- Latest Q4 letter from Pershing Square.

- New format using slides on their existing positions.

- This fund performed very strongly in 2019.

Tools

Evergreen resources and for the voracious learner.

Asking Questions?

- This is a great read on how to ask good questions and why that is so important.

- “Nobel-prize winner, physicist Arno Penzias, when asked what accounted for his success, replied,“I went for the jugular question.”

- Still practicing his questioning discipline today, Penzias recently commented at a Fast Company Conference, “Change starts with the individual. So the first thing I do each morning is ask myself, ‘Why do I strongly believe what I believe?’ Constantly examine your own assumptions.”

Greenlight Letter

- Lastest letter from Greenlight Capital.

- Interesting comments on Netflix (NFLX) and Tesla (TSLA).

The Browser

- As an investor one needs to read broadly.

- One of the best resources out there is The Browser.

- They curate all the interesting articles on the internet on a huge range of topics and send it in a daily email.

- They would know – their editor reads 1,000 per day!

- It isn’t free but the best money you will spend.

- Use Pocket to save them to read later.

2019 Internet Trend Report

- Mary Meeker’s latest Internet Trends Report is, as always, interesting.

- It is a treasure trove of information to do with Internet and Media.

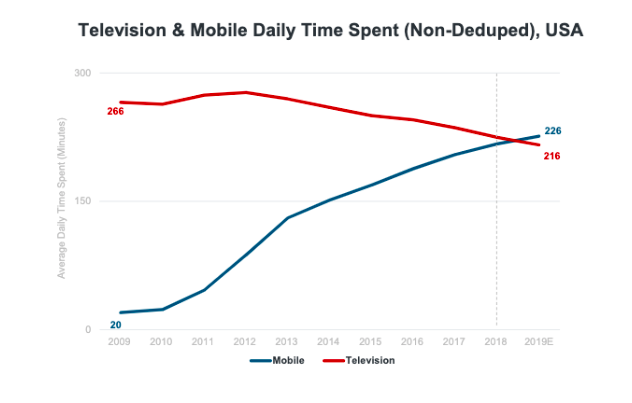

- For example this chart showing that in the US the amount of time spent on mobile surpassed time spent watching TV.

- More snippets to follow but the whole report is worth a flick.

Hoisington Latest

- Always worth reading the analysis of this bond management house.

- This is the latest report.

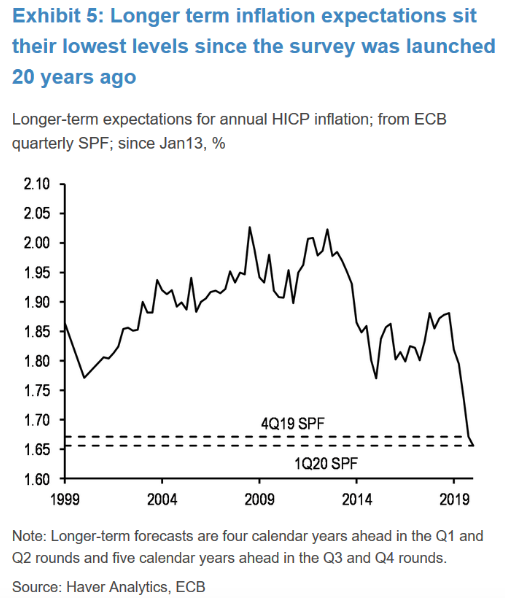

- Chart from Haver Analytics supports their arguments on subdued inflation.

- These five factors – loss of momentum, monetary restraint, high debt levels, flat profits and excess capacity – will bring about slower growth and continue to subdue core inflation.

- Over the past 65 years, yields on long dated risk-free U.S. treasury securities moved in the same direction as core inflation on an annual basis roughly 80% of the time. We believe that there is a high probability that this relationship will hold in 2020 as inflationary pressures continue to subside.

Hedge Fund Letters

- Latest Q4 2019 Batch is out … happy reading.

Sohn London Ideas

- Sohn is an annual conference where hedge fund managers pitch ideas

- Here are the notes from this year’s London one.

- Some interesting ideas. As usual be careful with following other’s advice and do your own work.

Farnam Street

- Understanding psychology is crucial for investing.

- Farnam Street is a site that gives you tools to make better decisions.

- For example this article is interesting on all the differences between an amateur and a professional.

- I have been an avid reader for many years, right from the start of my career.

Hedge Fund Letters

- Latest Q3 2019 Batch is out … happy reading.

FRED

Tools

- Snippet tries to give you useful tools. These include:

- A useful app to save articles to read later.

- How to check up on the health of the UK or US Economies.

- To see what stocks are being shorted.

- You can always find the Tools link in the sidebar.

- There will be plenty more to come.

NY Fed NowCast

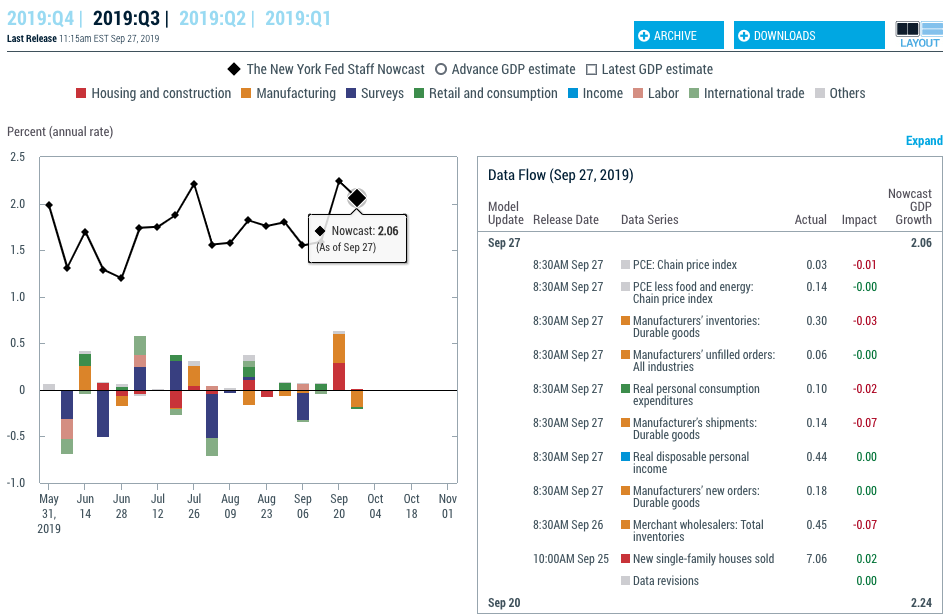

- Nowcast Report is a useful tool, produced by the New York Fed.

- It gives a NowCast (the best current estimate given data to date) of US Quarterly GDP.

- The inputs are laid out and it changes daily as prices come in.

- Most people use the more popular brother produced by Atlanta Fed GDPNow, but we have found this one to be more rigorous.

Google Trends

- Google Trends data is very useful for analysis.

- You can plot search traffic over time or compare search terms.

- Traffic is indexed (hit the ? next to “interest over time” for details).

- Worth playing around with this to see if it is useful in your analysis.

Market Currents

- Seeking Alpha has an excellent page called Market Currents.

- It is a feed of all the news going on in the US market with several bullet points on each news item.

Short Positions

- The FCA requires that any short position >0.5% be disclosed.

- You can find a spreadsheet on FCA website with all these positions – by stocks and by disclosing fund manager. Updated daily.

- You can then easily make a pivot table to see top shorted stocks etc.

- Kier, Thomas Cook and the AA are in the top.

- Many in the financial profession, especially those on the buy-side, will know that keeping up with reading is both vital and overwhelming.

- One app that is fantastic is Pocket.

- No time to read the interesting articles (posted on Snippet)? No problem. Just click the pocket button at the top of your browser to save it for later.

- You can then see all your articles in the app, and they all get downloaded to be read offline (like in the tube on the way home).

- It is very easy to use – you can then archive read articles, it gives you an estimate of how long each one takes to read etc.

- No more lost gems!

UK Economy at a Glance

- A very useful dashboard from the FT on the state of the UK Economy

- https://ig.ft.com/sites/numbers/economies/uk/

We are live

Welcome to Snippet.Finance. We aim to bring you lots of interesting snippets from reading widely about the financial world aimed squarely at those already engaged with it. Topics will include stocks, macroeconomics and strategy. We also plan to add useful personal finance tips for those in the UK and eventually provide some useful excel based tools for a small nominal charge. Feel free to subscribe or follow us on Twitter and LinkedIn (links on the side). Our disclaimer is simple – in no shape or form shall any of the content be considered financial advice. We will credit all and every source with a direct link. Happy reading!