Skip to content

George Magnus long article on China in 2020 and beyond. “China is certain to experience slower economic growth in the years ahead, but the bigger surprise may be that, in US dollar terms, this narrative could be a factoid because of a fault-line that leads to a precipitous fall in the Yuan. “

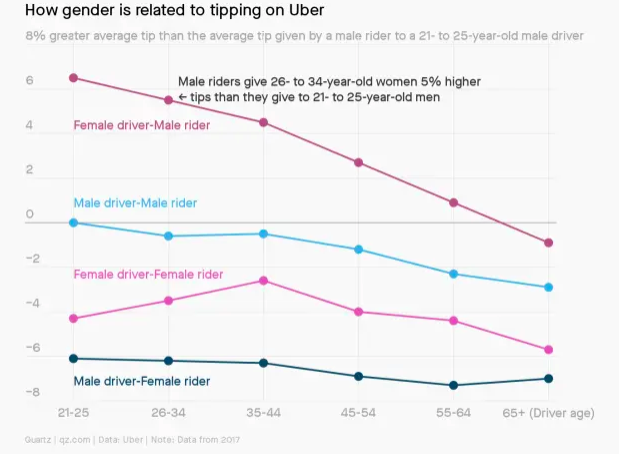

Study of 40 million rides on Uber and tipping behaviour. Summary – 60% of people never tip and only 1% of people always tip. Gender differences are clear as is seen in this chart – young male riders tip young female drivers most.

Venture backed businesses are increasingly pivoting towards taking more principal risk and moving away from acting as brokers. Latest example is Leavy , an Airbnb copy-cat, who are guaranteeing payments for your apartment holiday rental upfront. The real estate sector has seen this already – with companies offering to buy your home directly. As is discussed here this type of model leads to better margins in good times, but is a lot riskier. It feels like late cycle behaviour.

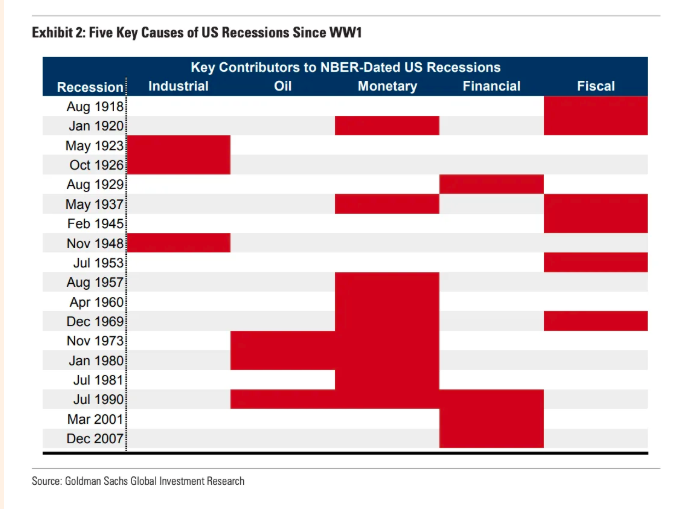

Great table from GS Research showing the main causes of US Recessions since World War I. “A review of the last century of US recessions highlights five major causes: industrial shocks and inventory imbalances; oil shocks; inflationary overheating that leads to aggressive rate hikes; financial imbalances and asset price crashes; and fiscal tightening.”

It is always important in investing to learn from failure. The verge have produced a list of 84 of the last decade’s tech failures. Enjoy and learn!

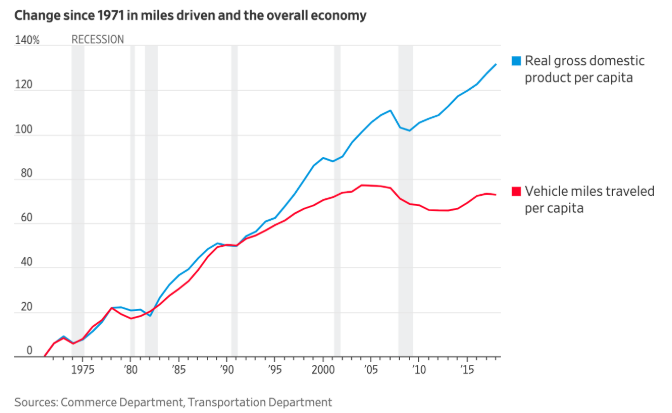

Miles driven used to match economic growth but this started to diverge since the 1990s in the US.

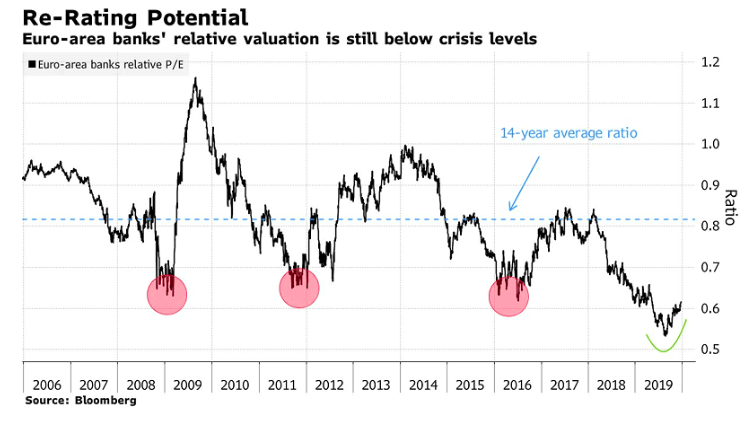

EU bank relative valuation is still below crisis levels. The banks are taking action by cutting costs . Banks are cutting 77,780 jobs this year the most since 2015. 82% of these cuts are originating from European banks with Deutsche bank topping the list with 18,000 through 2022.

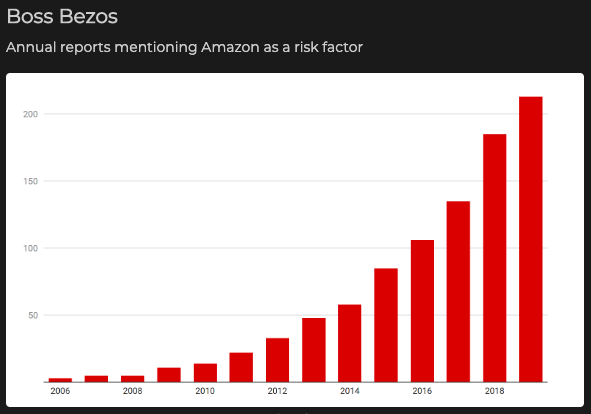

Big read on Amazon from the New Yorker. Worth a read, as Amazon, now the second largest employer in the US, touches more and more companies. This chart shows the growing number of companies mentioning Amazon as a competitive threat in their annual report.

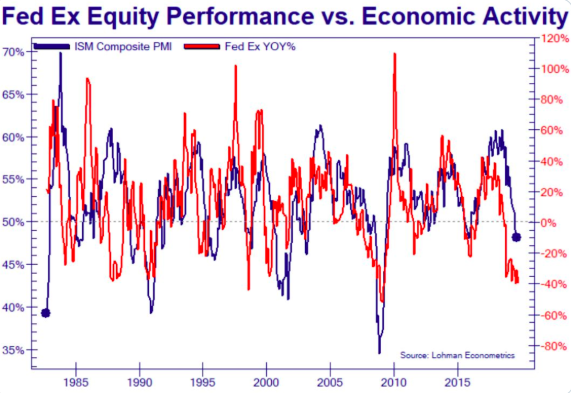

Fedex stock slightly leads/is coincident with the ISM composite. If you think ISM is heading up you should probably be buying Fedex. NB there are non-macroeconomic issues that one needs to consider.

A series of the most popular snippets of 2019 The cost declines of renewable energy compared to conventional energy generation has started to flat line. Real assets are at an all-time low against financial assets. Tech change is exponential. Fertility rates by education is a shocking stat.

Good interview with the always interesting Stanley Druckenmiller . Druckenmiller managed money for George Soros between 1988 – 2000 and was closely involved with the latter’s famous hedge fund bets . He discussed monetary policy and the upcoming US election.

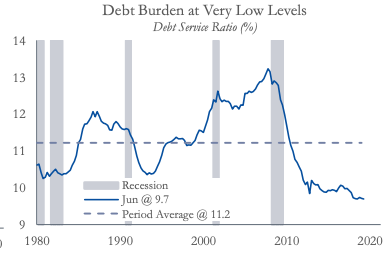

US household debt burden is at very low levels.

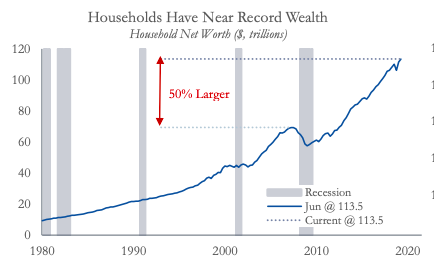

US household wealth is at record levels up 50% since the last peak.

Media is a tough business. This article paints a clear picture of what is going on behind the scenes . All told, according to The Columbia Journalism Review, 3,385 journalists lost their jobs in the past 12 months. With some estimates double this figure. Considering there are only 37,000 people classed as reporters in the US these are huge numbers.

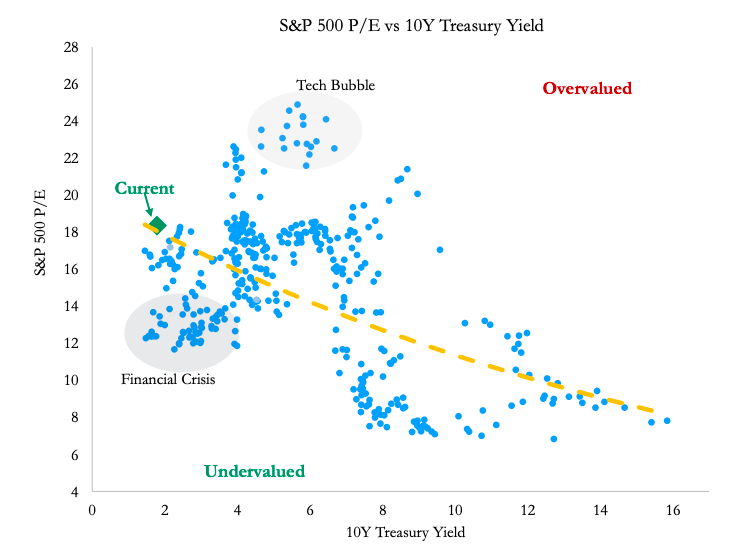

This chart suggests that relative to US Bonds equities are fairly priced. It correlates the S&P 500 P/E ratio vs. 10 Year Treasure Yield. Not a perfect correlation but a good guide.

Really interesting model to calculate customer value . This essential tool is used to understand which bit of revenue comes from what customer cohort and combines four models of behaviour. Important reading for anyone analysing stocks but does require further disclosure (the customer cohort chart) from companies.

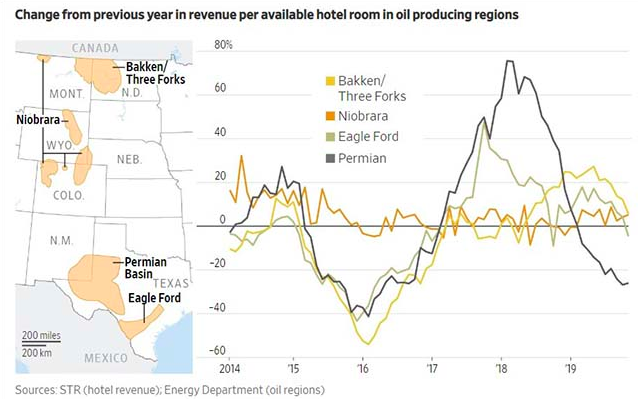

Interesting chart showing hotel room rates year on year in oil producing regions of the US. Shows clearly how investment is coming out of those markets as drillers focus on cash flows. This hurts periphery services likes hotels. h/t 361 Capital

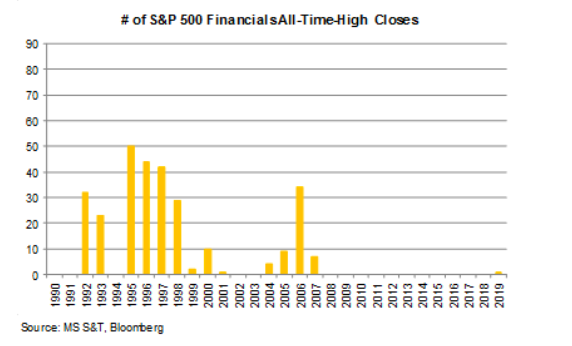

S&P 500 Financials hit all-time high just once in the last 10 years. For reference the S&P 500 index has done so 236 times.

WordPress Cookie Notice by Real Cookie Banner