- Retail shrink is effectively the corporate term for theft.

- It’s on the rise – mentions of the term in media and company transcripts in 2023 so far are already almost above 2022 levels.

- The problem is called out by several retail companies (e.g. Target forecasting a $500m profit hit).

Stocks

Interesting, and often contrarian, Snippets on individual companies and the stock market.

Training vs. Inference and GPU Demand

- Everyone is trying to figure out what AI means for GPU demand.

- It’s hard as the true picture is muddied by providers investing in their own customers, demand-pull forward, and strategic buying ahead of having a real use case (see Saudi, UAE, U.K.)

- Confounding all this is Meta releasing Llama 2 for almost free, followed most recently by its coding version (by far the most useful application of AI so far).

- This matters because training is a lot more GPU-intensive than inference. Free models mean less training needed. This specifically matters for Nvidia’s H100 chip (which by the way weigh over 30 kgs!).

- Qualcomm actually thinks processing might happen right in our phones (they of course would benefit most from this).

- “Eventually, a lot of the AI processing will move over to the device for several use cases. The advantages of doing it on the device are very straightforward. Cost, of course, is a massive advantage. It’s — in some ways, it’s sunk cost. You bought the device. It’s sitting there in your pocket. It could be processing at the same time when it’s sitting there. So that’s the first one. Second is latency. You don’t have to go back to the cloud, privacy and security, there’s data that’s user-specific that doesn’t need to go to the cloud when you’re running it on the device. But beyond all of these, we see a different set of use cases playing out on the device.” Qualcomm CFO Akash Palkhiwala (via The Transcript).

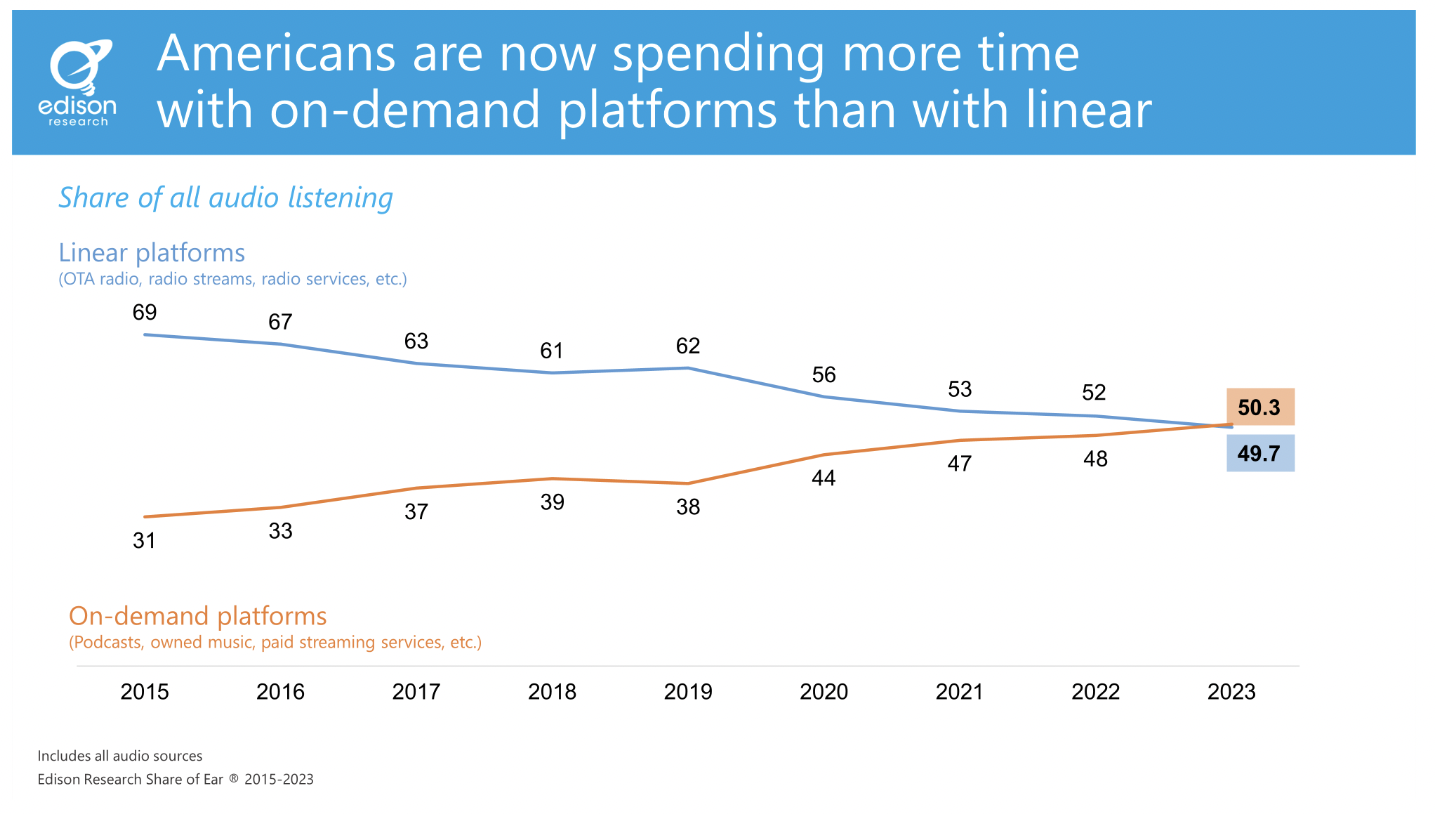

On-Demand Audio Milestone

- “At the end of 2015, a scant seven and one-half years ago, the margin between linear listening and on-demand listening was 38 percentage points. But drop by drop, quarter by quarter and year by year, the margin was erased, and now on-demand leads.“

- “linear” audio refers to – radio over the air, radio streams, Pandora’s free radio service, satellite radio, etc. and “on-demand” audio – paid streaming, podcasts, owned music, etc.

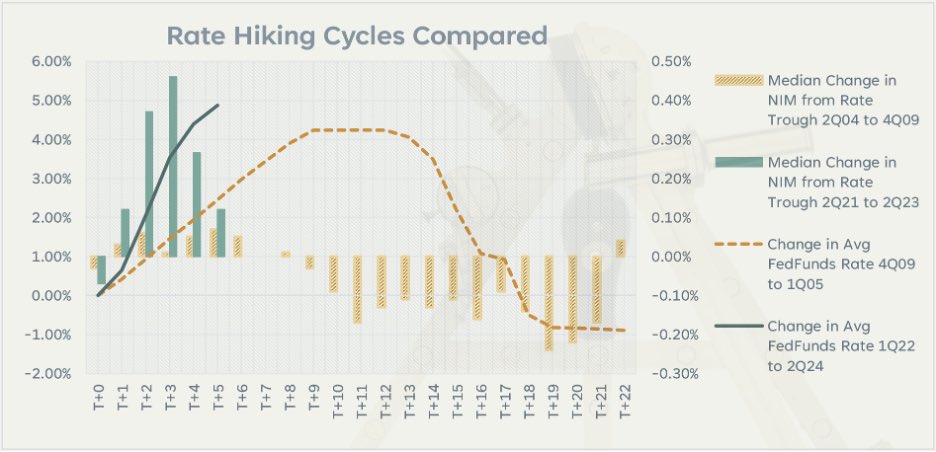

The Rate Cycle and Bank Net Interest margins

- Excellent analysis of how banks got themselves in a bad position this rate-rising cycle.

- So much to learn – capitulation led banks into buying MBS that suffer from negative convexity “trapping” (by rising rates extending weighted average lives) banks into low-yielding assets, not enough capital to take losses, held-to-maturity accounting choice requiring marking everything to market (“tainting the book”), the head fake from a higher portion of floating assets pulling forward net interest margin gains.

- The result – a worrying state of affairs with funding rates having a long way to go hurting earnings for a long time. This isn’t good for the credit outlook either.

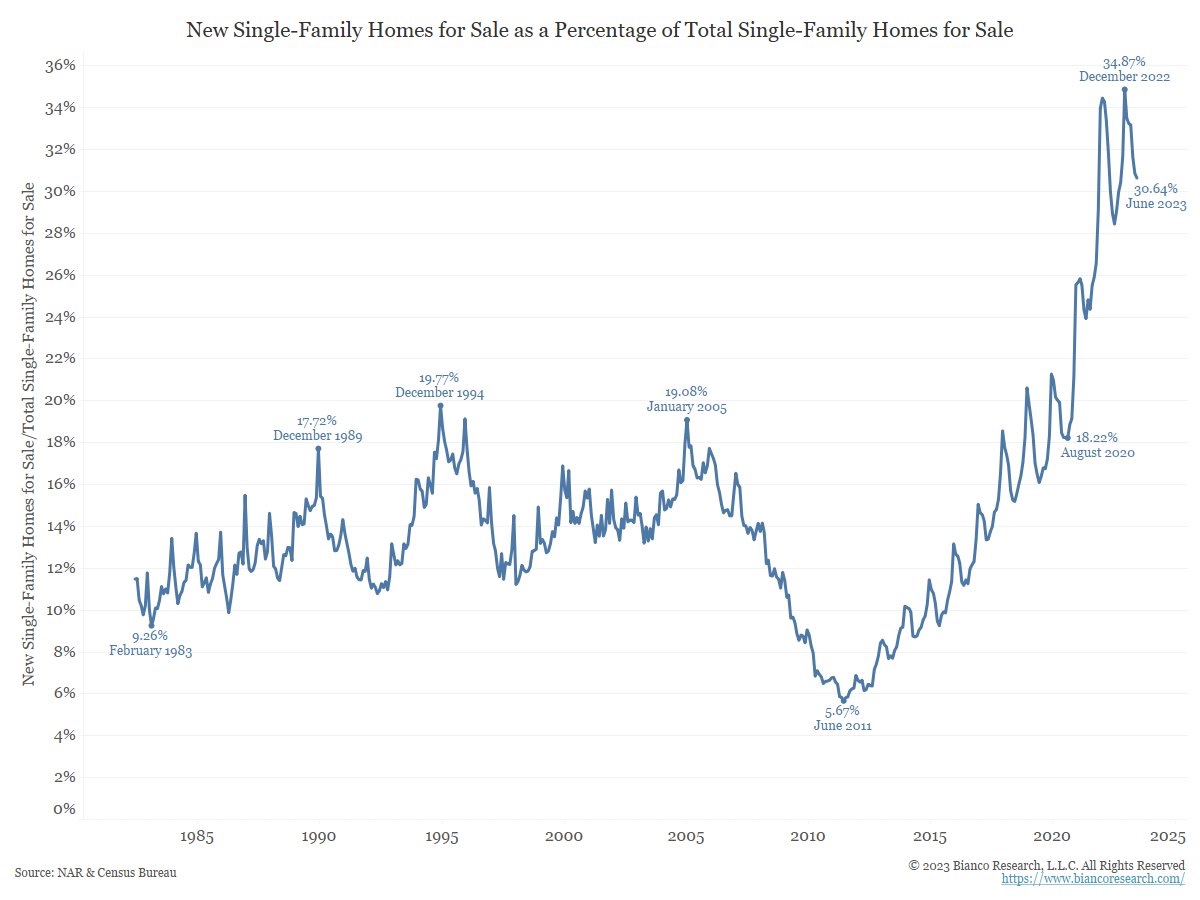

New Homes

- The US housing market supply situation is bad.

- Worsened now as many would-be sellers are staying put on their low fixed 30 year mortgage rates.

- This means newly built homes are stepping in.

Bundling and Unbundling

- Are said to be the two business models in media.

- Has the time for bundling come?

- Disney is planning to charge $35 for its standalone ESPN service.

- As a result, The Information now calculates that after all the prices rises for streaming a permutation of the main “channels” starts to cost $90 per month … the price of Comcast’s cable package.

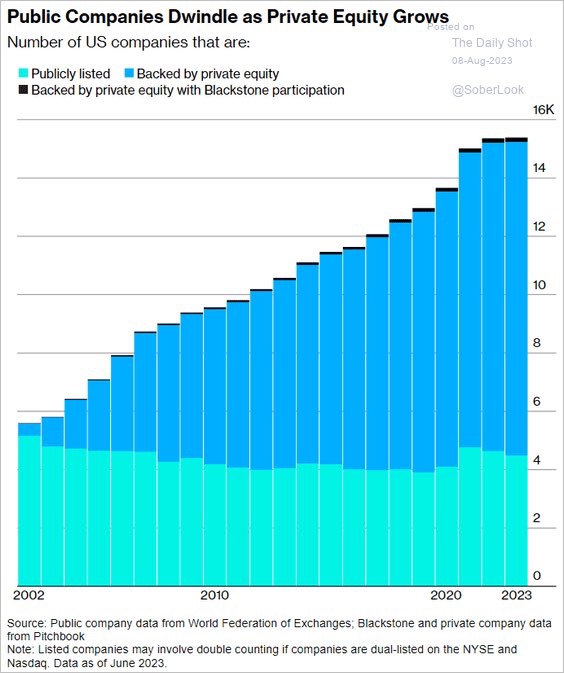

Public dwindling

- The number of public companies is stagnating.

- While private company numbers expand.

- Source: Dailyshot/Redburn.

Positioning

- Positioning, especially among discretionary investors, is down sharply.

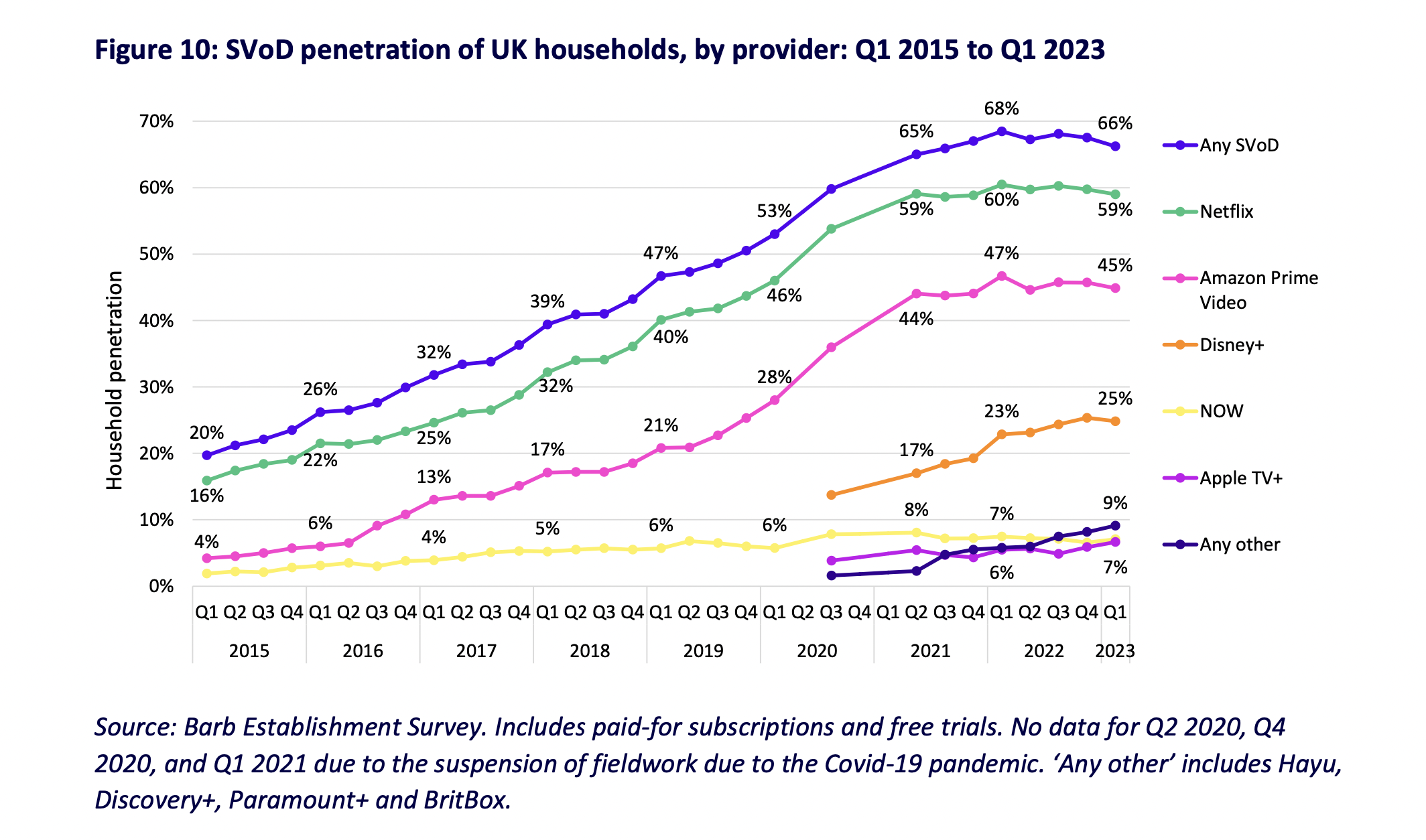

Video Streaming Penetration

- Data for the UK suggests we have hit saturation point.

- “The growth of SVoD household penetration slowed in 2022, and this continued into early 2023 as the rising cost of living, combined with SVoD service price rises, put greater strain on household budgets.“

- Source.

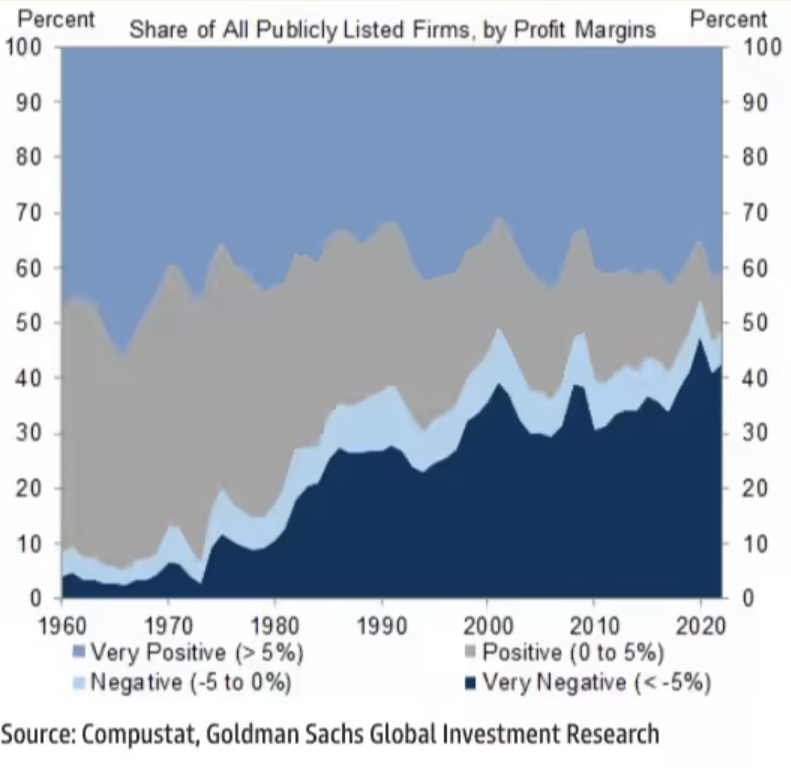

Unprofitable Firms

- The staggering rise over the decades in the proportion of firms that are unprofitable.

ESG Bear Market

- Perhaps it is more of a correction in a bull market?

- Chart showing the number of companies mentioning ESG on earnings calls – lowest number since Q2 2020 levels.

- The drop in peak has been seen in all sectors.

- Part of what is driving this is a record 165 pieces of anti-ESG legislation in the US.

- Source.

AI Semis

- Three excellent questions about the future of semiconductors and AI.

- “First, is AI additive to the semis market? Will purchases of AI chips increase overall demand for semis, or will they merely replace purchases of other chips?

- How will the market for AI Inference semis play out? How big will it be and who will win share?

- Can Nvidia be displaced from the market dominance it currently enjoys?“

- Some view on answers here.

Superfans

- “Averaged across all artist sizes, super listeners make up 2% of an artist’s monthly listeners, but account for over 18% of monthly streams.“

- However, as seen in this chart, this varies widely when compared by artist popularity (measured by number of fans).

- Source: Spotify Fan Study.

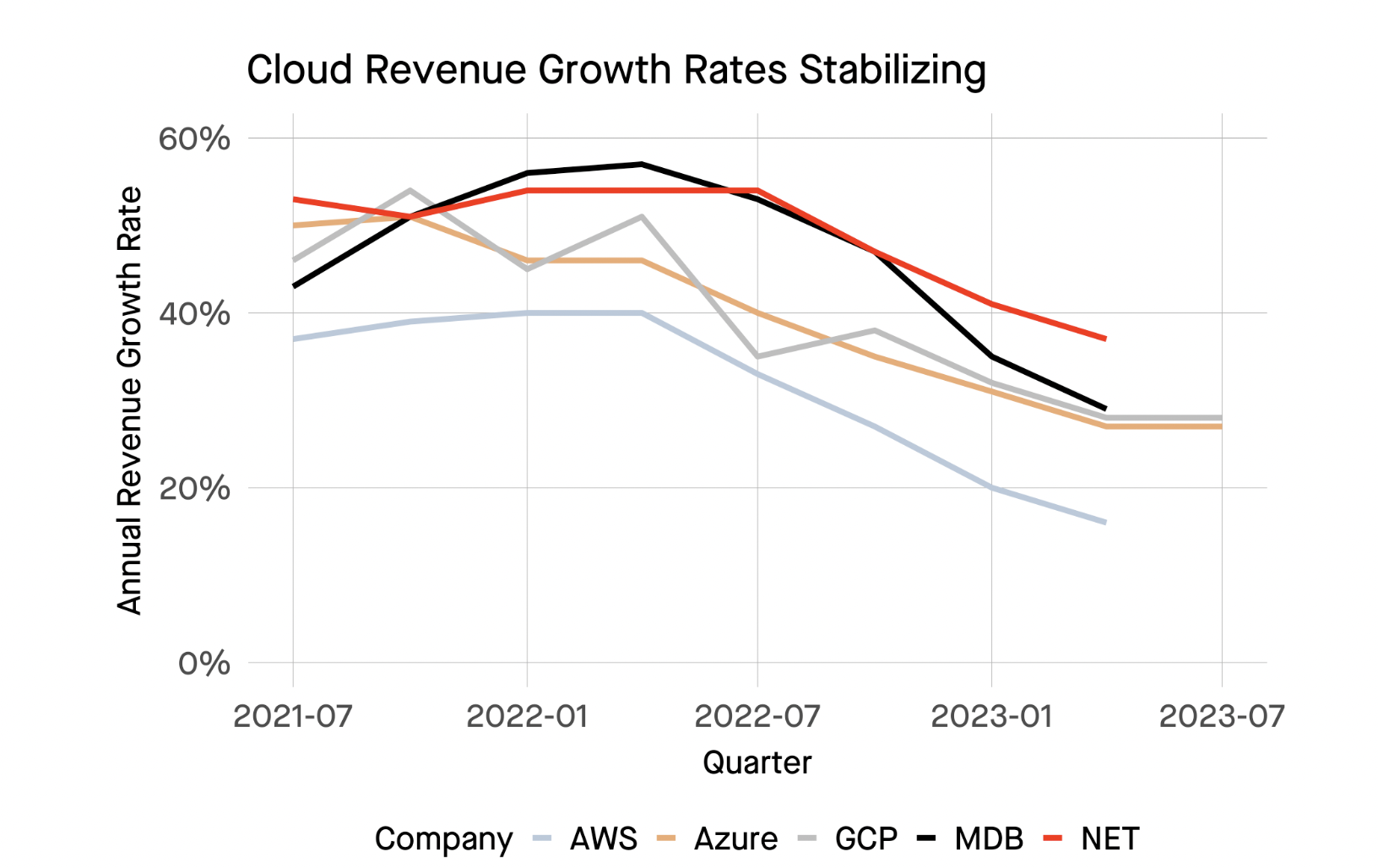

Cloud Bottom

- Has cloud growth bottomed?

- After falling for seven quarters – these growth rates have stabilized.

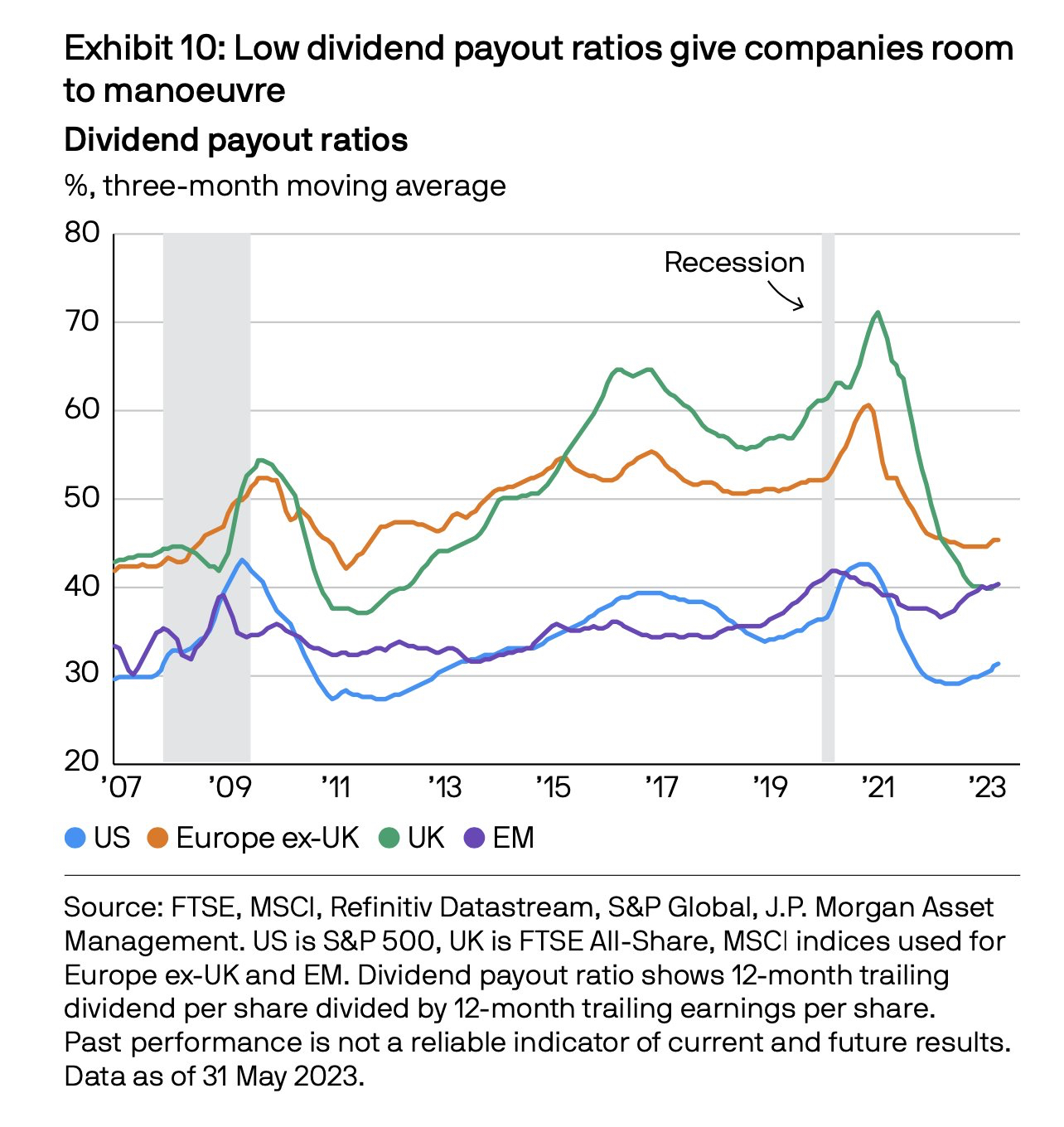

Dividend Payouts

- Interestingly dividend payout ratios have not recovered post covid.

- Source.

Cyclicals vs Defensives and PMI

- PMI has been falling for well over a year now.

- In the first stage, this took down cyclical stocks (measured by the GS cyclical/defensive ratio).

- However, the latter has recently bounced and is near a 12m relative high.

- This is an interesting setup.

- Source: Redburn.

SEO

- Google’s search robots shape and dominate everything online.

- AI is now making it easier to hit everything required to lure these algorithms but at a cost.

FTSE 250 vs. FTSE 100

- FTSE 250 is seen as a gauge of domestic UK stocks while the FTSE 100 is full of international exposure (e.g. oil, mining etc).

- The relative looks like it is bouncing off the Brexit lows.

- Source: Redburn.

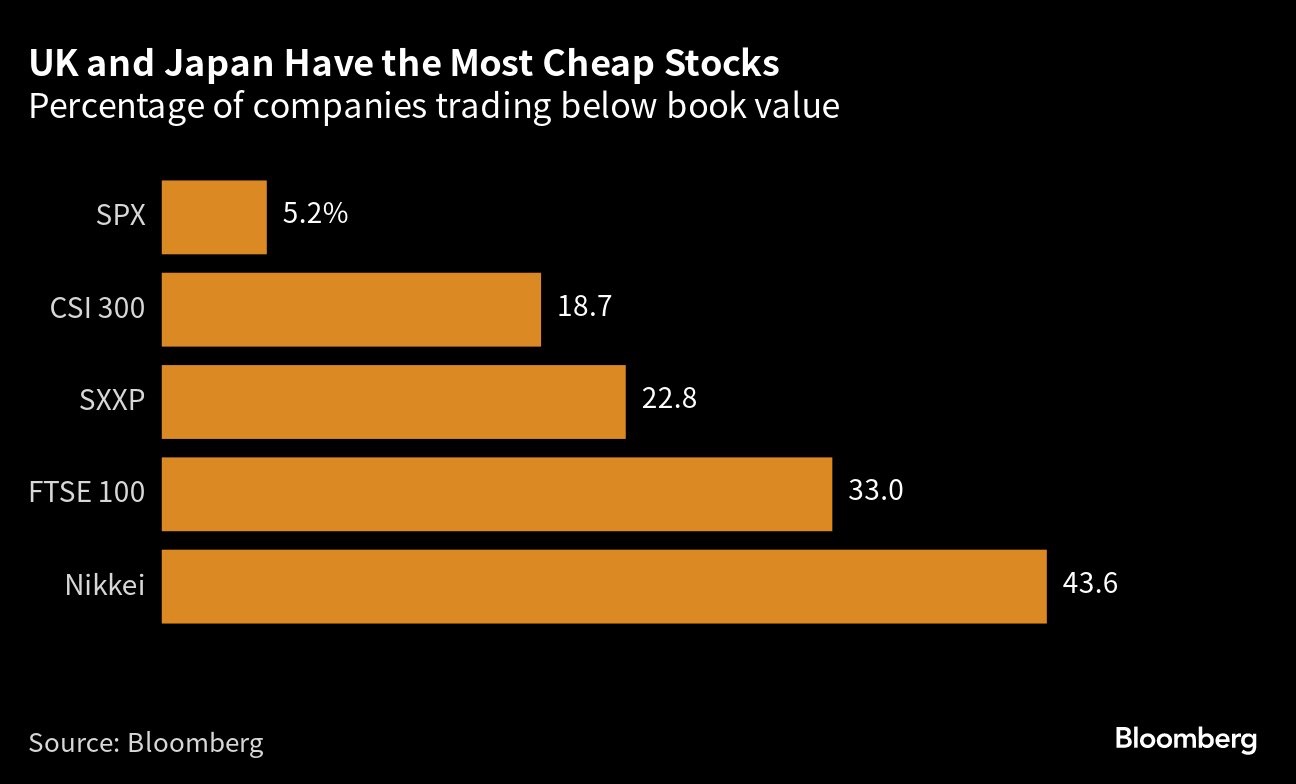

Trading Below Book

- U.K. is not far behind Japan in the percentage of companies trading below book value.

- Will the London Stock Exchange be writing letters soon?

Podcast Business and Spotify

- Podcast advertising leads to pretty good returns for brands.

- “After conducting a study with 250 advertisers and marketers, it says two-thirds (67%) of podcast ad buyers say that every $1 spent on podcasts returns between $4 and $6 for their brands.“

- Yet SPOT is struggling to capture this – why?

- This blog post covers a lot of reasons. For example:

- “[What’s] most misunderstood about Spotify is Spotify doesn’t get to monetize all the podcast content that they have. So in the most recent quarterly earnings report, they say that they had 5 million podcasts on their platform, but 99.9% of those podcasts, Spotify does not get to monetize.“