Skip to content

- Looks like a step change – should be positive for active management.

- Source: Blackrock.

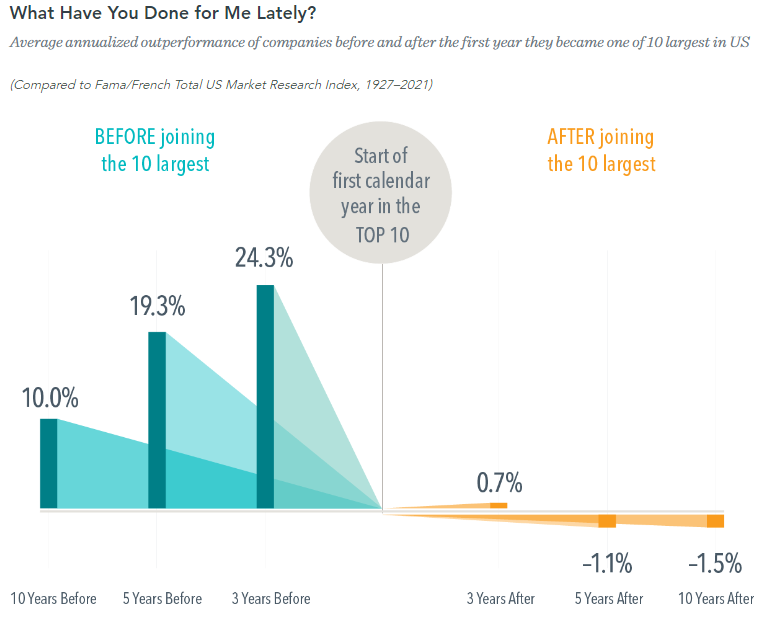

- This chart “shows the average annualized outperformance of stocks after they’ve become one of the largest top 10 in the S&P 500.”

- “As you can see, the top 10 largest companies underperform by an average of -1.5% over the subsequent 10 years.”

- Source.

- Has been on a bit of a tear recently (TOPIX +19%).

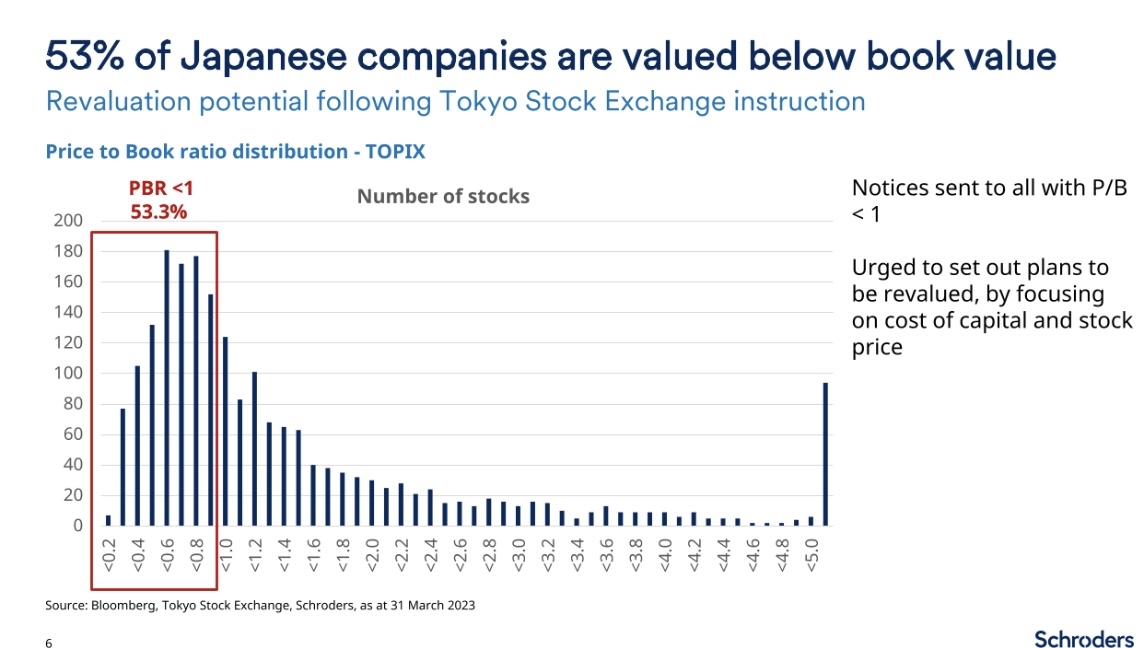

- It really is a stand-out market – 53% of companies trade below book value.

- Change is afoot – Tokyo stock exchange sent letters to all of these urging them to set concrete plans to reverse this valuation.

- Source: Schroders.

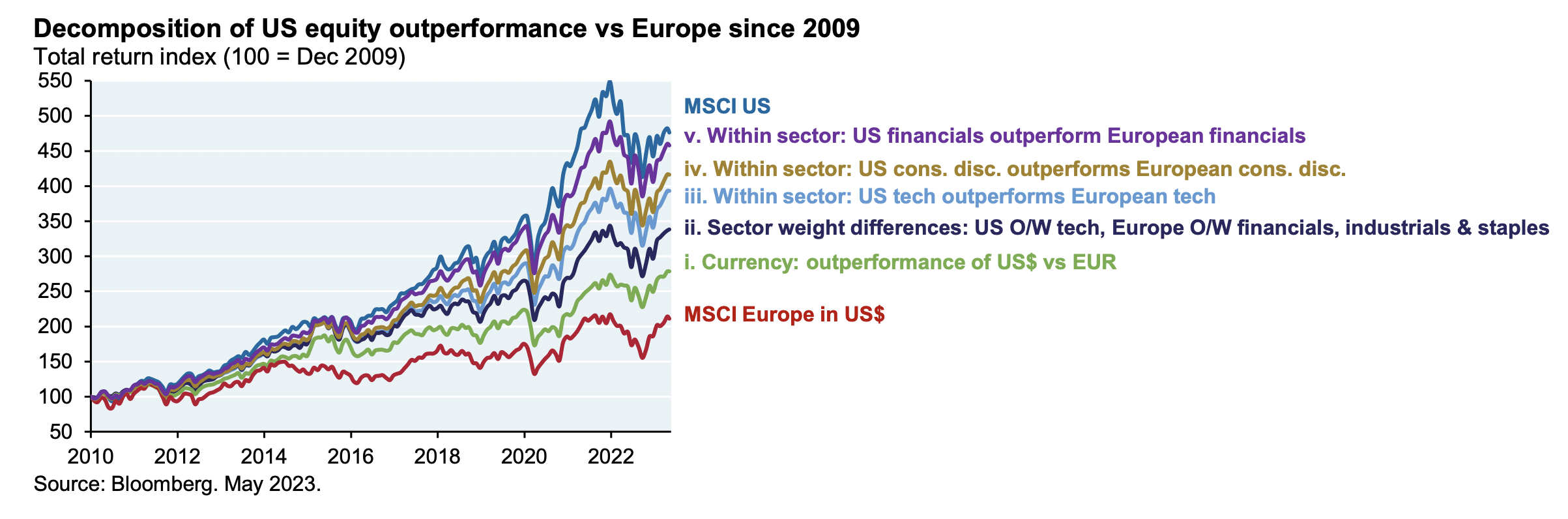

- Chart decomposing the outperformance of MSCI US vs. MSCI EU from 2010 until last year.

- Source.

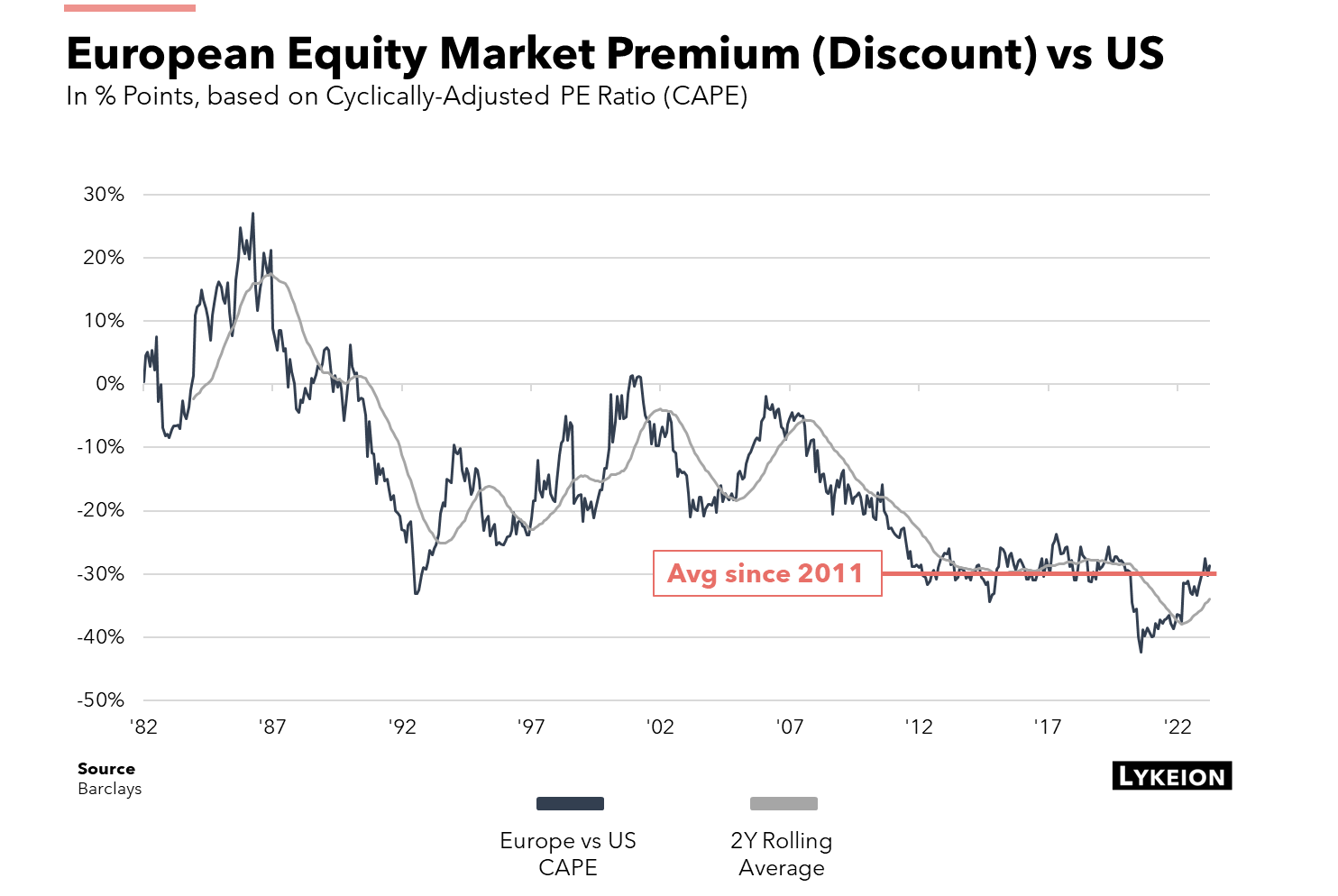

- After a recent rally, the discount is back to its post-2011 average.

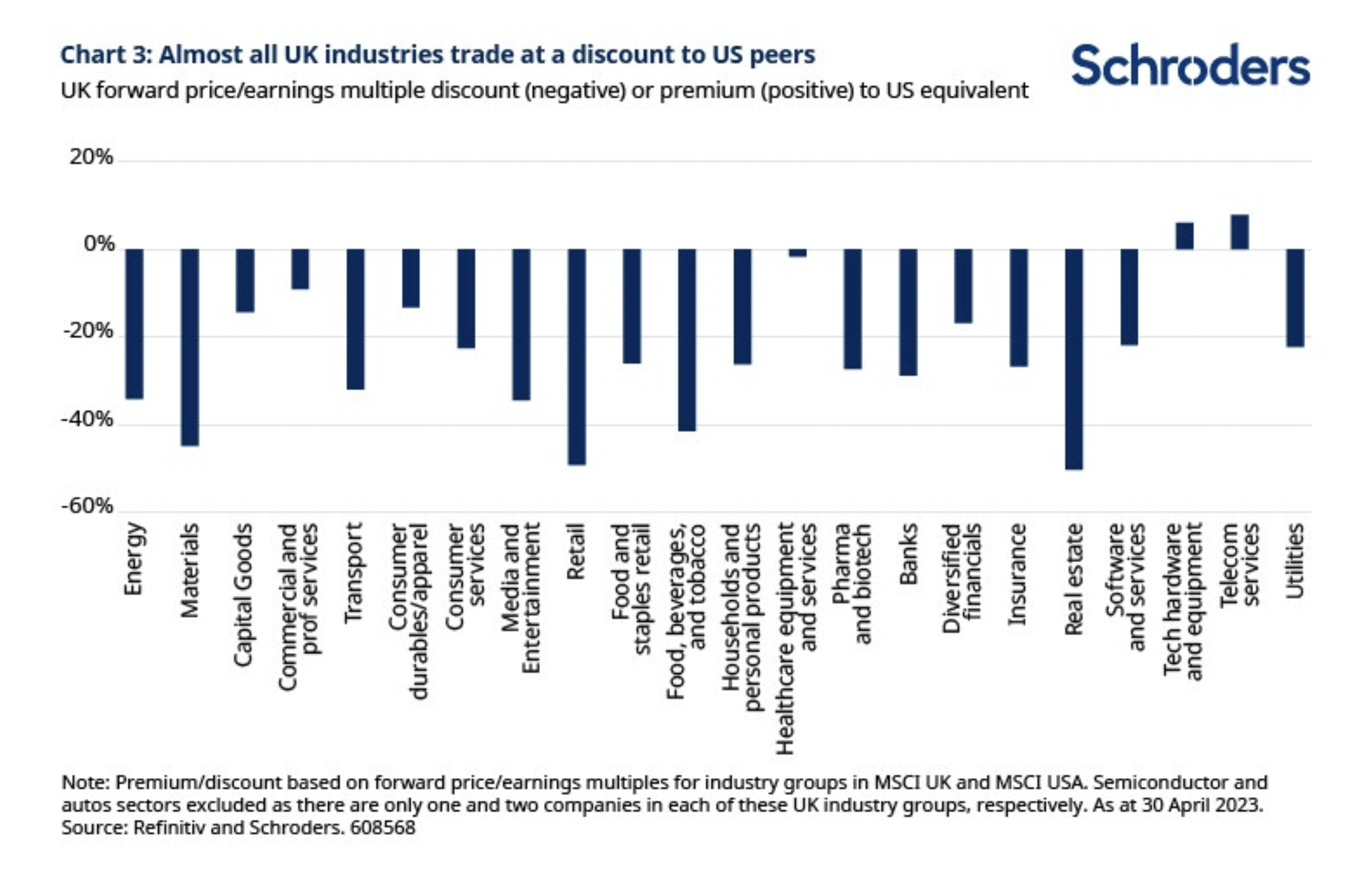

- A nice set of six charts showing how cheap the UK is.

- The UK trades at a near-record 40% forward P/E discount to the US and 20% vs the EU.

- Almost every industry, as seen in the chart, is cheaper than the US.

- A topic Snippet has covered a few times.

- For example – (1) how to adjust valuation for intangible assets (here) and (2) why some people confound their importance (here).

- This is a great webcast with Michael Mauboussin and Kai Wu on the topic – (requires sign-up; grab a free two-week trial here).

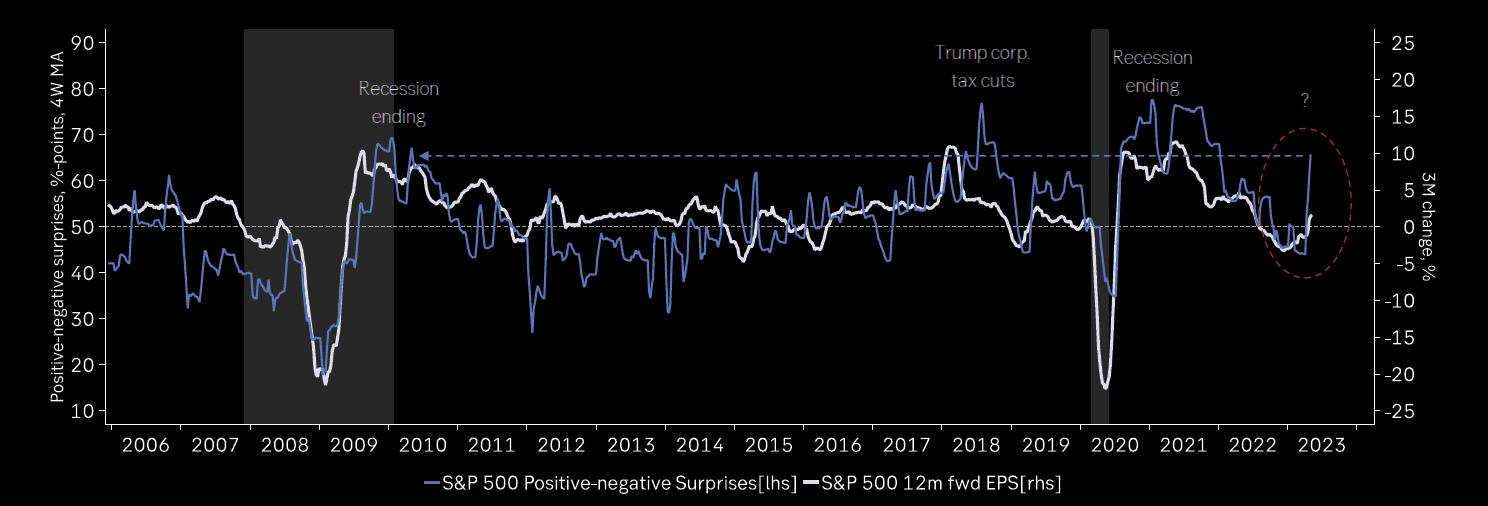

- Rare to see this level of positive surprises when a recession is expected.

- Source: themarketear.com.

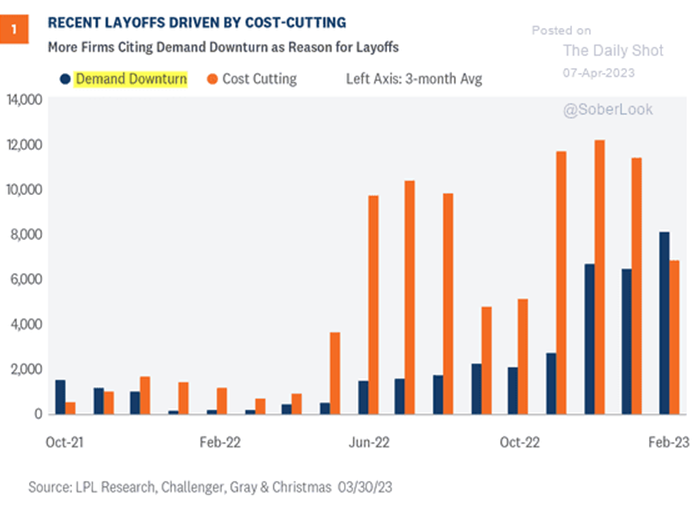

- “Demand downturn” overtook “cost cutting” as a key reason for layoffs.

- h/t DailyShot.

- Really something that QQQ relative to Russel 2000 (IWM) is almost back to 2021 peak with record speed.

- Source: themarketear

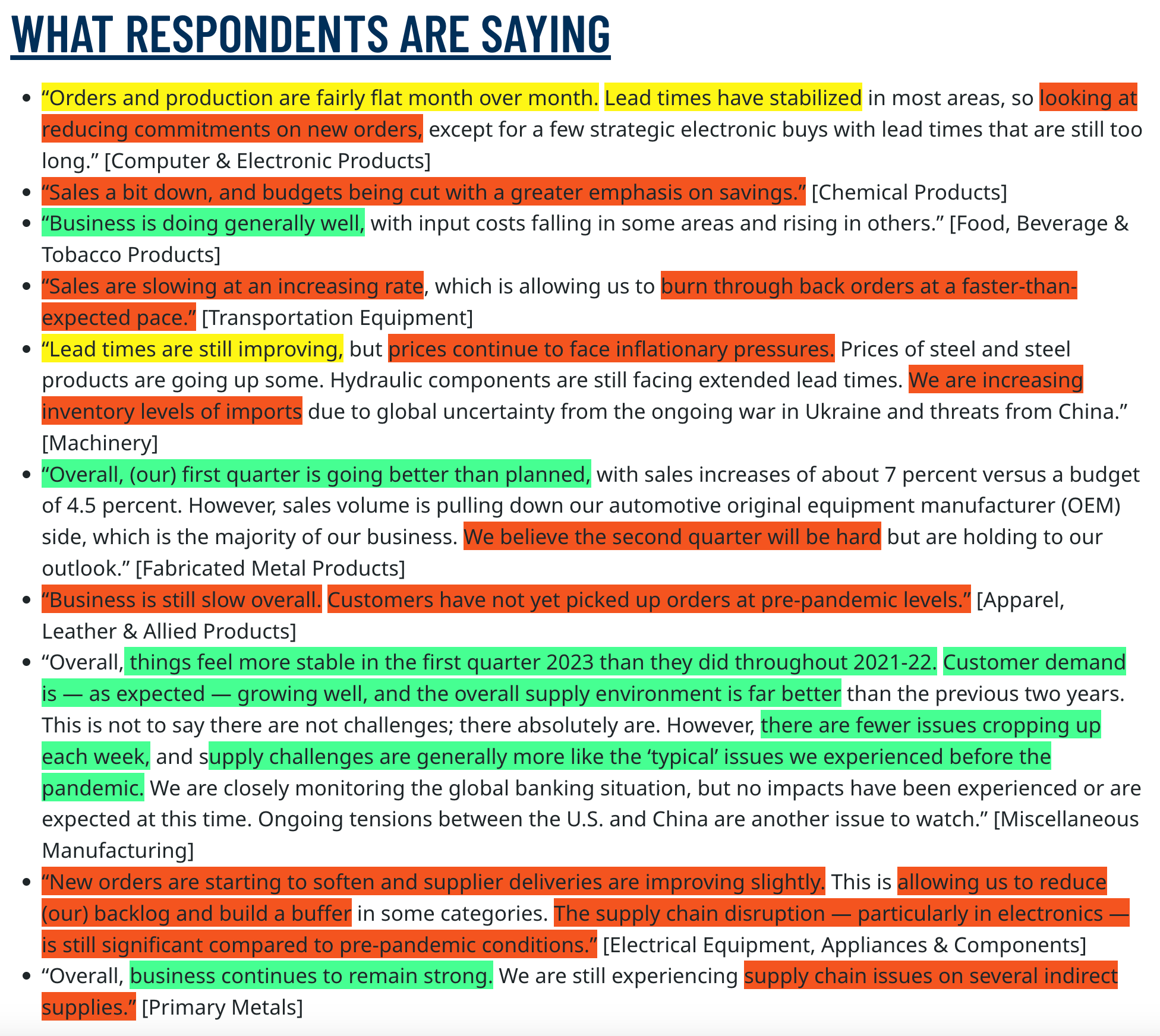

- Many investors look at the headline PMI number (46.3) but some of the guts of the release are well worth reading.

- FXmacro newsletter pulls the main quotes and categorises them into positive and negative.

- Very useful and worth subscribing.

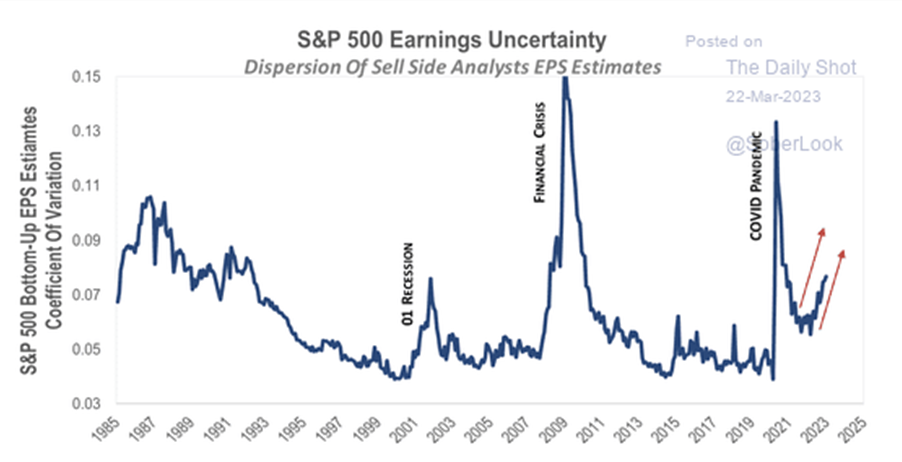

- Typically a sign of economic turbulence.

- Source: Daily Shot.

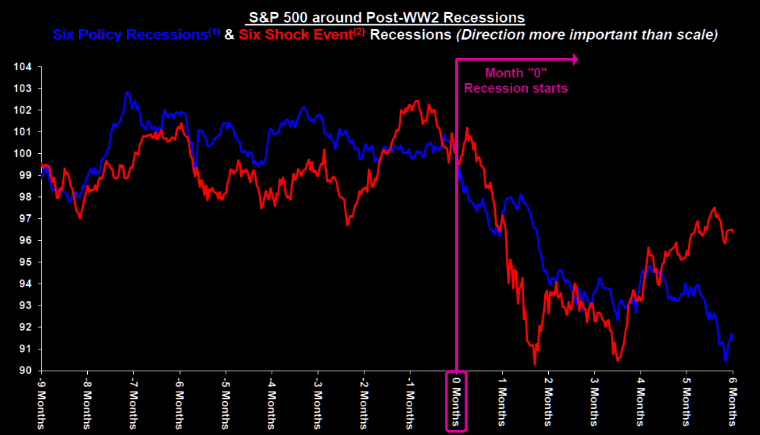

- According to Stifel (via themarketear) historically stocks trade in a range and only start to properly struggle when recession is clear.

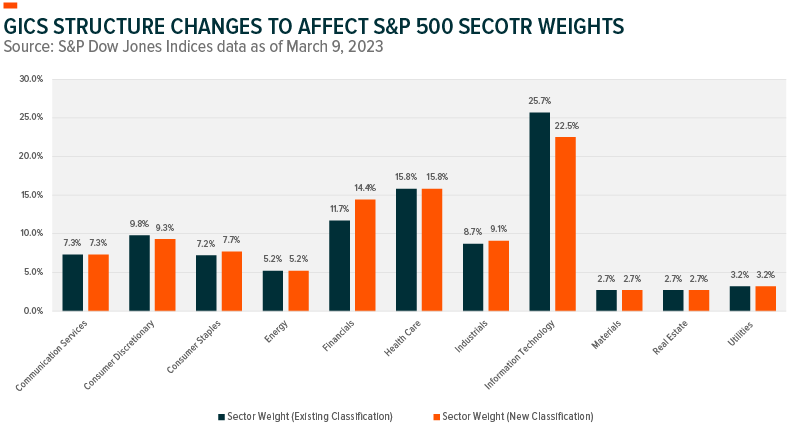

- Fintech is getting more recognition in the new GICS changes.

- As of March 17th, 11 S&P stocks will be reclassed out of IT and eight of them will land in Financials, into a new sub-industry focussed on payments.

- This will raise the Financials weight to 14% from 11% – though clearly reducing the weight of banks within that, at an interesting point in time.

- Source.

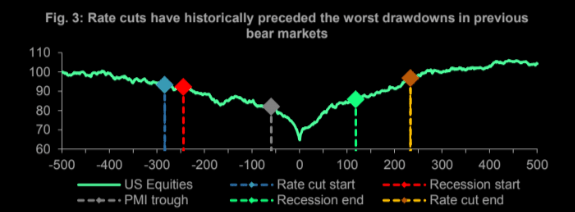

- Equities typically bottom some time after the first rate cut, based on historic bear markets since 1984.

- h/t themarketear.com

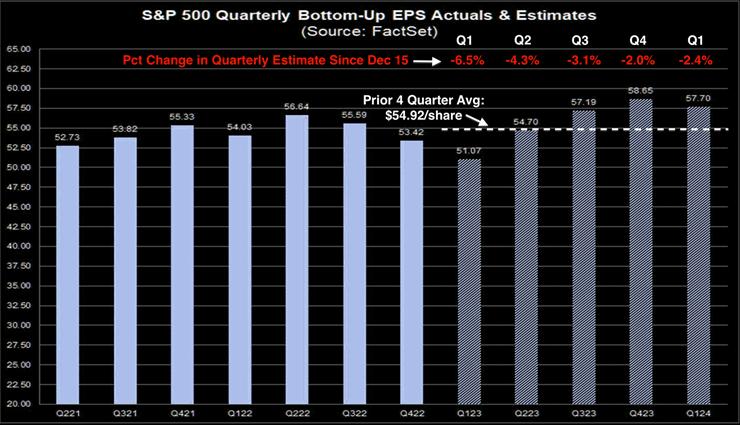

- Most of the earnings cuts have been to Q1/Q2 2023E.

- The typical pattern of an H2 recovery is still assumed.

- h/t themarketear.com

- Money supply in developed markets keeps decelerating.

- In the US it’s in correction territory, for the first time since 2006.

- h/t: Daily Shot.

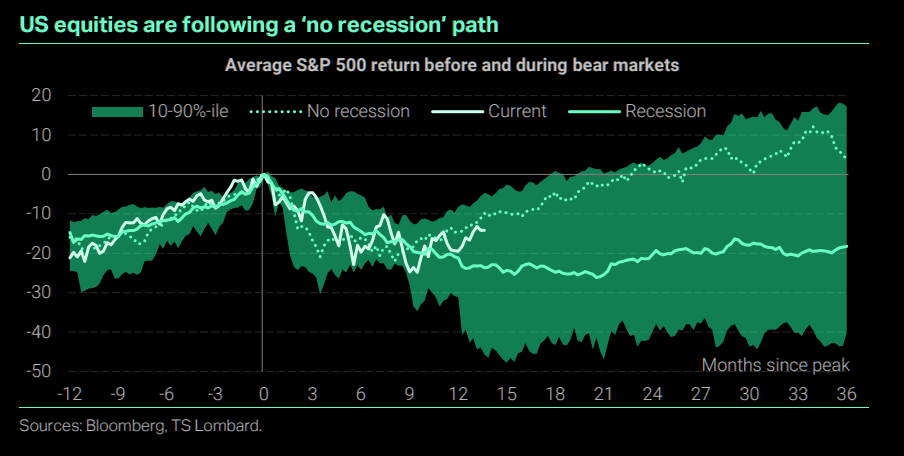

- Equities are following a no-recession path currently.

- If one does happen, things could look very different.

- Source: TS Lombard via themarketear.

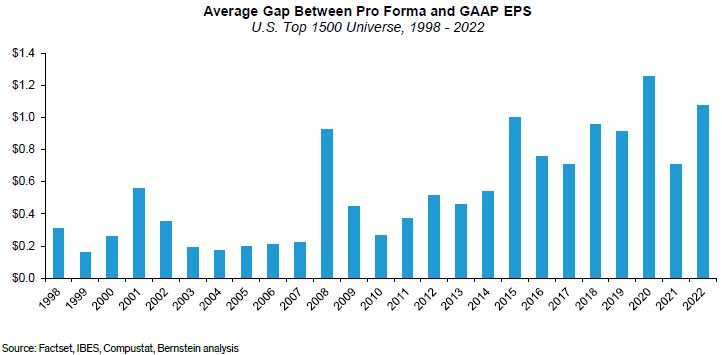

- The quality of reported earnings in the US has been deteriorating.

- Source: Bernstein.

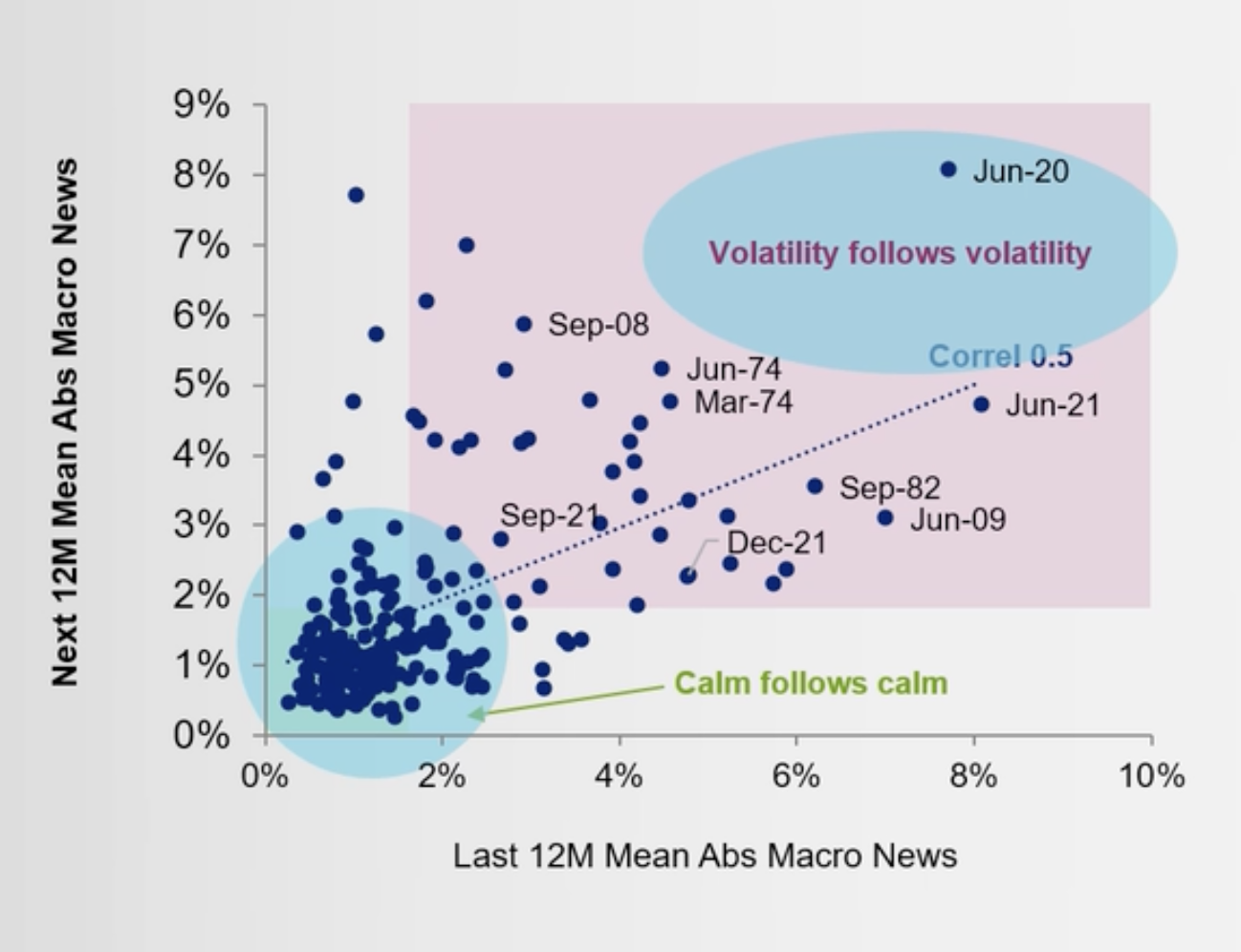

- Calm begets more calm, volatility begets more volatility.

- Source.

WordPress Cookie Notice by Real Cookie Banner