- This is a testament to the power of Amazon as the start of product searches, as well as the recognition of Nike’s brand.

- Despite Nike stopping selling any products directly on Amazon, its search rank on Amazon has not changed.

- From the always excellent Marketplaces Pulse – Market Places Year in Review 2021.

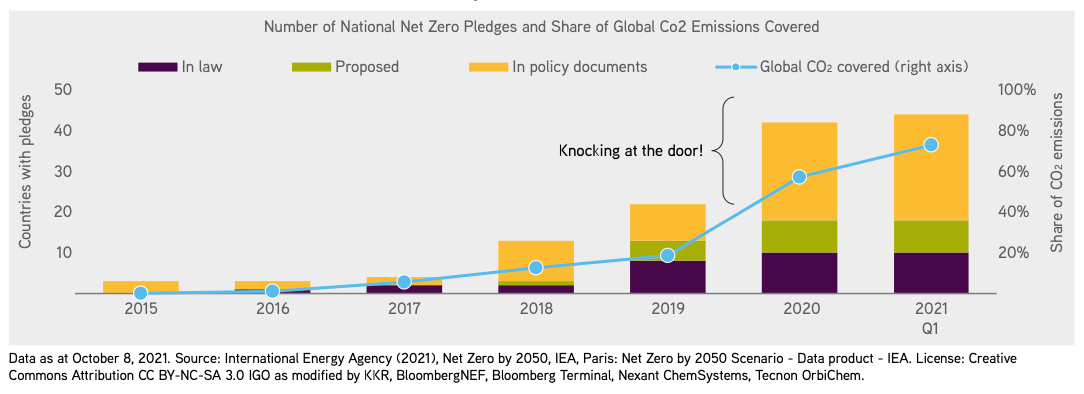

CO2 Pledges

- Governments are getting serious about reducing CO2 emissions – with over 80% of global CO2 emissions “pledged” to be eliminated if we include what is currently in policy documents.

Dynamism

- Despite the prevailing narrative, dynamisms in the US has been consistently falling since the last 1970s.

The 12 Best Financial Blogs

Below is a list of the twelve best financial blogs.

- Abnormal Returns – going since 2005 this daily email contains a delightful smorgasbord of links to articles, podcasts and posts across the financial web. Always a gem to be found for those who like to dig.

- The Browser – arguably the only non-finance resource you will ever need. A daily curation of the best five articles from the man who reads 1,000 per day. The resource is paid but worth every penny for those looking to broaden their horizons (something all investors should do).

- 361 Capital Weekly Research Briefings – a weekly tour of the US financial markets with charts, articles and more. Always something to ponder.

- FT Alphaville – the godfather of financial blogs and what got me interested in finance in the first place. The writers always deliver the most interesting and contrarian morsels of analysis on the major financial topics of the day. The further reading posts are also a rich seam of fascinating articles.

- Daily Shot – They say a picture paints a thousand words, so can you imagine what 80-120 charts a day can do*. This is a paid daily email that consist of charts covering global markets and economic trends. The broad coverage is a great way to survey everything, as certain markets (e.g. credit) or geographies (e.g. Asia) tend to see trends unfold faster than others. [*for the geeks out there a weeks worth of Daily Shot will get you just about a War and Peace worth of words].

- The Bear Cave – written by fintwit powerhouse Edwin Dorsey this letter is full of useful analyst resources and short ideas. The free version has a great list of management resignations and short reports.

- TheMarketEar – As market structures have changed, paying attention to technicals is becoming even more important. This site provides a supercharged twitter-like feed of charts, indicators and snippets from sell-side that does a pretty good job of surveying the short term market direction (and calling it at that). Although the service is now paid you can still get a free daily email.

- SITAL Week – written weekly by Brad Slingerlend of NZS Capital this site has been my favourite recent discovery. Like Snippet, Brad finds interesting topics/articles, especially from non run-of-the-mill sources (like academia) and adds a lot of fascinating insights when discussing them.

- Marginal Revolution – another old kid on the block this site, written by professor Tyler Cowen, is regarded as the best economics blog out there. Yet it is so much more than that. Like Snippet, I feel the interests are very broad and there is always something insightful to be found. Their assorted links posts are also some of the best out there.

- The Diff – reading Byrne Hobart just makes you automatically smarter. His real magic is akin to mathematics – he observes businesses, generalises their features as concepts, and then works with these concepts to build useful theories. It is a paid newsletter but the return on investment is outstanding.

- Glimpse – I look forward to this monthly most of all. Glimpse gives you exploding trends before everyone else discovers them (not boring ones; think alcohol gummies, limb extension surgery and veneers). The way they are described is my favourite part – I always learn something new and surprising. If you sign up you get a few glimpses for free but their value, especially for investors, makes it worth paying.

- Snippet Finance – That is this blog. What I do is read all the above and a lot more. I then curate the best bits (a decade of investing really sharpens one’s information processing skills) into short easy to digest Snippets. So save yourself time and subscribe – two emails per week, 3-4 snippets. There will always be something to inform and inspire.

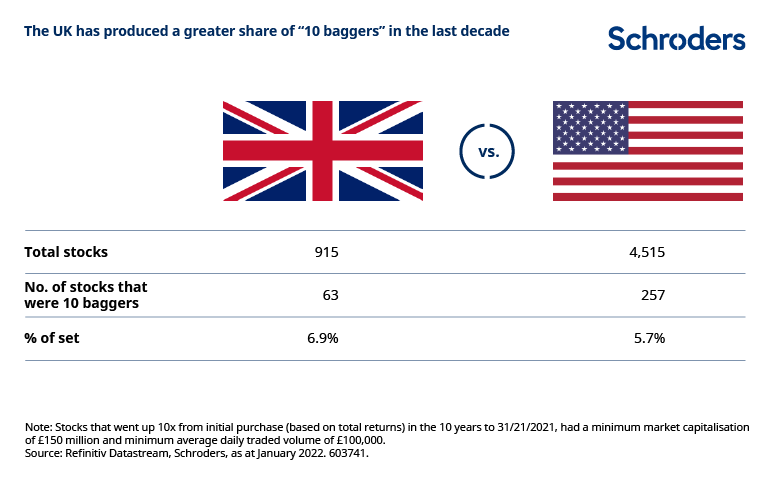

10 Baggers – UK vs US

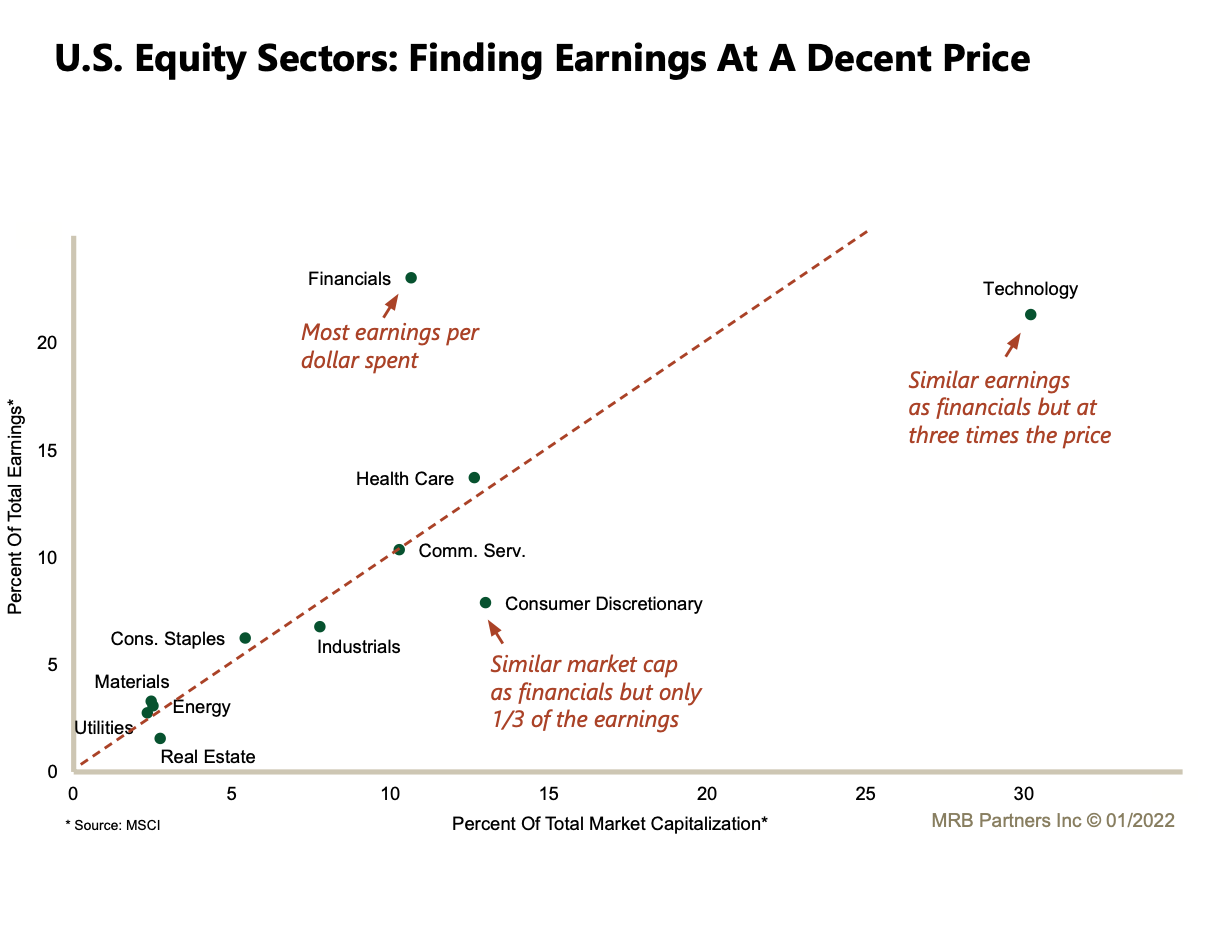

Earnings and Market Cap Share

- Useful chart from MRB plotting a sector’s percent share of total US market capitalisation on the x-axis and percent share of total market earnings on the y-axis.

- It of course misses a lot of elements (e.g. growth of earnings, returns etc) but is still worth thinking about.

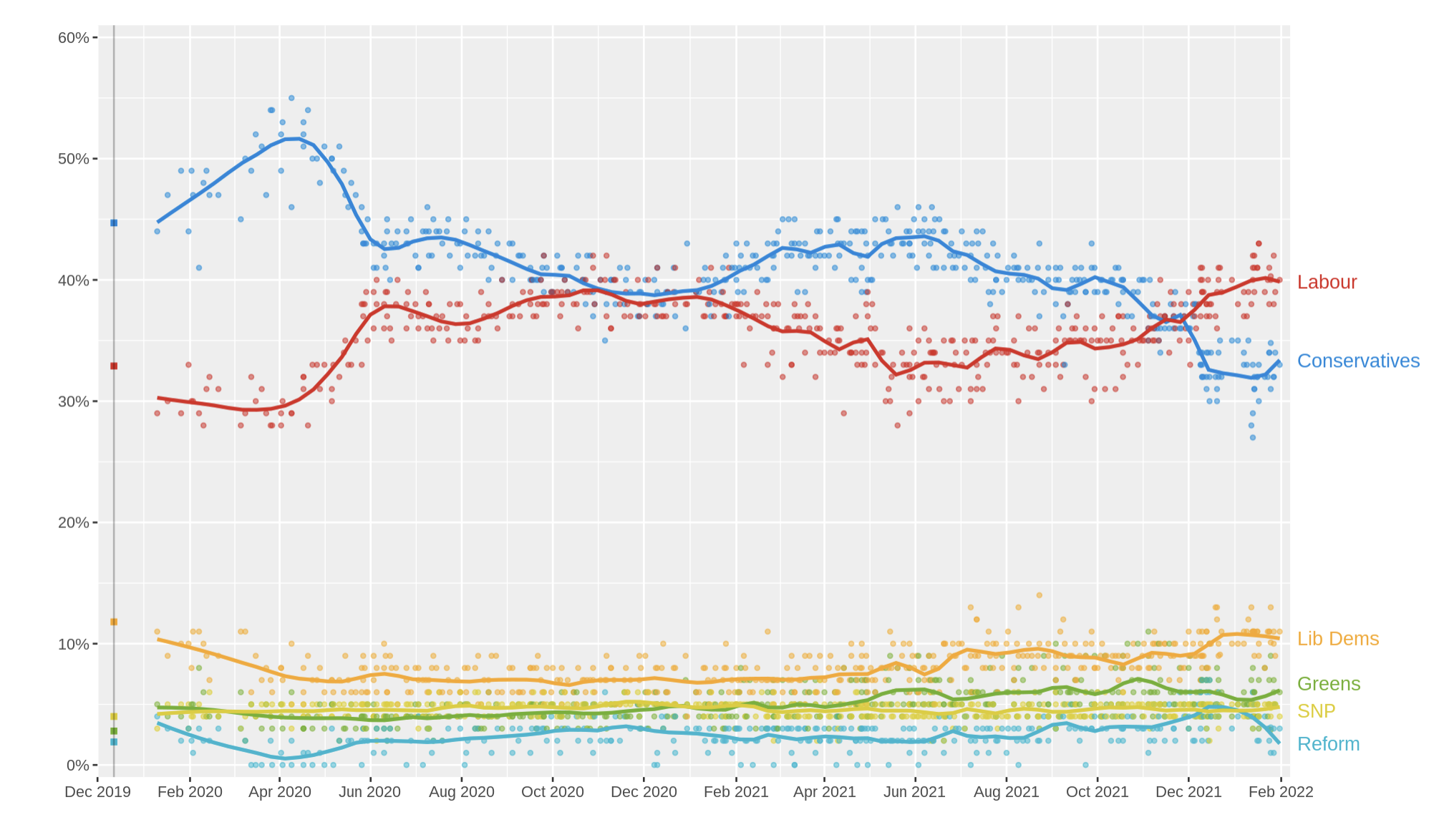

UK’s Labour Takes the Lead

- Latest opinion polls show Labour taking the lead.

- Source: Wikipedia poll tracker.

Energy Intensive Investment

- Nice chart comparing the level of investment by industry forecast for 2022E against its ten year average (Source: JPM).

- Energy-intensive industries have seen a collapse in investment.

- This sort of data is supportive of Einhorn’s thesis and the capital cycles idea popularised by Marathon Asset Management (here and here).

Exponential Trends Pt 2

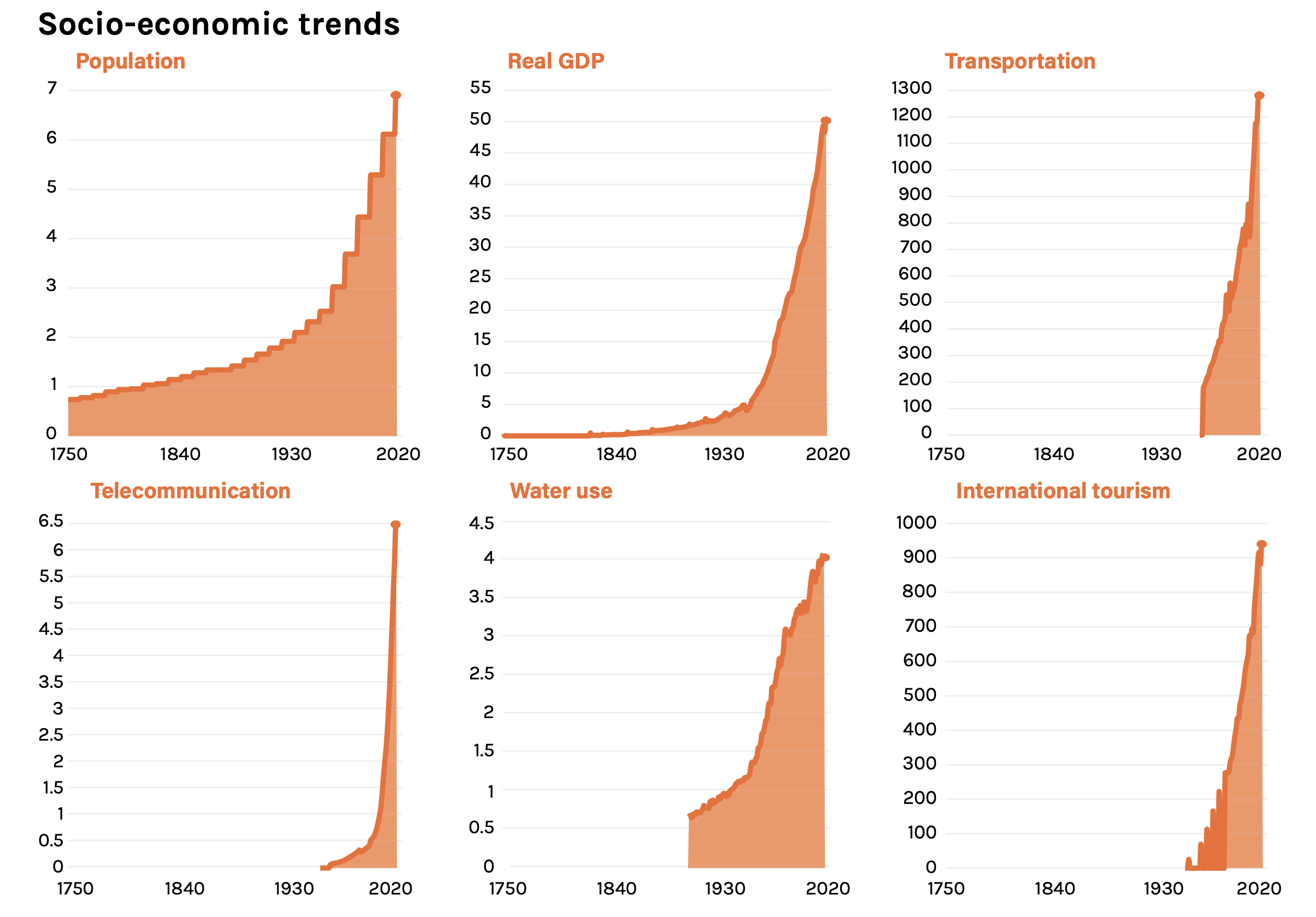

Exponential Trends

- The second half of the 20th century has seen a massive acceleration of all socio-economic trends.

- Source.

Obesity Paradigm

- What if I told you that the idea that “People get fat because they take in more calories than they expend” is wrong?

- That is exactly what this post does (in the Snippet tradition of contrarian ideas like here and here).

- “Consider using the identical logic to describe, say, why people get wealthy. Economists would (I hope) be embarrassed by a money-balance theory of wealth: People get rich because they take in more money than they spend. Clearly wealthy people did. We know that because they’re wealthy. The increase in wealth is the positive money balance. But this says nothing about how or why they accumulate such wealth. In obesity research, this tautological logic — saying the same thing in two different ways but offering no explanation for either — was allowed to become the central dogmatic truth.“

- Then what does cause obesity? “People don’t get fat because they eat too much, consuming more calories than they expend, but because the carbohydrates in their diets — both the quantity of carbohydrates and their quality — establish a hormonal milieu that fosters the accumulation of excess fat.“

Trained by AI

- You probably know, AlphaGo, the 2016 AI program that dominated the game of Go.

- Soon after, a software implementation called Leela was made available, to train human Go players.

- Data from 750k Go moves from 1,200+ players between 2015-2019 shows a significant improvement in move quality – especially among younger players (see chart) who are likely more open to learn from Leela.

- Source: State of AI report (an excellent slide deck!).

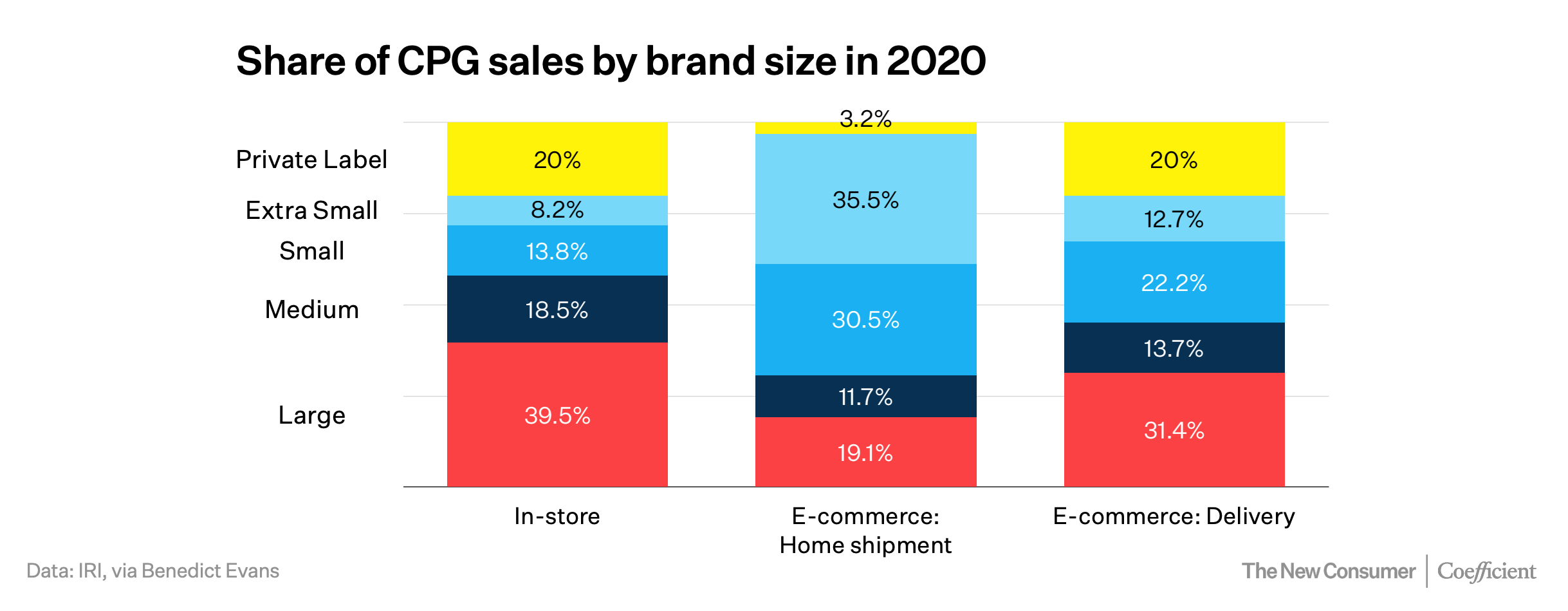

Small Brands

- Small consumer brands tend to beat large brands in the online world.

- Source: The New Consumer 2022 Report (lots of good slides here).

Russian Military Logistics

- Fascinating and important read about Russian military logistics and what it means for various strategies in Europe.

- “No other European nation uses railroads to the extent that the Russian army does.“

- “The rub is that Russian railroads are a wider gauge than the rest of Europe. Only former Soviet nations and Finland still use the Russian standard — this includes the Baltic states.“

- Interesting side note – Russia can thank the US for this standard, namely George Washington Whistler (father of the famous painter!). The US was looking out for its European allies all the way back in the 1840s.

- In summary – “they are not capable of a sustained ground offensive far beyond Russian railroads without a major logistical halt or a massive mobilization of reserves.“

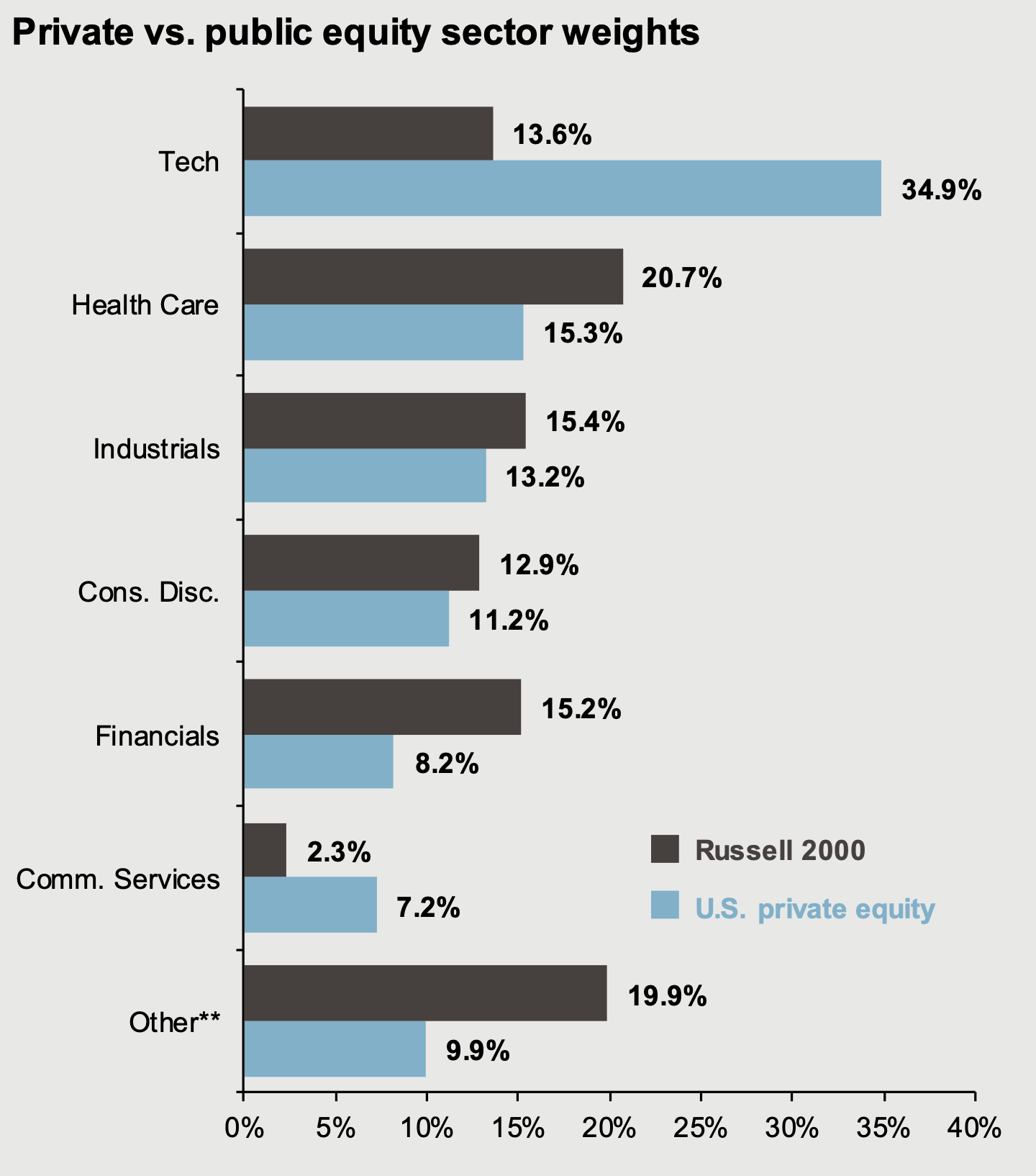

Sector Weights

- Interestingly US Private Equity has a much higher weighting in Tech than the Russell 2000.

- Source: JPM Guide to the Markets Q4 2021.

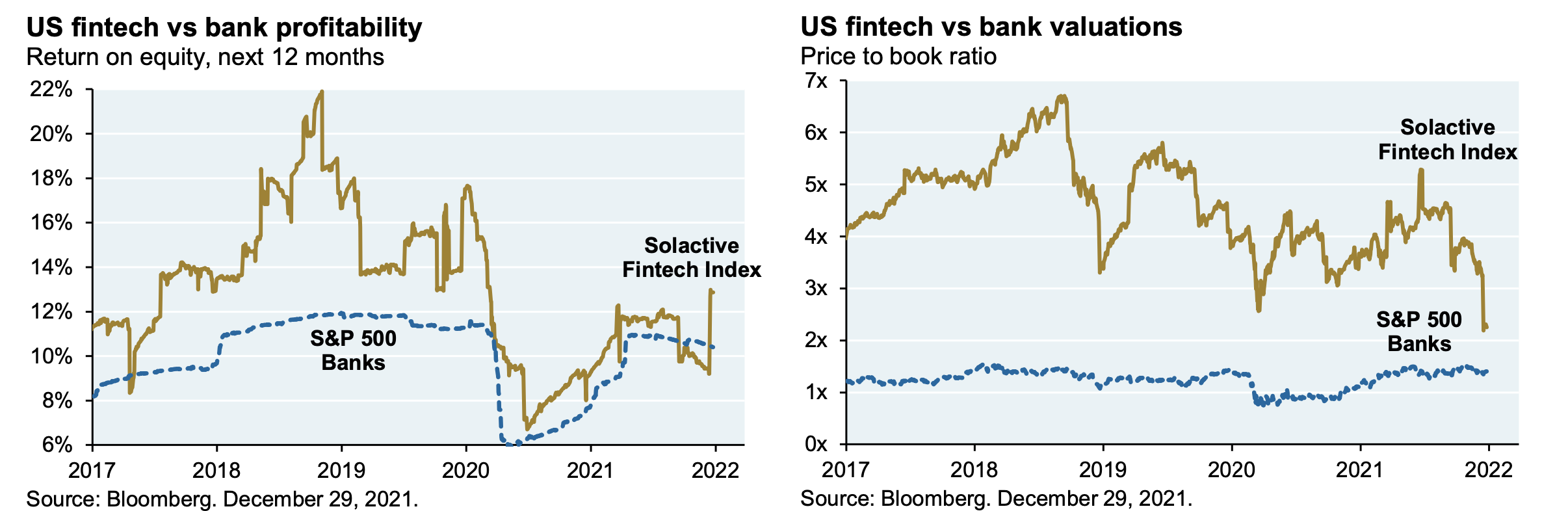

Banks vs Fintechs

DUC Inventory

- Drilled but uncompleted (DUC) well inventory (a form of hidden oil inventory) has almost normalised in the US oil patch.

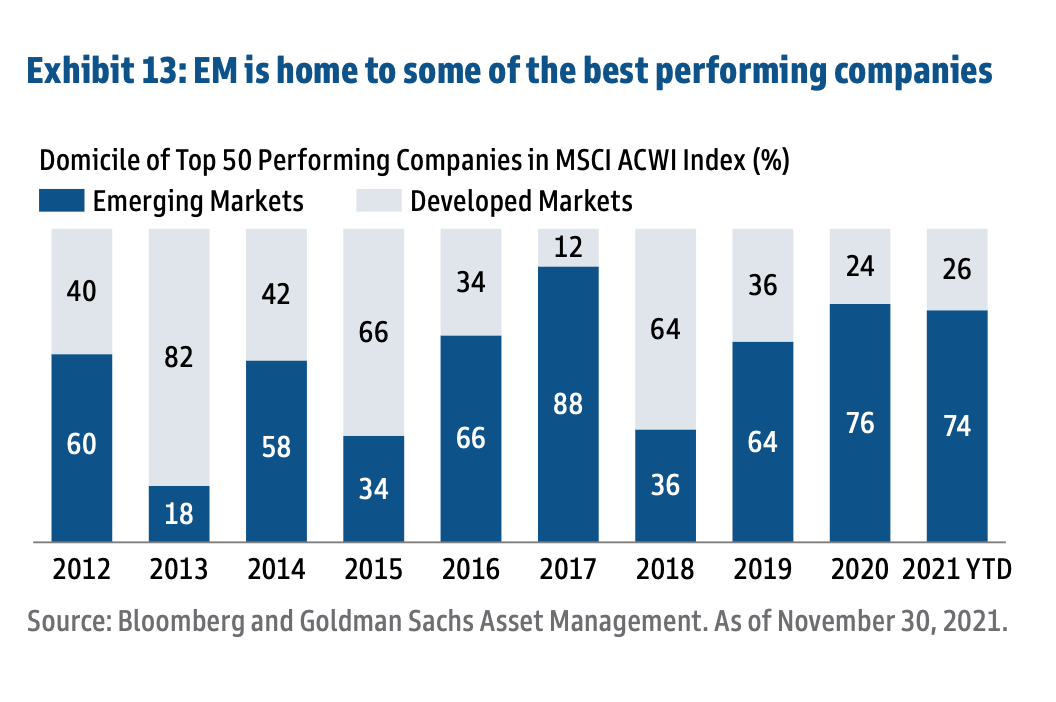

Emerging Market Stocks

- Surprisingly, EM stocks make up the majority of the top 50 best performing stocks in the MSCI All Country World Index (ACWI).

UPS

- A fascinating read about Jim Casey – the man who built UPS.

- “On August 28, 1907, nineteen-year-old James Emmett “Jim” Casey and his friend Claude Ryan borrowed $100 and founded the American Messenger Company in a six-foot by seven-foot basement office below a Seattle saloon.”

- From this grew one of the largest transportation companies – delivering 6.3bn packages globally in 2020.

- As with all histories there are some fascinating anecdotes

- “Merchants Parcel [an earlier name] considered painting their cars and vans bright yellow to attract attention, or even painting them different colors to make people think the company was larger than it was. But Charlie warned that they should not try to show up their retail customers, who were proud of their brightly decorated delivery vehicles. He had studied the more subtle Pullman brown, the color used on railroad sleeping cars to minimize signs of dust and dirt. Thus the partners decided to go with brown—only slightly modified in today’s UPS brown.“

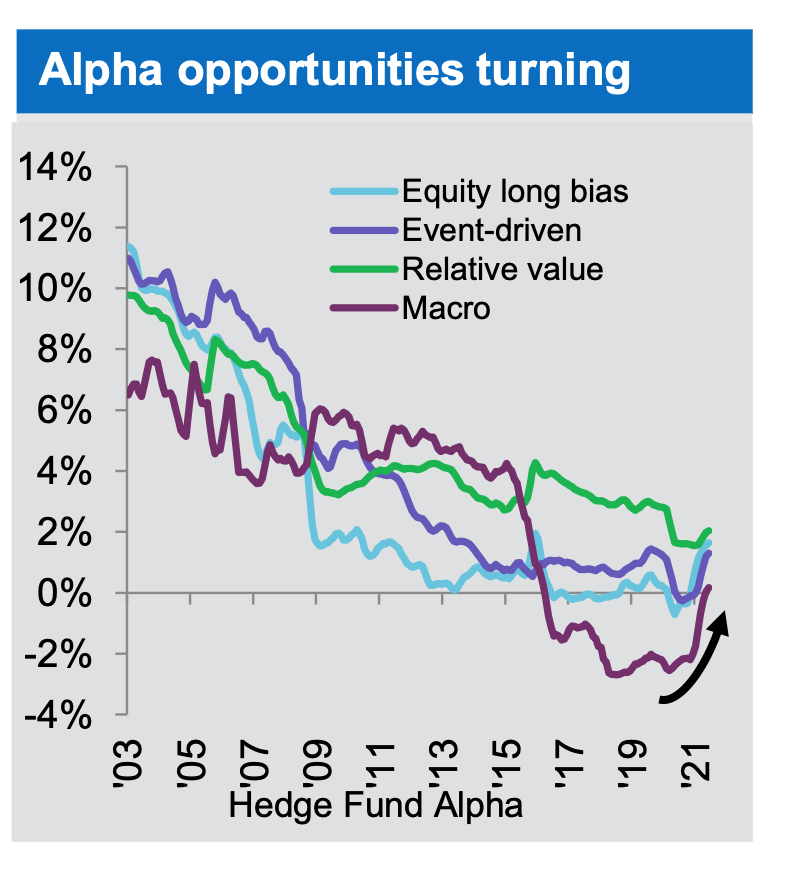

Alpha

- After years of declining it appears that hedge fund alpha, across strategies, could be turning.