Skip to content

Equities often continue to rise after a major bottom in global PMIs.

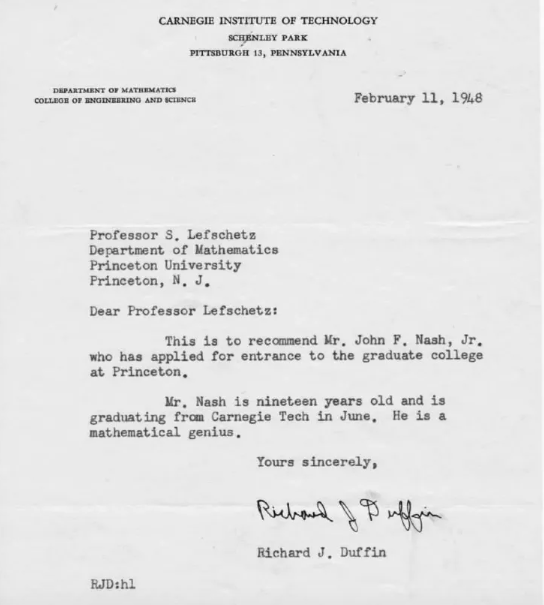

Interesting piece by Cliff Asness of AQR on the value factor. Valuation of value stocks (the cheapest ones) are near historic levels against the most expensive stocks on several measures – suggesting now might be a good time to invest in this factor. This chart shows the price to book ratio of the expensive 30% of stocks divided by this ratio for the cheapest 30%, adjusted for industry. The spread is now in 97th %ile of the ex-tech bubble range.

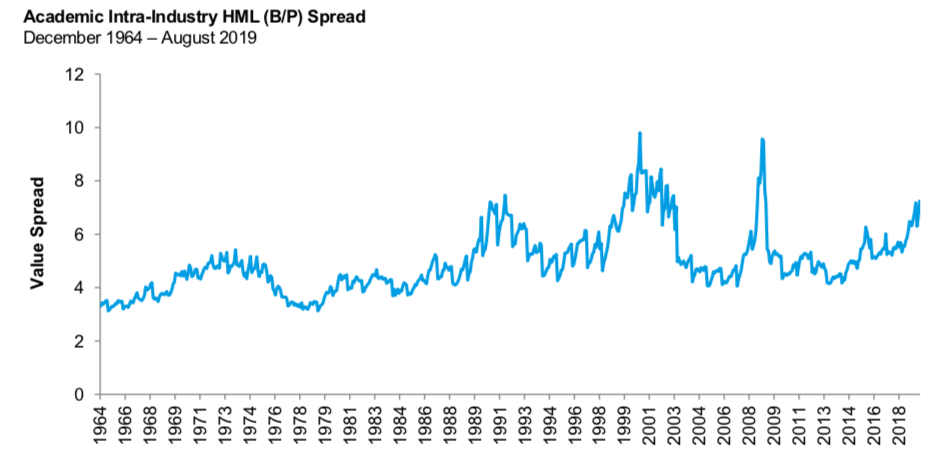

5th consecutive year of Hedge Funds closing. We previously wrote about lack of overall fund launches.

Fascinating read about one of the early backers of Silicon Valley. Roger McNamee first ran the T-Rowe Price Science and Tech Fund from 1989 and then co-founded private equity firm Silver Lake Partners. He has now turned a critic of big tech that he backed early on.

George Magnus long article on China in 2020 and beyond. “China is certain to experience slower economic growth in the years ahead, but the bigger surprise may be that, in US dollar terms, this narrative could be a factoid because of a fault-line that leads to a precipitous fall in the Yuan. “

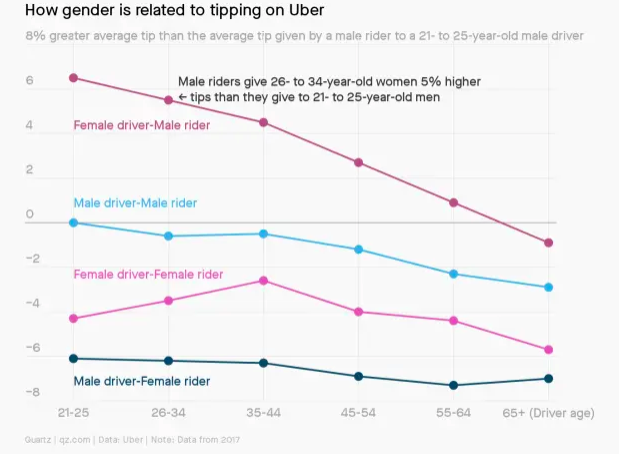

Study of 40 million rides on Uber and tipping behaviour. Summary – 60% of people never tip and only 1% of people always tip. Gender differences are clear as is seen in this chart – young male riders tip young female drivers most.

Venture backed businesses are increasingly pivoting towards taking more principal risk and moving away from acting as brokers. Latest example is Leavy , an Airbnb copy-cat, who are guaranteeing payments for your apartment holiday rental upfront. The real estate sector has seen this already – with companies offering to buy your home directly. As is discussed here this type of model leads to better margins in good times, but is a lot riskier. It feels like late cycle behaviour.

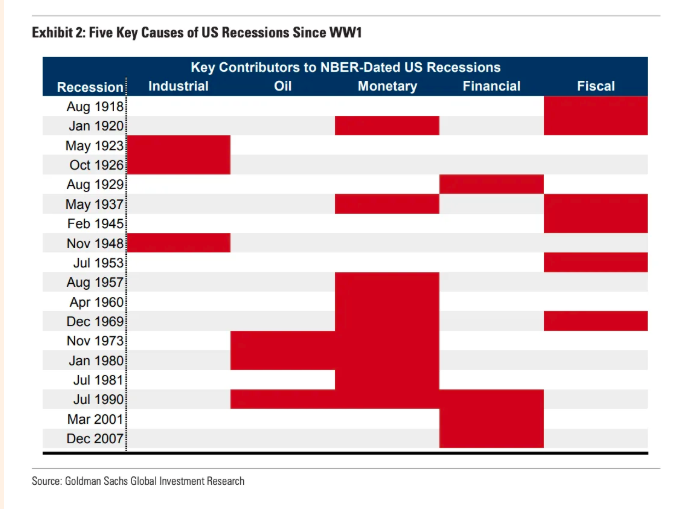

Great table from GS Research showing the main causes of US Recessions since World War I. “A review of the last century of US recessions highlights five major causes: industrial shocks and inventory imbalances; oil shocks; inflationary overheating that leads to aggressive rate hikes; financial imbalances and asset price crashes; and fiscal tightening.”

It is always important in investing to learn from failure. The verge have produced a list of 84 of the last decade’s tech failures. Enjoy and learn!

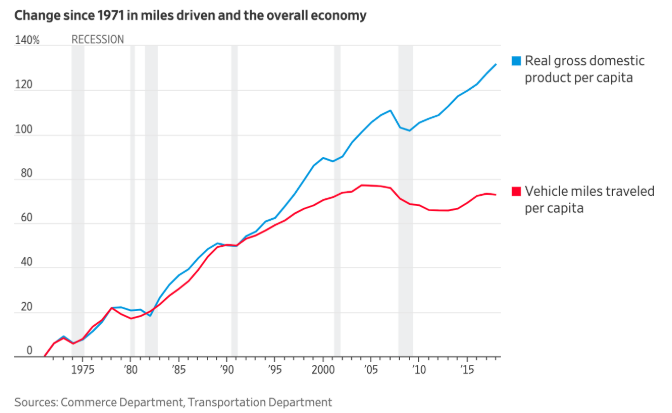

Miles driven used to match economic growth but this started to diverge since the 1990s in the US.

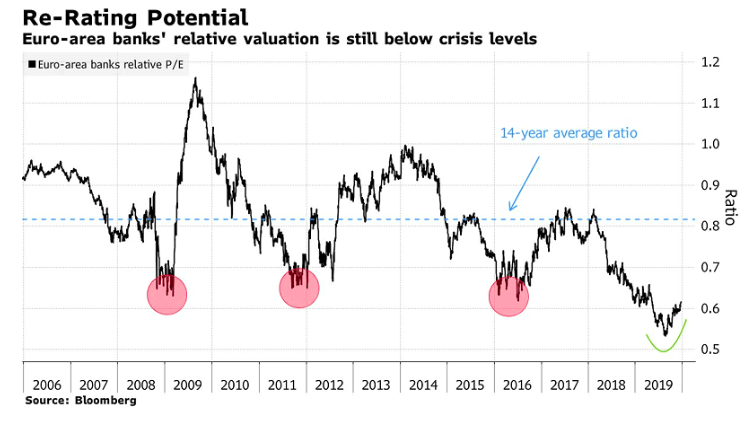

EU bank relative valuation is still below crisis levels. The banks are taking action by cutting costs . Banks are cutting 77,780 jobs this year the most since 2015. 82% of these cuts are originating from European banks with Deutsche bank topping the list with 18,000 through 2022.

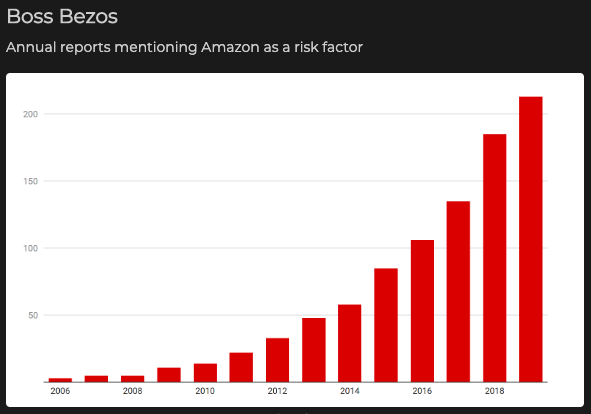

Big read on Amazon from the New Yorker. Worth a read, as Amazon, now the second largest employer in the US, touches more and more companies. This chart shows the growing number of companies mentioning Amazon as a competitive threat in their annual report.

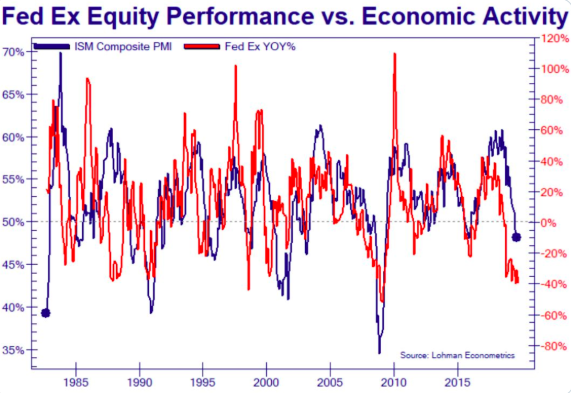

Fedex stock slightly leads/is coincident with the ISM composite. If you think ISM is heading up you should probably be buying Fedex. NB there are non-macroeconomic issues that one needs to consider.

A series of the most popular snippets of 2019 The cost declines of renewable energy compared to conventional energy generation has started to flat line. Real assets are at an all-time low against financial assets. Tech change is exponential. Fertility rates by education is a shocking stat.

Good interview with the always interesting Stanley Druckenmiller . Druckenmiller managed money for George Soros between 1988 – 2000 and was closely involved with the latter’s famous hedge fund bets . He discussed monetary policy and the upcoming US election.

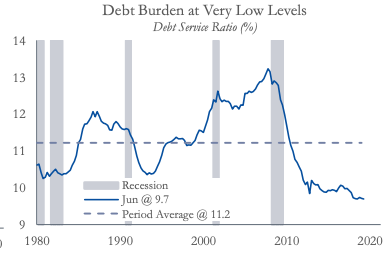

US household debt burden is at very low levels.

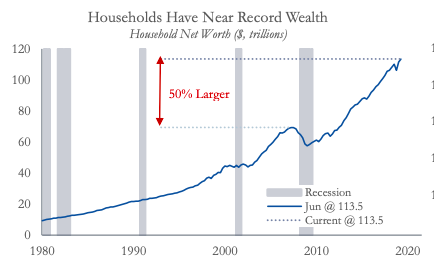

US household wealth is at record levels up 50% since the last peak.

WordPress Cookie Notice by Real Cookie Banner