- This suggests pent-up demand once mortgage rates fall.

- Source: Apollo US Housing Slide Deck.

Macroeconomics

Snippets on the big picture.

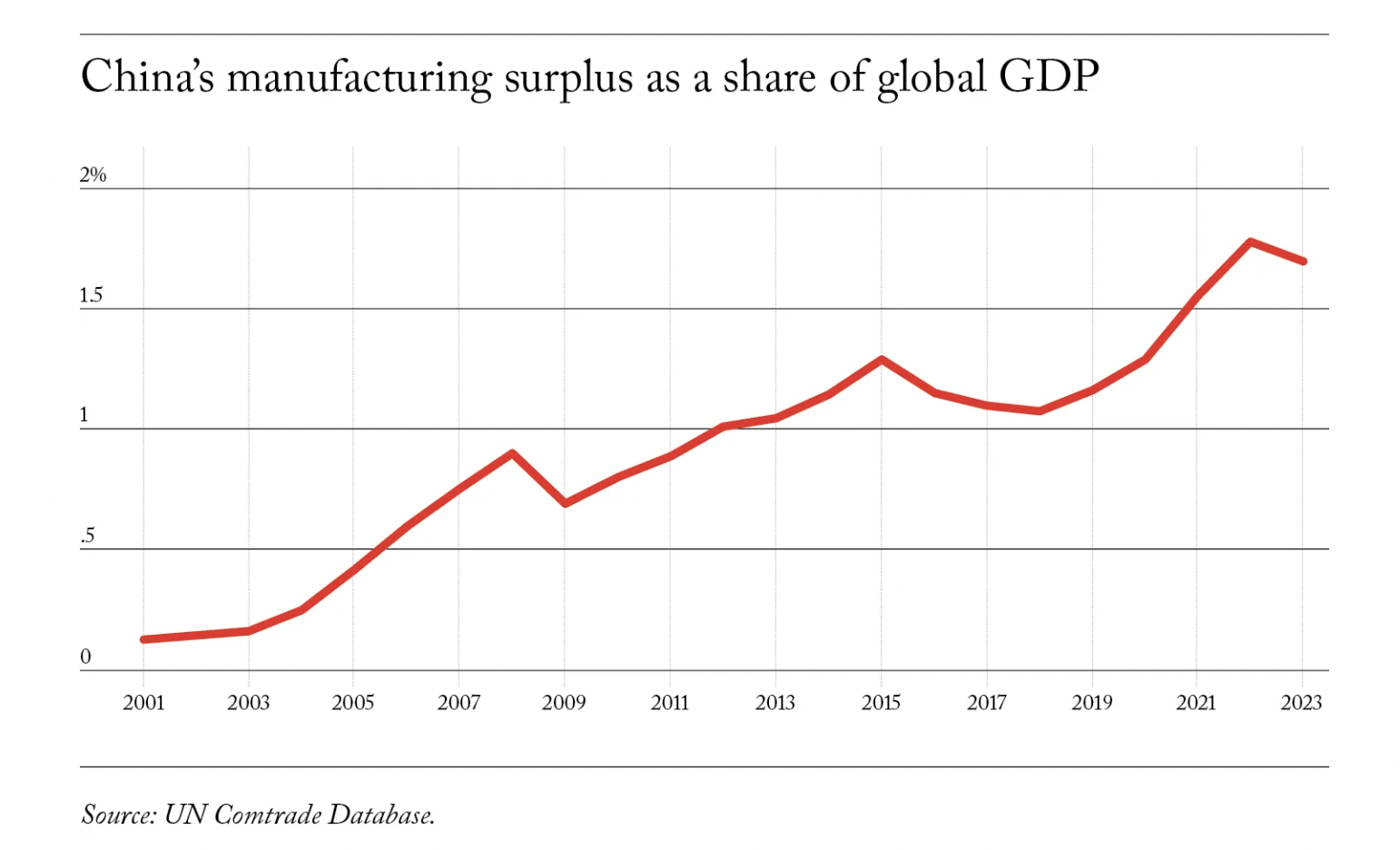

Myth of Deglobalization

- Deglobalization is a narrative that is prevailing in the press.

- Brad Setser argues that this isn’t the case.

- “China’s surplus in manufacturing has risen as much relative to world GDP in the last few years as it did during the first China shock following the country’s accession to the WTO“

- A big driver of this is the export of Chinese manufacturing into Vietnam and other countries for final export.

- “the reality is more complex: put plainly, it is impossible for a global economy characterized by a large U.S. deficit on one side and a large Chinese surplus on the other to truly fragment.“

- Corporate tax avoidance also boosts globalization – “American multinationals now often produce abroad to book large profits in offshore tax havens“.

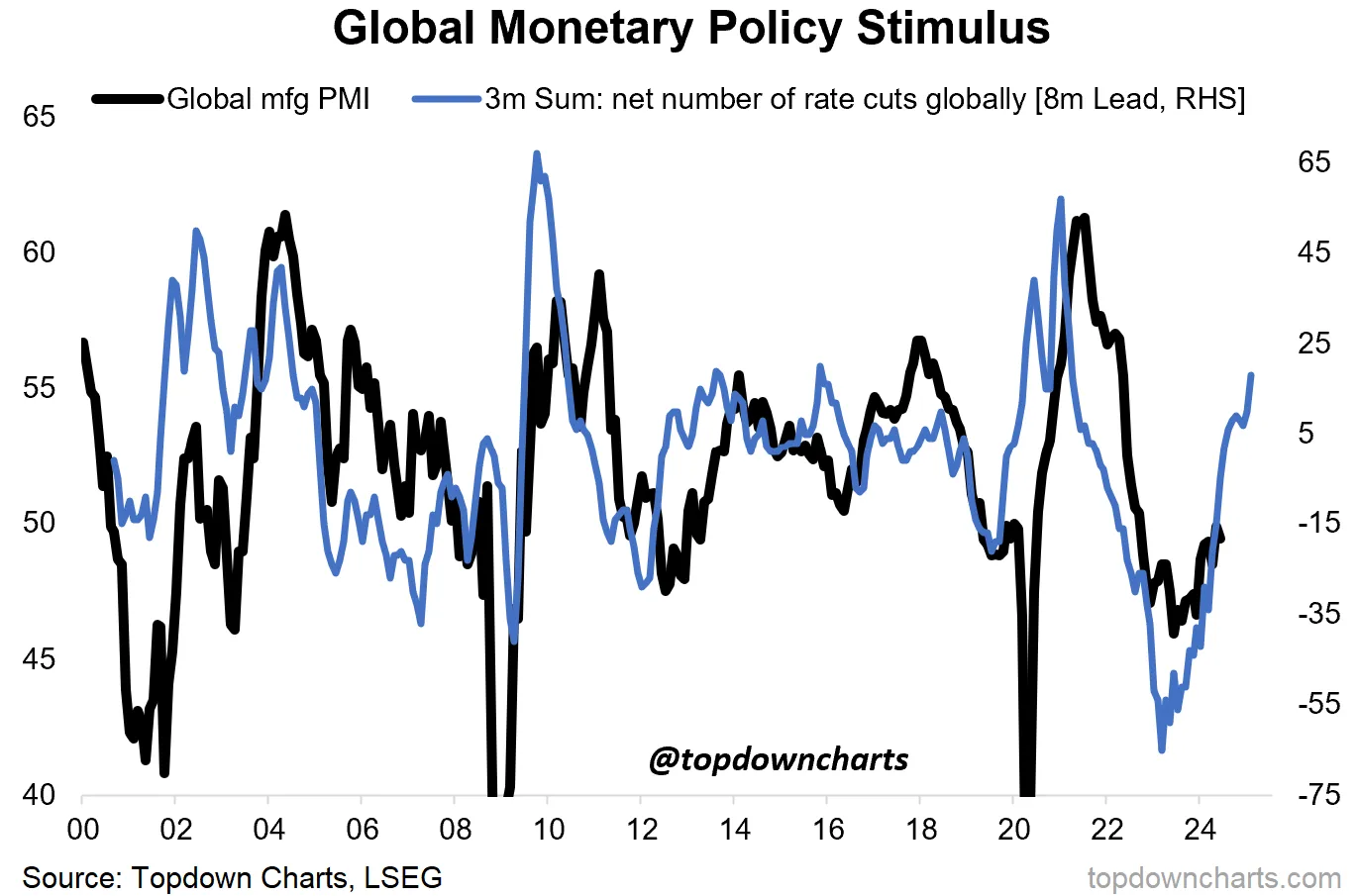

Reacceleration?

- Rate cuts lead the cycle turning.

- Source.

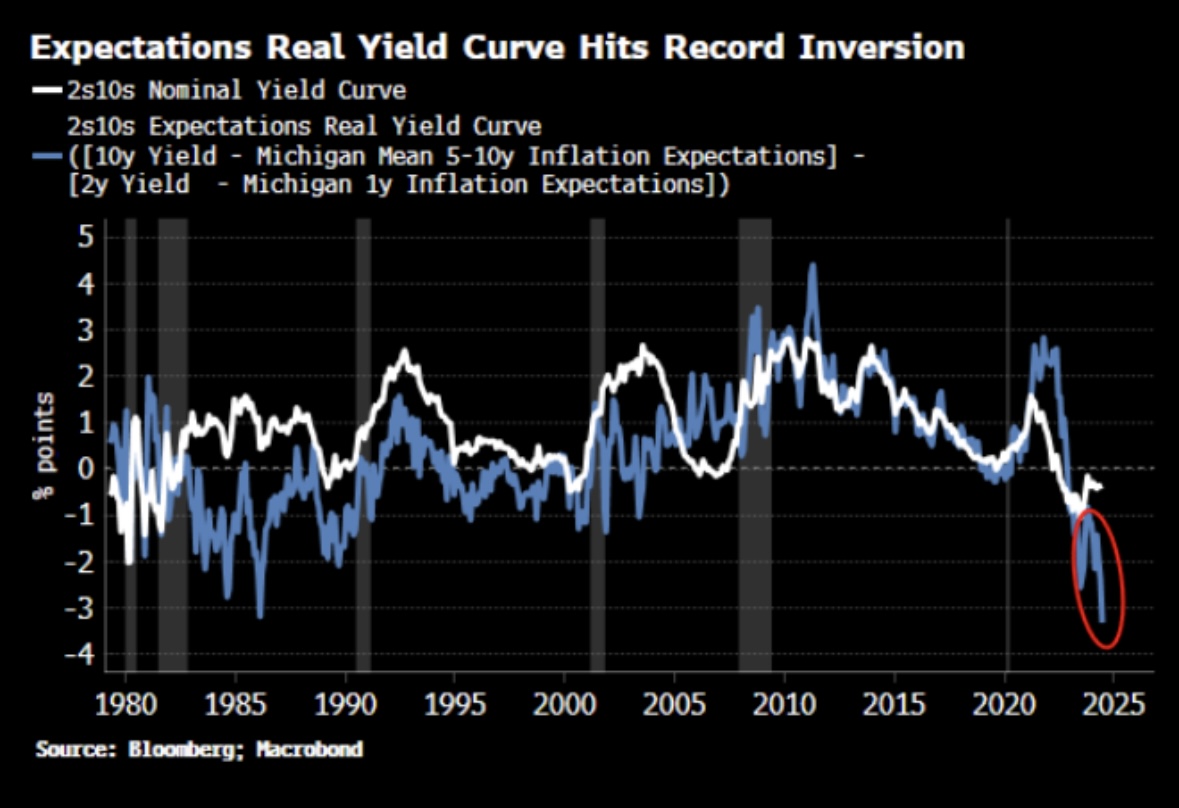

Real Yield Curve

- Deflating the yield curve by consumer price expectations shows a record inversion.

Trump Bloomberg Interview

- Important read given rising odds of US election win.

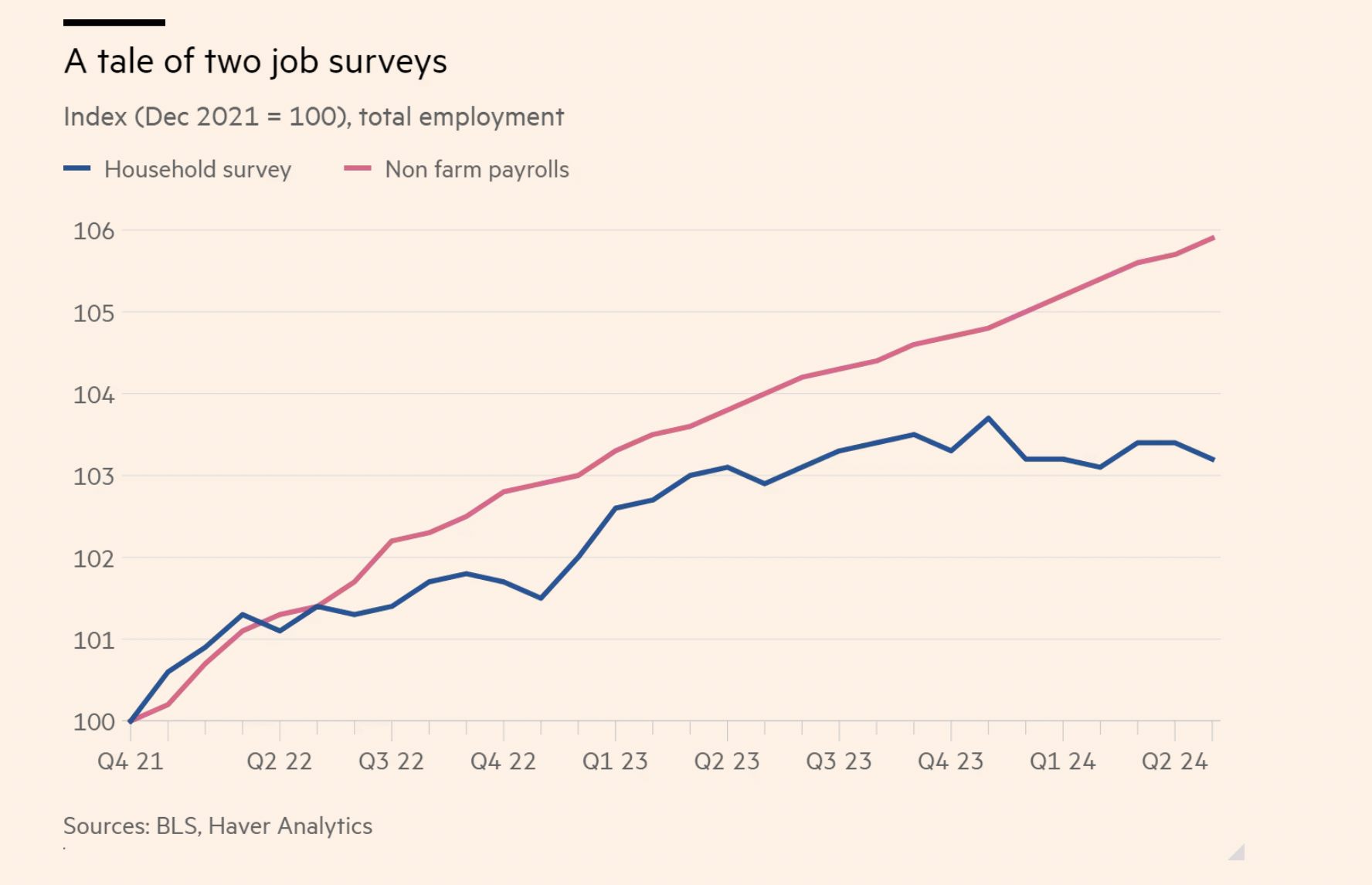

Jobs Data

- The two main US jobs surveys – the famous non-farm payrolls (establishment) and household survey – are broken.

- For one there is a stark difference in trajectory between the two.

- Response rates are also collapsing.

- “Totting it all up, ABN Amro finds that the gap between the two series is driven largely by underestimating immigration, and overestimating business births, and then definitions.“

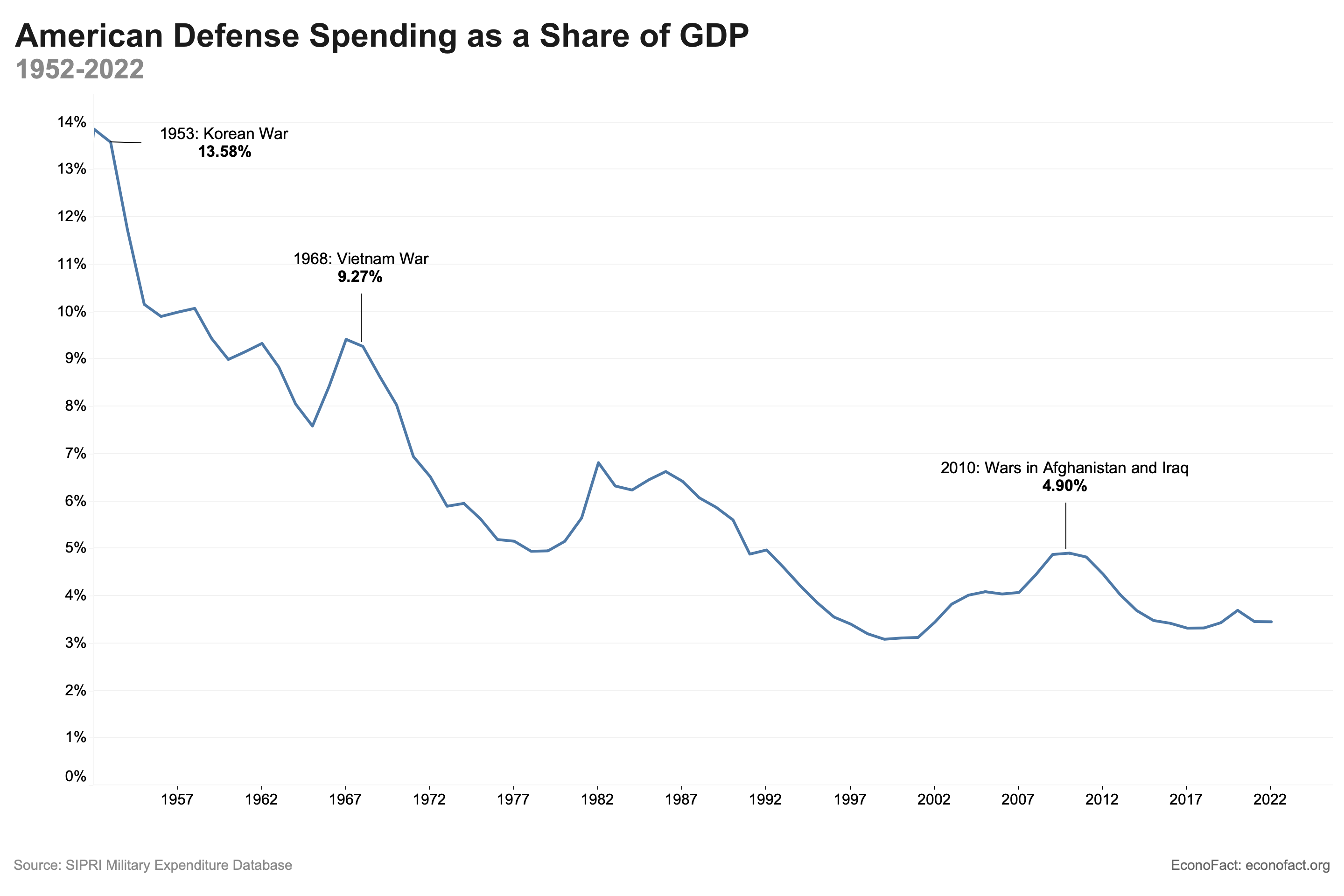

US Defense Spending

- “Current U.S. military spending is higher than at any point of the Cold War in inflation-adjusted terms, but relatively low as a percent of national income.“

- Source.

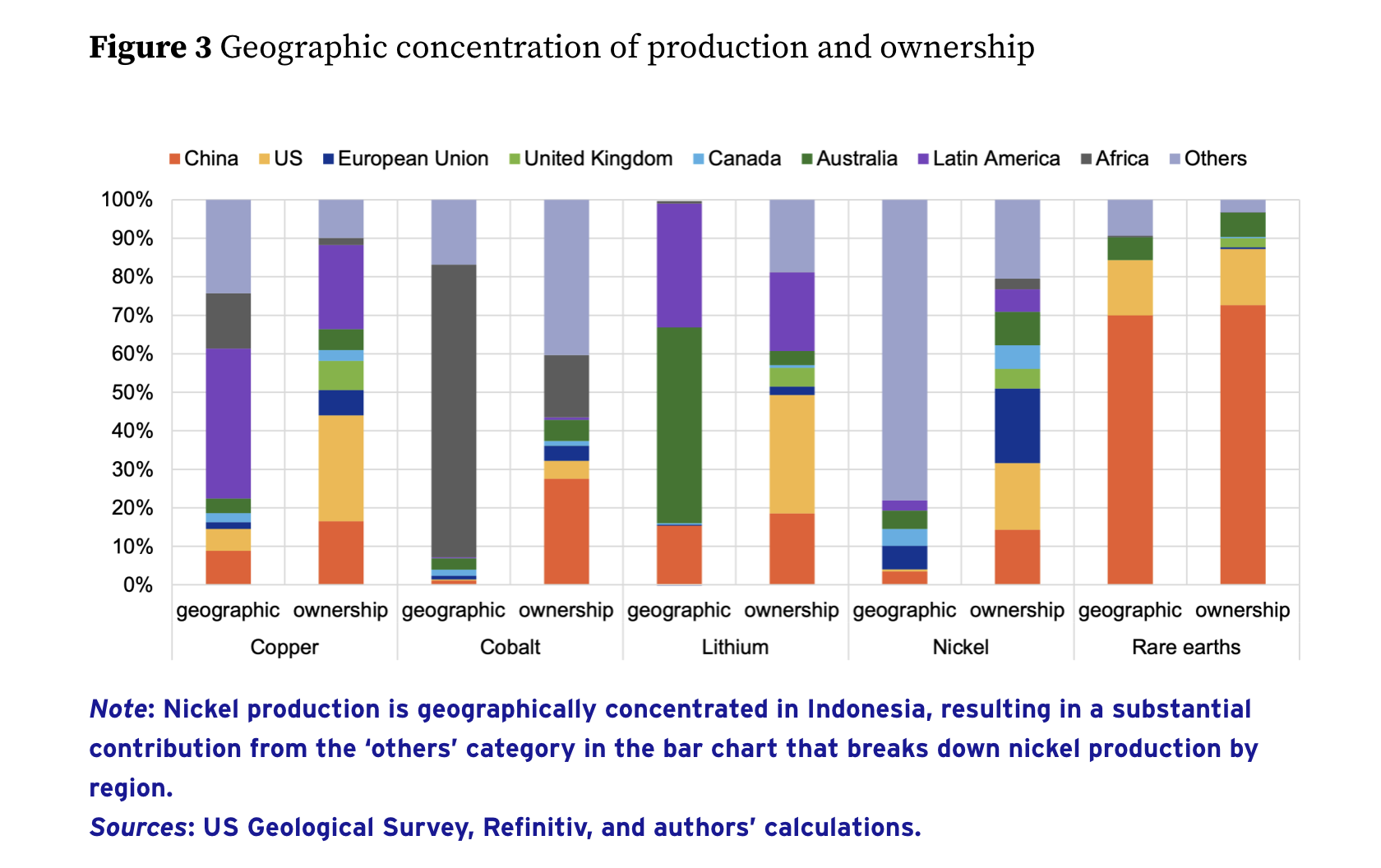

Mine Ownership

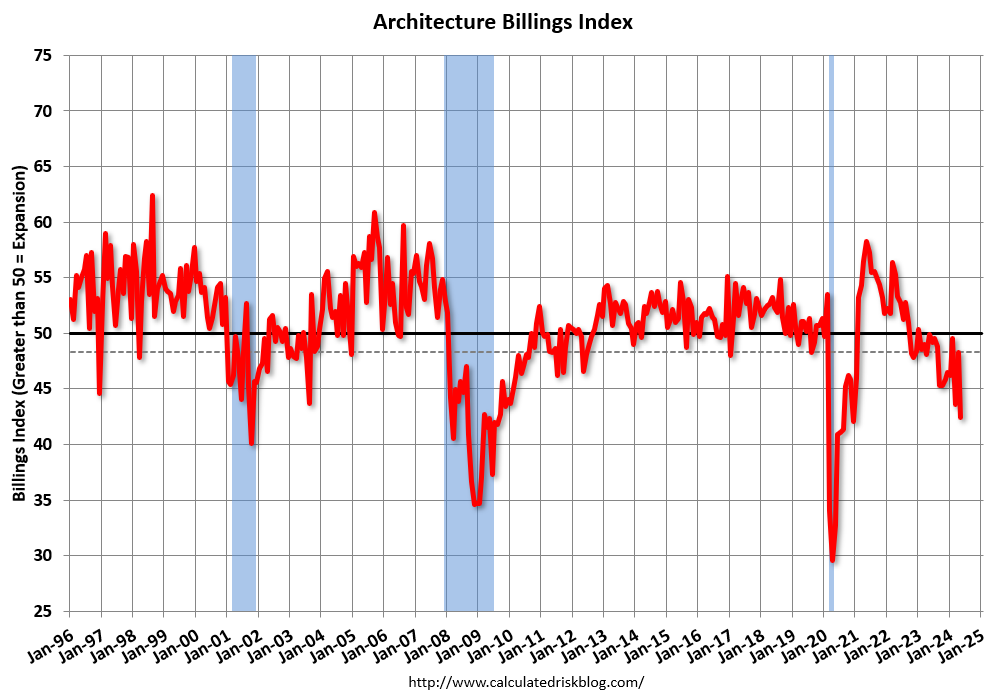

Architecture Billing Index

- “The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity.“

- May took another dive.

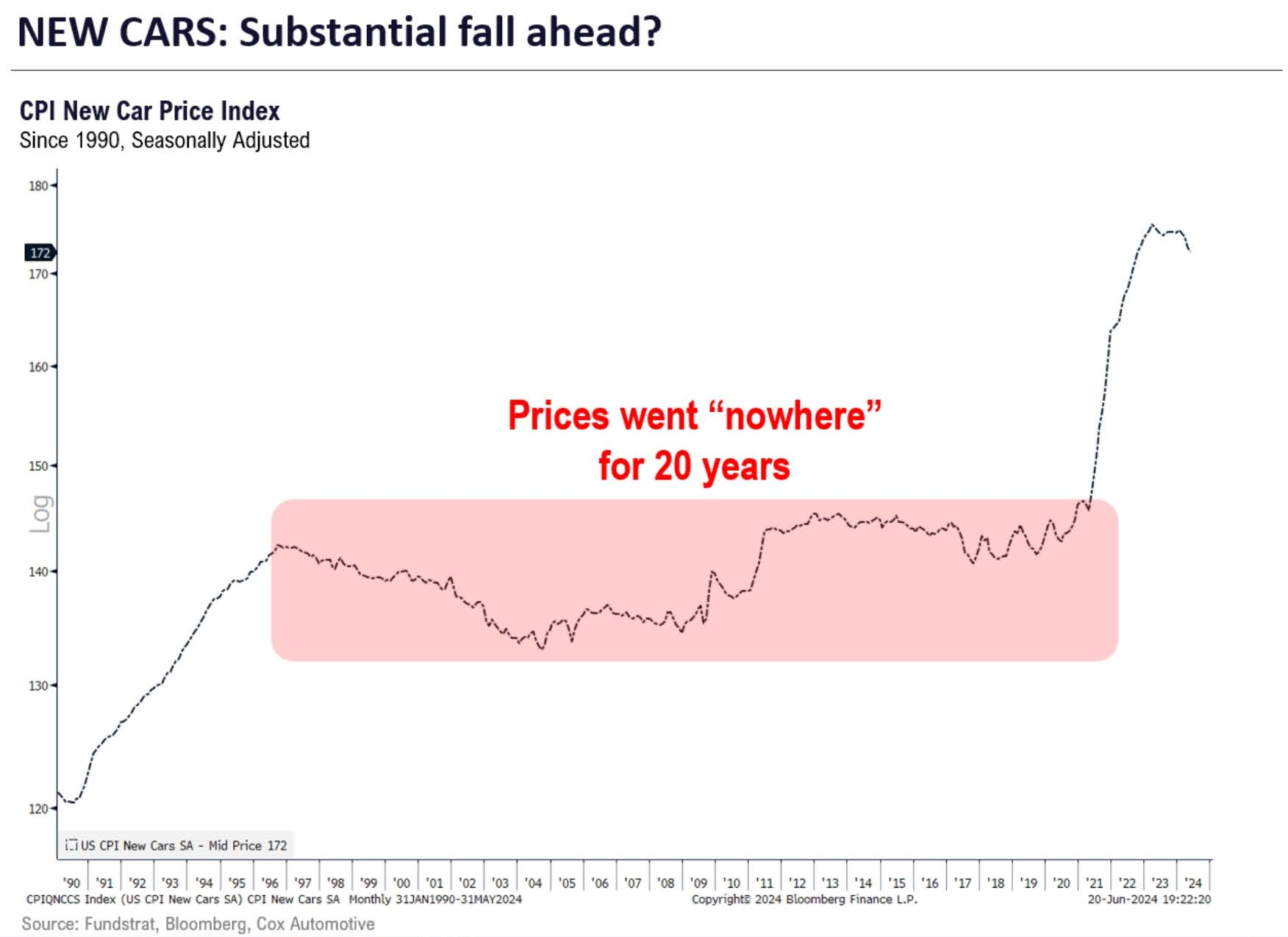

New Car Prices

- Recent experience looks very much out of place.

- Source: Fundstrat.

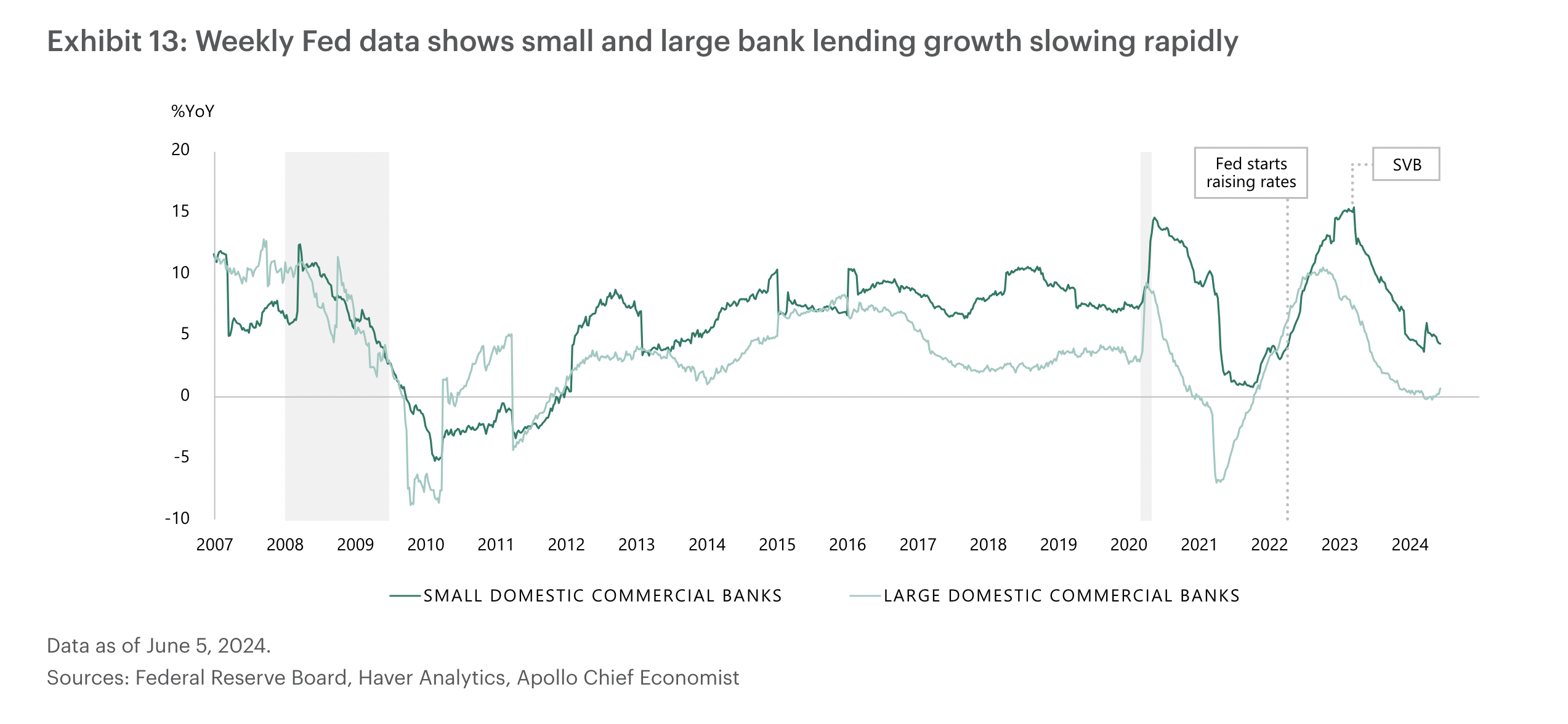

Bank Lending

- Weekly lending data shows a dramatic decline.

- Source.

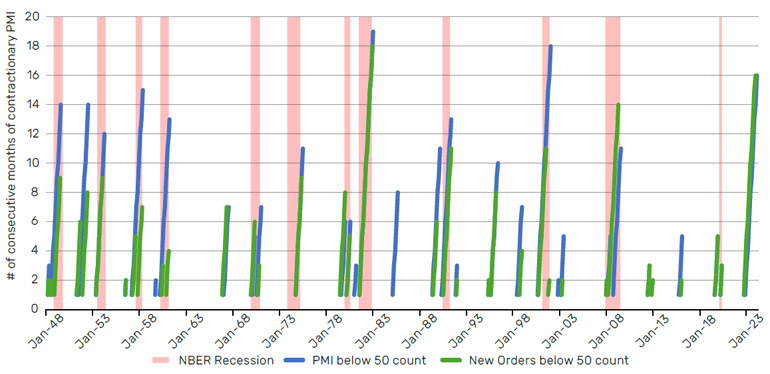

Soft landing?

- The ISM has been at or below 50 for 18 months now.

- “…where we’ve reached these heights previously, we’ve either been in a recession, or had one about to begin.“

- Source: more reasons for recession here.

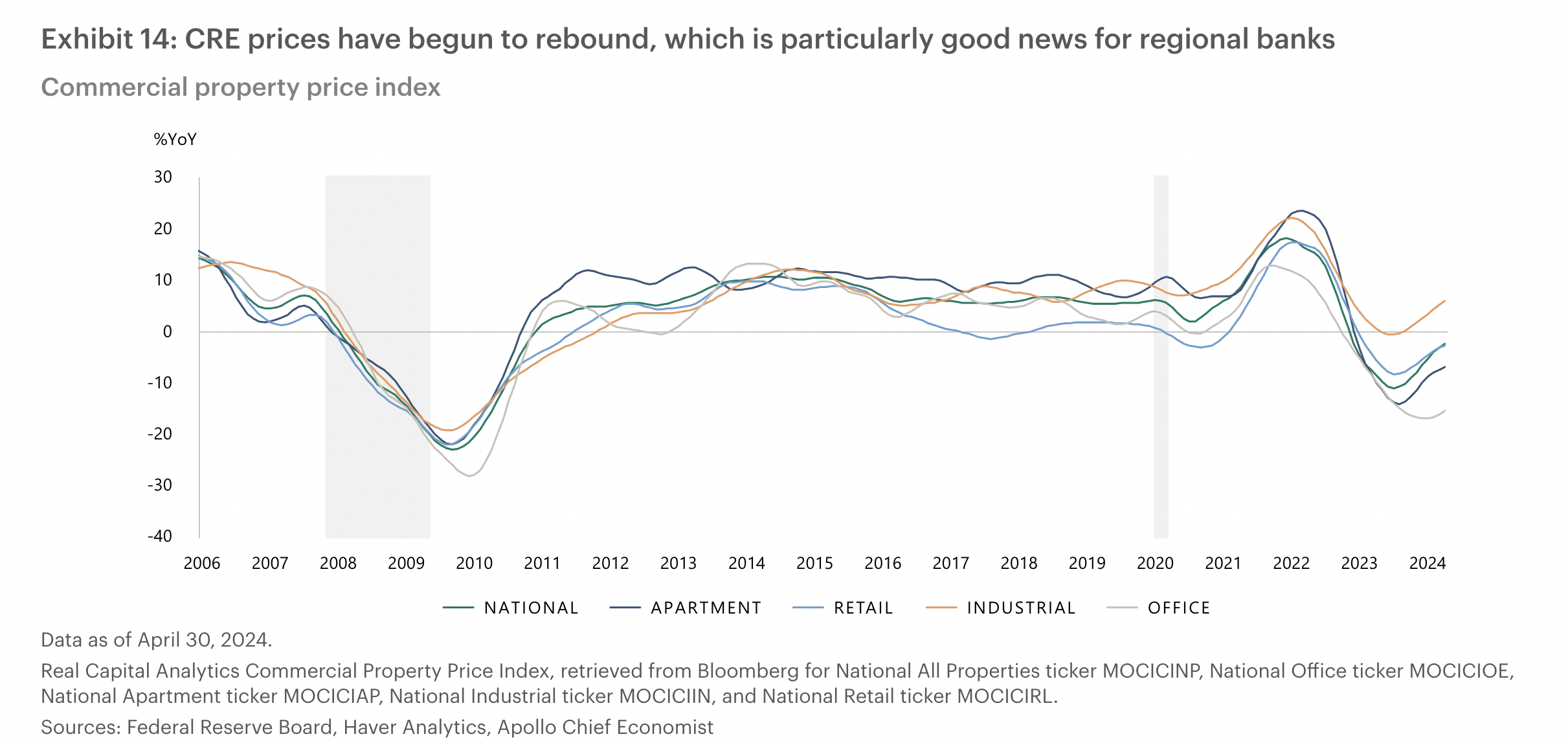

Commercial Real Estate

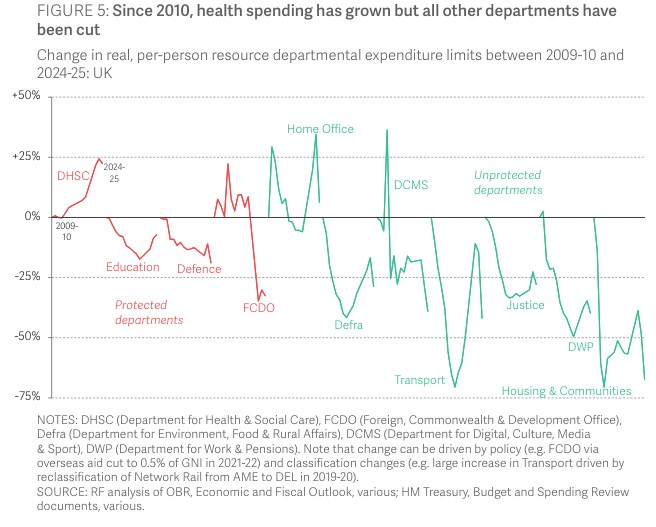

UK Public Spending

- Everything but healthcare has seen very sharp cutbacks.

- “What international comparisons tell us is that these cuts in public spending have moved the UK to the bottom of the G7 in terms of spending and taxation.“

- Source: Mainlymacro.

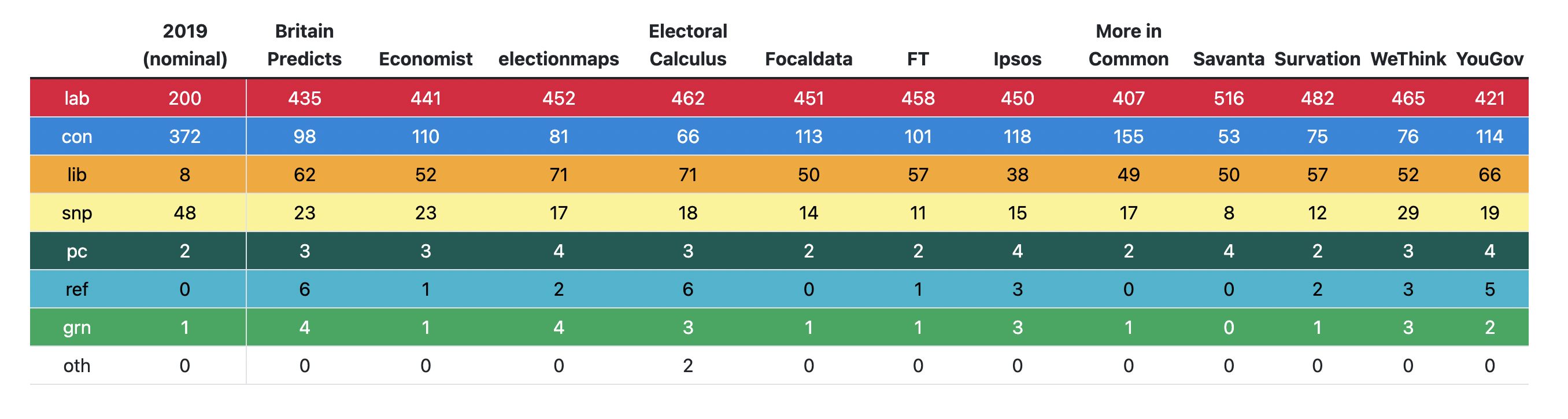

UK Election Prediction Aggregator

- Very useful site aggregating constituency-level predictions for the upcoming election.

- Summary – “This summary shows, for each model and each party, the number of seats where that party is predicted to get the most votes.“

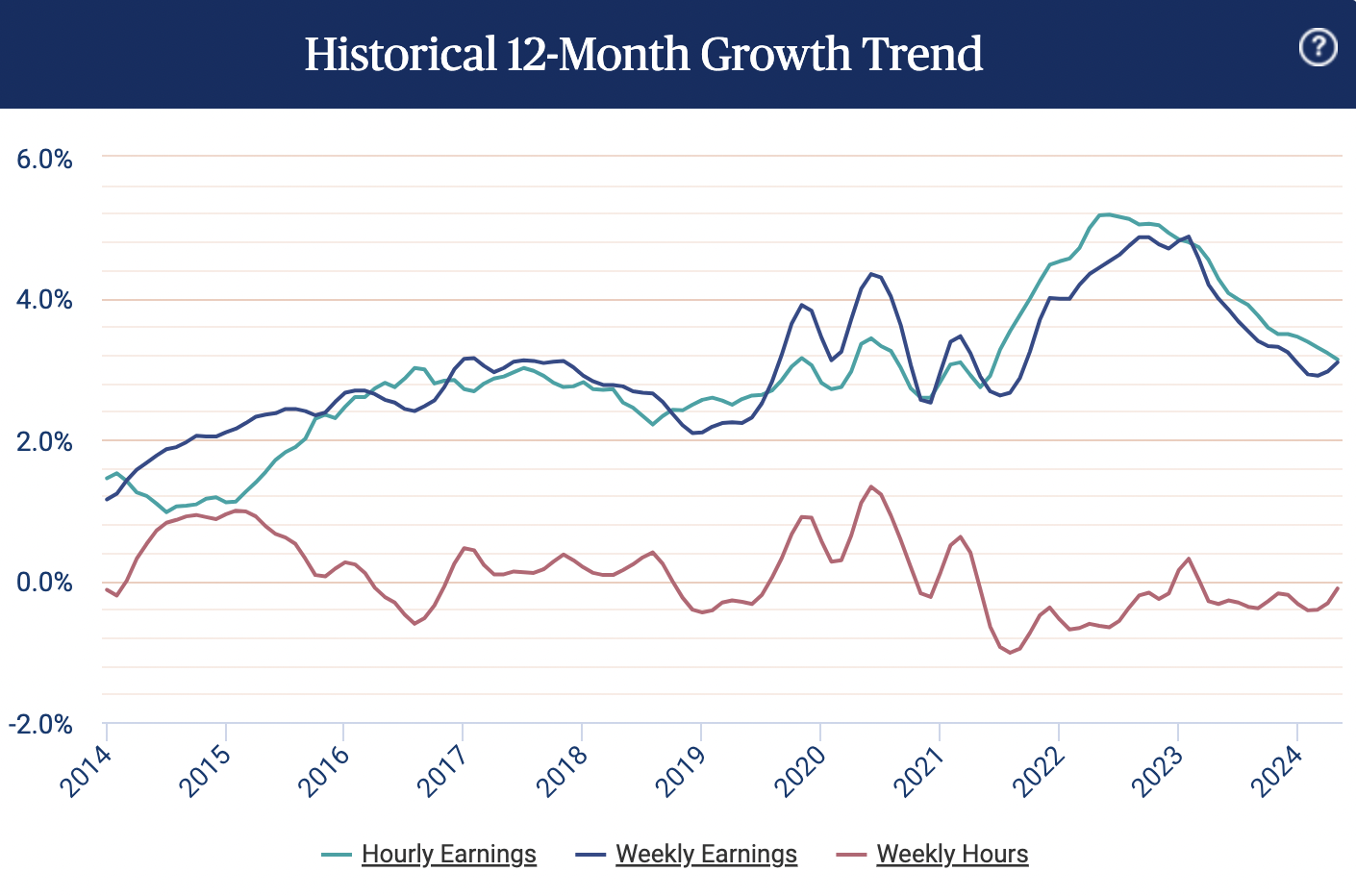

Wage Data

- Paychex small business wage growth data is soggy.

- “Hourly earnings growth slowed to 3.13% in May, recording the lowest level since June 2021 (2.90%).“

- “One-month annualized hourly earnings growth was 2.11%, more than one percent below the year-over-year rate and the lowest level since November 2020 (1.74%).“

Capital Markets

- Nice chart showing capital markets liquidity i.e. issuance across equity and debt as a % of GDP.

- Very depressed levels but turning up?

- Source.

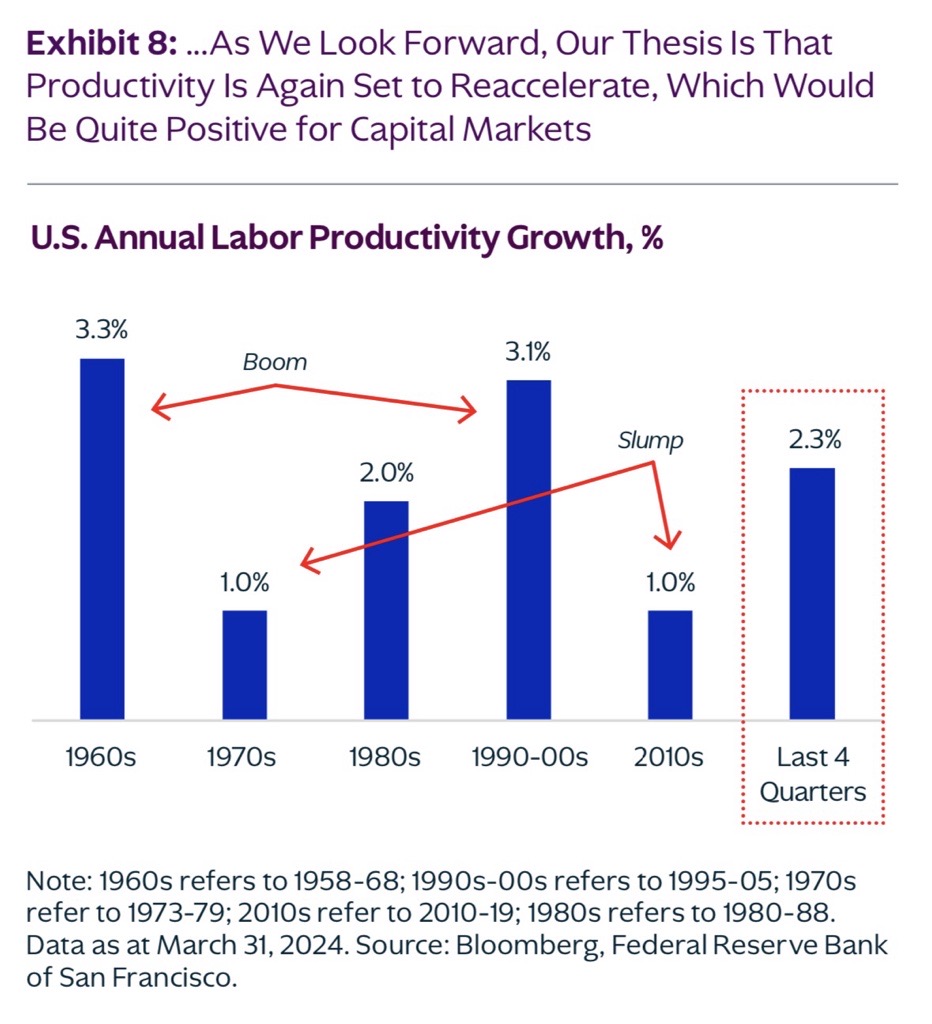

Productivity Growth

- Chart from KKR’s mid-year outlook showing that productivity could be accelerating leading to a boom as it did in the 1960s and 1990-00s.

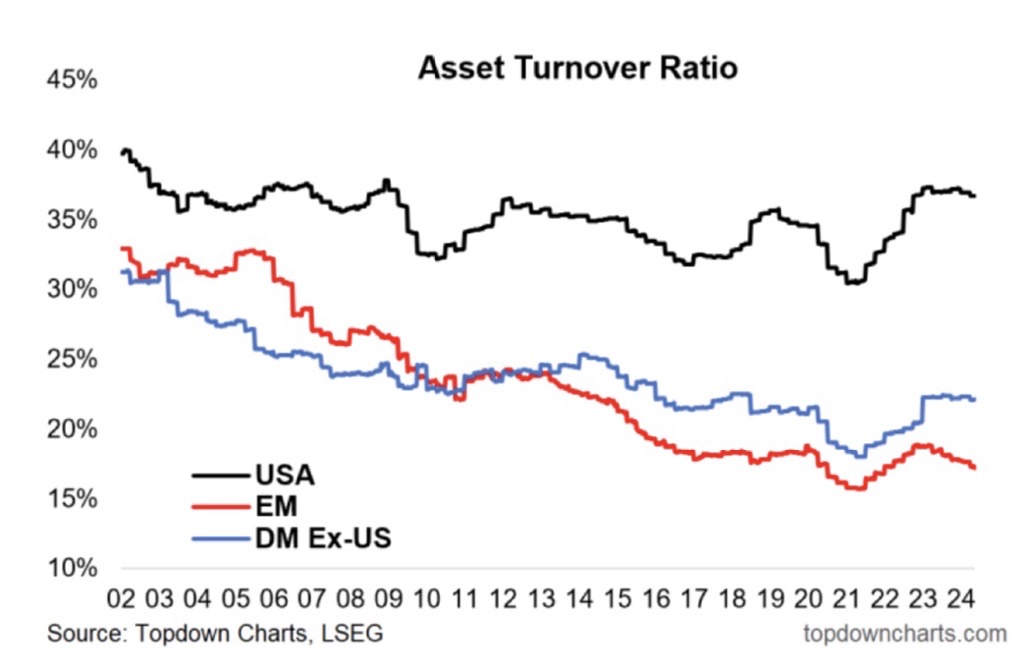

Asset Turnover

- One of the reasons US stocks have outperformed is that asset turnover (a key efficiency measure) has stayed high.

- From the excellent ChartStorm Perspectives Pack (download free for SF readers).

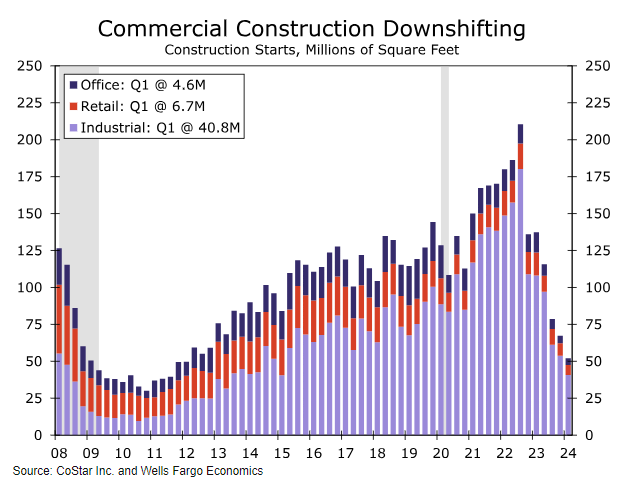

Commercial Construction

- Weak.