- Something not so good is going on in EV land – and it isn’t aggressive Chinese competition.

- Hertz for one has decided to dump 20,000 EVs citing hidden costs, especially of accidents.

- “Expenses related to collision and damage, primarily associated with EVs, remained high in the quarter, thereby supporting the Company’s decision to initiate the material reduction in the EV fleet.“

- Then there is this chart showing EVs are taking longer to sell.

Author: Snippet.Finance

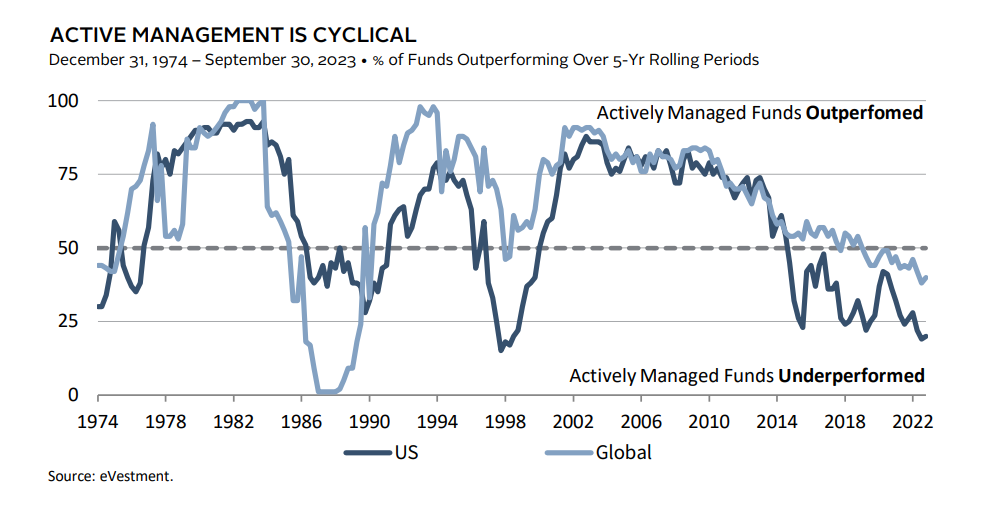

Active Management is Cyclical

- Periods of active underperformance tend to be followed by periods of outperformance.

- Source.

Trends to Watch from Expert Transcripts

- Alpha Sense Expert Insights uses its expert database to compile ten trends to watch.

- It’s a fairly interesting list and many trends are continuations from last year.

- You can grab two free weeks of access to the whole database of transcripts with your work email address for free here (see disclaimer).

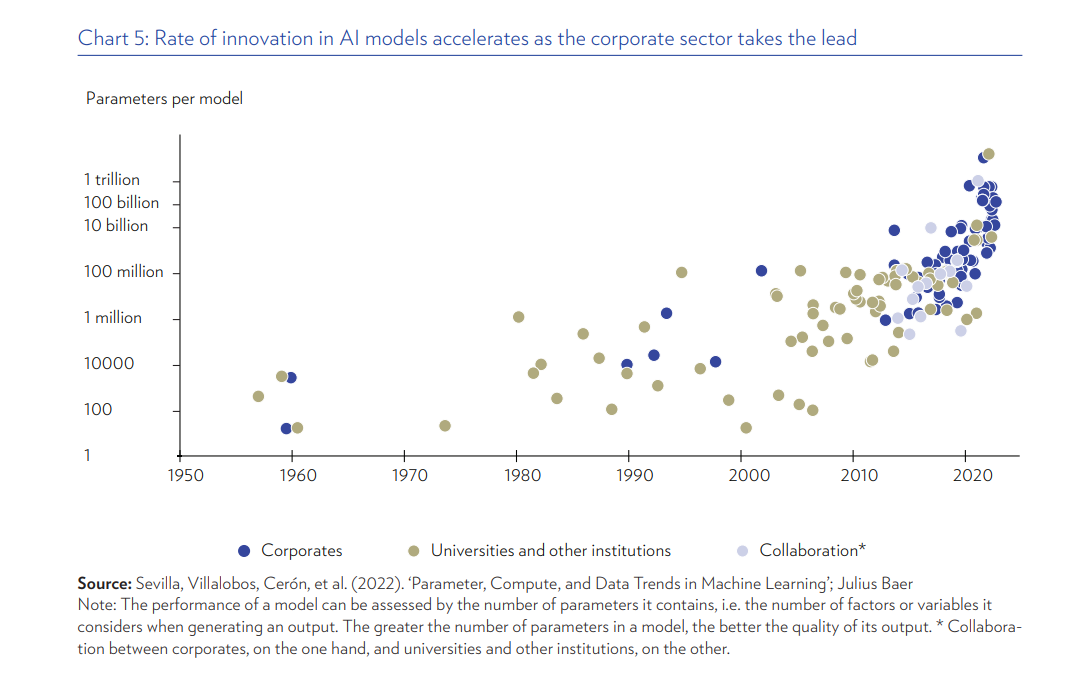

AI Innovation

- Nice chart showing the acceleration of innovation in AI as measured by parameters per model.

- Source: Julius Baer.

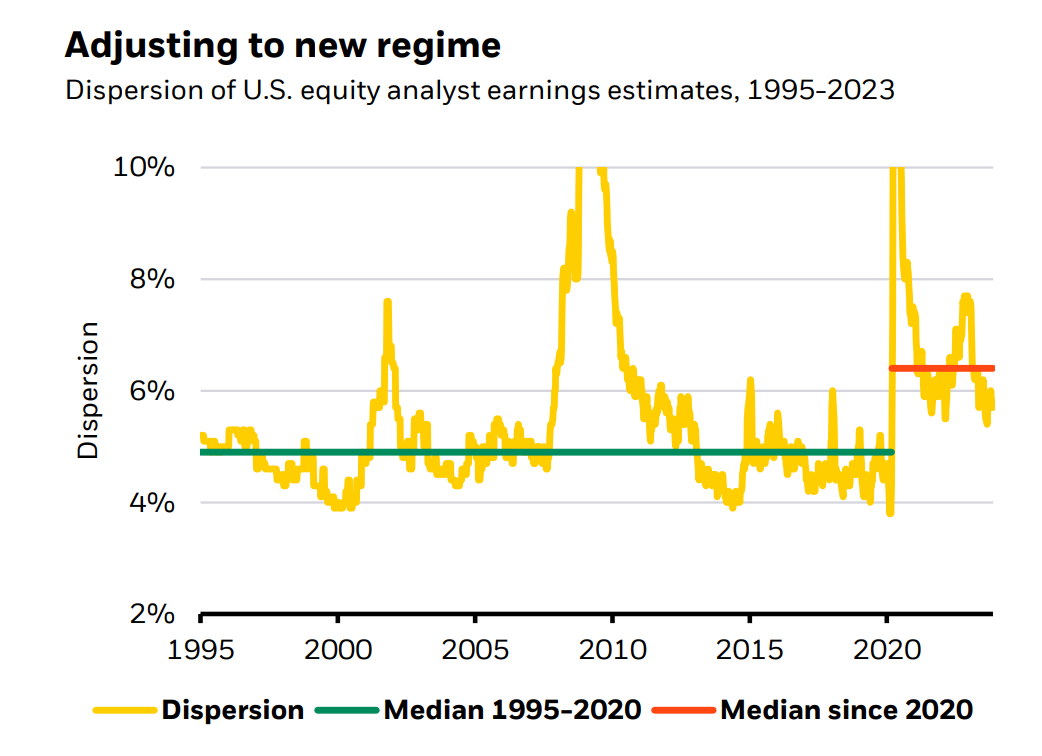

Dispersion of Estimates

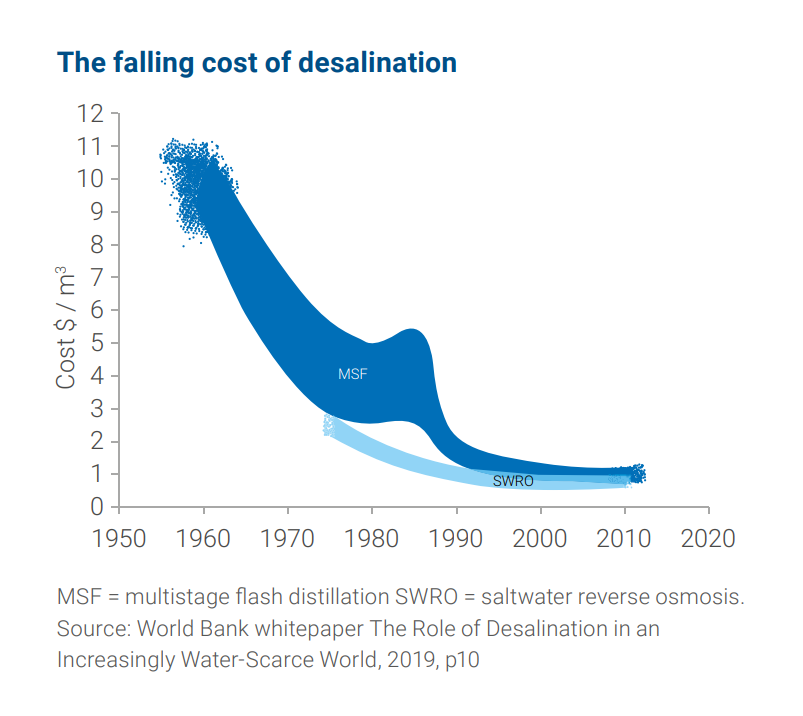

Desalination Costs

- Seems like a big deal.

- “The chart shows how the cost of desalination has fallen over the long term. This has been driven by technological advances, larger plants translating into greater economies of scale, and project development choices such as colocation of desalination plants with power plants.“

- Source.

Insurance Adjuster

- A fascinating glimpse into the world of how the decision to total a car by an insurance company after an accident is made.

Japan Becoming More Dynamic

Transsion Holdings

- China’s Transsion Holdings is a smartphone maker you may have never heard of.

- Not only are they the world’s number five, but more impressively they command 40% market share of Africa’s smartphone market.

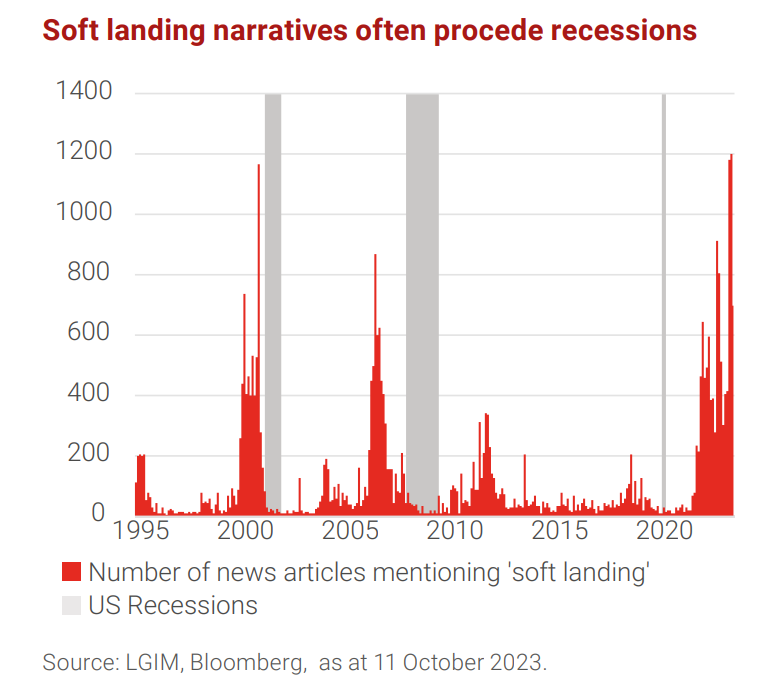

Narratives Before Recession

- Typically the chatter around soft landing peaks just as recessions happen.

- Source: LGIM

Manufacturing Recession

- What might come as a surprise to many, but we are currently tied for the worst global manufacturing recession on record.

- Source: Schwab.

2024 Investment Outlook Reports

- If you are into this sort of thing, a fairly comprehensive list of investment outlook reports from both sellside and buyside, composed by the FT.

Charlie Munger Quotes

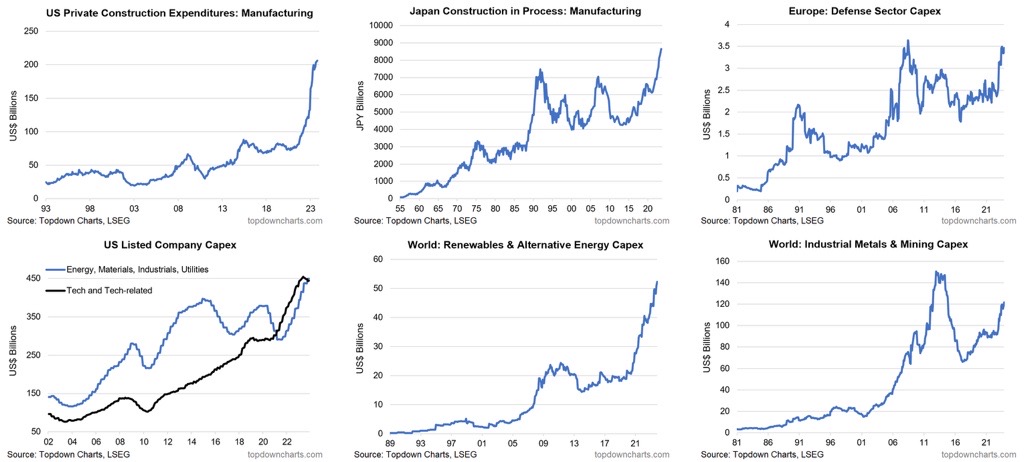

Capex Booms

- From US manufacturing construction to European defense – “2023 saw a multi-faceted global fixed asset investment boom“.

- Source: Top Down Charts.

Enlightened Concepts

- A list of thirty useful principles that offer delectable food for thought.

- Beginners bubble effect – “You cannot learn what you think you already know.”

- Benford’s law of controversy – “We tend to fill gaps in information with emotion.“

Retail Investors – a new base level

- It looks like retail trading has seen a step change since the pandemic that has stuck and even accelerated.

- Source.

52 Snippets from 2023

As is now a tradition here are 52 things I learned from publishing 320 snippets this year.

- “Utilizing the state-of-art deep learning technique to quantify facial attractiveness, we find that funds with facial unattractive managers outperform funds with attractive managers by over 2% per annum“. [SSRN]

- Banning sulfur from ship emissions has had the unintended consequence of heating up oceans along shipping lanes. [Leon Simons]

- The famous business model – razor and razor blade – was never actually employed by Gilette. [SSRN]

- 43% of Chinese residential homes were built after 2010. “If you put this in relation to total population it implies that in a single generation, China has built enough homes to house a billion people.” [Adam Tooze]

- “Since 1970, the team reported in Science in 2019, the number of birds in North America has declined by nearly 3 billion: a 29 percent loss of abundance.“ [ARS Technica]

- One institution owns 1/6 of all the land on the surface of the earth. [Madison Trust]

- It takes 200m liters of water to move a ship through the Panama Canal, pumped from the Gatun lake where the water level hit the lowest in decades. [Tema ETFs]

- Despite being produced in a matter of hours, it took days or even weeks for paint to dry on the Model T. [Material World]

- Dark chocolate is worse in terms of greenhouse gas emissions than lamb. [Nat Bullard]

- Tesla has the world’s fourth-largest cluster of Nvidia chips for AI. [State of AI Report]

- “The world is growing more equal than it has been for over 100 years.“ [Foreign Affairs]

- “37 percent of the world’s population, 2.9 billion people, have never used the Internet.“ [Tom Whitwell]

- After the 2011 devastating flooding, Copenhagen re-engineered itself as a “Sponge city”. [Spiegel]

- “For the first time, China has overtaken the United States as the number one ranked country or territory for contributions to research articles published in the Nature Index group of high-quality natural-science journals.” [Nature]

- You can track the 100 most visited pages on English Wikipedia daily. [Hatnote]

- The inventor of PowerPoint ensured his team’s office housed a museum-worthy collection of modern art. [MIT]

- Target think they will lose $500m of profit from theft in 2023, known in retail parlance as “shrinkage”. [MarketWatch]

- On-demand audio listening time (think podcasts) crossed linear audio listening (think radio) for the first time in 2023. [Snippet Finance]

- Mitochondria, the power stations of our cells, have their own DNA but, unlike nuclear DNA, it is only inherited from our mothers. Male mitochondrial DNA is a dead end. [In our time]

- Insurance coverage issues are starting to hurt home sales in Florida and California. [John Burns]

- If you are old, you are more likely to vote Conservative in the UK. However, if you have a struggling younger relative this flips to Labour. [FT]

- “Engineers at Tesla Inc. have developed a new process that they claim will reduce EV production costs by 50 percent, while reducing factory space by 40 percent.“ [ASSEMBLY]

- Canadian population growth is booming. [Noahpinion]

- Deepmind may have cracked a better sorting algorithm – that’s a huge deal for all kinds of applications. [Alpha Dev]

- “In 2023, for the first time, investment in solar energy is expected to beat out investment in oil production. It’s a stark difference from what the picture looked like a decade ago, when oil spending outpaced solar spending by nearly six to one.” [MIT Technology Review]

- Tokyo stock exchange has written to any company trading below book value, asking them for concrete plans to reverse this valuation discount. [Schroders]

- Biotech research is getting crowded around specific biological targets. In the early 2000s only three drugs were investigated per target, today that number is seven. [Nature Reviews]

- Nearly one in ten people have some form of autoimmune disease – far more than ever previously thought. These diseases also tend to cluster, a person with one is more likely to have another, more than ever previously thought. [University of Glasgow]

- It took ChatGPT five days to reach one million users, something Instagram only achieved in 2.5 months and Netflix in three and a half years. [Snippet Finance]

- Fab 18, one of TSMC’s 13 foundries, carves and etches a quintillion transistors – “more objects in a year than have ever been produced in all the other factories in all the other industries in the history of the world“. [Wired]

- China is set to overtake Germany and Japan as the world’s biggest exporter of cars, a feat achieved in just the last three years. [Gavekal]

- By 2050 the number of people of working age living in the US, Europe, China, and Japan will be 1.2 billion, which is down from 1.47 billion living there today – an 18% decline in the four largest economic regions. [EPB Research]

- A commercial airplane can land using a swoop landing, which is much better than the current standard stair descent. Many US airports are now adopting this approach. [Scientific American]

- The most successful film of all time by return on investment was “ET”. The other top films on this measure are equally surprising. [Info is Beautiful].

- China wants to launch 13,000 low-earth orbit satellites. At the start of this year, there were only 4,500 there already (mostly Starlink). [Rest of World]

- For the first time ever, more fish are farmed today than caught in the wild. [FAO]

- 10% of US motorists use more gasoline than the bottom 60% put together. [IEEE Spectrum]

- S&P 500 is 70% less labour-intensive than it was in the 1980s in terms of the number of employees it takes to produce $1m of revenue. [BAML]

- Challenger banks deploy app updates 4.6 times faster than incumbent banks. [Built for Mars]

- The output efficiency of electricity rose from 2% in 1900 to 15% in 1960 and has been stuck there ever since, despite power plants getting a lot more efficient. [Energy]

- Greece is one of the fastest-growing economies in the world. Some even say it is booming. [FT]

- Approval of labour unions has been on the rise since 2008 but union membership has continued to slide. [Bernstein]

- 83% of US adults have an unfavourable opinion of China. [Pew]

- The IRS makes on average 2x return on auditing people’s tax returns, which can be as high as 6x for the very wealthy. [Washington Post]

- The average size of a house in the US, after a brief blip during the pandemic, continues to decline. [Eyeonhousing]

- An AI server uses eight times more working memory (DRAM) and three times more storage than a classic server. [Yuri]

- “A leak from a Chinese social-media site last year revealed that it blocks no fewer than five hundred and sixty-four nicknames for him [Xi Jinping], including Caesar, the Last Emperor, and twenty-one variations of Winnie-the-Pooh.” [New Yorker]

- Thanks to digital payments, India hit its 80% financial inclusion goal 41 years early. [GPFI]

- CMS requires that any payment over $10 by a drug or medical device company to any medical professional in the US be disclosed on this website. You can even look up your doctor. [CMS]

- Trial documents revealed the keywords that make Google the most money on the week of 22nd September 2018. They are predictably boring – “iphone 8”, “iphone 8 plus”, “auto insurance”, “car insurance”, and “cheap flights”. [DOJ Trial Documents]

- Ultracrepidarian means “expressing opinions on matters outside the scope of one’s knowledge or expertise”. [Dictionary]

- A startup in Silicon Valley is working on a cure for tooth decay, by infecting one’s mouth with a genetically modified bacterium that outcompetes bacteria that cause cavities. [Astral Codex Ten]

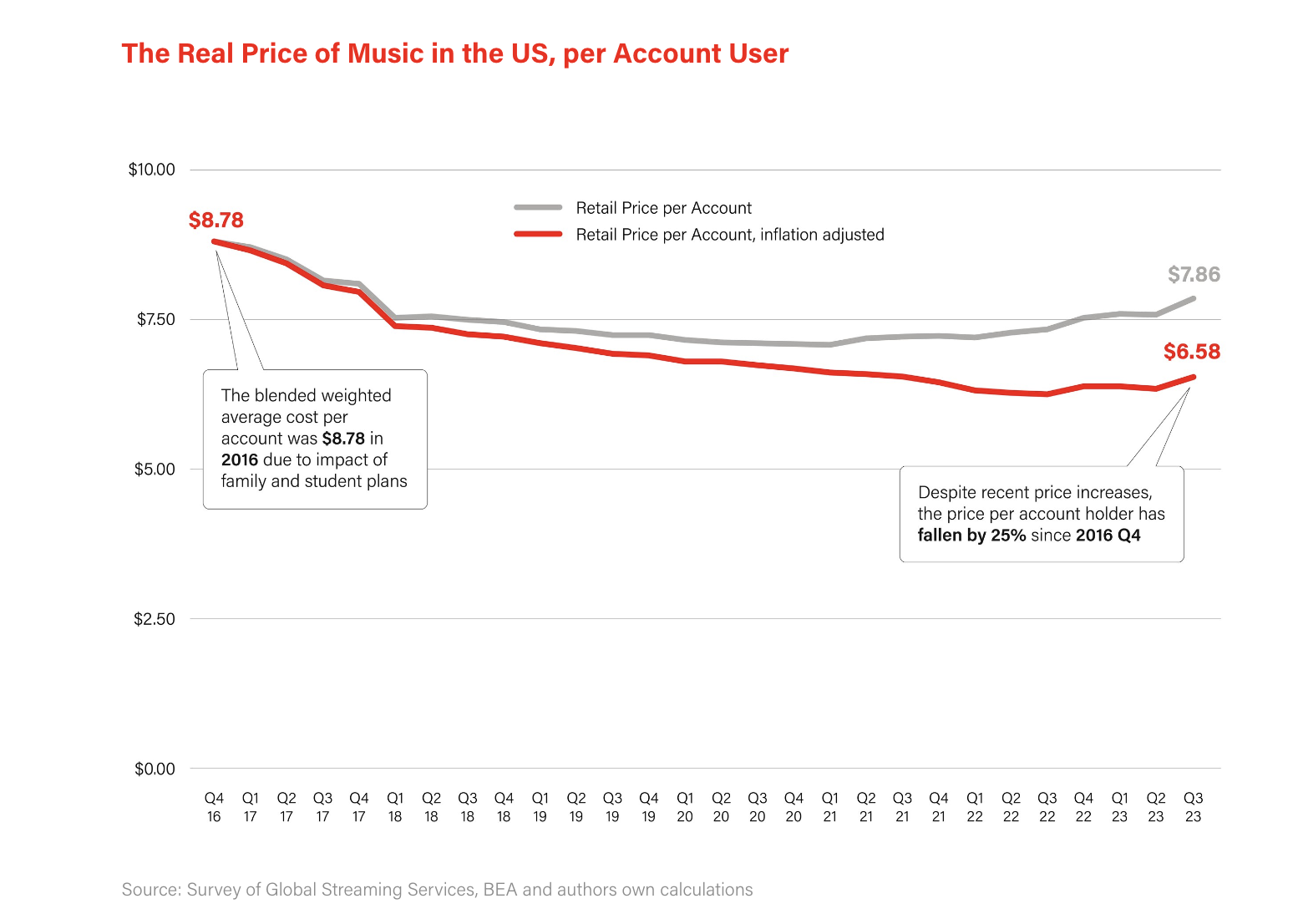

Streaming Prices

- Music streaming has seen declining prices when adjusted for inflation and new shared plans.

- Source: Pivotal (lots of interesting charts on music streaming inside).

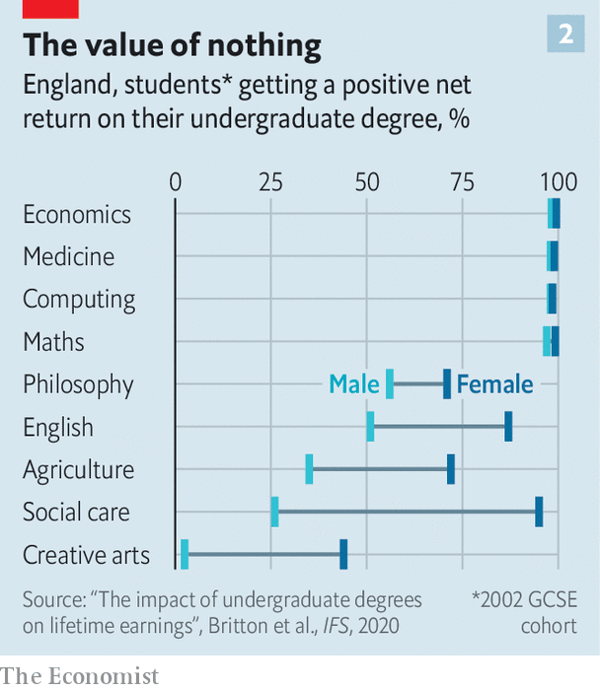

Return on Degrees

- This DoE/IFS study examined the return on undergraduate degrees in the UK.

- Interestingly, degrees where the percentage getting a positive return is low, are much worse for men than women.

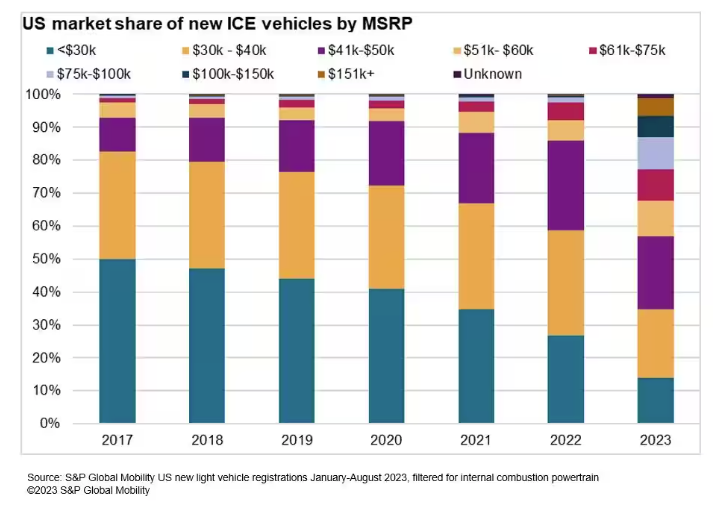

Cheap Cars are Disappearing

- “Based on S&P Global Mobility analysis of registration data since 2017, the US market has seen a significant decline in the share of new vehicles registered below a $30,000 price point. In just seven years, the percentage of vehicles registered with an MSRP below $30,000 has decreased from half the market to barely one-quarter – with vehicles in the $41,000-$60,000 band taking up nearly the entirety of that vehicle count.“

- Source: S&P Global