- Imagine if foundations/grants would only pay for projects that had already succeeded at making an impact, leaving “venture” to take the risk on which projects actually would succeed by buying shares in them.

- This idea, reverse engineering how capital markets operate, is discussed at length here in a very practical way.

Misc

Miscellaneous is often where the gems are.

AI Winners

- The argument that AI is unlikely to be a winner for the middle-ground companies.

- Why? “was a feature not a product” – in other words value will either accrue to core AI platforms (e.g. Open AI) or to incumbent software tools with distribution who will just add AI features.

- “Adobe will own the AI-based image editing market Office & Google Docs will own the AI-based writing market Salesforce will be the best AI-enabled CRM Shopify the best AI optimization and customer support Zoom the best AI meeting summaries … all with a few API calls“

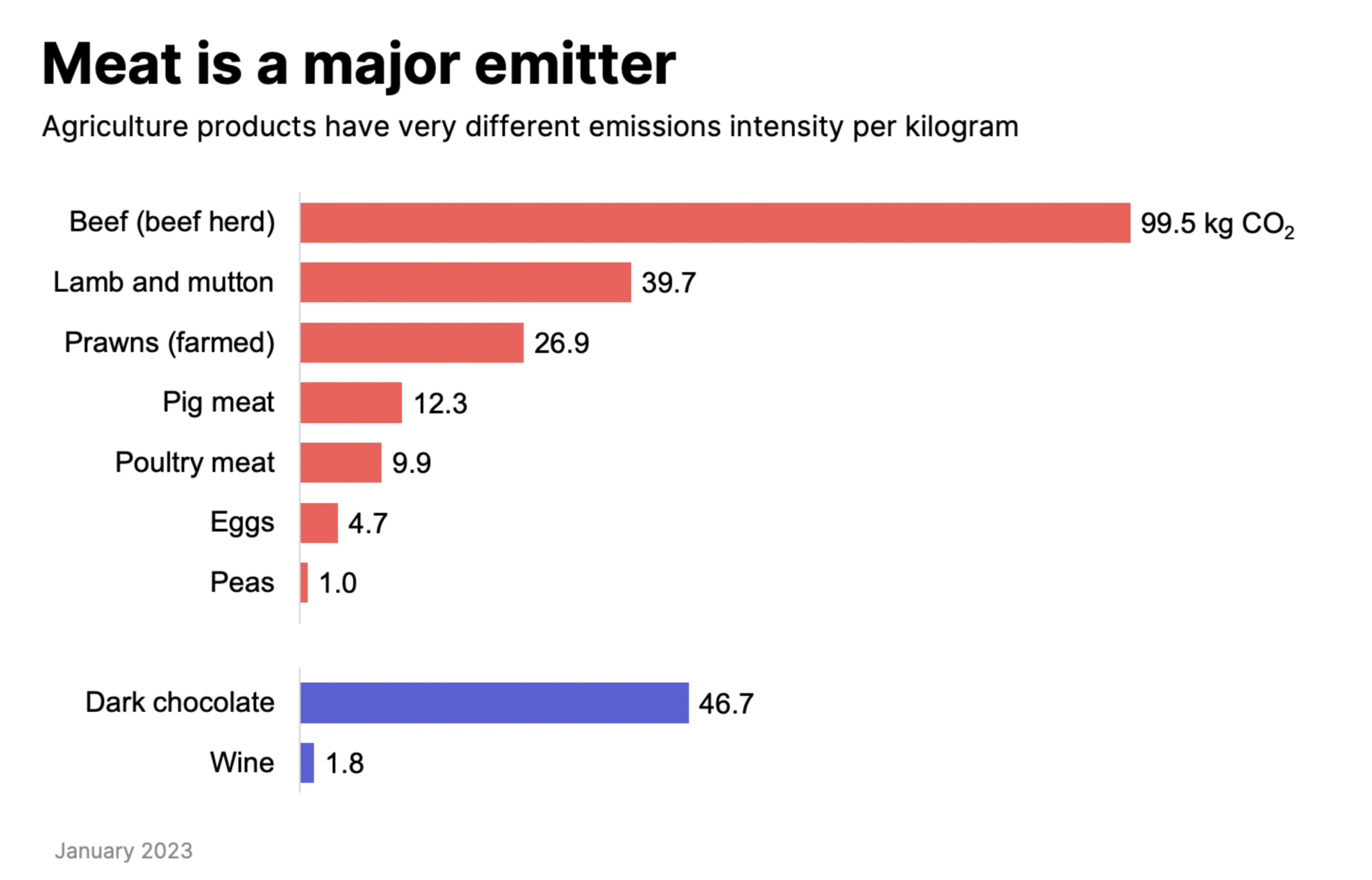

Dark Chocolate

- Is worse than lamb in terms of CO2 emissions.

- Source: This excellent climate-focused deck.

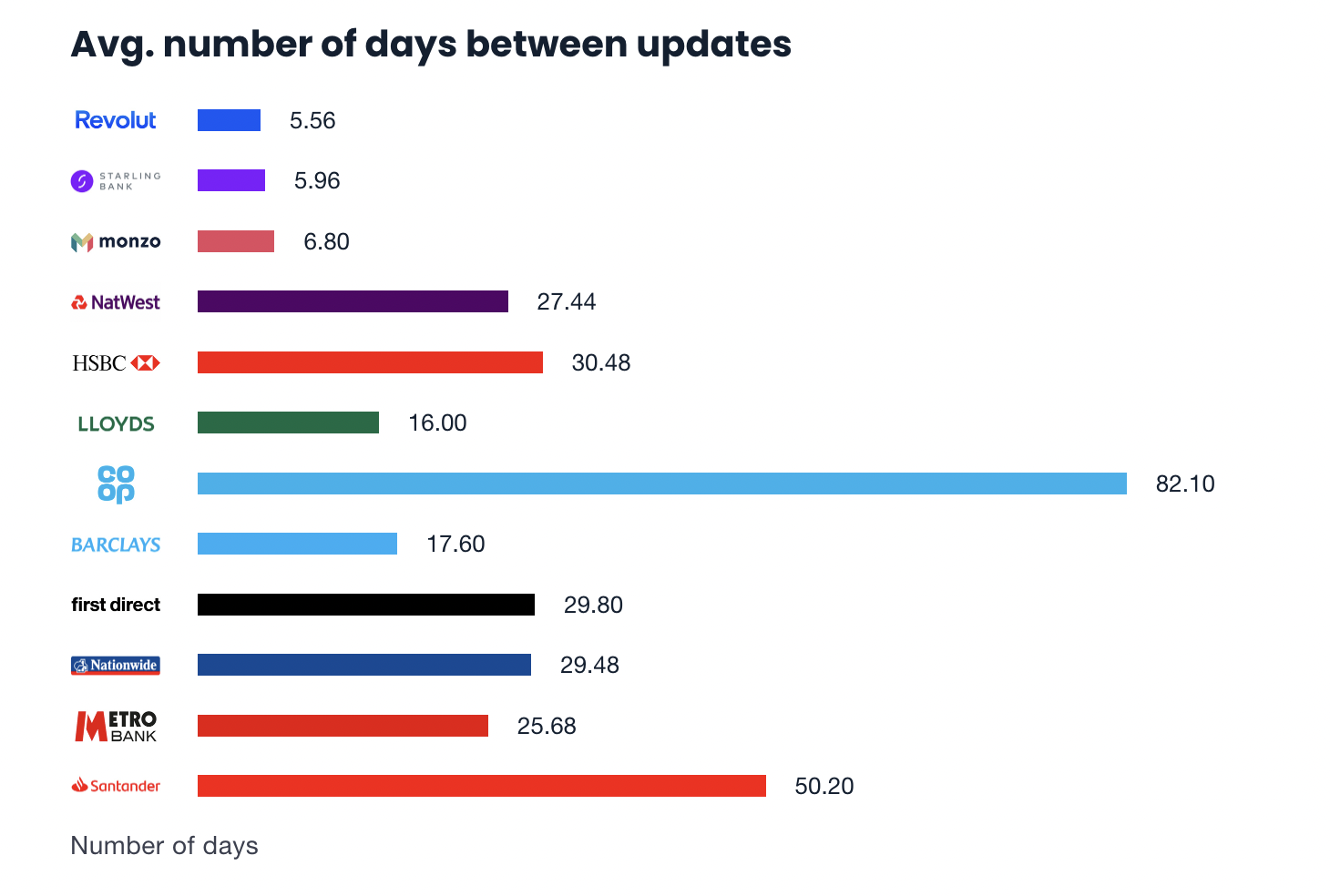

Challenger Banks Continue to Win?

- 900 days ago this site ran a series of article comparing challenger banks and incumbents in the UK on how good their user experience was (we covered it here).

- Today, there is an update, and the picture hasn’t changed.

- This chart for example shows the time between app updates – a measure of how quickly improvements are coming to customers.

- “On average, the challenger banks deploy updates 4.6x more frequently than the incumbents“.

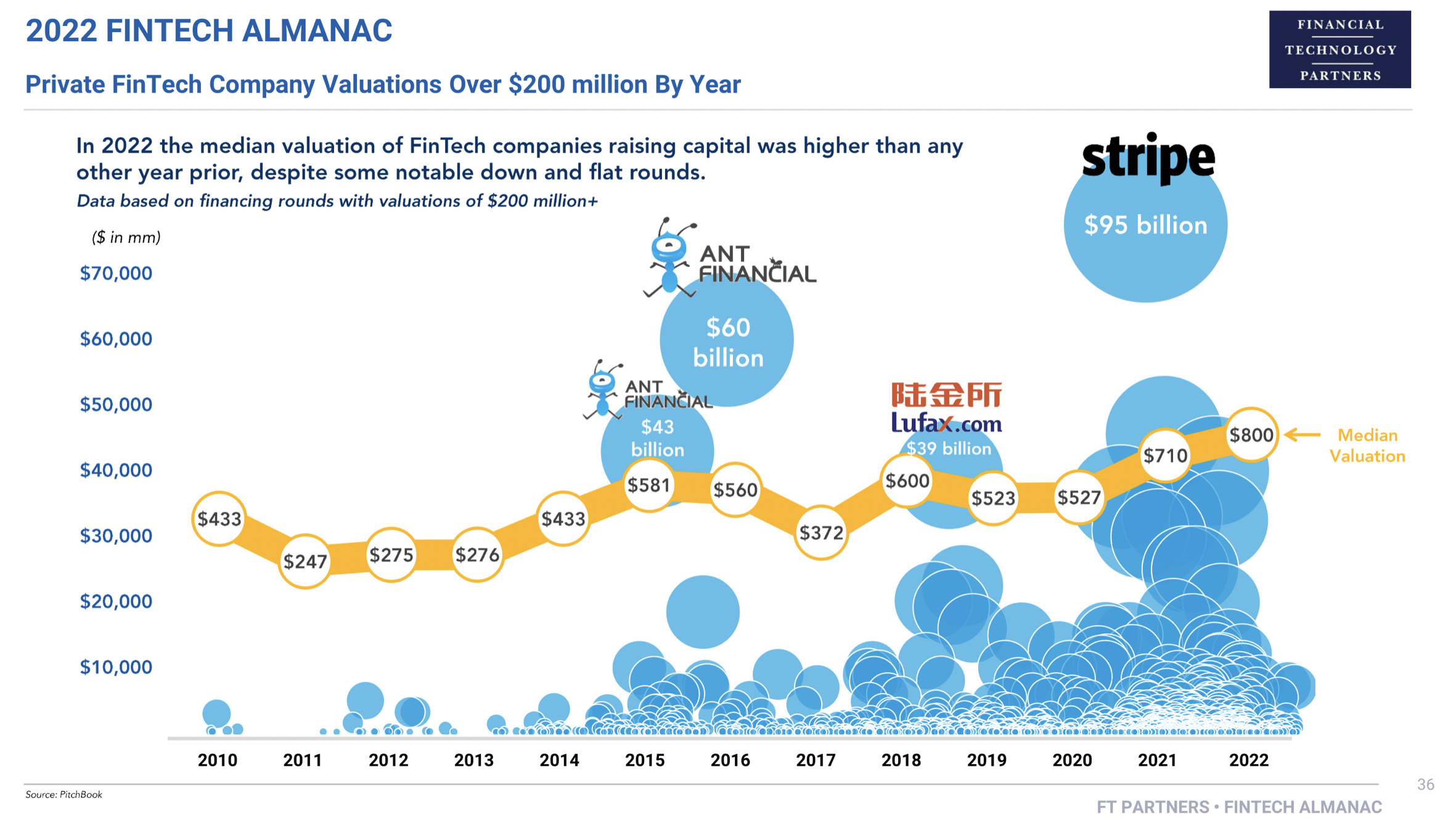

Fintech Valuations

- According to FT Partners latest monster 2022 Fintech Almanac, median private fintech valuations (>$200m) actually had a good 2022 – they rose.

- Slide on page 35 explains this partially.

- Of selected fintech unicorns – only Stripe, Klarna, Sumup, FinAccel saw valuations fall.

- Naturally, some didn’t need to raise money so would not feature on this list (e.g. Revolut).

Anti-ESG

- Charting the backlash against ESG across US states.

- “As of January 2023, almost 50% of US states either have some type of anti-ESG restriction in place or have placed blacklisting ESG action high on their legislative agenda.“

- “Analysis of these developments (111 in total as of 10 January 2023) reveals how at the state level, anti-ESG developments have rapidly outpaced those in support of ESG measures over the past three years.”

- The chart on page 66 of the deck suggests that this backlash, at least as it materialized in ESG ETF flows, is mostly an American and Japanese phenomenon.

- Original source here; chart from this excellent climate slide deck.

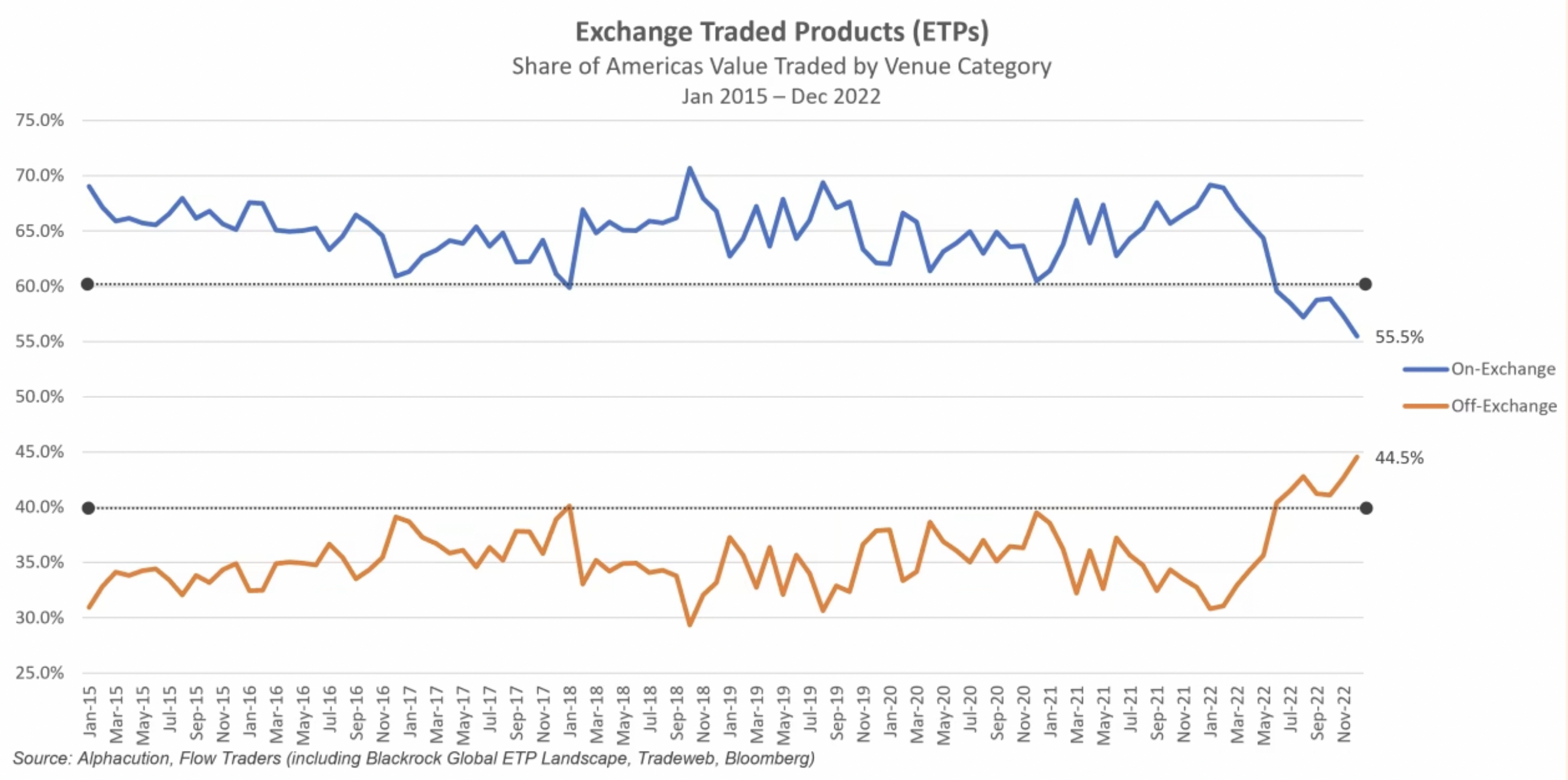

Off-Exchange ETP Trading

- 2022 saw a new record in off-exchange trading of US ETFs.

- Part of a broader trend where trading off-exchange in US equities went from 35% in 2015 to 43% last year.

- Yet, as the FT Alphaville article notes, “ETF shift from lit to off-exchange trading has actually been even starker than it has for equities as a whole“.

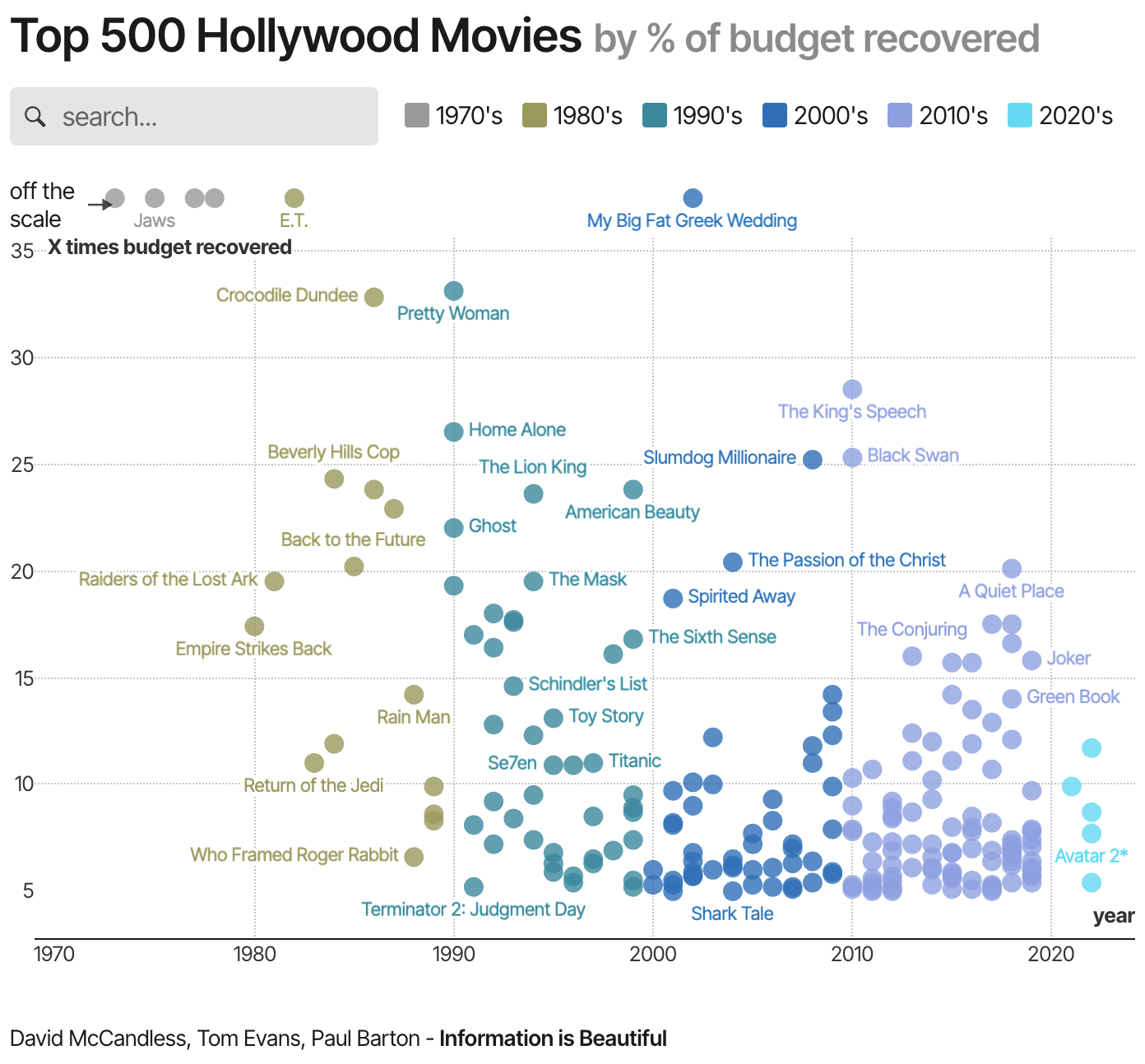

Most Successful Film of All Time?

- Films often get measured by gross box office, with Avatar (both of them) reigning supreme on this measure.

- However, using a measure of return on investment (percentage of budget recovered) throws up an alternative perspective.

- Winners on this measure are E.T. (7,552%) but also films like “The King’s Speech (2,849%), Home Alone (2,648%), and breakout sleepers like Crocodile Dundee (3,282%), Slumdog Millionaire (2,523%) and … er, Black Swan?“

- Source.

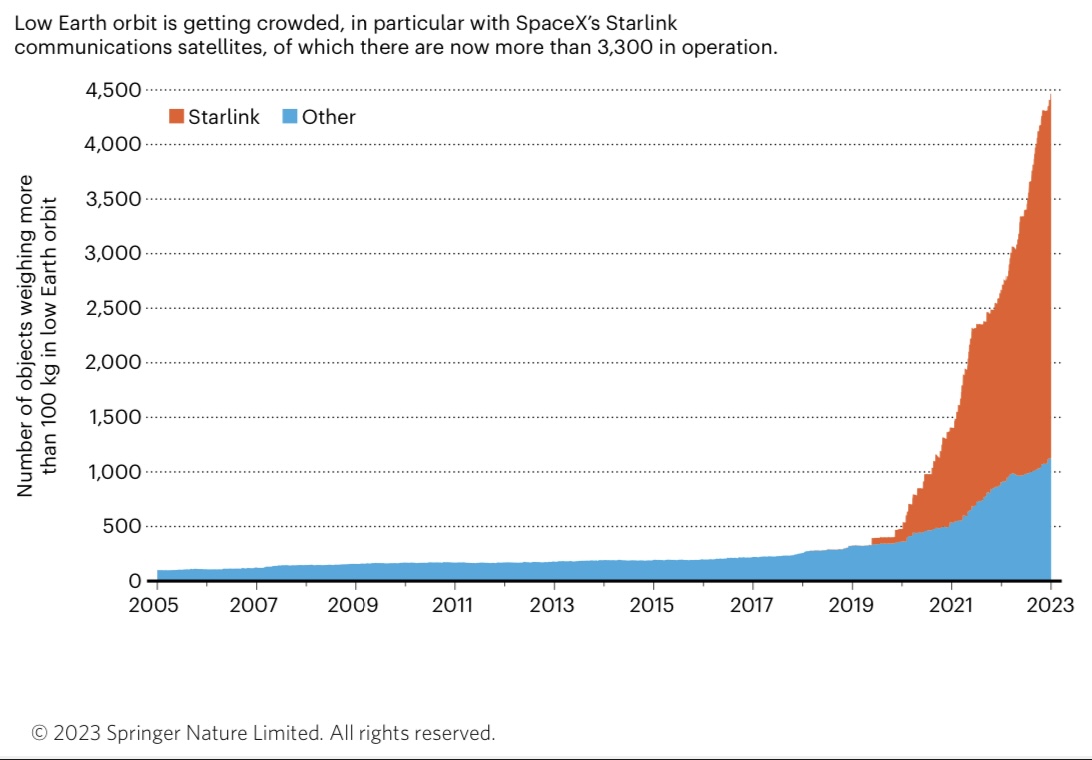

Low Earth Orbit

Hedge Funds Ranking

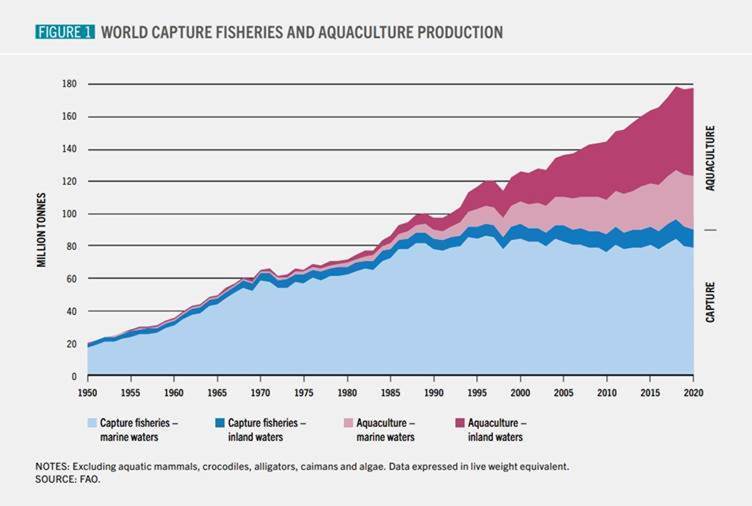

Aquaculture

- Aquaculture now accounts for just about 50% of the total production of fish.

Homo Silicus

- Interesting use case of GPT3 – to model economic agents – as was done in this paper.

- “These models can be used the same way economists use homo economicus: they can be given endowments, put in scenarios and then their behavior can be explored—though in the case of homo silicus, through computational simulation, not a mathematical deduction“

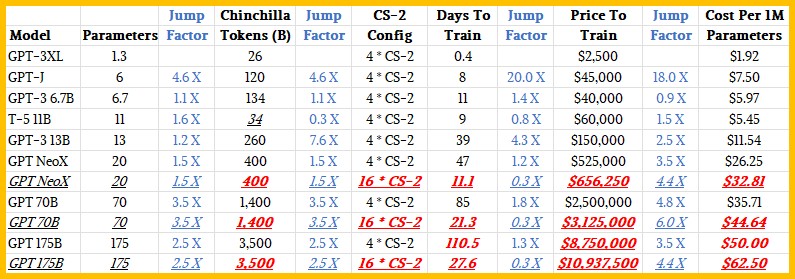

Scaling AI Model Training

- Interesting, but technical look, at what it costs to train large language models.

- This has implications for all kinds of businesses as this technology becomes more widely used.

52 Things – Tom Whitwell

- The classic annual list, 2022 edition. Eye opening as usual:

- “37 per cent of the world’s population, 2.9 billion people, have never used the Internet.“

- “40% of global shipping involves moving fossil and other fuels (oil, gas, wood pellets) around. More renewables (solar, wind, nuclear, geo), means fewer ships.“

- “If you want a question answered on the Internet, post a wrong answer first.“

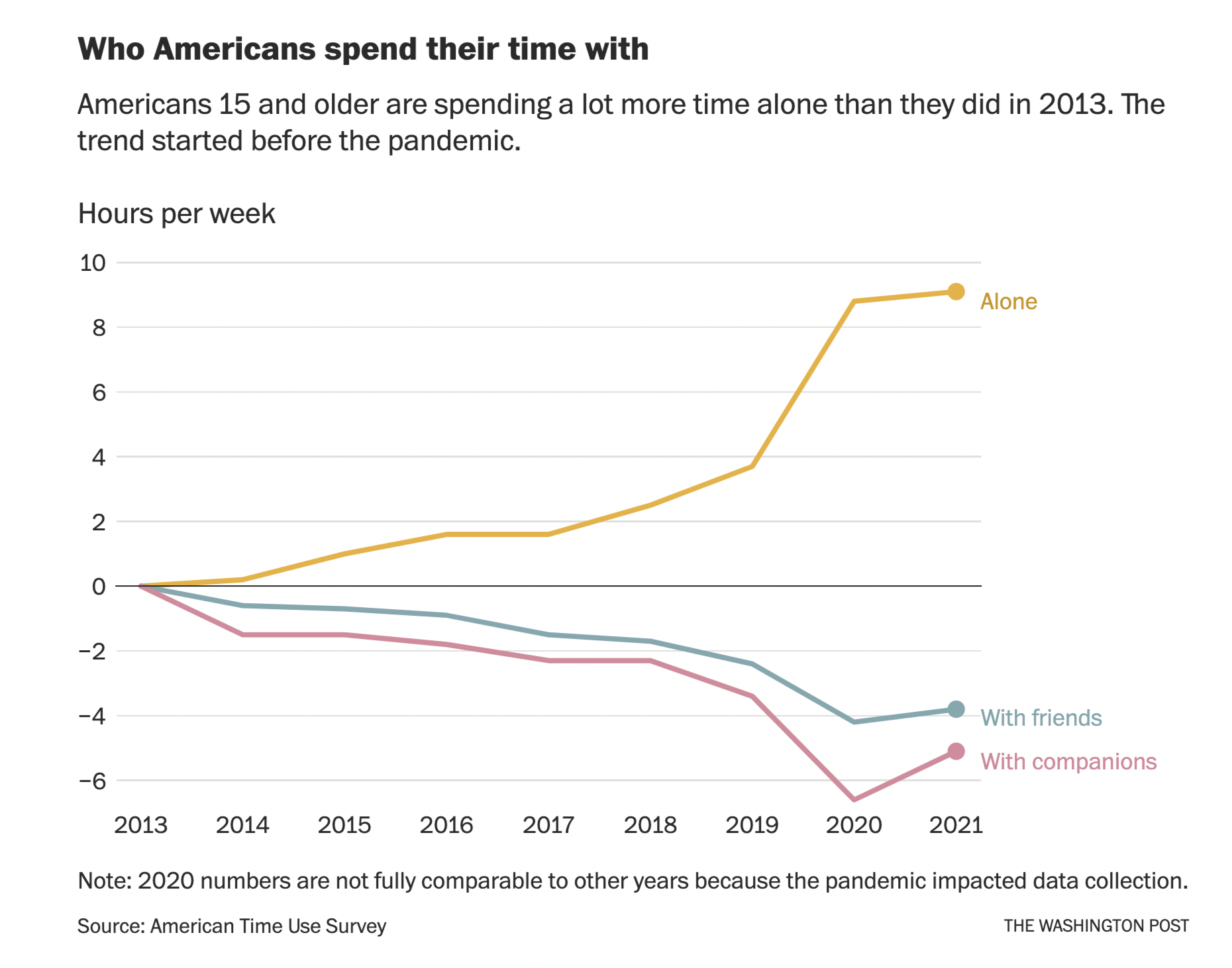

Being Alone

How to Negotiate

- Fascinating article based on a Wharton professor’s guide to negotiating for reasonable people.

- Some of the key points:

- Leverage – “In general, the person who feels better about “no deal” has the most leverage, and the person that’s less okay with “no deal” has the least leverage.“

- Have specific justifiable goals – preparation is key here.

- Establish and maintain trust – “If it’s not there, trust is the single biggest obstacle to a good deal.”

- Get information – “More listening = more leverage.”

- Concessions – “Link them with “if…then.” Make sure they recognize you’re giving up something of value so they feel the need to reciprocate.“

Consumer Trends 2023

- The latest slide deck from Coefficient Capital and The New Consumer is out and it is worth a flick.

- Interesting slides include 37 (rising CAC), slides on celebrity-backed brands, slide 57, slide 66 (Instacart’s share!), 76 (growth of prestige beauty brands).

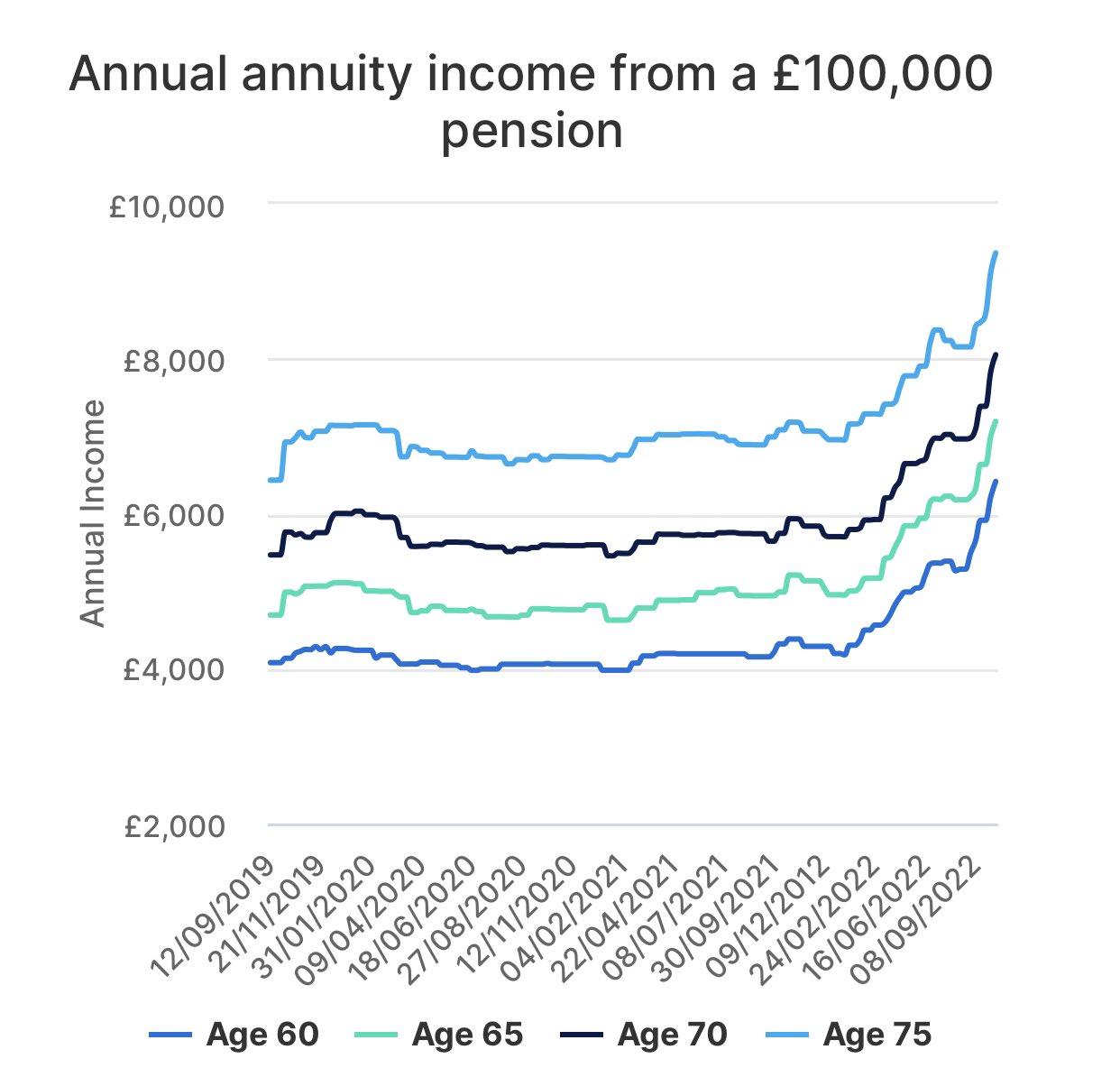

Savers Winning

- Interest rates rising mean savers are finally starting to see decent nominal (not real yet!) yields.

- One area this is showing up is annuities in the UK.

- Income from them is up 44% year to date.

- Will likely have interesting effects.

- h/t.

Common Misconceptions

- An awesome list of common misconceptions from Wikipedia.

- “Netflix was not founded after its co-founder Reed Hastings was charged a $40 late fee by Blockbuster. Hastings made the story up to summarize Netflix’s value proposition, and Netflix’s founders were actually inspired by Amazon“

- “Adidas is not an acronym for either “All day I dream about sports”, “All day I dream about soccer”, or “All day I dream about sex”. The company was named after its founder Adolf “Adi” Dassler in 1949. The backronyms were jokes published in 1978 and 1981.“

- ““420” did not originate from the Los Angeles police or penal code for marijuana use. California Penal Code section 420 prohibits the obstruction of access to public land. The use of “420” started in 1971 at San Rafael High School, where a group of students would go to smoke at 4:20 pm.“

- And so on …

- via The Browser (a must subscribe general newsletter).

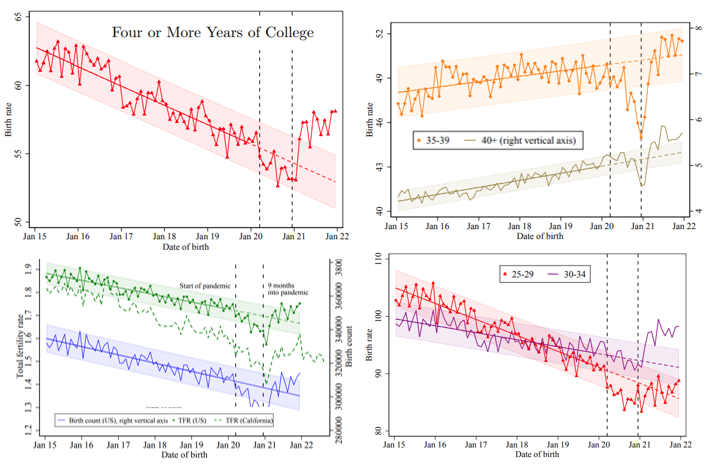

Mini Baby Boom

- New data suggests a small “baby bump” among US born mothers as a result of the pandemic.

- “The 2021 baby bump is the first major reversal in declining U.S. fertility rates since 2007 and was most pronounced for first births and women under age 25, which suggests the pandemic led some women to start their families earlier. Above age 25, the baby bump was also pronounced for women ages 30-34 and women with a college education, who were more likely to benefit from working from home.“

- Source: NBER via Eric.