Skip to content

Interesting chart of sector PMI in Asia. Output fell in all but one sector – Biotech.

We previously wrote about The Athletic here . Big article on the company from GQ including their UK assault. Interesting take on creating content that people actually want.

Comprehensive article about Tik Tok. Worth reading about an asset that went from $1bn valuation in 2017 to $78bn today. 45 minutes spent on it per day on average rivals many other media properties.

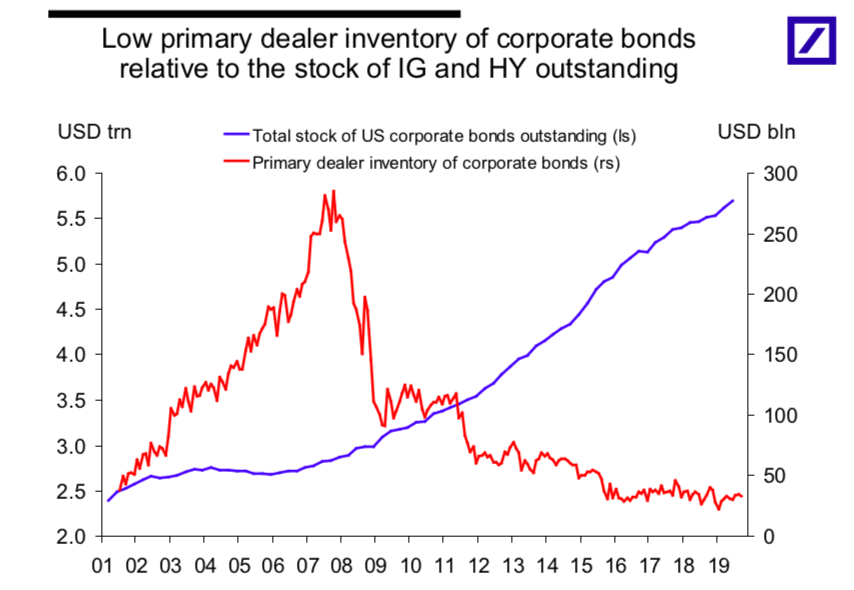

US Bonds outstanding continues to grow. However, inventory of bonds at primary dealers has stayed low since the financial crisis. This doesn’t however capture turnover of inventory – which has risen. Overall this still creates a very risky situation in terms of liquidity. Especially problematic now that Bond ETFs have hit $1 trillion.

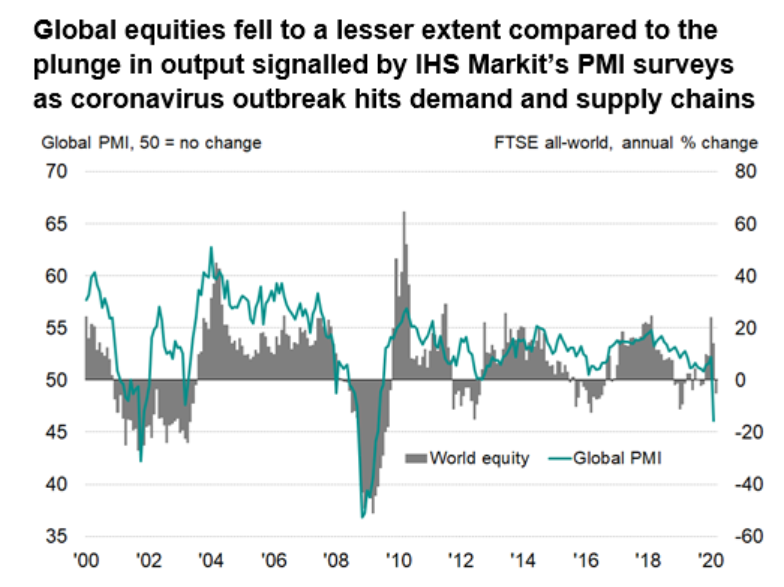

Nice chart from IHS Markit showing PMIs against equities YoY change. Suggests equities not yet reflecting weak PMIs. World Index P/E is about 15x and earnings still need to come down.

Interesting emerging trend of private equity firms buying from themselves – from one generation fund to the next. This used to be one-off transactions but now some are raising funds specifically for this. For example the TA Associates Select Opportunities Fund.

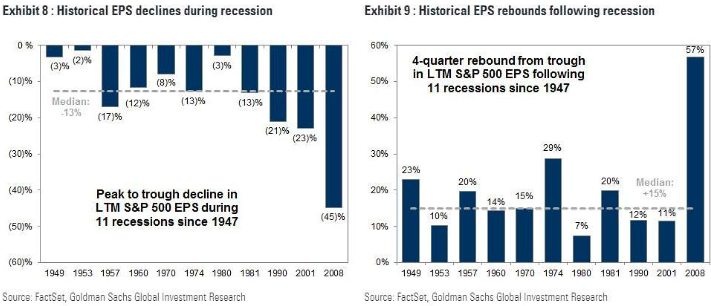

For those trying to model a recession this is a good chart to think about – EPS falls and rises during and after recessions respectively.

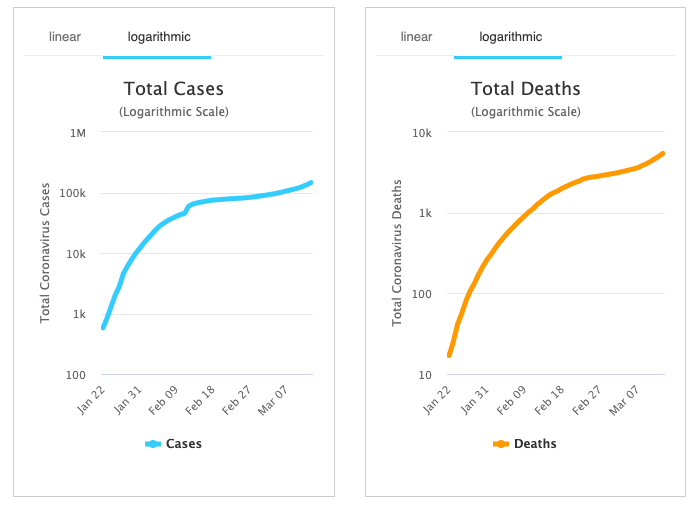

Useful resource to track the data. The WHO Report from their visit to China is also worth reading. For example the CFR (Case fatality rate) dropped to 0.7 after they got to grips with the situation.

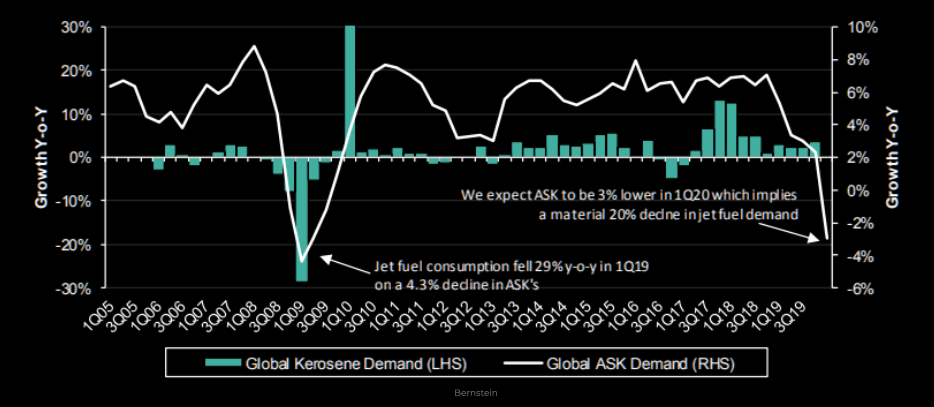

Q1 2020 decline in air travel demand is similar to Q1 2009. Kerosene demand is going to suffer strongly.

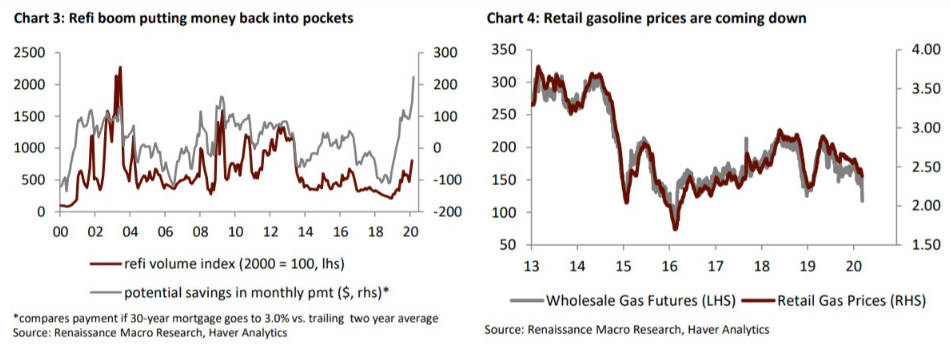

Amid the carnage probably worth remembering the boost the US consumer is getting. Low interest rates = savings on mortgage payments if one refinances. Low oil prices = cheaper to fill up the car.

ISM did a survey of US companies related to coronavirus. 75% of companies reported supply chain disruption. 12.8% have adjusted revenue targets downwards on average 5.6%. Manufacturers in China report operating at 50 percent capacity with 56 percent of normal staff.

Walmart are working on a Prime competitor. It is likely at first to be a rebrand of Walmart Delivery Unlimited ($98 per year for free same day delivery). They then hope to add perks – prescription drugs, gasoline discounts – things Amazon can’t compete with.

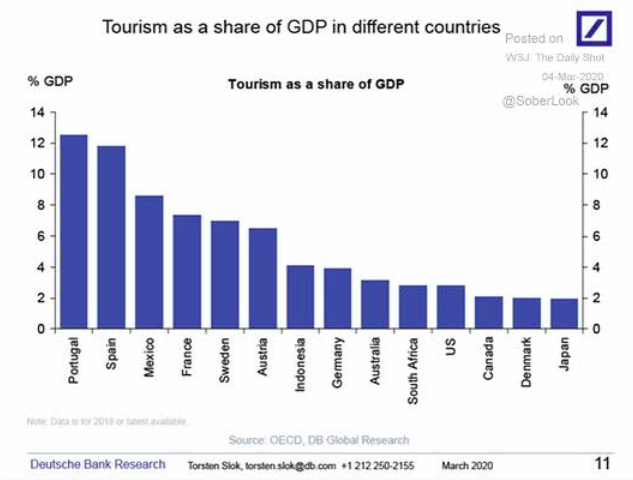

Useful chart during the Covid shutdown – showing Tourism as a % of GDP of various countries.

A recent study has some negative conclusions for the artificial sweetener Sucralose . They found that Sucralose + carbohydrates in healthy people can lead to glucose intolerance increasing risk of diabetes. This is negative for Tate & Lyle . Word of caution – the study had only 60 participants and didn’t control for other food intake during the investigation period. Artificial sweeteners have been seeing a lot of negative research. This is an interesting start-up that instead of making artificial sweeteners is developing a new delivery mechanism for sugar.It has the same taste but 40% less sugar is needed

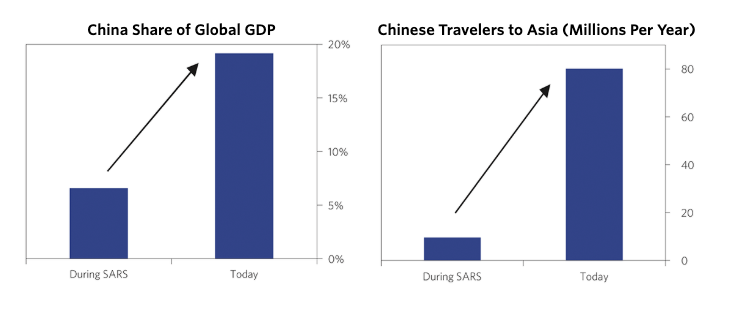

Month old post from Bridgewater on Coronavirus Still has relevant framework to think about the issue. This chart is worth keeping in mind – the economic impact is real and is far larger than during SARS.

UK saw PMIs jump nicely. Also interesting to see the moderation of Brexit worries.

Blog post from Dalio on his thoughts on the virus. Interesting he states that he isn’t an expert and doesn’t know anything. Still worth a read.

Contrasting coronavirus related transcript quotes. “We began to see the impact of the coronavirus on our business in mid-January with occupancy declines gradually spreading from Wuhan to other markets in the Asia Pacific region. In February RevPAR at our hotels in Greater China declined almost 90% versus the same period last year . ” – Marriott International CEO Arne M. Sorenson “we’re seeing that many of the cities around China, people are actually going back to work . We’re seeing some of the shops in Beijing are opening up. When you’re going on the freeway now, you’re actually seeing traffic jams versus, say, two, three weeks ago, where the roads were pretty empty…we started seeing activity pick up a little bit two weeks ago. And then also, this week, we’re also seeing continued pickup. “- Baidu (BIDU) CFO Herman Yu

PMIs , as expected, are showing a lot of weakness. Global PMI is down from 52.2 to 46.1 in February (right hand chart) The supply shock going on is also staggering (left hand chart).

WordPress Cookie Notice by Real Cookie Banner