- L’Oreal has started making TV shows.

- Interesting to see how they adapt to a world of less linear TV especially among younger generations.

- Streaming competition for content is helping this trend along.

Author: Snippet.Finance

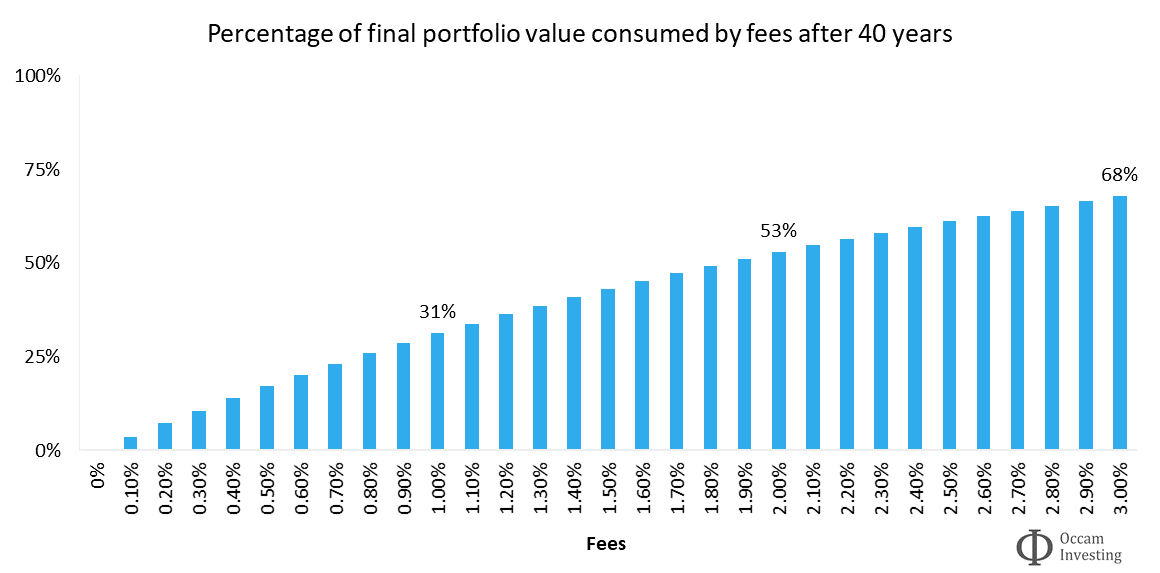

Fund Management Fees

- Pretty staggering chart on how much of the final value of a portfolio is consumed by fees at various fee rates (x-axis).

- It assume a portfolio returning 7% pa (this could be 0-10% and not change the analysis) over 40 years.

- A 1% fee consumes 31% of the final value.

- Definitely worth reading the full article – which discusses the question of whether fees predict performance.

Airbnb Recovery

- Interesting how much better Airbnb has fared than traditional hotels coming out of the pandemic.

- “As of April 2021, Airbnb’s sales were 182 percent higher than January 2019 sales, while sales volumes for the majority of traditional hotel companies were down an average of six percent compared to January 2019.“

- Only some Casino hotels (Caesers, Boyd) have done better.

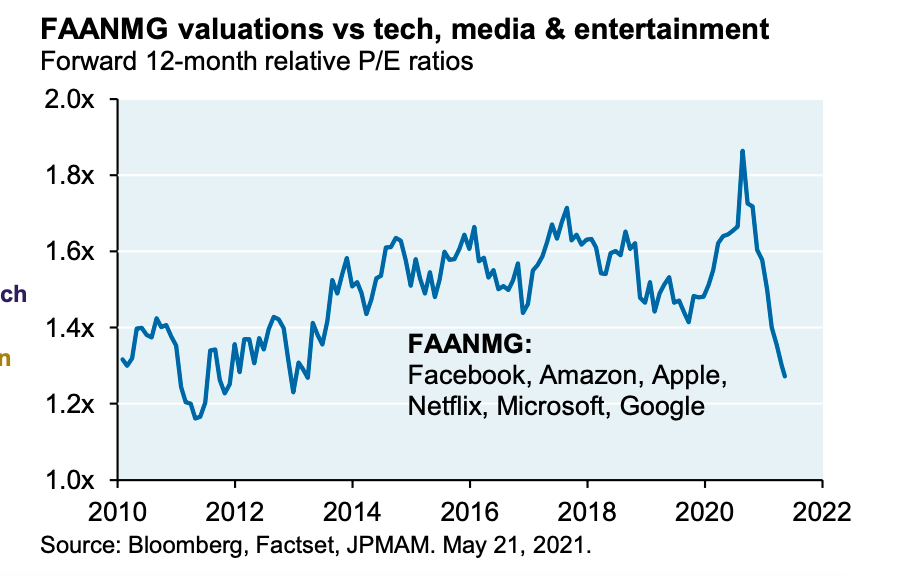

FAANMG

- FAANMG premium to the rest of tech sector has come down a lot.

- Source.

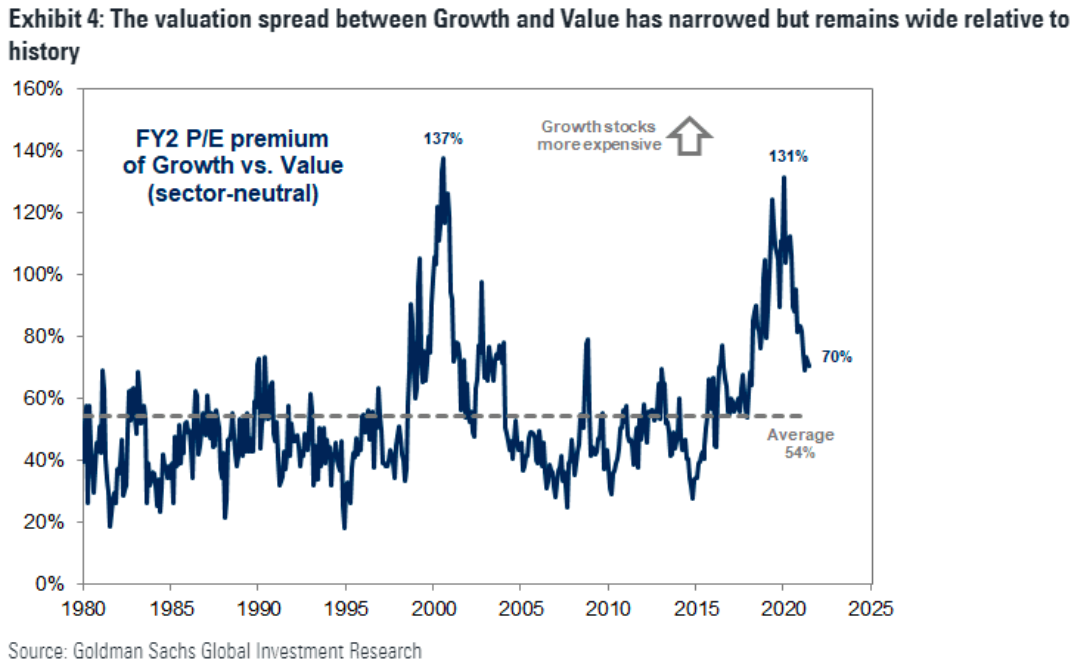

Growth Premium

- The valuation premium at FY 2 for growth stocks vs. value has come down a lot but is still above long-term average.

- Source.

eRetail 2.0

- The mind boggles at the level of innovation going in ecommerce.

- One major part is entertainment and retail = retailtainment – “shopping as a mass leisure activity”.

- This is a great article on the phenomenon, covering the plethora of ways it is developing.

- As usual one needs to look east where a lot of development is taking place.

- One of the enablers is software that is designed to be addictive – for example infinite scrolling can mimic the bottomless bowl effect leading to 73% more consumption.

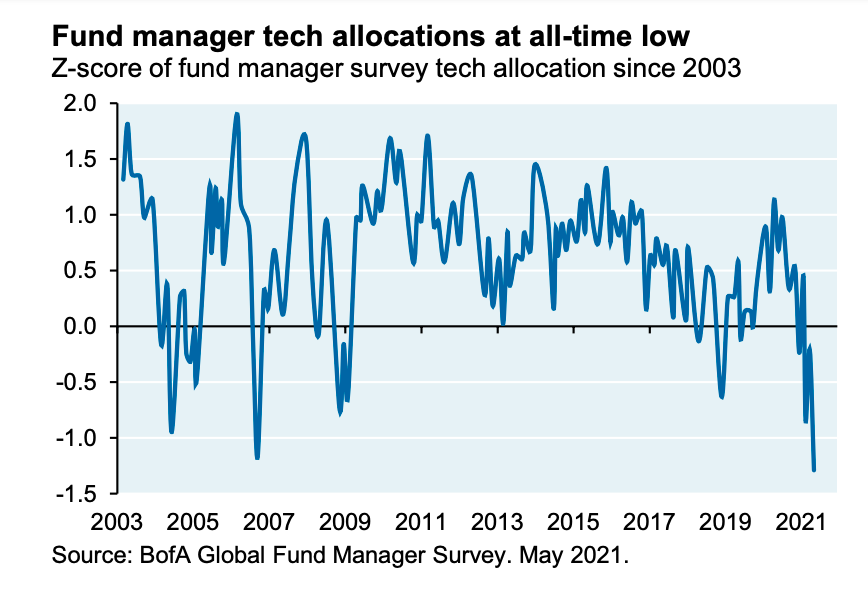

Tech Positioning

- According to the May BofA Global Fund Manager Survey allocation to tech is at an all time low.

- NB these surveys are self reported so actual positioning might be different.

- Source.

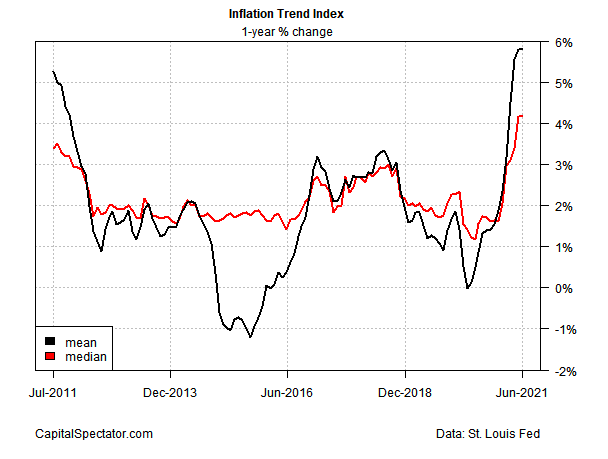

US Inflation Peaking?

- A useful inflation tracking index (consisting of seven measures of inflation) that is both more timely and overcomes the challenges of each individual measure.

- The latest update (7th June) – pictured – suggests inflation could be peaking.

- For the first time this year the mean and median are holding steady.

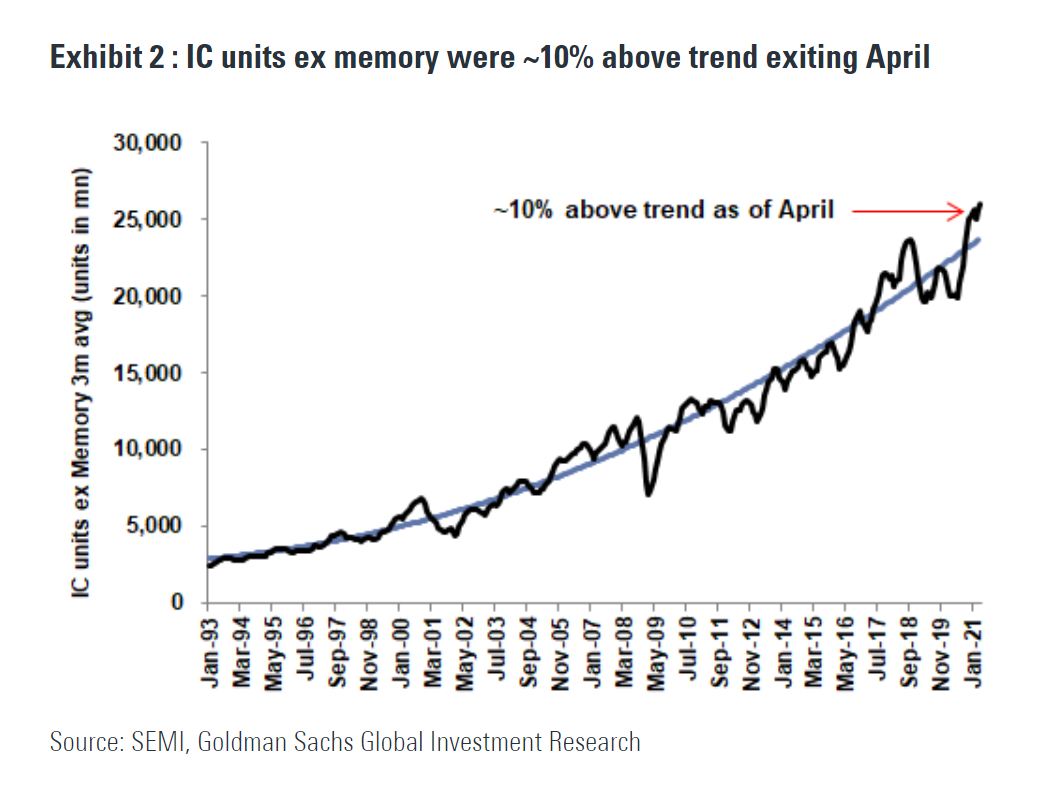

Semiconductor Market

- Neat demonstration of a structurally growing cyclical market – integrated circuit (IC) units excluding memory chips over time.

- Currently we are above trend but inventories are generally low.

Long Volatility

- This is a fascinating slightly old interview with Chris Cole of Artemis Capital Management.

- He runs a long volatility fund i.e. a crash protection fund.

- In the interview he talks about the core principle of the fund – to sacrifice the next linear predictable outcome in order to gain exposure to a truly convex upside outcome.

- Around minute seven he goes into a brilliant analogy using George Lucas’ success with Star Wars.

- Most interestingly, this idea can also be applied to life as Chris describes in minute 47 of the interview embedded here.

- Worth checking out their writing and following him on Twitter.

Shared Branches

- Interesting trend of big UK banks sharing branches in smaller towns.

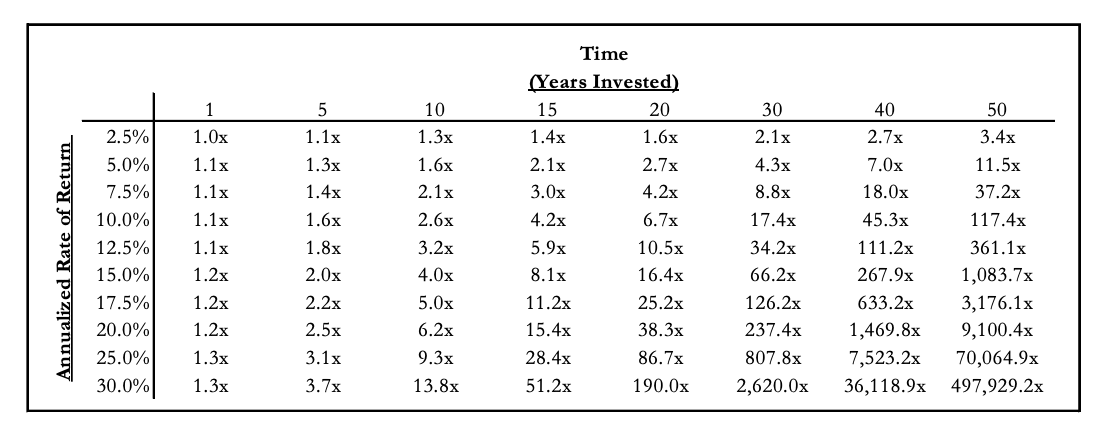

Compounding

- Helps to be reminded of this table from Hayden capital Q1 letter.

- Truly the 8th wonder of the world, as they put it “time in the market, beats timing the market”.

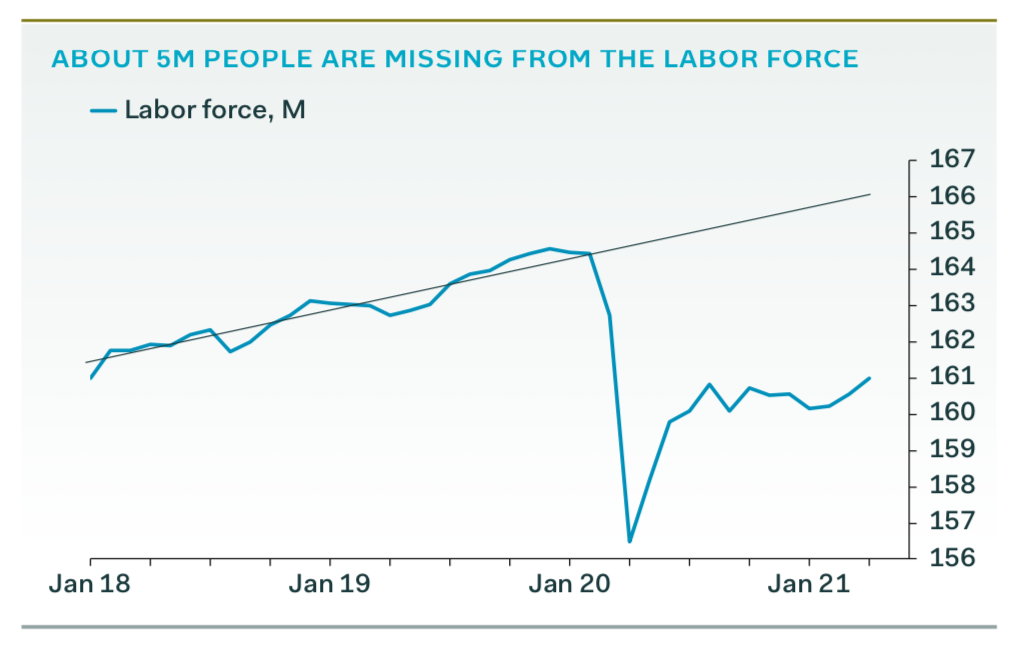

US Labour Market

- A big debate is going on about the tightness of labour markets in the US.

- This chart from Pantheon Macro is instructive – 5 million people are missing from the labour force.

- By Q3 factors holding individuals back will fade – enhanced unemployment benefit will expire (6th Sep) and all childcare/schools will likely be open.

- Near term however we have lots of evidence of tightness (signing bonuses, rising wages) and the Fed is taking notice.

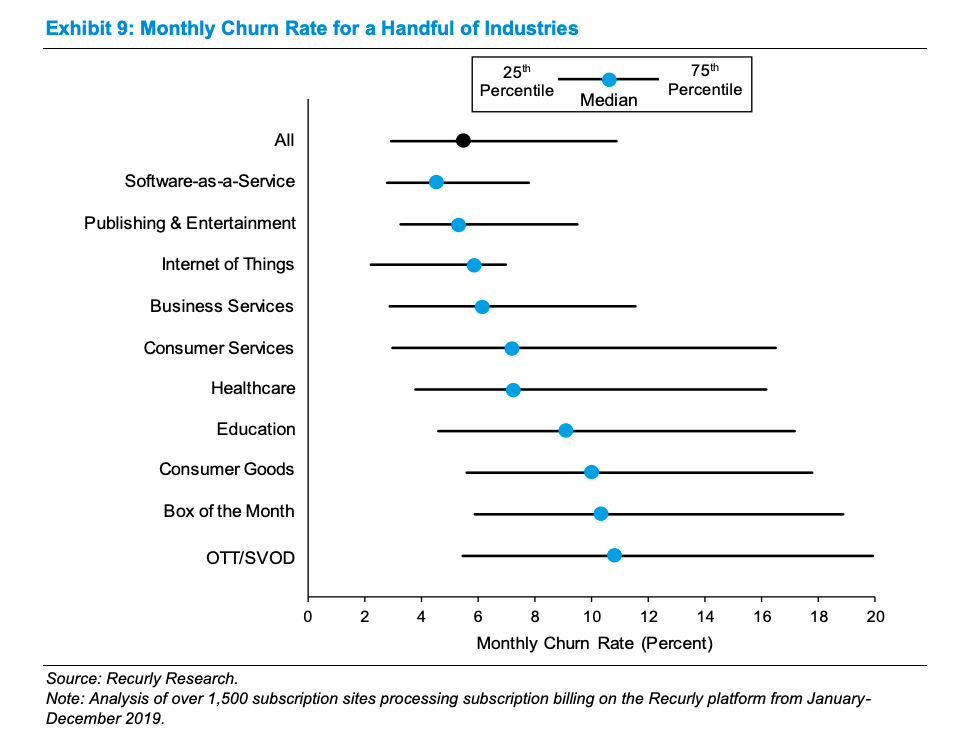

Churn Rates by Industry

- Useful chart from the latest Mauboussin note showing churn rates in various industries.

- The piece itself is about valuing customer based businesses – interesting read.

Andreessen Interview

Apple Wearables

- Pretty stunning how far Apple is ahead in wearable technology.

- This was a good article discussing their lead.

- Start by watching the AssistiveTouch for Apple Watch video – truly science fiction come to life.

- The article attributes Apple’s success to (1) being early (2) voice controlled devices distracting competitors (3) wearables requiring hardware design expertise (4) ecosystem synergies (5) and no price umbrella.

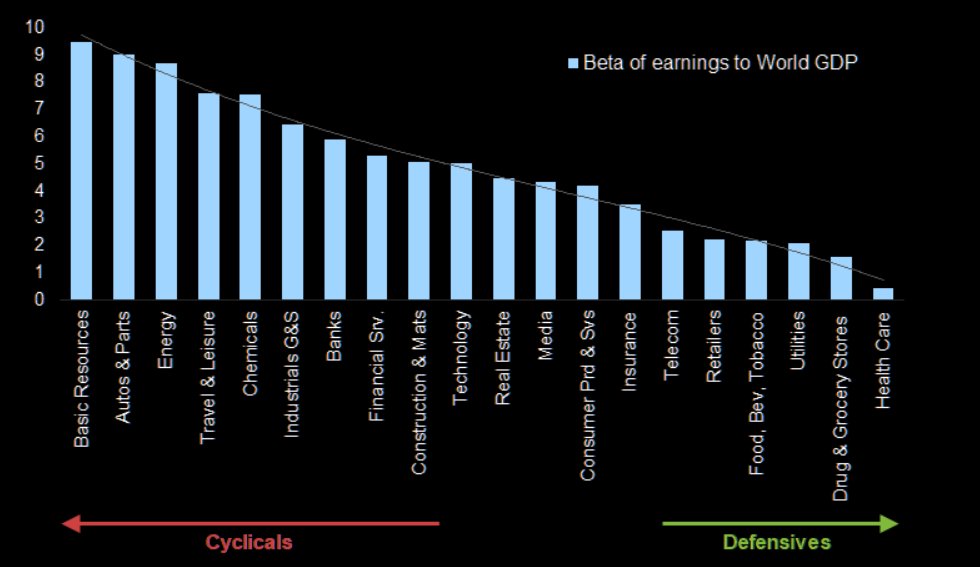

Defensives vs. Cyclicals

- In the current environment – with PMIs at highs and economic surprise indices flirting with zero – it is worth keeping this chart in the back pocket.

- Source.

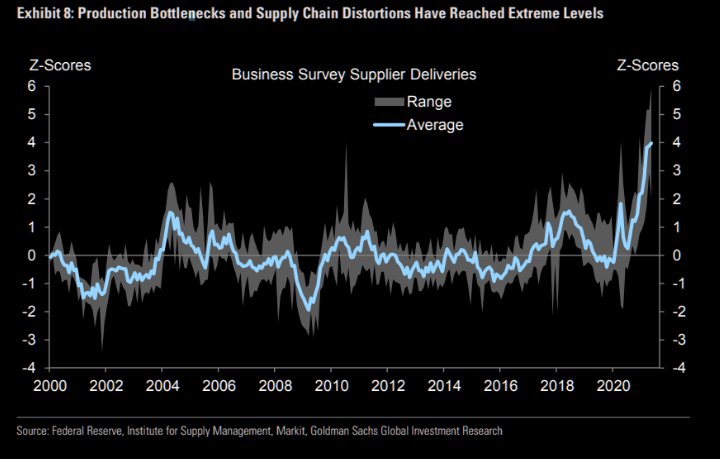

Production Bottlenecks

- Bottlenecks and supply chain disruptions are reaching extreme levels – is this temporary?

Carson Block

- Detailed and raw profile of the short selling legend behind Muddy Waters Research.

- Block named his research firm Muddy Waters after a Chinese proverb that translates as “muddy waters make it easy to catch fish”.

Impulse Buying

- How do you make online shopping conducive to impulse buying of gum and candy?

- Many food companies are trying to find creative solutions.