- Interesting to see cracks form in cloud computing paradigm.

- In the article a16z make a stark case for repatriating workloads – “We show (using relatively conservative assumptions!) that across 50 of the top public software companies currently utilizing cloud infrastructure, an estimated $100B of market value is being lost among them due to cloud impact on margins — relative to running the infrastructure themselves.”

- “If you’re operating at scale, the cost of cloud can at least double your infrastructure bill.” … “You’re crazy if you don’t start in the cloud; you’re crazy if you stay on it.“

- Good discussion of this article here.

- Computing paradigms do move in cycles but the analysis is missing things like flexibility (cloud is better at flexing workloads up and down) and capital intensity of businesses being a driver of valuation.

Tech

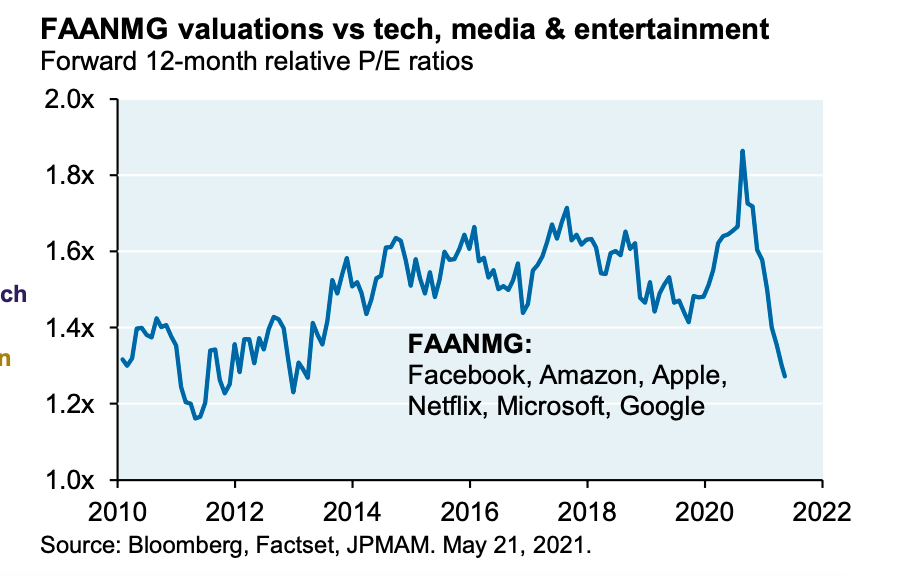

FAANMG

- FAANMG premium to the rest of tech sector has come down a lot.

- Source.

eRetail 2.0

- The mind boggles at the level of innovation going in ecommerce.

- One major part is entertainment and retail = retailtainment – “shopping as a mass leisure activity”.

- This is a great article on the phenomenon, covering the plethora of ways it is developing.

- As usual one needs to look east where a lot of development is taking place.

- One of the enablers is software that is designed to be addictive – for example infinite scrolling can mimic the bottomless bowl effect leading to 73% more consumption.

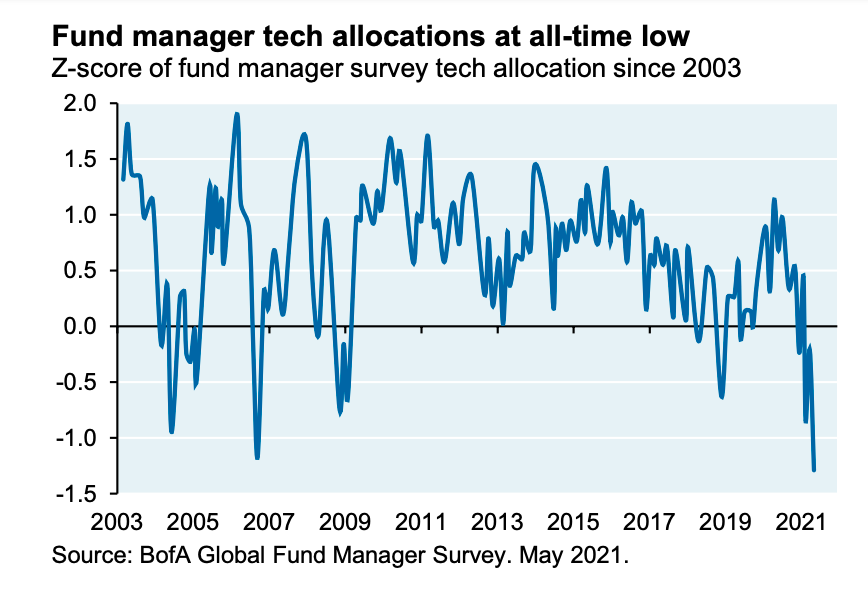

Tech Positioning

- According to the May BofA Global Fund Manager Survey allocation to tech is at an all time low.

- NB these surveys are self reported so actual positioning might be different.

- Source.

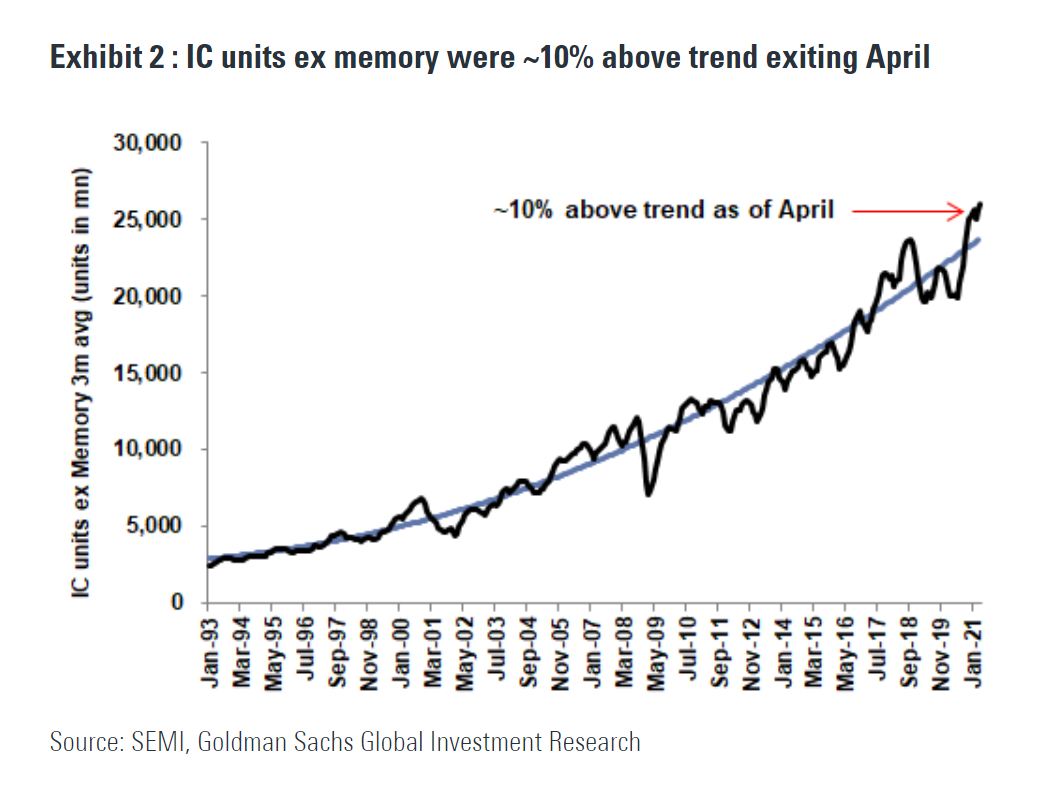

Semiconductor Market

- Neat demonstration of a structurally growing cyclical market – integrated circuit (IC) units excluding memory chips over time.

- Currently we are above trend but inventories are generally low.

Andreessen Interview

Apple Wearables

- Pretty stunning how far Apple is ahead in wearable technology.

- This was a good article discussing their lead.

- Start by watching the AssistiveTouch for Apple Watch video – truly science fiction come to life.

- The article attributes Apple’s success to (1) being early (2) voice controlled devices distracting competitors (3) wearables requiring hardware design expertise (4) ecosystem synergies (5) and no price umbrella.

iOS 14.5 App Tracking Opt-in Rate

- This site tracks daily the number of users* opting in for App Tracking with the new iOS 14.5 update.

- Useful for those invested in Facebook and other players in the mobile advertising industry.

- Here is the chart from May 14th for the World, the figure is 5% for the US.

- *they count app users not individuals users. So it is for every app.

- Good article on what participants are doing in the early days.

Apple’s M1 Positioning

- Apple is upending the traditional (x86) CPU markets.

- It is doing this by offering the same M1 chip in laptops, tablets and desktop PCs.

- The same M1 chip at all price points (from $699 to $1,699).

- “Apple’s willingness to position the M1 across so many markets challenges the narrative that such a vast array of x86 products is helpful or necessary. It puts Intel and AMD in the position of justifying why, exactly, x86 customers are required to make so many tradeoffs between high performance and low power consumption. Selling the M1 in both $699 and $1,699 machines challenges the idea that a computer’s price ought to principally reflect the CPU inside of it.“

Semiconductor Start-ups

Tiger Global

- A fascinating read about Tiger Global’s innovative velocity focussed venture/growth strategy.

- It can be summed up as follows:

- Be (very) aggressive in pre-empting good tech businesses

- Move (very) quickly through diligence & term sheet issuance

- Pay (very) high prices relative to historical norms and/or competitors

- Take a (very) lightweight approach to company involvement post-investment

- Above all, deploy capital, deploy capital, deploy capital

- It is disrupting venture investing and earning high returns in the process.

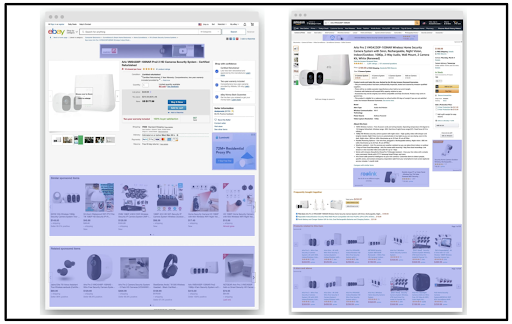

Amazon Ads

- Pictured below are Ebay and Amazon pages.

- Staggeringly, everything shaded in blue is an ad.

- Both have now replaced product recommendations with advertising.

- It makes sense as surveys show nearly 50% of product searches start on Amazon.

- Amazon’s advertising business now likely has the same profitability as its cloud business.

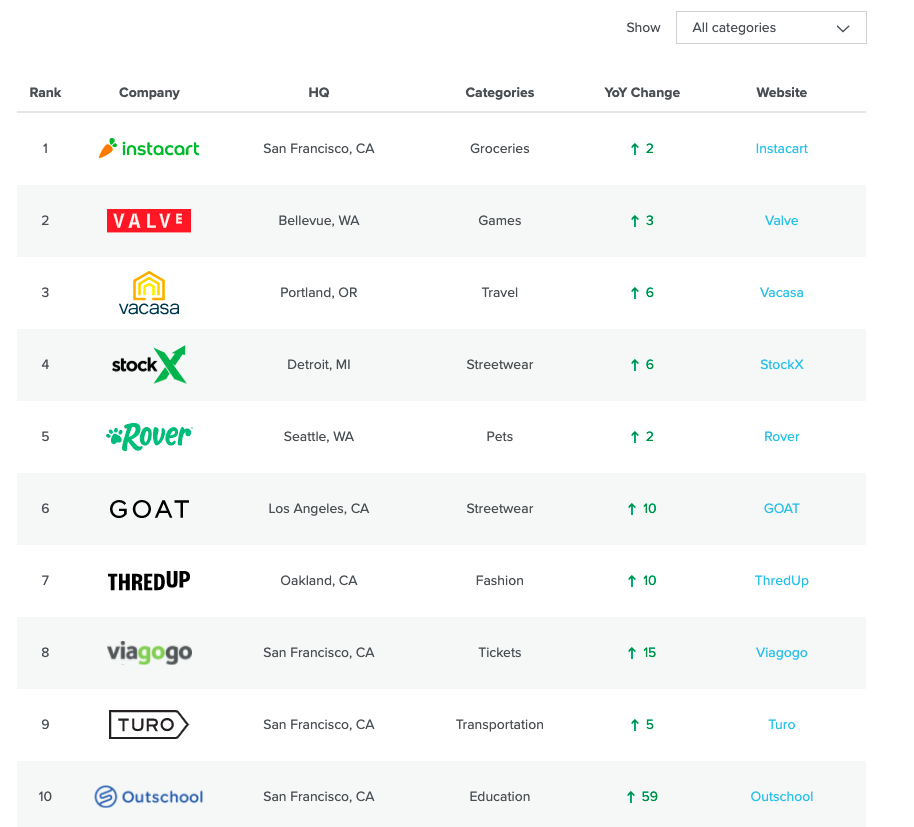

a16z Marketplace 100: 2021

- The latest edition of the top 100 private/start-up consumer facing marketplaces using Bloomberg real-time consumer spending data.

- A lot has changed in 2020 for obvious reasons. The full report is here.

- Interesting to see Turo at number 9 (up 5 places), which is an investment (they own ca. 26.8%) by IAC that few talk about.

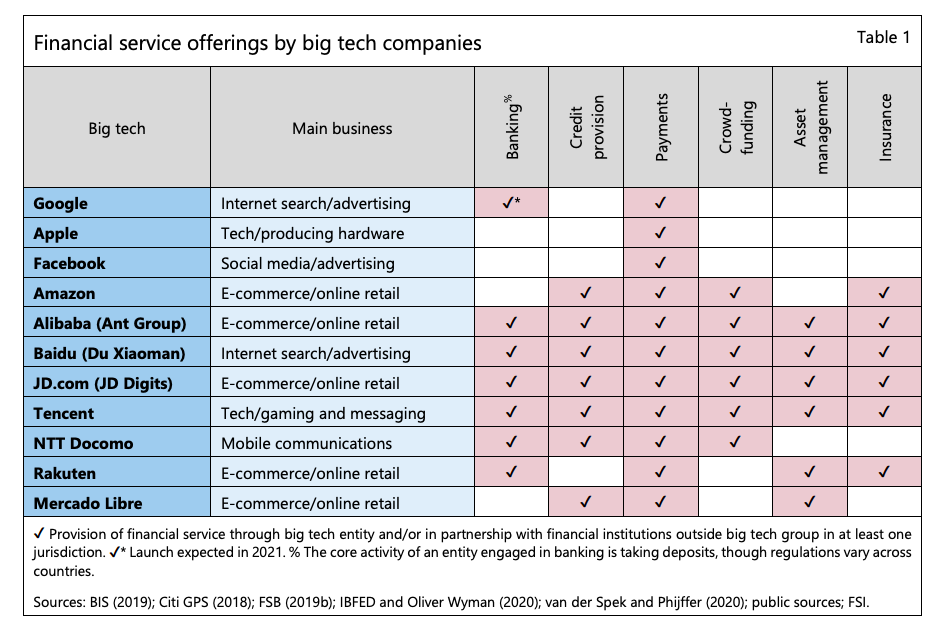

Big Tech in Finance

- Large tech firms continue to plot their way into financial services.

- This table from a new BIS report shows the current lay of the land.

Tim Wu

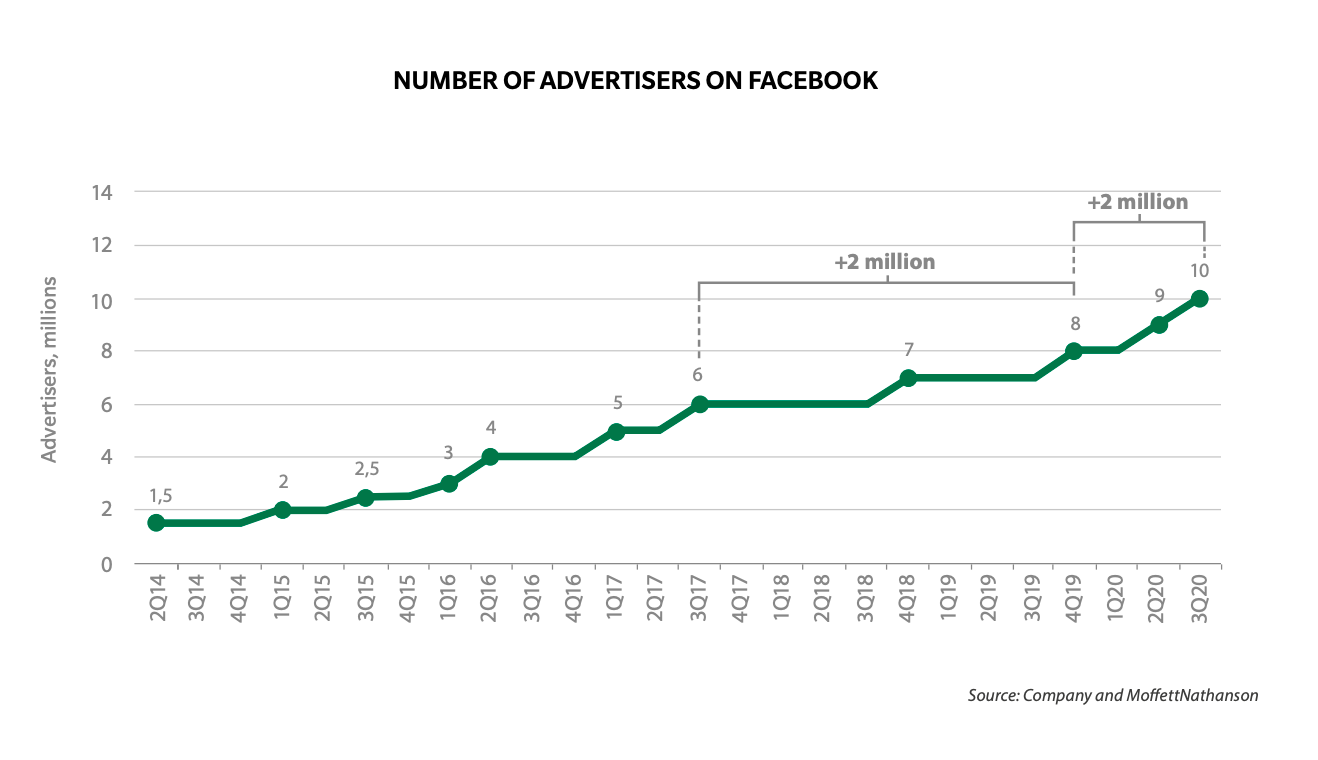

- In the three quarters of 2020 Facebook added 2m advertisers to its platform.

- This is the same amount as in the preceding three years.

- Source.

Automotive Semis

- Informative post on what is going on in automotive semiconductor markets.

- Shortages in the short term – mainly because the pandemic wrong-footed car makers.

- Growth in the long term – driven by the amount of semi-content in a car (an electric vehicle has 110% more content than a conventional vehicle, autonomous driving doubles that).

Octahedron Capital Slides

- Titled “A few things we learned in Q4 2020” this deck is a 97 slide tour of what is going on in digital advertising, gaming, payments & fintech, on-demand and e-commerce and software.

- It largely consists of quotes from management calls and latest company data points.

- Worth a flick.

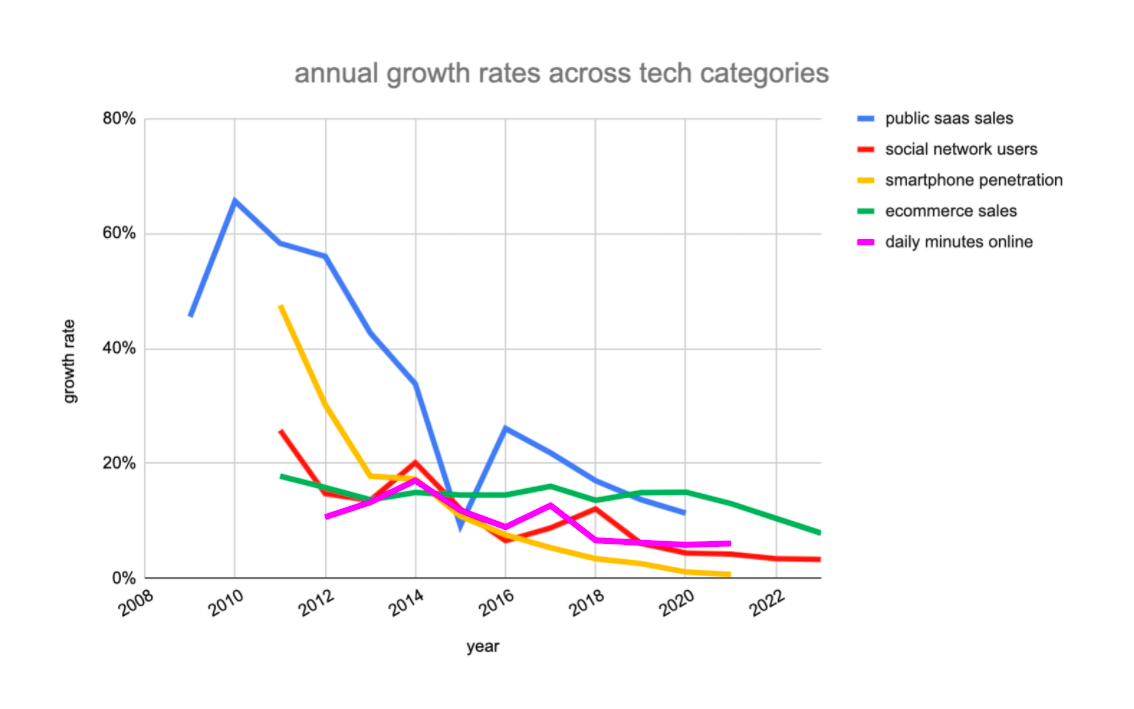

The Internet

- A thought provoking and contrarian read arguing that the tailwinds from the internet and silicon valley are fading i.e. the industry is maturing.

- This chart shows that growth rates are coming down in most areas of tech.

- Worth noting it was done in early 2020 so missed the pandemic driven acceleration (the unanswered question being whether that was just pull forward or a true step change).

- This type of environment leads to a rebalance of growth away from start-ups towards internet-first incumbents – as the former can’t rely on the market to grow and the latter use vast operational muscle.

- This has profound effects including the financialisation of the technology industry.

Repairability Index

- France has introduced something very interesting.

- From this month on, makers of certain electronic devices, like phones and laptops, will be required to give them a score on how repairable they are.

- This will allow consumers to chose devices that are easier to repair and incentivise durability.

- Other countries (including the EU) are looking to follow.