- Fascinating read on how to price a data asset.

- Relevant especially with the rise of AI. At first quantity matters here but “as training sets grow ever larger, it’s often more efficient to do this than to acquire the next token; beyond a certain point, data quality scales better than data quantity“.

- “So there you have it: 5000+ words on data pricing. We’ve covered use cases and users; quality and quantity; internal and external value factors; pricing axes and maturity curves; table stakes and usage rights; and much more.“

Major Sociological Theories

- Useful list to broaden horizons on one of the most important, yet often overlooked disciplines especially in financial circles.

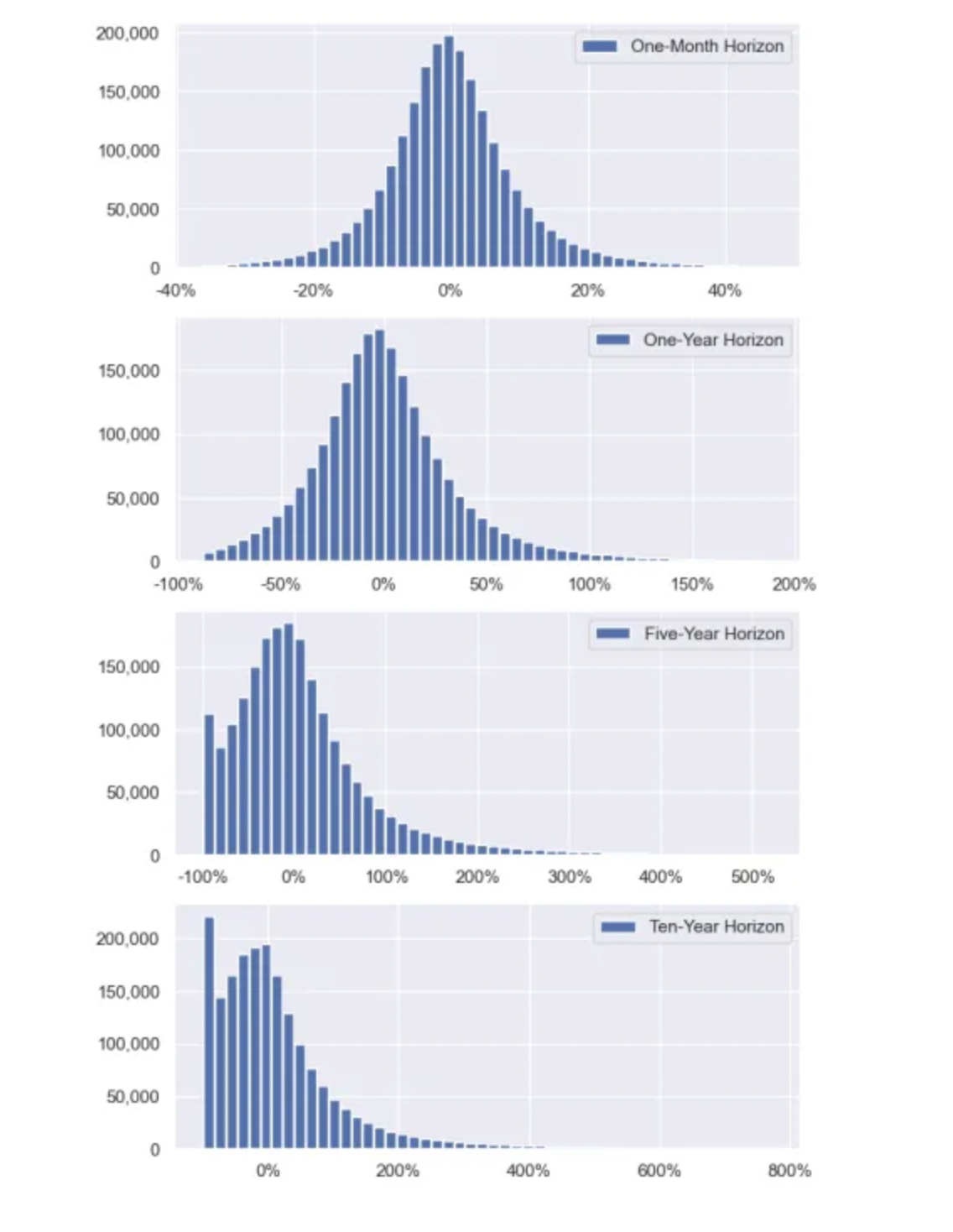

Average is not Median

- “Antti Petajisto analyzed the return distribution of all US stocks in the CRSP database going back to 1926. Below is the distribution of returns for different investment horizons. Note that the distribution gets more and more skewed to the left as investment horizons increase and that the left-hand side of the distribution is not zero, but a total loss of investment (-100% return).“

- Source.

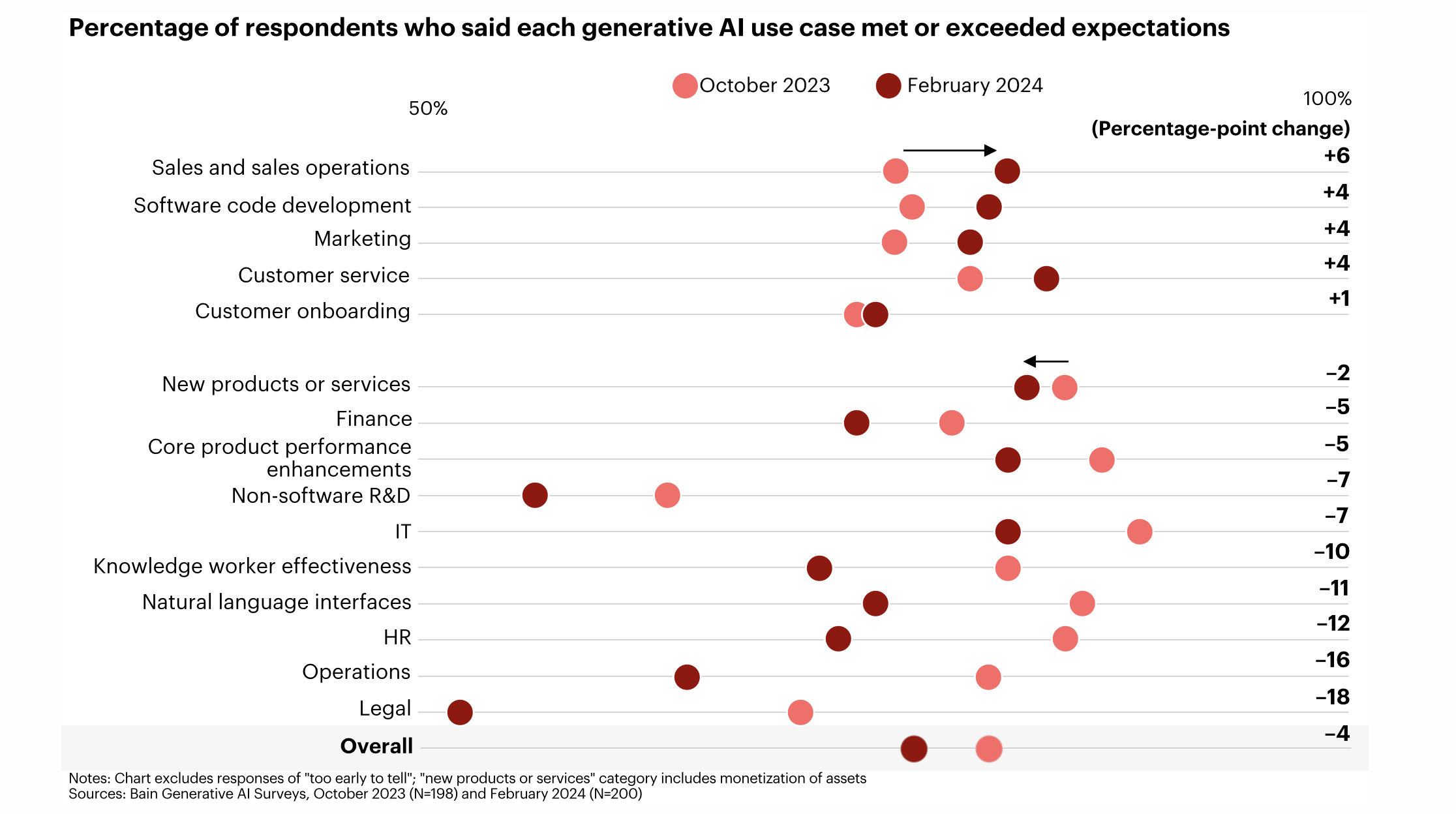

Gen AI Use-cases in Real Life

- An interesting survey from Bain shows how different functions have found Gen AI has stacked up against expectations.

- Source.

Old Maps Online

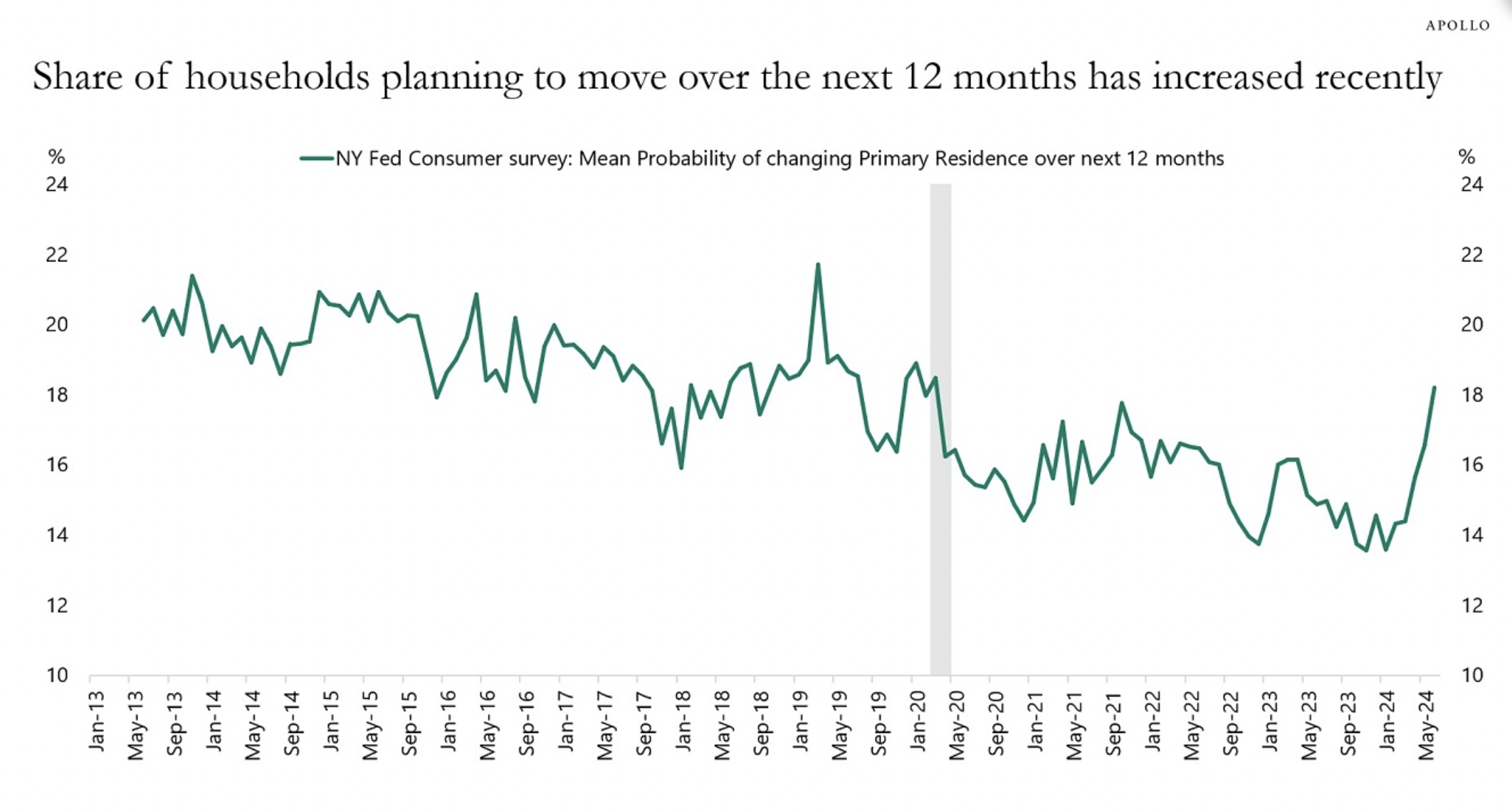

Households want to Move

- This suggests pent-up demand once mortgage rates fall.

- Source: Apollo US Housing Slide Deck.

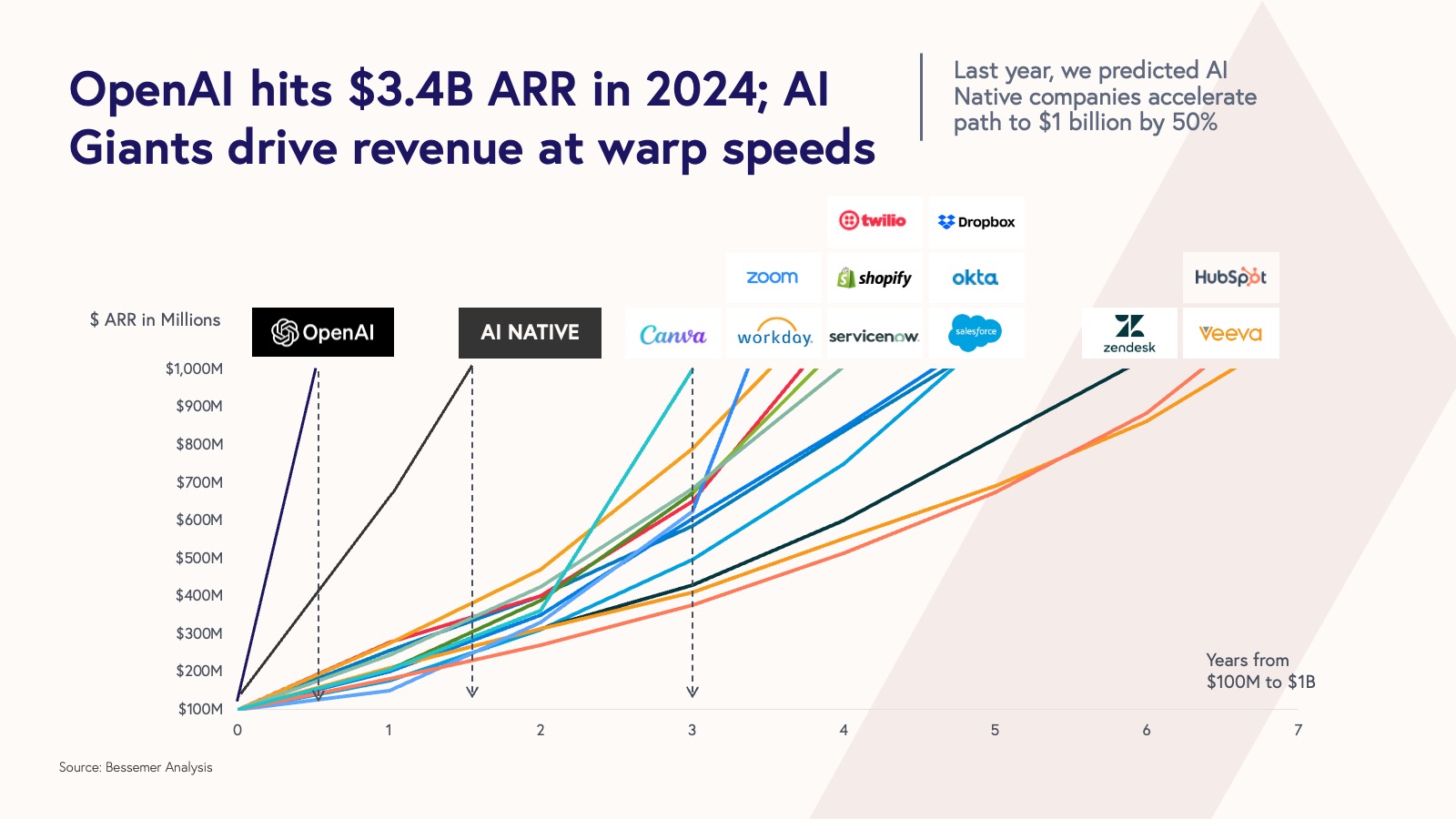

Bessemer State of the Cloud 2024

- Annual report from Bessemer Ventures, which this year is renamed State of the AI Cloud.

- This chart probably explains why AI startups are attracting all the funding.

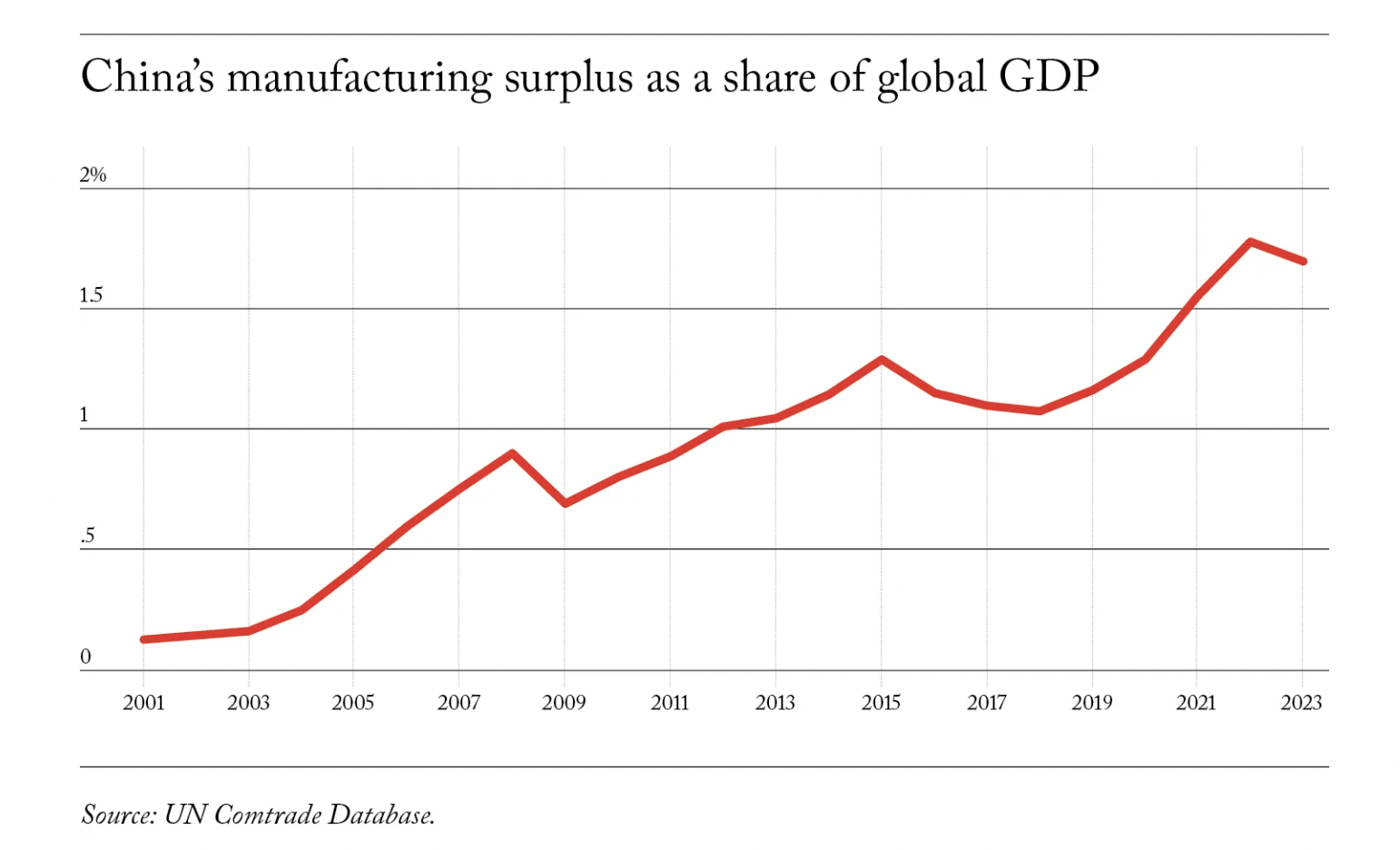

Myth of Deglobalization

- Deglobalization is a narrative that is prevailing in the press.

- Brad Setser argues that this isn’t the case.

- “China’s surplus in manufacturing has risen as much relative to world GDP in the last few years as it did during the first China shock following the country’s accession to the WTO“

- A big driver of this is the export of Chinese manufacturing into Vietnam and other countries for final export.

- “the reality is more complex: put plainly, it is impossible for a global economy characterized by a large U.S. deficit on one side and a large Chinese surplus on the other to truly fragment.“

- Corporate tax avoidance also boosts globalization – “American multinationals now often produce abroad to book large profits in offshore tax havens“.

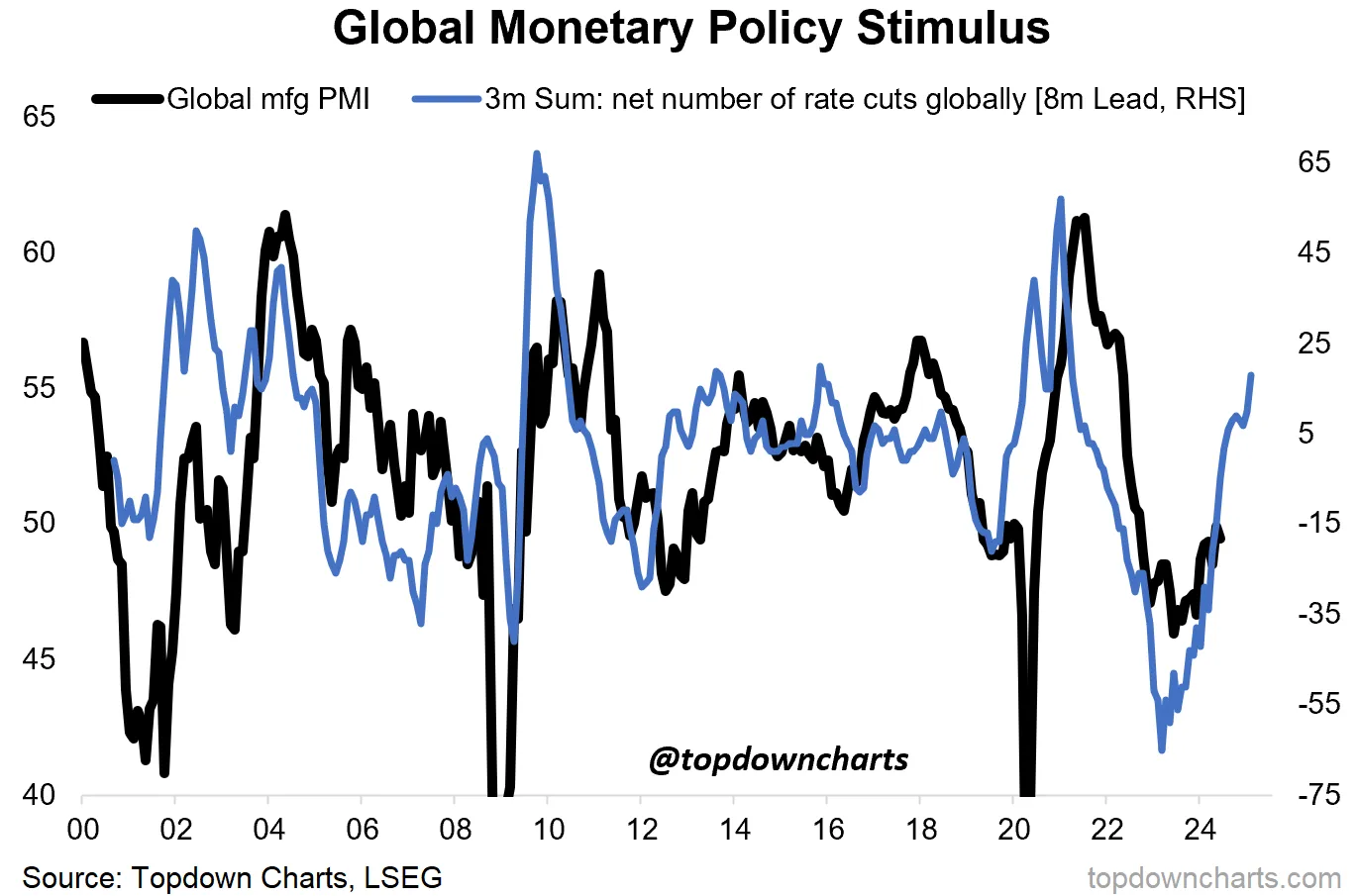

Reacceleration?

- Rate cuts lead the cycle turning.

- Source.

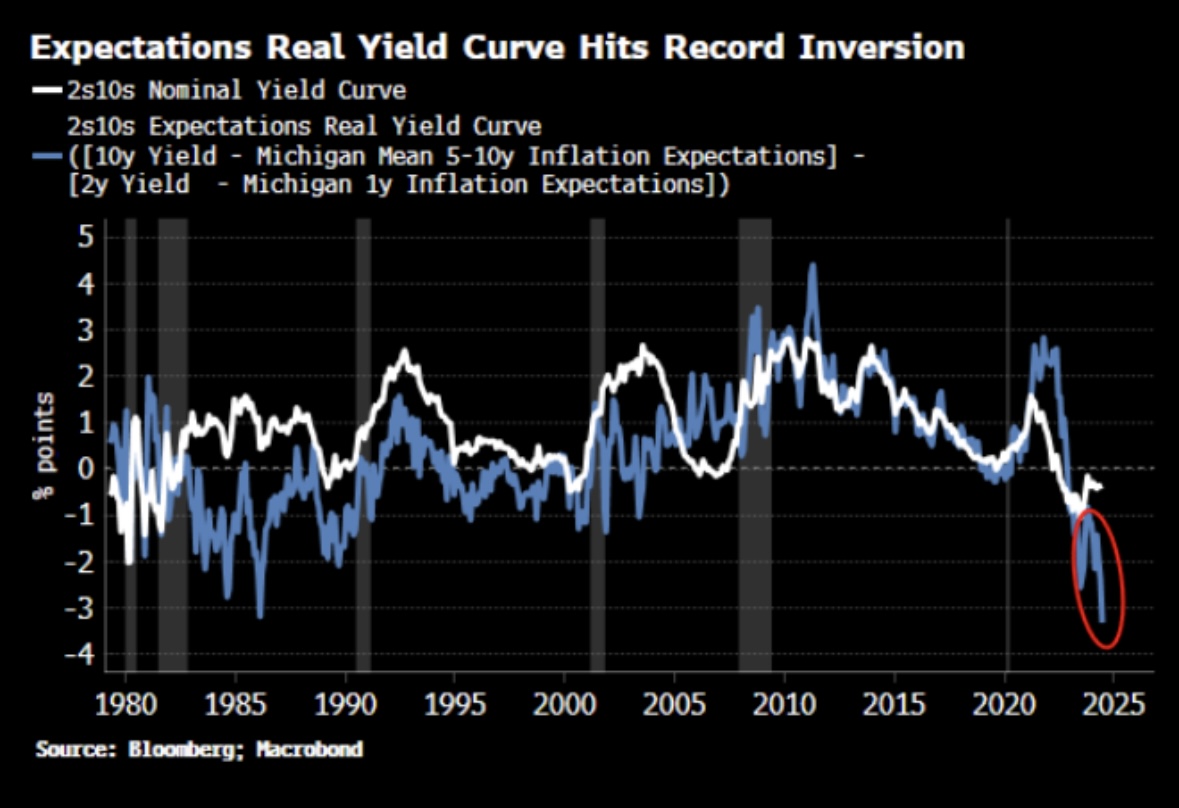

Real Yield Curve

- Deflating the yield curve by consumer price expectations shows a record inversion.

Trump Bloomberg Interview

- Important read given rising odds of US election win.

Shein and Temu – the tax loophole

- Shipping goods with a value less than $800 in the US (150 EUR in Europe) is import duty free – something Chinese firms have been taking advantage of.

- By some estimates these firms account for 30% of these de minimis shipments in the US. Most is by air freight.

- This is all about to change in the EU. Will the US follow?

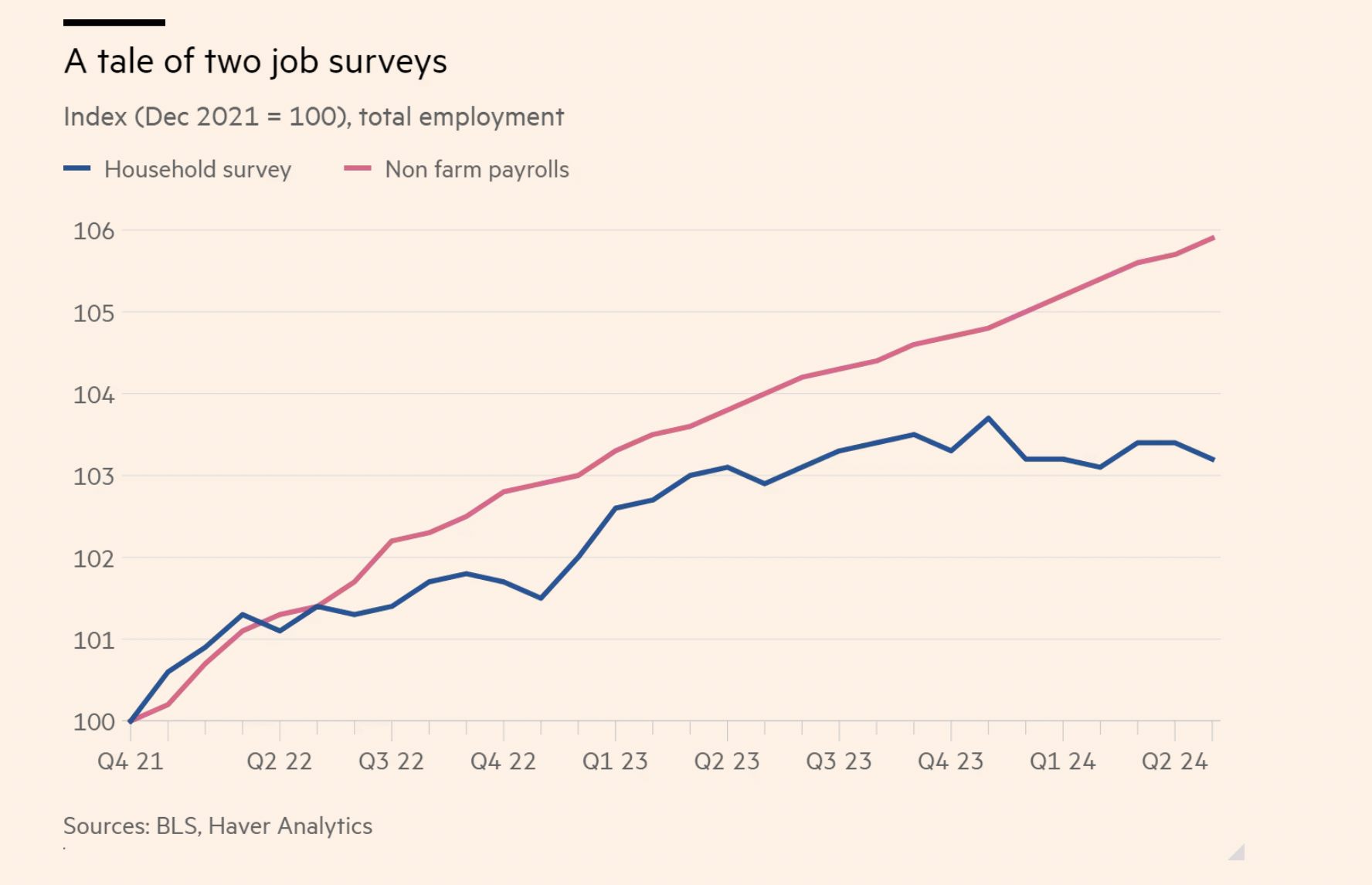

Jobs Data

- The two main US jobs surveys – the famous non-farm payrolls (establishment) and household survey – are broken.

- For one there is a stark difference in trajectory between the two.

- Response rates are also collapsing.

- “Totting it all up, ABN Amro finds that the gap between the two series is driven largely by underestimating immigration, and overestimating business births, and then definitions.“

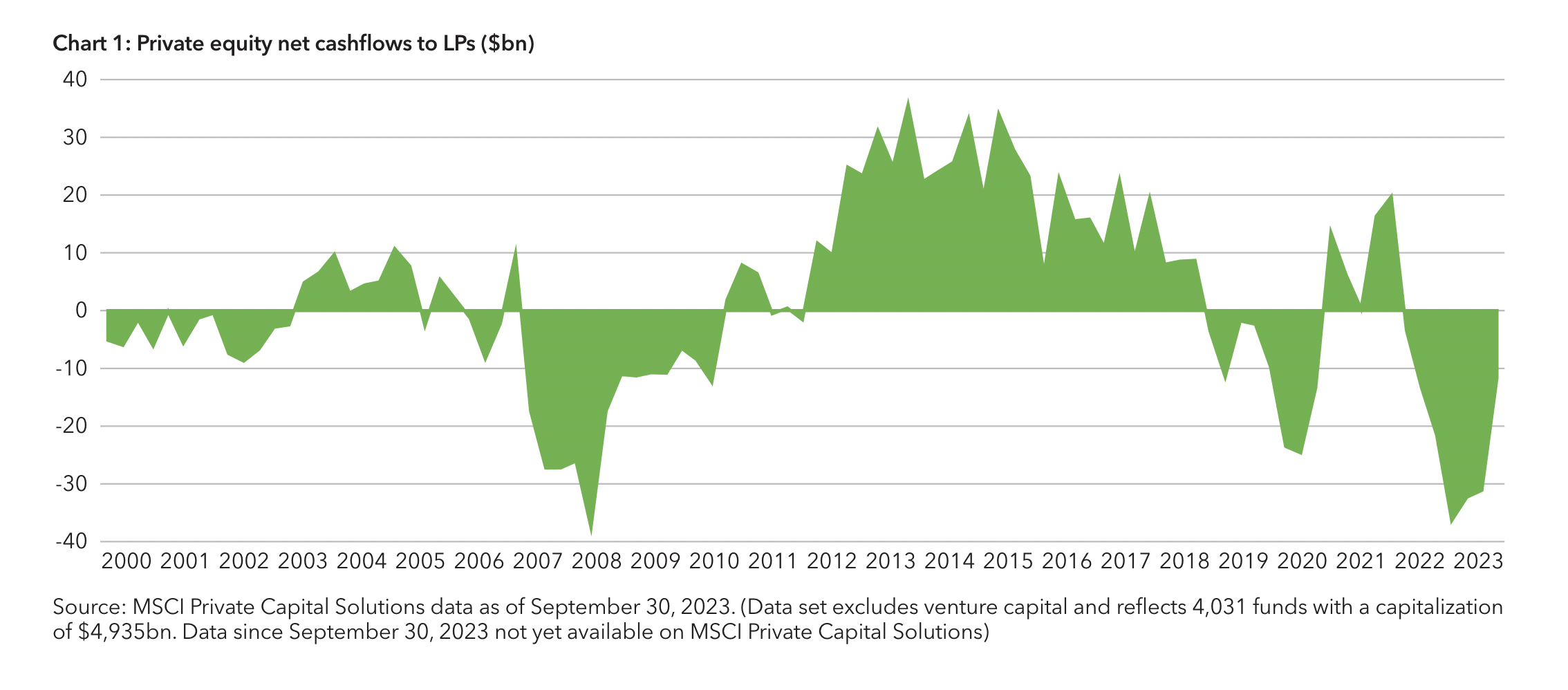

Private Equity Net Cashflows

- PE funds have called far more capital than they have distributed, almost on par with what was seen during the GFC.

- This is a serious issue for LP liquidity.

- Source.

Coatue Deck 2024

- Latest deck with some interesting charts. Usual health warning.

Failure Mindset

“Perfection is impossible. In the 1526 singles matches I played in my career, I won almost 80% of those matches. Now, I have a question for you.

What percentage of points do you think I won in those matches? Only 54%.

In other words, even top-ranked tennis players win barely more than half of the points they play. When you lose every second point on average, you learn not to dwell on every shot.

You teach yourself to think, okay, I double-faulted … it’s only a point. Okay, I came to the net, then I got passed again; it’s only a point. Even a great shot, an overhead backhand smash that ends up on ESPN’s top 10 playlist. That, too, is just a point.

And here’s why I’m telling you this. When you’re playing a point, it has to be the most important thing in the world, and it is. But when it’s behind you, It’s behind you. This mindset is really crucial because it frees you to fully commit to the next point and the next point after that, with intensity, clarity, and focus.

You want to become a master at overcoming hard moments. That is, to me, the sign of a champion. The best in the world are not the best because they win every point. It’s because they lose again and again and have learned how to deal with it. You accept it. Cry it out if you need to and force a smile.”

— Roger Federer (via FS).

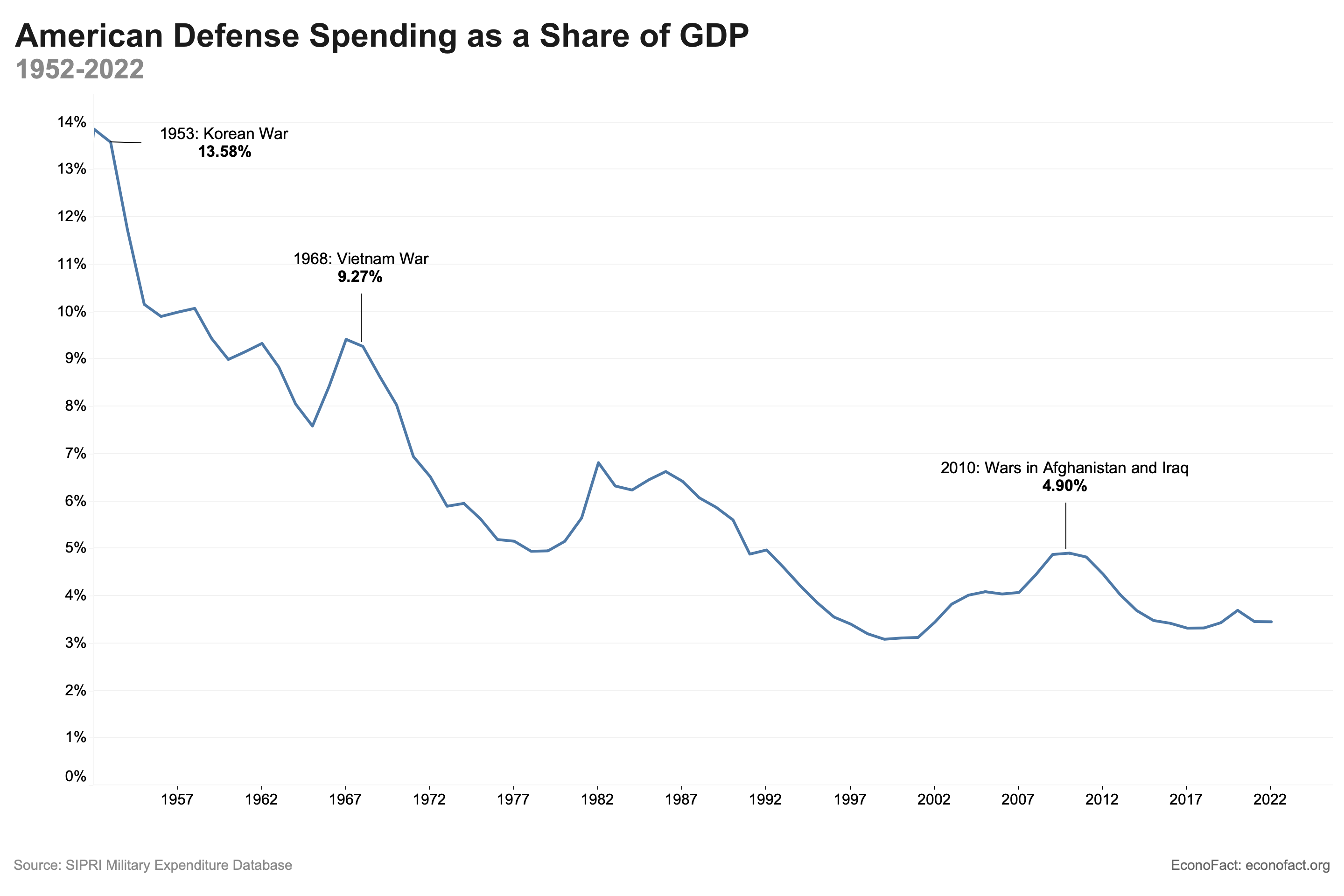

US Defense Spending

- “Current U.S. military spending is higher than at any point of the Cold War in inflation-adjusted terms, but relatively low as a percent of national income.“

- Source.

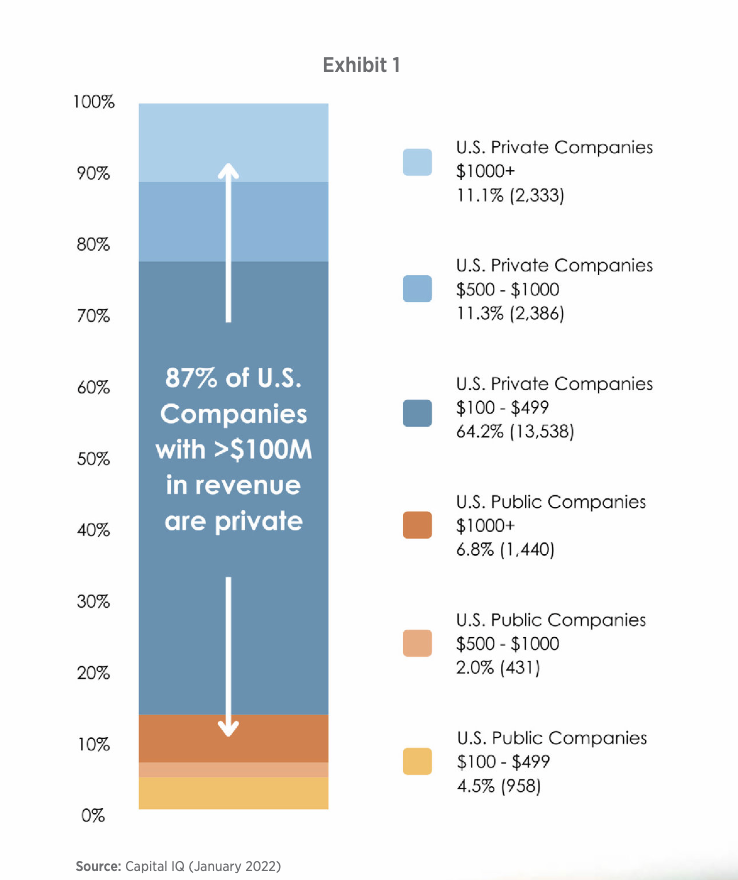

Private Companies

- 87% of companies with revenues above $100m are private.

- Source.

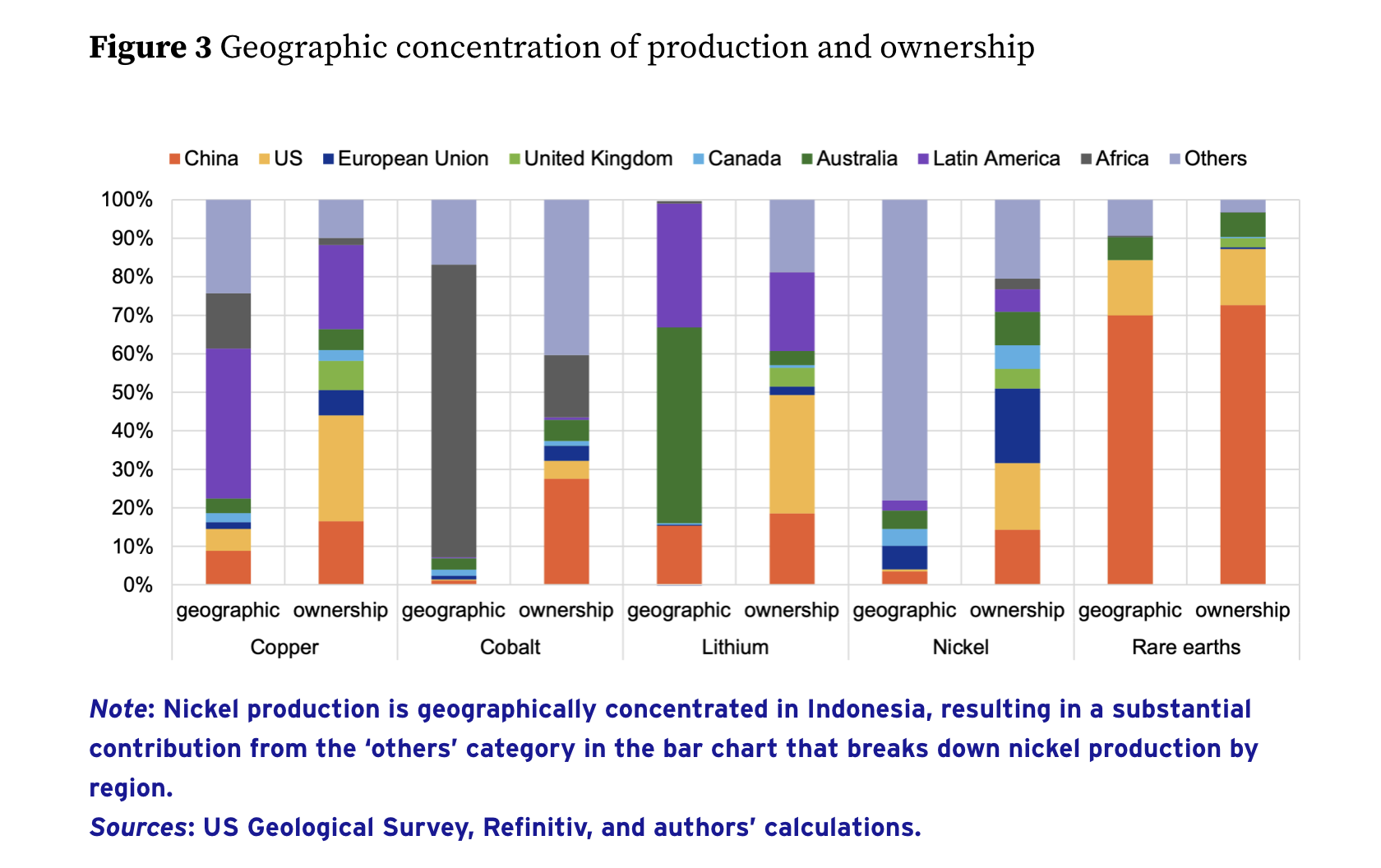

Mine Ownership

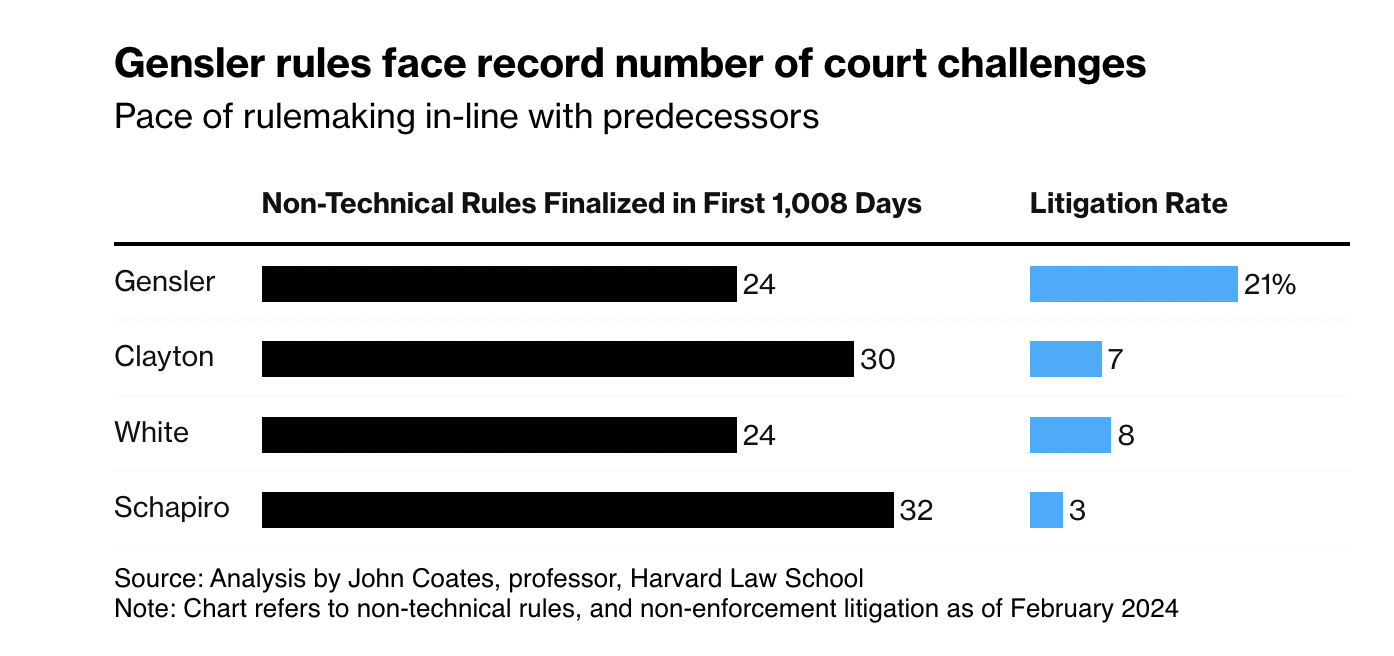

Fighting the SEC

- The SEC rulemaking has been under legal siege under Gensler – here is one reason why.

- “A recent study by Harvard Law School professor John Coates found that Wall Street has rushed to the 5th Circuit. Coates, who served as Gensler’s first general counsel at the SEC, says firms are challenging the regulator’s rules in court more often under the chair than his immediate predecessors. He said that, as of February, 80% of those challenges during Gensler’s tenure were in the 5th Circuit.“