- It was always hard and it isn’t getting any easier.

- A nice article reflecting on the troubles of the Boeing 737 MAX – an update to a 50-year-old plane instead of a brand new model and why that decision was taken.

- As we wrote before there really isn’t anything like this industry – “Aerospace is one of the deepest branches of humanity’s technological tree. It is a telling fact that more countries have produced a nuclear bomb than mass-produced a jet engine.“

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Useful Reminder – Intra-Year Drawdowns

- Great chart from the jam-packed Guide to the Markets Q4 Deck from JPM AM.

- “Despite average intra-year drops of 14.2%, annual returns were positive in 33 of 44 years“

Japan Trying to Fix Shareholder Value

- Last year the Tokyo Stock Exchange sent letters to all sub book value companies urging them to set concrete plans to reverse this valuation.

- This is an interesting slide deck and case studies of what happened since.

Biopharma M&A Green Shoots

- Surprisingly a flurry of deals at the end of the year means 2023 was a record in terms of the number of deals >$1bn in value (source: Centerview, h/t Tema).

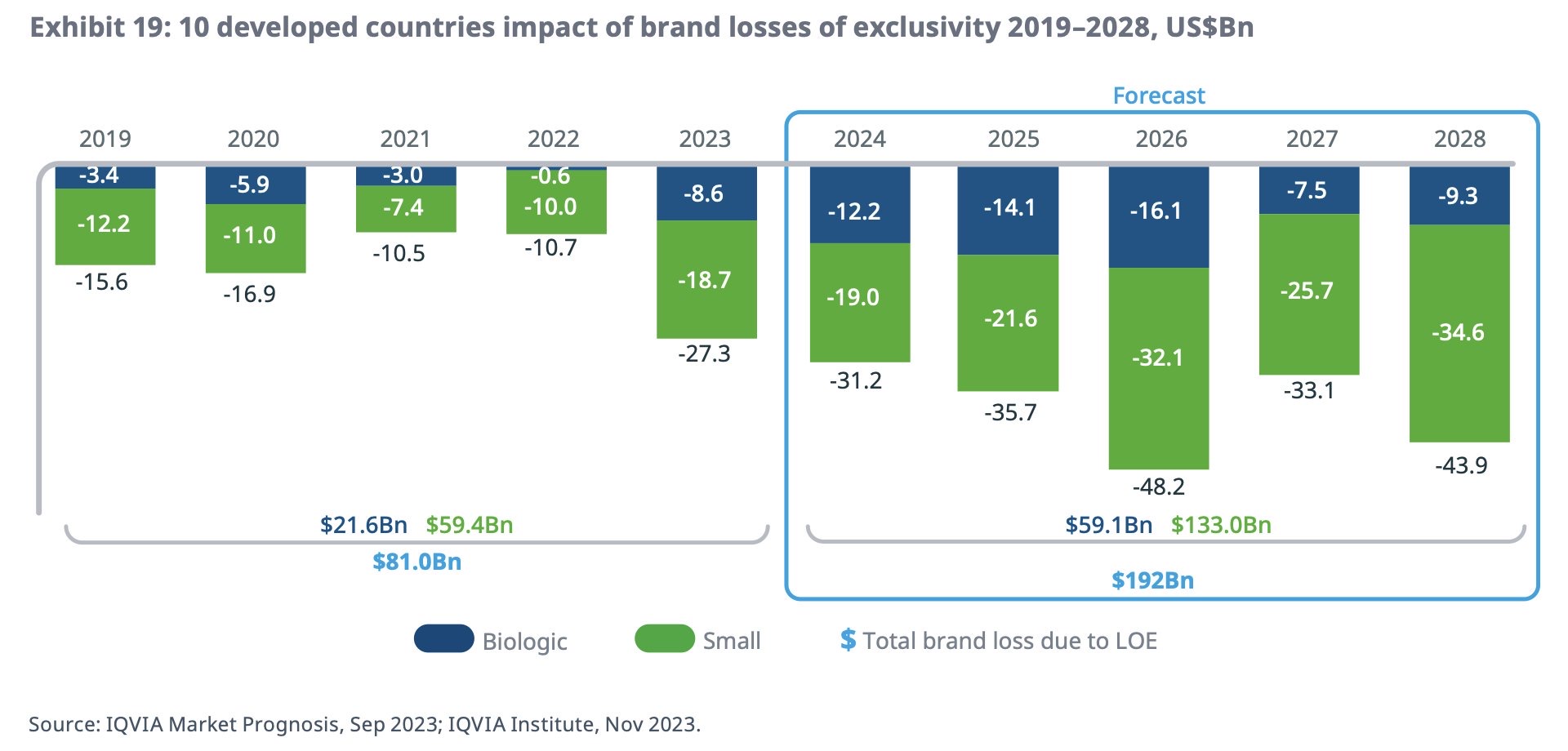

- One of the reasons is likely a looming patent cliff.

- Tema estimates that large-cap pharma has $838bn of dry powder – enough, even after the rally, to buy almost 70% of the XBI (without a premium).

Einhorn’s Greenlight Q4 Letter

- Always a good read.

- The below sticks out. It is something many UK investors have long ago had to become accustomed to.

- “We believe that the strong returns and alpha from the long book came from a successful adaptation of our style. We have become even more disciplined about price and emphasize investments where we get paid by the issuers, as opposed to relying on other investors to revalue the security. Payment can come to us in the form of buybacks, dividends, interest, or in some cases, a take-out from a buyer. With the decimation of the active fund management industry, we don’t believe we can reasonably expect securities to be re-rated by investors who are actively trying to figure out what they are truly worth.“

Google Circle to Search

- Gemini, Google’s AI model that runs on a phone, is coming to the latest Samsung flagship phone.

- One cool feature is this.

- Interesting corollary from Ben Evan’s “the most interesting thing is a new Google feature called ‘circle to search’. You can use your finger to draw a circle around anything on your Android phone screen, in any app, and Google will do a text or image search. So, you can circle a hat in a Tiktok and Google will tell you where to buy it. It occurred to me a while ago that screenshots are the native file format of smartphones, but they lose context. But what if the OS knows what’s on the screen, in every app? Screen-scraping is the new API…”

- Source: Ben Evans.

China Positioning

- Everyone is bearishly positioned when it comes to Chinese equities.

- Source: themarketear.

Patent Cliffs

- The amount of revenue hit from the loss of exclusivity of major pharmaceutical patents is about to accelerate after a few benign years.

- This likely explains the pick-up in M&A of SMID biotechs at the end of last year and into this year at the JPM conference.

Big Tech Anti-Trust

- Excellent interview with Herbert Hovenkamp professor at Penn Law School specializing in US anti-trust on what he thinks of the big cases against Big Tech in the US.

- Worth a read for any holders of AAPL, META, GOOG, AMZN.

State of Healthcare VC

- 2023 Annual report from SVB full of interesting stats.

- The amount of investment going into AI in healthcare, and their valuations, is pretty staggering.

- “VC deals for healthcare AI have jumped 2.1x since 2019, a rate nearly double the increase for AI in tech overall.“

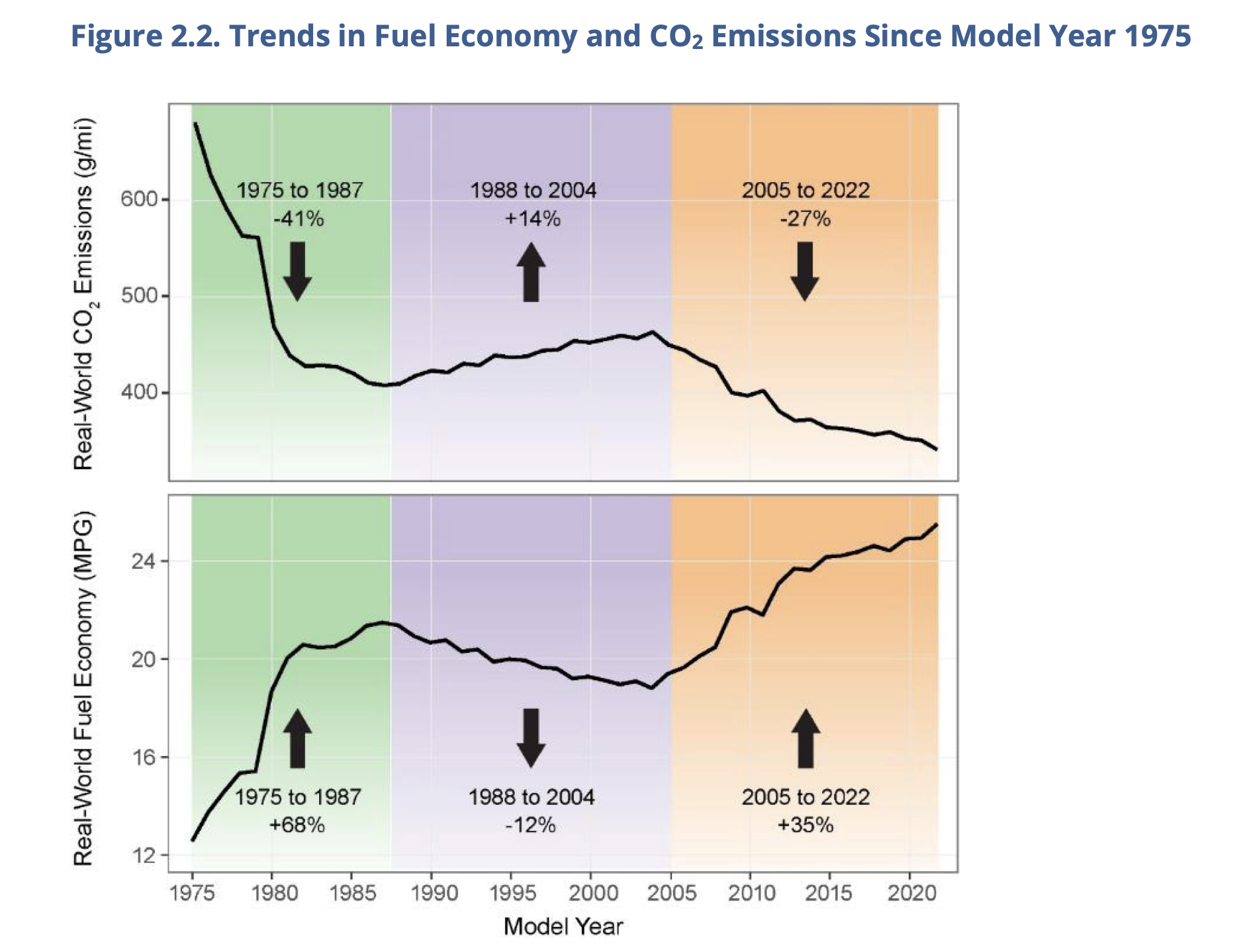

Fuel Economy and CO2 Trends

- “In model year 2022, the average estimated real-world CO2 emission rate for all new vehicles fell by 10 g/mi to 337 g/mi, the lowest ever measured. Real-world fuel economy increased by 0.6 mpg, to a record high 26.0 mpg.1 This is the largest single year improvement in CO2 emission rates and fuel economy in nine years.“

- 2023 model year is already showing improvement on this.

- The long-term trend is encouraging (see chart) all while horsepower is up 88% since 1975 (see page 27).

- Loads more excellent data from 2023 EPA Automotive Trends Report.

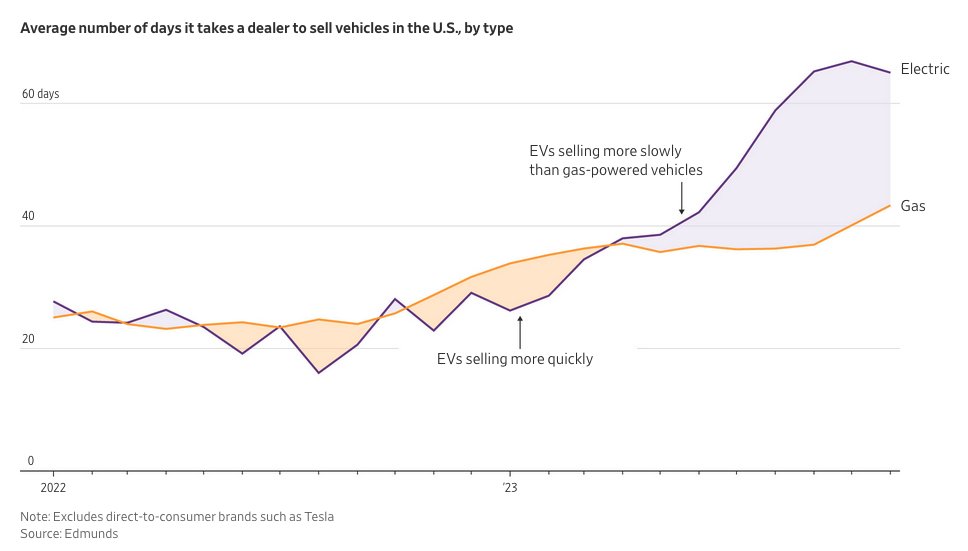

EVs Having Issues

- Something not so good is going on in EV land – and it isn’t aggressive Chinese competition.

- Hertz for one has decided to dump 20,000 EVs citing hidden costs, especially of accidents.

- “Expenses related to collision and damage, primarily associated with EVs, remained high in the quarter, thereby supporting the Company’s decision to initiate the material reduction in the EV fleet.“

- Then there is this chart showing EVs are taking longer to sell.

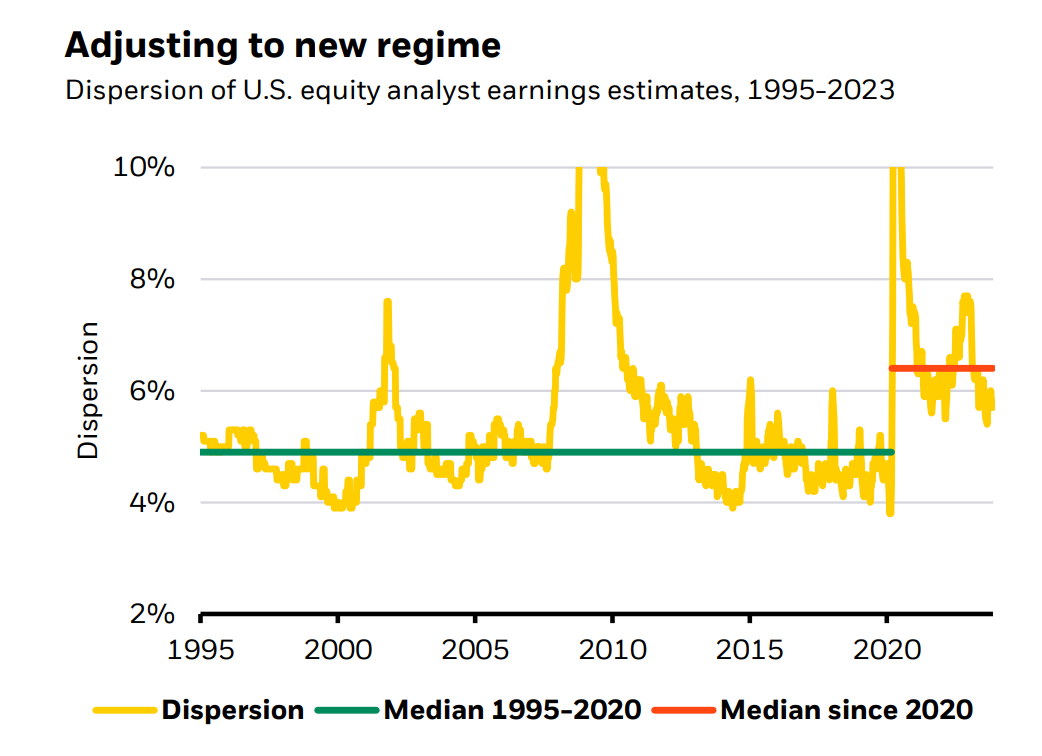

Dispersion of Estimates

Insurance Adjuster

- A fascinating glimpse into the world of how the decision to total a car by an insurance company after an accident is made.

Japan Becoming More Dynamic

Transsion Holdings

- China’s Transsion Holdings is a smartphone maker you may have never heard of.

- Not only are they the world’s number five, but more impressively they command 40% market share of Africa’s smartphone market.

Retail Investors – a new base level

- It looks like retail trading has seen a step change since the pandemic that has stuck and even accelerated.

- Source.

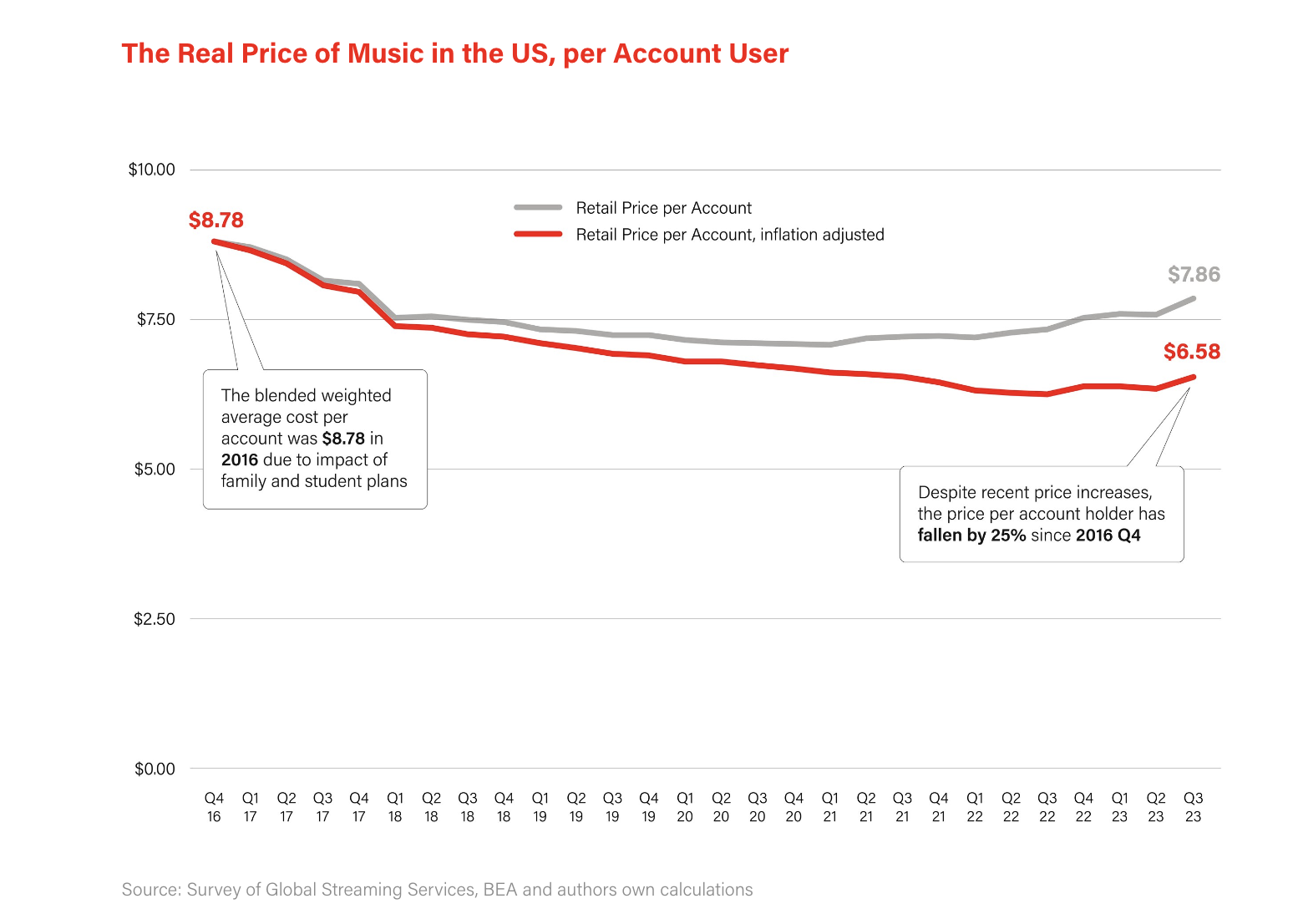

Streaming Prices

- Music streaming has seen declining prices when adjusted for inflation and new shared plans.

- Source: Pivotal (lots of interesting charts on music streaming inside).

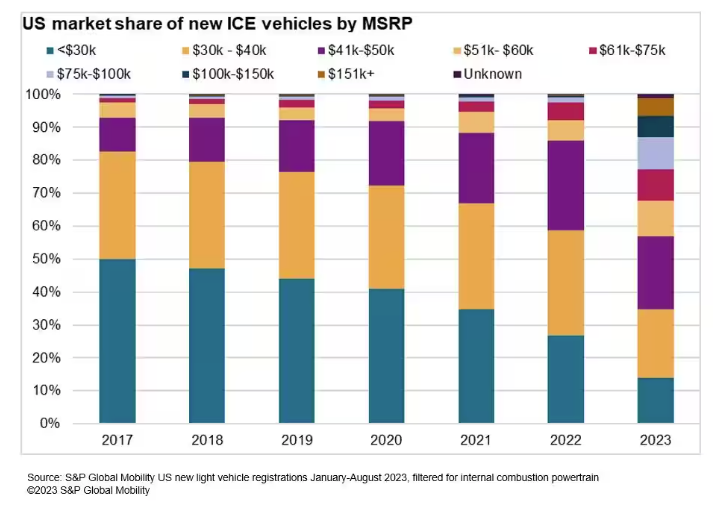

Cheap Cars are Disappearing

- “Based on S&P Global Mobility analysis of registration data since 2017, the US market has seen a significant decline in the share of new vehicles registered below a $30,000 price point. In just seven years, the percentage of vehicles registered with an MSRP below $30,000 has decreased from half the market to barely one-quarter – with vehicles in the $41,000-$60,000 band taking up nearly the entirety of that vehicle count.“

- Source: S&P Global

Autonomous Vehicle Safety

- “In over 3.8 million miles driven without a human being behind the steering wheel in rider-only mode, the Waymo Driver (Waymo’s fully autonomous driving technology) incurred zero bodily injury claims in comparison with the human driver baseline of 1.11 claims per million miles. The Waymo Driver also significantly reduced property damage claims to 0.78 claims per million miles in comparison with the human driver baseline of 3.26 claims per million miles.“

- Source: Swiss Re.