- 2,300 Americans were asked who they think the best source of financial advice is.

- Right after financial advisor, a staggering proportion said either themselves or their partner.

- Interestingly dead last, at just 3%, was financial professionals in the media.

Behavioural

Investing Aptitude

- “Aptitude is the rate at which you level up, by changing the nature of the problem you’re solving (and therefore how you measure “improvement”). The interesting thing is, this is not purely a function of raw prowess or innate talent, but of imagination and taste.“

- This is a nice way to think about learning in investing – as returns to a particular area diminish, it is key to open a new front.

The Hedgehog and The Fox, revisited

- Many readers will have heard of the famous distinction from the celebrated essay by Isiah Berlin.

- But few have read past the first chapter. Much of the brilliant writing has been overlooked.

- The latest Snippet Blog article is a correction of that omission.

- In Berlin’s words are ideas that give the analogy a much deeper meaning and in the process help guide investors.

The Hedgehog and The Fox, revisited.

“There is a line among the fragments of the Greek poet Archilochus which says ‘The fox knows many things, but the hedgehog knows one big thing’“.

Thus starts one of the most celebrate essays of Isiah Berlin, first given as a lecture at Oxford, then written down and buried in an obscure journal before being resurrected, extended and published. It was an instant hit and to this day is Berlin’s most popular work.

The popularity of the work stems almost entirely from the distinction captured in that first line that “marks one of the deepest differences which divides writers and thinkers, and, it may be, human beings in general“. From its first appearance in 1953, this distinction captured the imagination of the Western world, largely because of its simple and powerful intuition. Everywhere commentators were separating people into hedgehogs, who “relate everything to a single central vision, one system … a single, universal, organising principle“, and foxes, who “pursue many ends, often unrelated and even contradictory, connected, if at all, only in some de facto way … related to no moral or aesthetic principle.”

This categorisation, between monists and pluralists, reached the shores of the investing world at the turn of this century (from what I can tell). It was given a big push by the popularity in those circles of the 2005 book Superforecasting by political scientist Philip E. Tetlock. Tetlock borrowed the analogy heavily as a way to support the key finding of the Good Judgement Project – that foxes (generalists, realists) were better forecasters than hedgehogs (experts, specialists). Forecasting, after all, is crucial for investing. Today a Google Search of “investing hedgehog fox” yields 945,000 results – blog posts, articles and even a book – and none of the results involve erinaceous or vulpine ETFs.

I recently re-read the original essay. It is a master class in writing. Sentences span whole paragraphs and yet have the clarity of an alpine lake. Arguments are beaten home to the drum of nuanced repetition. What is astounding though is that Berlin only dwells on the famous analogy for a mere three pages. The thrust of the essay is dedicated to understanding Count Lev Nikolaevich Tolstoy, who, Berlin hypotheses, was “by nature a fox, but believed in being a hedgehog“. This conflict is dissected on the plate of Tolstoy’s view of history, itself dismissed by critics and ignored by readers.

As I made my way through this essay it dawned on me that many of the commentators in the investment world (and more widely) had very likely never read past the first chapter. Much like Tolstoy’s philosophy of history, the bulk of The Hedgehog and the Fox, has “not obtained the attention it deserves“. This post is a correction of this omission. Like the fox, I don’t seek to construct a unified theory, but rather pull-out interesting observations, as they relate to investing. Ideas that Berlin clearly intended to help us move beyond the surface level of the analogy, thereby deepening its meaning and usefulness.

Investors are actually foxes that want to be hedgehogs

The premise of Berlin’s essay is that Tolstoy was a fox but wanted to be a hedgehog. It strikes me that investors, the good ones at least, are all in fact exactly like this.

Foxes are good at pointing out flaws in other’s theories (especially those of hedgehogs). Tolstoy was in this respect perhaps the fox. At his hand “pretenders are exposed and struck down one by one” with an intellectual force never seen before (or since). A good investor must posses this quintessential fox’s quality, the ability to take down other’s ideas.

In Tolstoy’s ideas on history we can see this process at work. He strongly rejected the scientific approach to history. There are no dependable laws to be discovered, no underlying causes and hence predictions are impossible. Historians who attempt this, commit “a gross error” by setting emphasis in a world where determinants are vast and varied and, consequently, no one individual, no matter how powerful, can guide destinies.

Yet all this intellectual chipping isn’t destruction – it has a purpose. Tolstoy believed stronger than anyone else that a core exists, the answer is out there. He wanted to be a hedgehog. Yet, this can only be achieved if one walked the path of the fox. Precisely in taking down his opponents the answer might eventually reveal itself. “He continued to kill his rival’s rickety constructions with cold contempt, as being unworthy of intelligent men, always hoping that the desperately-sought-for ‘real’ unity would presently emerge from the destruction of the shams and frauds“. A good investor embodies this – they are compelled by a sense that the truth is out there, although they can’t grasp it. The path to that truth is argument. Like a sculptor who starts with a sheer slab of stone, every chip brings one closer to the truth.

Does the essay give any clue what the truth might be?

History, in Tolstoy’s eyes, is only a blank succession of unexplained events, an “inexorable process”, “a thick, opaque, inextricably complex web of events, objects, characteristics, connected and divided by literally innumerable unidentifiable links – and gaps and sudden discontinuities too, visible and invisible“. One could just as easily use this description for the march of financial markets.

Tolstoy believed those who fail to face the “inexorable historical determinism” miss the most important thing – the “inner events“, “the most real, the most immediate experience of human beings“. In elevating history to political and public events, individuals are blurred. There is stark contrast between “real life – the actual, everyday, ‘live’ experience of individuals with the panoramic view conjured up by historians“. This is ironic because “no one in the actual heat of the battle can begin to tell what is going on” – something Tolstoy makes clear time and time again in his great historic novel War and Peace.

So to understand what is going on around us we must look to the indivisible units – human beings. This is something all great investors know – that companies and markets consists of people. In order to piece together history, and the markets, these units must be integrated. How? “This is the integrating of infinitesimals, not, of course, by scientific but by ‘artisitic-psychological means‘”. In other words, some of the answer lies in understanding human psychology. It is not that we must wholly reject scientific approaches but that we must give the ‘inner’ world equal prominence as the ‘outer’. Tolstoy’s preferred tool here was the novel, and it does beg the question why more novels exploring the inner lives of ordinary workers, market participants or consumers aren’t written.

What makes this integration so difficult is that we simultaneously live inside it. The very tools we use to understand the world, are what we are trying to understand. “Our thoughts, the terms in which they occur, the symbols themselves, are what they are, are themselves determined by the actual structure of our worlds”. Investors live inside the market they are trying to conquer.

Berlin offers some advice here – “for we ourselves live in this whole and by it and are wise only in the measure to which we make our peace with it“. In short, investors must come to terms with their own psychology. This reminds me of another beautiful quote by Huxley “We cannot reason ourselves out of our basic irrationality. All we can do is to learn the art of being irrational in a reasonable way.“

By reading past the title and the first few pages, readers are rewarded with a much deeper understanding that can be carried over to other domains. A fox who wants to be a hedgehog is a more appropriate characterisation of a good investor than the oft drawn distinction between the two animals. It is better to argue one’s way to the truth, than to try to construct it. In the same way, even Tolstoy’s own theory of history holds lessons for investors – to look past the panoramic view and focus instead on the indivisible units – human beings. It is in understanding human psychology, including one’s own, that some of the mysteries of markets can be unlocked.

All is not rosy though. A fox that dreams of being a hedgehog, is a tormented existence. The stronger the instinct of the fox, the stronger the desire to be a hedgehog. Berlin captures this right at the end where he describes the great thinker, and one can’t help but feel the great investor as well, as:

“at once, … omniscient and doubting everything, cold and violently passionate, contemptuous and self-abasing, tormented and detached”.

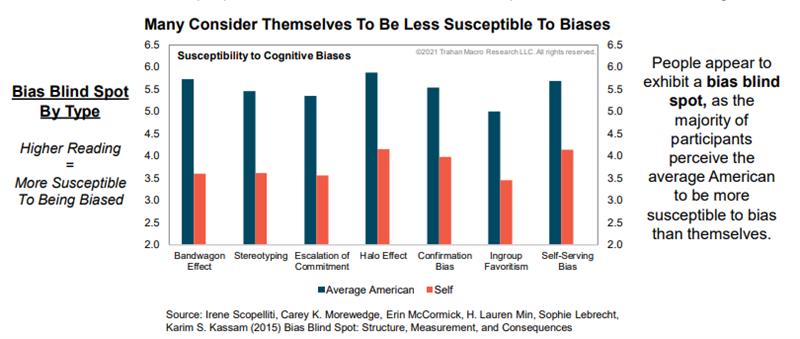

Bias Blind Spot

- “People exhibit a bias blind spot: they are less likely to detect bias in themselves than in others.“

- “Most people recognise that other people are likely to be biased when judging an attractive person, for example, but think that their own judgment of an attractive person is unaffected by this type of halo effect.“

- Clearly, the majority of people cannot be less biased than their peers – hence the blindspot.

- Source.

Psychology of Human Misjudgement

- An investing classic – must read talk by Charlie Munger – rewritten in 2005.

- In it he covers 25 biases that all investors should know.

Luck

- How to make your own luck. Lots of interesting ideas inside re biases and the “serendipitous mindset”.

- Key elements are being “open and alert to the unexpected” and being “prepared”.

Being Negative

- This is an eye-opening essay on The Art of Negativity with useful read-across to investing.

- This was an interesting result from research – “there is a clear “asymmetry in the way that adults use positive versus negative information to make sense of their world; specifically, across an array of psychological situations and tasks, adults display a negativity bias, or the propensity to attend to, learn from, and use negative information far more than positive information.“”

- A nice quote – “An optimist believes we live in the best possible of worlds. A pessimist fears that this is true.”

Art of Reading

- This is a neat post on the art of reading well.

- Without giving too much away there is a lot to be learnt about how to read effectively.

- One idea that really struck home was, as one reaches the fourth and final level of reading, synoptic, connections start to form.

- Then, as Steve Jobs said, “Creativity is just connecting things”.

Power of a Story

- A really nice piece about the power of stories in academic research, investing.

- And even innovation as seen in these great extracts from Rory Sutherland’s Book:

- “Making a train journey 20 per cent faster might cost hundreds of millions, but making it 20 per cent more enjoyable may cost almost nothing.“

- “The Uber map is a psychological moonshot because it does not reduce the waiting time for a taxi but simply makes waiting 90 per cent less frustrating.“

- “It seems likely that the biggest progress in the next 50 years may come not from improvements in technology but in psychology and design thinking. Put simply, it’s easy to achieve massive improvements in perception at a fraction of the cost of equivalent improvements in reality.“

Lessons from Gian-Carlo Rota

- Twelve lessons from the famous mathematician and lecturer.

- They relate largely to teaching and writing mathematics but, with Farnam Street’s magic commentary, they transcend to much of life.

- A nice quote from Feynman as well – “Richard Feynman was fond of giving the following advice on how to be a genius. You have to keep a dozen of your favorite problems constantly present in your mind, although by and large they will lay in a dormant state. Every time you hear or read a new trick or a new result, test it against each of your twelve problems to see whether it helps. Every once in a while there will be a hit, and people will say: ‘How did he do it? He must be a genius!’”

Parable of the Pottery Class

- “The ceramics teacher announced on opening day that he was dividing the class into two groups. All those on the left side of the studio, he said, would be graded solely on the quantity of work they produced, all those on the right solely on its quality. His procedure was simple: on the final day of class he would bring in his bathroom scales and weigh the work of the “quantity” group: fifty pounds of pots rated an “A”, forty pounds a “B”, and so on. Those being graded on “quality”, however, needed to produce only one pot – albeit a perfect one – to get an “A”. Well, came grading time and a curious fact emerged: the works of highest quality were all produced by the group being graded for quantity. It seems that while the “quantity” group was busily churning out piles of work – and learning from their mistakes – the “quality” group had sat theorizing about perfection, and in the end had little more to show for their efforts than grandiose theories and a pile of dead clay.” (Source).

Probability Errors

- “Gaining a better understanding of probability will give you a more accurate picture of the world and help you make better decisions. “

- Great list of common mistakes associated with not understand how probability works. A must read.

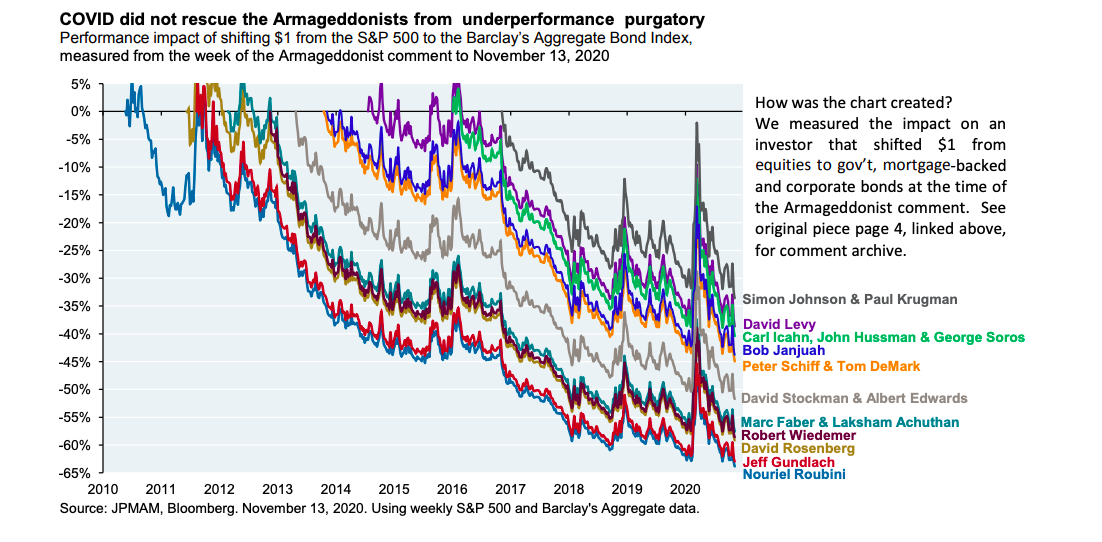

Armageddonists

- Armageddonists (“the market-watchers, forecasters and money managers whose apocalyptic comments spread like wildfire in print and online financial news”) haven’t been bailed out from underperformance by COVID in 2020.

Forecasting

- A nice post reminding us, with supporting studies, that most forecasting isn’t very good whether it is recessions, GDP, interest rates, exchange rates etc.

- And yet we persist – “To understand the extent of our forecasting fascination, I analysed the websites of three management consultancies looking for predictions with time frames ranging from 2025 to 2050. Whilst one prediction may be published multiple times, the size of the numbers still shocked me. Deloitte’s site makes 6904 predictions. McKinsey & Company make 4296. And Boston Consulting Group, 3679. In total, these three companies’ websites include just shy of 15,000 predictions stretching out over the next 30 years.“

Ten Attributes of Great Investors

- A classic by Michael Mauboussin.

- Many of the ideas are familiar and simple but nonetheless powerful.

- h/t Safal Niveshak.

DARPA and Innovation

- It helps to study organisations that have been innovating consistently.

- One such organisation is DARPA.

- Since 1958, it has been a driving force in the creation of weather satellites, GPS, personal computers, modern robotics, the Internet, autonomous cars, and voice interfaces, to name a few.

- This fascinating and thorough article, or more precisely a self describe “collection of atomic notes”, attempts to explain why DARPA works in search of creating a private sector funded “ARPA”.

- The section on program managers is worth a look as the characteristics described there are also those that make good investment analysts.

Lessons

- An absolutely brilliant ten bits of advice by Milton Glaser, the famous graphic designer. Each one a gem.

- “It makes me nervous when someone believes too deeply or too much. I think that being skeptical and questioning all deeply held beliefs is essential. Of course we must know the difference between skepticism and cynicism because cynicism is as much a restriction of one’s openness to the world as passionate belief is. They are sort of twins.”

Forecasting is Hard

- Phil Tetlock has spent 30 years studying forecasting and has written a must read book on the subject.

- It turns out that there are characteristics that make a better forecaster. One needs to be like a fox (these ideas are explained in detail here).

- This is a fascinating article that, in five steps, brings to life Tetlock’s work in the current Covid environment.

Poker Psychology

- As opposed to some video games, where probabilities are tweaked to psychologically hook players, in poker “the probabilities are what they are: they don’t accommodate. Instead, they force you to confront the wrongness of your intuitions if you are to succeed. “Part of what I get out of a game is being confronted with reality in a way that is not accommodating to my incorrect preconceptions,””

- This from a brilliant article by a psychologist learning to play poker.

- Our beliefs are skewed because small samples don’t mirror large ones, that this leads to the emergence of the gamblers fallacy, but perhaps this bias actually has positive advantages through an internal locus of control and our understanding of luck.

- All have clear relevance to investing.

- For a full 1 hour podcast from the author – head here.