- Turo, part owned by IAC, is the leading peer to peer car sharing company (think Airbnb for cars).

- Turo has been gaining share – it has tripled from 2% in June 2019 to 6% in June 2021.

- Still miles away from the top three rental firms (Enterprise 37%, Avis 31%, Hertz 26%).

- Competition in the space is heating up with Uber unveiling their own rent-a-car service and Lyft partnering with SIXT for care rental.

- Source.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

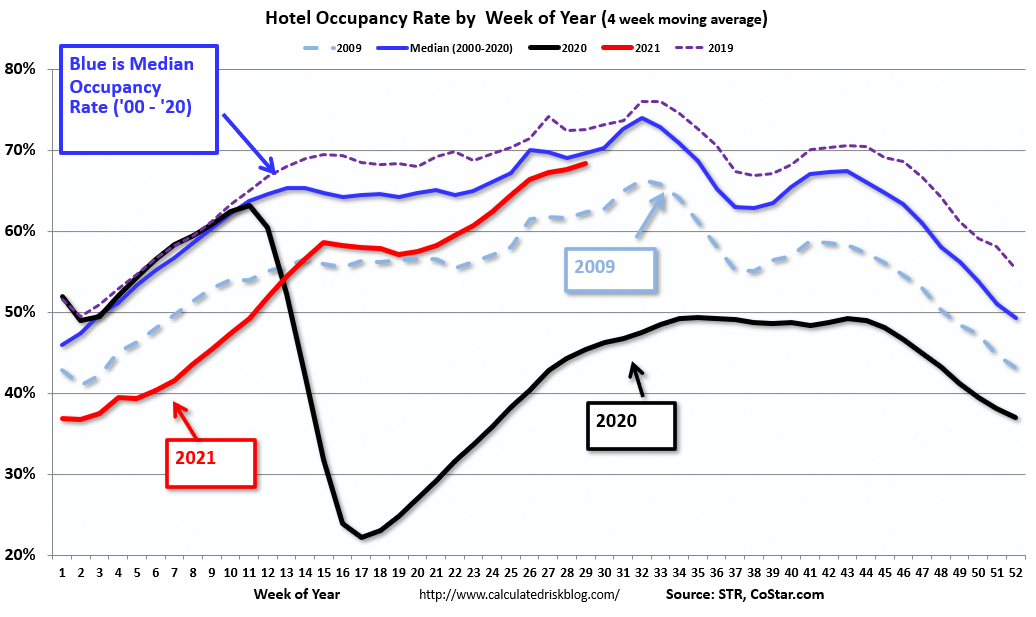

Hotel Occupancy Rate

- The occupancy rates of hotels has recovered nicely and is almost at the median level (’00 – ’20, blue line).

- Leisure demand is “doing the heavy lifting” (as seen in weekend occupancy rates), meaning a solid picture through the summer.

- Source: Calculated Risk.

Newsletters

GSK

- GlaxoSmithKline has been the subject of an activist attack by Elliott, who built up a significant stake in the company in April.

- GSK then hosted their long awaited investor day in June – laying out a plan for a future after spinning off their consumer health division.

- Elliott then released a letter which was quickly rebutted by the board of GSK who called for the usual “stability”.

- This was a good write up of the whole interaction.

- One interesting element that has not entered the discussion is the balance sheet.

- NewGSK will have 2x ND/EBITDA, even after gearing up consumer health to 4x and paying a dividend back. It also has a pension (£2bn deficit) and minority payments to ViiV partner Shionogi. All of this constrains the firm.

Stripe

- A lot has been written about this remarkable company and its even more remarkable founders.

- This was a really great, long piece covering everything from history to strategy.

- “In 2006, using an SAT score from a test he’d taken at the age of 13 (an infuriating anecdote), Patrick matriculated to Lisp’s birthplace: the Massachusetts Institute of Technology. He’d sped through the final two years of his high school curriculum in just twenty days.”

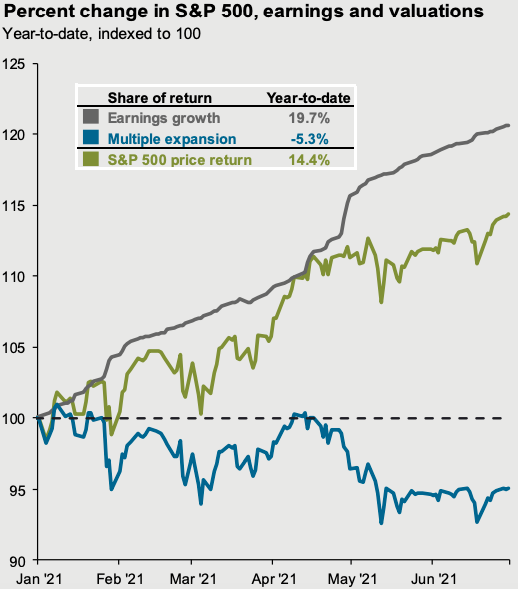

S&P H1 Return Decomposition

- Interesting to see that more than 100% of the 14% H1 2021 return of the S&P 500 index is earnings growth.

- Source.

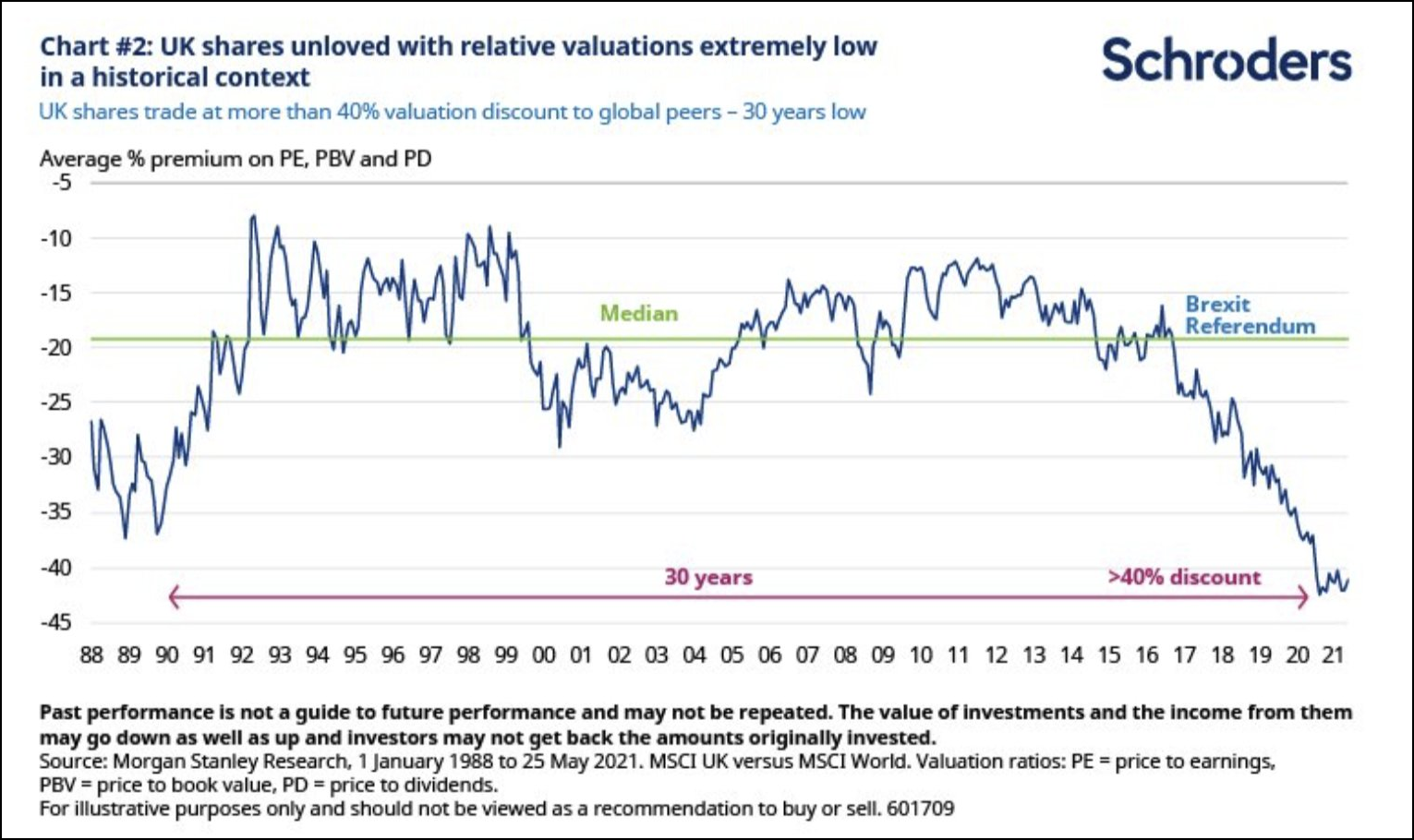

UK Valuation

- UK stocks are very cheap relative to the world (Source).

- This compares valuation at index level and hence index sector composition has a big impact.

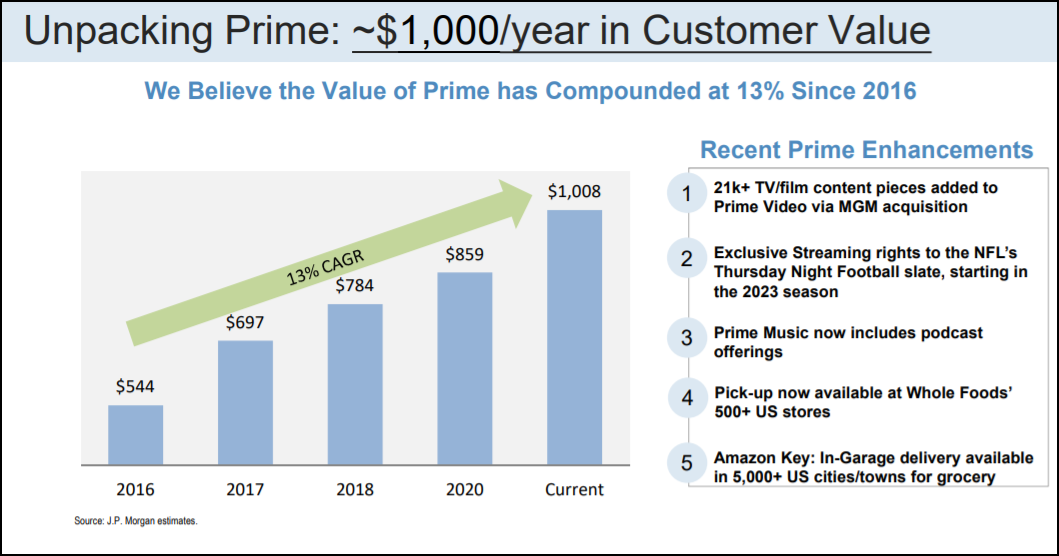

Amazon Prime

- JPM think Amazon Prime, which costs $119 per year, offers over $1,000 of customer value.

Banks – a Contrast

- These are two very contrasting views on the future of banking.

- The first is a very neat newsletter from Hosking Partners that presents banking in as simple light as possible.

- Banks are trusted to hold deposits, to transform their maturity and take diversified credit risk. As a result they have high earning power. The latter is tough to beat and large banks will beat challengers on customer facing technology reaping the cost savings.

- Contrasting this are two pieces from Net Interest, chronicling his journey through the evolving world of decentralised finance (DeFi – for those interested this is a good background on the topic).

- First he tries to start his own decentralised bank and then writes about Maker DAO, an existing one.

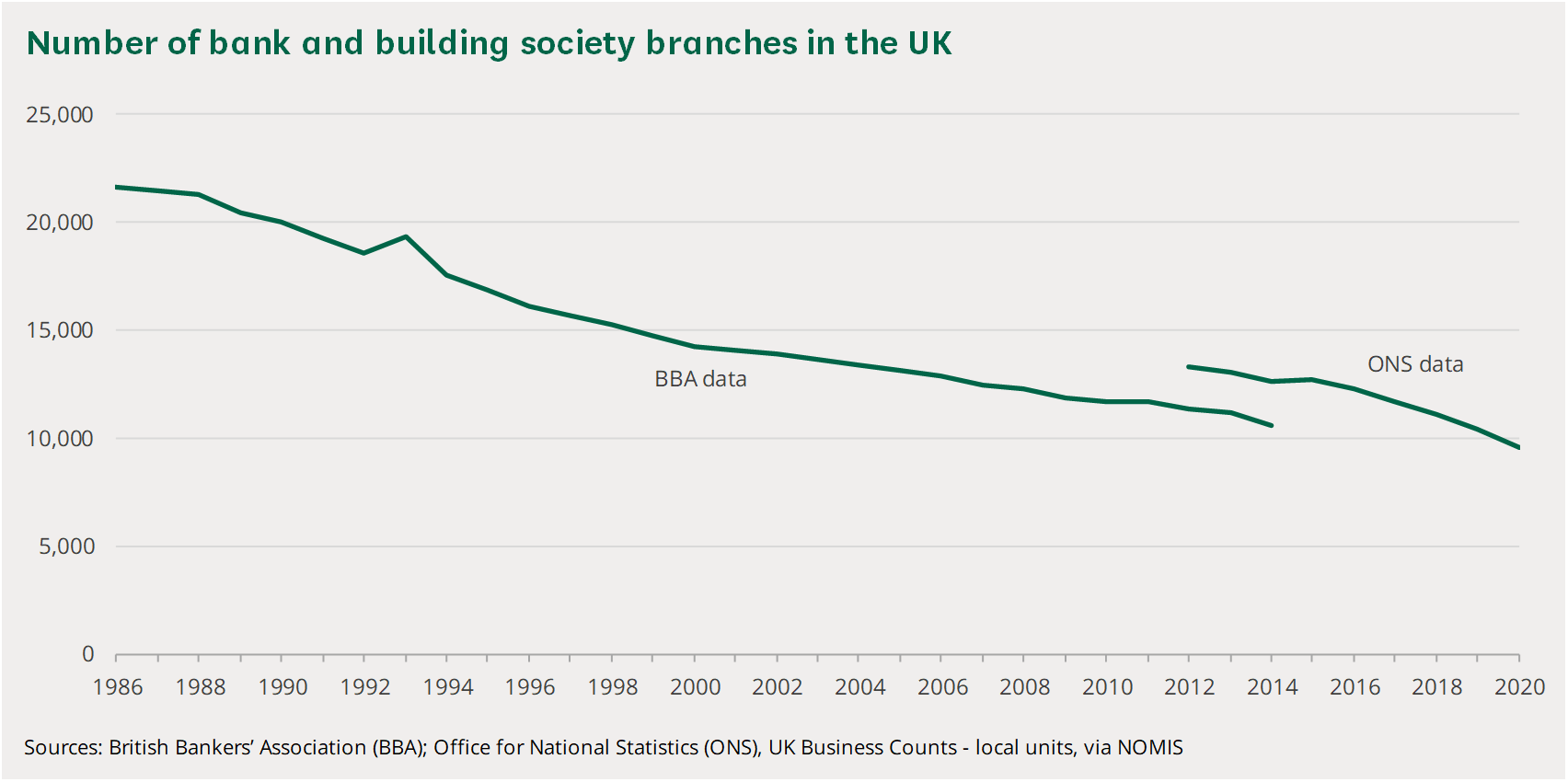

UK Bank Branches

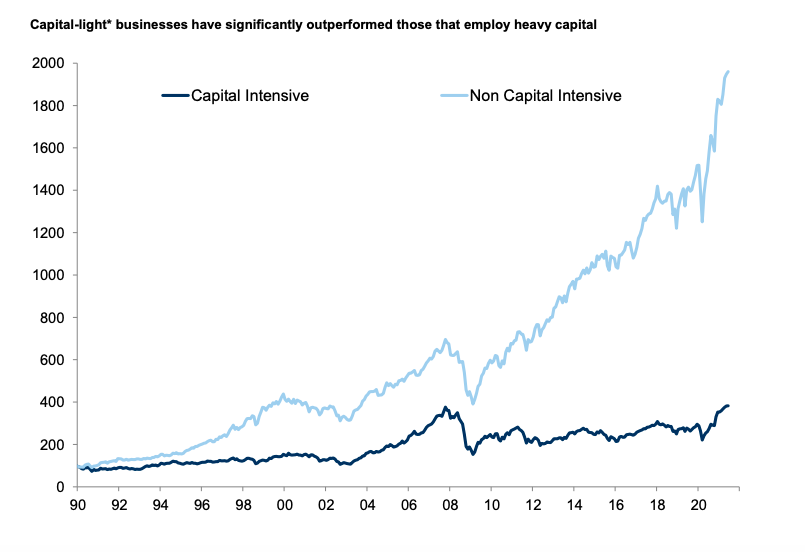

Capital Intensive

- Staggering chart on how much non-capital intensive industries have outperformed.

- Explains why corporate language has also changed.

InPost

- Poland’s InPost, that recently listed, has an interesting story and strategy.

- It almost went bust but now handles 36% of Poland’s eCommerce volumes and is aiming for 50% margins.

- They believe “slipper distance” lockers are the future of eCommerce parcel delivery – they are greener, more convenient than convenience stores, and safer than leaving parcels on a porch.

- It will be interesting to see if this strategy is indeed the future.

Car Software

- Fascinating article on the ballooning software requirement in cars.

- “Even low-end vehicles are quickly approaching 100 ECUs and 100 million of lines of code as more features that were once considered luxury options, such adaptive cruise control and automatic emergency breaking, are becoming standard“.

Private Label

- Private label penetration by retailers – pretty high across the board.

- h/t Libertyrpf.

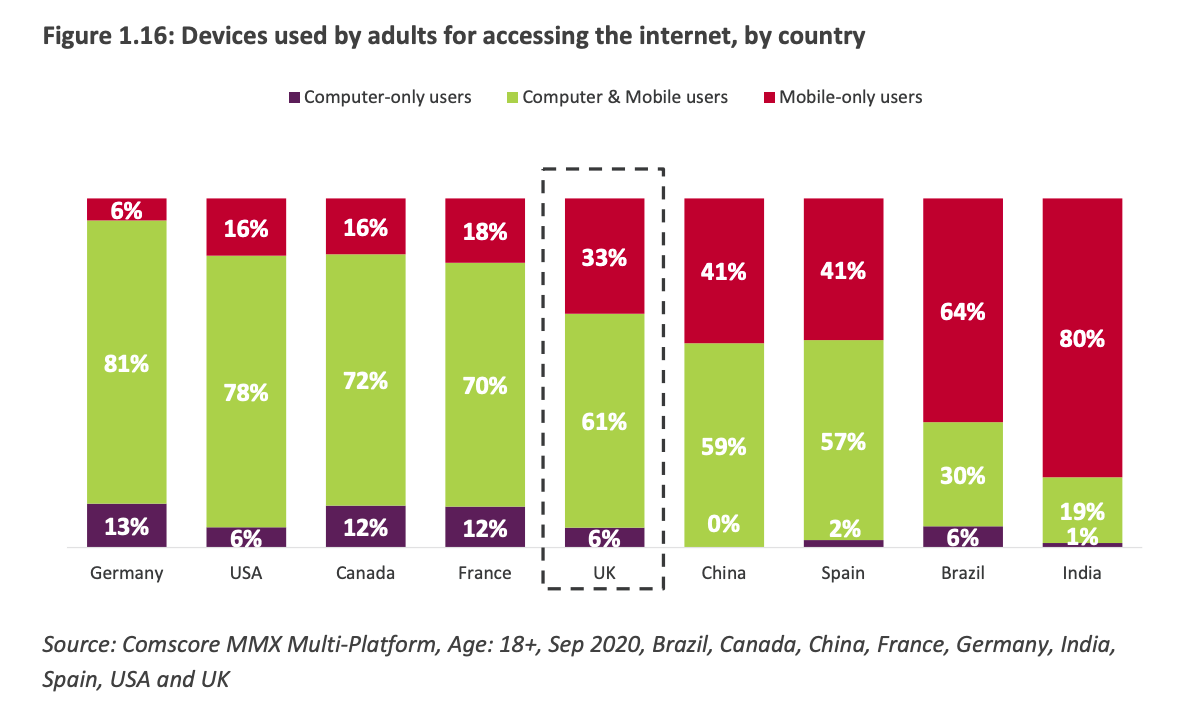

Device Preference

- 80% of users in India are mobile only.

- In the US the preference is a mix of mobile and computer (78%).

- Source.

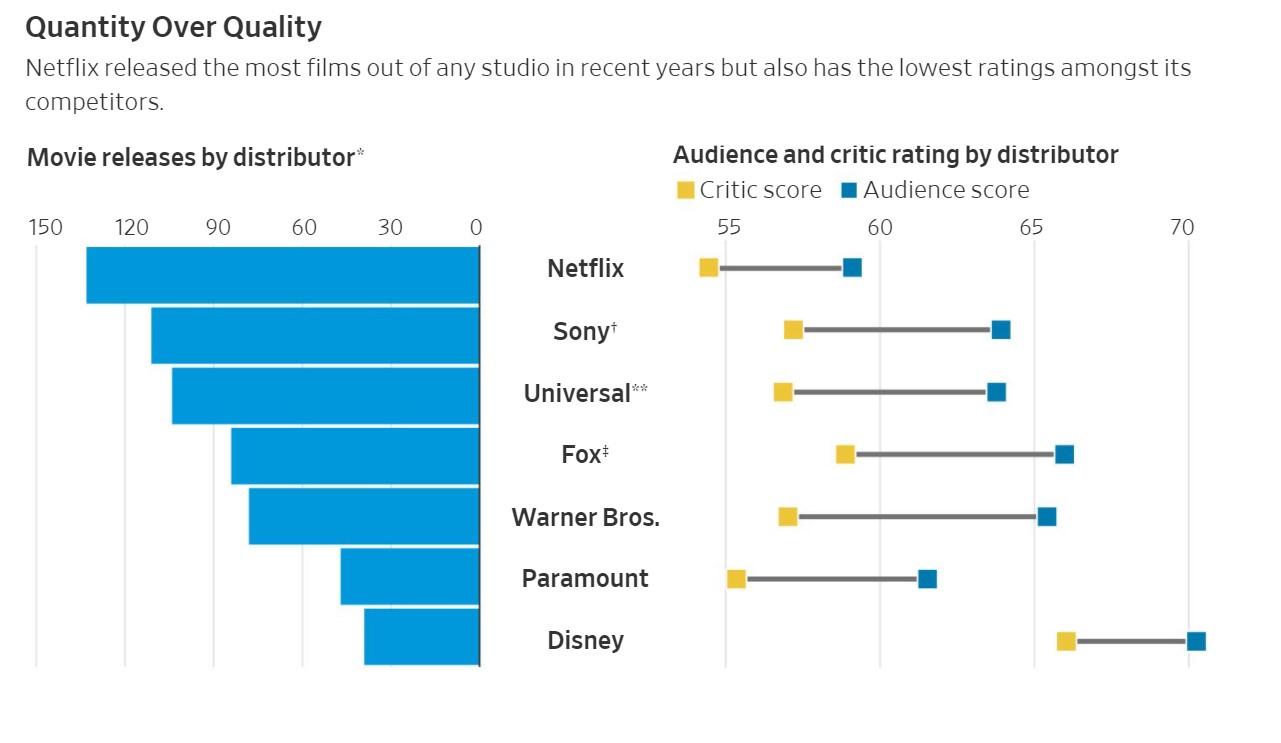

Movie Ratings

- Netflix makes the most number of films but has the lowest ratings.

- Will the others also scale like this?

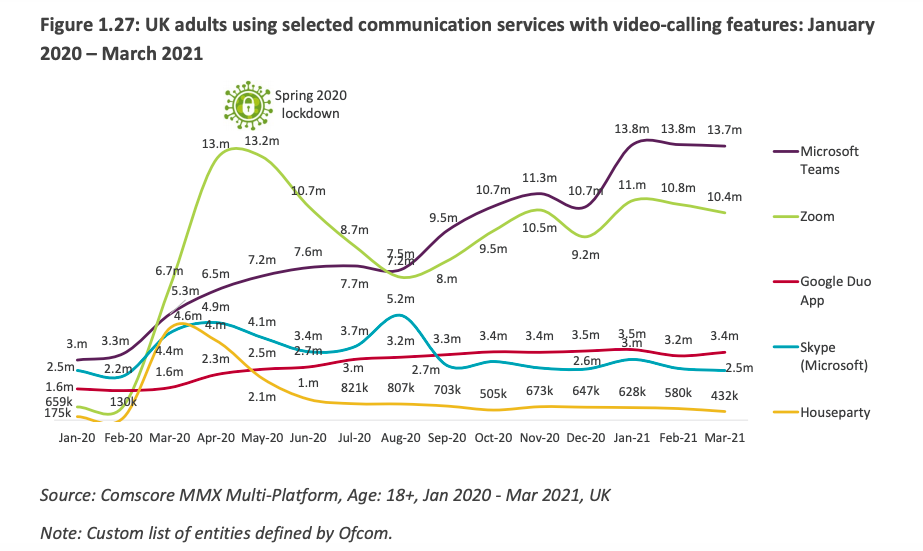

Video Call Competitors

- Interesting contrast among the various video calling apps over the pandemic period.

- Zoom usage grew strongly but fell back after its initial peak into a pattern of steady growth.

- Microsoft Teams grew steadily throughout.

- Houseparty looks like a flash in the pan – 4.6m peak to only 432k users today.

- Source (based on UK data).

Web3

- Interesting essay on the future of the web – Web3.

- Web3 allows a new generation of disrupters to create products that actually pay people to use them, and aligns the incentives of creators, consumers, suppliers, and investors.

- “Imagine going to Disney World, and getting shares in Disney, the company, every time you took a ride, bought Mickey Merch, or sent your friend a picture. Or that owning shares in Disney let you skip all of the lines as long as you held the shares. That’s what tokens do.“

- In the essay he presents Web3 competitors to all the major web platforms.

- One neat way to describe the landscape is to think of “crypto as listed versions of traditional VC, with a real-time, 24/7 quoted price.” (Source).

Big Tech Regulation

- Good analysis of the bill proposed in Congress on regulating Big Tech.

- The bill tries to restrict a lot of activity that is seen as anti-competitive behaviour on platforms.

- It is also aimed at breaking up the businesses, making data easily portable, and acquisitions harder.

- “Taken together, these laws would be a revolution in antitrust law, adapted for an era where Big Tech marketplaces, not railroads, are the dominant businesses of the day. They could also have many serious unintended side effects, so the final form of these laws matters a lot.”

Disney+ Delight Score

- A new measure of customer satisfaction – the delight score.

- On this measure Disney+ scores very well.

- “88% of customers were likely to recommend Disney+ and, perhaps more impressively, 74% of Disney+ customers did recommend the product to someone in their social circle.“