- It is taken for granted in the industry that pharmaceutical company productivity is in decline (here and here).

- Indeed productivity has fallen by 8.4% per year since the 1950s.

- However, these views are outdated (data tends to run to 2010), often fail to account for start-ups (i.e. by following a pre-existing cohort) and are an extrapolation of a trend.

- The pictured chart is an updated graph of the number of new drugs or new molecular entities (NMEs) per $bn of R&D spend.

- Interestingly it has actually been stable for much of the 2000s and can be explained in part by the industry having better information and how it is used. This article explains in depth.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Elliott

- Elliott are talking about a 50% drawdown from Feb highs as a likely outcome.

- “Our gut tells us that a 50% or deeper decline from the February top might be the ultimate path of global stock markets.”

- “To us there does not appear to be a gilded cornucopia of shining bargains”

Barry Diller Interview

- Worth listening to Barry Diller on the picture right now.

- Barry acquired Expedia right after 9/11. Saying “where there is life there is travel“.

- He described today as cataclysmic, no sharp reversal and not being analogous to 09 or 9/11.

- Diller spoke of advertising as particularly hit as of Q2.

- Expedia (he is chairman) typically spends $5bn per year on advertising but revenues at zero it will be lucky to be $1bn this year.

- On that topic this is a good article describing what is happening at GOOG and FB in terms of advertising.

- Despite their strong positions and likelihood to gain share things are looking bad.

Remdesivir Update

- Remdesivir, an antiviral, is one of the leading drugs in development for COVID-19.

- Recent published cohort analysis was supportive.

- “In this cohort of patients hospitalized for severe Covid-19 who were treated with compassionate-use remdesivir, clinical improvement was observed in 36 of 53 patients (68%).”

- Crucial to understand the limitations of this data – the need for a randomised placebo controlled trial.

- Gilead’s (GILD) CEO Daniel O’Day in an open letter expresses this.

- These trials are ongoing with results coming in end of April/May.

- “While it may feel like a long wait for data given the urgency of the situation, it has been only two months since the first clinical trials began. Given that it can take a year or more to have the first clinical data for an investigational treatment, it is remarkable that we expect to have the first remdesivir trial data so soon.”

- The latest buzz from Chicago is also just a snapshot and drawing conclusions is “scientifically unsound“.

- We will have to wait – but not long.

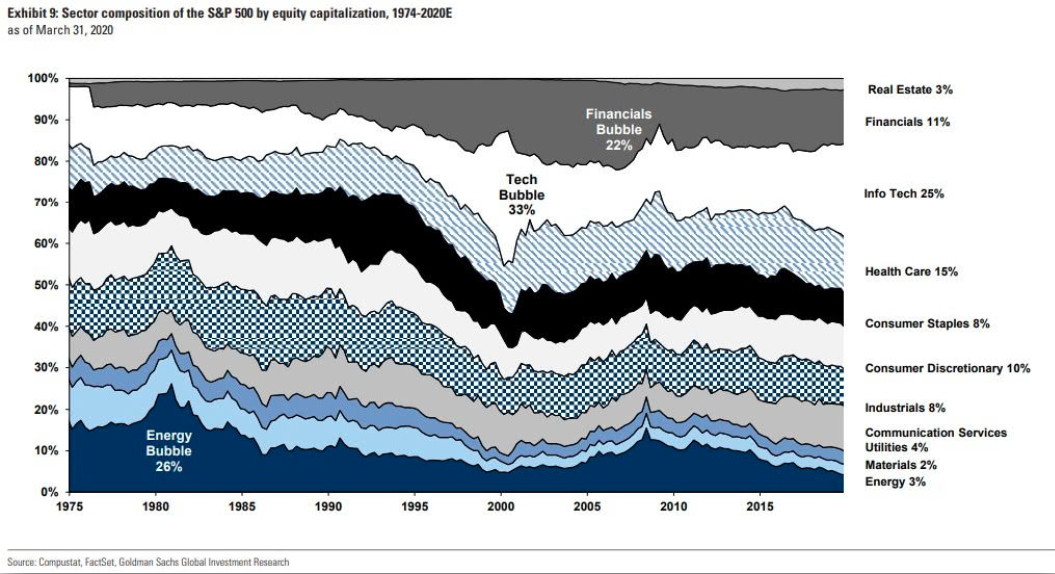

Sector Composition of SPX

- Long run (1974-2020) chart of sector composition of the S&P 500 index.

- Energy is just 3% of the S&P down from 26% in 1980s.

- Financials have also shrunk from 22% to 11%.

- Interestingly IT is now 25% from 33% at the peak.

- However, we need to add Communication Services (10% today) – which puts it above peak.

Covid Impact 9 – eCommerce

- Great chart showing the Top 100 fastest growing and declining e-commerce categories right now.

- Click (twice) and zoom in for details.

- Source: Slackline h/t 361Capital.

Microsoft

- Microsoft is seeing an explosion of usage across their cloud product suites – this is expected.

- Interestingly they are rather selective with the data they provide.

- This includes making a mistake in a recent post:

We have seen a 775 percent increase of our cloud services in regions that have enforced social distancing or shelter in place orders.- We have seen a 775 percent increase in Teams’ calling and meeting monthly users in a one month period in Italy, where social distancing or shelter in place orders have been enforced.

- That is a big difference.

- They also put out press saying video calling on Teams was +1000% in March – yet without an absolute figure or comparison this isn’t that meaningful.

- There is no doubt Teams is growing – now up to 44m daily average users (DAU) from 20m in November 2019.

- However, as Slack CEO points out (and he would) – this is only 20% of Office 365 users.

Newspapers

- Interesting article about advertisers blacklisting covid19 keywords.

- This means that despite news outlets seeing a surge in visitors (The Guardian for example has seen +47% search traffic according to Google Trends), the industry can’t reap the advertising rewards.

- The industry can’t catch a break.

Covid Impact 8 – BofA

- “March was really different each week. From the beginning of March to the end of March, the amount of money that flowed through the company by our consumers went from around $60 billion a week to $mid-40 billion a week and that can bounce around depending on the week runs and where it is in the monthly cycle. But you saw it slow down.” Bank of America CEO

JP Morgan Q1 Results

- Good slide from JPM on what they saw happen in March across their business lines.

- Source: JPM Q1 2020 Results Presentation.

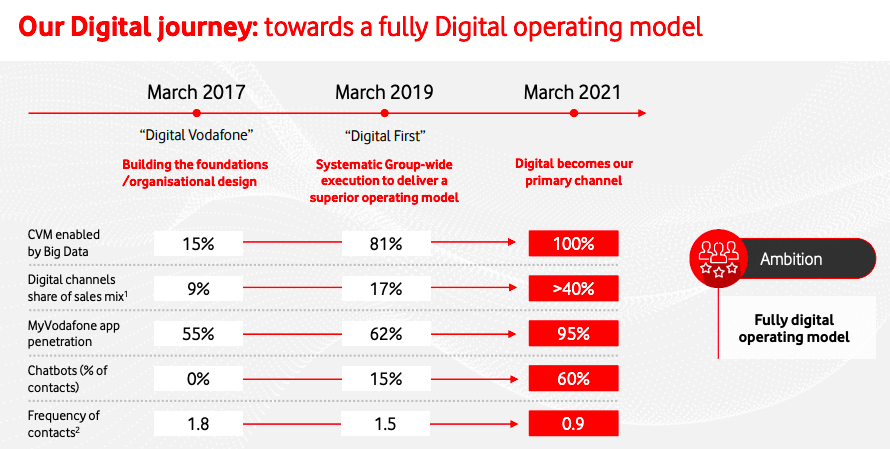

Vodafone

- Interesting slide pack from Vodafone about how digital is transforming their business.

- The figure shows their goals – the virus impact likely accelerates this change and the cost savings are massive.

- Getting digital to 40% of sales channels could save on the €2.5bn spent on commissions per year.

- Less than one human interaction per year by next year could cut into the €1.2bn spent on customer operating costs.

- VOD also built the Dreamlab app – which connects mobile phones during the night to a powerful network to aid research.

Ad tracking

- Apple have taken a big step – entirely banning third-party cookies in Safari browsers by default.

- This is the final step since introducing Intelligent Tracking Prevention (ITP) which started to severely restrict cookies.

- This could have serious ramifications for online advertising businesses but likely strengthens the big giants – FB and GOOG.

- Other browsers are likely to follow suit (likely MSFT new improved Edge browser).

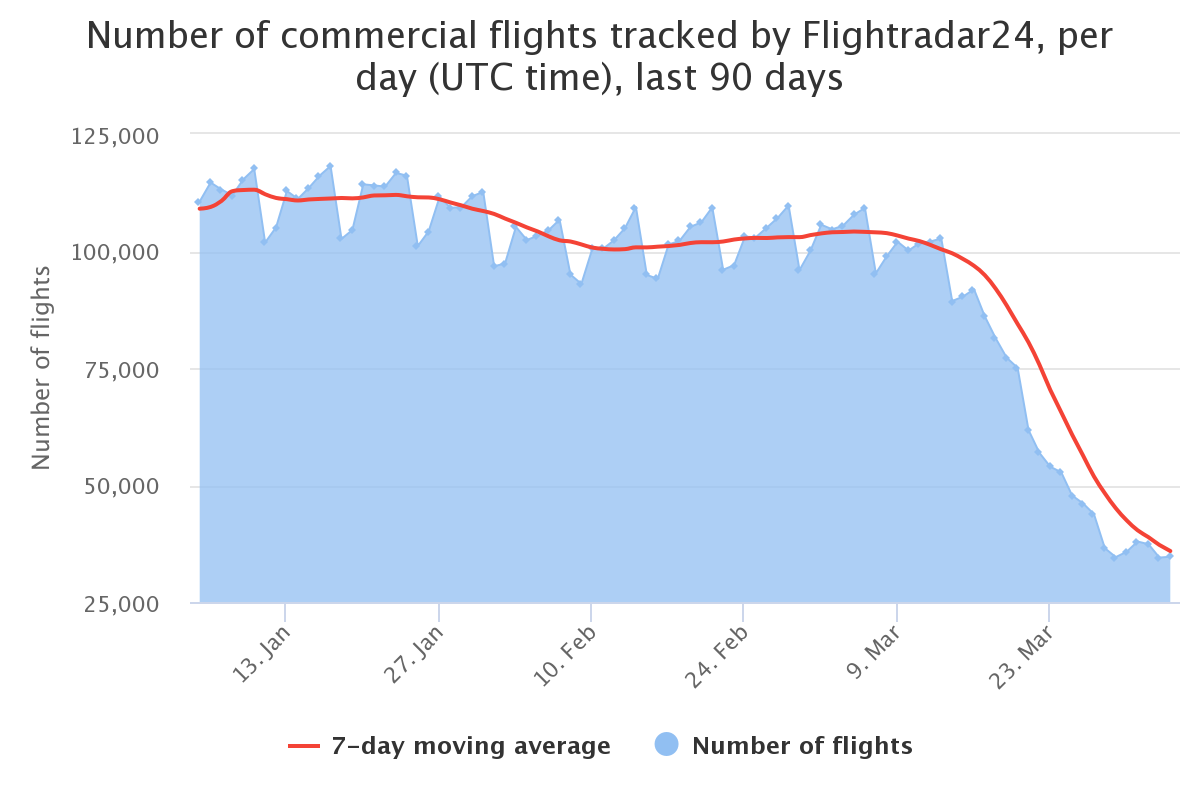

Covid Impact 6 – Flights

- The sheer decline in flight traffic is staggering.

- Total number of commercial flights tracked is -68% since January on a 7-day moving average basis.

- This is a nice visualisation of what has happened.

- No real sign of bottoming.

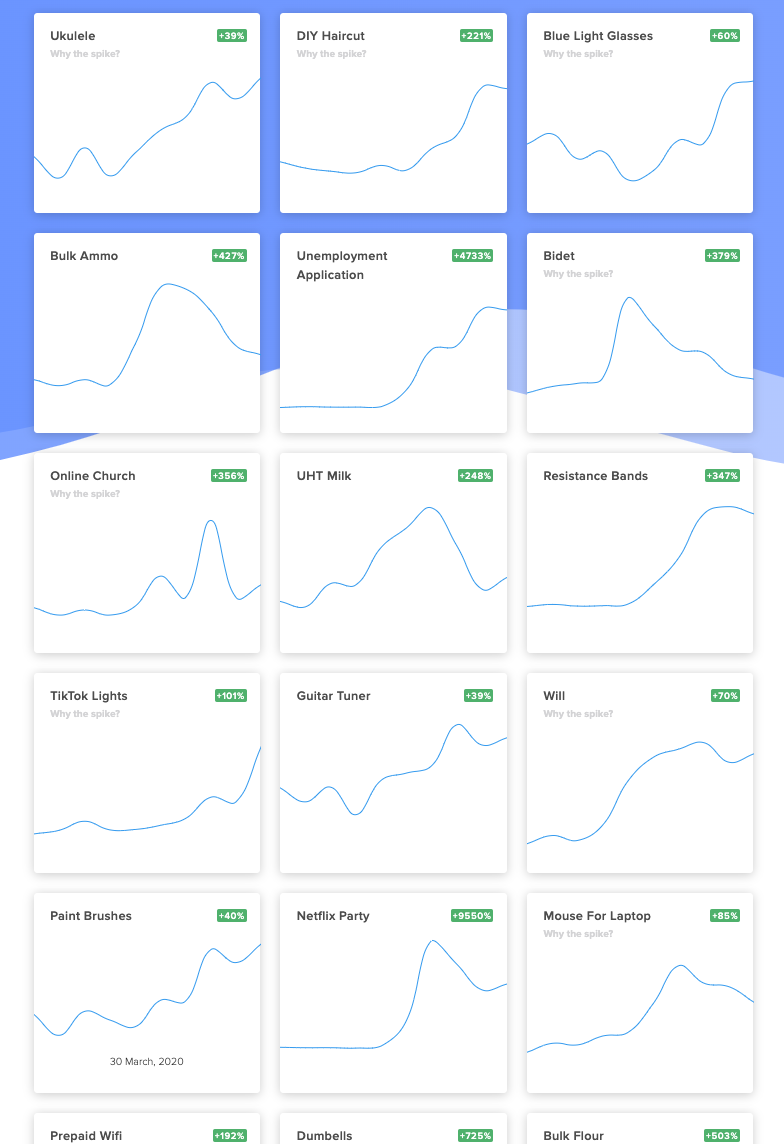

Covid Impact 4 – Trends

- This is a list of topics that have seen a big rise during the Covid crisis.

- If you click on the down-arrow in the link – that gives the list of topics that have seen a sharp drop in trend.

- Glimpse is an interesting service that helps spot trends. Sign up using this link for 2 free trends a month.

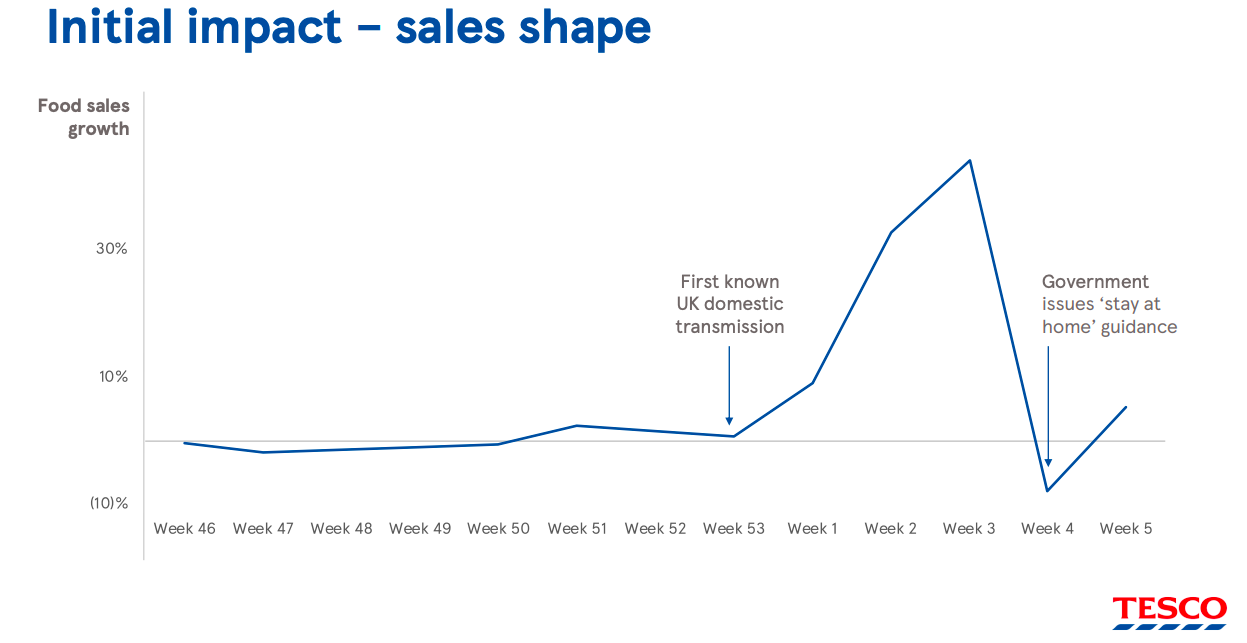

Tesco

- Tesco results and slides are worth reading.

- Fascinating that the presumed beneficiary is actually struggling.

- “if customer behaviour were to return to normal by August it is likely that the additional cost headwinds incurred in our retail operations would be largely offset by the benefits of food volume increases, twelve months’ business rates relief in the UK and prudent operations management.”

- There are clearly huge operational challenges.

- Interestingly – the initial spike in volume (pictured) was driven by 30% of customers buying 60% of the volume (slide 23). Certain items flew off the shelves (slide 24) – you can guess which.

- General merchandise, clothing, and fuel have been hit hard (FT suggests the latter two by -70%).

- Staff has seen a massive spike in absence and they have had to recruit 45,000 people since 20th of March.

- Scaling online has proven very difficult.

- Additionally Tesco Bank will swing from £193m profit to a loss this fiscal year (due to bad debts and fall in income).

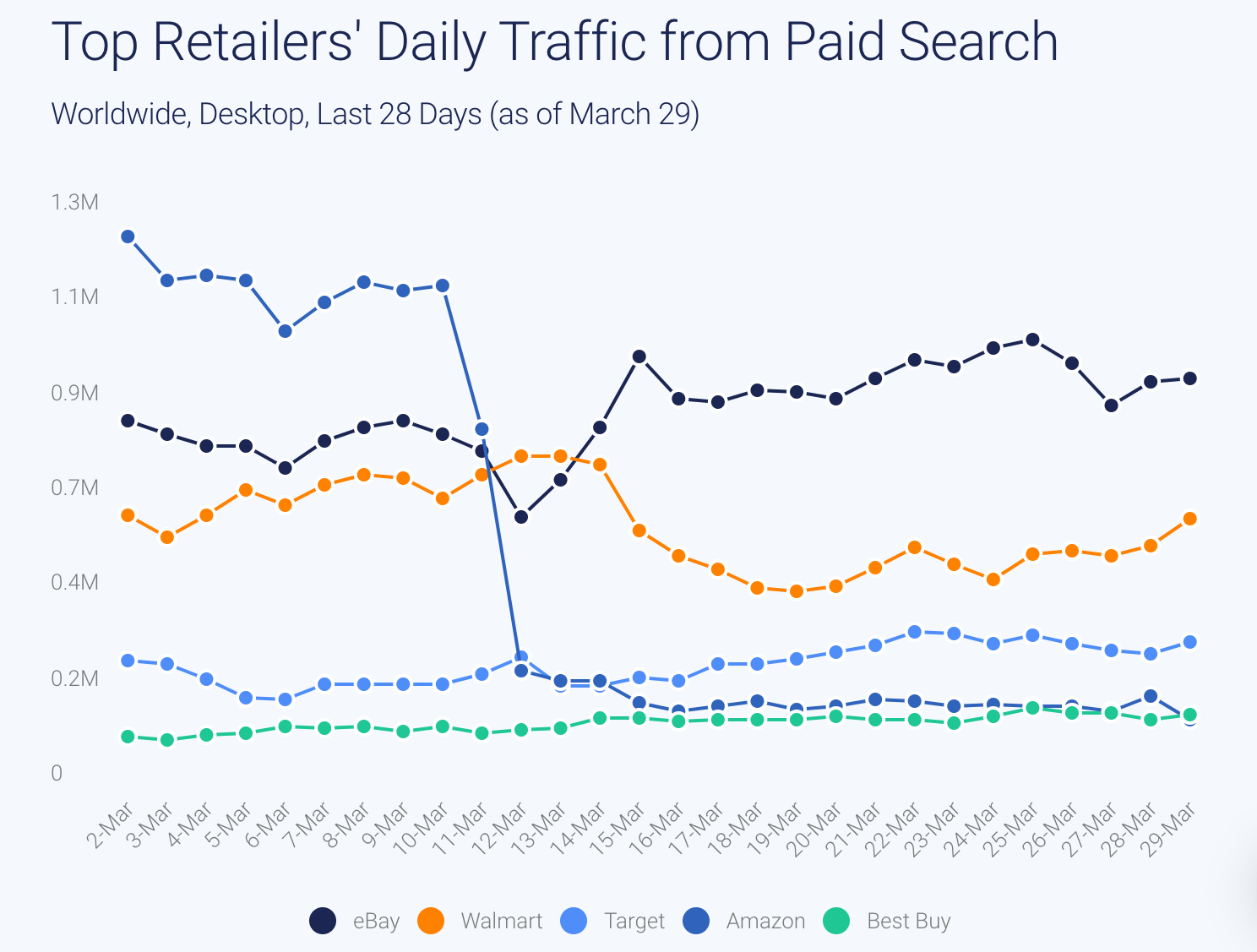

Online Advertising Tactics

- Interesting to see tactics online.

- On 11th of March Amazon put a halt to almost all of its spending on Google Ads.

- “Amazon seems to have completely removed itself from the competition for essential goods, effectively leaving one million daily visits on the table for other competitors to take.”

- Paid search traffic to the site fell 90% almost immediately costing 11.2m visits.

- Ebay has capitalised to a certain extent on this by bidding on high volume keywords – you guessed it – “toilet paper”, “n95 mask” and “hand sanitizer”.

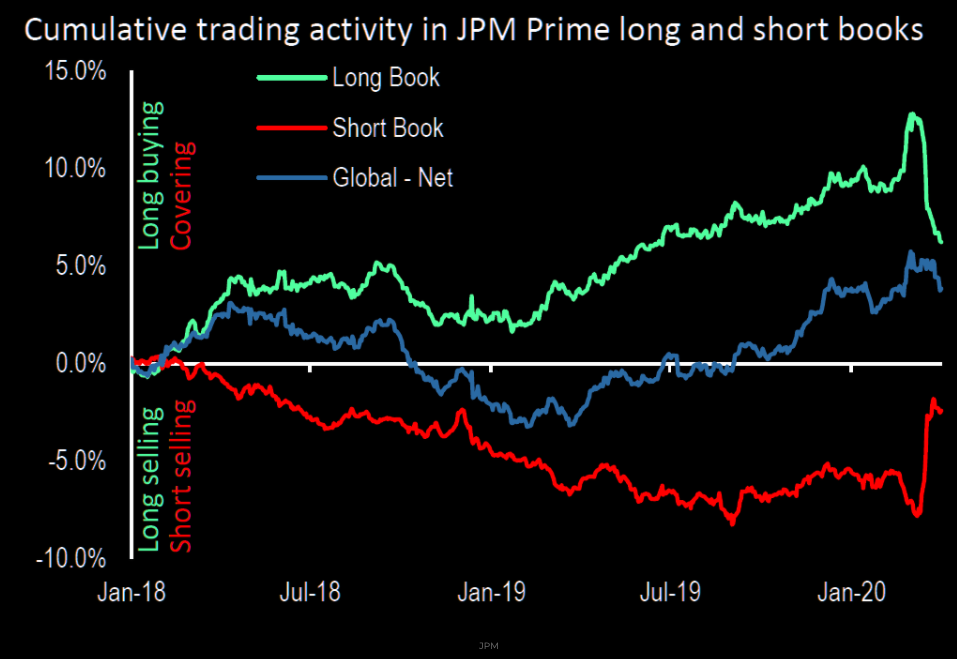

Equity Positioning

- JPM prime broking suggests considerable de-risking on both sides (longs and shorts) has taken place.

Pershing Square Letter 2

- We previously covered Ackman’s $2.6bn hedge win.

- He put out a new letter defending against allegations that his CNBC appearance was designed to spook markets so the fund could profit.

- Interesting read.

Covid Impact 2 – Internet Traffic

- Interesting internet activity data from Cloudflare.

- Shows the shift in terms of what people are doing in the internet.

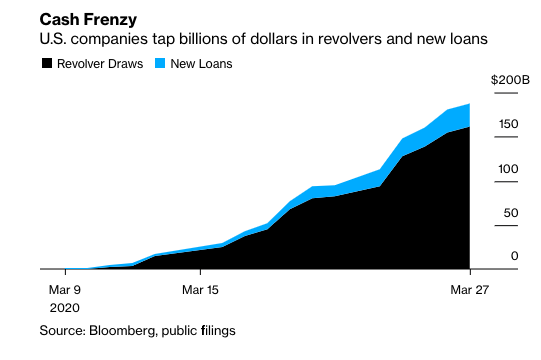

Credit Lines

- Companies are quietly drawing credit lines and revolvers down.

- This has caused banks to push borrowers away from this activity – it is a lot less profitable than a new loan.

- There is obviously liquidity concern – companies want as much liquidity as possible but banks can’t satisfy it all.

- Interesting pull and push.