- Interview with Schwarzman, founder of Blackstone worth a listen

- Skip the first 4 min.

- h/t The Browser.

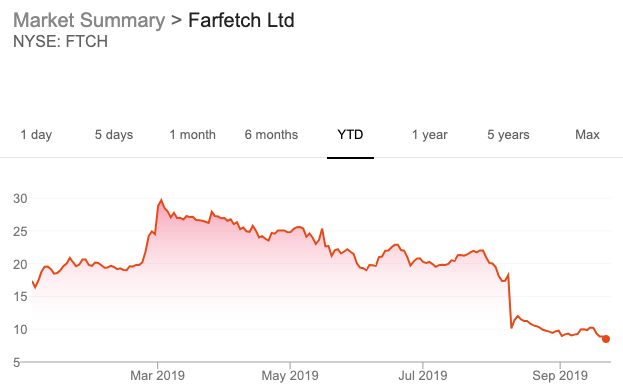

FTCH

- Shares of Farfetch (luxury online clothing retailer) have collapsed.

- Looks like a huge over-reaction to slowing GMV and an acquisition.

- In fact, GMV only slowed a tiny bit and the deal looks interesting (a vertical integration).

- More concerning is the departure of the COO (online retail is an operationally heavy business).

- FTCH trades below 1x GMV – attractive if 40%+ growth can continue.

Common Sense Disclaimer. We plan to ponder about stocks and other investments here on Snippet. Some will look attractive and some we might recommend. Some we are buying/own ourselves (always disclosed). You should always do your own work, use common sense and invest responsibly!

Immigration Economics

- Ever find yourself in an argument about immigration.

- This great article lays out, in considerable detail and with supporting evidence, the economic effects of immigration.

Private Equity

- Last week shares in private equity firm EQT saw a 25% pop on the first day of trading.

- Interesting to see private equity listing again – something that marked the top of the last cycle (except Carlyle/Oaktree both listing in 2012).

- EQT raised 5.3bn SEK of new money and 13.5bn of sales by shareholders – a telling sign.

- In the meantime over the last year the existing listed players have also started to convert their shares from limited partnerships to common stock – widening investor bases.

Zero-click Searches

- June was a milestone.

- For the first time, since the advent of the modern search engine, more than 50% of Google searches resulted in zero-clicks.

- In other words, people searched on google and didn’t click on an ad or an organic search result.

- This trend has been steadily building and has profound implications for businesses around the world.

How do people get new ideas?

- In 1959 a scientist asks Isaac Asimov to join a project to develop the most creative approach possible to a ballistic missile defence system.

- Asimov eventually declines, but leaves one contribution – a wonderful essay on creativity.

- Full of lessons that can be applied to investment meetings. Such as:

- Meet in a relaxed place.

- Meetings shouldn’t always involve the same people.

- No more than 5 people per meeting.

- Try not to link pay to generating ideas – instead link it to executing ideas/tasks.

Pressure Point Theory

- Often peak noise tends to lag the underlying trend that caused it.

- Worse the trend is often already receding when noise picks up.

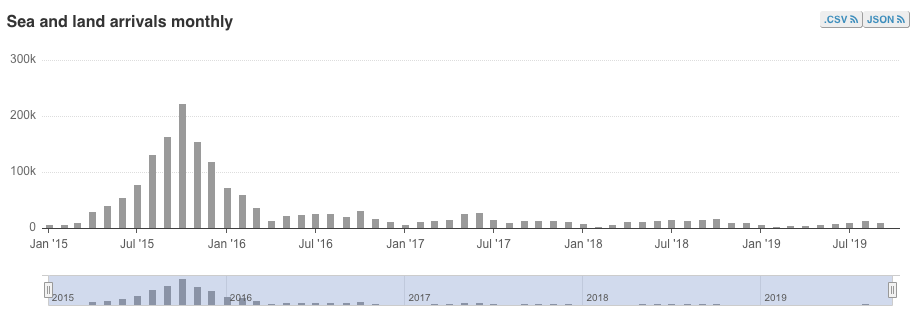

- A great example is the refugee situation in the EU.

- This is a chart (source: UN) of arrivals into Europe by land and sea.

- Although the numbers peaked in the autumn of 2015 the noise still continues.

- This is important for investing – next time you find yourself pondering noisy news flow, ask yourself – what is the data saying? What is the underlying trend doing?

How things change

Google Trends

- Google Trends data is very useful for analysis.

- You can plot search traffic over time or compare search terms.

- Traffic is indexed (hit the ? next to “interest over time” for details).

- Worth playing around with this to see if it is useful in your analysis.

Help to Buy

- It took the government 30 pages to come to the conclusion that was obvious from the start of the program.

- “Help to Buy was originally intended as a short-lived scheme but will now last for 10 years and consume over 8 times its original budget, yet the value achieved from its extension is uncertain.”

- “Around three-fifths of buyers who took part in the scheme did not need its support to buy a property, and the large sums of money tied up could have been spent in different ways to address a wider set of housing priorities and focus more on those most in need.”

Spaced Repetition

- Ever wonder what the most efficient way to learn something is?

- This fascinating piece argues that the best approach for long term memory retention and learning is spaced active repetition.

- The idea is to actively (i.e. asking a question) recall information at ever increasing intervals, using software to help timing.

- As the chart below shows – cramming (massed repetition) works well in the short run but for the long run spaced repetition wins.

Boeing

- A fascinating article on Boeing and where it all went wrong.

- In 1997 Boeing was pushed to merge with MacDonnell Douglass.

- This turned into a reverse take-over – “McDonnell Douglas bought Boeing with Boeing’s money” – corrupting the engineering-first culture.

- The results of this are only now being felt.

- It is important to always look at the long-term history of a company.

- There is an even longer read on the topic over at The New Republic.

Iran vs. Saudi

- Sabres are once again rattling in the Middle East.

- We are reminded of an excellent piece comparing the current situation to that of the 30 years war in Europe.

- Historical analogies have limitations but can be useful.

- After all, “History doesn’t repeat but it often rhymes” Mark Twain.

Gold Miners

- Despite the gold price at a six year high, miners are showing restraint at the latest industry conference, preferring mergers instead.

- “A general theme of this conference has been the need to maintain discipline” CEO of Agnico Eagle Mines.

- This should be taken as a positive (looking past the fact that gold isn’t actually ever consumed).

- Read about it here.

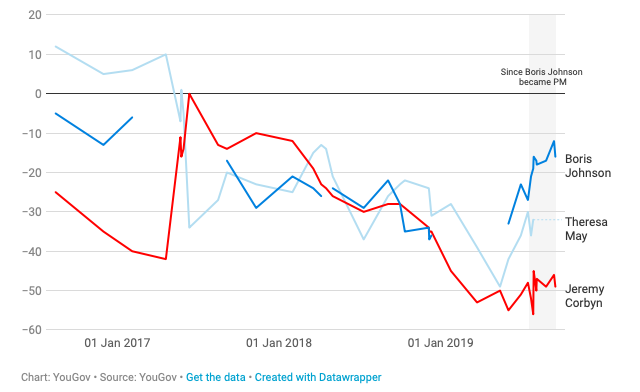

Boris

- YouGov latest paradoxically finds that despite the difficulties faced by the prime minister since taking office his popularity has grown.

Consumer vs. Industrial

- “…we still see consumer spending really strong ….the consumer continues to be strong so the caution that we see is really on the commercial side…So the consumer, despite the headlines we all get up and read every day, looks pretty good.” American Express CFO.

- “…you are starting to see some places where the slowing is beginning to hit and I mentioned Germany as an example for Europe. But the channel slowness that we have seen in a few places does definitely continue… I think, as we look out, I think there’s going to be continued cloud for some time.” Honeywell CFO.

- Interesting contrast between these two companies, suggesting consumers are doing well while there is clearly slowing in the industrial economy.

- h/t The Transcript

Disney & Twitter

- Turns out Iger considered buying Twitter but decided against it.

- “The troubles were greater than I wanted to take on, greater than I thought it was responsible for us to take on. There were Disney brand issues, the whole impact of technology on society. The nastiness is extraordinary.”

- Full Interview in the NYT coinciding with the release of his memoire.

Hedge Fund Letters

- We have recently discovered this site.

- They have a big store of the latest investment letters from all the hedge funds.

- Naturally stay tuned for interesting snippets as we trawl through these.

- However, if you can’t wait we thought we would share it for our readers to dig themselves.

- Common sense disclaimer. Just because a big hedge fund is buying a stock doesn’t mean you should. One never knows what offsetting hedges or positions they hold. Be smart, do your own work, use common sense and invest responsibly.

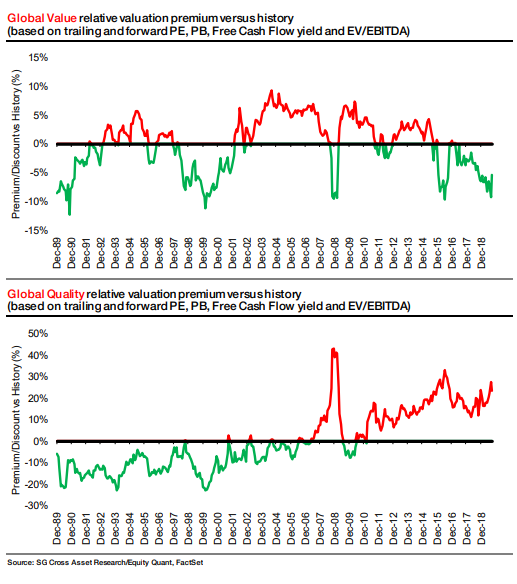

Value vs. Quality

- Markets have a tendency to push prices further than anyone thinks.

- As Keynes said “The market can stay irrational longer than you can stay solvent”.

- Markets also have a tendency to snap back against trends – often violently.

- A painful example of this has been value stocks.

- The last few years have seen value stocks underperform strongly while quality has been relentlessly bid up.

- This has cost many value investors, including some titans of the industry, as the trend persisted and persisted.

- The last two weeks have been an example of a violent reversal.

- On a long-term valuation chart (below) it looks like a blip – the valuation dislocation built up over the last many years is still present.

- Is it the start of a trend or just a counter trend move?

- h/t Soc Gen Research via FT Alphaville.

Great Ideas

- Something to think about in relation to investing. Original ideas.

- “Coming up with a genuinely original idea is a rare skill, much harder than judging ideas is. Somebody who comes up with one good original idea (plus ninety-nine really stupid cringeworthy takes) is a better use of your reading time than somebody who reliably never gets anything too wrong, but never says anything you find new or surprising.”

- From a good article.