- COBOL is the programming language that underpins the entire financial system.

- “Over 80% of in-person transactions at U.S. financial institutions use COBOL. Fully 95% of the time you swipe your bank card, there’s COBOL running somewhere in the background.“

- “The second most valuable asset in the United States — after oil — is the 240 billion lines of COBOL”

- The language is old (from the 1960s) and runs on huge machines (mainframes), yet it is extremely suited to the task of processing billions of transactions very fast.

- A fascinating read.

Misc

Miscellaneous is often where the gems are.

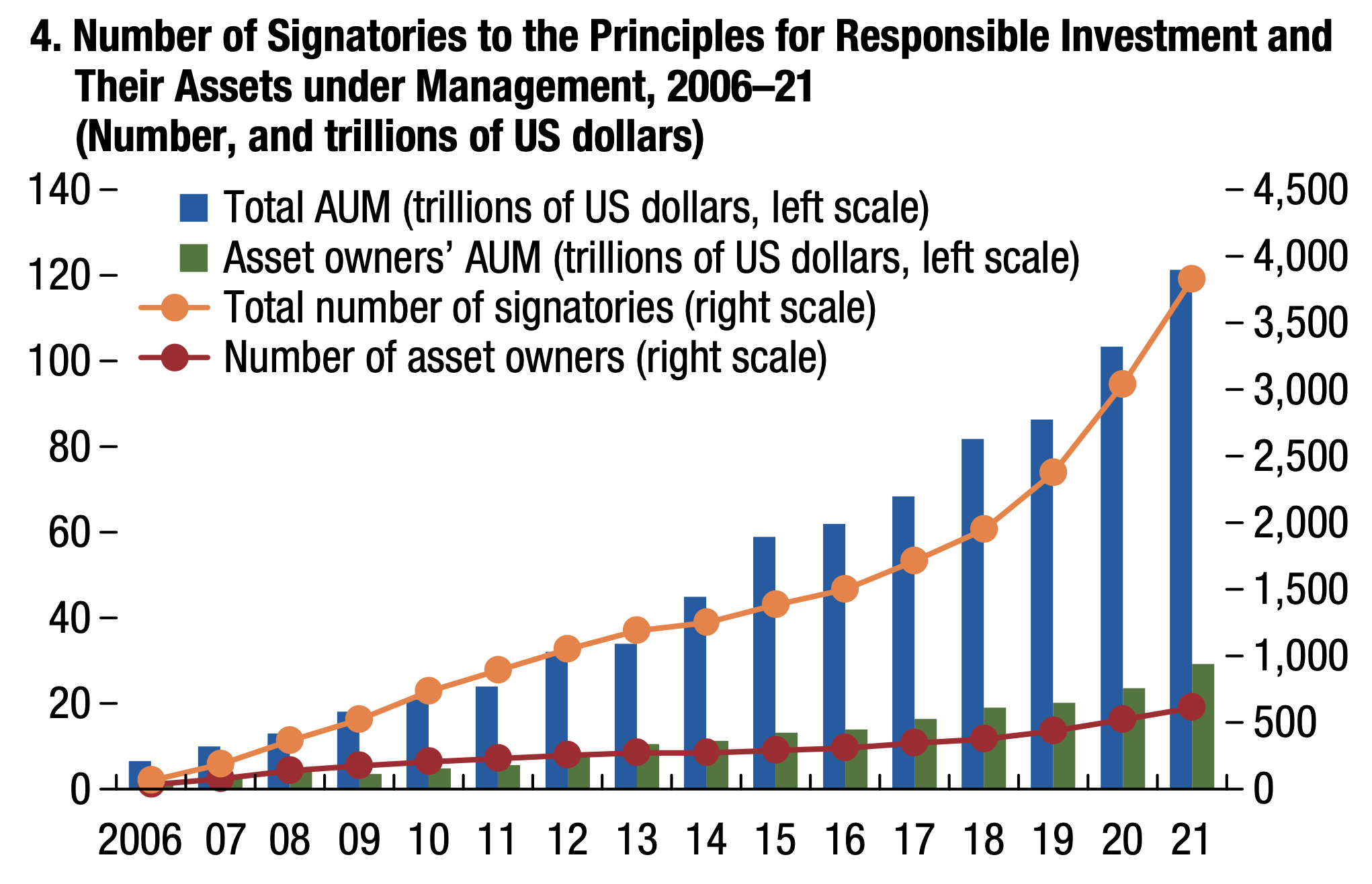

UNPRI

- “The number of asset managers and asset owners that are signatories to the Principles for Responsible Investment – thereby committing to incorporate environmental, social, and governance considerations into investment analysis and decision-making processes – more than doubled from about 1,400 in 2015 to more than 3,000 in 2020“

- Source: IMF.

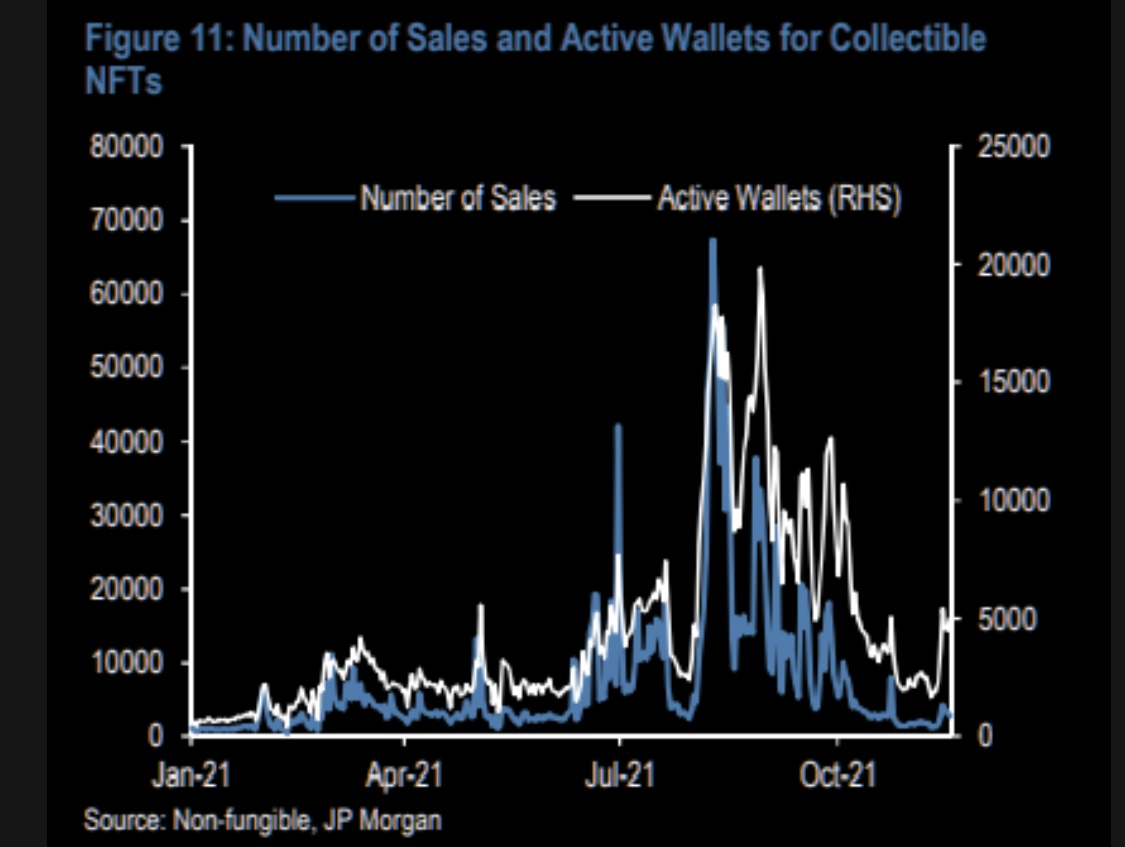

NFT Volumes

- NFTs see huge bouts of popularity and spikes in volumes.

- But so far these volumes have not seen sustained growth.

- h/t themarketear.

Carbon Tax

- 70% of American’s including 50% of Republicans support a carbon tax.

European Cloud (update)

- Two years ago we posted about Europe’s attempt to challenge US tech dominance in cloud computing.

- Predictably it has struggled.

- “In conversations with POLITICO, more than a dozen industry and government officials involved with the work of Gaia-X said the project was struggling to get off the ground amid infighting between corporate members, disagreement over its overall aims and a bloated bureaucratic structure that is delaying decisions. One industry official closely involved in the work of Gaia-X called it a “mess.”“

Peter Thiel

- Intriguing review of latest book on the Silicon Valley legend.

- The book “does an excellent job of unpicking the disparate elements of the Thiel mythology”

- From trying to get out of his early Facebook investment as fast as he could, including trying to convince Zuckerberg to sell to Yahoo for $1bn.

- To his failed anti-college scholarships.

- Absolutely worth a read.

Collecting is Dead

- Building on the antilibrary this essay explores the idea that collecting has been killed by the evolution of the digital world.

- A lot to be said for collecting and arranging books on a book shelf.

- Perhaps the rise of NFTs can bring at least one element of collecting back.

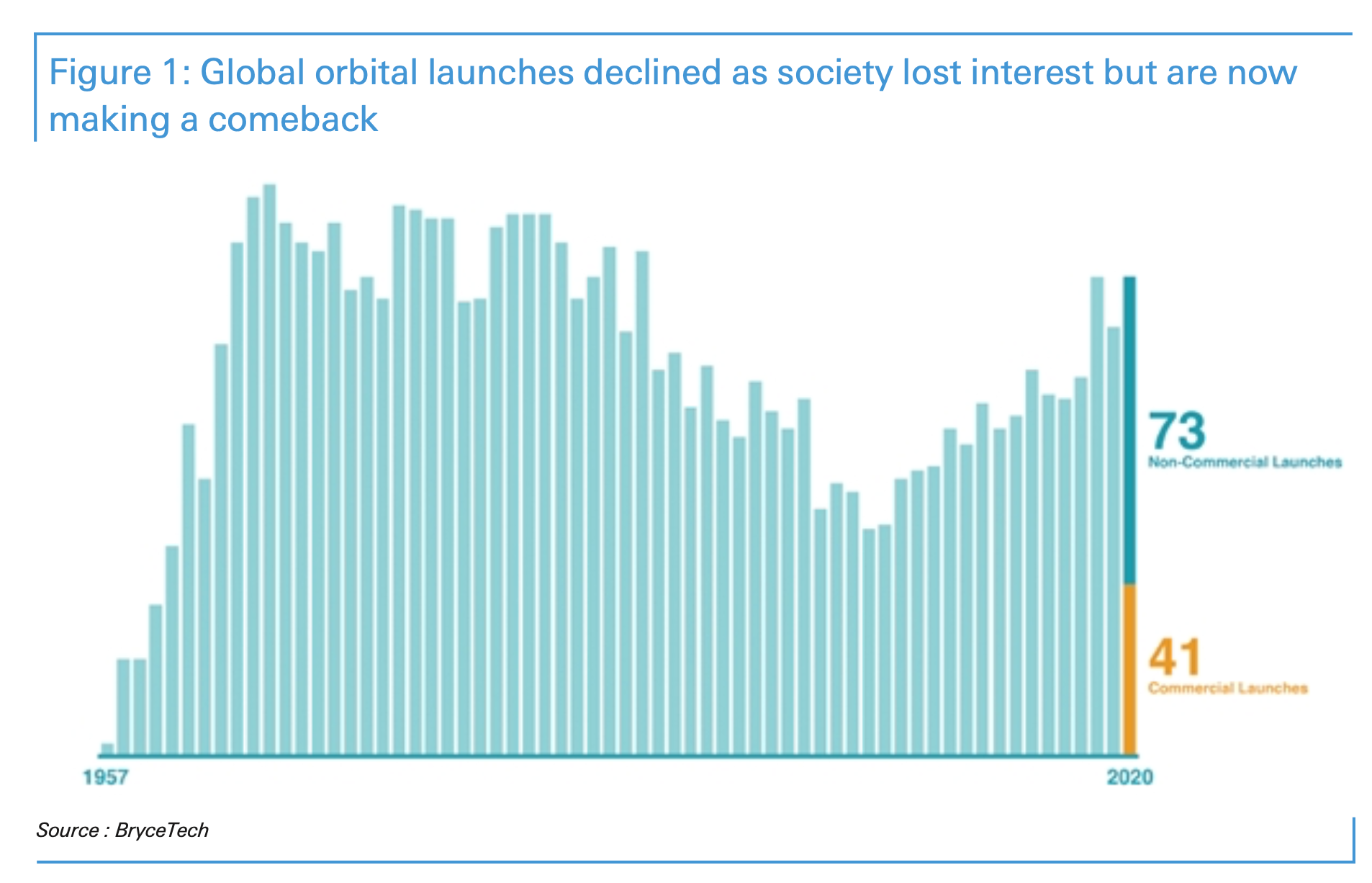

Orbital Launches

- Launching into space is in a new bull market.

- Likely helped by falling costs.

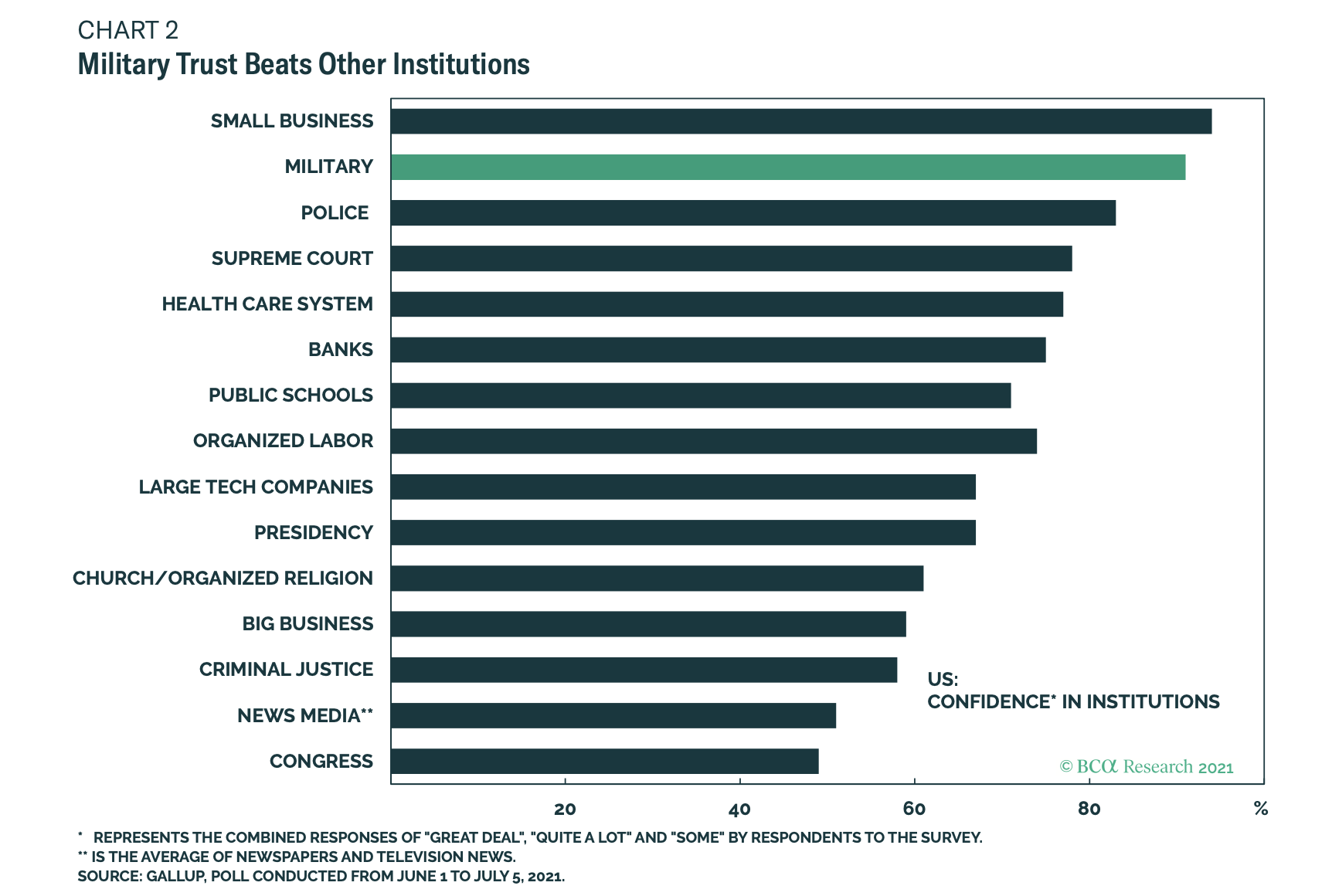

Trust

- American’s trust small business and the military above all other institutions, especially Congress.

- Source: BCA Research.

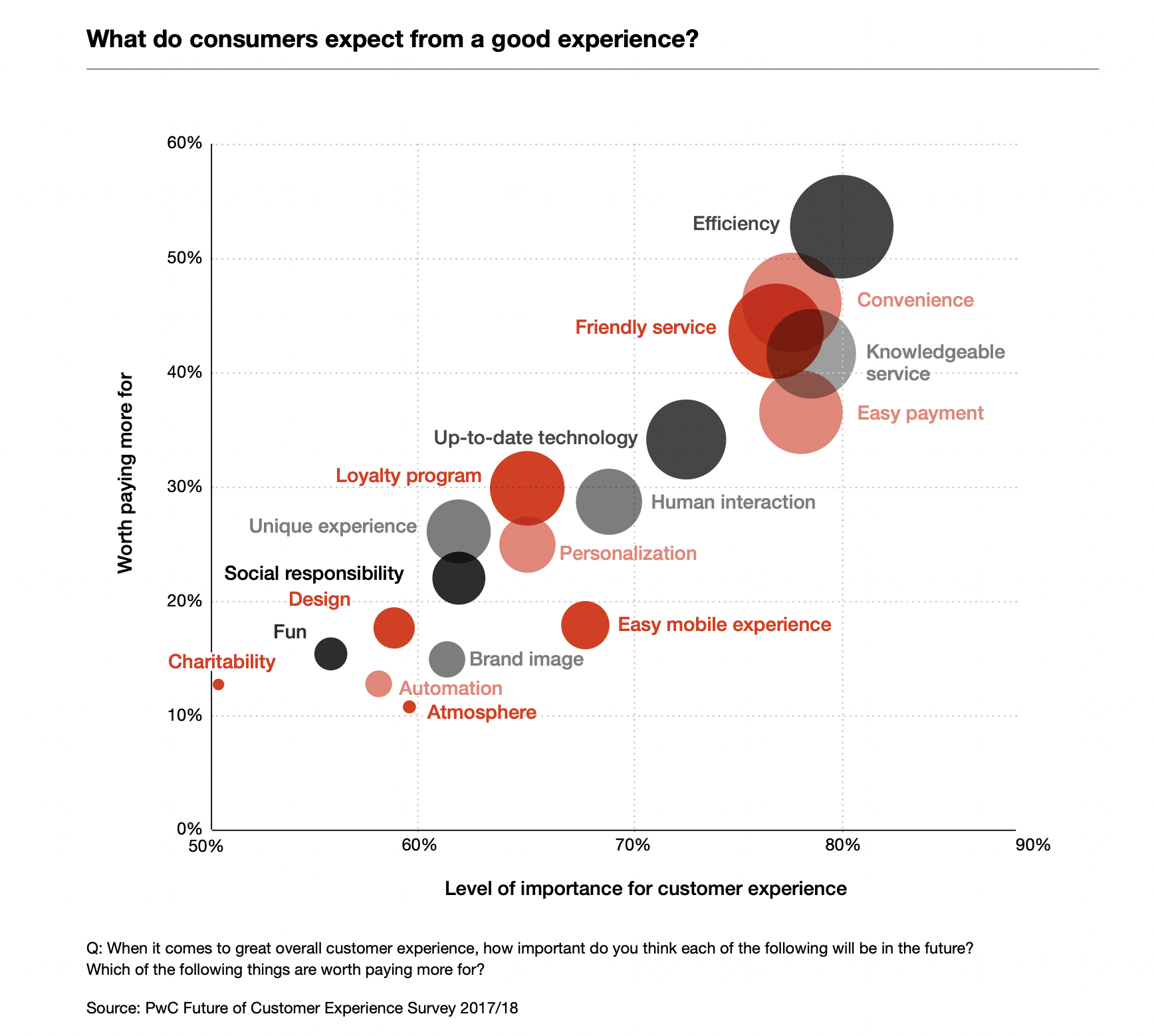

What Consumers Want

- Useful and interesting chart on what consumers want from and are willing to pay for, digital ad supported services.

- Source: PwC.

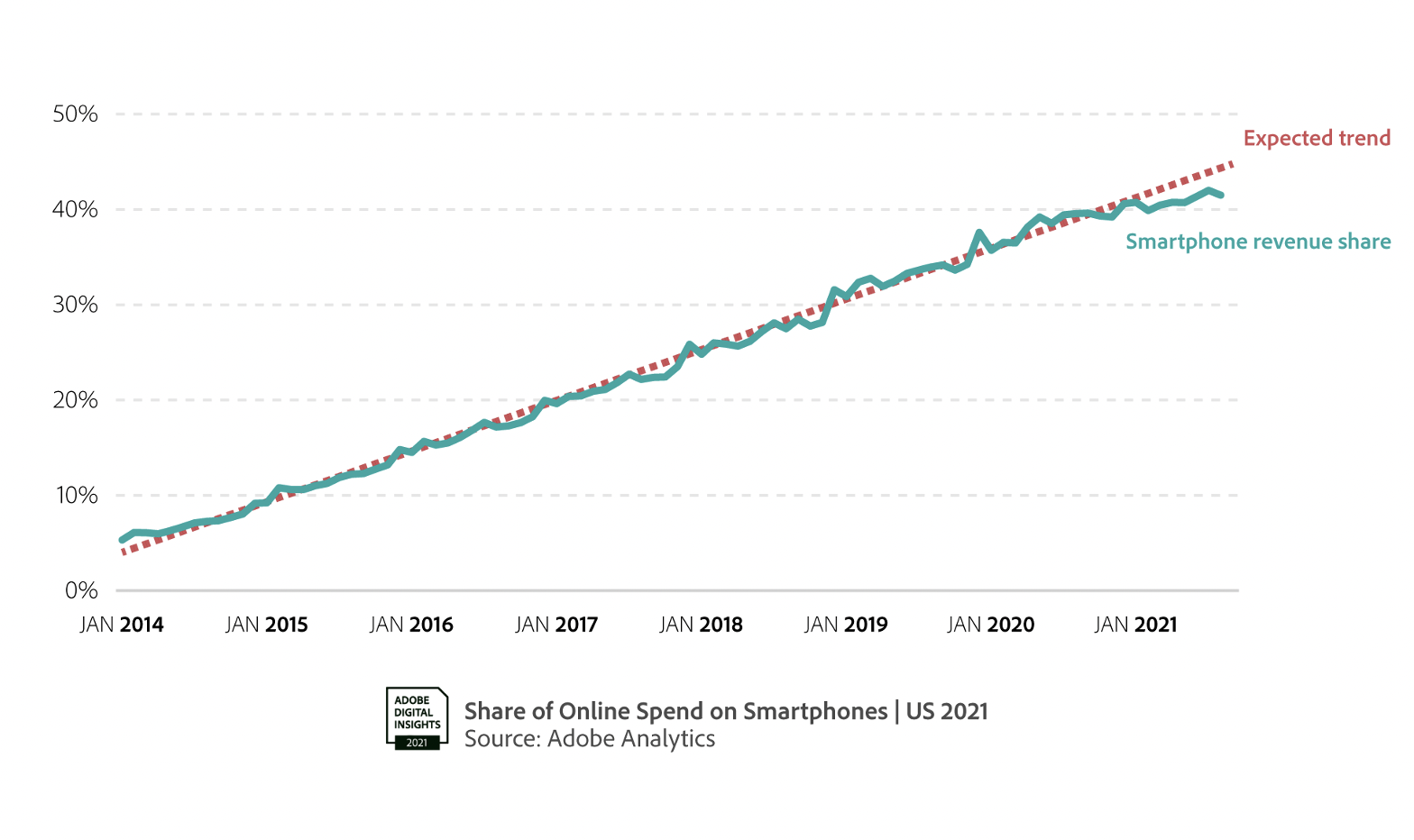

Mobile Shopping

- Shopping on mobile phones is hitting a plateau.

- Source: Adobe Holiday Shopping Forecast 2021.

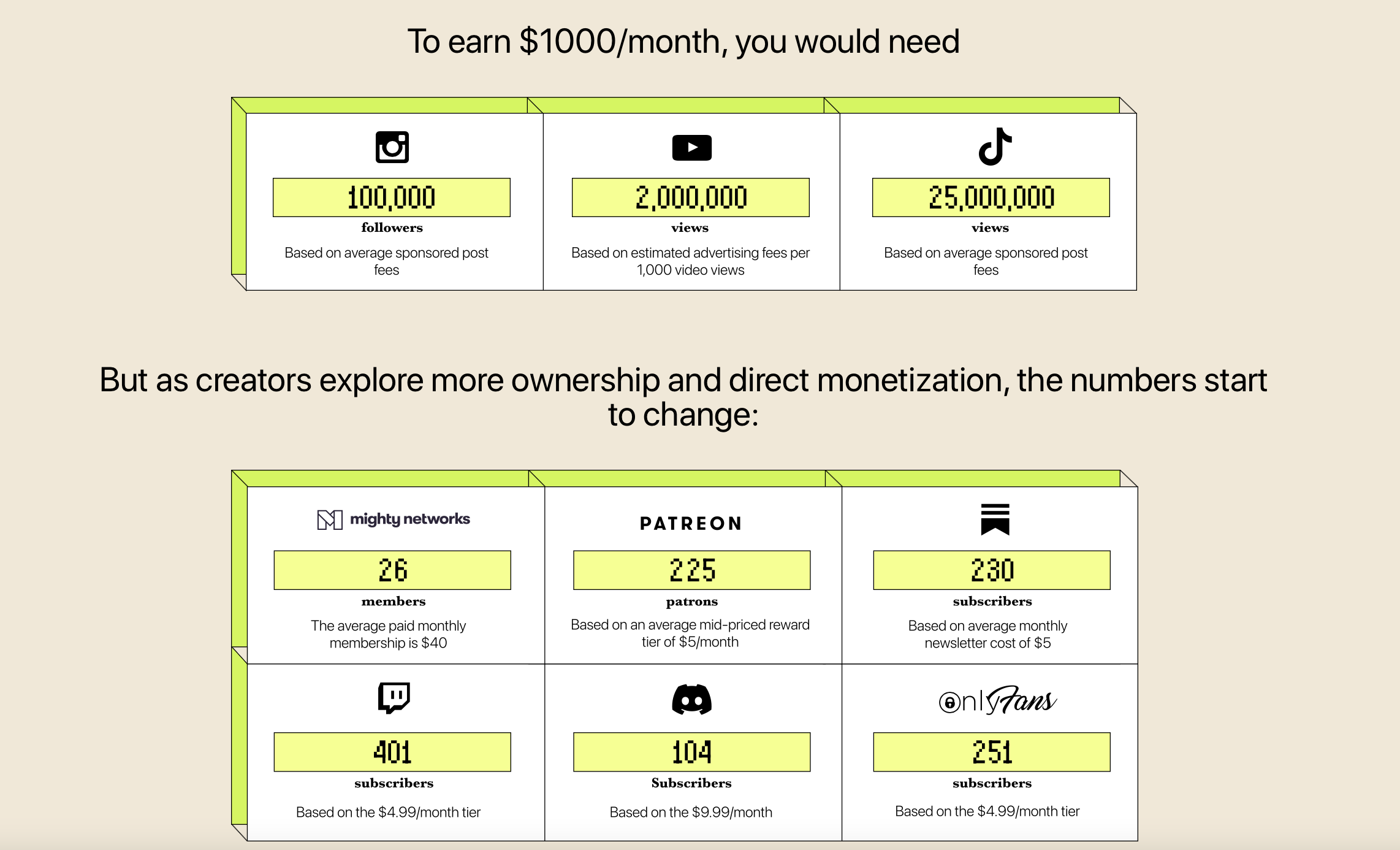

Creator Economy

- The creator economy is booming.

- New platforms are largely to thank – they have transformed the economics of creating.

- This is seen in the table from The Independent Creator Manifesto.

- “In aggregating monetization across these 50 platforms, we’ve found that creators will soon pass more than $10 billion in aggregate earnings. While 2020 saw a jump in new creators, it wasn’t a one-time spike. A year later, creators are still coming online at a record clip: the number of creators is up a whopping 48% year-over-year. In total, these platforms have onboarded 668,000 creators.“

- Substack just announced they have hit 1 million paid subscribers.

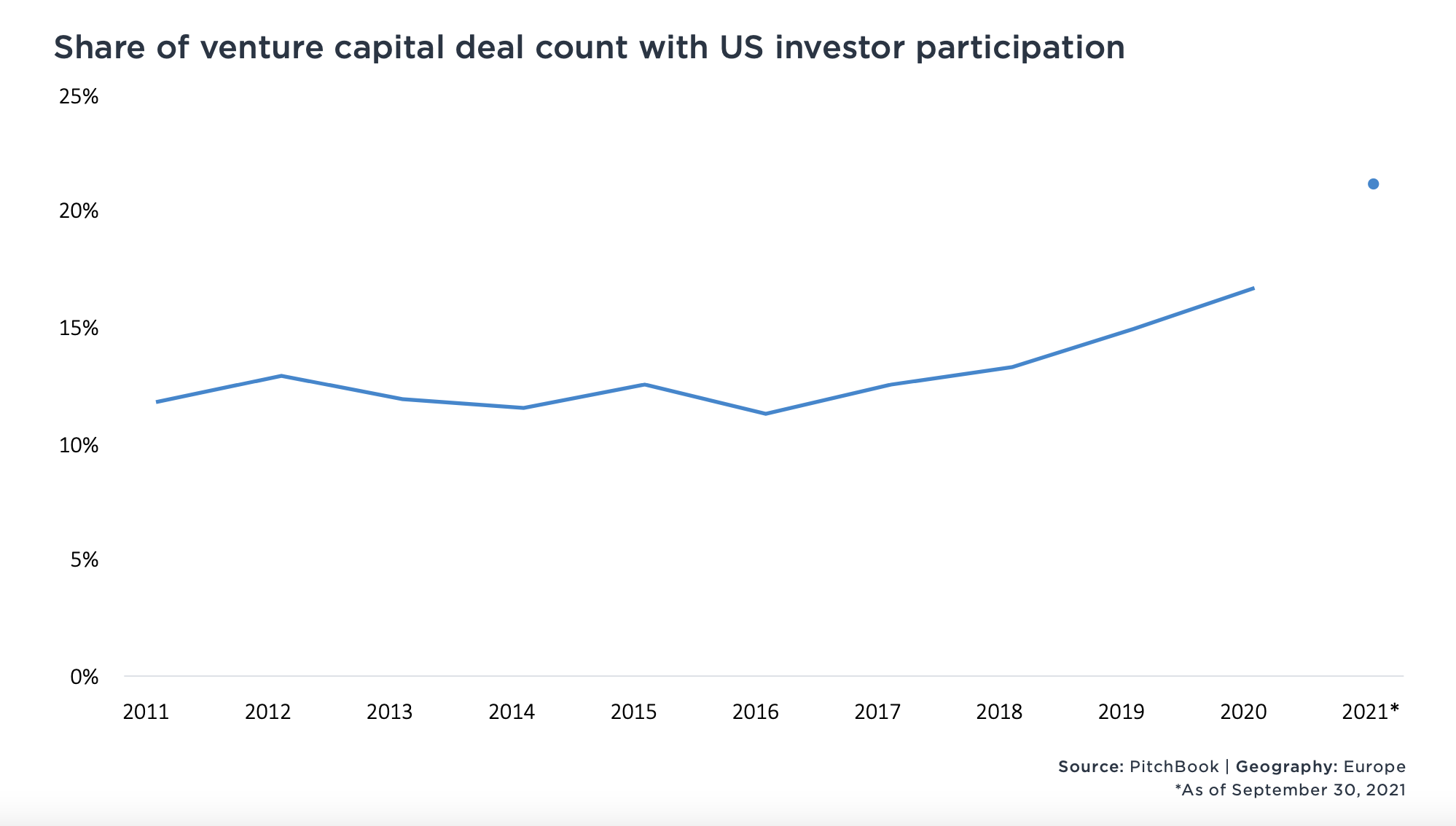

Barbarians at the Gate

- A record 21.2% of all European VC deals have seen some sort of US investor participation in 2021.

- Source: Pitchbook.

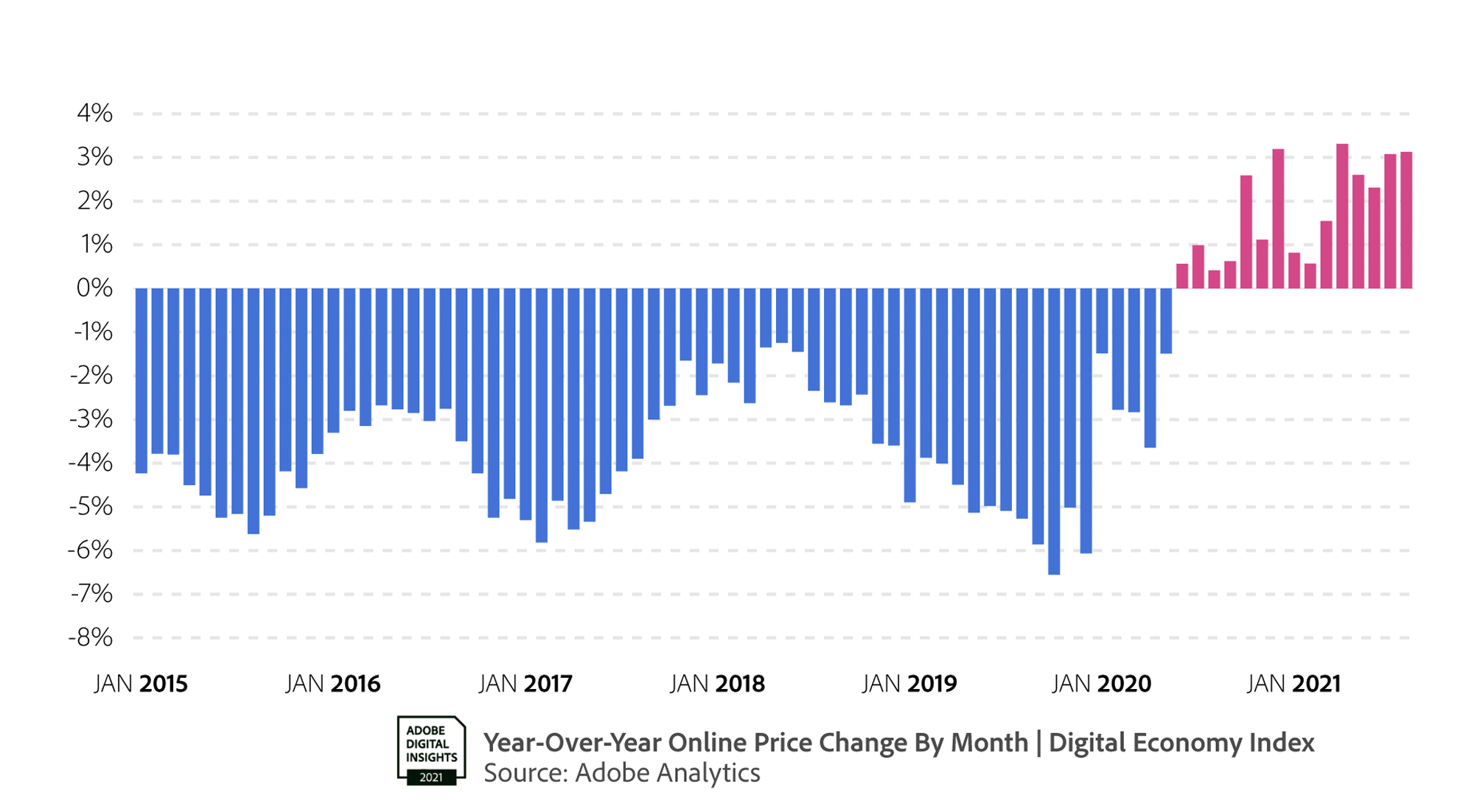

US Online Holiday

- US online holiday pricing is experiencing inflation for the first time ever.

- “Instead of overall online prices being 5% lower YoY, before seasonal discounts hit, they are up 3.3% YoY“.

- Source: Adobe Holiday Shopping Forecast 2021.

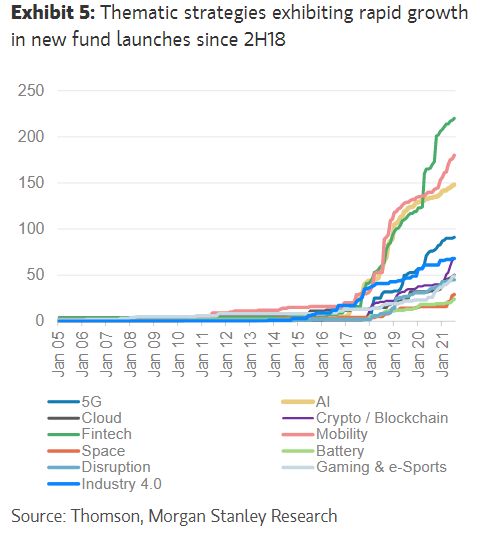

Thematic Investing

- Thematic investing has exploded.

- h/t Callum Thomas.

Energetic Aliens

- What accounts for the difference between “cognitive stamina and observed levels of energy between individuals“?

- This article is a really interesting start on understanding these so-called “energetic aliens” – people who can work hard, consistently and obsessively.

- Examples include George Church who “after finishing his undergrad in 2 years, worked 100 hour weeks in the lab during grad school, famously getting kicked out due to not attending classes because he was just so absorbed in his research.“

- As well as – Napoleon, Robert Moses, Alexander Grothendieck, Paul Erdos, Isaac Asimov, Honore de Balzac, Danielle Steel and more.

- Absolutely worth a read.

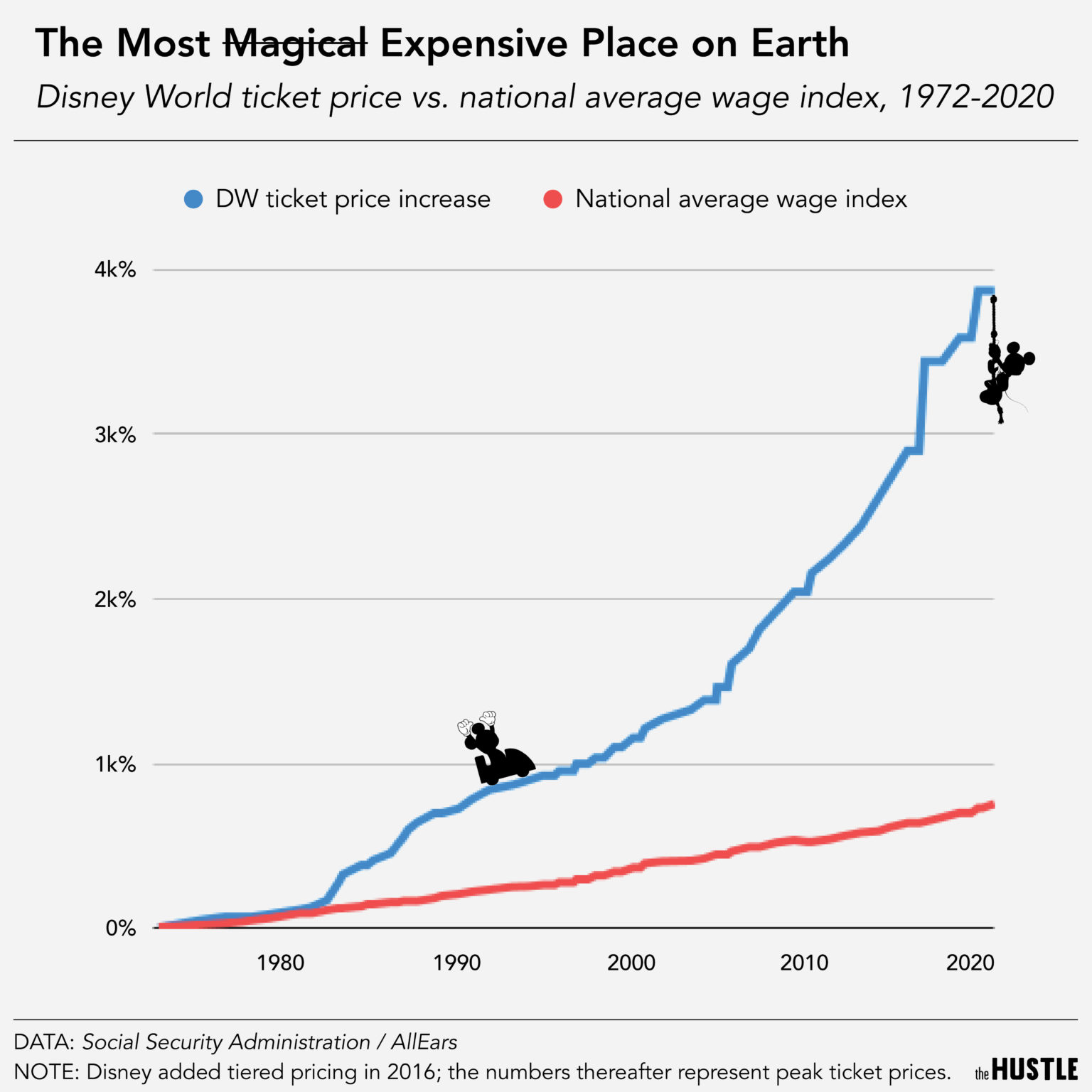

Reservations

- Wonderful article about how reservations are taking over our lives.

- “The end result of this movement is that our access to real world experiences is experiencing a kind of digital enclosure.“

- The master of this new world are Disney Theme parks, which the author covers in all their planning glory.

- The latest pinnacle here is the Disney Genie app – though consumers aren’t fans (the launch video has 13k dislikes vs. less than a 1,000 likes).

- The big issue is likely the attached chart – Disney ticket prices have outpaced wage growth for years (Source).

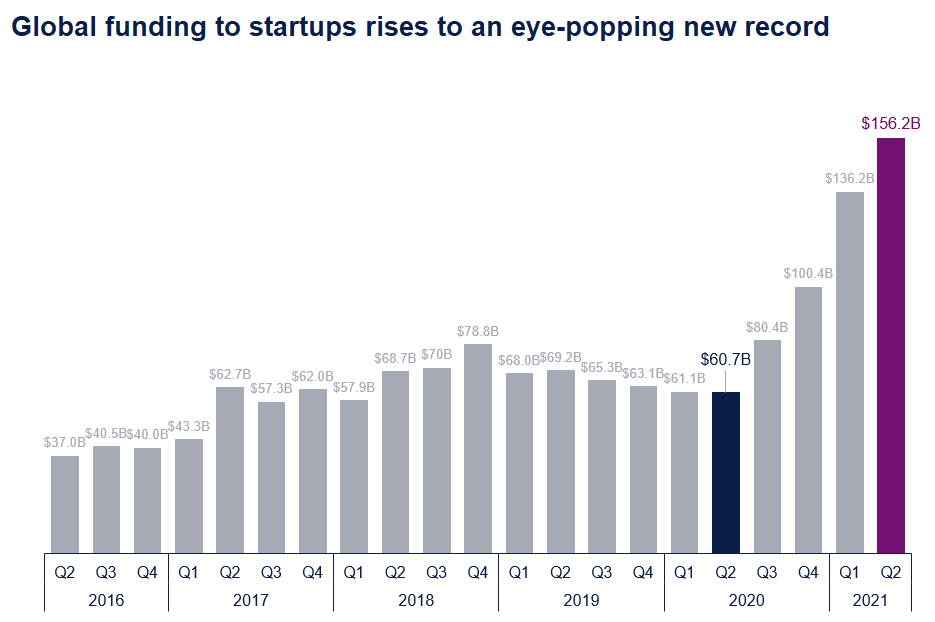

Venture Investing

Honus Wagner

- The “Mona Lisa of sports cards” is the Honus Wagner T206.

- Honus Wagner, though he was a star during his time, was a shrewd operator who restricted images of himself.

- These cards are so rare – a few dozen are known to exist – that one recently sold for $6.6 million at auction.

- Great read.

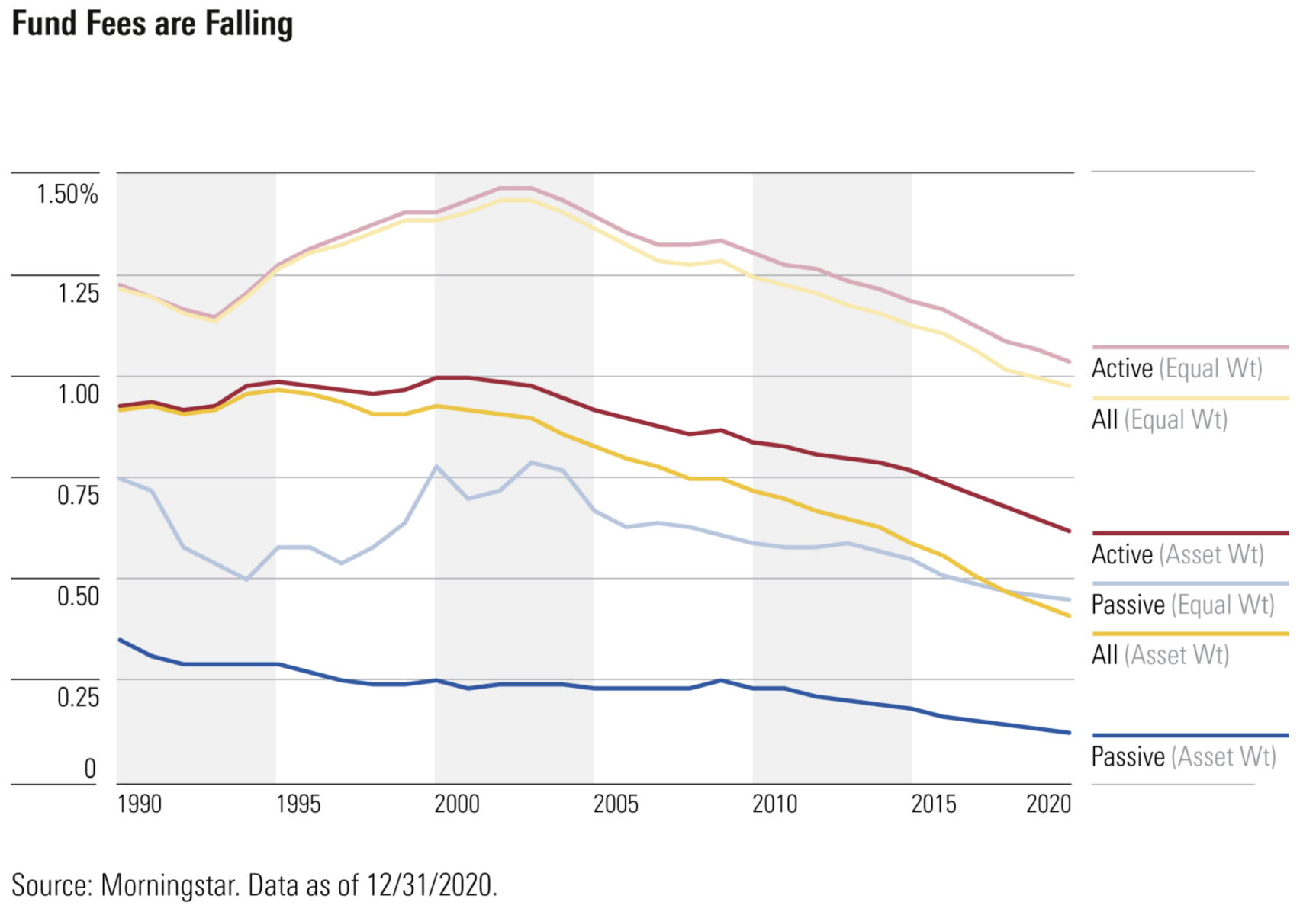

Fund Fees

- Fees continue to be under pressure across active and passive funds.

- The associated article from Morningstar makes for interesting reading.