- The post-COVID spike in new business formation at the time looked temporary.

- However, four years later, business formation, especially for high-propensity businesses (businesses that plan to expand and hire employees), has stayed at a new elevated level.

- Source.

Macroeconomics

Snippets on the big picture.

UK Business Confidence

- “The IoD Directors’ Economic Confidence Index, which measures business leader optimism in prospects for the UK economy, fell to -65 in November 2024 from -52 in October and for the fourth month running.“

- Source.

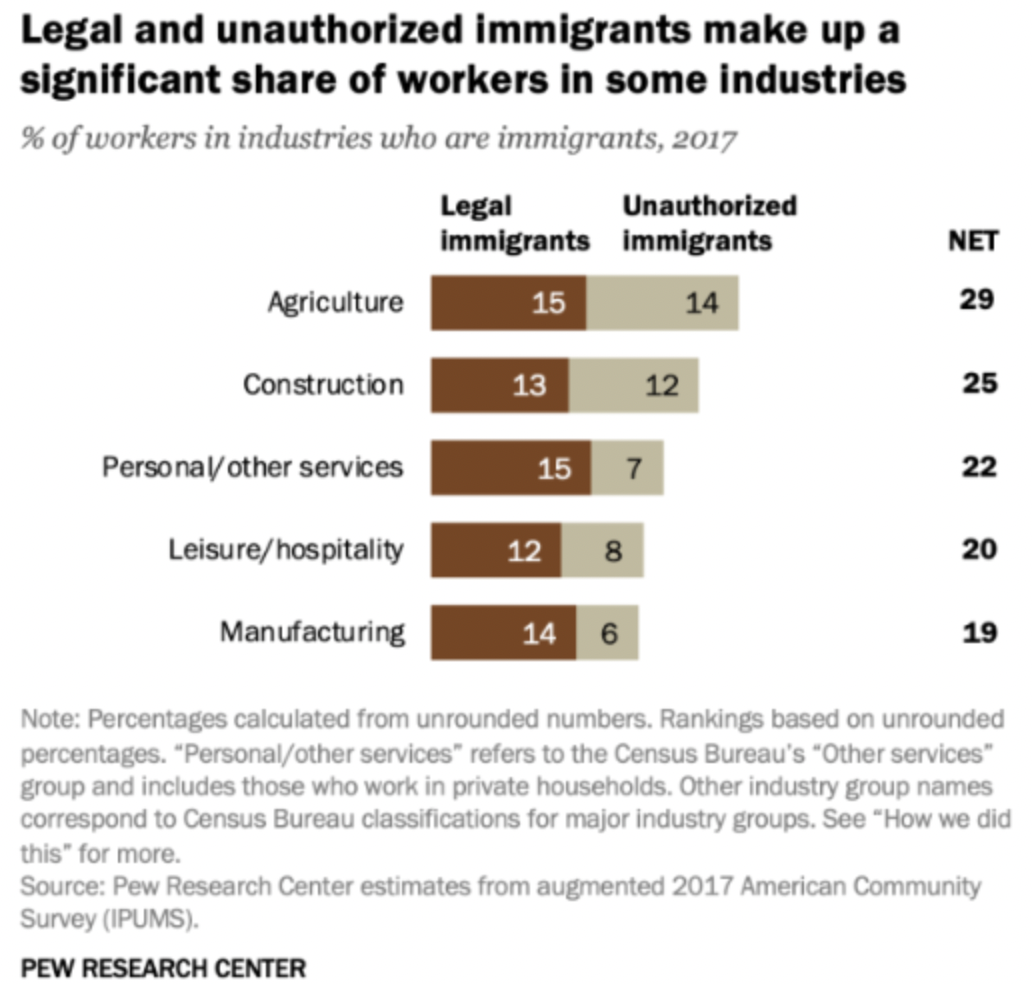

Industries and Immigration

- Those making policy should probably consider this chart (from a 2017 survey).

- 29% of all workers in agriculture and 25% in construction are immigrants.

- Source.

How to Devalue the Dollar

- Donald Trump and the path of the USD are difficult to analyse, as conflicting forces are pushing in different directions.

- Ultimately if Trump wanted a weak dollar there are things he could do.

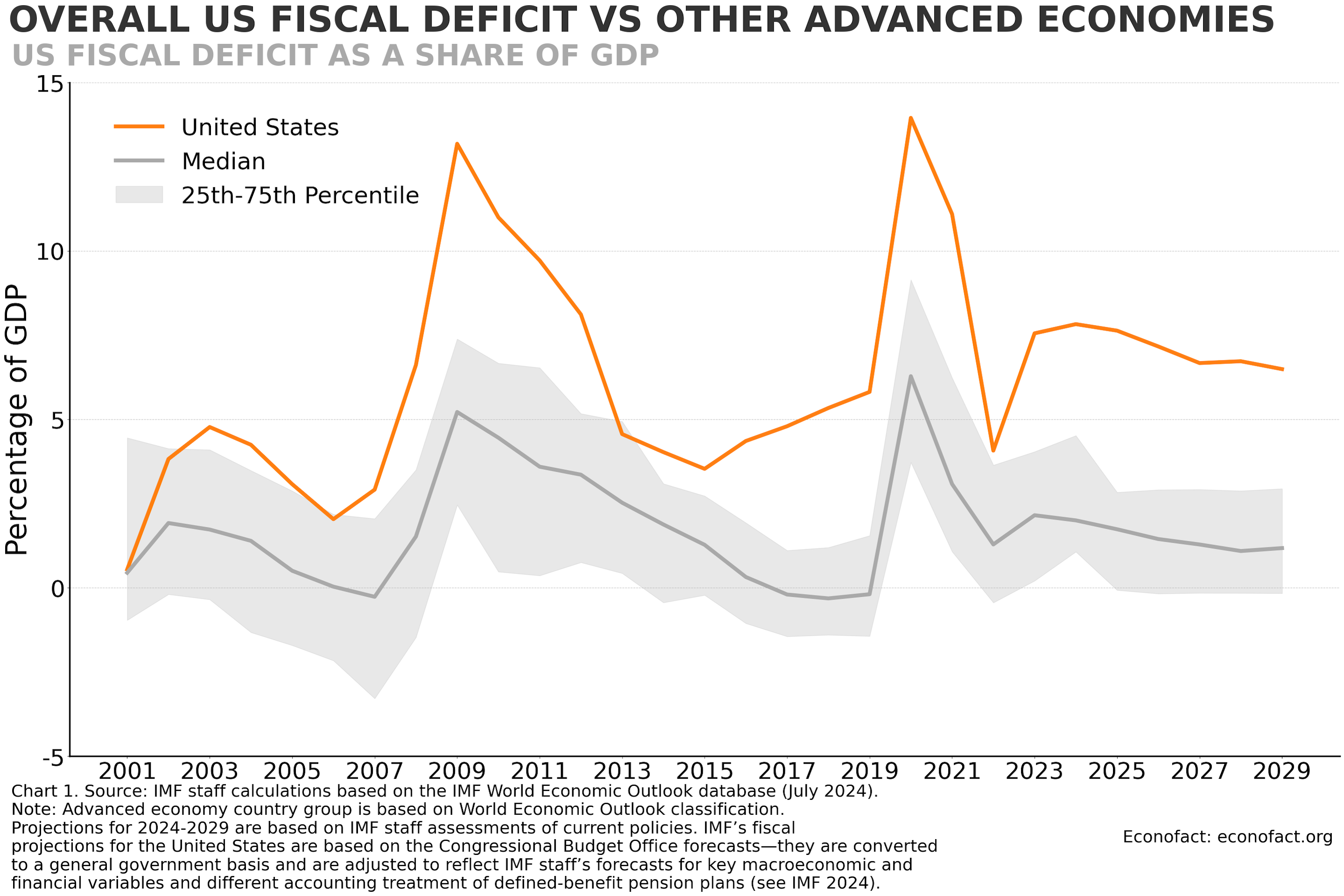

U.S. Fiscal Position

- U.S. fiscal deficit stands out vs. other advanced countries.

- Source.

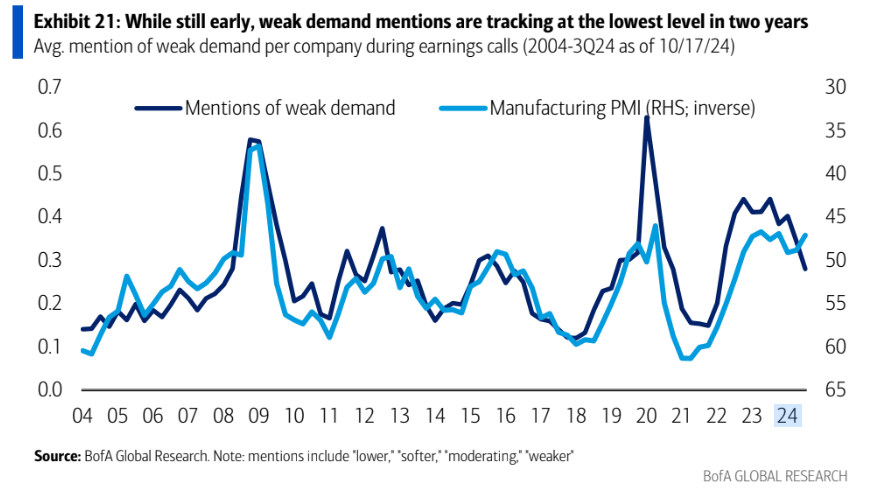

Weak Demand?

- Despite a continued PMI below 50, mentions of weak demand on company conference calls (as of 17th October) are falling.

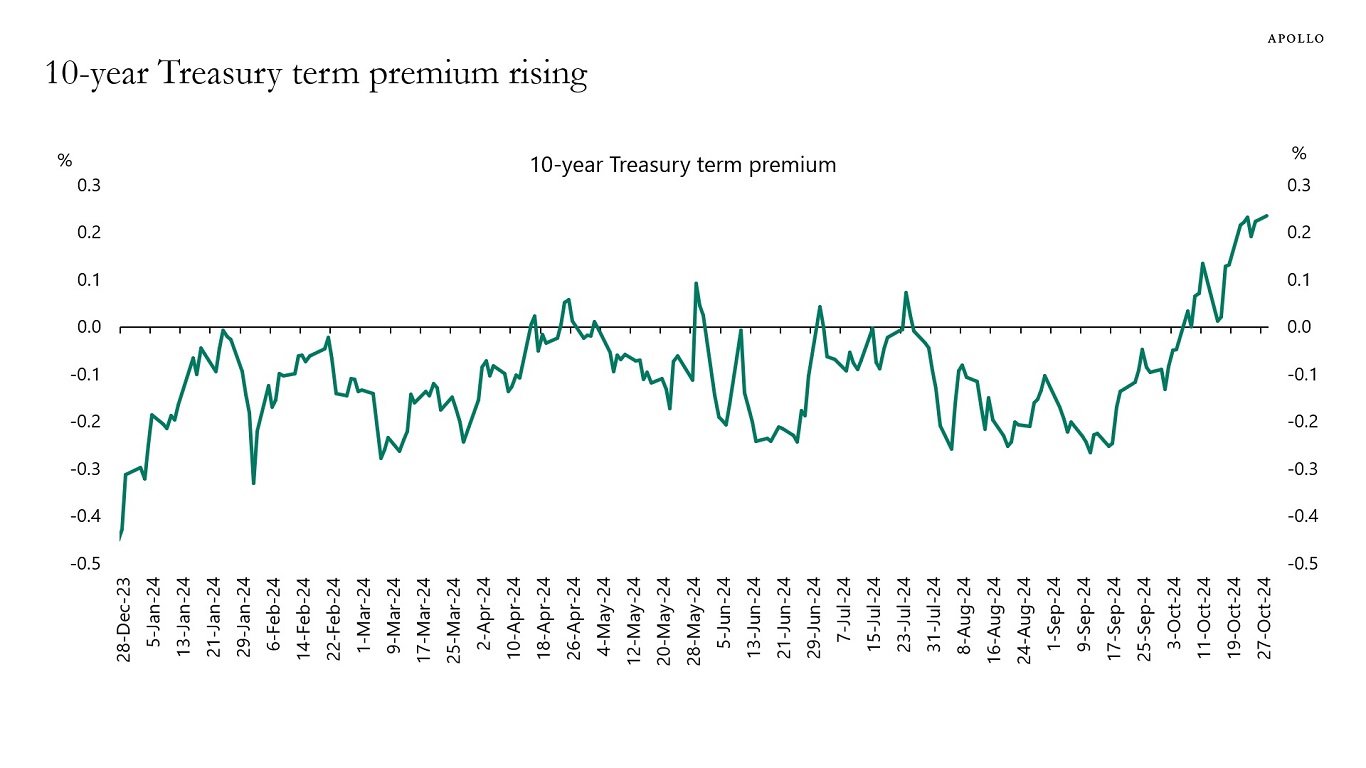

Rising Term Premium

- Despite the yield whipsaw last week, 10-year rates were starting to price in a term premium, likely due to worries about the US fiscal position under Trump.

- Source.

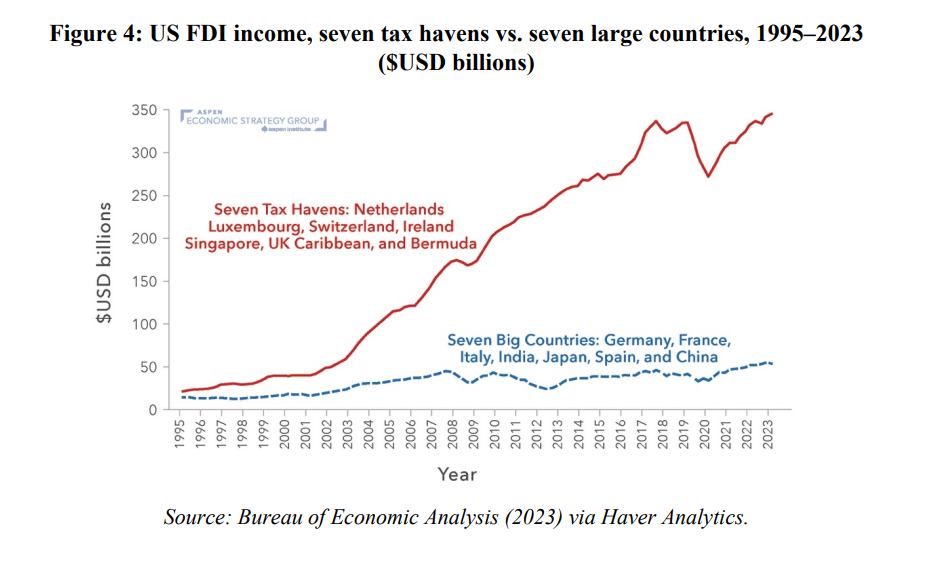

Globalization’s Resiliance is Partly Tax

- “Globalization has also persisted because the Trump-Ryan reforms to the U.S. corporate tax system, implemented through the Tax Cuts and Jobs Act (TCJA), did not end tax-related incentives for U.S. firms to offshore production and profits.“

- A reversal of the latter could be an issue for big pharma and semiconductor firms.

- China’s export-led growth strategy is the other, admittedly larger, driver.

- Blog post here and full paper here.

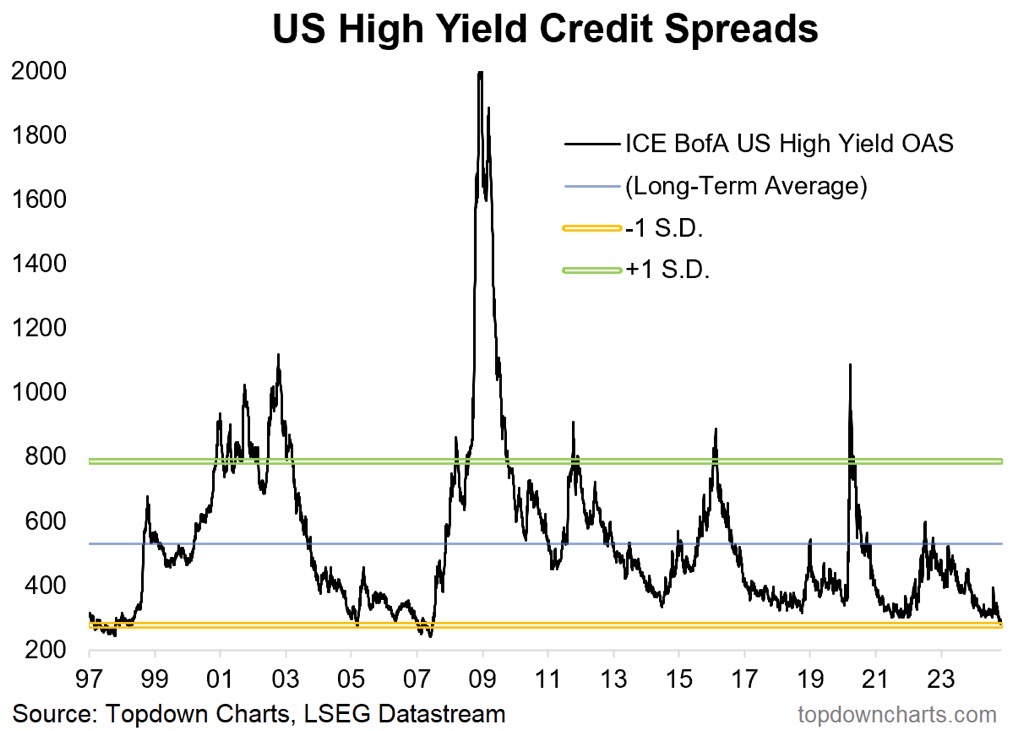

High Yield Credit Spreads

- Historic low.

- Source: Top Down Charts.

Consumer Price Index

- “Of all the economic statistics produced by the U.S. federal government, none has a direct impact on the lives of everyday Americans quite like the Consumer Price Index.”

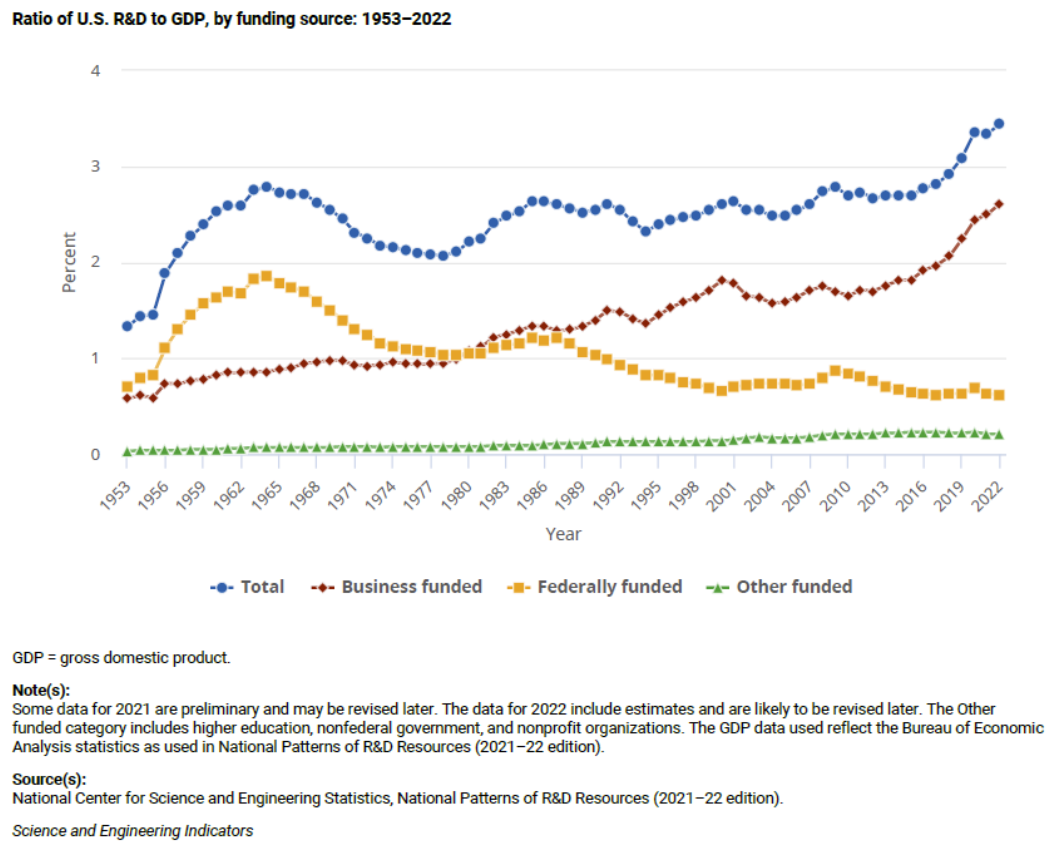

US R&D Spending is Surging

- In the last decade, spending on R&D in the U.S. has surged.

- Almost entirely driven by businesses.

- More than offsetting the multi-decade decline of government spending on R&D.

- Source.

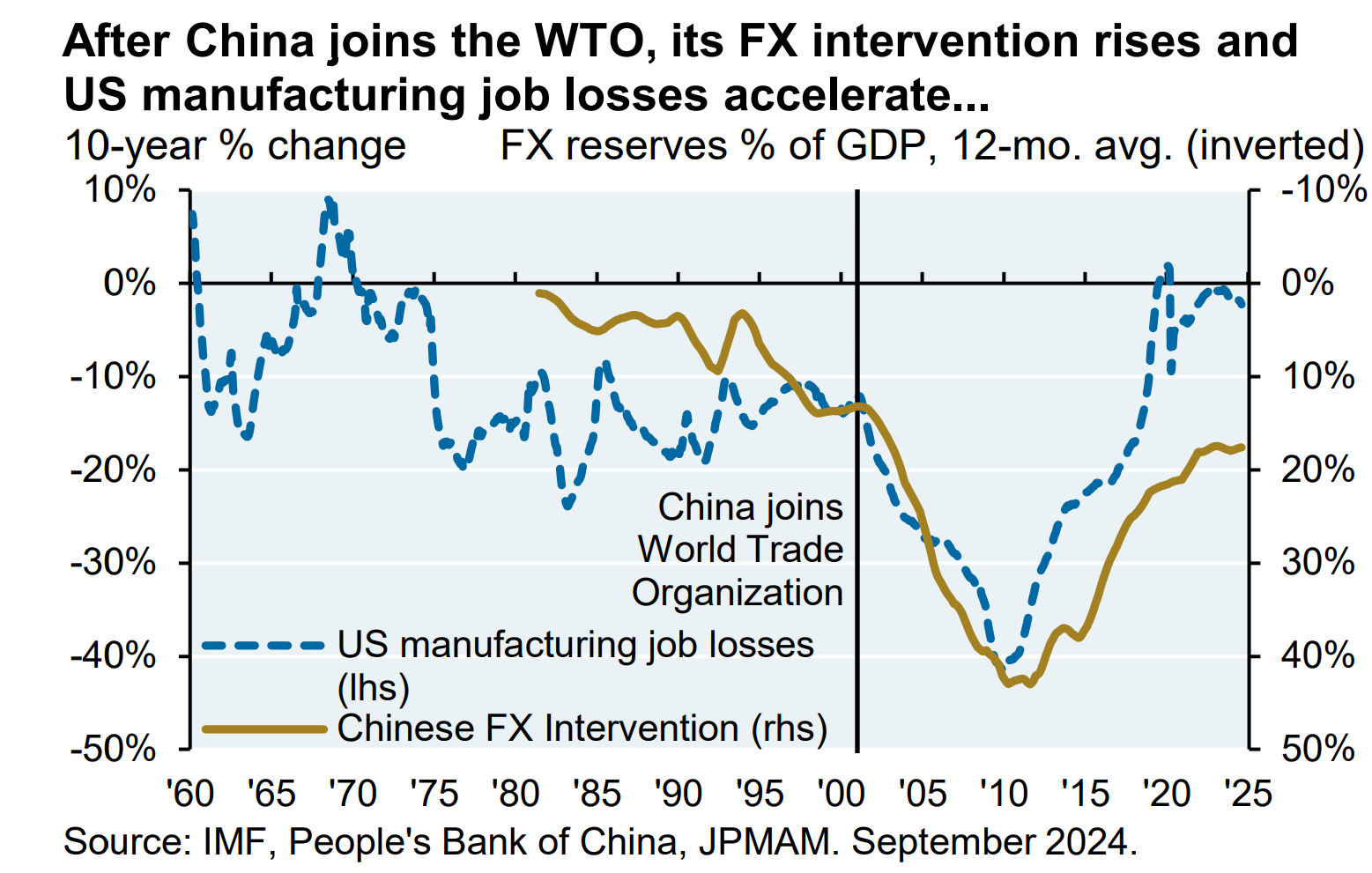

China and the US

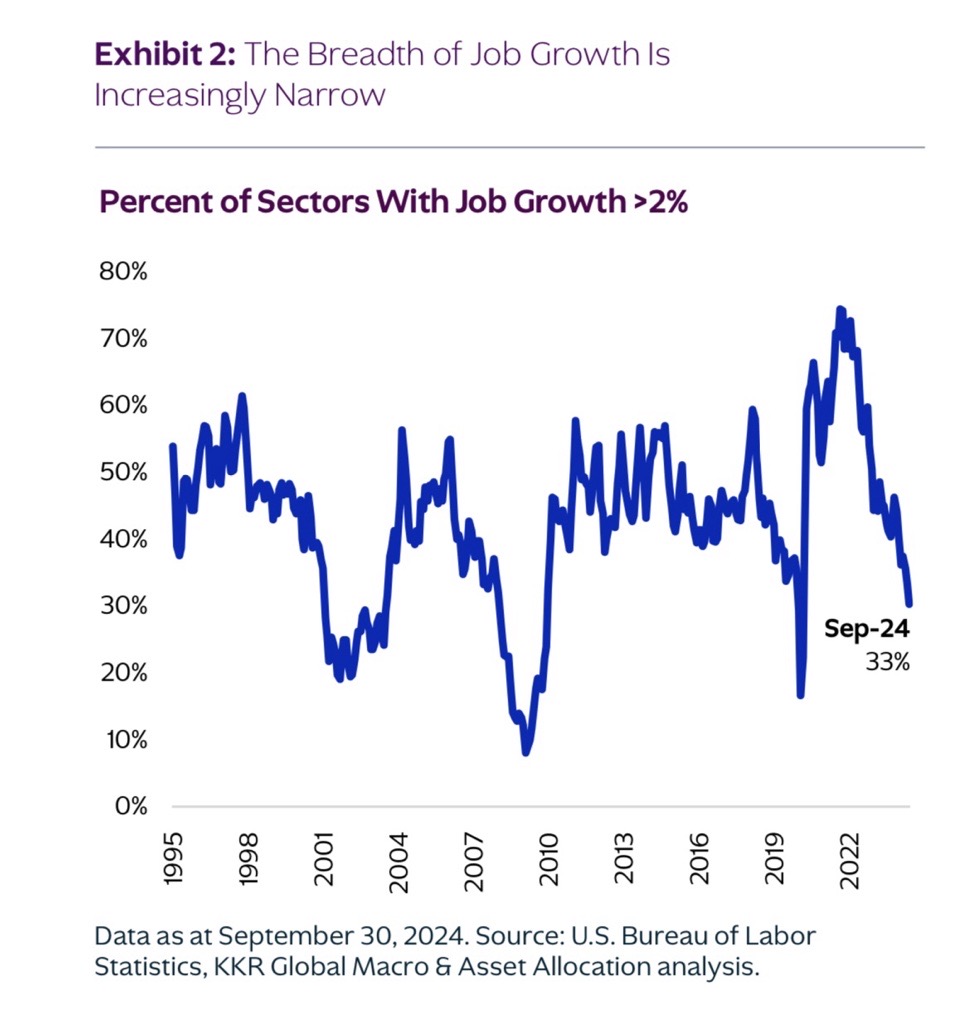

Job Growth Breadth

- Is increasingly narrow.

- Source: KKR.

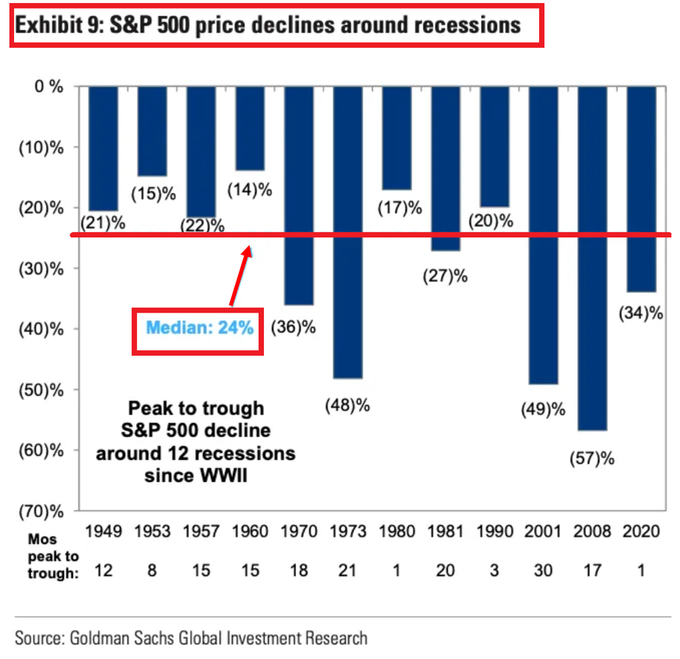

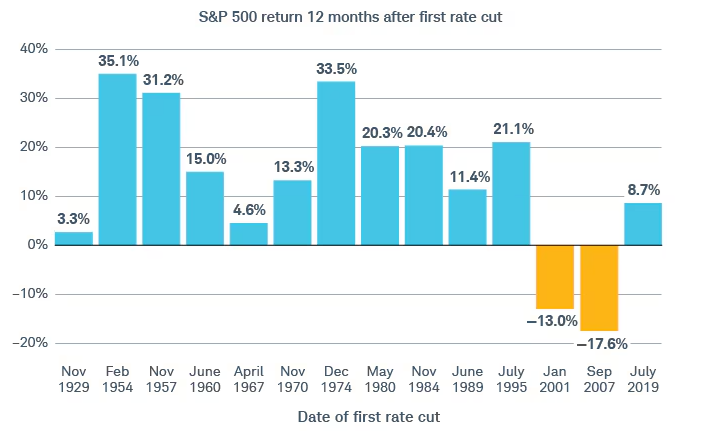

Economic View is Key for Markets

- Plenty of charts around showing that, if there is no recession after a rate cut, the market is up on a 12-month view.

- If there is, the market could be down. The median decline is 24%.

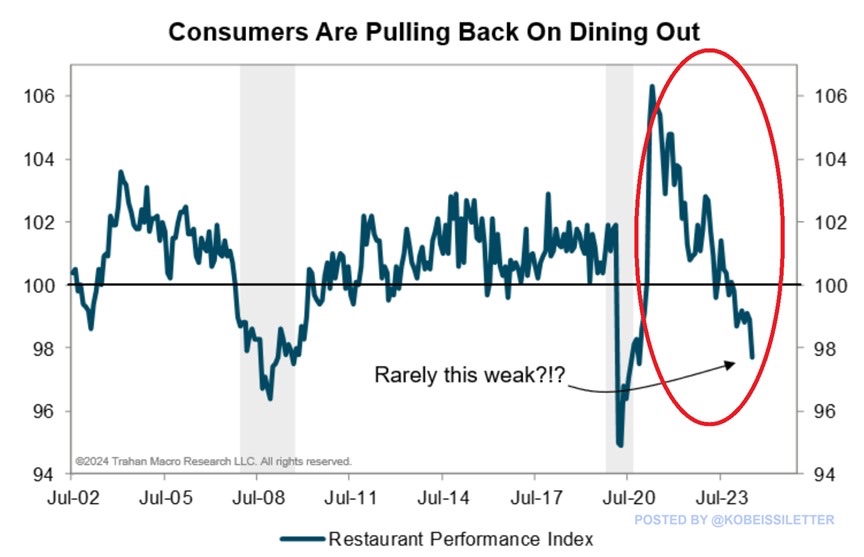

Restaurant Spending

- Some distortion post-COVID could be causing some reverberations, but it looks fairly weak.

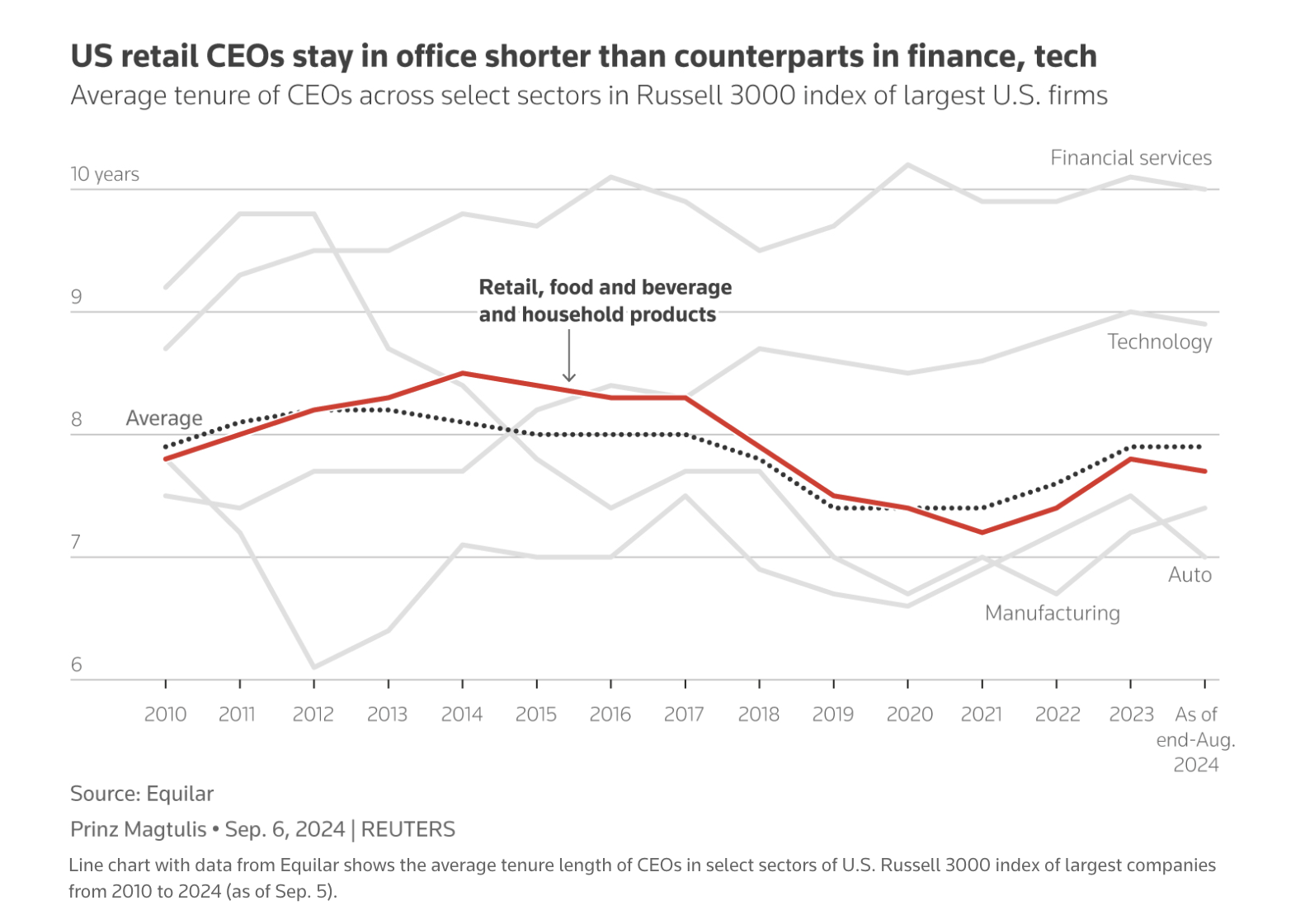

CEO Tenure

- Consumer/retail CEO tenure is surprisingly low compared to other sectors.

- Source.

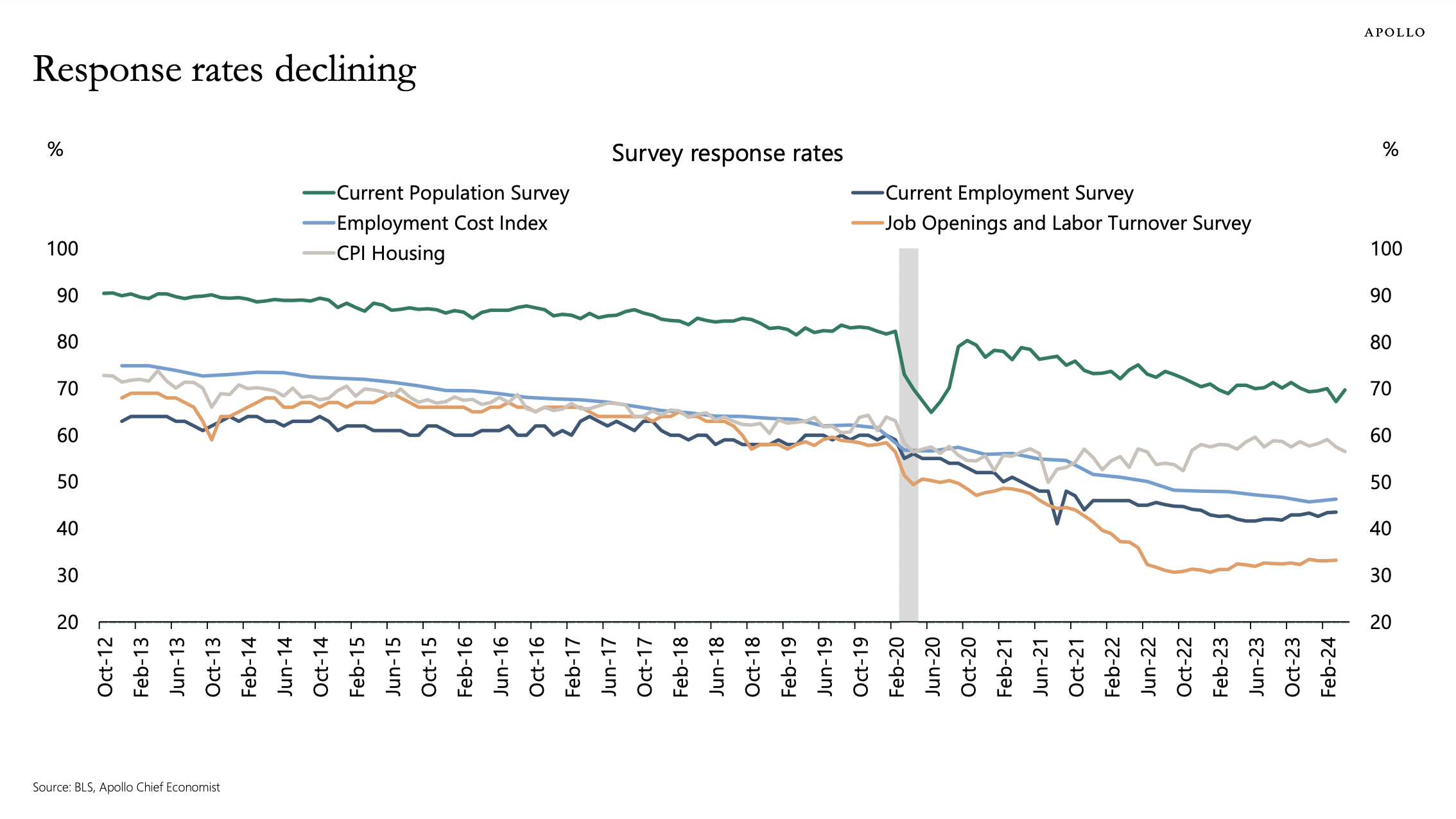

Economics Data Quality

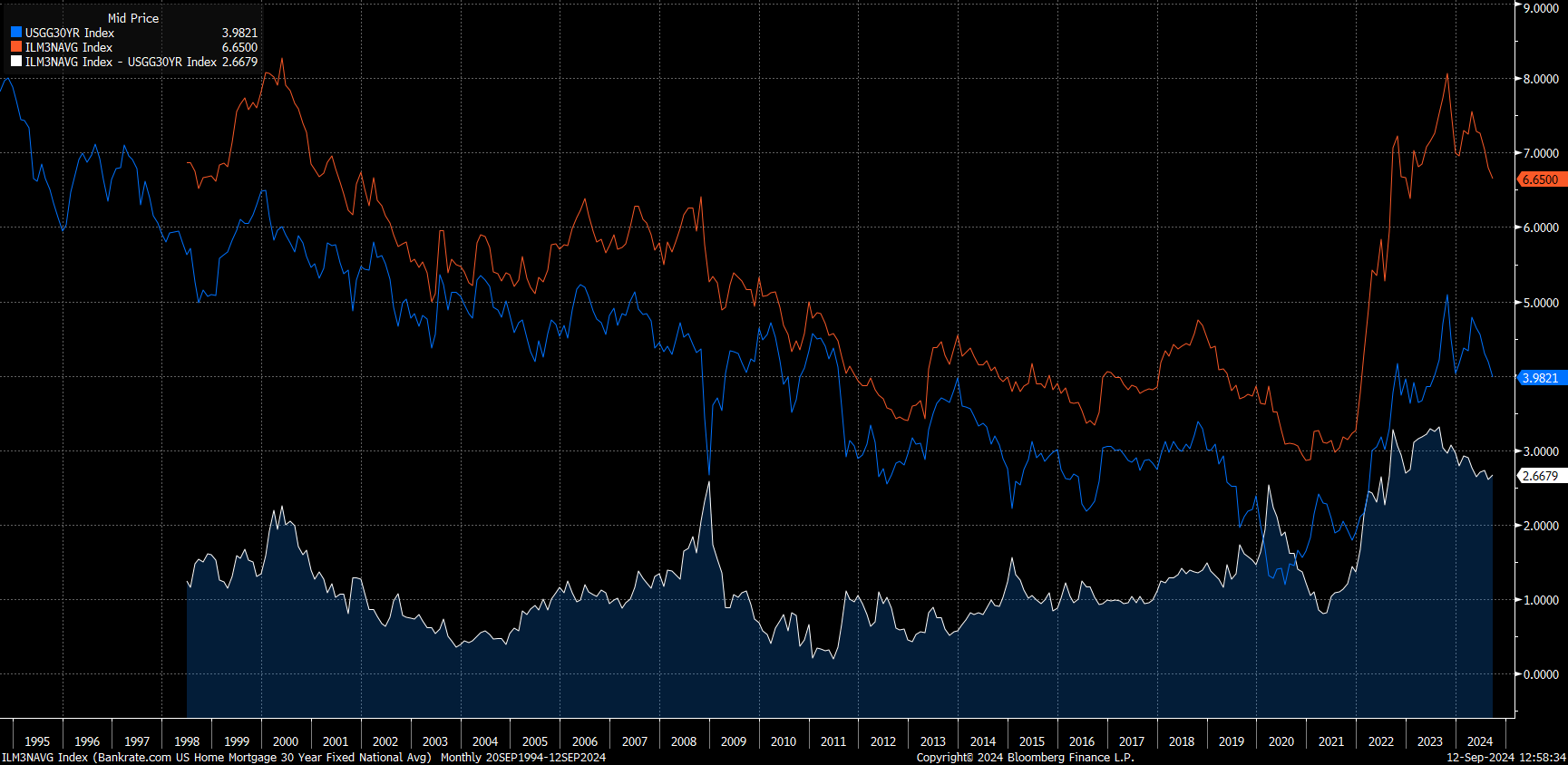

Mortgage Rates

- US 30-year fixed mortgage rates (orange line, bankrate data) are coming down, pushed by falling 30-year treasury rates (blue line).

- Interestingly, the spread to 30-year US treasuries (white line) went up a lot this rate cycle and remains (2.67%) well above the historic average (1.3%). Normalisation here could be a big boost.

S&P Returns Post Rate Cuts

- 12-month returns are largely positive except in 07/01.

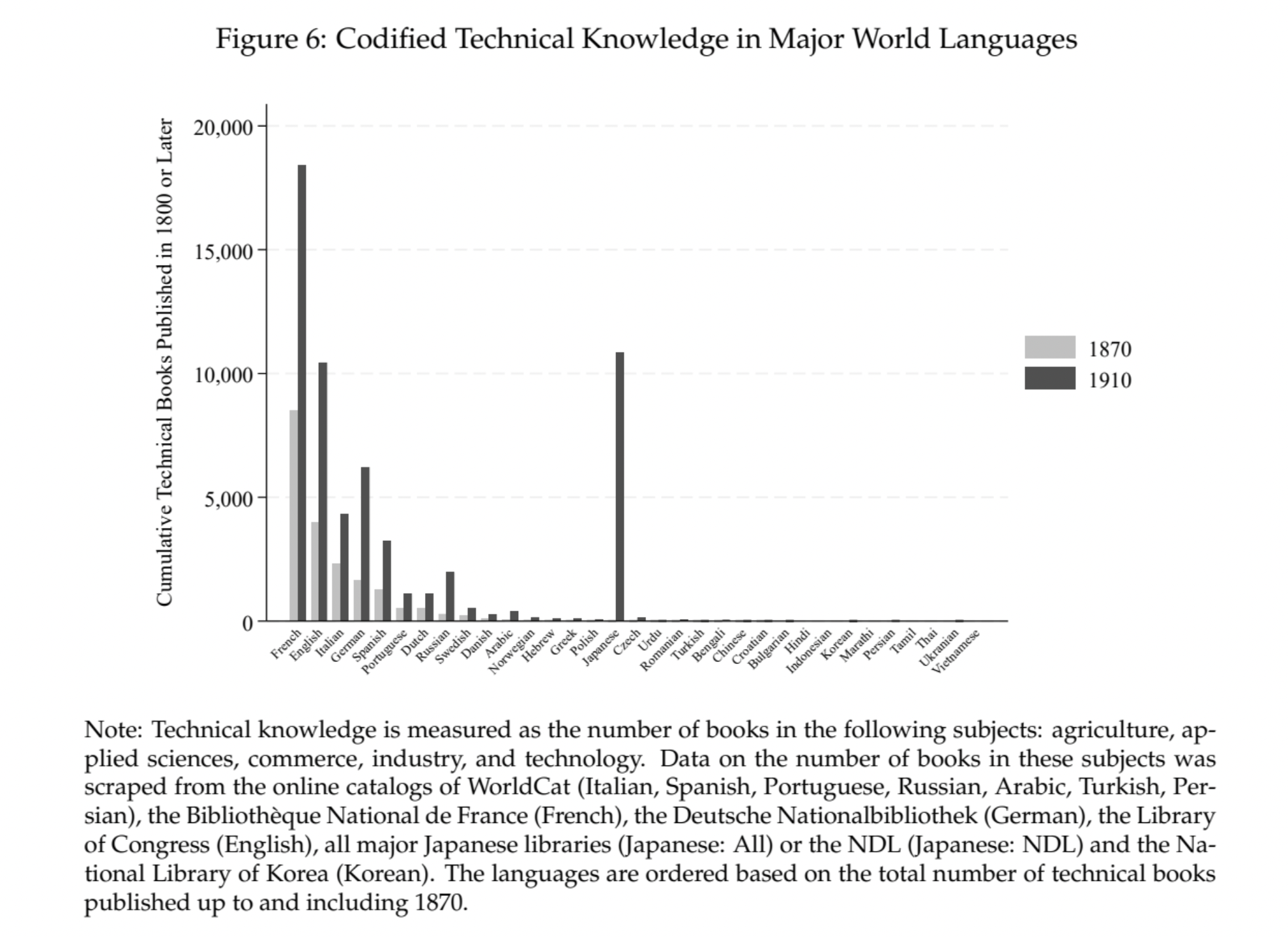

How Japan Transformed

- At the end of the 19th century “Japan transformed from a relatively poor, predominantly agricultural economy specialized in the exports of unprocessed, primary products to an economy specialized in the export of manufactures in under fifteen years.“

- How did it achieve such a feat?

- “In a remarkable new paper, Juhász, Sakabe, and Weinstein show how the key to this transformation was a massive effort to translate and codify technical information in the Japanese language. This state-led initiative made cutting-edge industrial knowledge accessible to Japanese entrepreneurs and workers in a way that was unparalleled among non-Western countries at the time.“

- Source.