- A new paper examines the question of why CEO’s allocate precious time to appearing on podcasts.

- Between 2016 – 2020 over a quarter of all S&P 1500 CEOs appeared on at least one podcast.

- This has grown from 6% in 2016 to 22% in 2020.

- They find it tends to be CEO’s of firms more focussed on consumers and ESG.

- It also tends to be CEOs who have strong reputation incentives (looking for a new job, have own twitter account, founders).

Behavioural

Gender and NYRB

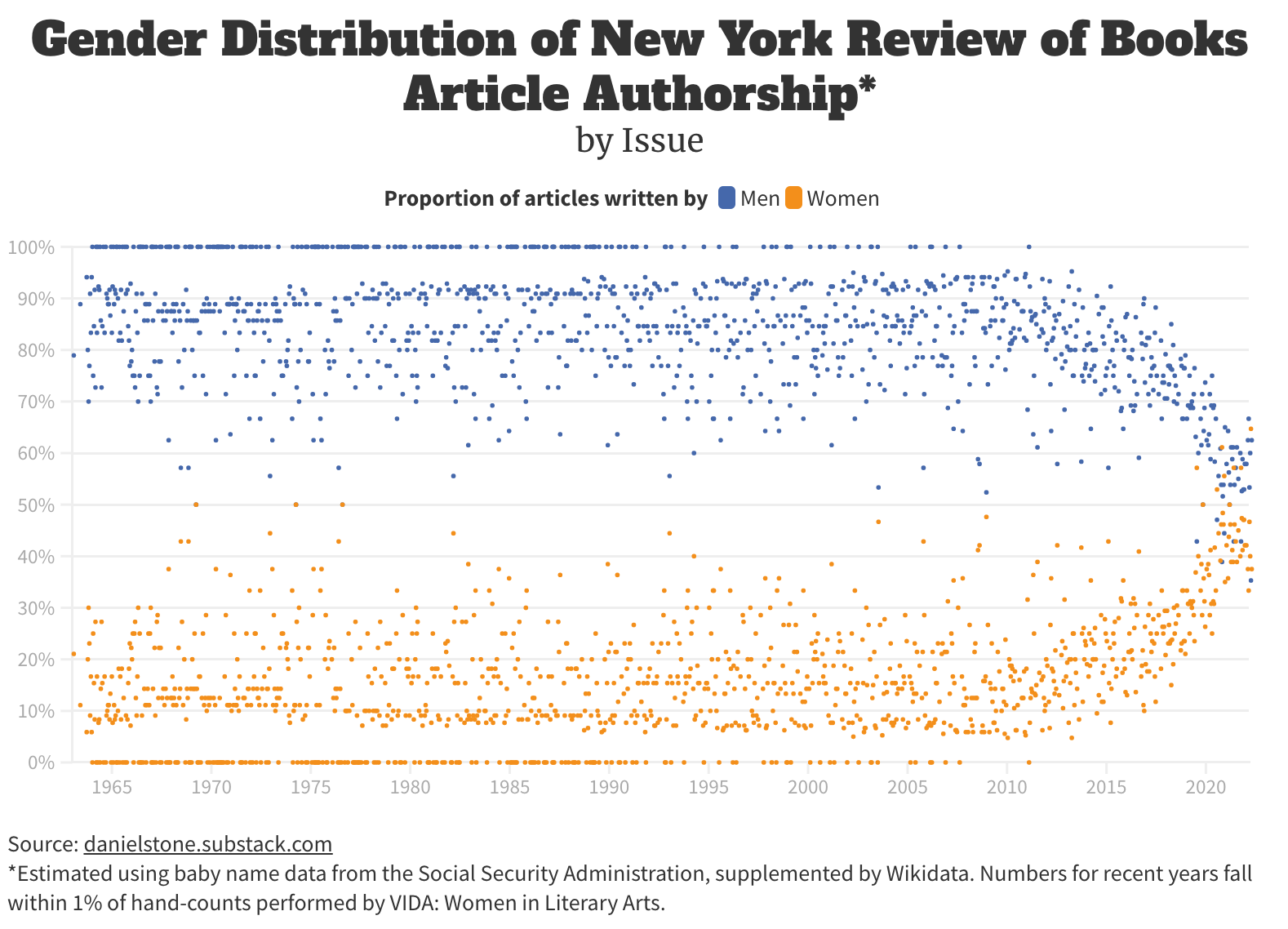

- Interesting chart via The Browser (a must subscribe) plotting each issue of the New York Review of Books (NYRB) by the gender mix of authors.

- “What you are seeing is that there are only twelve issues out of 1228 (1%) to which women have contributed half or more of the articles. Nine of them have appeared within the past three years. Meanwhile there are about 196 issues (16%) to which not a single woman contributed an article.”

- Source (more stats inside).

Thinking Tools

- This is a useful collection of thinking tools and models – presented in a well designed way.

- Several of these are useful to investors – for example the second order thinking advocated by Howard Marks.

Soros and Reflexivity

- Many have heard of George Soros’ idea of reflexivity.

- This idea is important especially as we look at the current market situation.

- To understand it more deeply it is worth reading Soros’ own writing on the subject – especially this piece from the Journal of Economic Methodology (2014).

- Here Soros lays out his full framework which is actually based on two propositions – reflexivity but also human fallibility – together the siamese twins that form “the human uncertainty principle”.

- “My conceptual framework deserves attention not because it constitutes a new discovery, but because something as commonsensical as reflexivity has been so studiously ignored by economists.”

Ten Commandments by Bertrand Russell

1. Do not feel absolutely certain of anything.

2. Do not think it worthwhile to proceed by concealing evidence, for the evidence is sure to come to light.

3. Never try to discourage thinking for you are sure to succeed.

4. When you meet with opposition, even if it should be from your husband or your children, endeavor to overcome it by argument and not by authority, for a victory dependent upon authority is unreal and illusory.

5. Have no respect for the authority of others, for there are always contrary authorities to be found.

6. Do not use power to suppress opinions you think pernicious, for if you do the opinions will suppress you.

7. Do not fear to be eccentric in opinion, for every opinion now accepted was once eccentric.

8. Find more pleasure in intelligent dissent than in passive agreement, for, if you value intelligence as you should, the former implies a deeper agreement than the latter.

9. Be scrupulously truthful, even if the truth is inconvenient, for it is more inconvenient when you try to conceal it.

10. Do not feel envious of the happiness of those who live in a fool’s paradise, for only a fool will think that it is happiness.

Alpha = Pick the Right Stocks

- According to new data analysis – the alpha generated by professional fund managers comes from one major source = research process.

- Inalytics studied 752 portfolios, with at least three year performance data.

- The average alpha was 308bps.

- Stock research added on average 319bps while position sizing led to average alpha loss of 11bps.

- Only 46% of participants delivered any positive alpha from sizing.

- “Stock picking is the primary area in which managers demonstrate skill”

- Source.

Interview Questions

- Google has hard ones.

- But what about the really good ones?

- Reid Hoffman used to ask – “What do you plan to do after you leave Linkedin” – brilliant as it acknowledges that people don’t stay in jobs forever and communicates a support for their vision of the future.

- This one from Marginal Revolution is also great – “What are the open tabs in your browser right now?”

Far from Nick Train

- Brilliant podcast interview with the Nick Train of Lindsell Train.

- Nick has an unique grasp of history when it comes to companies, with a horizon that feels 15-20 years longer than others.

- His recommendation to a younger self, right at the end of the podcast, was also excellent.

103 Bits of Advice

- Another wonderful list from KK (the previous one is here).

- A few of my favourites:

- Half the skill of being educated is learning what you can ignore.

- Ask funders for money, and they’ll give you advice; but ask for advice and they’ll give you money.

- It is the duty of a student to get everything out of a teacher, and the duty of a teacher to get everything out of a student.

The First Financial Engineer

- Robert (Bob) Merton is a giant of modern finance science.

- He is also, as argued by Andrew Lo in this really outstanding talk, the first financial engineer.

- It is in this combination – being both a scientist and engineer that his true astounding contribution surfaces.

- “I believe that a body of knowledge only becomes a science when a corresponding field of engineering emerges from it.”

Compounding

- Compounding is very difficult for human minds to comprehend.

- As the famous riddle goes:

- “Imagine it’s 10:00 AM on a small pond with a single lily pad. If the number of lily pads on the pond doubles every minute, and the entire pond is full of lily pads by 11:00 AM, at what time is the pond half full of lily pads?“

- The answer is here and many get this wrong.

- Morgen Housel brings this up in his conversation with Tim Ferriss (worth a full listen) when he talks about Warren Buffett who’s real talent, when compared to other greats like Jim Simons, was not the level of investment returns (Simons’ are much higher) but their longevity. As he says “if Buffett had retired at age 60, like a normal person might, no one would’ve ever heard of him” (transcript).

Genius

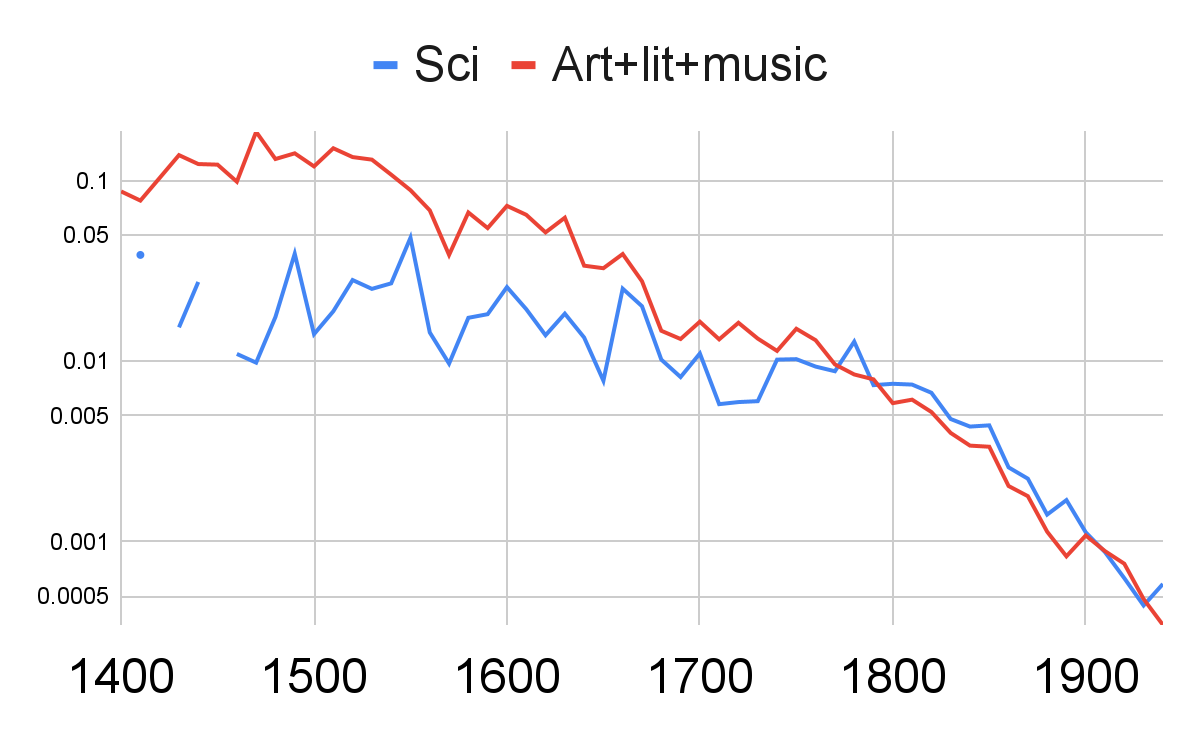

- “Below, we can see the number of acclaimed scientists (in blue) and artists (in red), divided by the effective population (total human population with the education and access to contribute to these fields).”

- Full data source. h/t Astral Codex

Are you Smart enough to work at Google?

- 10, 9, 60, 90, 70, 66 … what is the next number in this series?

- Give it a try.

- This is a question asked during an interview at Google.

- So is this one “You are shrunk to the height of a penny and thrown into a blender. Your mass is reduced so that your density is the same as usual. The blades start moving in sixty seconds. What do you do?”

- Both of these interview questions are taken from this brilliant book which is about difficult interview questions at top companies.

- Once you tried those questions – hit this preview link for the answers.

Dan Loeb

- A belated snippet of this outstanding profile of legendary investor Dan Loeb (I posted his letters several times) – founder of Third Point Capital, a $20bn hedge fund, that compounded over +15% pa for 25 years and pioneered activist investing.

- Third point is named after his favourite surf break in Malibu.

- In the early days of the fund – Loeb posted on forums as “Mr Pink”. Interesting to see further confirmation of media-first investors.

52 Things I learned – 2021 edition.

- We previously covered this brilliant list of 52 things learnt for 2018, 2019 and 2020.

- Here is the 2021 edition – full of gems. A few choice examples:

- “Social media headlines are evolving fast. Since 2017, they’ve got shorter (11 words vs 15 words), and many clickbait phrases like “…will make you…” or “things only … will understand” no longer work.” [BuzzSumo].

- “Adding nature imagery (grass, trees, rainbows) to a pitch document seems to increase the likelihood of investment a little.”

- “Baileys Irish Cream was invented in 45 minutes in 1973 by two ad creatives in Soho.“

Energetic Aliens

- What accounts for the difference between “cognitive stamina and observed levels of energy between individuals“?

- This article is a really interesting start on understanding these so-called “energetic aliens” – people who can work hard, consistently and obsessively.

- Examples include George Church who “after finishing his undergrad in 2 years, worked 100 hour weeks in the lab during grad school, famously getting kicked out due to not attending classes because he was just so absorbed in his research.“

- As well as – Napoleon, Robert Moses, Alexander Grothendieck, Paul Erdos, Isaac Asimov, Honore de Balzac, Danielle Steel and more.

- Absolutely worth a read.

The Monty Hall Problem

- 🚪🚪🚪Three doors.

- Behind one is a car 🚗. Behind the other two are goats 🐐.

- You pick a door. The gameshow host opens another, revealing a goat.

- You can choose to stay with your original choice or switch. What should you do? [Give it a try!].

- The Monty Hall problem became famous when a columnist, Marilyn vos Savant, known as the world’s smartest woman, said you should switch, resulting in hundreds of letters, including from the brightest minds in mathematics, arguing she was wrong.

- This engrossing article by Steven Pinker shines a bright light on this dilemma.

- “People’s insensitivity to this lucrative but esoteric information pinpoints the cognitive weakness at the heart of the puzzle: we confuse probability with propensity.”

- “A propensity is the disposition of an object to act in certain ways. Intuitions about propensities are a major part of our mental models of the world.“

- Probability is “the strength of one’s belief in an unknown state of affairs“

- “The dependence of probability on ethereal knowledge rather than just physical makeup helps explain why people fail at the dilemma.“

- “They intuit the propensities for the car to have ended up behind the different doors, and they know that opening a door could not have changed those propensities. But probabilities are not about the world; they’re about our ignorance of the world. New information reduces our ignorance and changes the probability.“

- Surely there is an analogy here to investing.

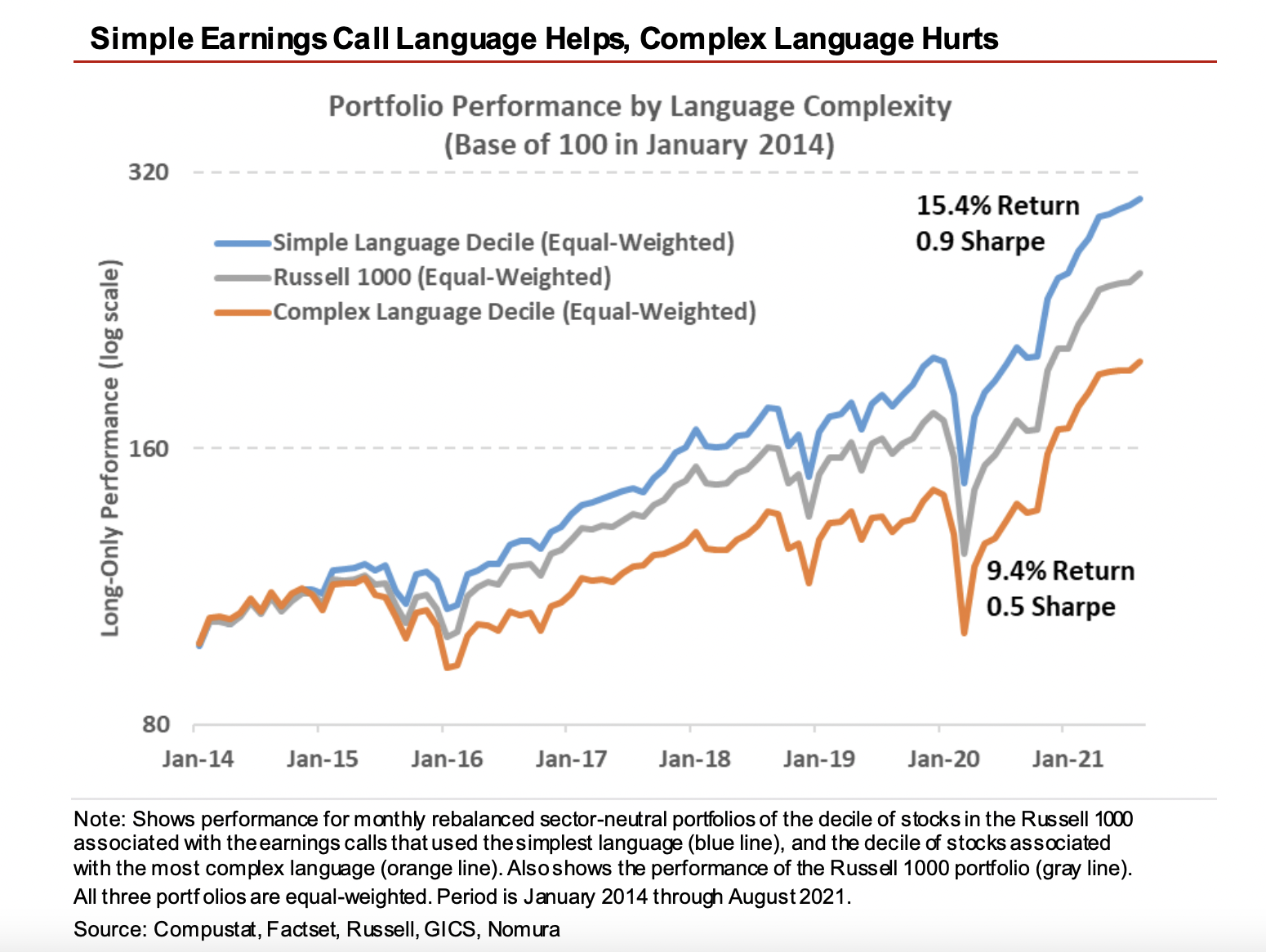

The Value of Simple Language

- The type of language used in earnings calls has a significant impact on stock returns.

- According to Nomura, simple language (as measured using Gunning Fog Index) leads to higher returns and a considerably better Sharpe ratio when compared to complex language.

- This is distinct from earnings call length – which doesn’t correlate to complexity.

- For those interested we previously posted further interesting stats on language in company publications.

Orwell on Writing

- Orwell offers a lot of advice on writing well, a vital skill for any investor, in his essay “Politics and the English Language”

- This post pulls out some of the main “bad habits” to be avoided.

- It matters because writing clearly reveals understanding.

- “You can shirk it by simply throwing your mind open and letting the ready made phrases come crowding in. They will construct your sentences for you — even think your thoughts for you, to certain extent — and at need they will perform the important service of partially concealing your meaning even yourself.”

- “A scrupulous writer, in every sentence that he writes, will ask himself at least four questions, thus: What am I trying to say? What words will express it? What image or idiom will make it clearer? Is this image fresh enough to have an effect? And he will probably ask himself two more: Could I put it more shortly? Have I said anything that is avoidably ugly?“

AntiLibrary

- “Tsundoku (積ん読) is a beautiful Japanese word describing the habit of acquiring books but letting them pile up without reading them.“

- So starts a sublime essay on the antilibrary – “a private collection of unread books”.

- What is a digital version of that?