Skip to content

In 2008 Bessemer Venture Partners published the famous 10 laws of cloud computing. They have now come up with an updated version after having invested in over 200 such companies. Worth keeping an eye on these if you are invested in cloud stocks.

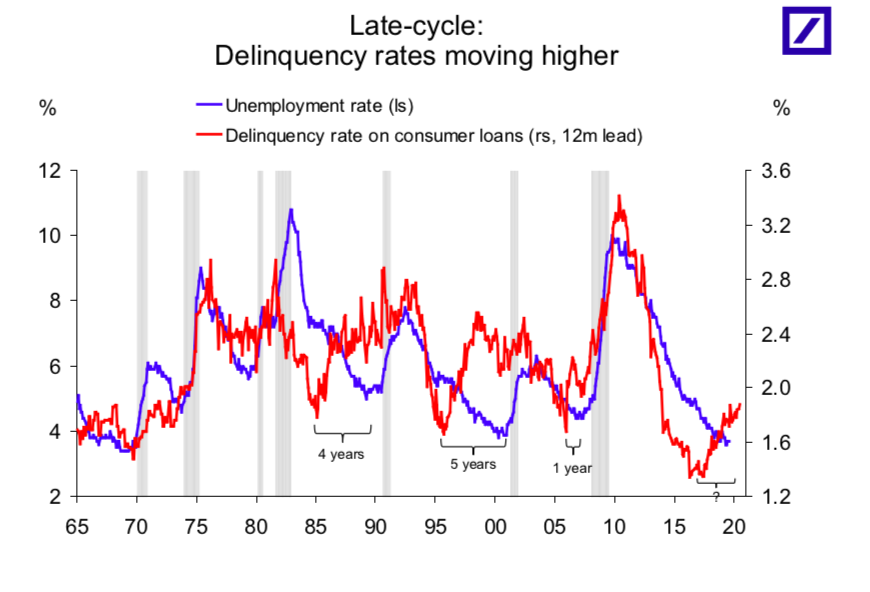

Interesting to see Consumer Loan delinquencies rising. Consumer loans consist of eight loan types including automobiles. Credit card delinquencies have been better behaved.

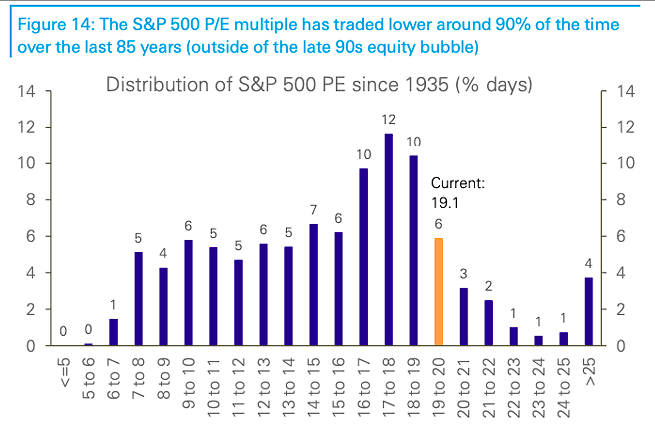

Interesting chart showing distribution of S&P 500 P/E since 1935. The distribution is % of days S&P P/E spends in a particular range. Around 90% of the time the S&P has been cheaper.

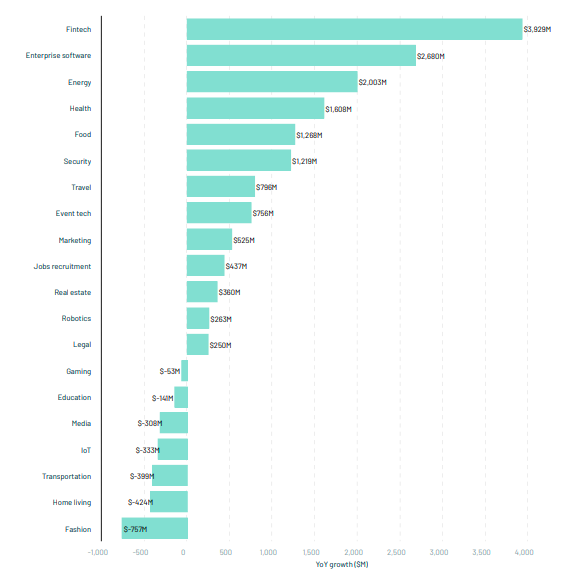

Interesting chart showing year on year change in Venture Capital investing by sector in Europe 2019 vs. 2018. This is useful to track for equity market investors – it shows you where capital is being added. Fintech, Enterprise Software and Energy are top additions, while Fashion, Home living and Transport seeing less money going in.

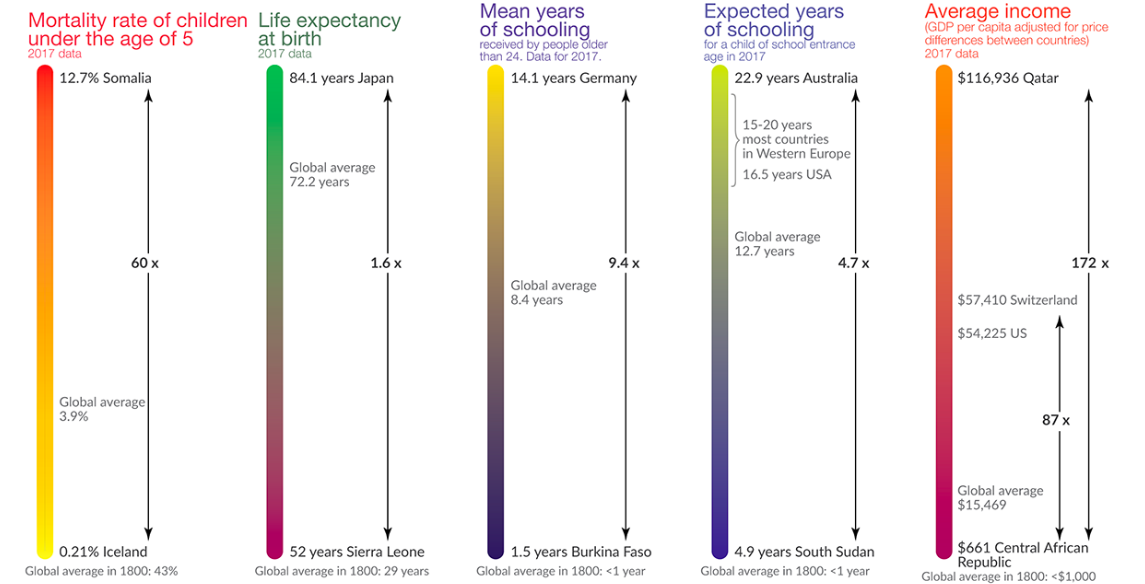

Charts shows the distribution of countries by various statistics. Interesting to see who is top and bottom – try guess before you look. The categories are – Mortality rate of children under the age of 5, life expectancy, mean years of schooling, expected years of schooling, average income.

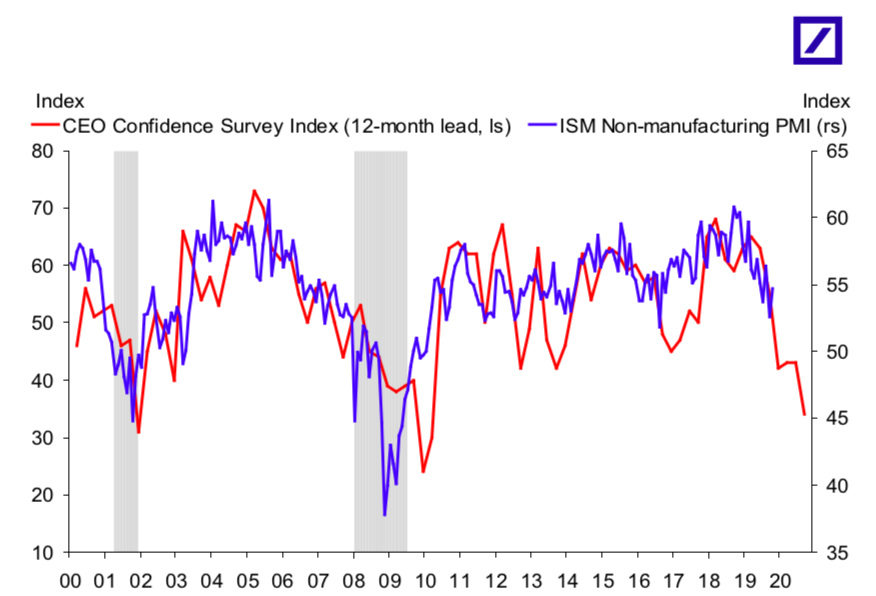

CEO confidence has about a 12 month lead on ISM. The correlation is not perfect but suggests PMIs won’t recover just yet.

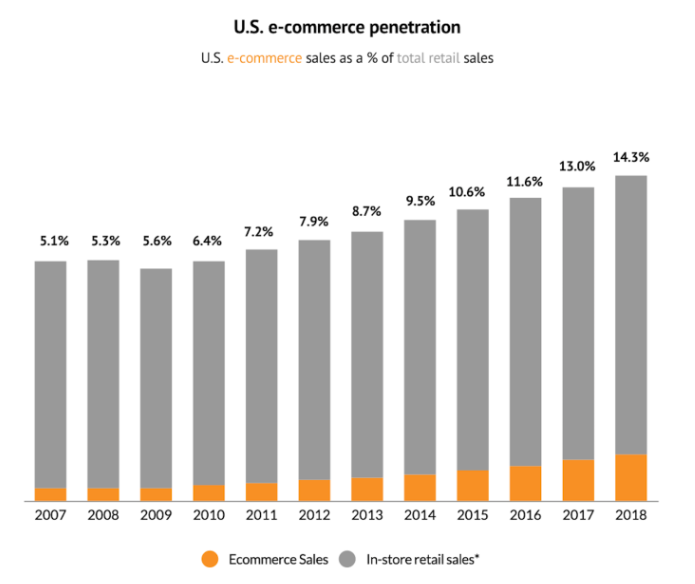

There is a lot of press about eCommerce in the US. Yet staggeringly only 14% of US retail sales are online. The number is growing but the runway is clearly long.

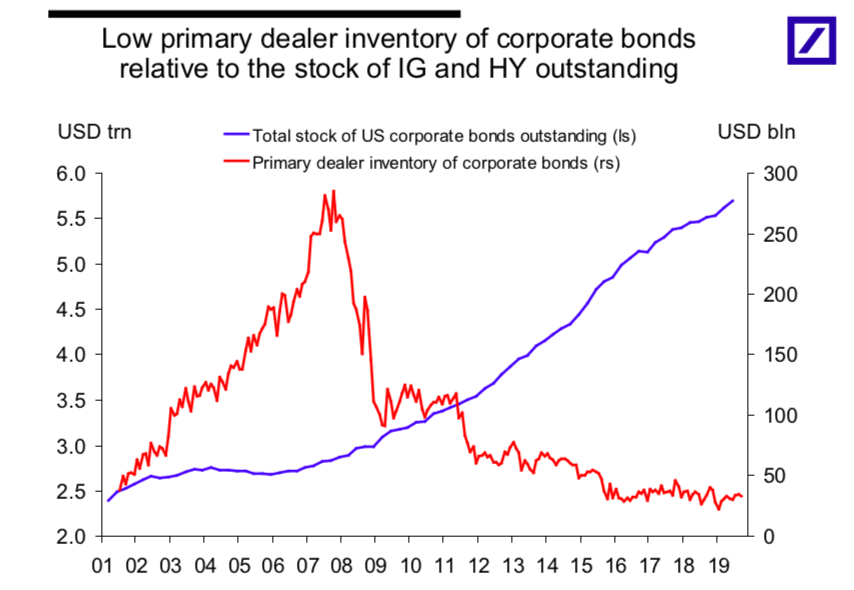

US Bonds outstanding continues to grow. However, inventory of bonds at primary dealers has stayed low since the financial crisis. This creates a very risky situation in terms of liquidity. Especially problematic now that Bond ETFs have hit $1 trillion.

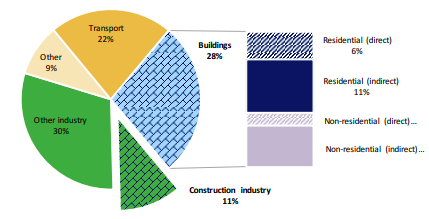

Nearly 40% of global energy related CO2 emissions are buildings . 11%pts is construction. No surprise we are seeing innovation in construction techniques. This is a fascinating article on developments there.

Two years ago Apple introduced Intelligent Tracking Prevention for Safari browser in mobile and desktop. This meant that advertisers lost the ability to target ads on Safari. It has been remarkably successful – the cost of reaching Safari users has fallen 60% in the last two years, while other browsers have risen. That is a huge change in the landscape especially in mobile where Safari market share is 53% and tend to be higher value eyeballs.

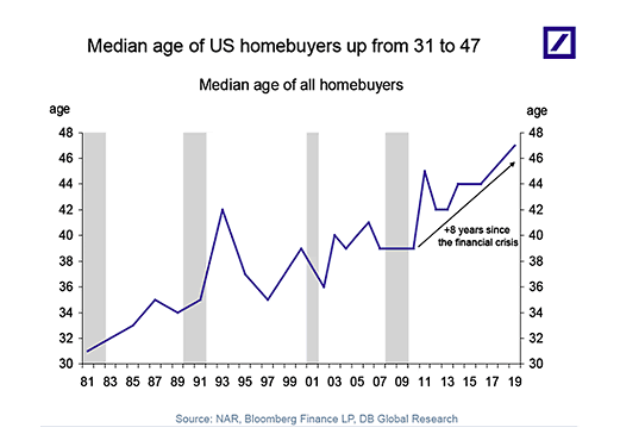

The median age of US homebuyers used to be 31 in the 1980s. It has now risen to 47. 8 years have been added to the median age since the financial crisis.

China is ordering all state offices to remove all foreign tech in 3 years. This is going to hurt MSFT, HP, Dell. Only a matter of time before it spreads to state owned enterprises and possibly private business.

Great post showing how air pollution is detrimental to intelligence. Chess players make more mistakes on polluted days: “We find that an increase of 10 µg/m³ raises the probability of making an error by 1.5 percentage points, and increases the magnitude of the errors by 9.4% .World Bank air pollution data can be found here . Interestingly pollution has been declining, but 45% of the global population is still exposed to levels above those recommended by WHO.

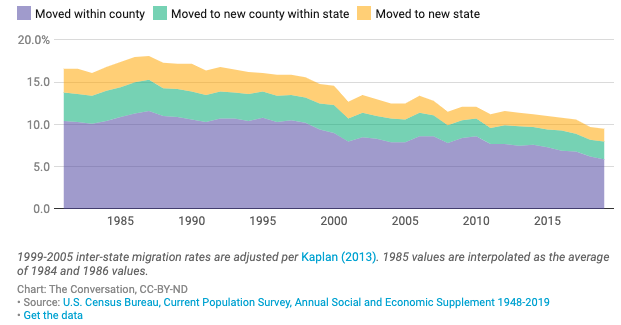

An amazing chart showing the percentage of Americans moving home has fallen from 18.1% in 1987 to just 9.4% now. This is having profound effects on economics and society.

Interesting article about the “cashmere king”, who, over 40 years, built the business that bears his name from nothing. His company doesn’t allow any emails after 17:30 among many other interesting ideas about how a business should be run. Those who come to me and say, “You know, I work 15 hours a day,” I say, “I am not interested.” I am interested in the quality of working hours, not the quantity. The brain of the human being. Do you think that during the first five hours of the day you are the same as you are in the last five hours? No way. You’re tired, and if you’re tired, you stop listening, and the decisions you make are risky.

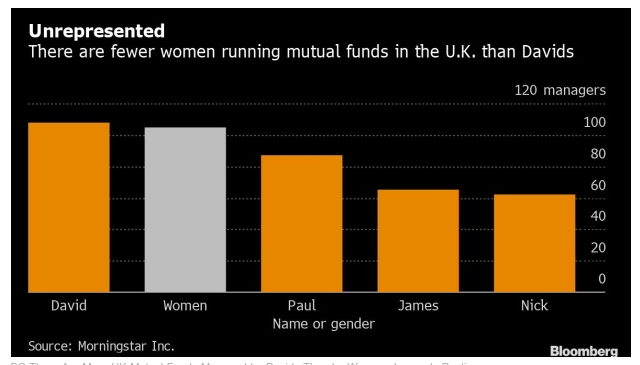

Shocking stat that there are more men named Dave in the fund management industry in the UK than there are women.

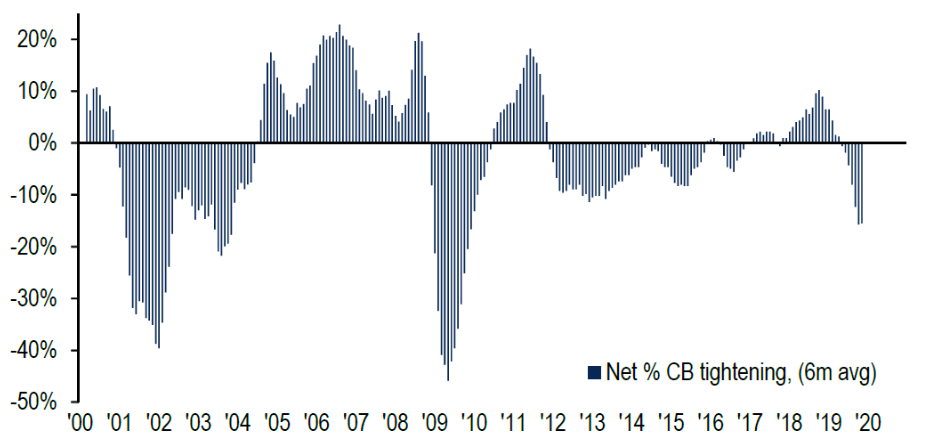

Global Central Banks are cutting again – at the fastest rate since 2009. Interesting set up for 2020 market performance – is the absolute level that matters or the second derivative?

Good article analysing the threat of TikTok, who are planning to launch a rival music streaming service in India, Indonesia and Brazil. TikTok has had nearly 1.5bn downloads, a staggering number. The latest is that the streaming service will involve so clever social features. Will be interesting to watch.

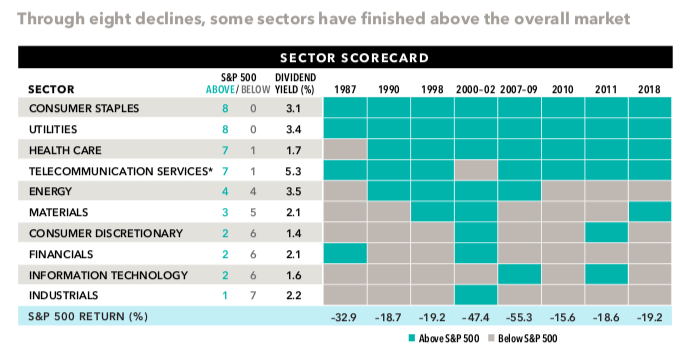

Table showing sector outperformance in the last eight market falls. Will come in handy if you are worried where the market is headed.

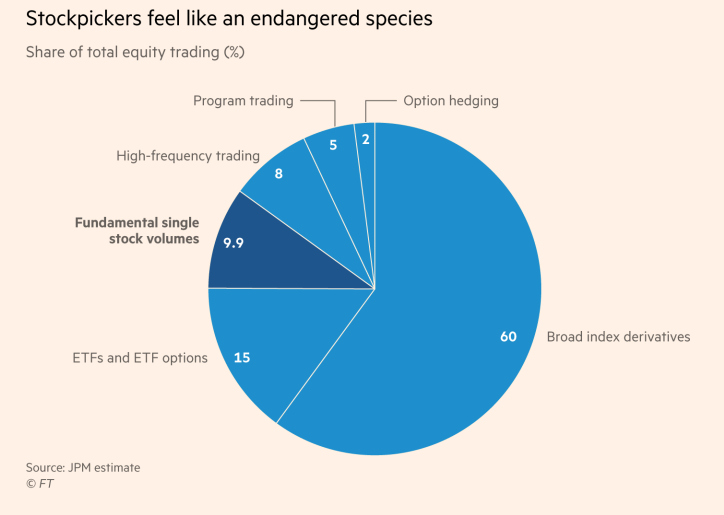

This chart from the FT is sobering. Only 10% of stocks traded are by fundamental stock pickers.

WordPress Cookie Notice by Real Cookie Banner