- Covid-19 is driving a large (+14%) increase in insurance pricing – the highest since the 2012 inception of the Marsh Global Insurance Market Index.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

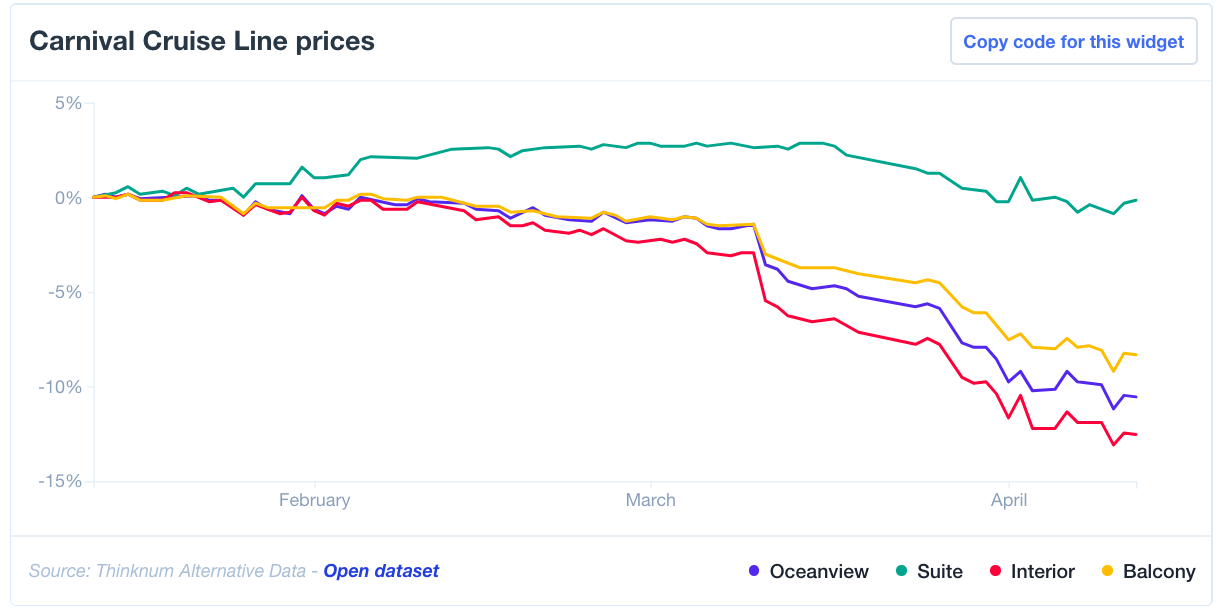

Cruising

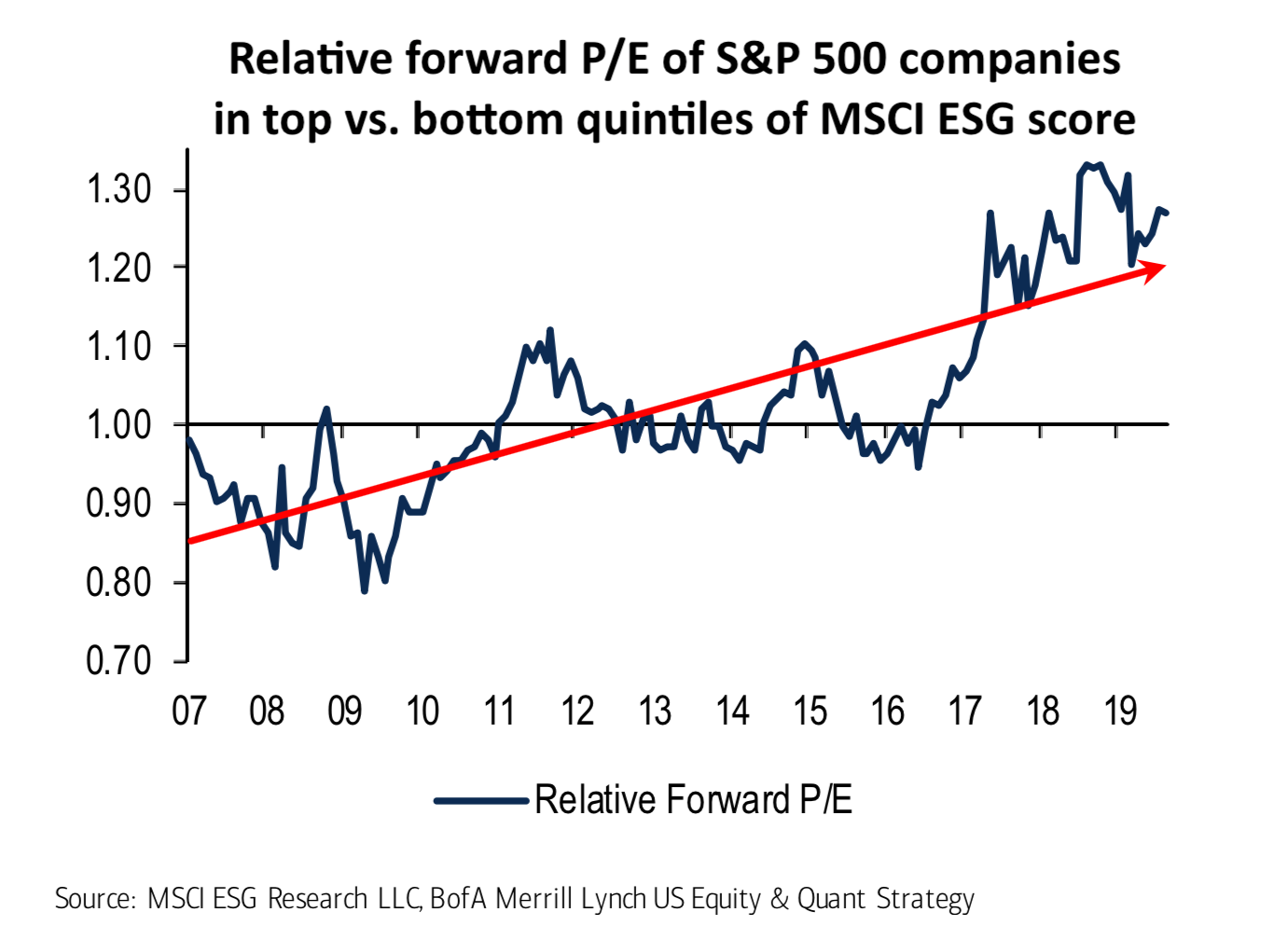

ESG impact on valuation

- Interesting chart showing the relative valuation of stocks with a high environmental, social and governance (ESG) score.

- Although the chart is to mid-2019 this trend is likely to continue after the Covid19 related market gyrations are over.

Behind the Scenes

- In investing one mostly hears from the CEO, CFO, and investor relations. It is important to dig deeper.

- One vital function is the Chief Technology Office (CTO).

- Here for example is an excellent post from the outgoing CTO of New York Times.

- The legal department is also interesting. Here is a fascinating podcast featuring the general counsel of Netflix.

- Incidentally also the first lawyer hired by the company when they were still sending DVDs and who now heads up a team of 650 people.

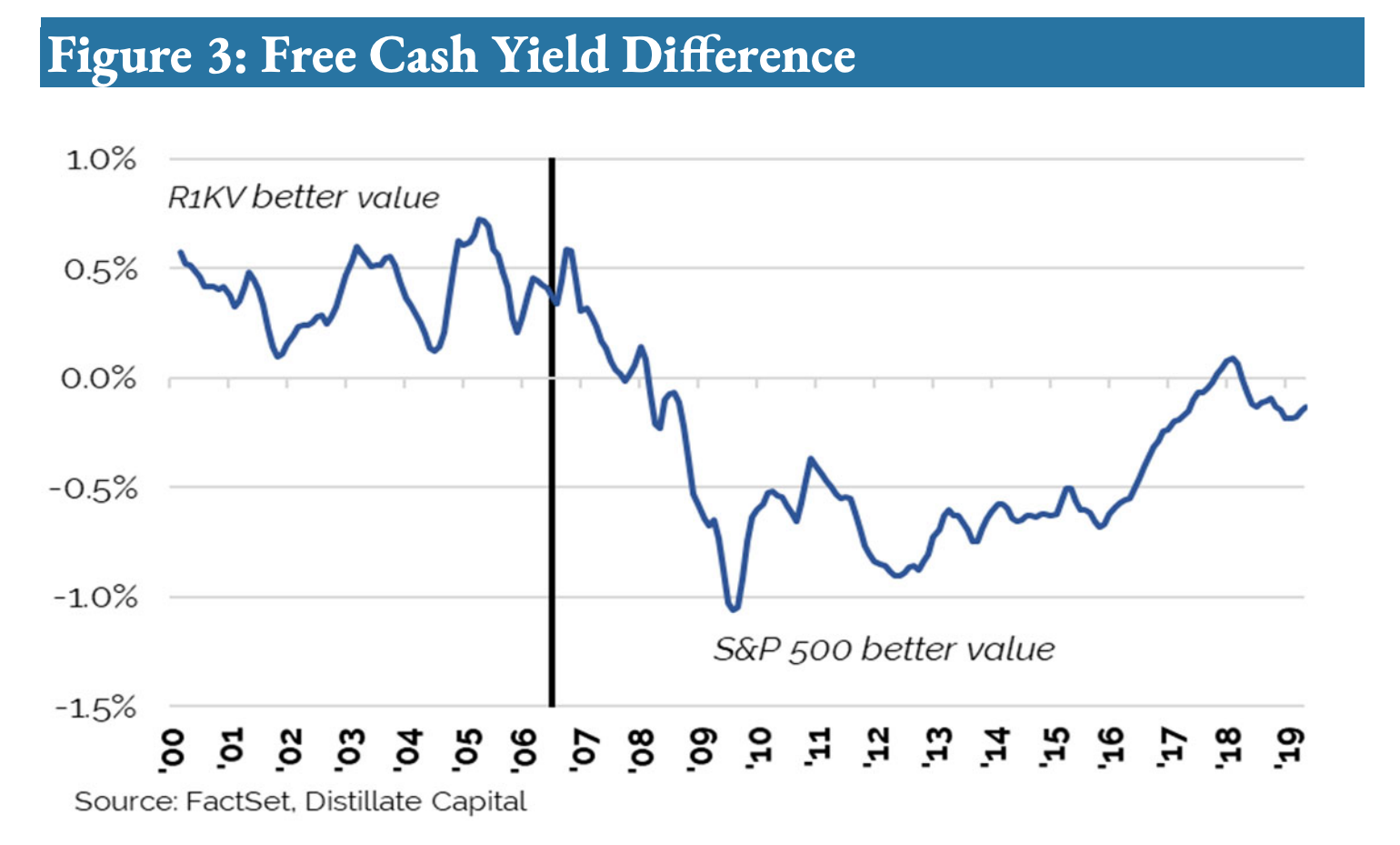

Value Investing

- Interesting chart that suggests that the underperformance of value investing since 2006 is down to valuation.

- The reason is that the valuation metric to look at is free cash flow yield to enterprise yield and not P/B or P/E.

- On this metric the Russel Value Index has been expensive since 2007.

- This is partly because in 1985 68% of the market value of the S&P 500 was tangible assets, today that number is 16%.

13-F

Shopify

- Not a lot of people know this $86bn Canadian company.

- This article is a brilliant way to describe Shopify’s approach using the analogy of popular strategy computer game StarCraft.

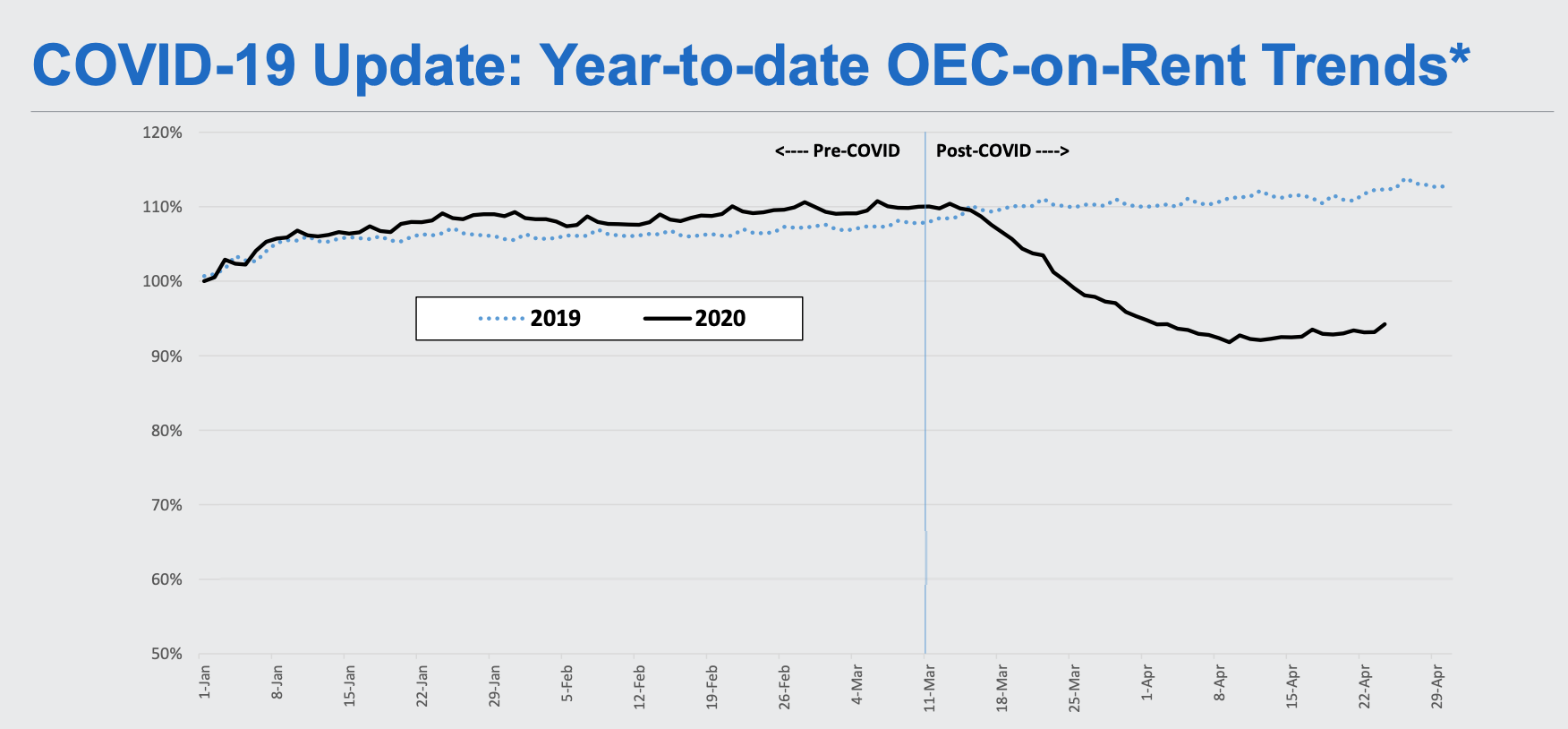

United Rentals

- United Rentals, the equipment rental business, is a company worth watching as they are very early cycle.

- This is an interesting chart from their results.

- It shows that “OEC on rent” – volume of fleet rented at original equipment cost.

- This metric fell in March but has been stable the last several weeks.

Lockdown vs. Reopening Portfolio

- Interesting chart from BofA.

- It shows the relative performance of the “reopening” portfolio vs. the lockdown portfolio.

- You can imagine what stocks make up each portfolio.

- Interesting to see “reopening” struggling despite some of the green-shoots here.

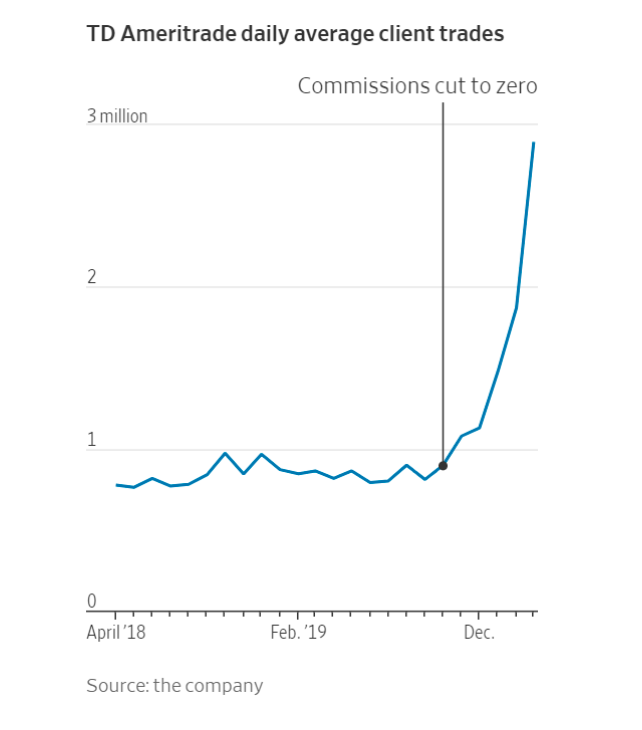

Retail Trading

- A record number of people have started investing/trading financial markets.

- TD Ameritrade saw a record 608,000 new funded accounts in Q1, E-trade saw 363,000 and Charles Schwab 609,000.

- There is some speculation this is due to a lack of other outlets to gamble, and these traders are gravitating to more volatile stocks.

- It isn’t just the US – Japan saw 250,000 new investors join the market (source).

- Technology and cost are often seen as a key impediment to speculation as described really nicely here.

- This is captured in the pictured chart which shows what happened to the number of trades when commissions were cut to zero.

- This is a good tool to track this influx of new investors.

Apple and Intel

- It has long been rumoured that Apple is going to boot Intel out of the next generation of Mac computers.

- These rumours are now suggesting this will be next year.

- In 2006 Apple sold 5.5m Macs against 226m PCs.

- In 2019 Apple sold 275m iOS devices of which 20m are Macs against a 250m PC market.

- Apple, and ARM, on which its CPU designs are based, has scale now.

Google Shopping

- This is a really interesting post.

- It is from Stratechary – a must read for anyone interested in tech.

- Google is now making Google Shopping free.

- This is a move aimed squarely at Amazon.

- A survey in 2019 of nearly 5000 people showed that 49% of product searches start on Amazon. For Prime members who are frequent users this figure is closer to 80%.

- Google is notching up the competition.

- Shopify, which Ben points out is a key member of this anti-amazon alliance, is also launching an app of their own to showcase the nearly 1m merchants using the platform.

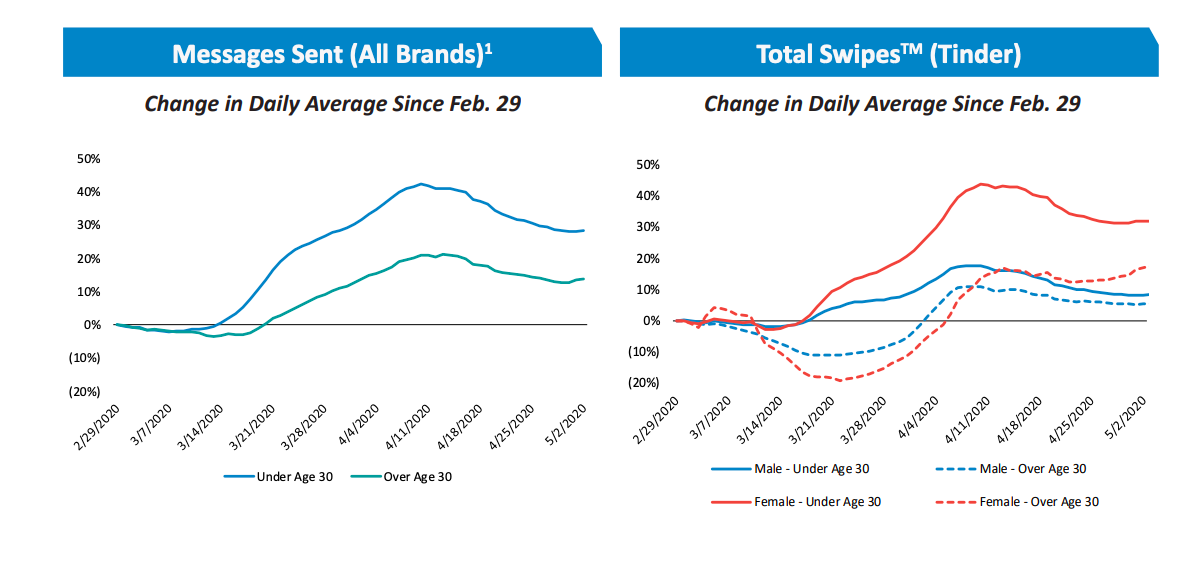

Online dating during lockdown

- Interesting chart from Match Group, the online dating powerhouse.

- It shows change in daily average messages sent across their dating platforms (left hand side) and Tinder swipes (right hand side).

- You can see after an initial dip there was a spike during the lockdown, especially among those under 30 and female.

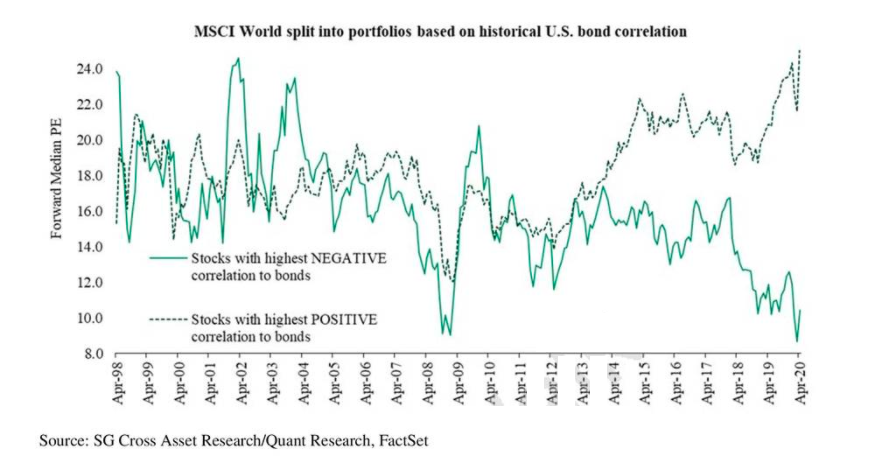

Valuation Chart

- Interesting chart from SG via Einhorn’s Q1 Letter.

- It shows the median forward P/E ratio of MSCI World Stocks split into two groups.

- The first (dotted line) are stocks with the highest positive correlation to bonds. These trade on 24x.

- The second (green line) are stocks with the highest negative correlation to bonds. These trade at 10x.

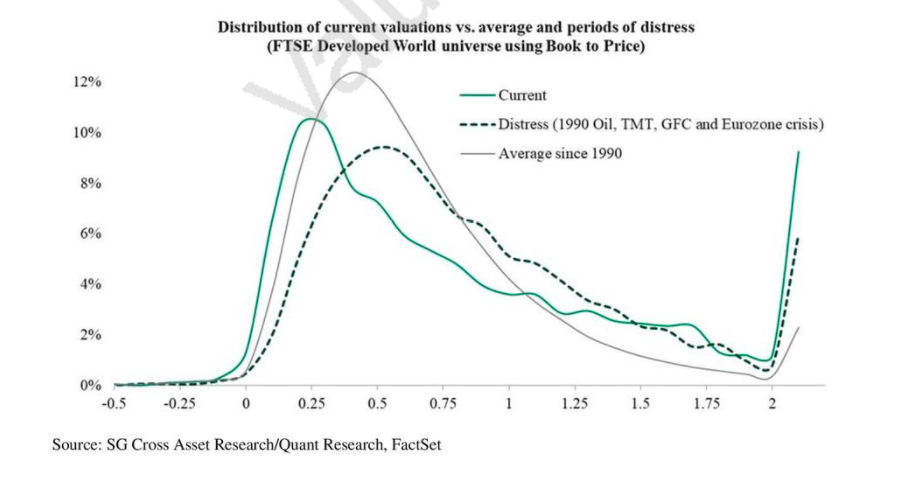

Valuation Distribution

- An interesting chart from SG via Einhorn’s Q1 letter.

- It shows the distribution of valuations (using a book to price ratio).

- It compares today (solid green line), distressed periods (dark green and dotted) and average (since 1990).

- The conclusion is that today’s valuations are more extreme – especially the cheapest and most expensive stocks.

Farnam Ackman Interview

- Really interesting podcast interviewing Bill Ackman.

- It is by Farnam Street’s Knowledge Project.

- “One of the most influential things he [Buffet] said to me was if you want to be successful, all you need to do is look around the room and think about the classmate or classmates you most admire and what qualities they have and just decide to adopt those qualities. If you do that, your chances of being successful go up enormously.”

- “I actually think that people will be that much more desperate for human connection after this experience than they were before.”

- He is probably right on the last point – long human connection?

Greenlight Q1 2020 Letter

- Latest investment letter from Einhorn’s Fund Greenlight Capital.

- The fund is -21.5% in Q1 and down a futher -1.1% in April (despite the market rebound).

- Interesting discussion of how, despite taking net from 74% to 15%, they still struggled with performance against a falling market.

- Eninhorn’s value style is struggling in recent years and these markets. Despite this Greenlight is starting to market the fund again.

- Letter includes interesting debate on inflation post-crisis, what to buy in that environment, his current holdings and shorts (incl TSLA), new positions. Always worth a read.

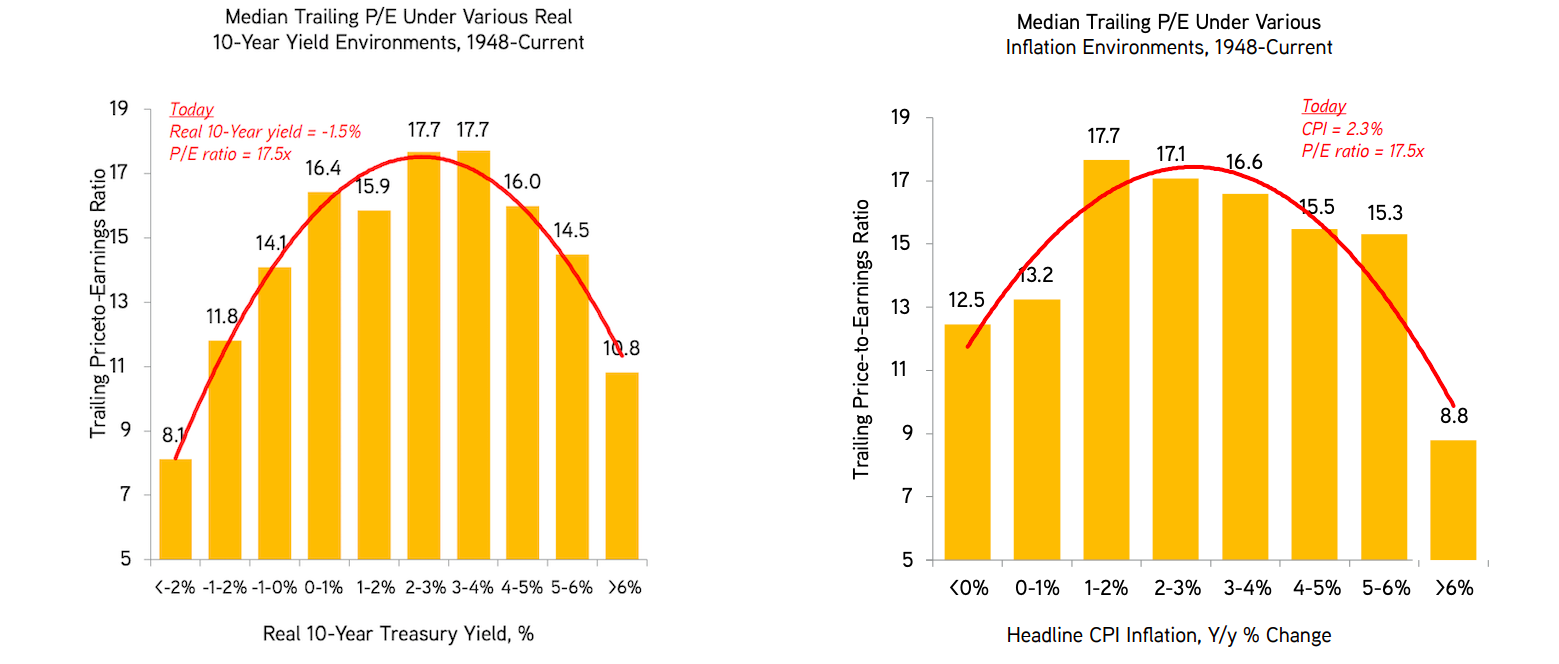

P/E vs. real rates and inflation

- Two great charts from KKR Macro Insight.

- They plot the markets trailing P/E ratio against CPI inflation (right hand side) and the 10-year real treasury yield (left hand side).

- The data is from 1948 to today and sourced from BofAML

- As real-rates go negative or inflation falls multiples tend to be lower.

- KKR analysis suggests there isn’t some funny data skewing results here.

- What about today? at the current real 10-year yield of -1.5% and inflation rate of 2.3% (likely to fall) the 17.5x P/E ratio for the market (since increased) stands out as too high.

- These types of equity strategy charts are good to hang on to.

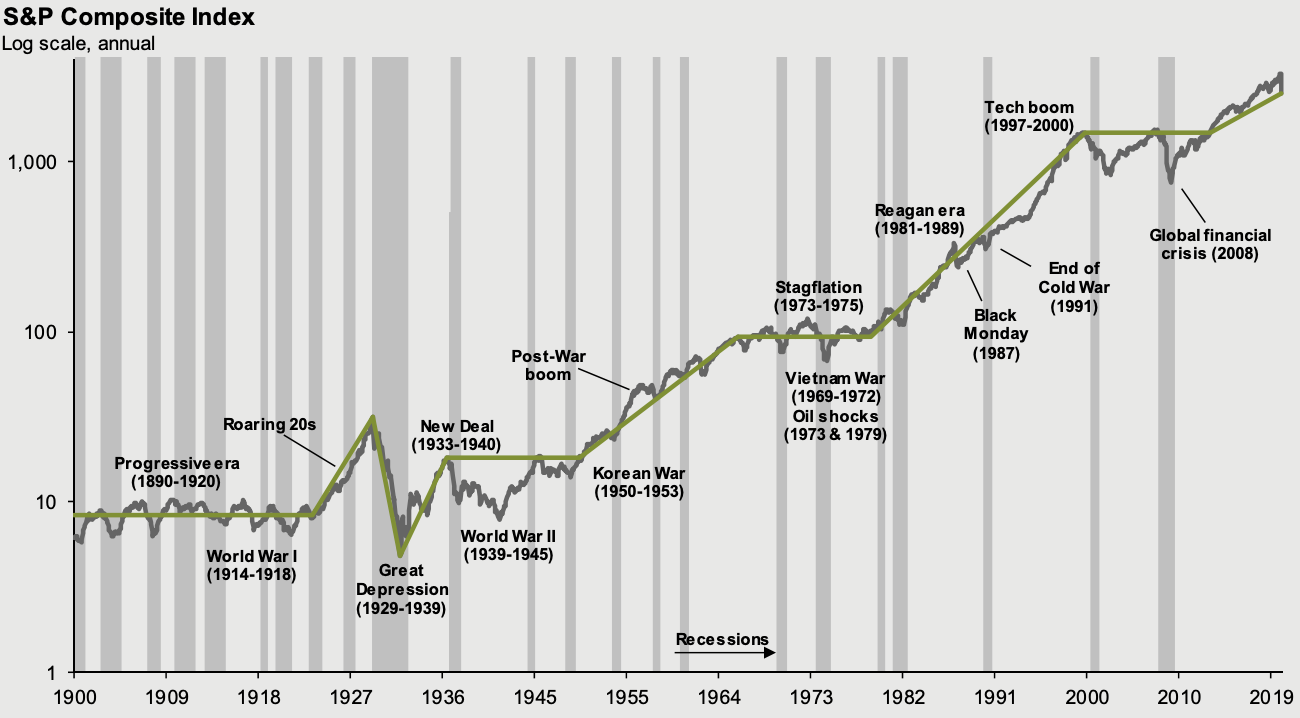

Stocks for the long-term

- Sometimes it is important to take a step back and look at the chart of the long term history of markets.

- This is a great one from JPM of the S&P 500 index annotated for various events going back to 1900.

Amazon Commission Cuts

- Pretty big move by Amazon – they are planning drastic cuts to affiliate commissions.

- This is commissions paid to third party publishers for driving traffic (via links) to Amazon via recommendations.

- The cuts look deep and could have serious implications for some media businesses.