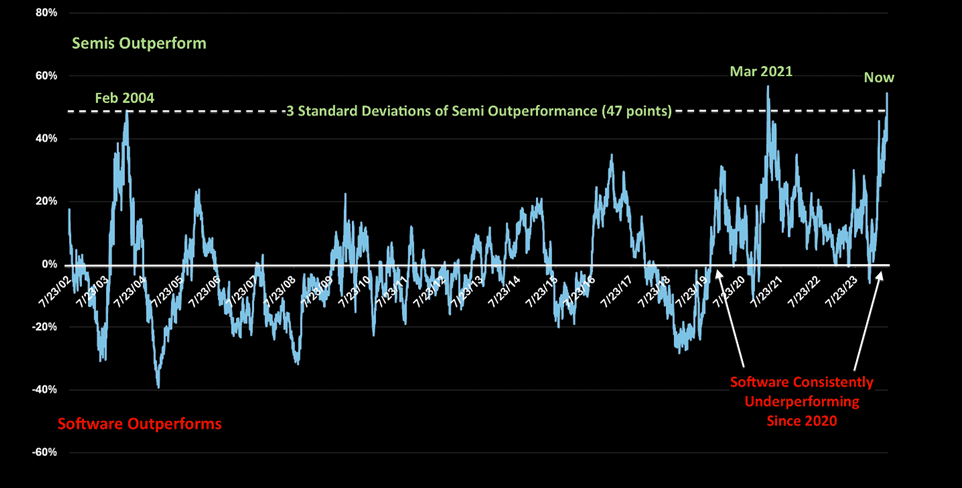

- Hedge funds, based on prime book data, have gone very long hard tech (semis) and reduced net exposure to software.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

How to Build an AI Data Center

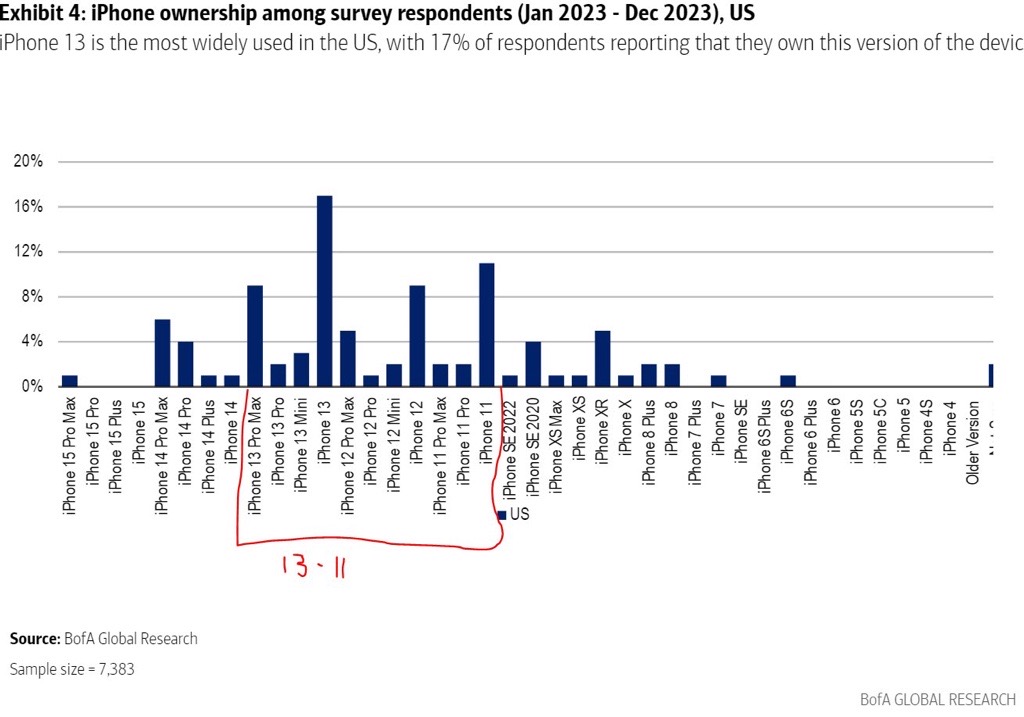

iPhone Replacement Cycle

- Chart showing what iPhone model nearly 8,000 survey participants own.

- iPhone 13 – 11 are the most widely owned i.e. 3-5 year old models. Replacement time?

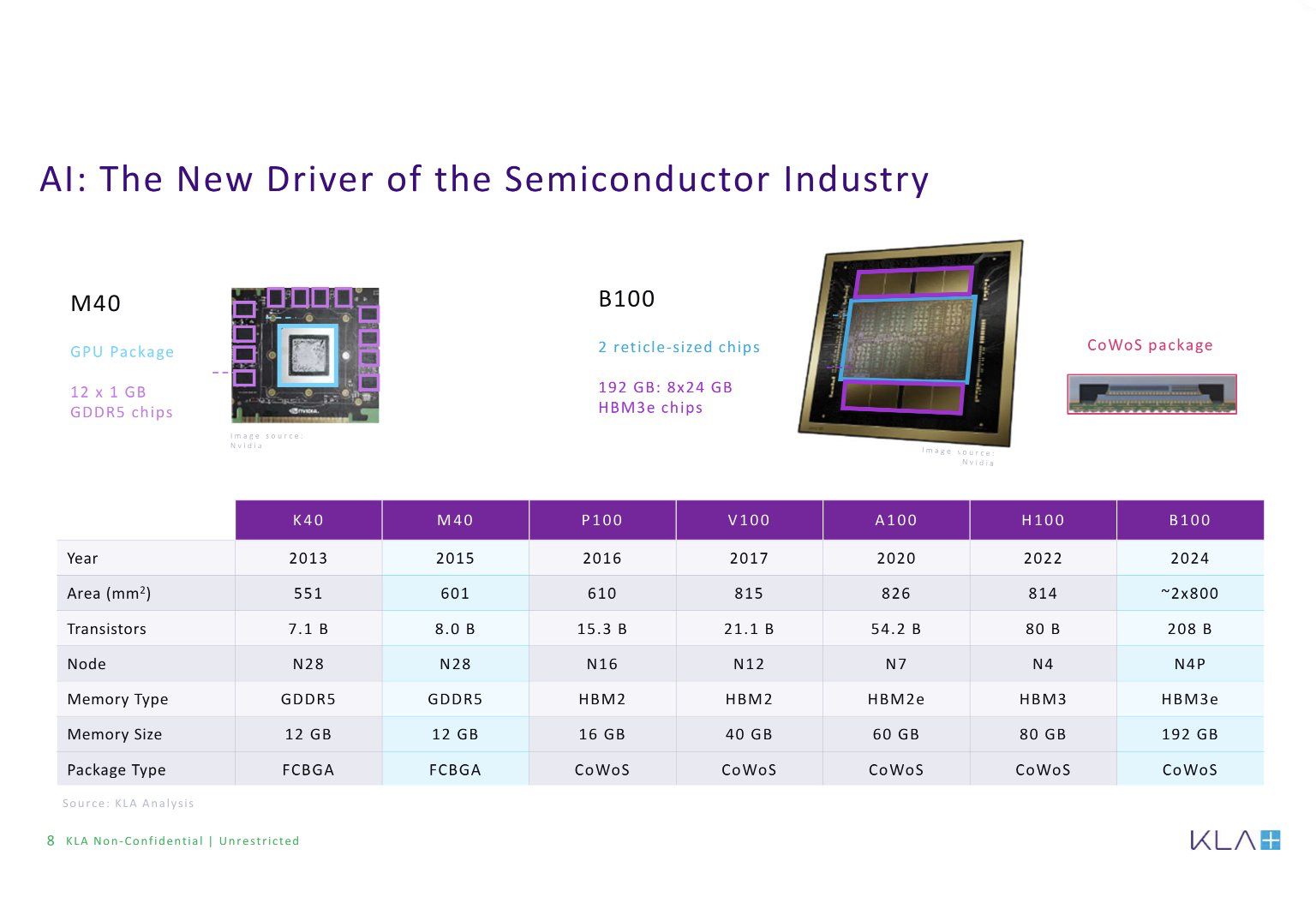

GPU Semiconductor Content

- Nice slide from KLA.

- “So I tried just to put together this chart to show how different the GPU package is between 2015 & 2024. So of course, the B100 chip, the GPU introduced a few months ago, and this is not enough because Jensen has already introduced the next generation of GPU last week” (h/t The Transcript).

AI Publisher Partnership Tracker

- Tracking all the AI deals between publishers and platforms.

Semi vs Software

- This level of outperformance has only happened twice before in the last two decades.

- Source: themarketear.com

GLP-1s and Addiction

- There is probably enough evidence now to suggest GLP-1s, like Ozempic, work to treat all kinds of addiction.

- Why does this matter? “Addiction kills more Americans than cancer or heart disease but only 4% of people with substance use disorders currently receive medication.“

- The big breakthrough in this field will likely be the next generation of weight loss drugs, especially orals.

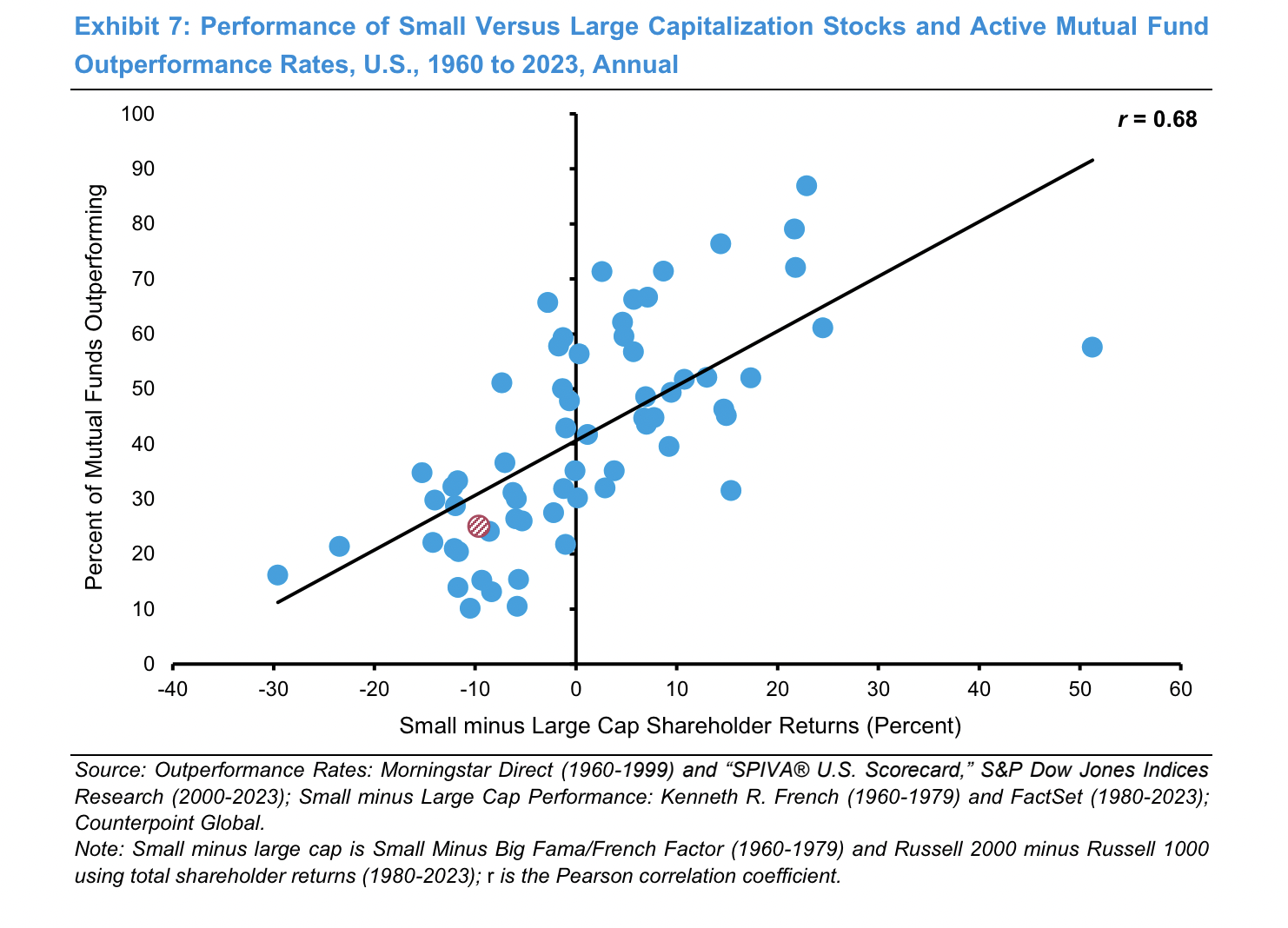

Concentration and Active Management

- “Rising stock market concentration is challenging for active managers because on average they own stocks with smaller market capitalizations than those in their benchmarks. That means when large-cap stocks do well relative to small-cap stocks, the percentage of mutual funds that outperform the benchmark tends to go down. When small caps outperform large caps, active managers outperform at a higher rate. Exhibit 7 shows this relationship from 1960 to 2023. The striped red dot shows the outcome for 2023.“

- Source: Mauboussin.

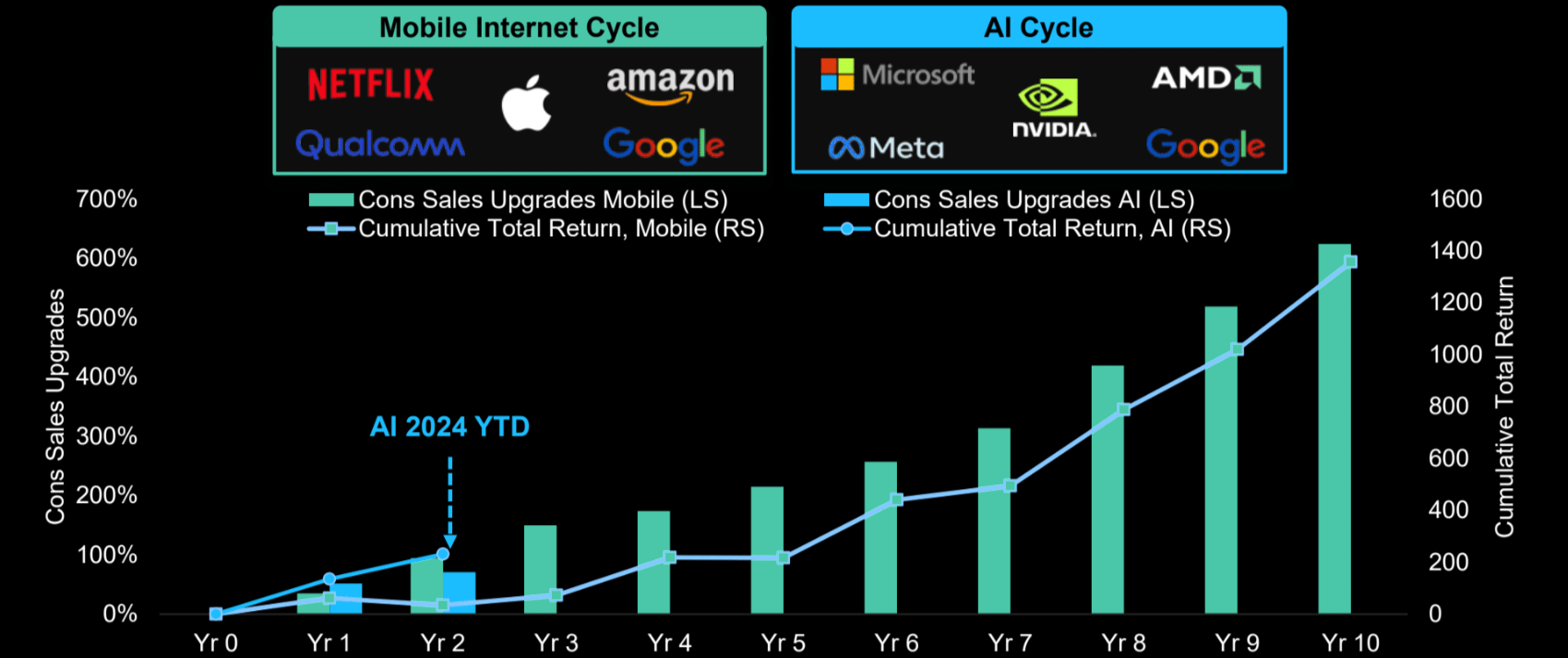

Mobile Internet vs. AI Cycle

- Long way to go?

- Source: themarketear.

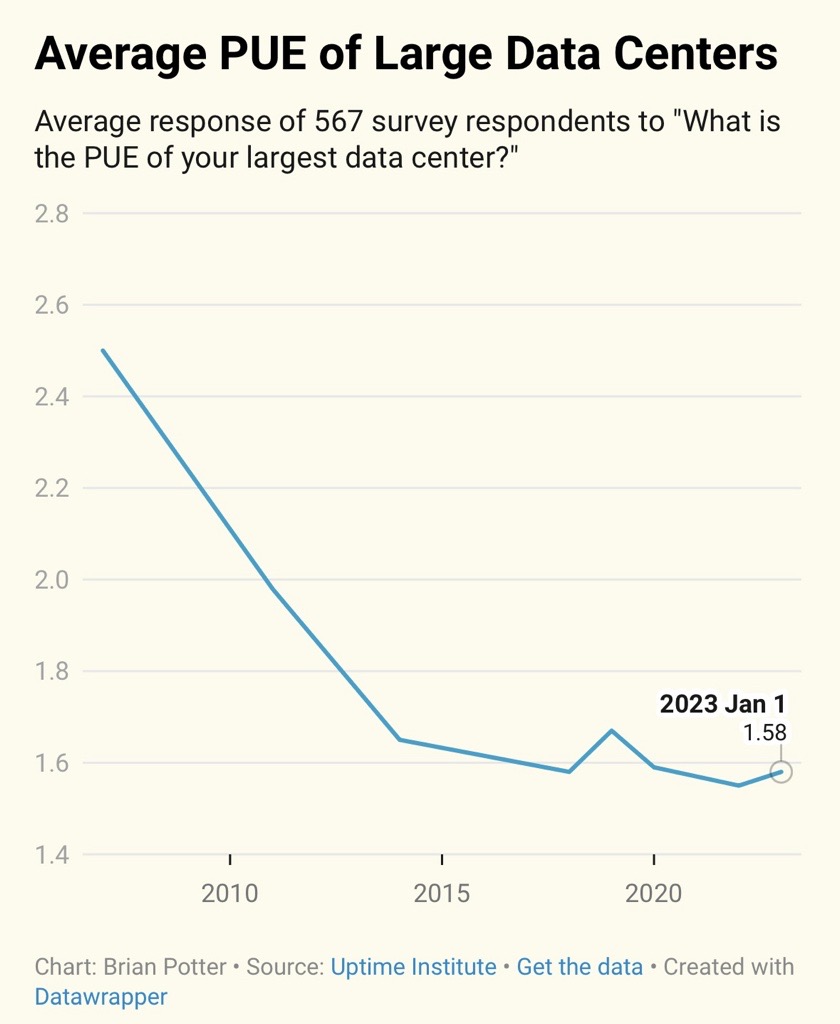

Data Center Boom

- Nice WSJ piece on the pace and challenges of building data centers to meet booming demand.

- “Bill Vass, vice president of engineering at Amazon Web Services, said a new data center pops up somewhere in the world every three days.“

Animal Health

Algo Collusion

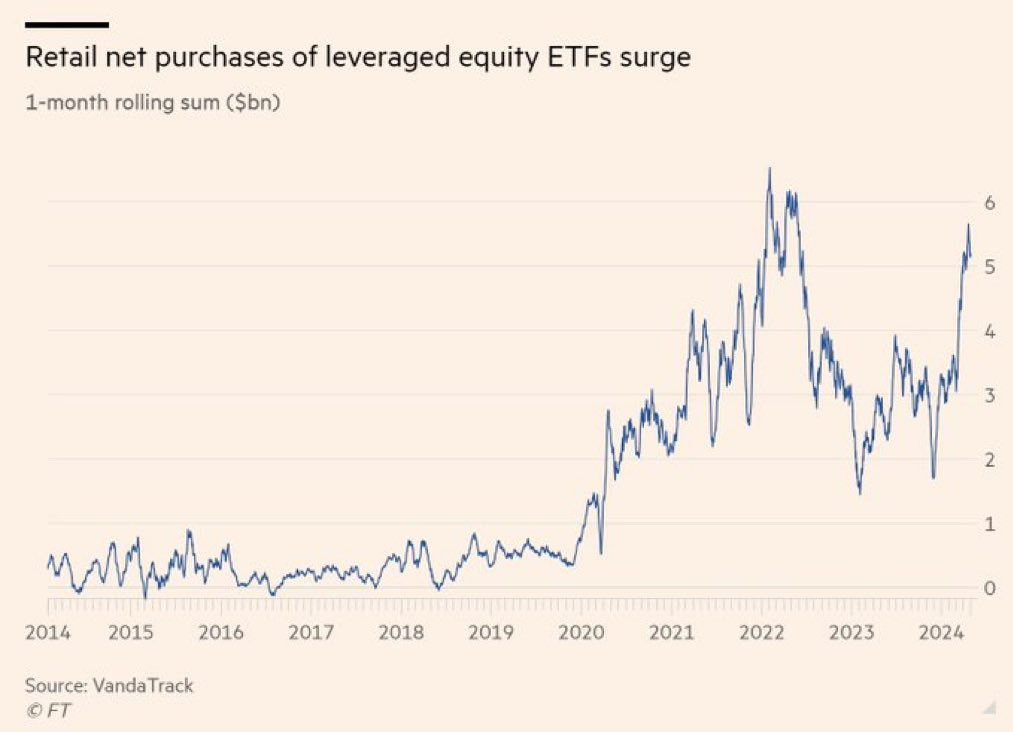

Retail Frenzy

- Retail purchases of leveraged equity ETFs. Sign of the times?

- Source.

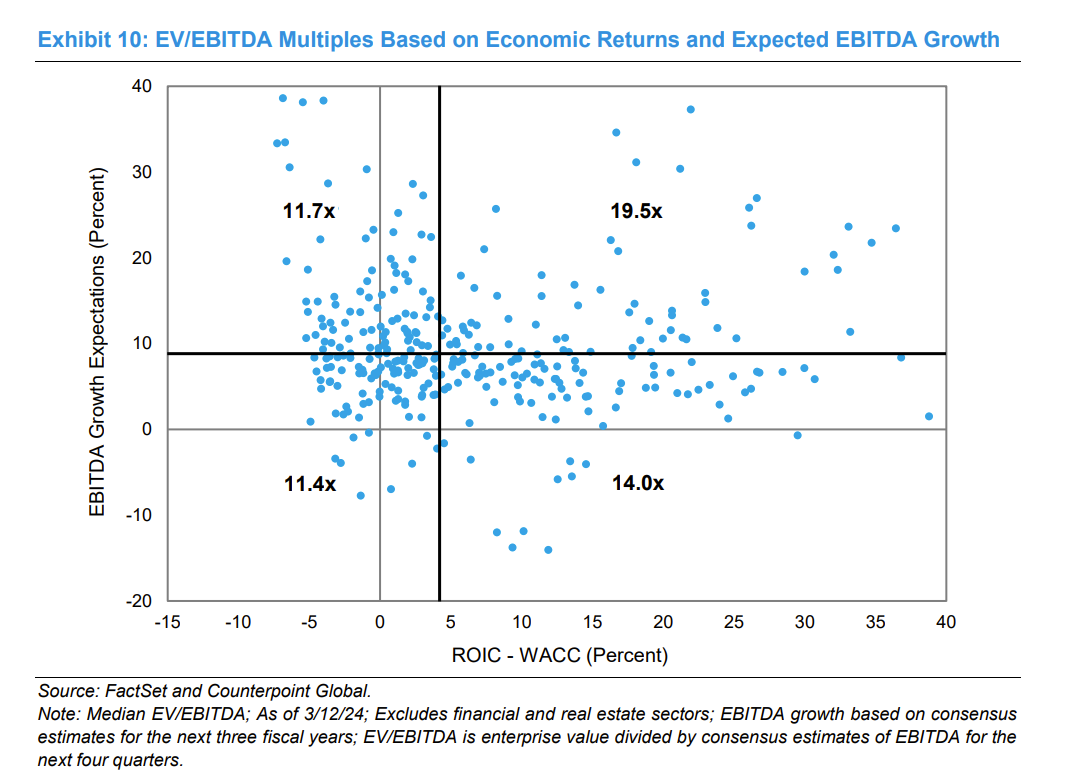

Valuation Chart

- Useful calibration of EV/EBITDA valuation multiple relative to growth in EBITDA and ROIC-WACC.

- Source.

Short Seller Outlook

- Interesting, Q1 letter from a short seller looking for shorts at the thematic level.

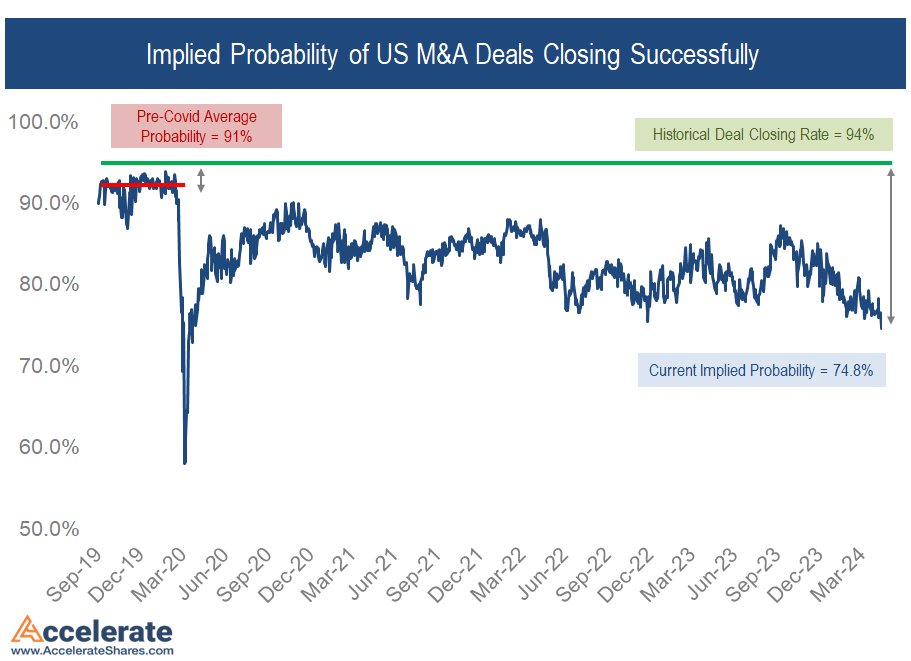

Merger Arb

- The probability of deal success is currently very low. In a small part, this is due to interest rates but also an aggressive DOJ/FTC (see JetBlue/Spirit).

- Source.

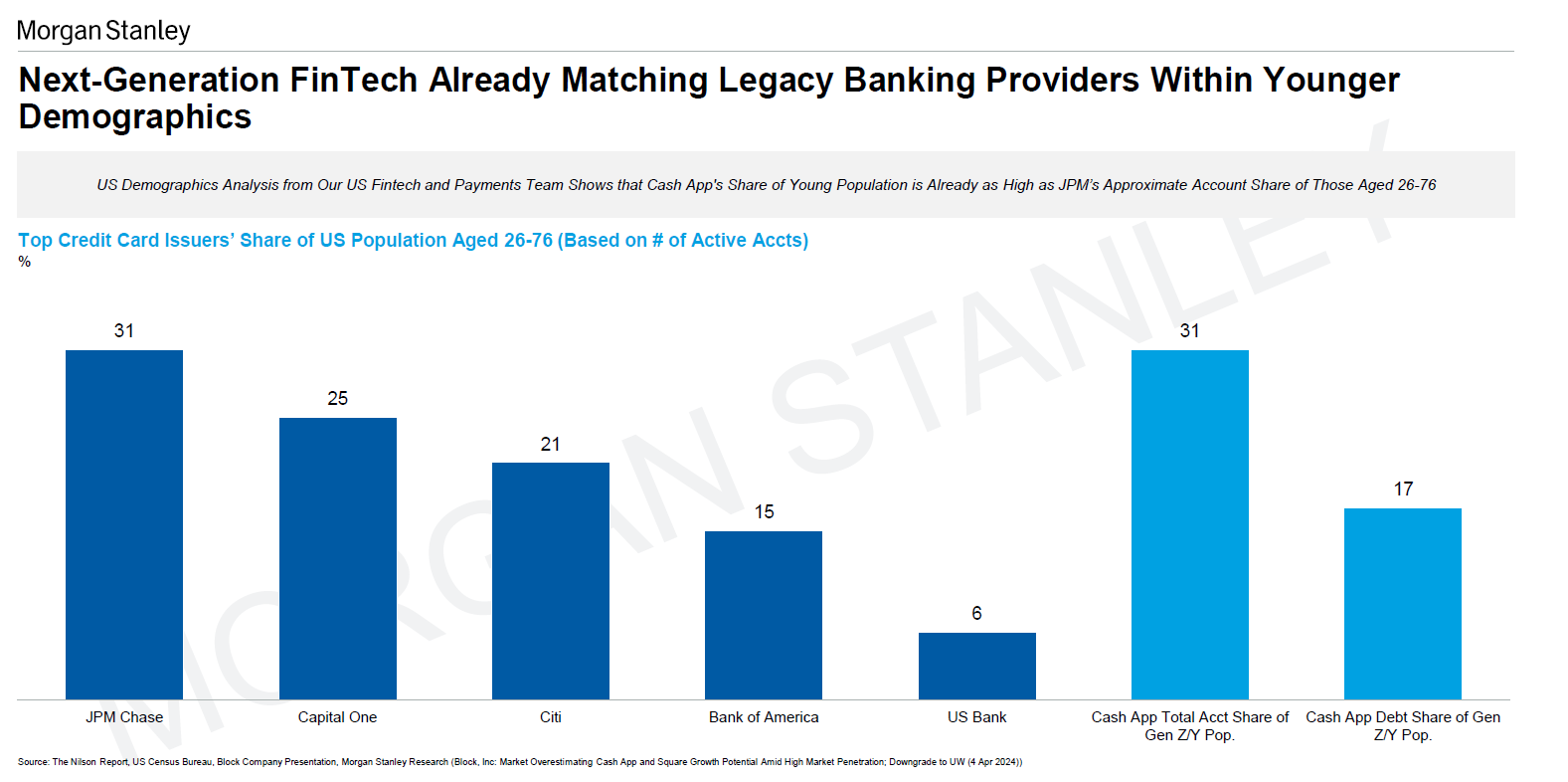

Fintech Customers

- When looking at younger customer cohorts, fintechs are catching up.

- Source.

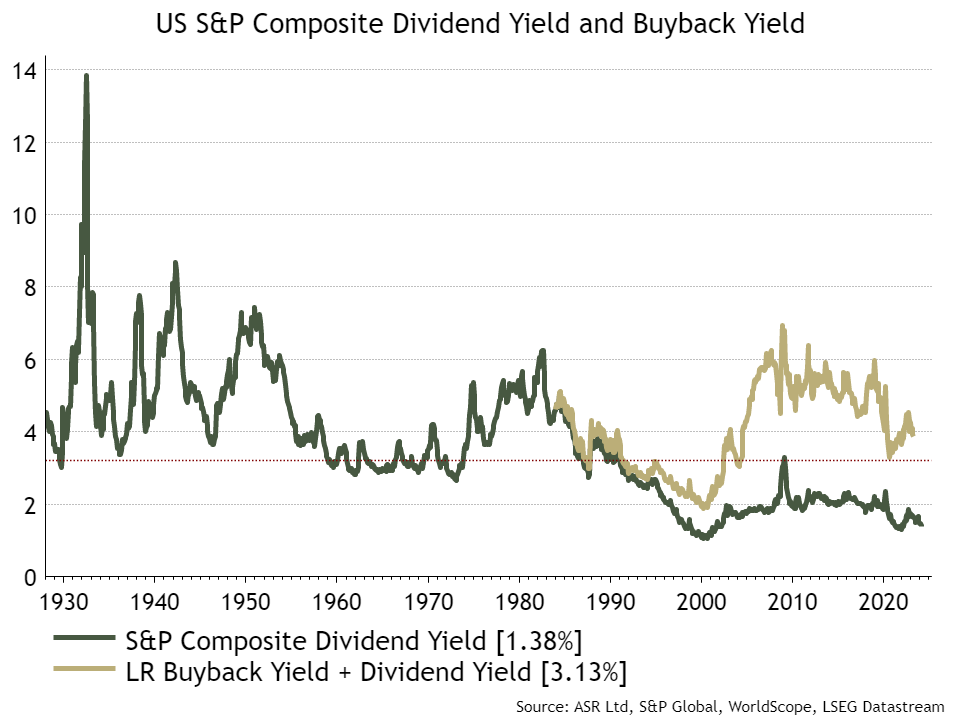

Composite Dividend and Buyback Yield

- Once buybacks are added the S&P 500 yield doesn’t look so bad.

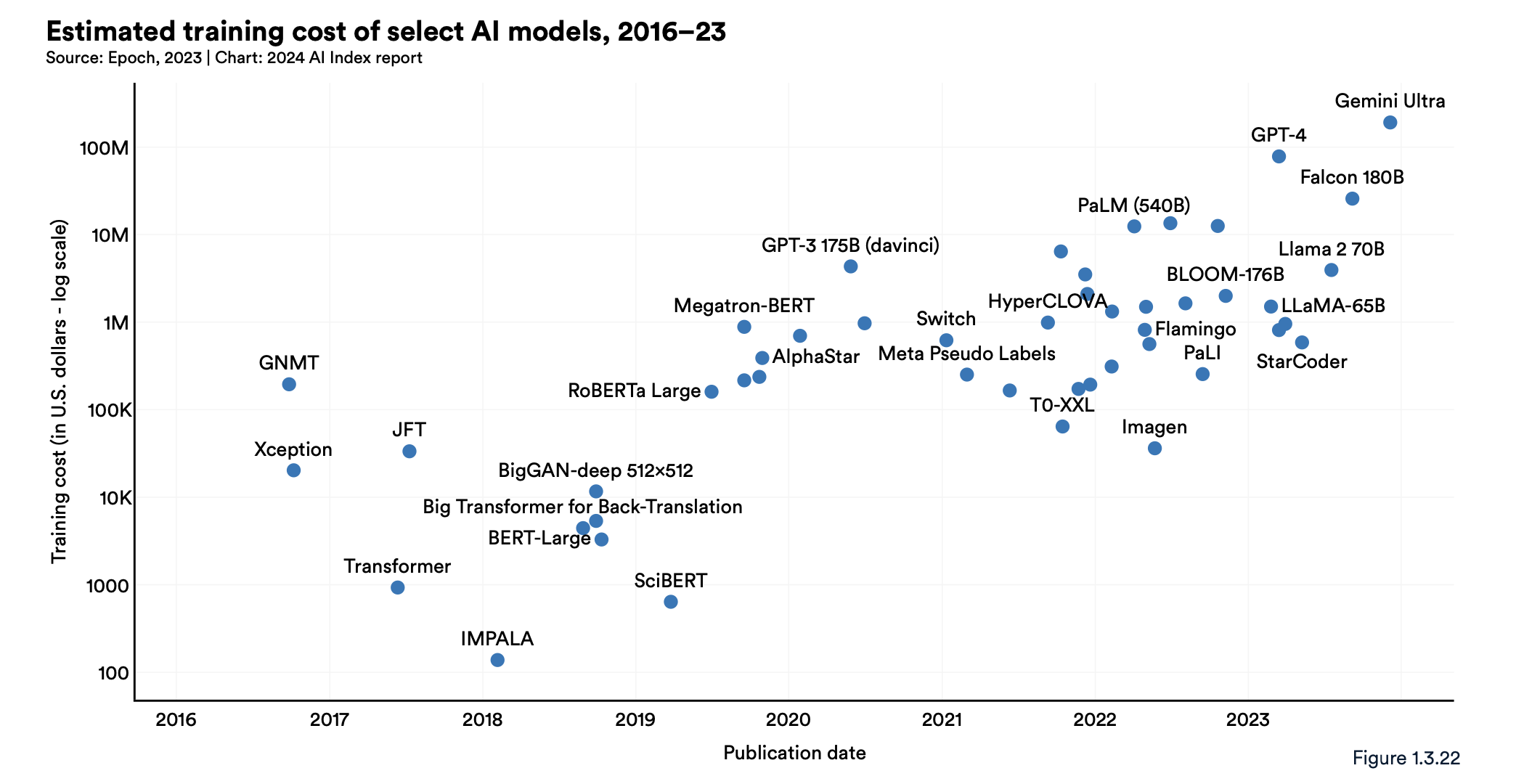

Stanford AI Index Report

- The latest report is worth a flick.

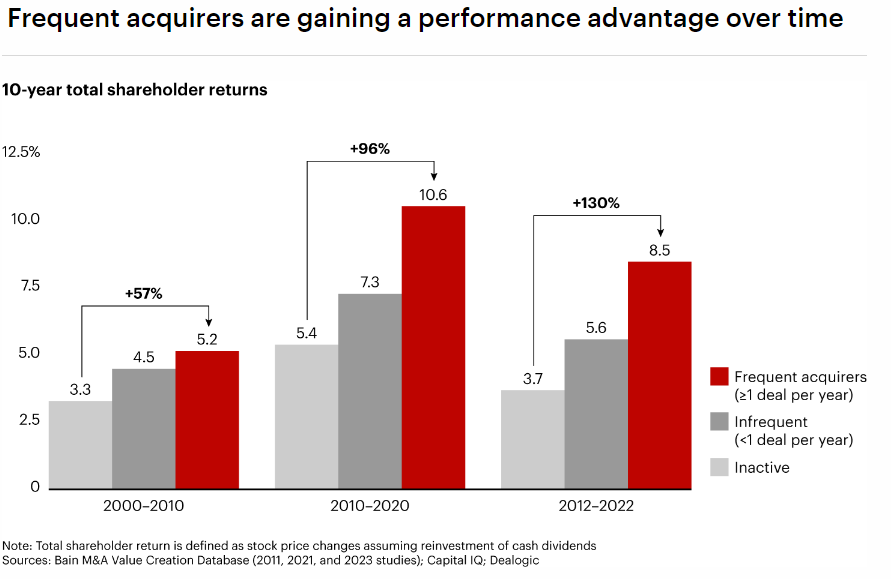

Frequent Acquirers

- Bain study shows that frequent acquirers outperform.

- “To put some data behind this assertion, from 2000 to 2010 companies that were frequent acquirers earned 57% higher shareholder returns vs. those that stayed out of the market. Now that advantage is about 130% (see Figure 1).“