- Interesting to see Consumer Loan delinquencies rising.

- Consumer loans consist of eight loan types including automobiles.

- Credit card delinquencies have been better behaved.

Macroeconomics

Snippets on the big picture.

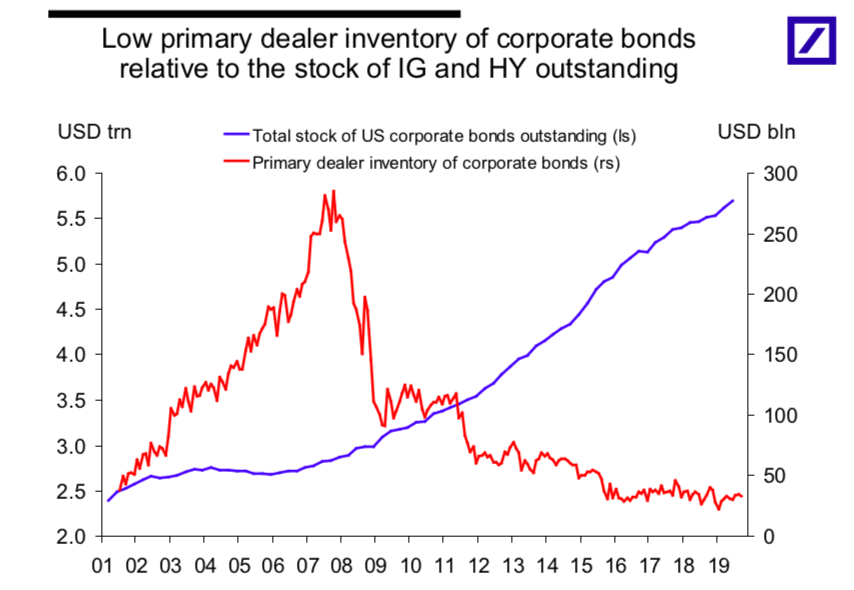

Primary Dealer Inventory

- US Bonds outstanding continues to grow.

- However, inventory of bonds at primary dealers has stayed low since the financial crisis.

- This creates a very risky situation in terms of liquidity.

- Especially problematic now that Bond ETFs have hit $1 trillion.

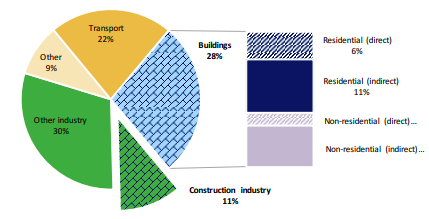

Building

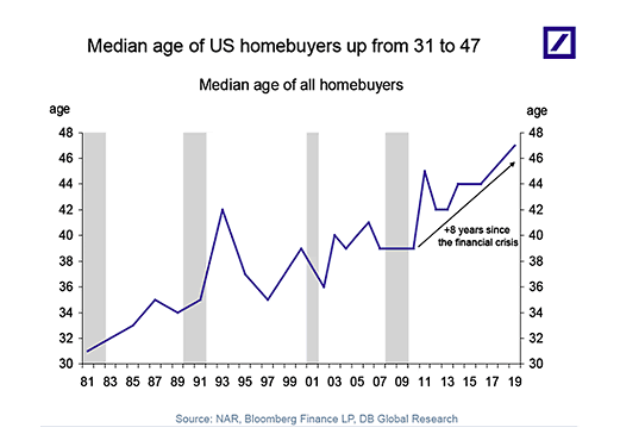

US Homebuyers

- The median age of US homebuyers used to be 31 in the 1980s.

- It has now risen to 47.

- 8 years have been added to the median age since the financial crisis.

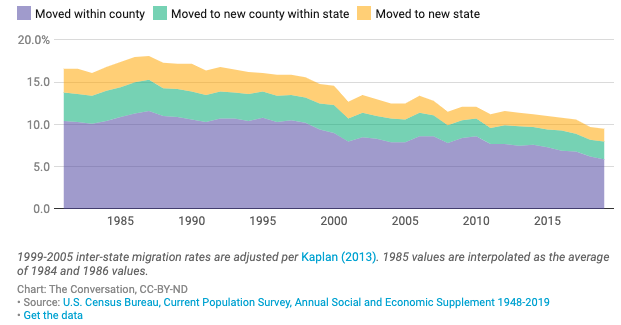

Americans Moving

- An amazing chart showing the percentage of Americans moving home has fallen from 18.1% in 1987 to just 9.4% now.

- This is having profound effects on economics and society.

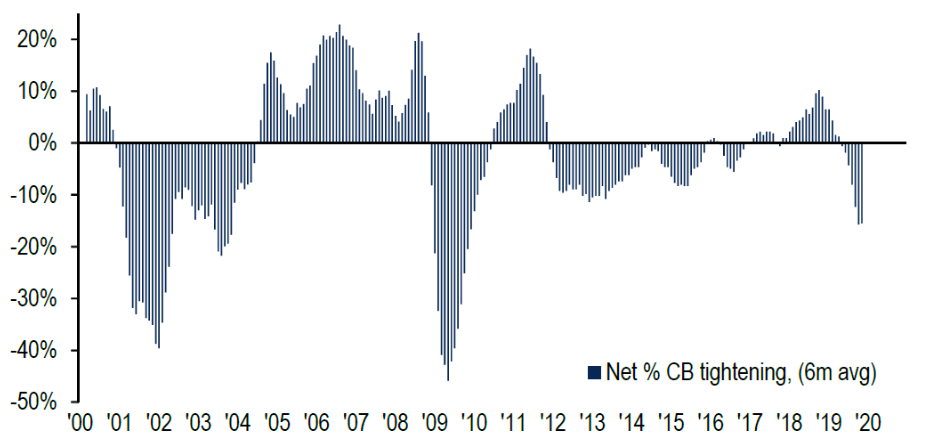

Central Bank Cutting

- Global Central Banks are cutting again – at the fastest rate since 2009.

- Interesting set up for 2020 market performance – is the absolute level that matters or the second derivative?

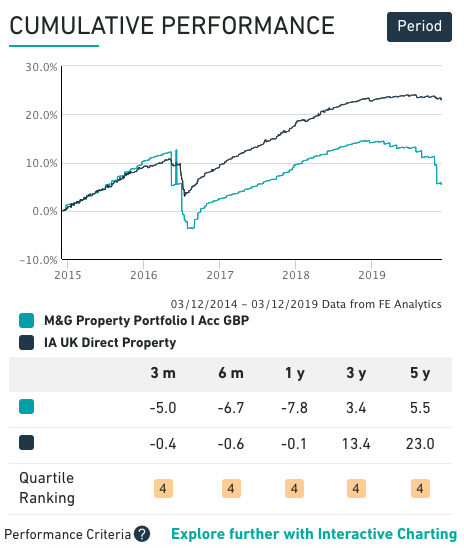

M&G suspends property fund

- M&G have suspended their UK commercial property fund – the largest.

- It is a £2.5bn fund.

- It has suffered £1bn of outflows over the last 12-months.

- They cite Brexit uncertainty. There was a 4-month suspension in 2016 post the referendum.

- Performance since 2016 relative to the sector has been poor.

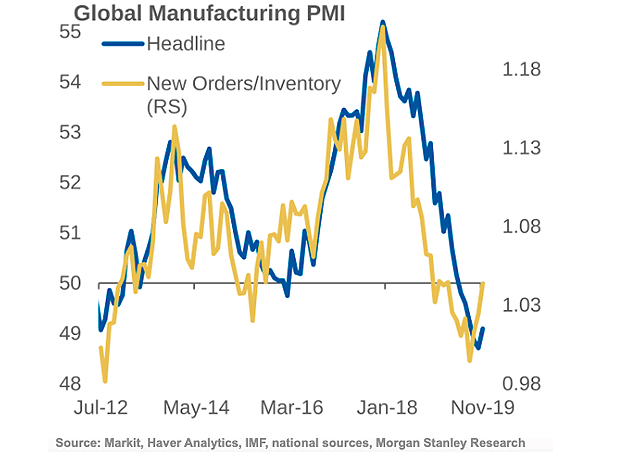

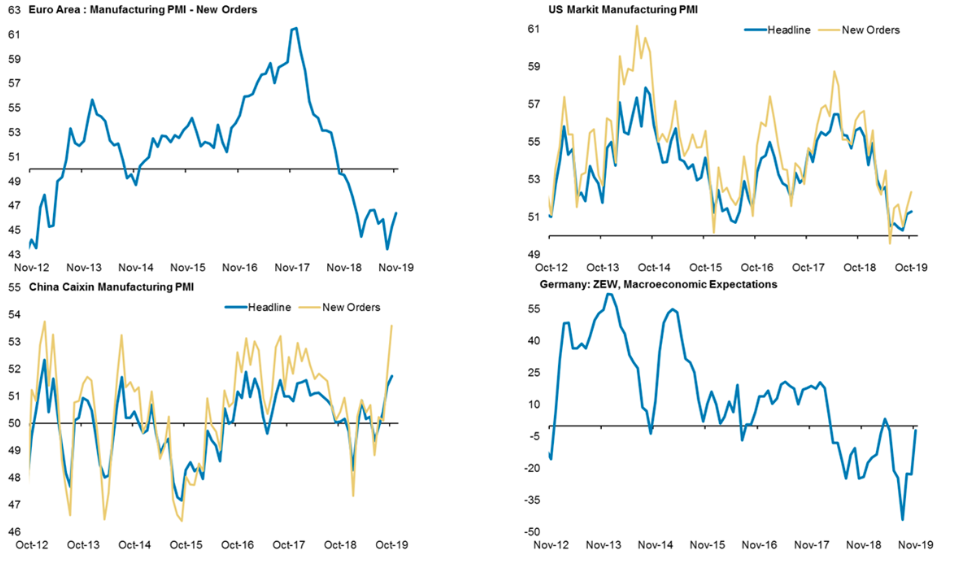

New Orders vs. Inventories

- The Purchasing Managers Index (PMI) contains several components.

- Two of these are new orders and inventories.

- The ratio of these two tends to lead the overall series – as we see now.

- It makes sense – if orders are rising and inventories are low we could see a snap back in manufacturing.

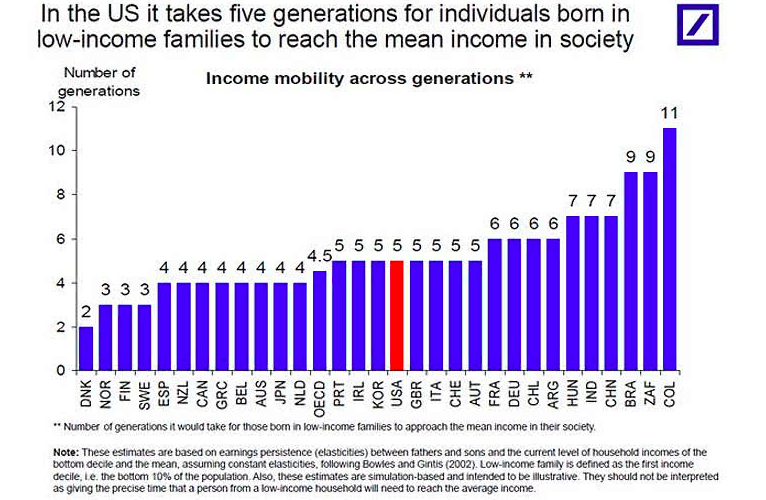

Income mobility

- US doesn’t rank very high in income mobility.

- It takes 5 generations for someone to move from low to high income.

Leading Indicators

- Lots of leading indicators are perking up.

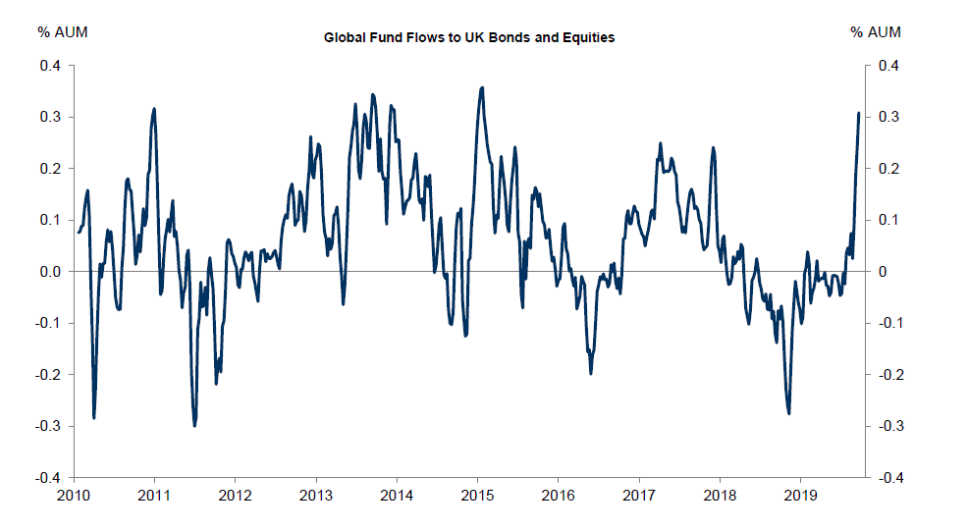

UK Flows

- Could UK no longer be an investment pariah …

- h/t The Market Ear

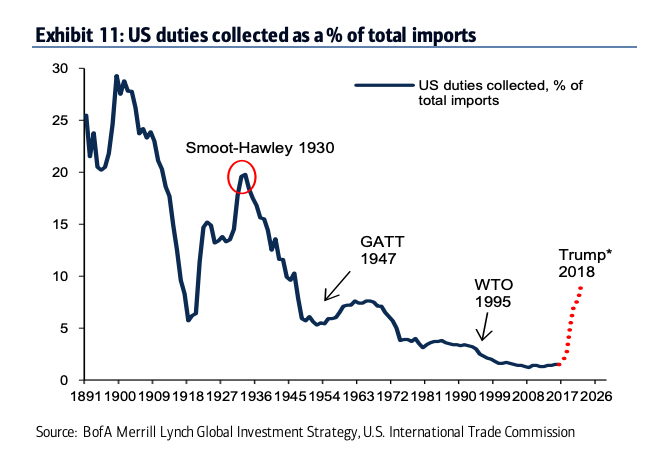

Tariffs

- A chart of US duties as % of imports since 1891 …

- Interesting long term trend punctuated with spikes.

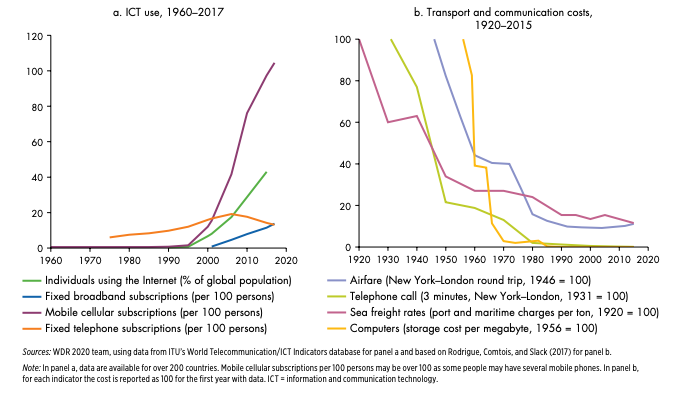

Technology (cont.)

- A nice chart showing how Information and Communication Technology (ICT) use has ballooned.

- While the cost of transportation (airline tickets and sea freight) and communication (telephone calls) has collapsed.

- From World Bank Development Report.

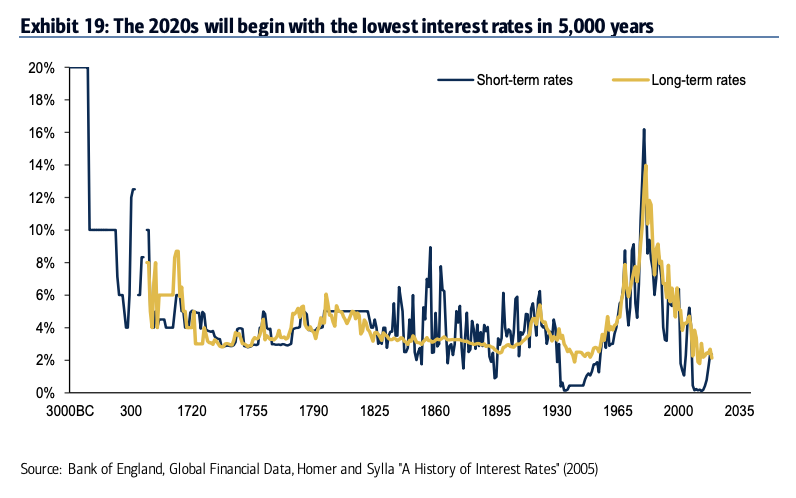

Interest rates

- The very (from 3000 BC!) long term history of interest rates.

Geopolitics

- Understanding geopolitical trends is vital to forecast shifting investment landscapes.

- This is the latest trove of leaked Iranian reports showing their level of influence in Iraq.

- Has ramifications around the world.

- “The reports reveal far more than was previously understood about the extent to which Iran and the United States have used Iraq as a staging area for their spy games.“

- “The documents show how Iran, at nearly every turn, has outmanoeuvred the United States in the contest for influence.“

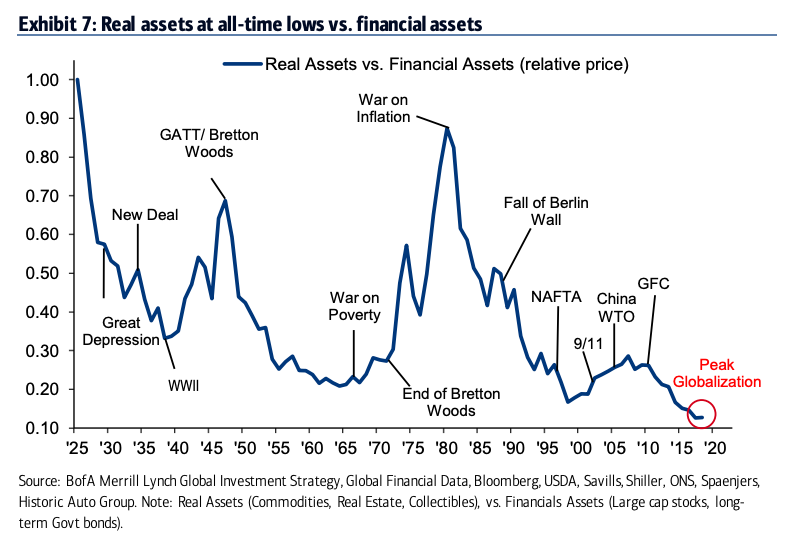

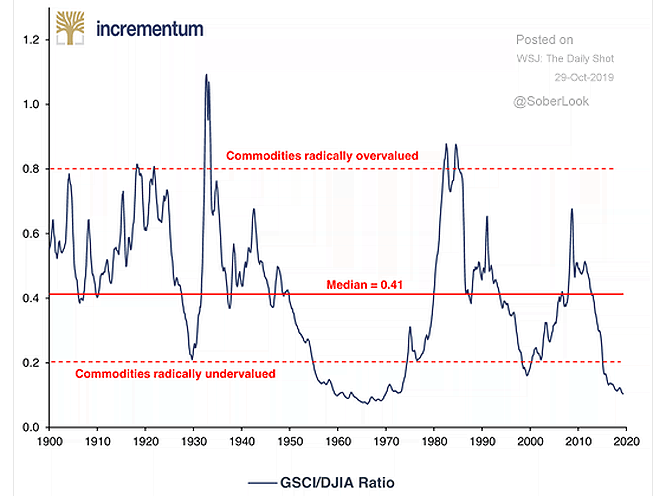

Real vs. Financial Assets

- Real asset (defined as commodities, real estate, collectibles) prices are at an all time low vs. financial assets (defined as large cap stocks and long-term government bonds).

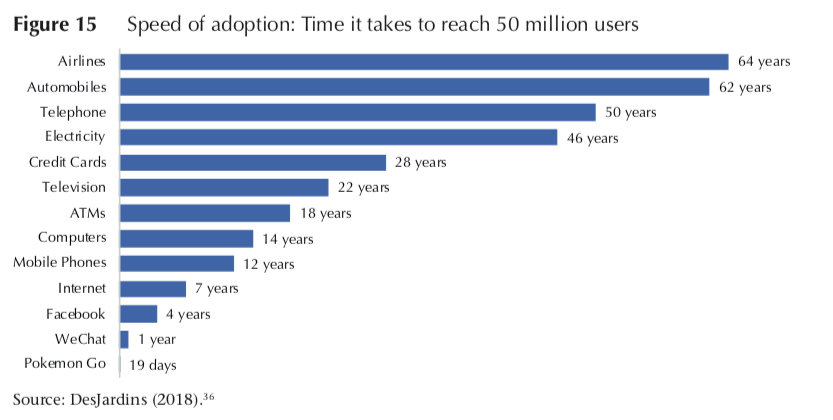

Technology

- Tech change is exponential.

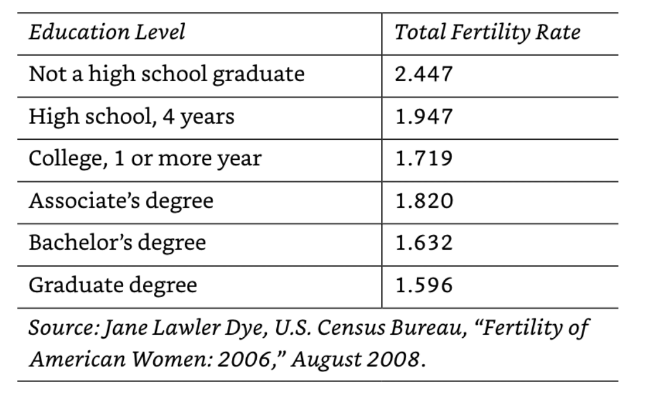

Fertility by Education

- Interesting table of US fertility by education level.

Semiconductors vs. ISM

- Semiconductor index (SOX) strength could be pre-ordering from China ahead of trade war.

- or a genuine pick up in end demand.

- Regardless likely to perk up lead indicators.

Commodities

- Commodities are at a record low valuation vs. stocks.