- Useful resource for capital market history enthusiast out there.

- A large library of manuscripts on investing and securities going back more than 300 years.

Tools

Evergreen resources and for the voracious learner.

Orwell on Writing

- Orwell offers a lot of advice on writing well, a vital skill for any investor, in his essay “Politics and the English Language”

- This post pulls out some of the main “bad habits” to be avoided.

- It matters because writing clearly reveals understanding.

- “You can shirk it by simply throwing your mind open and letting the ready made phrases come crowding in. They will construct your sentences for you — even think your thoughts for you, to certain extent — and at need they will perform the important service of partially concealing your meaning even yourself.”

- “A scrupulous writer, in every sentence that he writes, will ask himself at least four questions, thus: What am I trying to say? What words will express it? What image or idiom will make it clearer? Is this image fresh enough to have an effect? And he will probably ask himself two more: Could I put it more shortly? Have I said anything that is avoidably ugly?“

Gitlab Handbook

Verdad Curriculum

- Verdad Capital has shared a curriculum they give all their incoming interns.

- It essentially consists of summaries and links to academic financial papers.

- A useful resource for both experienced and inexperienced investors.

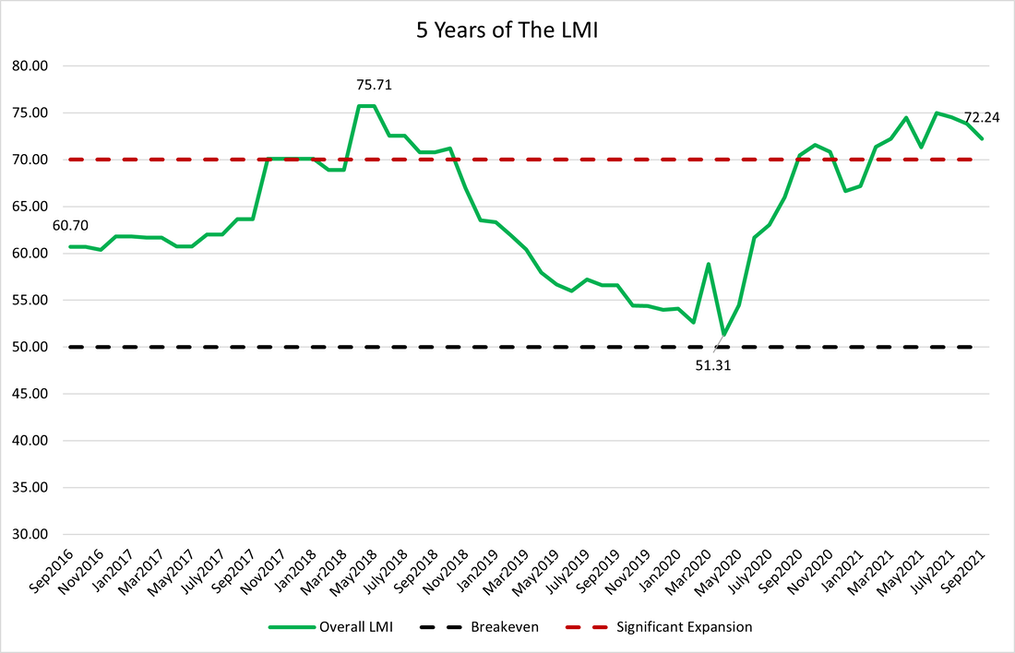

Logistics Manager’s Index

- Useful resource assessing the state of the logistics industry.

- The index has been going for 5 years, consists of eight components and is calculated using a diffusion index i.e. readings above 50 indicate expansion.

- The current stretch above 70 – meaning significant growth – is the longest on record.

- Will be interesting to watch if the situation improves and along which components.

Public APIs

- For those inclined to program, a useful database of free and publicly available APIs.

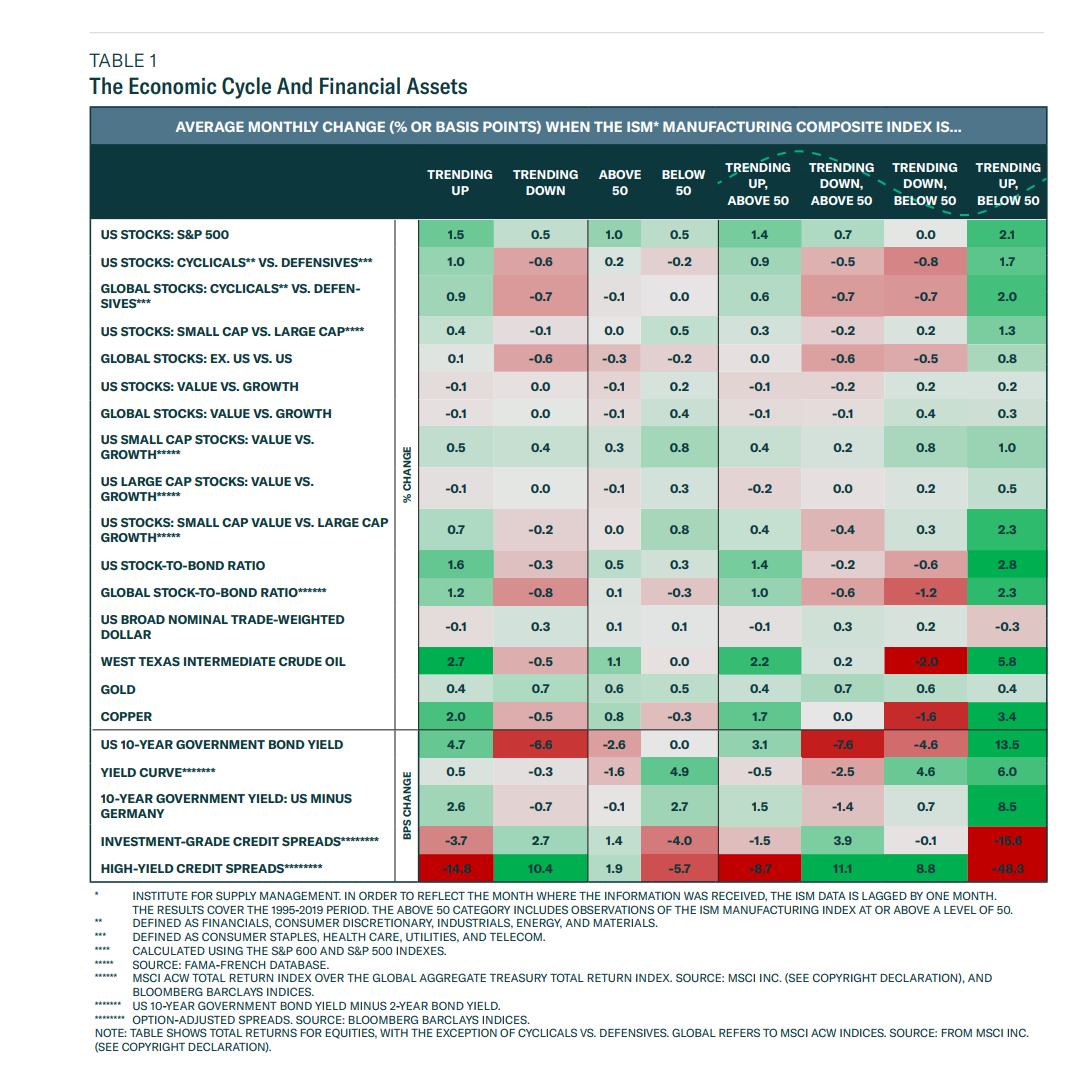

Economic Cycles and Financial Assets

- Useful table to have in the back pocket.

- It shows how various financial assets (down the rows) react to the changing economic cycle (columns) as measured by the ISM Manufacturing Composite Index.

- It covers the period 1995 – 2019.

- Right now we are above 50 on the ISM index (59.9) but trending down.

- Source: BCA Research.

Extracts from The Man Who Solved the Market

- The story of Renaissance Technologies and Jim Simons is worth reading in full.

- But this post does a great job pulling out the key extracts.

- One consistent feature of their success relates to this – “What you’re really modeling is human behavior. Humans are most predictable in times of high stress — they act instinctively and panic. Our entire premise was that human actors will react the way humans did in the past…we learned to take advantage.”

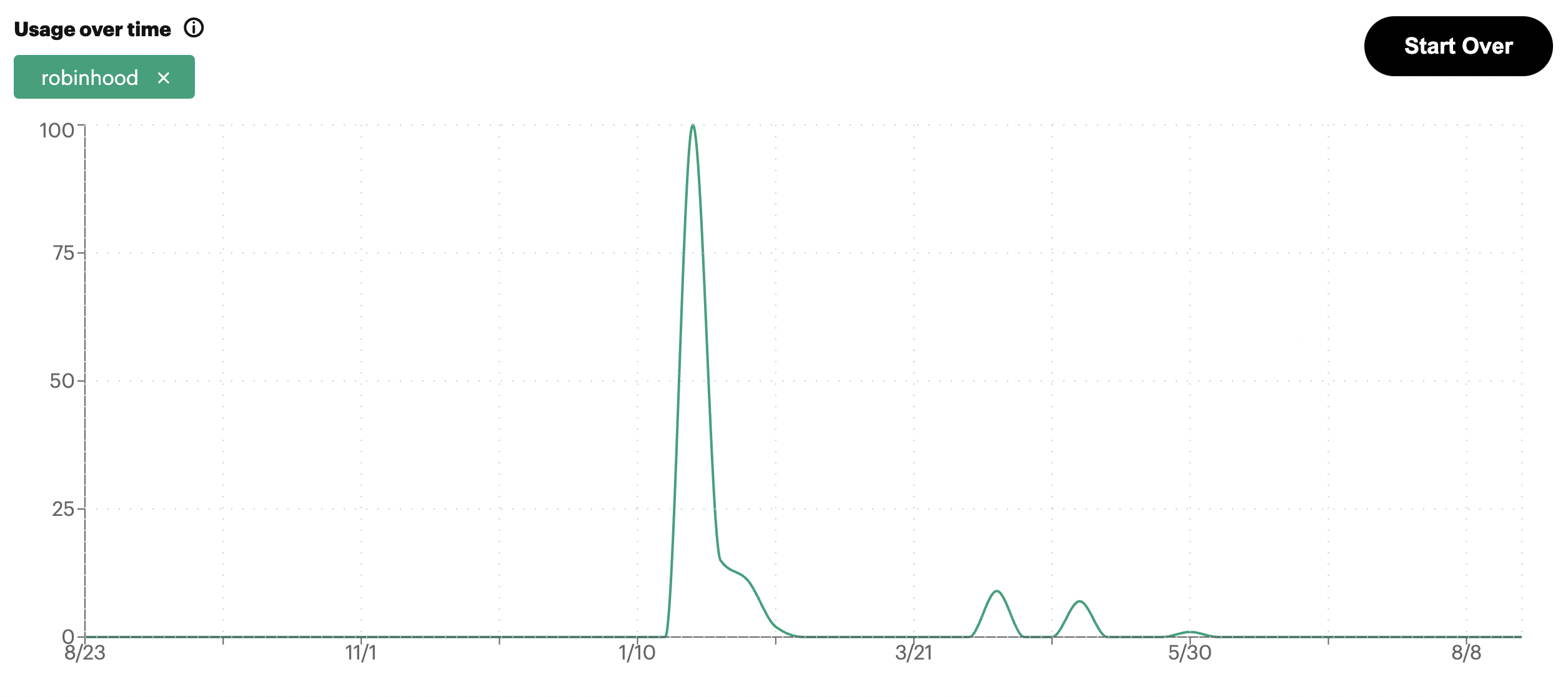

Snapchat Trends

- A neat tool to explore trending topics on Snapchat (which has 293m daily active users).

- Pictured for example is “Robinhood”.

- The site also gives you example Snaps related to this trend.

- Similar to the hugely useful Google Trends.

More is Less

- The number of words in a 10-K report has been climbing over time.

- 10-Ks are also using more redundant, boilerplate (used in 75% of other 10-Ks) and sticky words (repeated from prior year).

- They are also getting less readable (compared to academic texts (COCA) and newspapers).

- A lot of this has to do with growing SEC requirements (especially around risk factors, internal controls and fair value measurement).

- Source: Great post on the topic worth a full read.

Peter Davies of Lansdowne

- A really great and rare podcast with the legendary investor.

- His points on how to frame buy and sell decisions are particularly good.

- As is his view of the UK needing capital to unlock the world-class IP historically generated there and give people ambition to build global platforms instead of solving individual problems.

- Finally, his advice to young people about enthusiasm really rings true.

- This was a good summary of other points by a former colleague, but the full thing is absolutely worth your time.

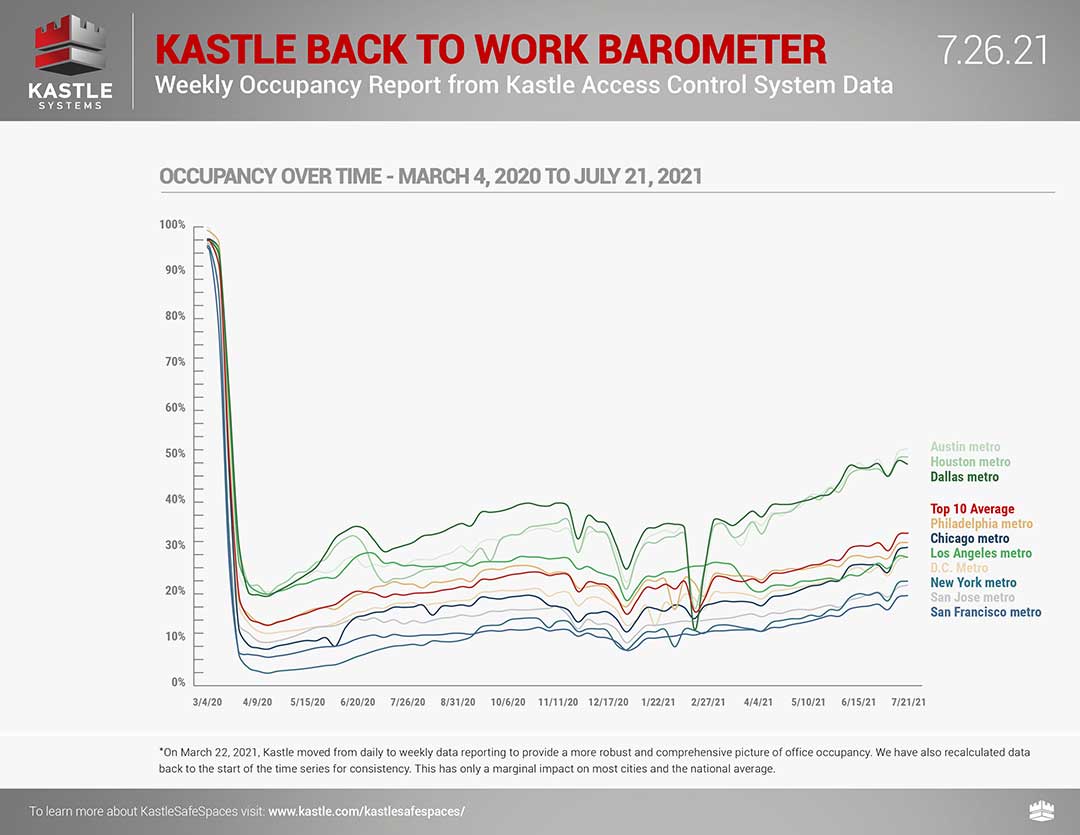

Back to Work Tracker

- Nice tool tracking office occupancy across top ten cities in the US using building security system swipes.

- The chart shows 21st July where the occupancy rate was 34.8%.

- It has since fallen to 34.3% at the latest reading (2nd August).

Greenlight Q2 2021

- Latest newsletter from Einhorn is out.

- He makes an interesting point that since the financial crisis (2009) certain industries have faced very high costs of equity (low valuations), and shareholder demands to return capital and limit or stop fully capacity expansion.

- This is still the case, but against high current and pent up demand (savings, though there are mitigating factors here and here), under investment will lead to higher pricing and profits.

- He gives examples of housing, air freight, copper, Titanium dioxide, cement, thermal coal/natural gas, and paperboard.

- The latter is perhaps the only one that has ESG credentials in this list.

Wall Street Reading List

- Comprehensive list of finance and business books.

- “This is a project a few ex-bankers put together to share our favourite business books. Currently 135 books have made the list, 26 are ranked Tier 1, 26 are ranked Tier 2, and 45 are ranked Tier 3.“

Loser’s Game

- A classic essay by Charles Elis.

- It makes the distinction between a winner’s game (where you win by winning) and a loser’s game (where you win by not losing).

- He argues that investing has become the latter but does offer some advice:

- (1) play your own game – “Impose upon the enemy the time and place and conditions for fighting preferred by oneself.” Simon Ramo suggests: “Give the other fellow as many opportunities as possible to make mistakes, and he will do so.“

- (2) keep it simple – “Play the shot you’ve got the greatest chance of playing well.”

- (3) concentrate on defence (selling) vs. offence (buying).

- (4) don’t take it personal.

Long Volatility

- This is a fascinating slightly old interview with Chris Cole of Artemis Capital Management.

- He runs a long volatility fund i.e. a crash protection fund.

- In the interview he talks about the core principle of the fund – to sacrifice the next linear predictable outcome in order to gain exposure to a truly convex upside outcome.

- Around minute seven he goes into a brilliant analogy using George Lucas’ success with Star Wars.

- Most interestingly, this idea can also be applied to life as Chris describes in minute 47 of the interview embedded here.

- Worth checking out their writing and following him on Twitter.

Third Point Q1 2021 Letter

- Striking how the latest letter has a total different feel to what they used to write about (here and here).

- A lot of their investments are now private and they participate in a lot of SPAC transactions.

- Part of it likely has to do with the change they made in Q2 2020 to invest in quality/compounders.

Psychology of Human Misjudgement

- An investing classic – must read talk by Charlie Munger – rewritten in 2005.

- In it he covers 25 biases that all investors should know.

Biotech Guide

- For those interested in biotech this is a brilliant guide – “to get from 0-60 in understanding the field as quickly as possible.“

Support Snippet

- Snippet started as a passion project a year and a half ago.

- Since then almost 5,000 of you follow us across various platforms.

- A big thank you to everyone who reads and shares.

- With such growth the site is starting to incur higher costs like our Mailchimp bill.

- Therefore, I would be grateful for any support, commensurate to the value you feel Snippet provides.

- Thank you in advance.