- A very comprehensive look at active share.

- The bottom line: evidence suggests active share is not correlated to better performance. The reason:

- Active share means higher dispersion (bigger range of results).

- Higher fees.

- Positive skew (the more concentrated the lower chance of owning the few stocks that generate most of the returns).

- Lots more in the discussion including a really excellent part on the role of luck vs. skill.

- In many ways supports what Hosking Partners talk about and put in practice.

Misc

Miscellaneous is often where the gems are.

Solitude and Leadership

- A must read essay on what leadership means and what solitude (seemingly a contradictory state) has to do with it.

- Lessons here for investors – solitude, concentration, introspection, original thought.

- This quote was also a gem – “I used to have students who bragged to me about how fast they wrote their papers. I would tell them that the great German novelist Thomas Mann said that a writer is someone for whom writing is more difficult than it is for other people.“

Broken Windows at Scale

- Bastiat’s broken window fallacy states: breaking a window may seem to generate economic activity through its repair, but it’s actually a loss once you take the opportunity cost into account.

- But what if things looked different at scale? Does destruction lead to positive effects?

- What if we all “both underestimate the costs of being stuck in bad equilibria, and overestimate the pain caused by burning down the system.“

- This article explores this idea, by reviewing several fascinating economic papers.

- Does the same apply at the company level?

Cloud is not all Great

- Interesting to see cracks form in cloud computing paradigm.

- In the article a16z make a stark case for repatriating workloads – “We show (using relatively conservative assumptions!) that across 50 of the top public software companies currently utilizing cloud infrastructure, an estimated $100B of market value is being lost among them due to cloud impact on margins — relative to running the infrastructure themselves.”

- “If you’re operating at scale, the cost of cloud can at least double your infrastructure bill.” … “You’re crazy if you don’t start in the cloud; you’re crazy if you stay on it.“

- Good discussion of this article here.

- Computing paradigms do move in cycles but the analysis is missing things like flexibility (cloud is better at flexing workloads up and down) and capital intensity of businesses being a driver of valuation.

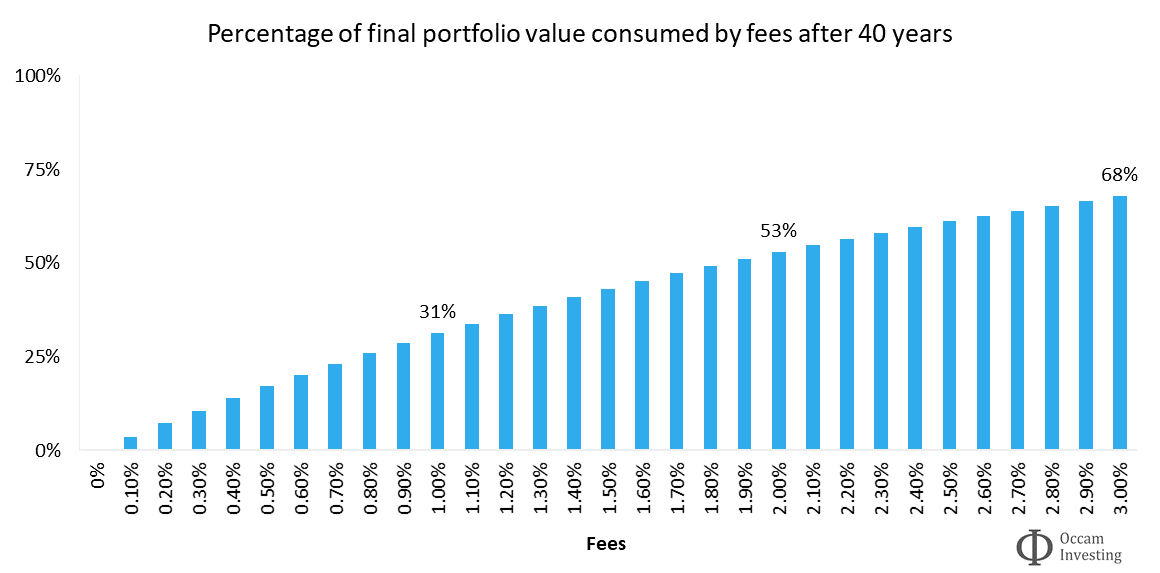

Fund Management Fees

- Pretty staggering chart on how much of the final value of a portfolio is consumed by fees at various fee rates (x-axis).

- It assume a portfolio returning 7% pa (this could be 0-10% and not change the analysis) over 40 years.

- A 1% fee consumes 31% of the final value.

- Definitely worth reading the full article – which discusses the question of whether fees predict performance.

eRetail 2.0

- The mind boggles at the level of innovation going in ecommerce.

- One major part is entertainment and retail = retailtainment – “shopping as a mass leisure activity”.

- This is a great article on the phenomenon, covering the plethora of ways it is developing.

- As usual one needs to look east where a lot of development is taking place.

- One of the enablers is software that is designed to be addictive – for example infinite scrolling can mimic the bottomless bowl effect leading to 73% more consumption.

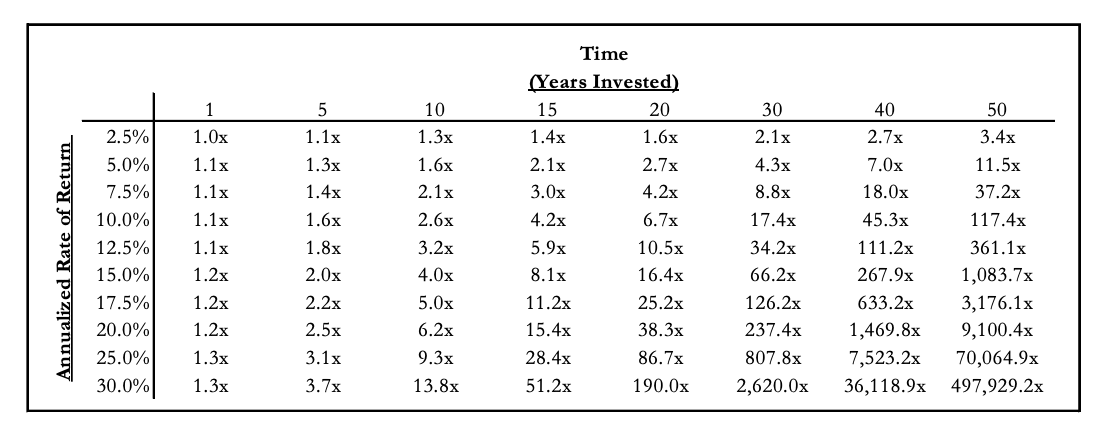

Compounding

- Helps to be reminded of this table from Hayden capital Q1 letter.

- Truly the 8th wonder of the world, as they put it “time in the market, beats timing the market”.

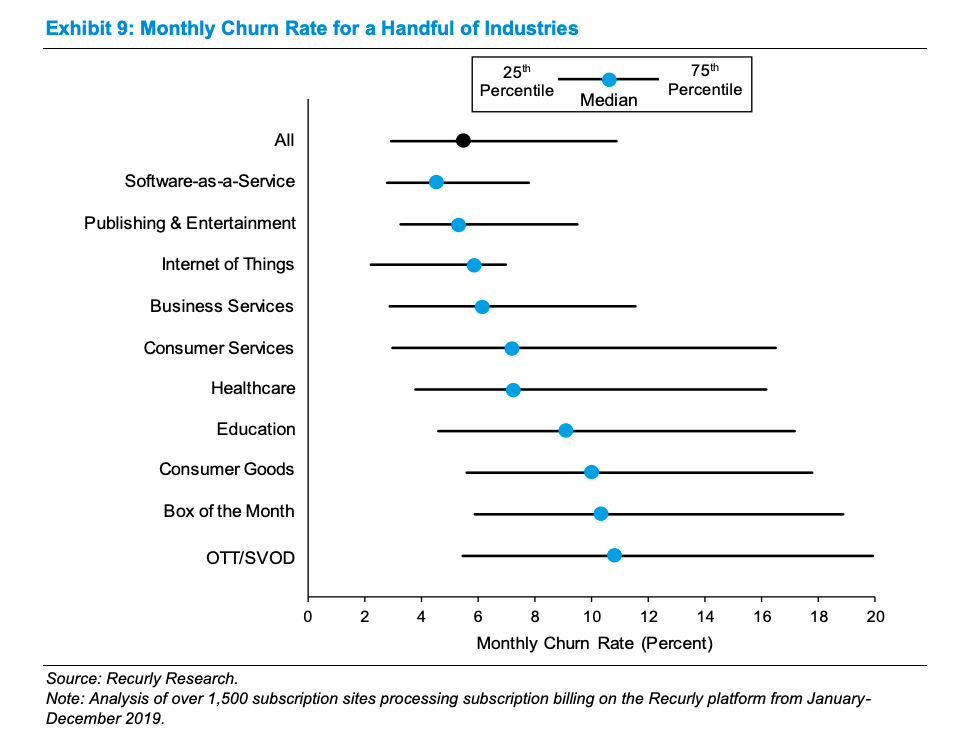

Churn Rates by Industry

- Useful chart from the latest Mauboussin note showing churn rates in various industries.

- The piece itself is about valuing customer based businesses – interesting read.

Andreessen Interview

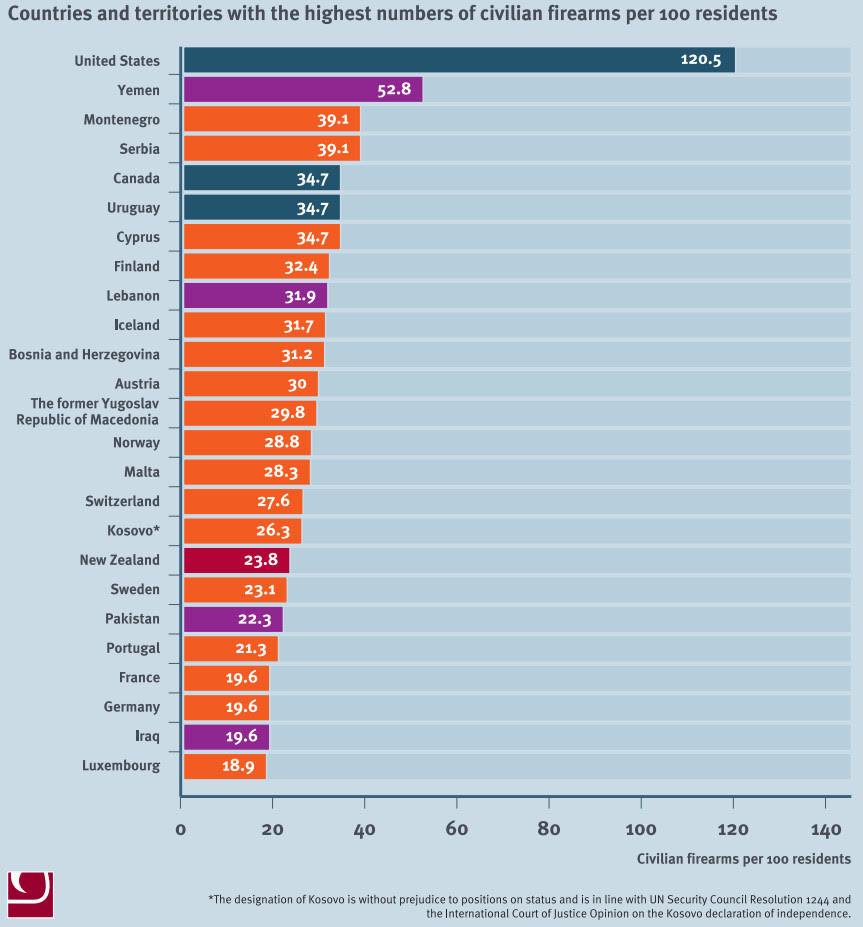

Fire Arms

- Everyone knows the US has the highest civilian gun ownership.

- Somewhat surprising to see which countries come next in the list.

- Source (h/t Big Picture).

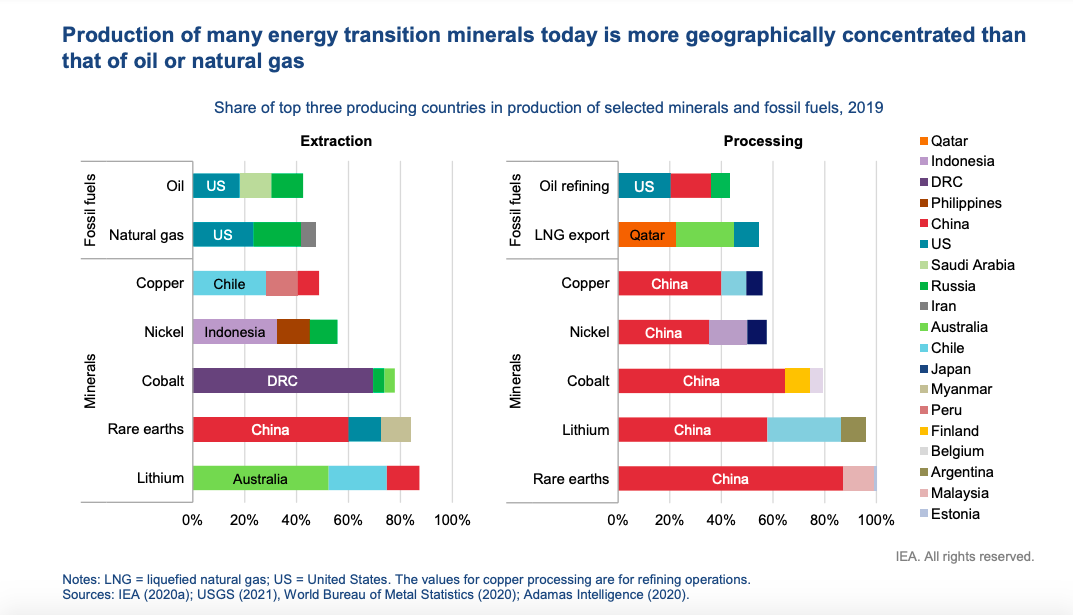

Energy Transition and Geopolitics

- Fascinating chart showing the shifting balance of geopolitics as the world transitions from fossil fuels to renewables.

- Interestingly, it is far more geographically concentrated.

- Source.

A Few Short Stories

- A brilliant set of short anecdotes each carrying an important lesson.

- An example – “When we condemn [the past] for slavery, or for Native American removal, or for denying women their full role in the life of the nation, we ought to pause and think: What injustices are we perpetuating even now that will one day face the harshest of verdicts by those who come after us?“

Flights to Nowhere

- Asiana Airlines in Korea has operated 75 flights to nowhere.

- These flights don’t go anywhere but allowed 8,000 passengers to shop duty free, spending on average $1,450 per flight.

Tiger Global

- A fascinating read about Tiger Global’s innovative velocity focussed venture/growth strategy.

- It can be summed up as follows:

- Be (very) aggressive in pre-empting good tech businesses

- Move (very) quickly through diligence & term sheet issuance

- Pay (very) high prices relative to historical norms and/or competitors

- Take a (very) lightweight approach to company involvement post-investment

- Above all, deploy capital, deploy capital, deploy capital

- It is disrupting venture investing and earning high returns in the process.

Interviewing Asset Managers

- Nice excerpt from podcast host and allocator Ted Seides’ book – Capital Allocators – on how asset allocators should grill investors.

- Interesting insights and bits of advice largely on interview technique.

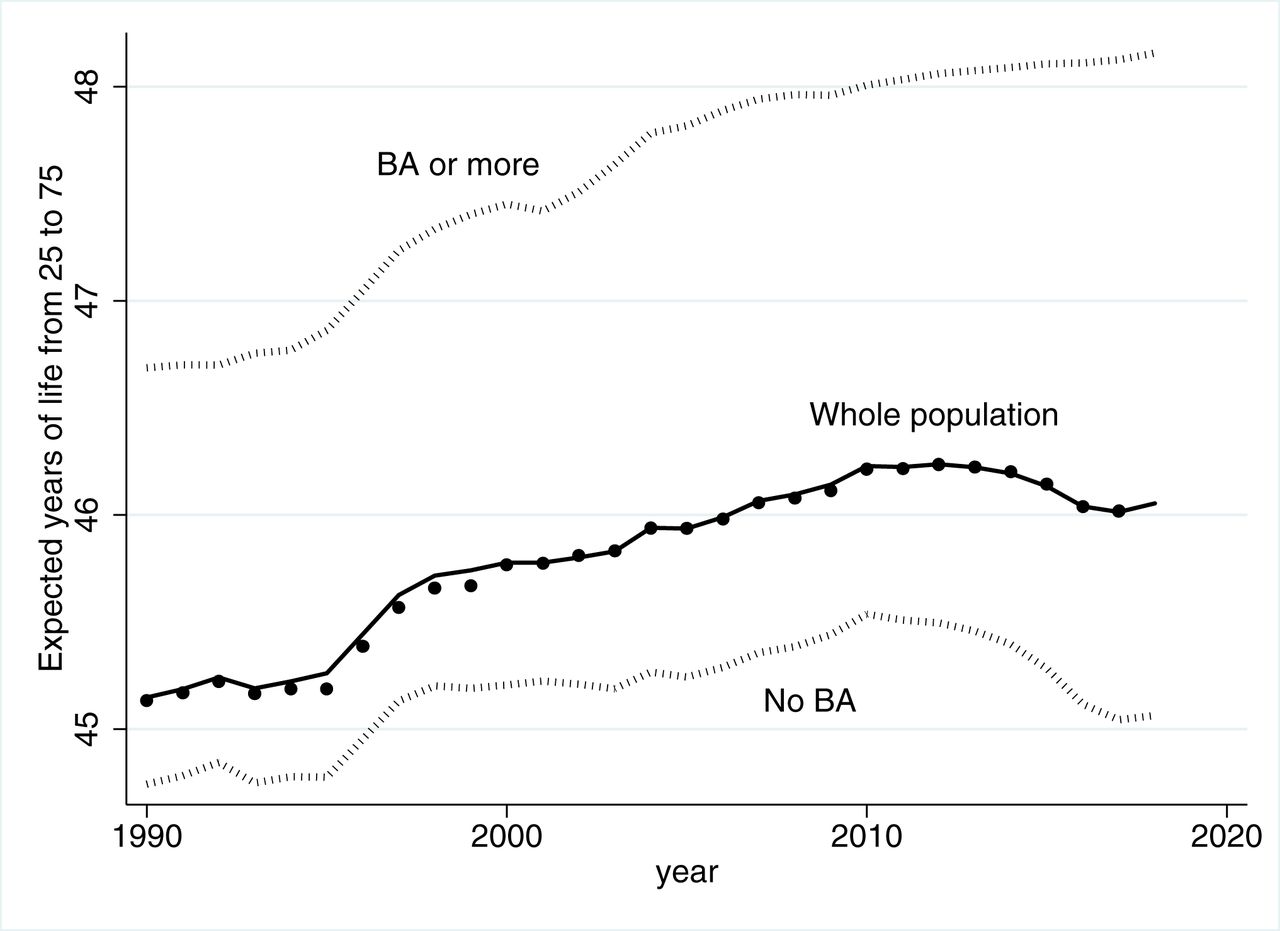

Life Expectancy and Education

- The difference between life expectancy in the US for those with a degree and those without is stark and has been widening.

- Source.

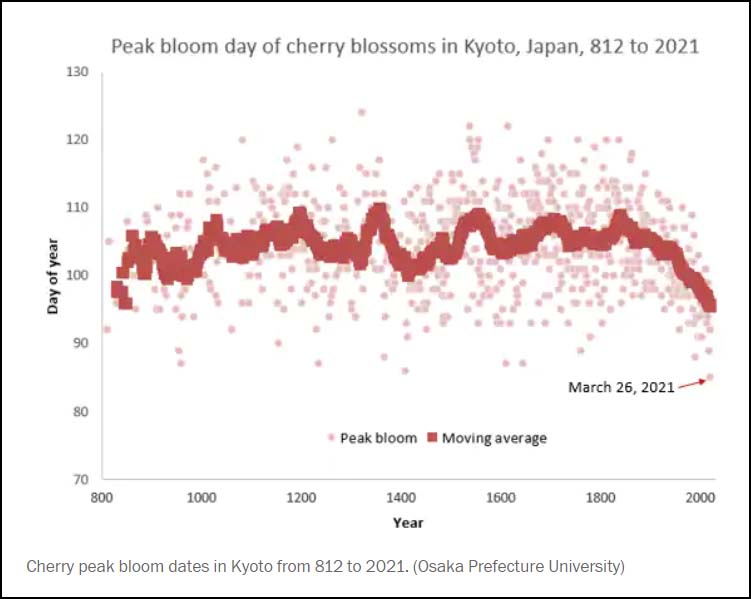

Cherry Blossom

- The Kyoto cherry blossom peak bloom has been recorded since 812 AD.

- March 26th 2021 peak bloom date surpassed the previous record March 27th 1409 (a century before Columbus sailed for America).

- Scientists suggest this is a clear sign of climate change.

- h/t 361 Capital.

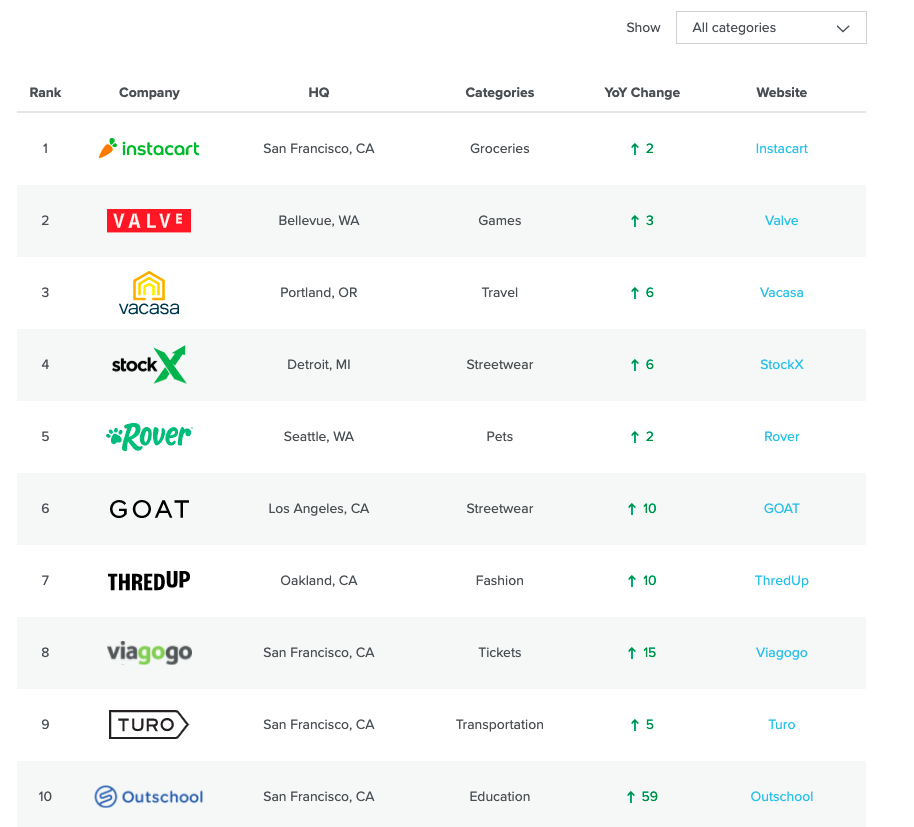

a16z Marketplace 100: 2021

- The latest edition of the top 100 private/start-up consumer facing marketplaces using Bloomberg real-time consumer spending data.

- A lot has changed in 2020 for obvious reasons. The full report is here.

- Interesting to see Turo at number 9 (up 5 places), which is an investment (they own ca. 26.8%) by IAC that few talk about.

Luck

- How to make your own luck. Lots of interesting ideas inside re biases and the “serendipitous mindset”.

- Key elements are being “open and alert to the unexpected” and being “prepared”.

Being Negative

- This is an eye-opening essay on The Art of Negativity with useful read-across to investing.

- This was an interesting result from research – “there is a clear “asymmetry in the way that adults use positive versus negative information to make sense of their world; specifically, across an array of psychological situations and tasks, adults display a negativity bias, or the propensity to attend to, learn from, and use negative information far more than positive information.“”

- A nice quote – “An optimist believes we live in the best possible of worlds. A pessimist fears that this is true.”