- The annual deck is always worth a flick.

- This chart shows the still-present DAU to WAU problem.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

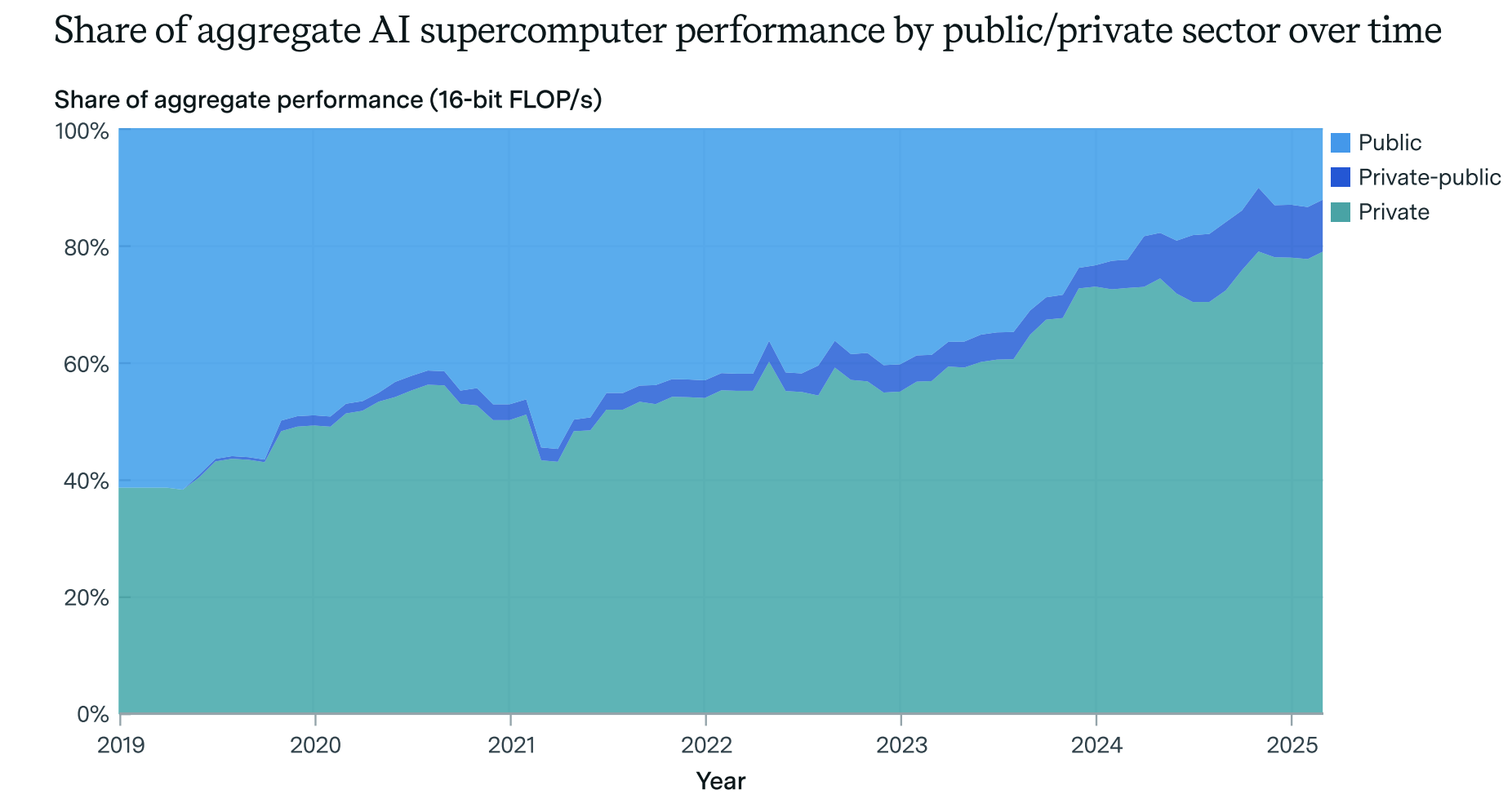

AI Supercomputer Trends

- “The computational performance of leading AI supercomputers has doubled every 9 months“.

- “Power requirements and hardware costs of leading AI supercomputers have doubled every year.“

- “If the observed trends continue, the leading AI supercomputer in June 2030 will need 2 million AI chips, have a hardware cost of $200 billion, and require 9 GW of power.“

- “We find that the share of private sector compute rapidly increased from less than 40% in 2019 to about 80% in 2025.” (see chart).

- Source.

FTC Meta Trial Trove

- Exhibits are uploaded daily giving unparalleled insights into the inner workings of the company.

- From Ben Evans – “There’s a lot of email on the daily struggles of running social networks (people worrying that US growth is slowing (2022), or that WhatsApp is overtaking Messenger (2013), and I didn’t know that Meta tracks consumer sentiment towards Meta the company. There also a few tantalising ideas – a project for a paid, premium version of Facebook from 2020, for example. And there are charts of how the ad load has doubled. But really, what you see across all of these documents is a relentless focus from the top on making the current thing work better while worrying about the next thing.“

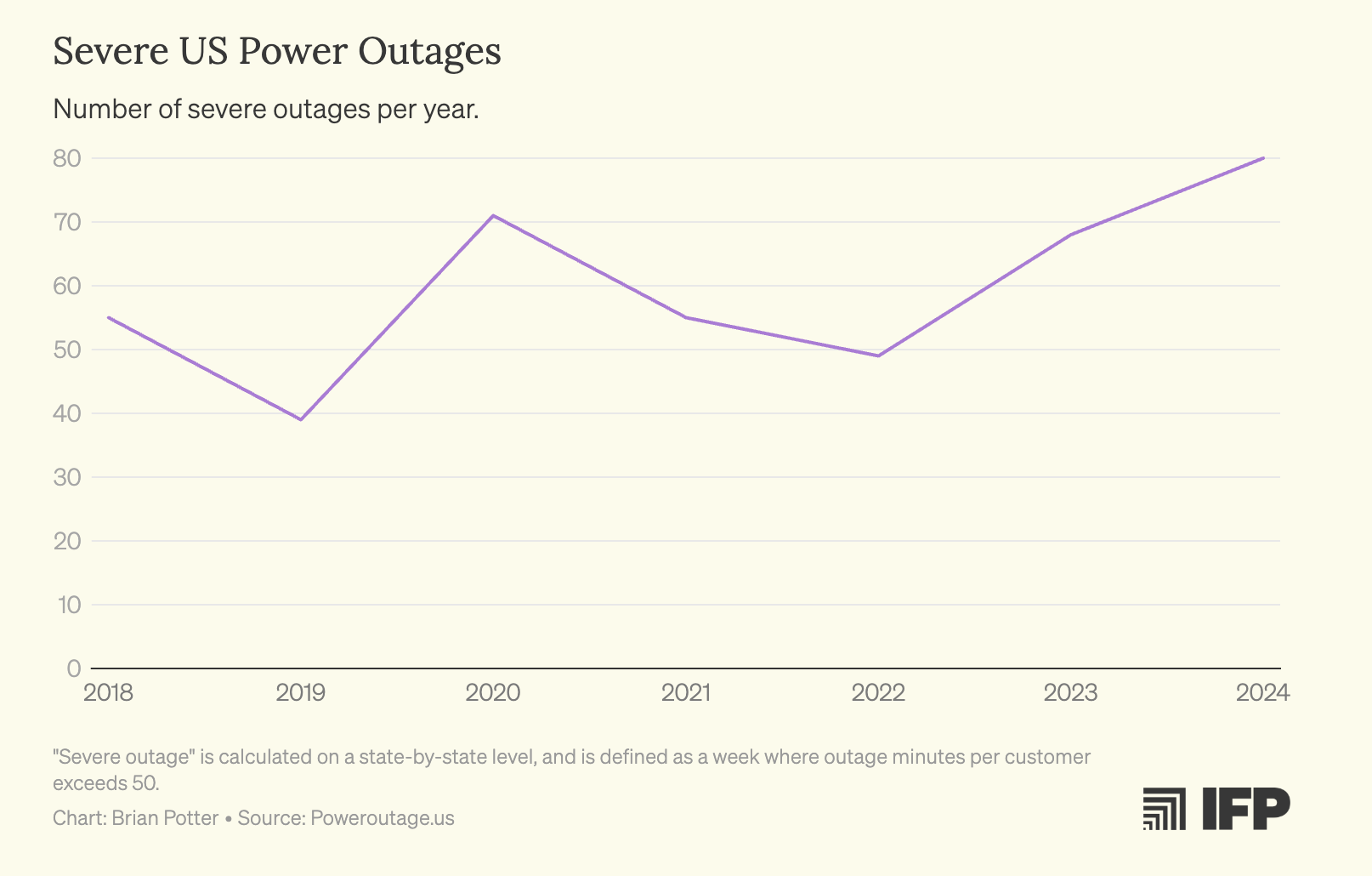

Power Outages

- The number of severe power outages in the US has been going up.

- Source.

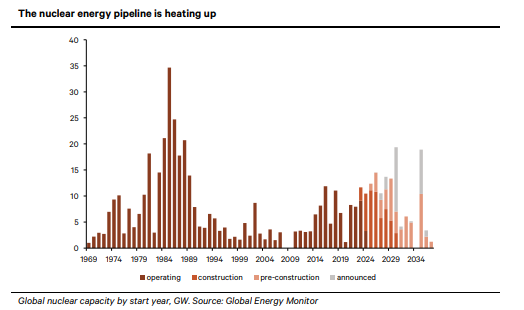

Nuclear Renaissance

- Pipeline heating up.

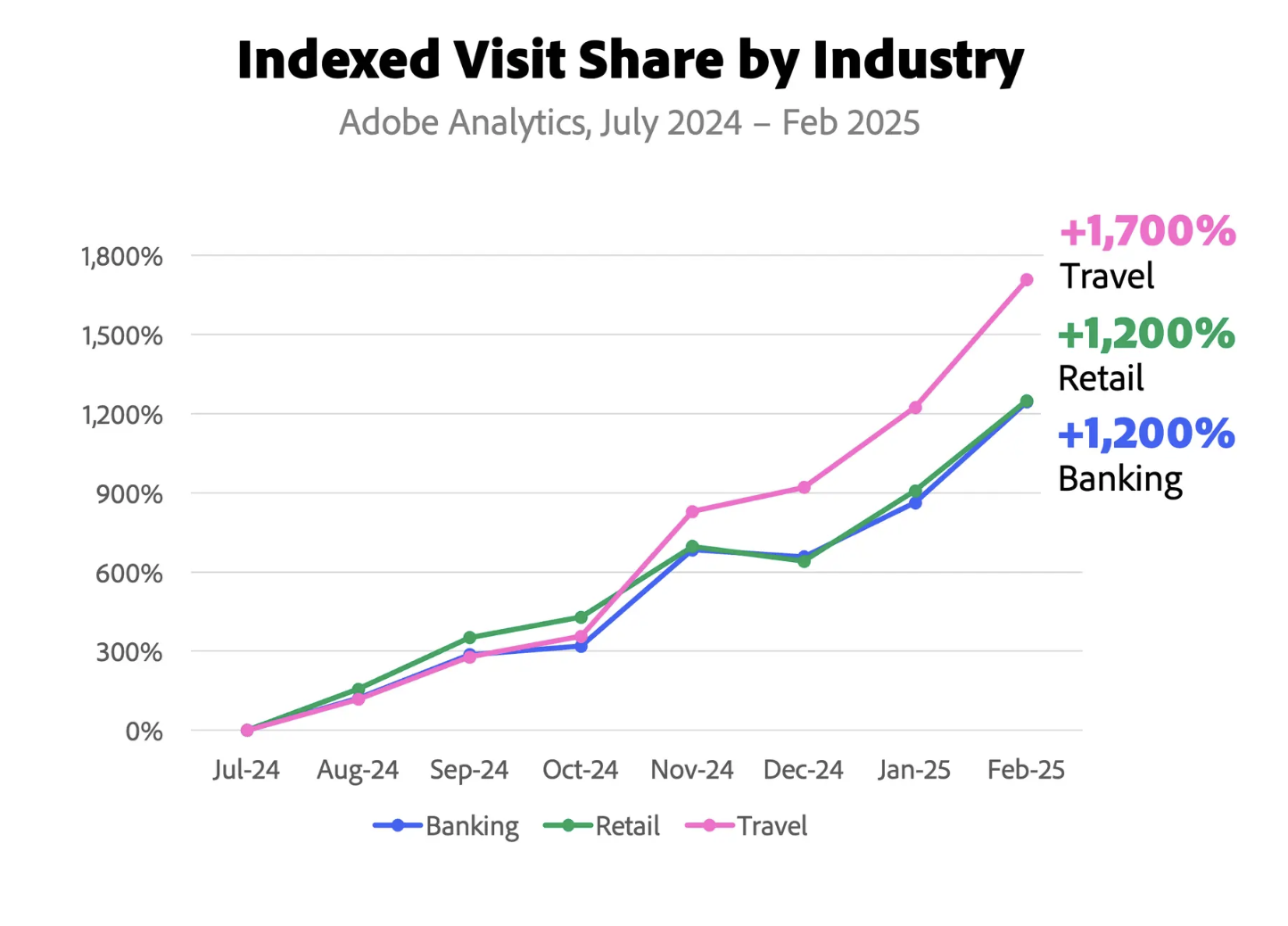

Gen AI for Shopping

- Though still small, Adobe is reporting sharp growth in this type of traffic, “doubling every two months since September 2024.”

- 39% of consumers use Gen AI for shopping.

- This traffic is more engaged but has a 9% lower propensity to spend (up from a 43% gap just over 6 months ago).

- No wonder OpenAI is looking at this use case.

US China AI Race

- What stands out from this deep analysis is the renewed optimism in China on advanced semiconductor design and manufacturing.

- “Ren [Huawei founder] further said that he is leading a network of more than 2,000 Chinese companies who are collectively working to ensure that China achieves self-sufficiency of more than 70 percent across the entire semiconductor value chain by 2028. These predictions should be taken seriously.“

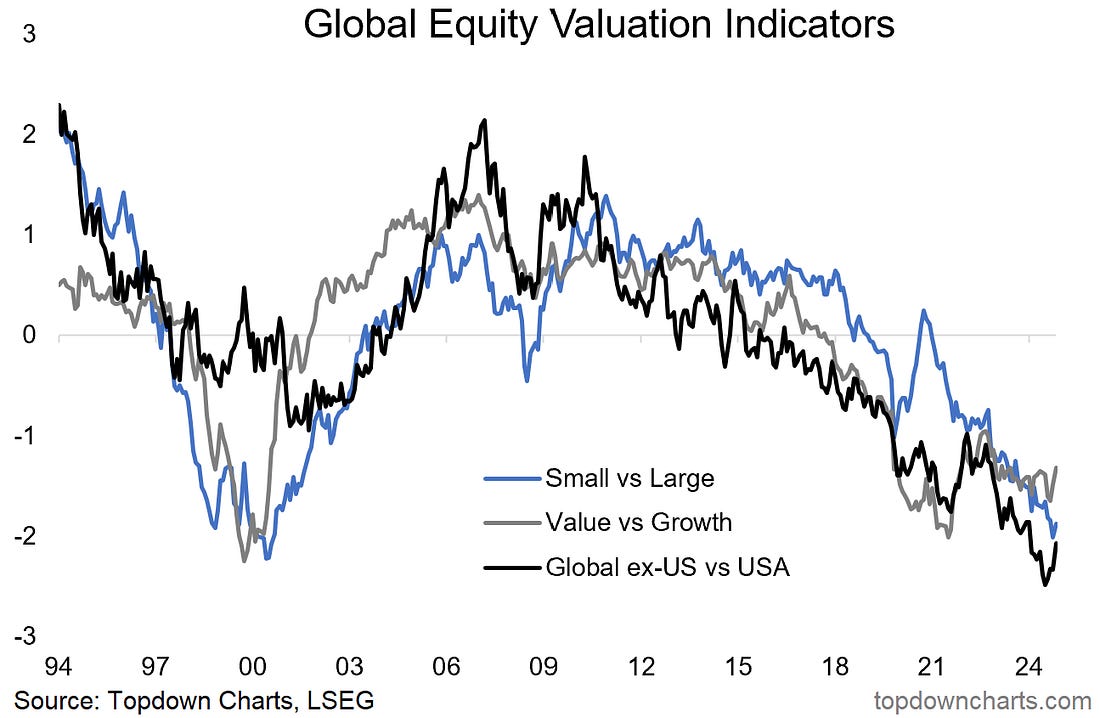

One way Street

- It would be something if this reverses.

- Source.

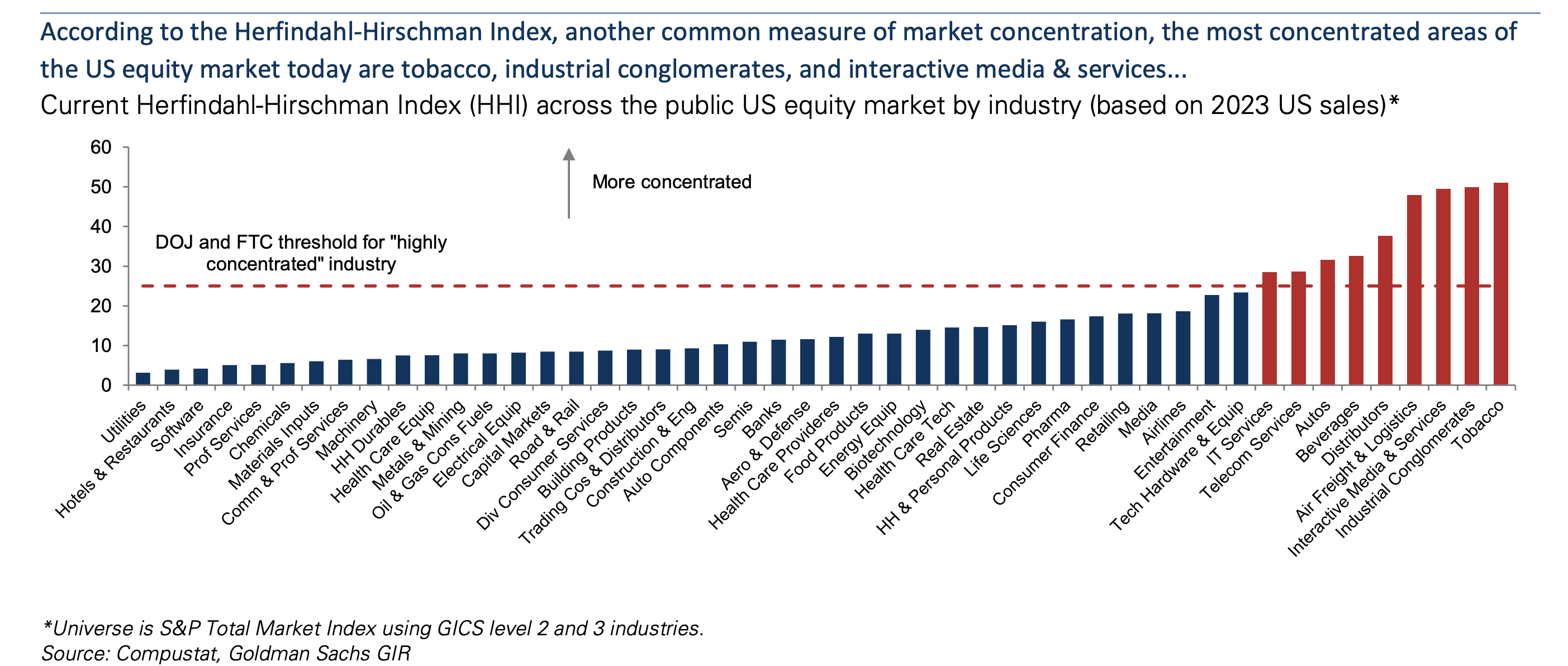

Industry Concentration

- The most concentrated areas of the US equity market ranked.

- Source.

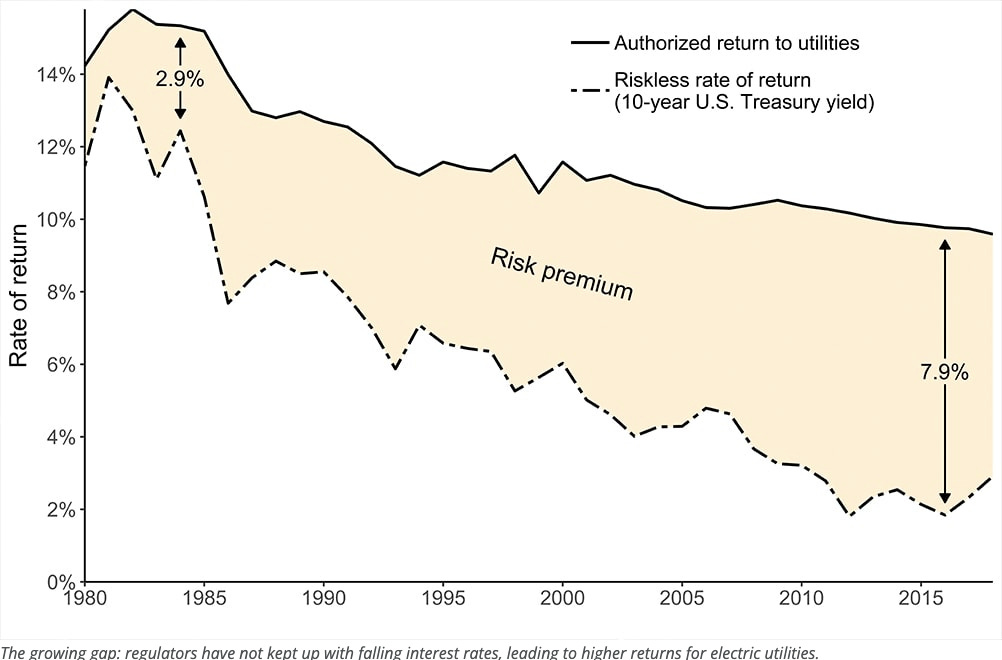

US Electric Utilities

- Just four companies serve 90% of the technical testimony utilities use to calculate the rate of return in the US.

- “In 2019, two experts at Carnegie Mellon, Paul Fischbeck and David Rode, analyzed 1,600 rate cases over 40 years, and noted the “balance between utility companies and their customers has been shifting over time, in favor of the utilities.” What investors were being paid to take risk in putting money into a utility in 1980 was about 3%, today it is nearly 7%.”

- More on how US electric utilities work.

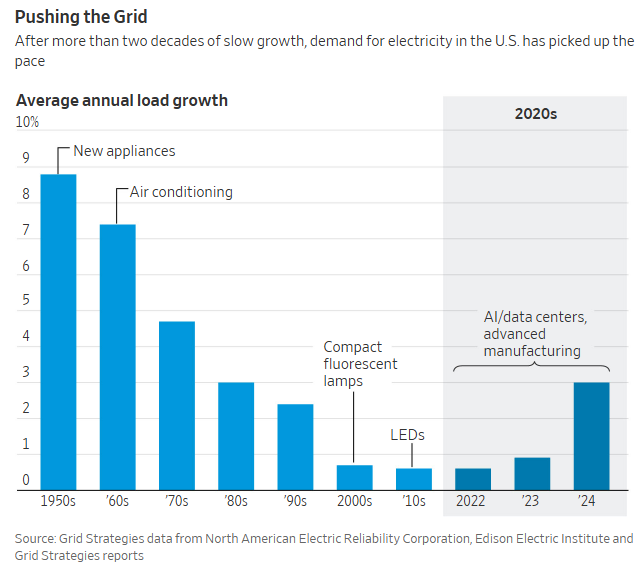

Electrification

- Electricity demand is starting to grow again. Forecasts are for 40-50% increase by 2040.

- This should create a very large electrification investment cycle.

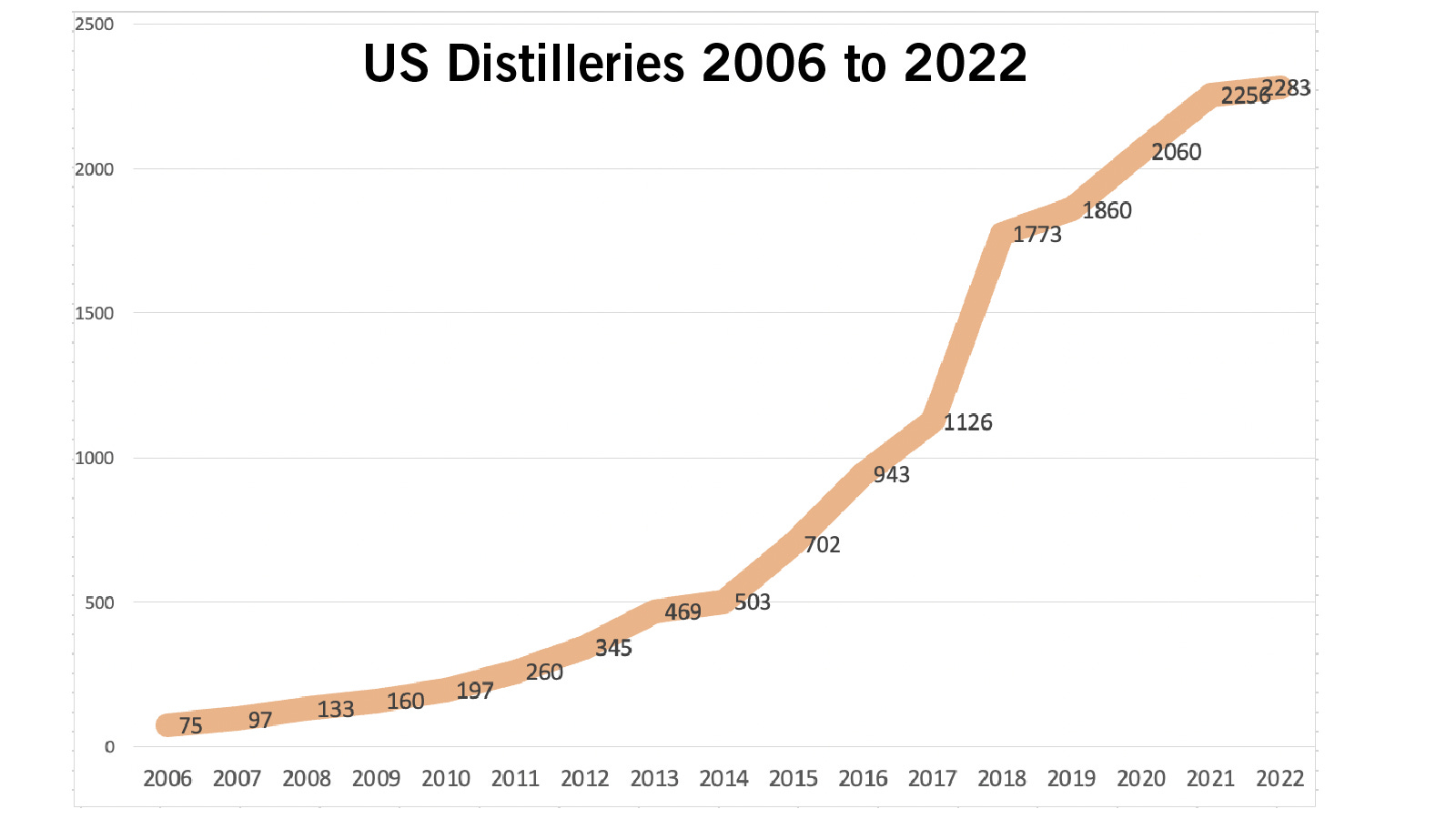

Bourbon Distilleries

- Capital cycle, exacerbated by the fact that to be called bourbon inventory must age for two years.

- Source.

NIH Analysis

- National Institutes of Health (NIH) is currently facing chaotic cuts – this article does a decent job laying out how things like a capping indrect spending can only be done via Congress and generally the state of the NIH.

Stripe Annual Letter 2024

- Stripe did $1.4 trillion payments volume in 2024 – it is worth reading their annual letter.

- Topics include AI Economy (their data shows top 100 AI firms reach $5m ARR in 24 months vs. 37 months for their top SaaS firms in 2018), vertical SaaS, stablecoins, Europe.

Comparative Earnings Vol

- There are many reasons investors have, rightly or wrongly, rewarded the US stock market.

- One possibly right reason is lower earnings volatility.

Fragrances and AI

- “Consumers of all age groups are using around four different fragrances regularly, which is a significant change from a decade ago when they had one signature scent.“

- “Some people talk about the ‘Deep Seek Syndrome,’ saying, ‘You’re overspending, you’re spending $500 billion, you’re overspending! You can save so much more by spending less.’ But I think they are looking at it the wrong way. How much percent of GDP will be replaced by a billion-dollar smart system? I would say at least 5% within 10 years. That 5% is $9 trillion—or if it’s 10%, it’s $18 trillion. So, somewhere between 5% to 10% of today’s GDP will be replaced by this superintelligence. Well, if that’s the amount of return, you shouldn’t be scared of spending a few trillion dollars. If the return is $9 to $18 trillion per year, why should you save? Why should you try to be efficient? For what? I don’t get it. Just a little difference makes a huge return on your market share.” – Softbank CEO Masayoshi Son

- Source: A good smorgasbord of quotes from recent transcripts.

Pharma Patent Expiries

- The amount of revenue lost due to loss of exclusivity is going up in the next three years.

- Source.

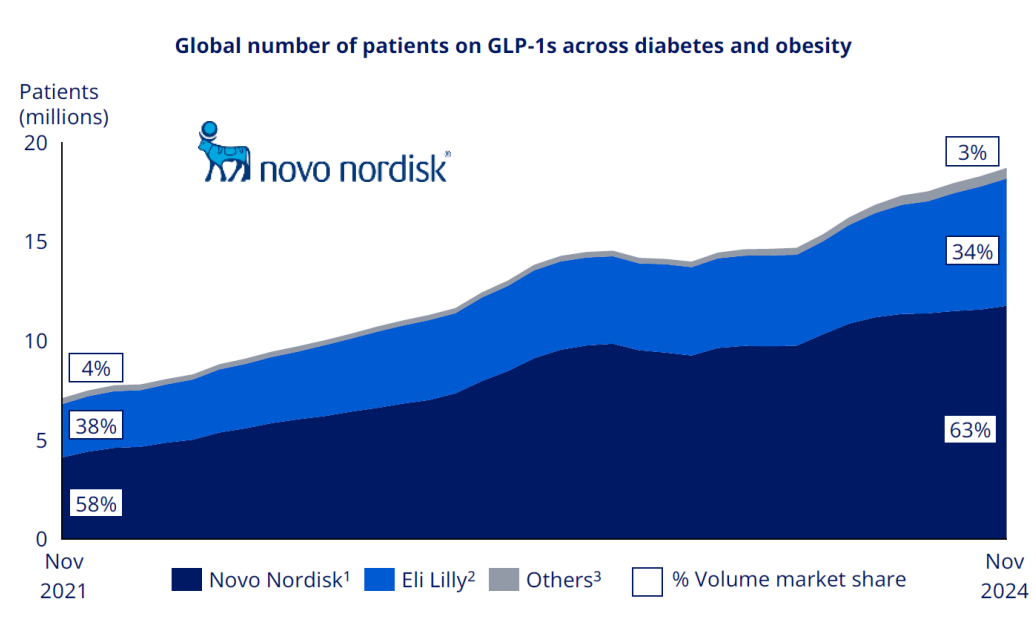

Number of Patients on GLP-1

- Number of patients on GLP-1, whether for diabetes or obesity, has tripled in the last three years thanks to Novo Nordisk and Eli Lilly.

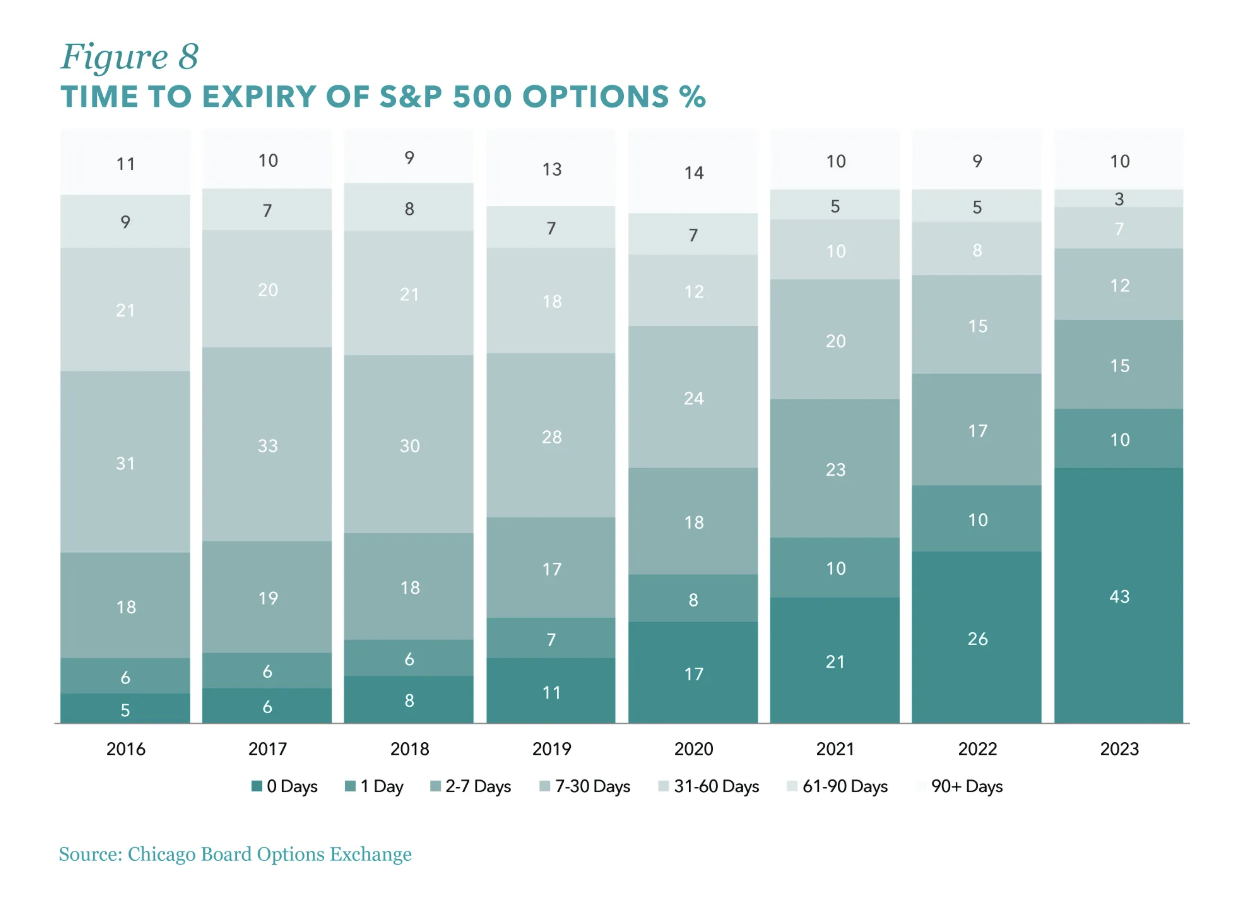

Zero Day Options

- Nice chart showing the evolution of options markets towards the zero-day to expiry dominating.

- Source.

Analyst Coverage

- Big stocks get all the coverage – another argument for the 493 other stocks?