Skip to content

Interesting chart showing the performance of three buckets of S&P 500 based on their use of capital since December 2017. Suggests the stock market hasn’t rewarded reinvestment.

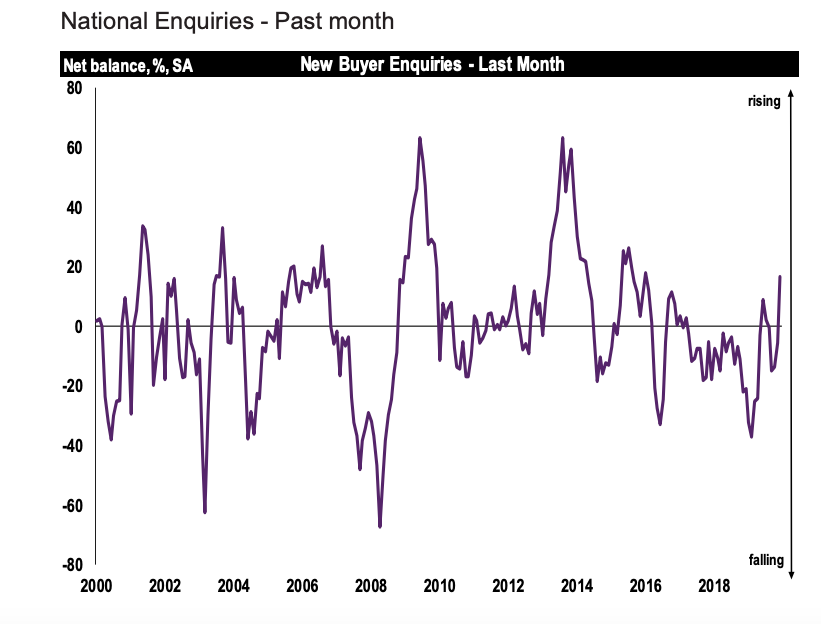

December post-election RICS survey was rather positive. JPM write via Alphaville – The RICS survey, which was post election, “showed a marked and regionally broad-based improvement in its forward looking questions,” says JP Morgan Cazenove. “The expected prices balance leapt from 1 to 23, expected sales shot up from 13 to 31 and new buyer enquiries surged from -5 to 17. These are comfortably the highest levels reported since before the referendum and, in one reading, have swung from below to above their long-run averages. ” Full charts in the link .

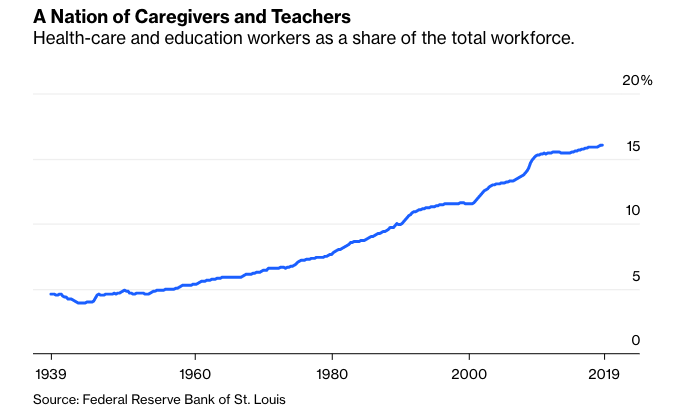

Rather staggering growth in the % of the US economy dedicated to healthcare and education. These two activities account for 15% of jobs.

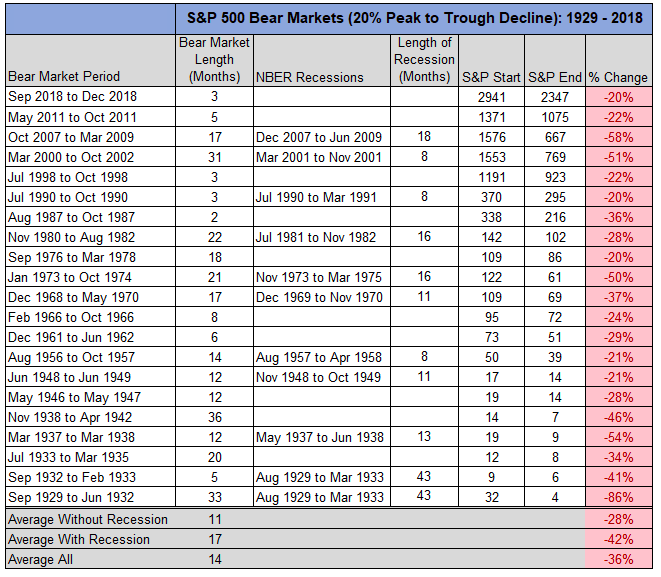

Nice table showing all the US stock bear markets since 1929. 11 without economic recessions and 17, more severe bear markets, with recessions.

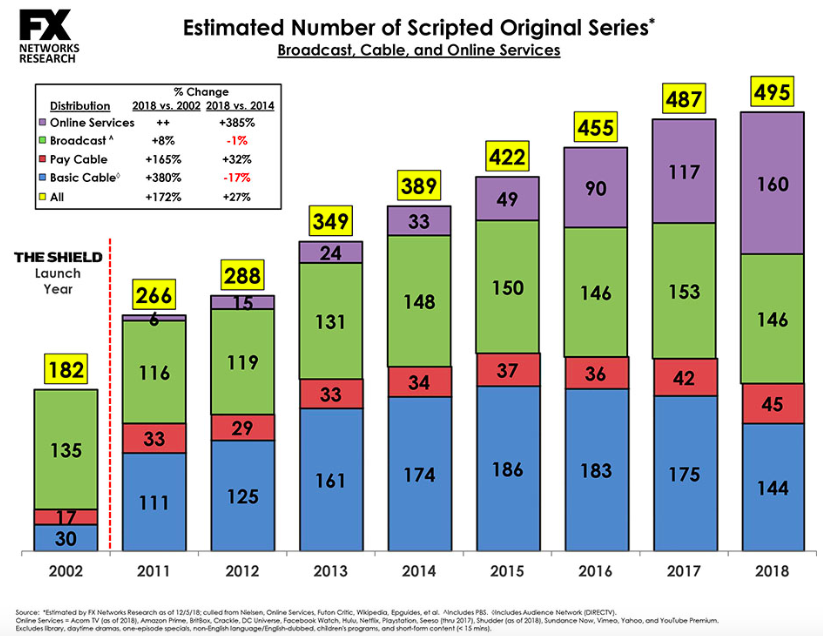

Original scripted series hit a new record in 2019 of 532. Growth was 7% this year, up from 1.6% in 2018 which was a previous record of 495 shows. The charts is from 2018 – showing massive growth in online – FX have stopped producing the split.

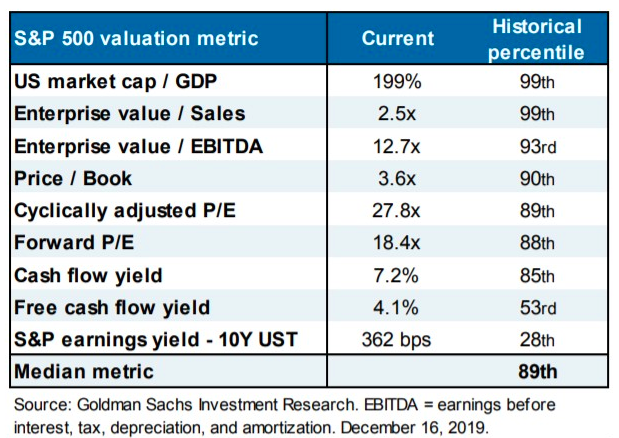

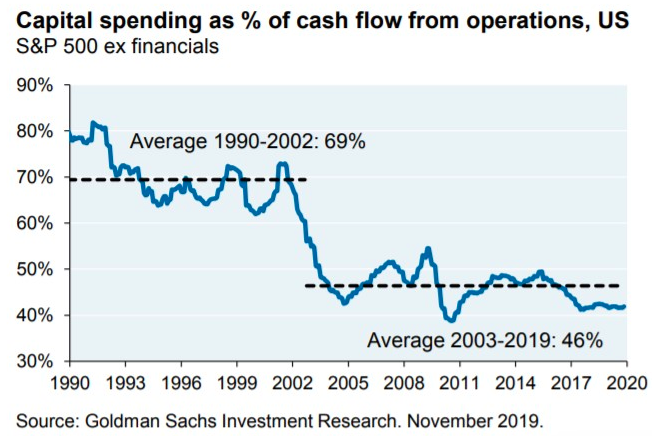

On every measure valuation in the US Stock market is towards to top of historic ranges. The stand out is Free Cash Flow yield. However, as we saw here , capital spending has reset structurally lower which explains this discrepancy.

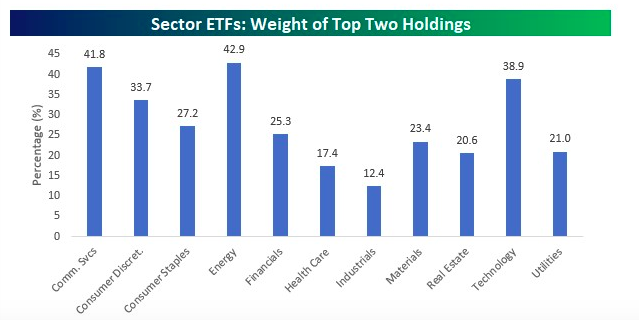

Table showing weight of top two holdings of sector ETFs. Amazingly 3 ETFs have two holdings account for ca. 40% of the assets.

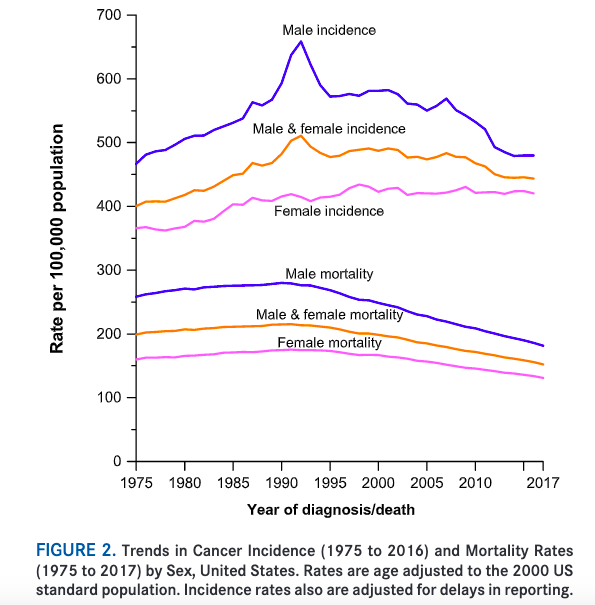

New stats from the US Cancer Society show that between 1991 and 2017 the mortality rate of cancer has dropped 29%. According to the report, this was due to lower smoking rates, improved early detection methods and advances in treatment. This trend means more than 2.9m lives were saved since 1991. Really amazing.

Capital expenditure in the US looks to have moved structurally lower (as a % of cash flow) in the early 2000s and remains so to this day.

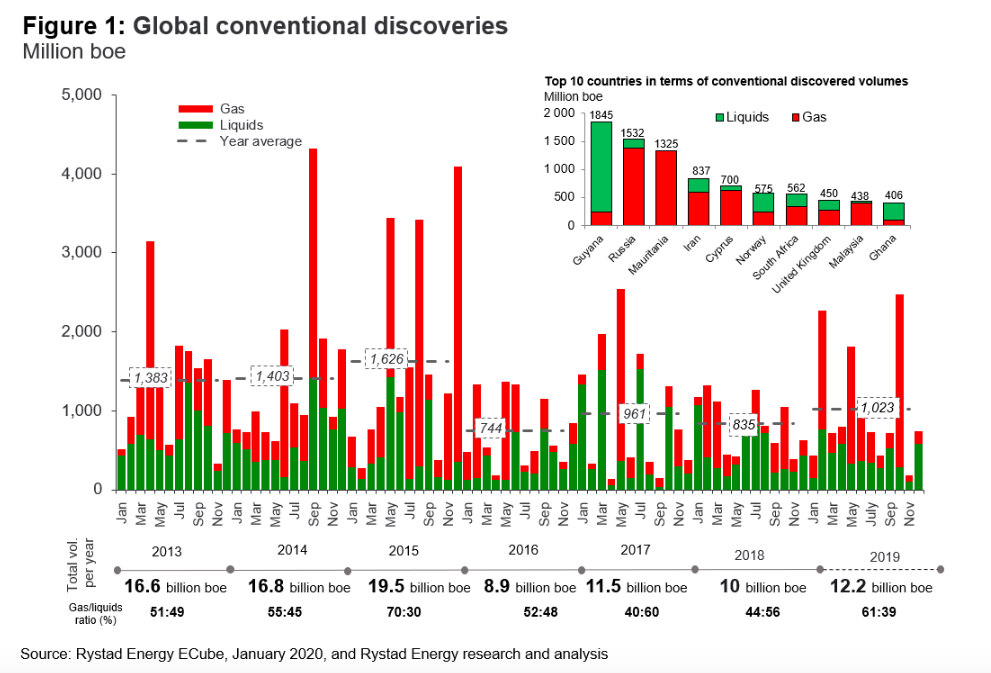

Oil discoveries in 2019 were at a four-year high (Rystad Energy ). There were 26 discoveries of more than 100 million barrels of oil equivalent (boe). Exxon (XOM) was explorer of the year for a second year adding 1bn boe driven by discoveries in Guyana.

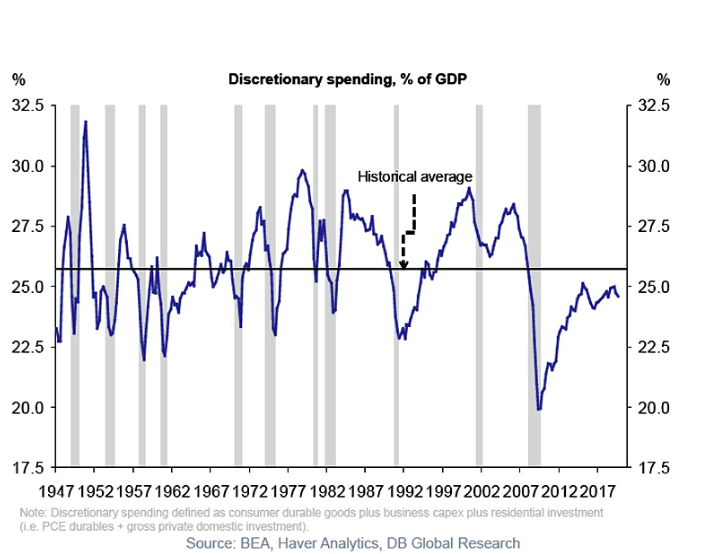

Discretionary Spending as % of GDP for this expansion is still below historic average.

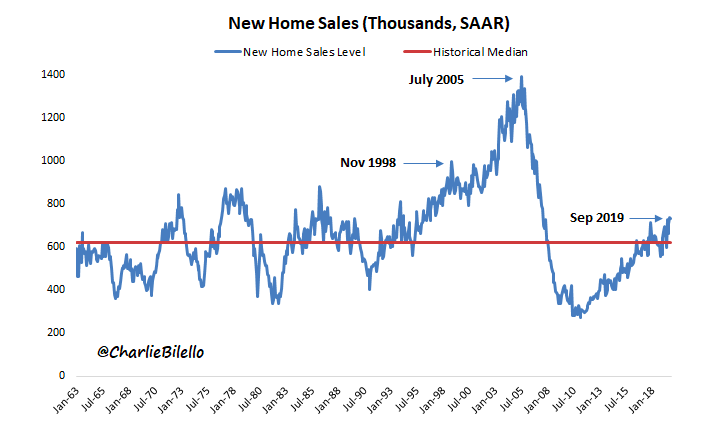

New home sales data shows little exuberance.

Dotdash , a business created by IAC from the remnants of About.com, is a very interesting business you probably haven’t heard about. It reaches 100m monthly users, is profitable ($40m of EBITDA) and growing. It is also unique event in digital media – a turnaround. “Our job is to make great content that loads quickly with relevant non-intrusive advertising,” he insists. “If we execute, the search results will be fine.” His critics call this naive, but Vogel is trying to build a billion-dollar publishing business, not a search colossus. He’s betting that Google will drive traffic to the best content.

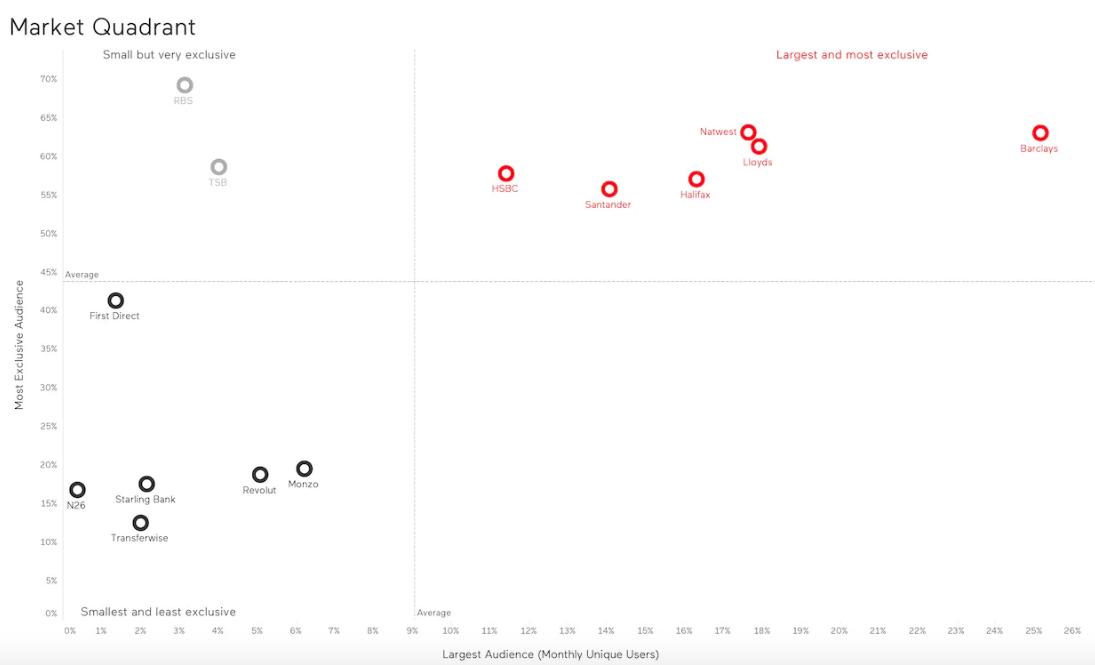

Interesting chart from Alphaville . This is analysis from the behaviour of 688,000 mobile banking users for 3 months of 2019. The x-axis shows the proportion of people who use each of the major banking apps at least once a month. The y-axis shows the proportion of those people that use that banking app exclusively. It suggests that high street banks not only have the highest share of mobile app usage, but also a far more loyal base of users. Lots of further interesting stats inside the article .

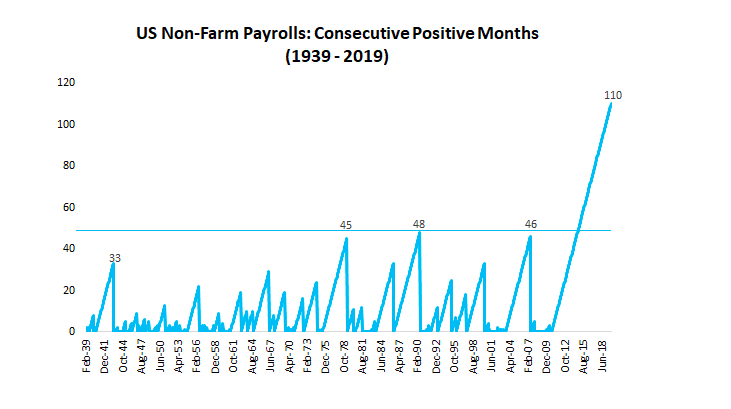

Another way to visualise the length of the recent expansion – number of months of consecutive positive payrolls.

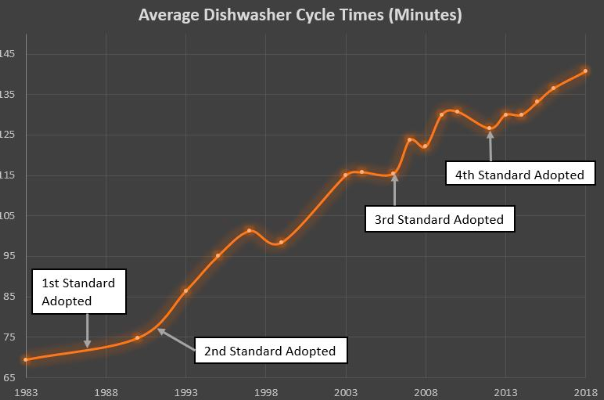

Interesting article about what has been going on with dishwashers. In summary they have gotten a lot worse. In order to reduce water use from the original 15 gallons to 3 gallons, cycle times have increased. The chart (source ) is striking. The wash results have also gotten a lot worse due to chemical regulation. Consumers think that by buying a newer model these problems will be solved but the reality is that an older model will do a better job.

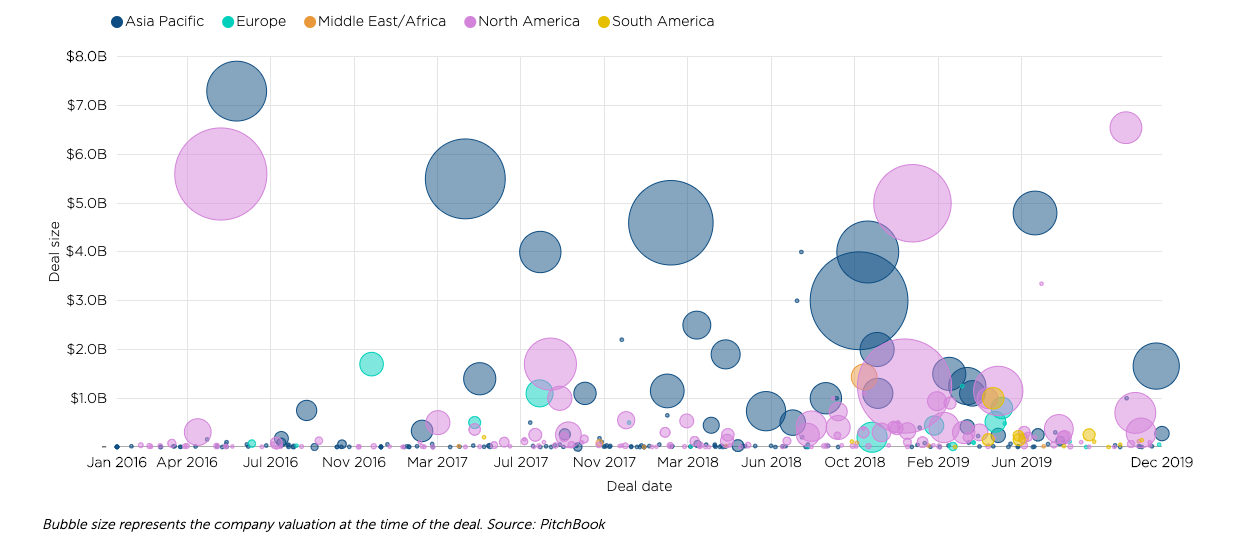

Despite set backs in 2019 Softbank continues to invest heavily. The chart shows investments by country and size to date. Although reports are coming in that they have walked away from deals despite originally citing just delays in completion.

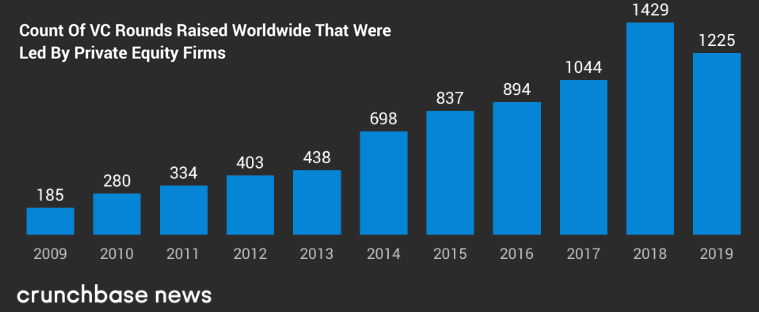

Increasingly private equity (PE) are getting involved in venture (VC).

We have written before about Iran here . This is a really interesting article on Operation Ajax . It involves the 1953 overthrow of a democratically elected prime minister in Iran by the US and UK.

WordPress Cookie Notice by Real Cookie Banner