google and type this “[COMPANY NAME] filetype:pdf site:.gov”.

- Finds any mentions of the company on government websites. Especially good for internal emails.

- h/t Hidden Monopolies.

Investor Amnesia Library

- Useful resource for capital market history enthusiast out there.

- A large library of manuscripts on investing and securities going back more than 300 years.

Orwell on Writing

- Orwell offers a lot of advice on writing well, a vital skill for any investor, in his essay “Politics and the English Language”

- This post pulls out some of the main “bad habits” to be avoided.

- It matters because writing clearly reveals understanding.

- “You can shirk it by simply throwing your mind open and letting the ready made phrases come crowding in. They will construct your sentences for you — even think your thoughts for you, to certain extent — and at need they will perform the important service of partially concealing your meaning even yourself.”

- “A scrupulous writer, in every sentence that he writes, will ask himself at least four questions, thus: What am I trying to say? What words will express it? What image or idiom will make it clearer? Is this image fresh enough to have an effect? And he will probably ask himself two more: Could I put it more shortly? Have I said anything that is avoidably ugly?“

Gitlab Handbook

Verdad Curriculum

- Verdad Capital has shared a curriculum they give all their incoming interns.

- It essentially consists of summaries and links to academic financial papers.

- A useful resource for both experienced and inexperienced investors.

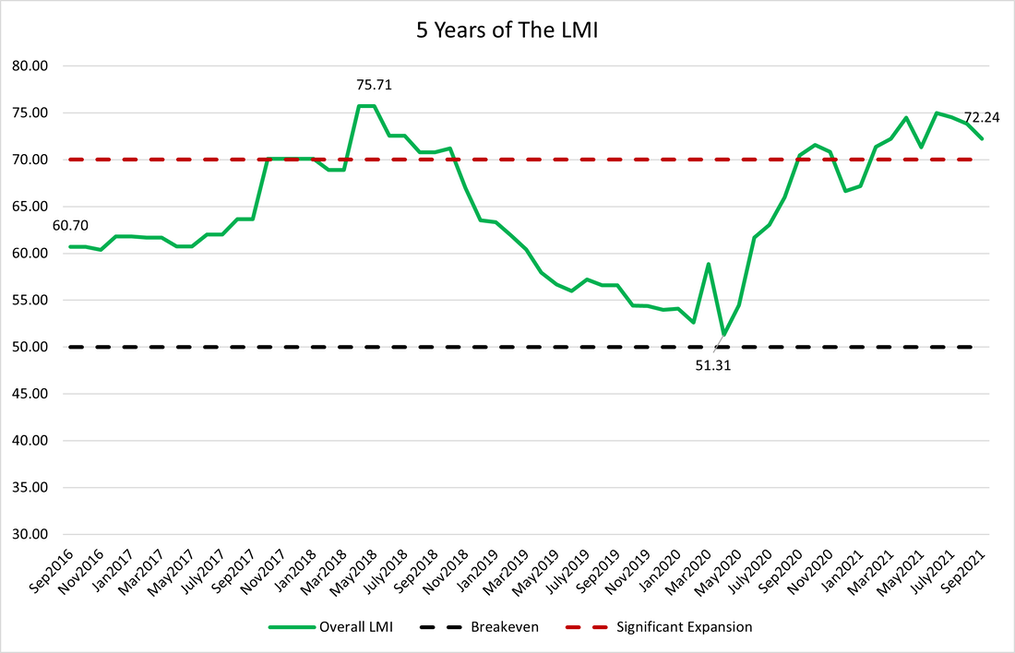

Logistics Manager’s Index

- Useful resource assessing the state of the logistics industry.

- The index has been going for 5 years, consists of eight components and is calculated using a diffusion index i.e. readings above 50 indicate expansion.

- The current stretch above 70 – meaning significant growth – is the longest on record.

- Will be interesting to watch if the situation improves and along which components.

Public APIs

- For those inclined to program, a useful database of free and publicly available APIs.

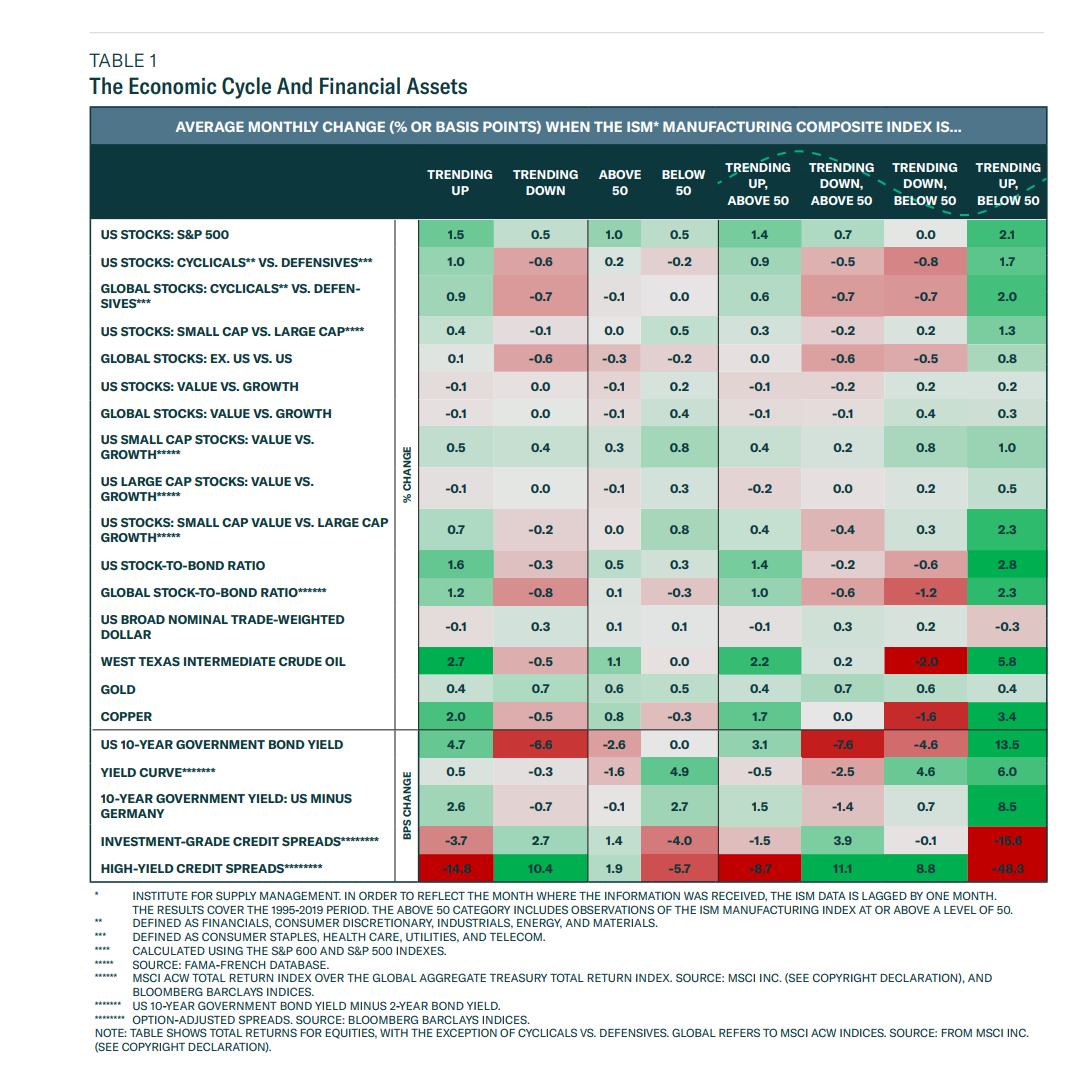

Economic Cycles and Financial Assets

- Useful table to have in the back pocket.

- It shows how various financial assets (down the rows) react to the changing economic cycle (columns) as measured by the ISM Manufacturing Composite Index.

- It covers the period 1995 – 2019.

- Right now we are above 50 on the ISM index (59.9) but trending down.

- Source: BCA Research.