- Hit a record 40% of all IPOs last year (20% from China).

- Source: Topdown Charts.

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

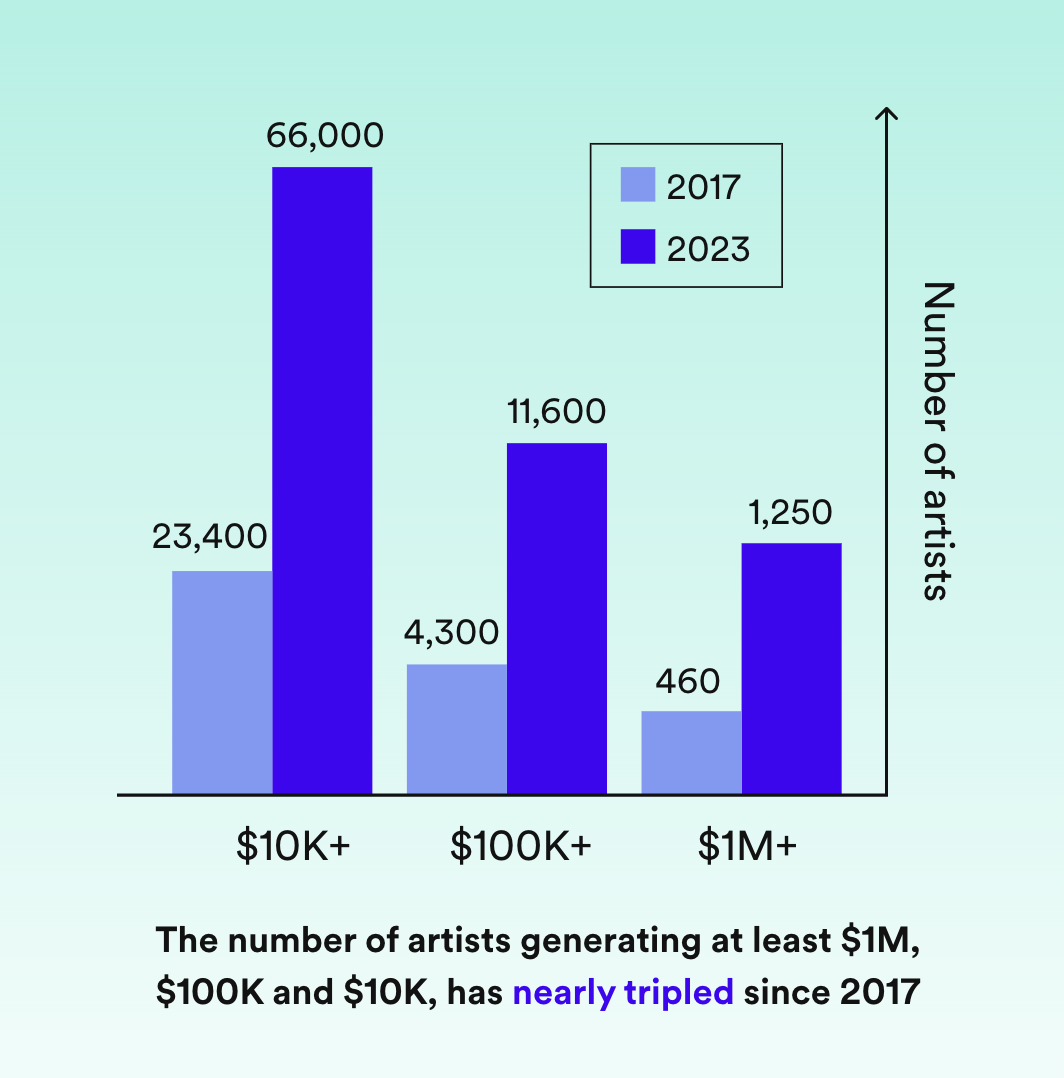

SPOT Annual Music Economics

- Interesting stats in this report.

- For example, the remarkable growth in earnings artists – across thresholds these numbers have tripled since 2017.

Life after GLP-1

- What are the next 10 weight loss drugs and what GLP-1 problems do they solve?

- Tolerability looks to be important long-term followed closely by supply, the key constraint currently as GLP-1 molecules are peptides, which could be solved instantly if a non-peptide white pill is developed.

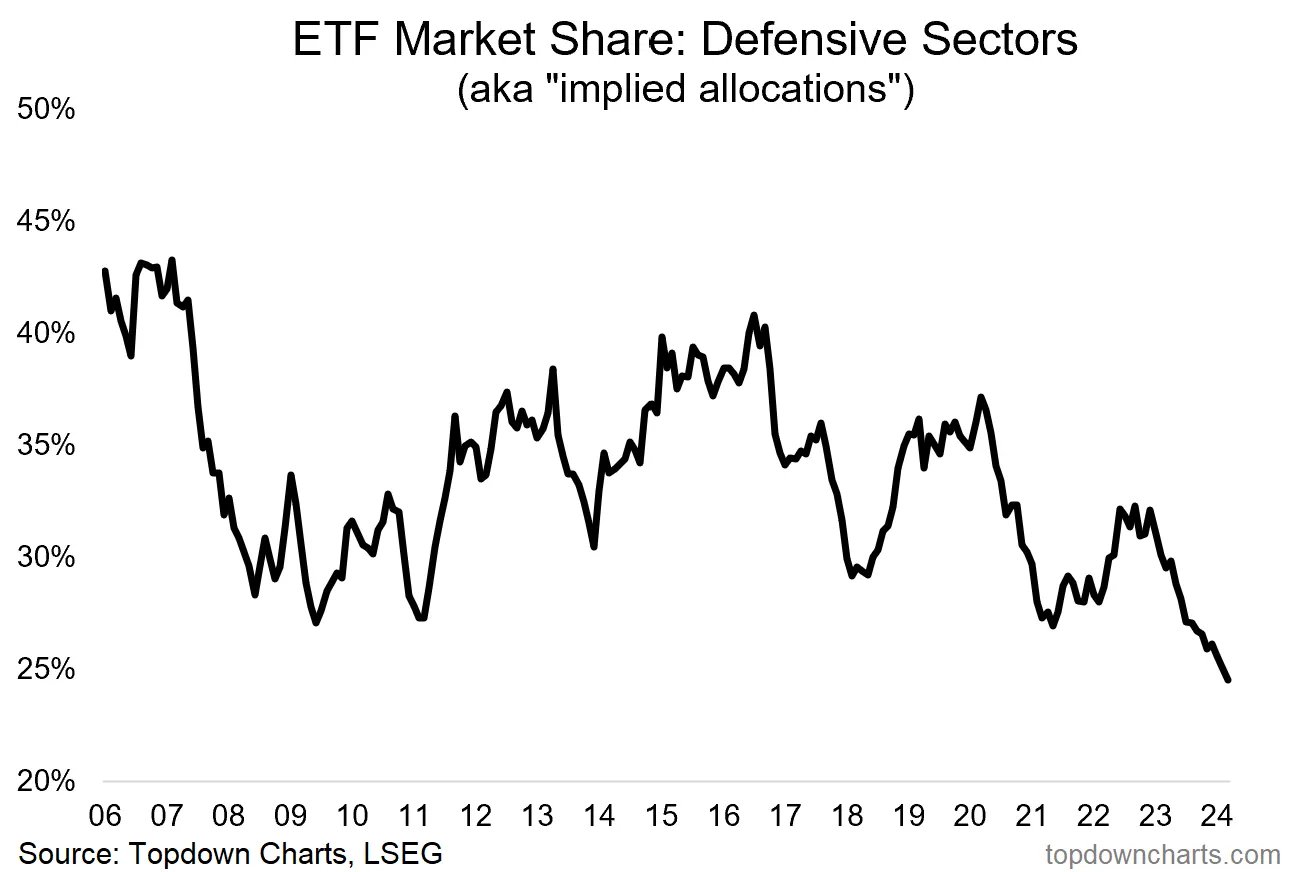

Everyone hates Defensives

- Defensive allocations, measured by ETF “market share”, are at a record low.

- Source: Topdown Charts.

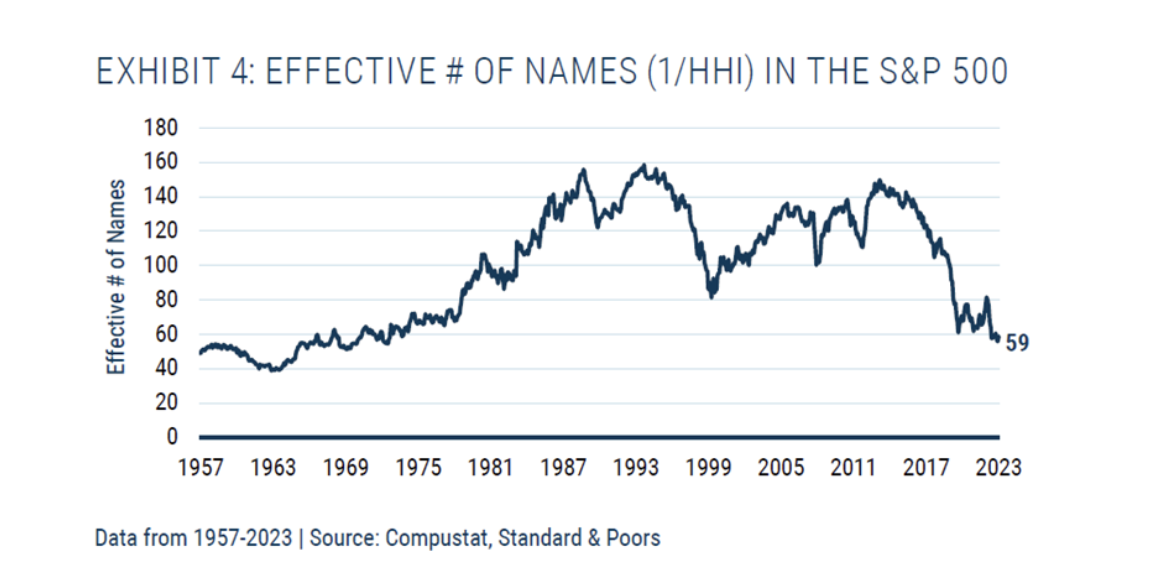

S&P 59

- “The S&P 500’s total concentration, which we can measure using a Herfindahl-Hirschman Index (or HHI), is equivalent today to that of an equal-weighted, 59-stock portfolio. Ten years ago, the index was more than twice as diversified. We have never seen – over any 10-year period – a decline (or increase) in diversification of the magnitude we have just witnessed.“

- Source: GMO.

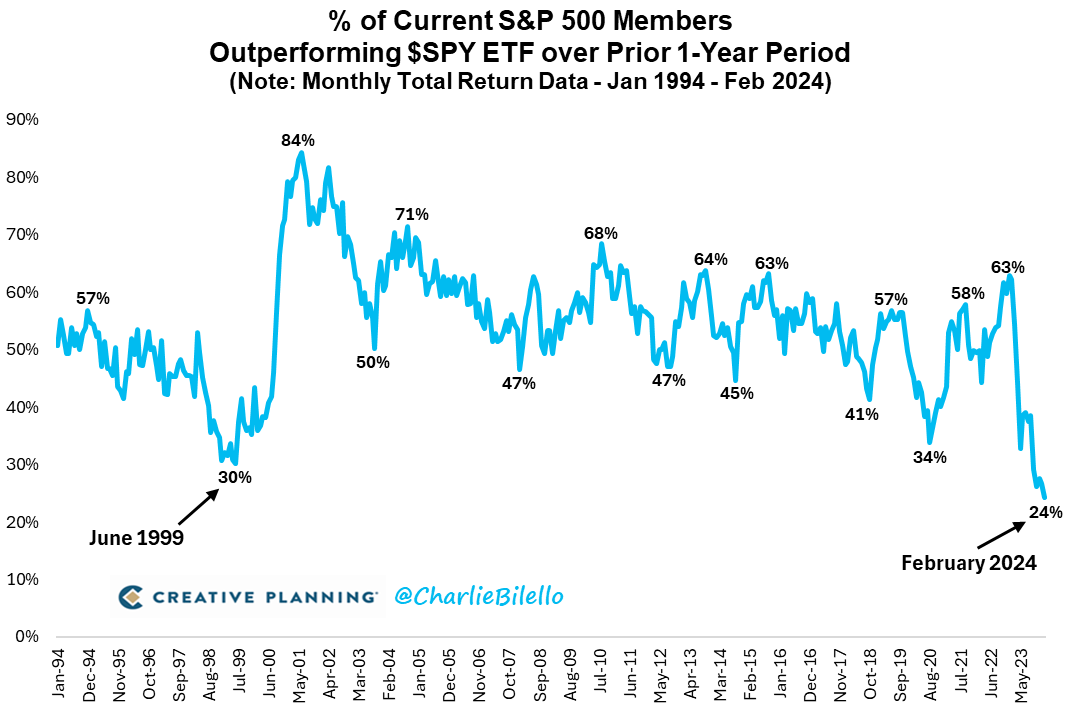

Stocks Outperforming SPX

- A record low 24% of stocks are outperforming SPX over the last 1 year period.

- No wonder active is hard.

AI = Insane Energy Demand

- “Boston Consulting Group believes that AI and regular data center demand will grow to 7% of total electricity demand by 2030. To put this in context, this is the equivalent of the electricity used for lighting in every home business and factory across the United States. It’s a huge amount of energy. Most traditional data centers that were built 10 years ago were 10 megawatts or less. Today, it’s not uncommon to see 100-megawatt data centers. And with our clients, we’re talking about data centers that approach 1,000 megawatts. And they require 24/7 power. This is something that doesn’t get talked about enough in my opinion.”

- That is from Constellation Energy’s CEO Joseph Dominguez (Source: The Transcript) – who of course is talking his own book but still.

- Others confirm this, like the IEA – which thinks AI energy demand will double by 2026 – “that’s equivalent to adding a new heavily industrialized country like Germany to the planet”.

- There are other huge environmental impacts – e.g. water.

Academic Publishing

- Interesting paper analyisng the effect of concentration in academic publishing on prices and science.

- “Elevated prices and substantial publisher power significantly diminish the volume of article citations and collaborative research.“

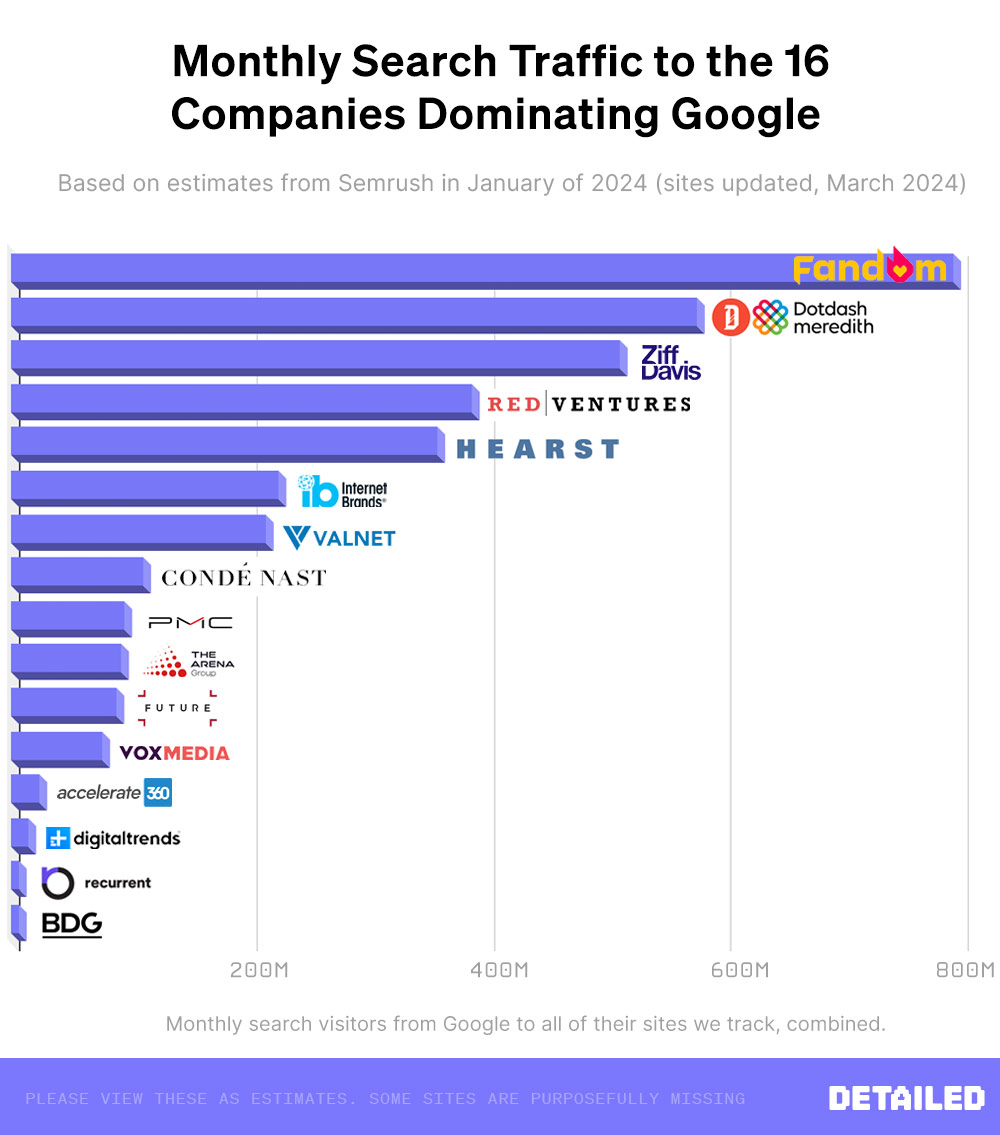

Dominating Google

- These 16 companies dominate Google search results. Odds are you haven’t heard of any of them.

- “Across 10,000 terms where affiliates are ranking, which cover products in every niche you can think of (home, beauty, tech, automotive, cooking, travel, sports, education and many more), these 16 companies ranked on the first page of 8,574 (or 85%) of them.“

- Detailed write-up here.

Altman’s $7 Trillion

- Back-of-the-envelope analysis of why Altman wants this sum to build semiconductor capacity and why it isn’t such a crazy number.

- “It’s a useful reminder of what it will take for AI to scale in the coming years.“

- The article also links some more serious analysis of the trend in the cost of training AI (like this).

Interview with Vlad Tenev

- Interesting throughout – on the state of the company and his vision for Robinhood.

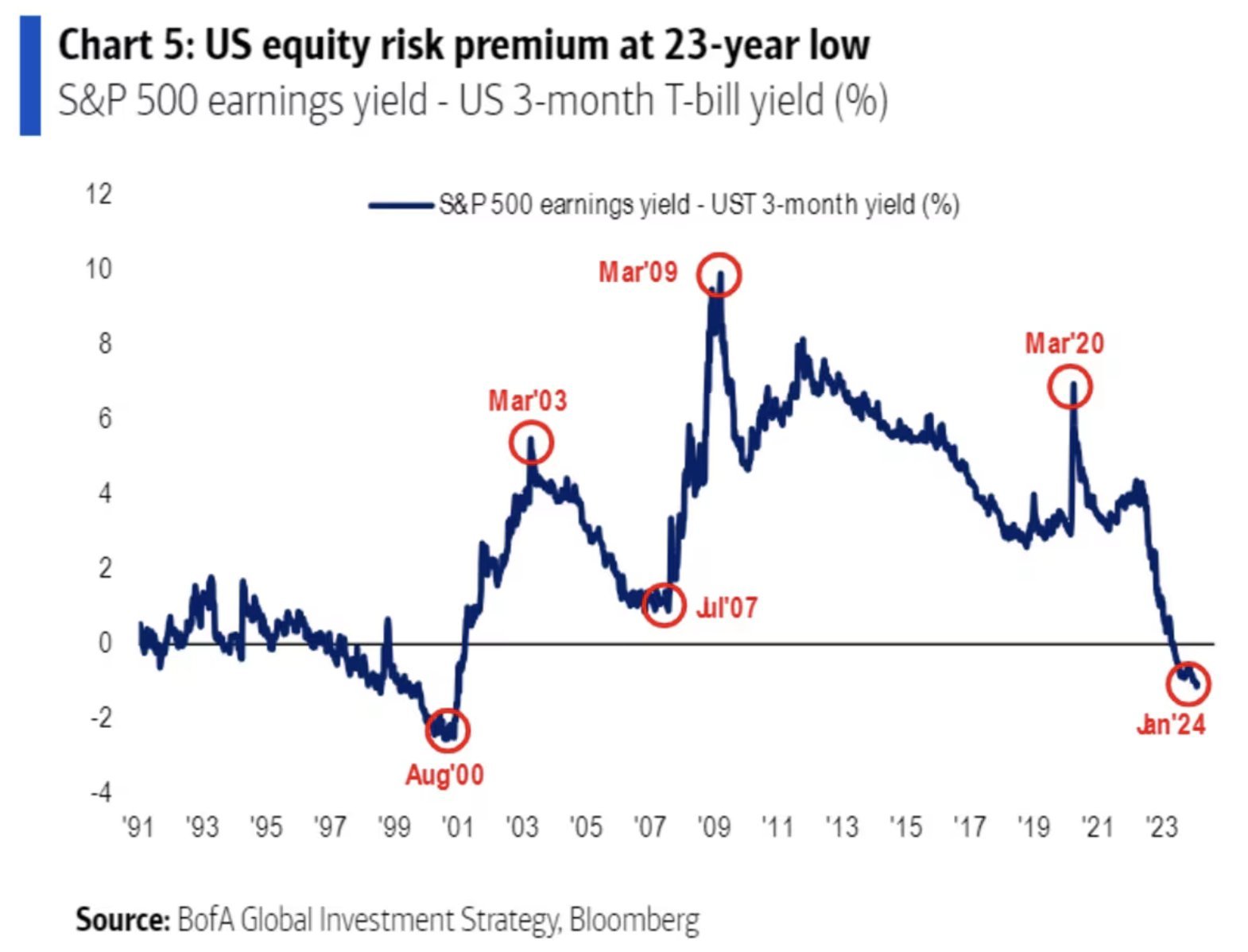

Equity Risk Premium

- In the US it is hitting very low levels.

Semiconductor Manufacturing

- Interesting analysis on staying competitive in semiconductor manufacturing.

- “The dotted black lines toward the bottom show the estimated cost of building a leading edge fab (the lower line) and a line showing double that number (the upper line). Our thesis is that companies whose annual revenue fall between those two lines are at risk of falling off the Moore’s Law treadmill.“

- TSMC came close once. Samsung looks close now (though this doesn’t include the rest of the group subsidising the fab). It also shows that Intel’s plans to offer fab services need to succeed.

- Source.

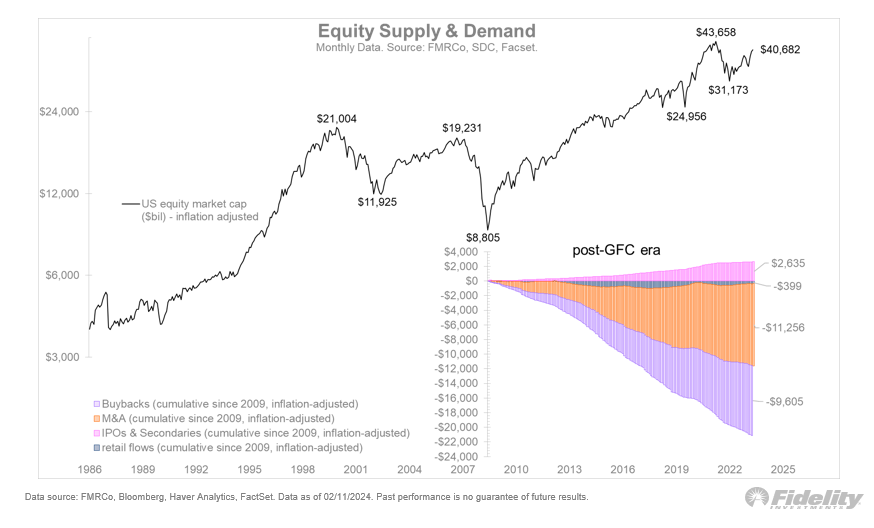

Equity Shrinkage

- There has been an enormous amount of equity supply shrinkage since the Global Financial Crisis.

- $2.6 trillion of supply vs. $21 trillion of demand.

- Source: Fidelity.

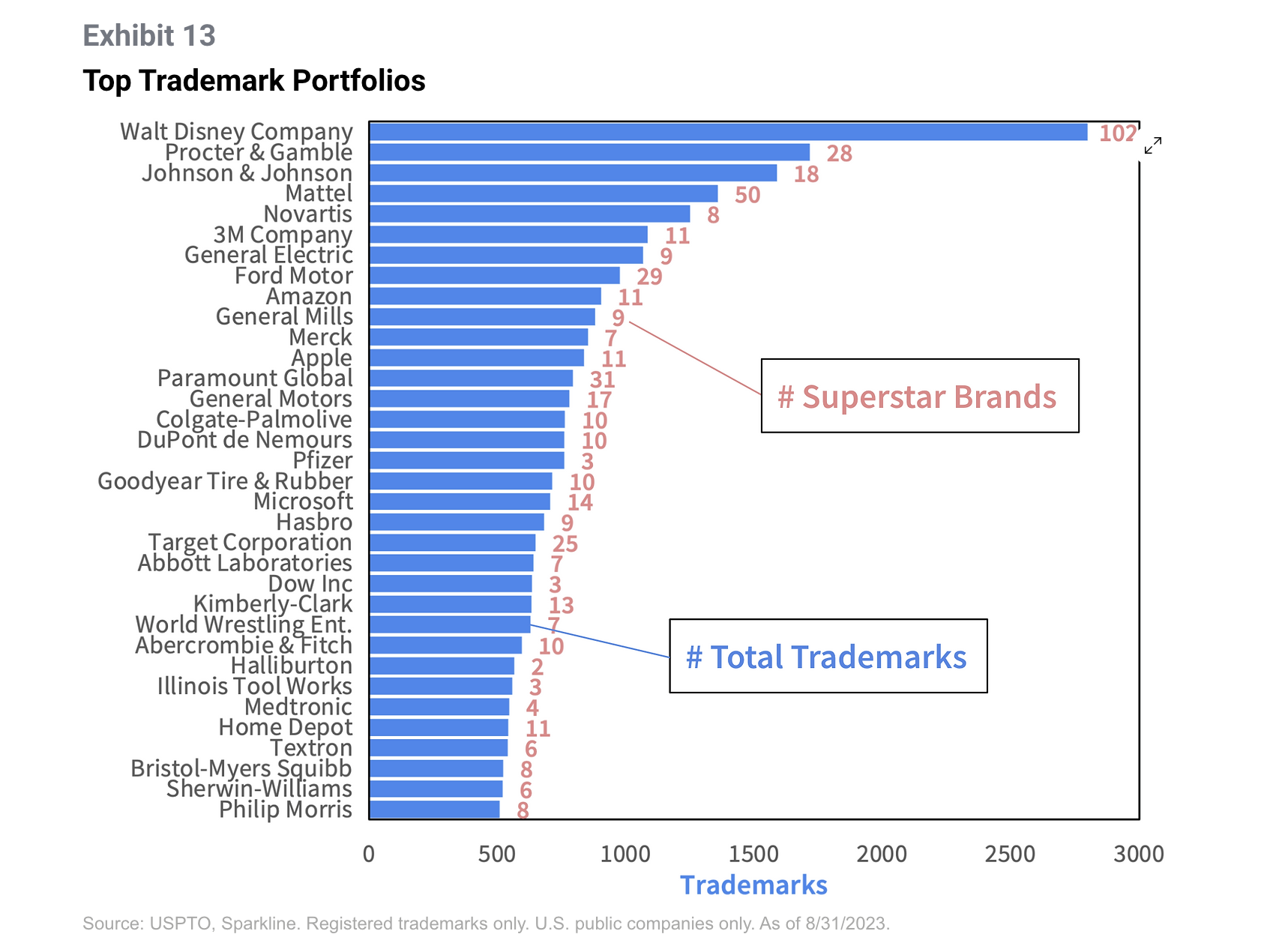

Trademarks and Brands

- Fascinating analysis of trademark data.

- So much inside, such as the evolution of Barbie trademarks (Exhibit 11) across product categories from doll to hand sanitizer.

- The below chart is interesting in terms of companies with the most trademarks and superstar brands.

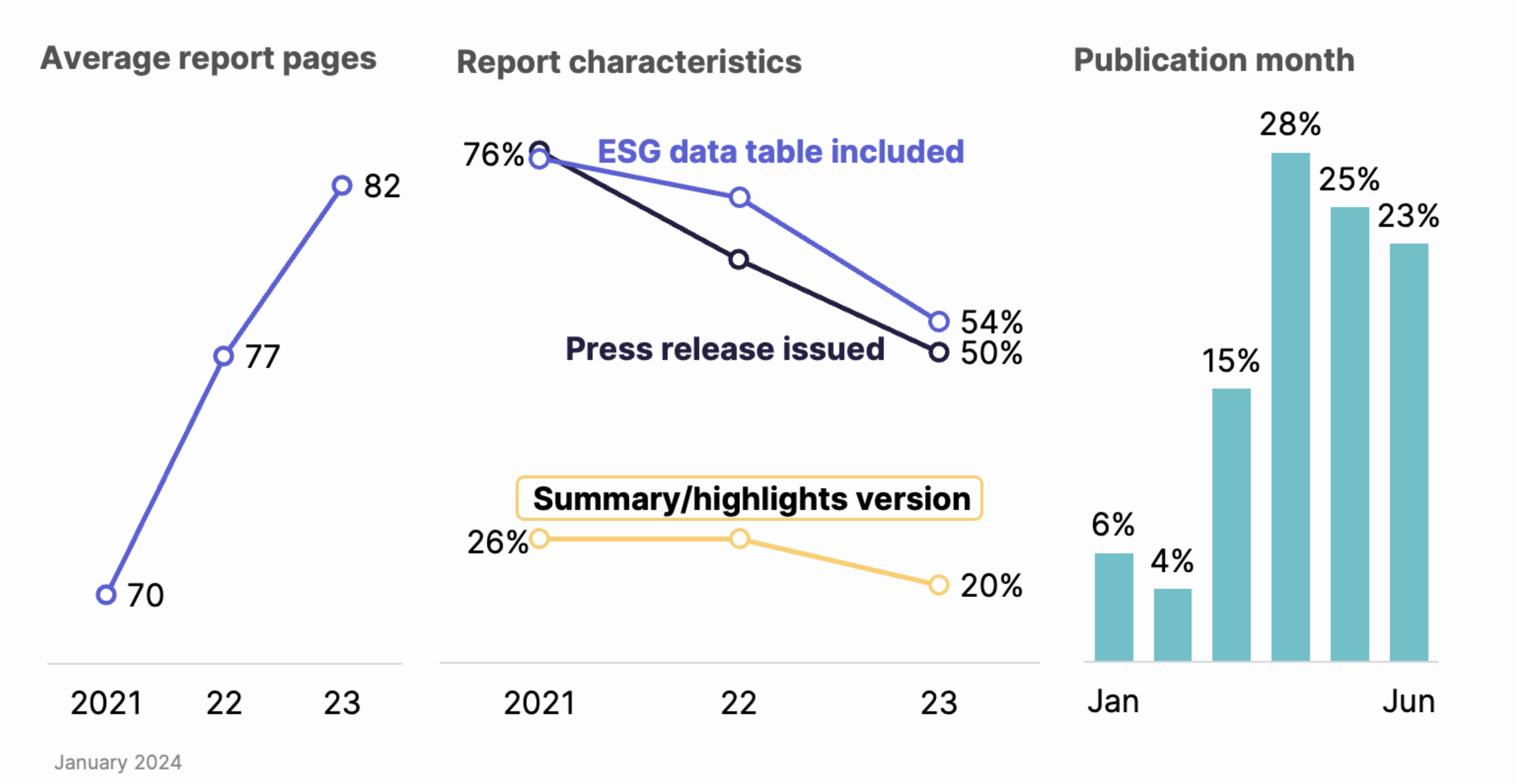

Sustainability Reports are Getting Worse

- “US company ESG reports are growing in size, declining in clarity, and are published relatively late“.

- Source.

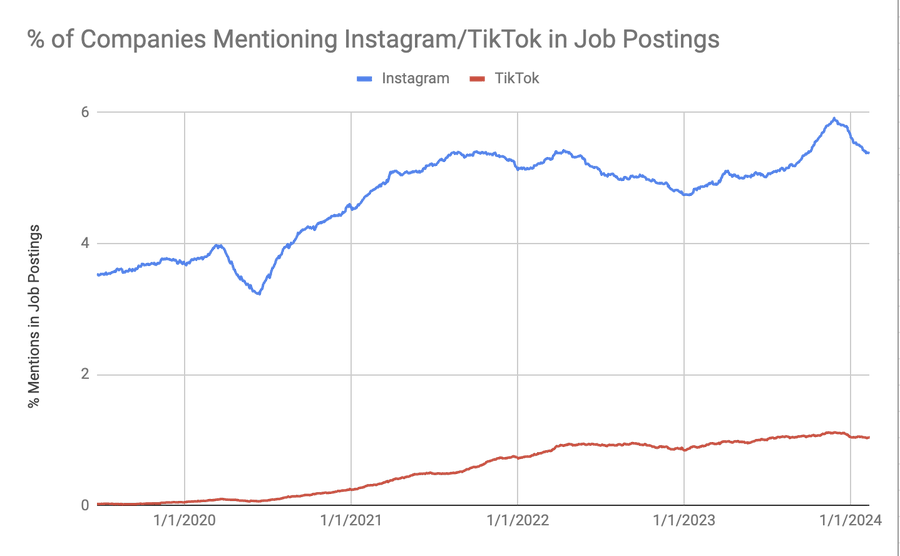

Instagram Business Dominance

- Chart showing that, at least when it comes to job postings mentioning the company, Instagram still wins out to TikTok and the gap is getting wider.

- Source: @RihardJarc

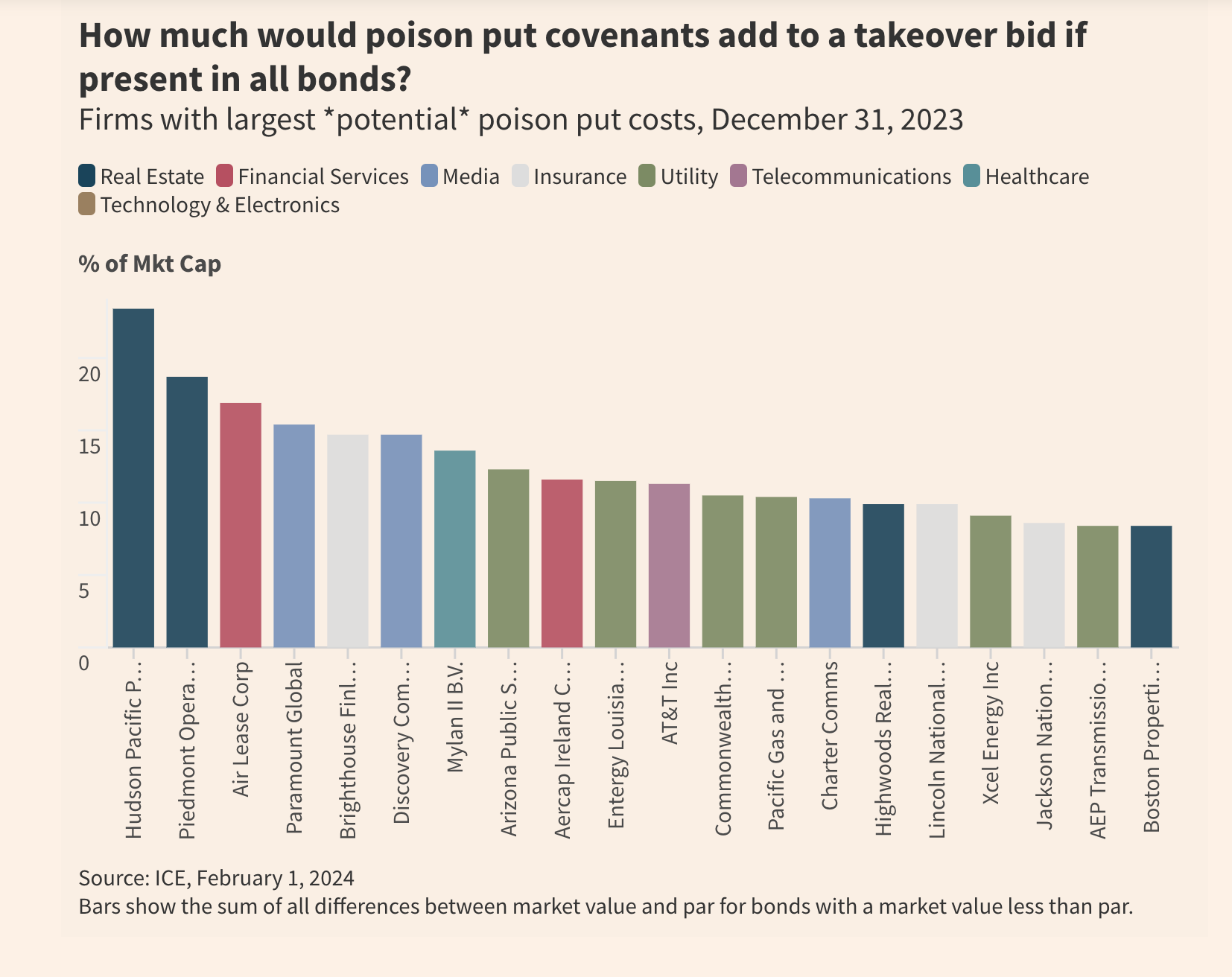

Bond Change of Control Covenants – The New Poison Pill?

- Many bonds have a covenant in case of a change of control allowing holders to put the bond back at par.

- That didn’t matter when bonds were trading above par, but many don’t today – creating a potential headwind for M&A.

- Here are some issuers where this is a big problem.

- Lots more interesting analysis here.

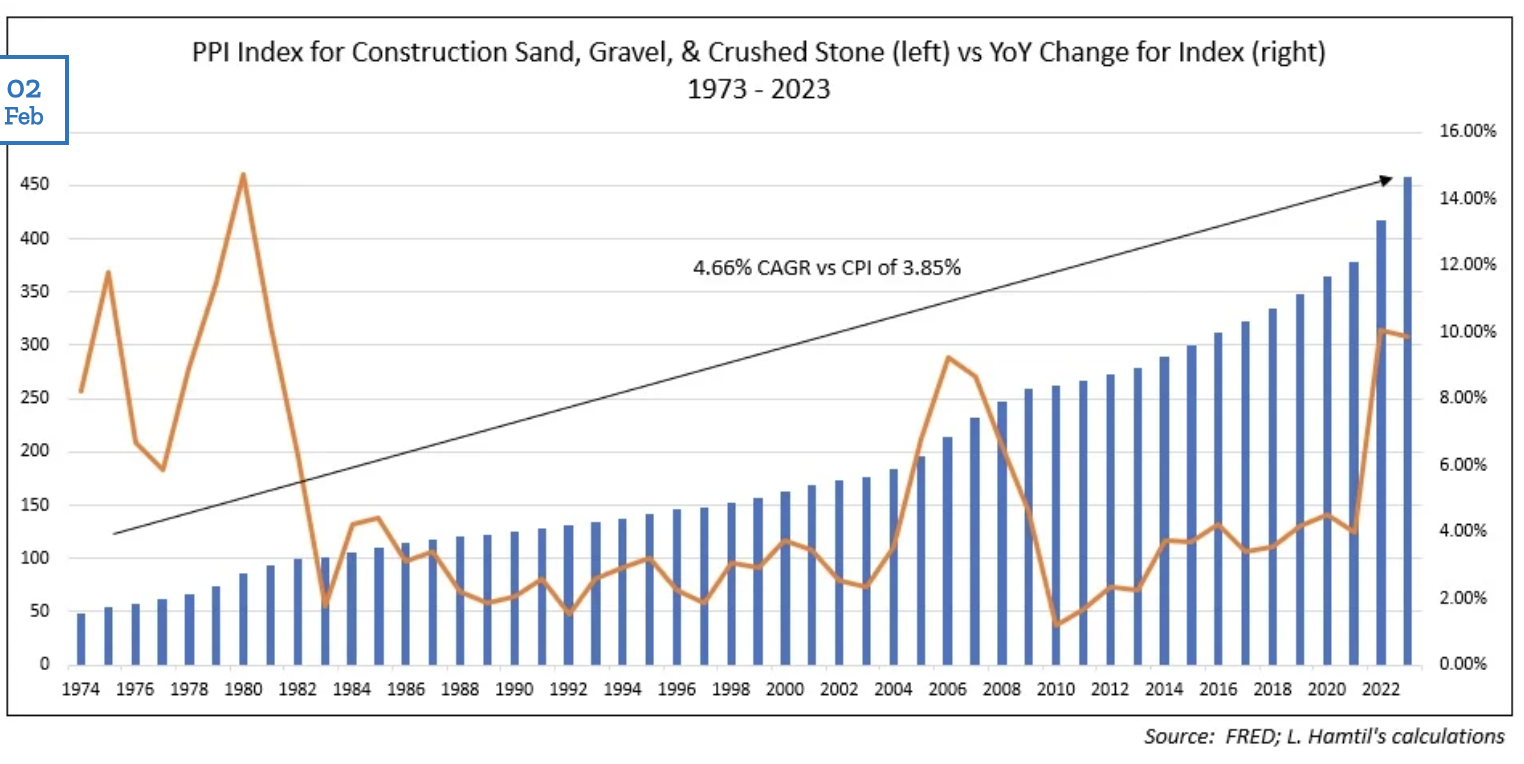

Aggregates Rock

- Nice post about why aggregates businesses are so good.

- “What makes a rock pit valuable is that nobody else can compete with it. The nearest rival owner from two towns over isn’t going to haul his rock into your territory because the trucking bills would eat up all his profit. No matter how good the rocks are in Chicago, no Chicago rock-pit owner can ever invade your territory in Brooklyn or Detroit. Due to the weight of the rocks, aggregates are an exclusive franchise. You don’t have to pay a dozen lawyers to protect it.” -Peter Lynch in One Up On Wall Street, 1989

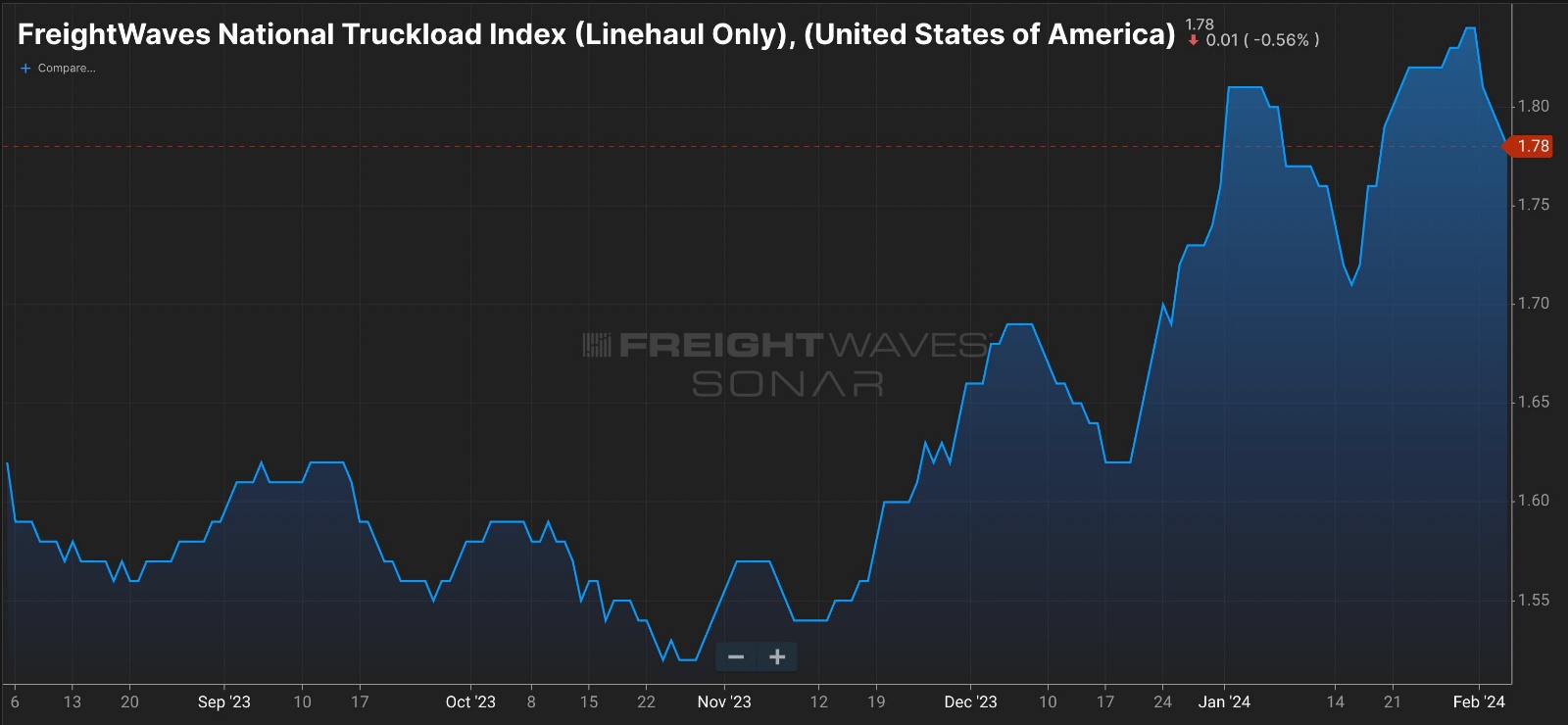

Trucking Prices

- “By most metrics, freight markets are showing clear signs of a lasting recovery … In short, the early stages of this recovery are characterized by a rebalancing market, a return to normalcy after a four-year roller coaster of volatility.“

- Freight pricing has perked up.