- China has lost almost all of its wage advantage vs. the US.

- Source.

Author: Snippet.Finance

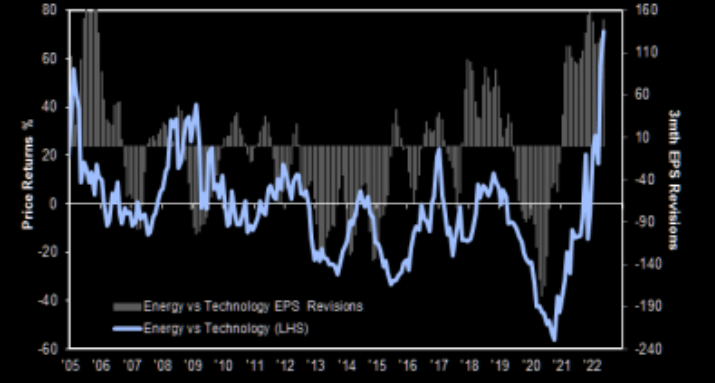

Energy vs. Tech

- Energy vs. Tech looks extended, both in terms of price performance and earnings revisions.

- Chart from JPM Quant team via themarketear.com.

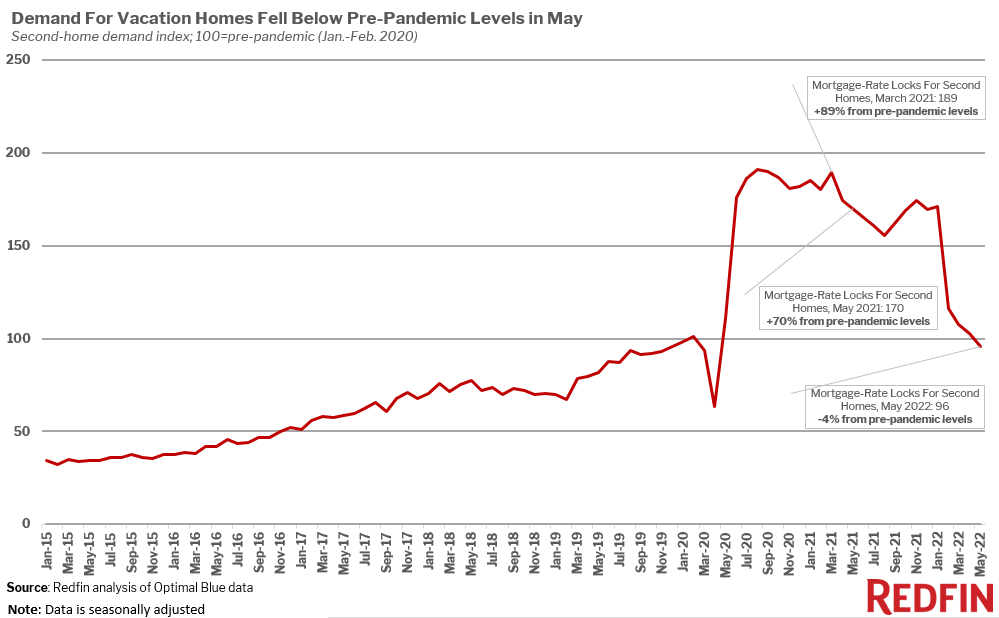

Demand for Second Homes

- Another in a series of charts showing a reversal of pandemic trends.

- This one shows that the demand for vacation homes in the US is back below pre-pandemic levels.

- NB the chart uses mortgage-rate lock data (which requires disclosure of purposes of home purchase).

- Source.

CEOs Appearing on Podcasts

- A new paper examines the question of why CEO’s allocate precious time to appearing on podcasts.

- Between 2016 – 2020 over a quarter of all S&P 1500 CEOs appeared on at least one podcast.

- This has grown from 6% in 2016 to 22% in 2020.

- They find it tends to be CEO’s of firms more focussed on consumers and ESG.

- It also tends to be CEOs who have strong reputation incentives (looking for a new job, have own twitter account, founders).

Infrastructure Building

- Interesting article arguing that state capacity is the real constraint for delivering infrastructure projects, not interest rates.

- “The new tunnels for New York’s East Side Access project cost about $4 billion per kilometer, while Paris built a similar project (infill development, went under the Seine, had problems with catacombs) for $230 million per kilometer. Copenhagen, Barcelona, Naples, and Milan were all cheaper still, while South Korea was generally the cheapest, with a tunneling cost around $100 million per kilometer, or perhaps less. That’s quite a difference in state capacity.“

- It’s not just tunnelling – NYC spent $39m per station to add elevators, Boston $25m while in Berlin it cost just $2.6m.

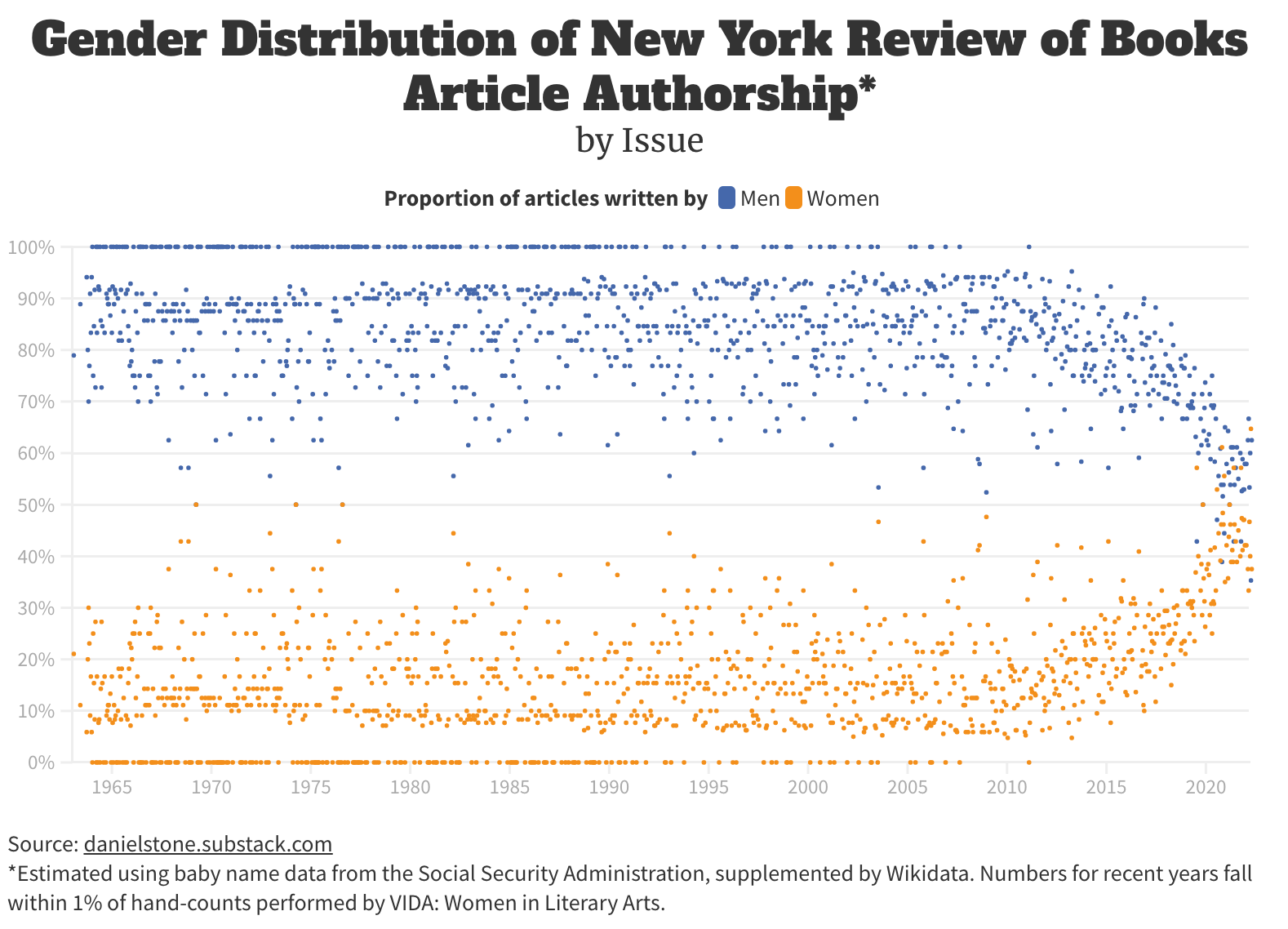

Gender and NYRB

- Interesting chart via The Browser (a must subscribe) plotting each issue of the New York Review of Books (NYRB) by the gender mix of authors.

- “What you are seeing is that there are only twelve issues out of 1228 (1%) to which women have contributed half or more of the articles. Nine of them have appeared within the past three years. Meanwhile there are about 196 issues (16%) to which not a single woman contributed an article.”

- Source (more stats inside).

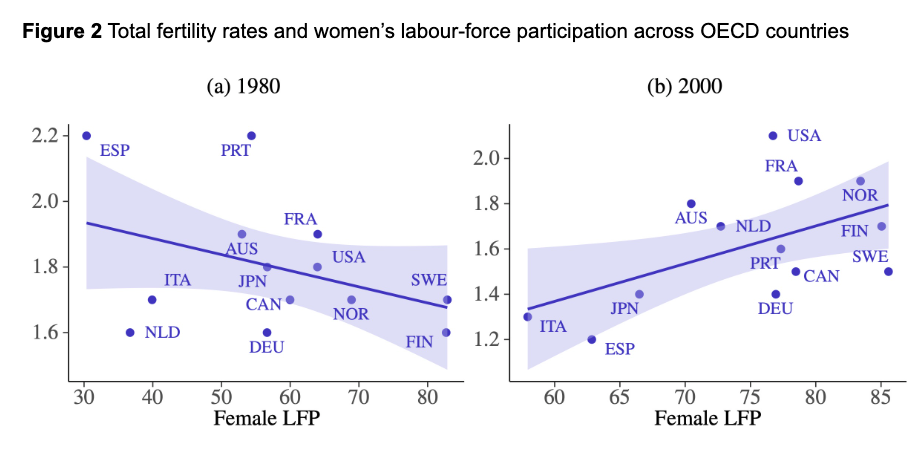

New Era of Fertility Economics

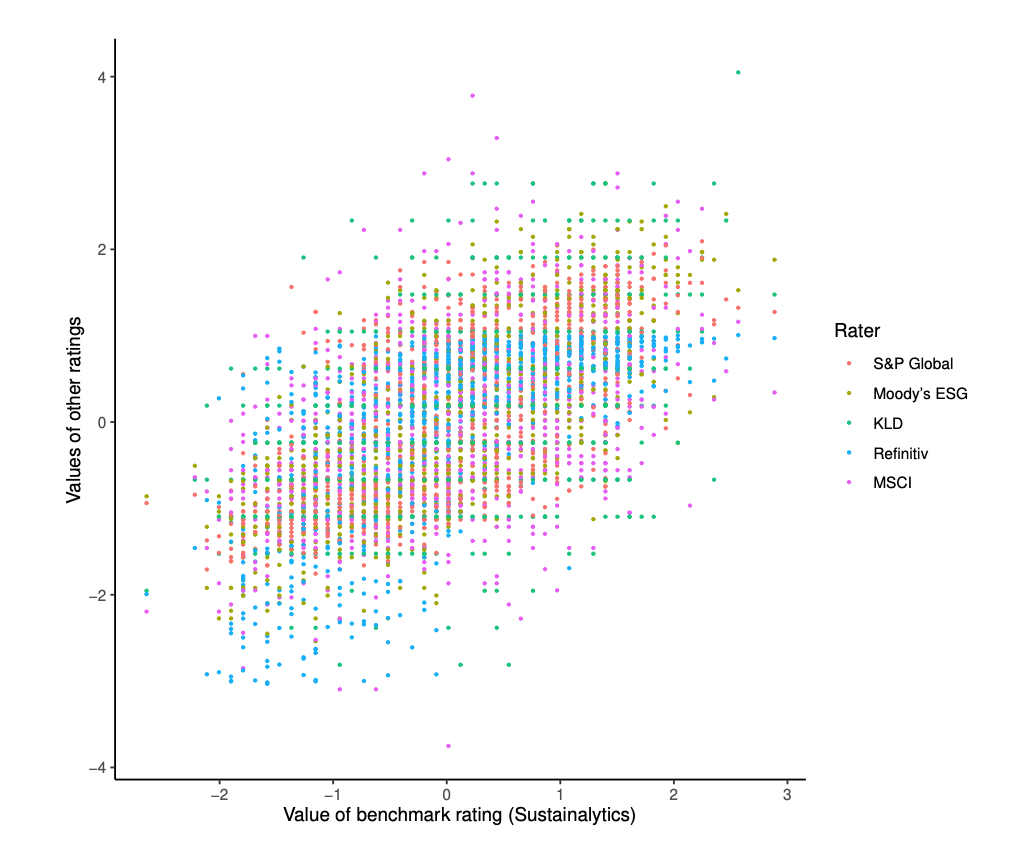

ESG Ratings Divergence

- ESG ratings from various providers just don’t agree and this is a nice chart to demonstrate this point.

- The horizontal axis takes Sustainalytics ratings for 924 firms as a benchmark.

- Ratings by other providers are then plotted on the vertical axis using different colours (see key).

- For each rater the ratings are normalised to a Z score (zero mean, unit variance).

- The results = for any level of benchmark rating there is a big range of values given by other ratings.

- The divergence is so bad between firms “it is difficult to tell a [ESG] leader from an average performer”.

- The paper then goes on to try to understand why this is.

Thinking Tools

- This is a useful collection of thinking tools and models – presented in a well designed way.

- Several of these are useful to investors – for example the second order thinking advocated by Howard Marks.

Private Equity Valuations Paid

- Bain report on private equity industry is always worth a flick.

- This was an interesting chart on valuations – showing that multiples started to drift up from 2015 onwards reaching highs last year.

- Part of this was a mix shift towards growth and technology, where 2020/2021 saw ballooning multiples paid for software businesses (here, page 49).

Biotech IPO by Stage

- Amazing rise in the % of pre-clinical biotechs IPOing.

- Source.

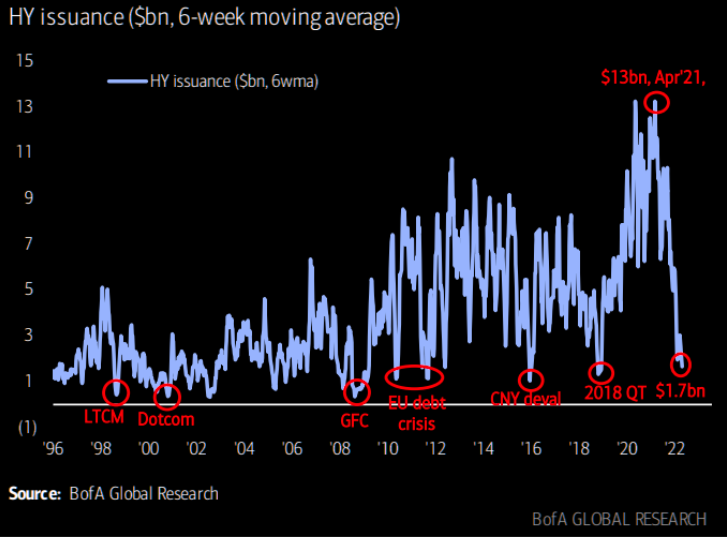

High Yield Issuance

- HY issuance has collapsed to levels seen in historic crises.

- Source: themarketear.com

Soros and Reflexivity

- Many have heard of George Soros’ idea of reflexivity.

- This idea is important especially as we look at the current market situation.

- To understand it more deeply it is worth reading Soros’ own writing on the subject – especially this piece from the Journal of Economic Methodology (2014).

- Here Soros lays out his full framework which is actually based on two propositions – reflexivity but also human fallibility – together the siamese twins that form “the human uncertainty principle”.

- “My conceptual framework deserves attention not because it constitutes a new discovery, but because something as commonsensical as reflexivity has been so studiously ignored by economists.”

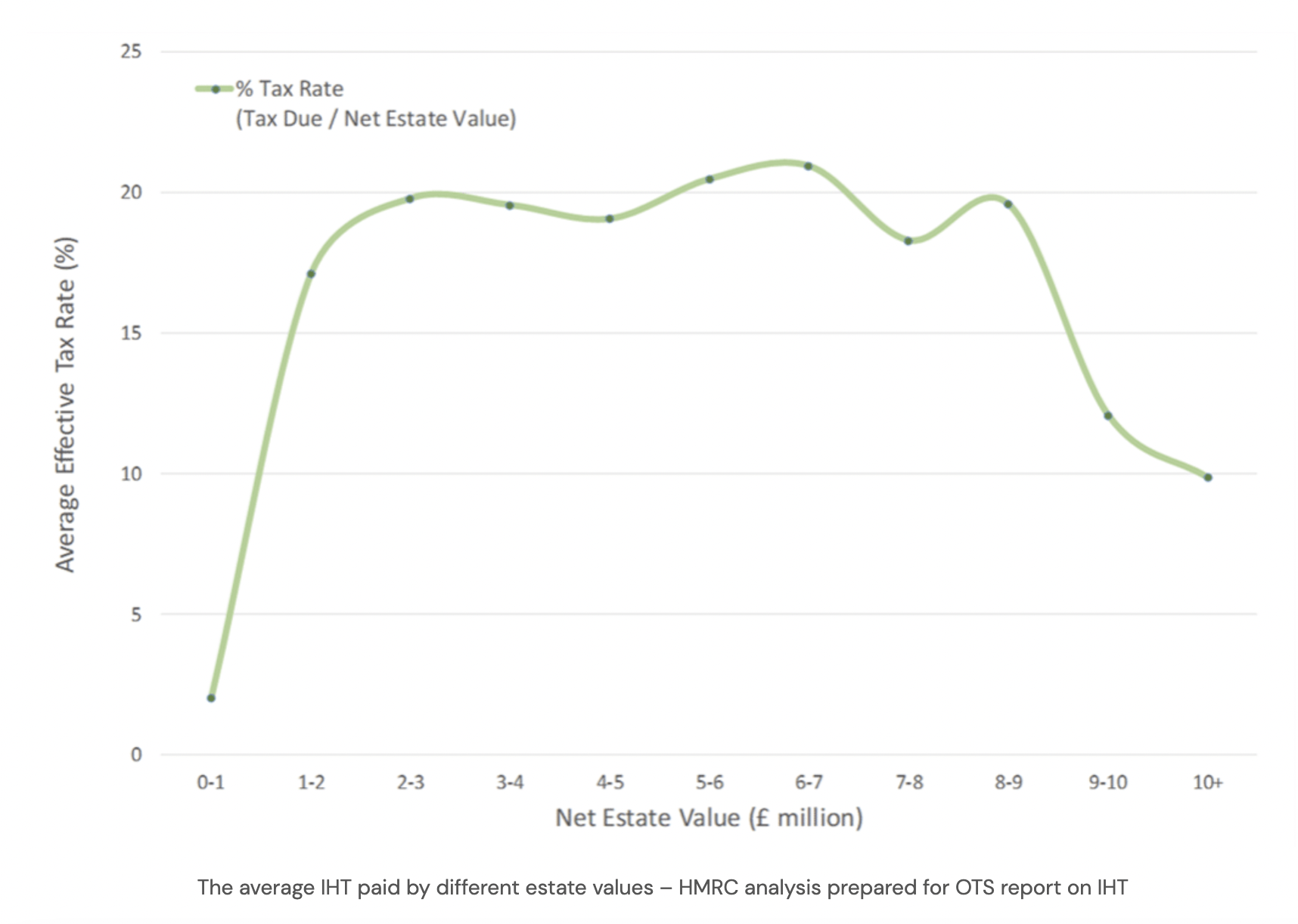

UK Inheritance Tax

- UK’s Inheritance Tax (IHT) system seems broken.

- The effective rate looks very different to other countries and raises less than it should.

- In addition, take this chart from HMRC’s (UK tax authority) analysis of 2016/17.

- It shows estate values on the x-axis and the effective tax rate on the y-axis.

- Notice the huge drop off for large estates (£9m+).

- It turns out the IHT is only progressive for mid/upper-mid classes.

- There are plenty of reasons why this is (listed in the article).

- IHT is “a tax with a terrible combination of a high rate (which makes it unpopular and drives avoidance) and poorly targeted/overly-generous exemptions (which then enable avoidance).“

Support Snippet

- Please consider supporting Snippet Finance, commensurate with the value you feel these insights bring in your investing and/or learning.

- Thank you in advance. Your support makes all the difference.

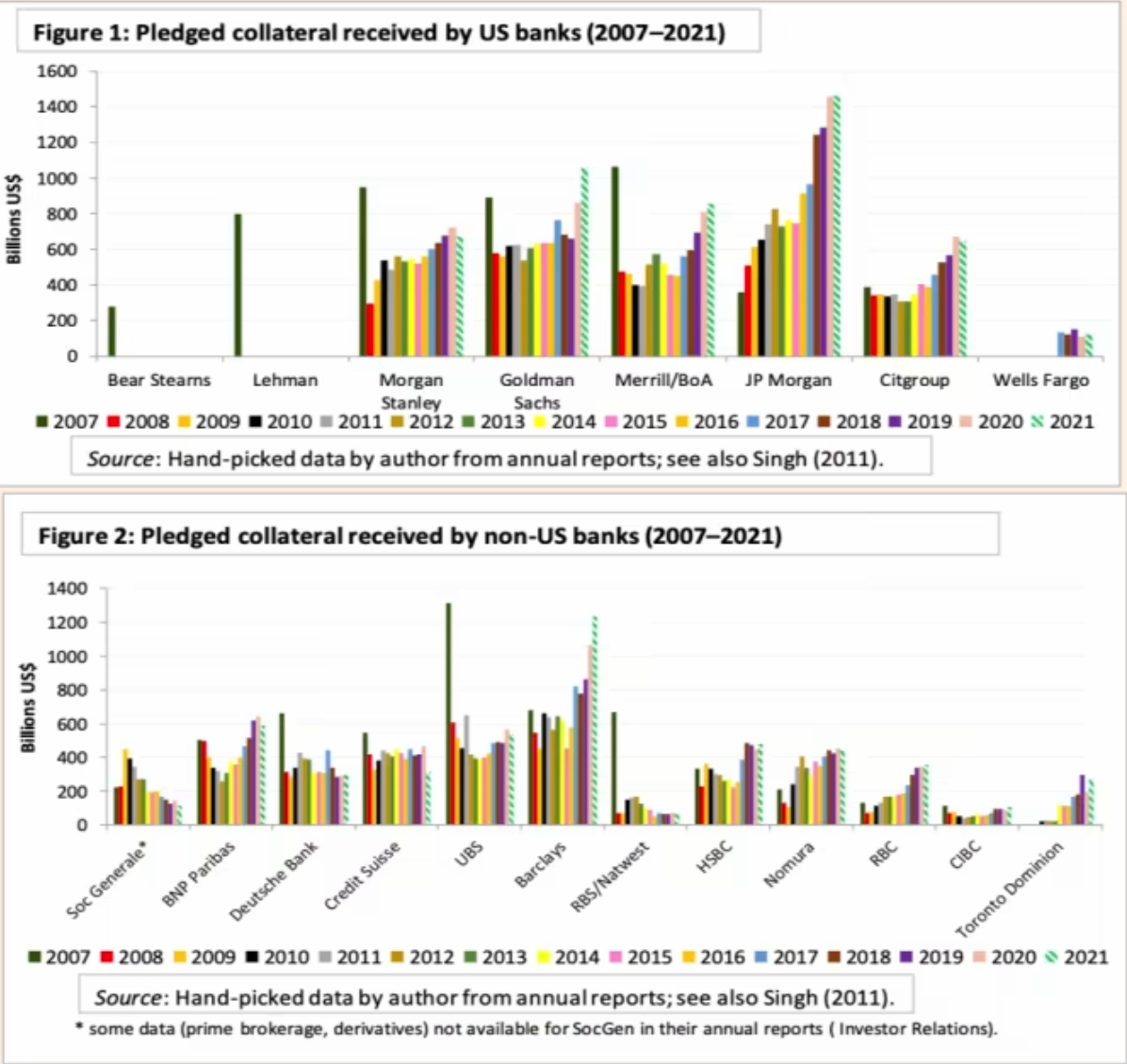

Financial Plumbing

- The Global Financial crisis 14 years ago ushered in a new era of attempting to understand the pipes of the global financial system – especially incorporating the shadow banking world.

- One big node point is pledged collateral and so called collateral velocity. The world expert on this is IMF senior economist Manmohan Singh.

- This latest post on FT AV by Singh is absolutely worth a read to understand what is going on now.

- These charts are one part of the picture – showing how pledge collateral has grown but also moved around.

- “As you might expect, a lot has changed since 2007, with the disappearance of Lehman Brothers and Bear Stearns, the reshuffling of business models by UBS, Credit Suisse and Deutsche Bank, and the rise of JPMorgan and Barclays.“

Ten Commandments by Bertrand Russell

1. Do not feel absolutely certain of anything.

2. Do not think it worthwhile to proceed by concealing evidence, for the evidence is sure to come to light.

3. Never try to discourage thinking for you are sure to succeed.

4. When you meet with opposition, even if it should be from your husband or your children, endeavor to overcome it by argument and not by authority, for a victory dependent upon authority is unreal and illusory.

5. Have no respect for the authority of others, for there are always contrary authorities to be found.

6. Do not use power to suppress opinions you think pernicious, for if you do the opinions will suppress you.

7. Do not fear to be eccentric in opinion, for every opinion now accepted was once eccentric.

8. Find more pleasure in intelligent dissent than in passive agreement, for, if you value intelligence as you should, the former implies a deeper agreement than the latter.

9. Be scrupulously truthful, even if the truth is inconvenient, for it is more inconvenient when you try to conceal it.

10. Do not feel envious of the happiness of those who live in a fool’s paradise, for only a fool will think that it is happiness.

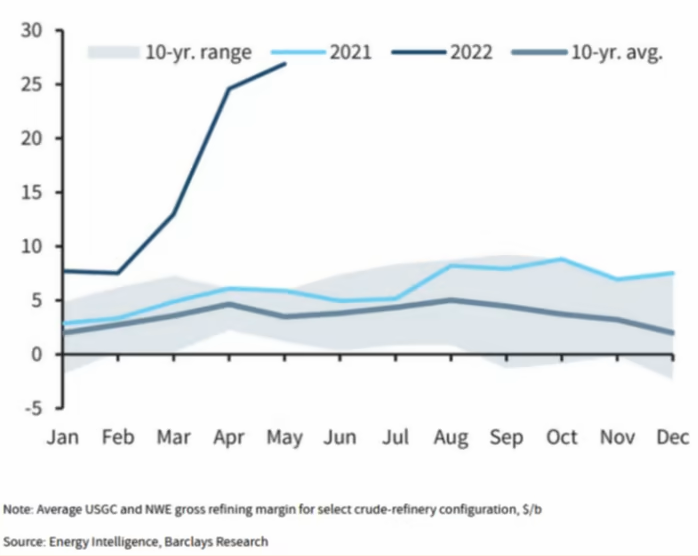

Refining Margins

- Spectacular pop in refining margins.

- “Permanent refinery closures since the start of 2019 reduced global capacity by around 4.7mn barrels per day, Barclays estimates, and new refinery capacity such as at Kuwait’s Al Zour can’t be brought quick enough. As a result, US and European refinery gross margins are least four times the long-run average“

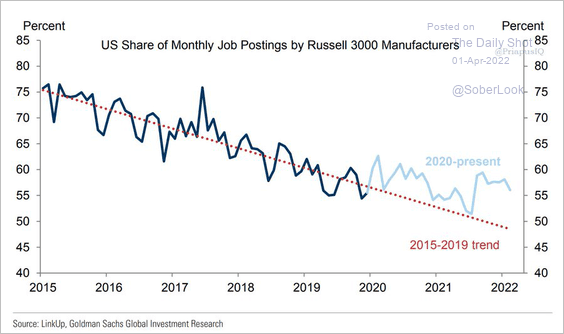

Re-shoring

- Data showing a break in the long term trend of declining US manufacturing jobs.

- Source: Daily Shot.

Kalshi

- Nice read from Bloomberg about Kalshi – the CFTC approved prediction market.

- Especially interesting is the long journey to getting regulators on board in the US (after years or resistance).

- “One day during their time at Y Combinator, Lopes Lara and Mansour say, they cold-called 60 lawyers they’d found on Google. Every one of them said to give up”.