- “Recent and experienced college graduate unemployment rates have always been lower than the national average, until now”.

- Source: Oxford Economics, via Matthew B

Macroeconomics

Snippets on the big picture.

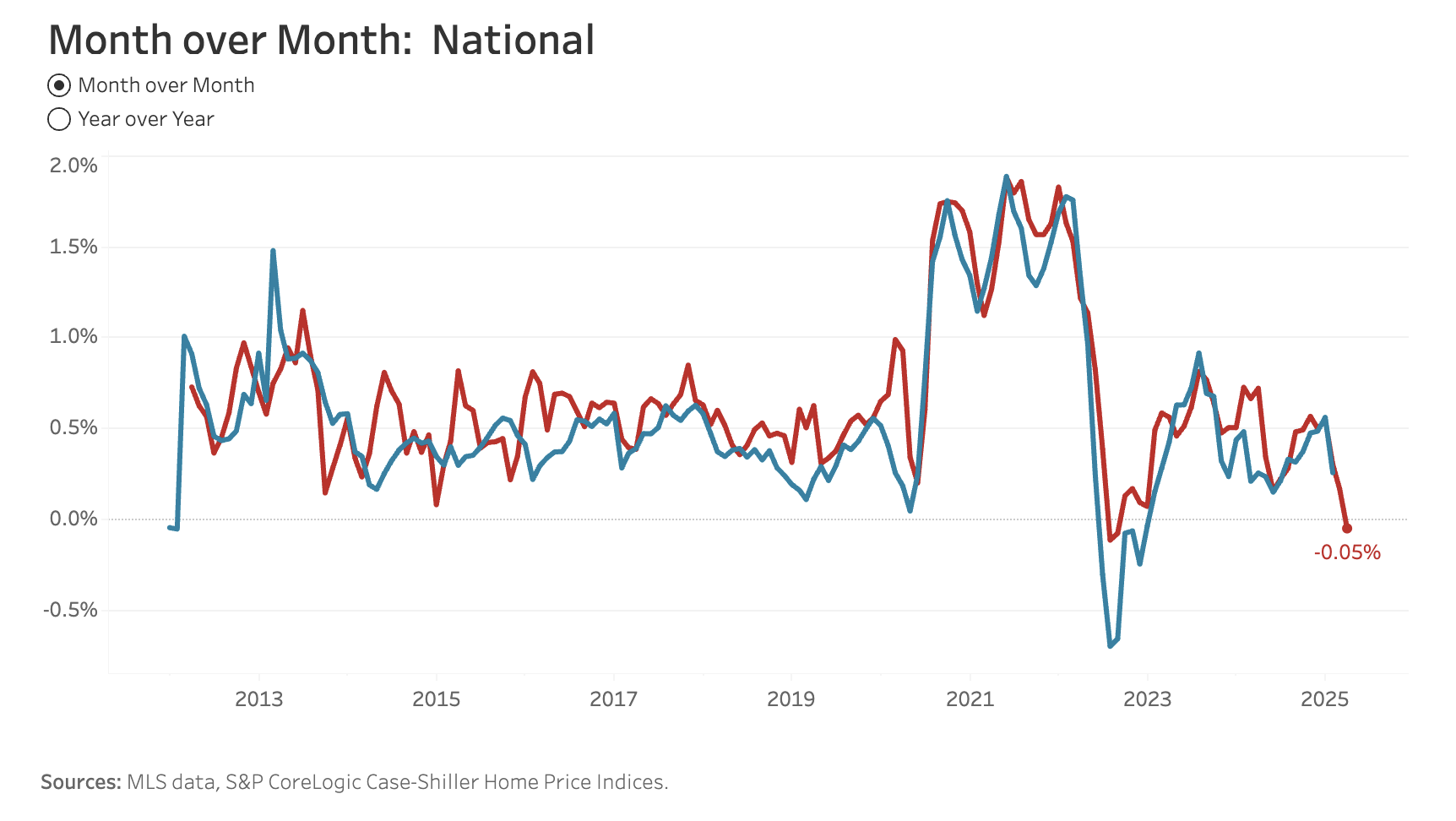

Redfin House Prices

- Redfin data shows April house prices are falling (-0.1%).

- The red line is the Redfin HPI MoM, and the blue line is the Case Shiller Index MoM.

- Source.

Financial Economy

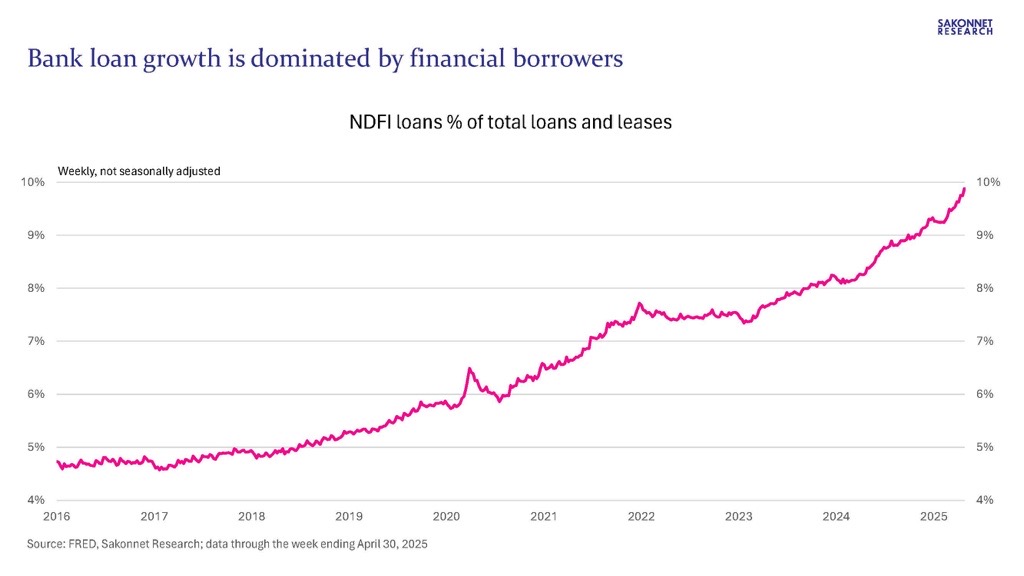

- Bank lending to nondepository financial institutions (NDFIs) is booming.

- What’s going on? The financialization of the U.S. economy; banks are lending ever more money to broker-dealers, hedge funds, private equity/credit firms, securitization vehicles, etc., all part of the levered investment industry.

- Source.

Housing Inventory Going up

- “The number of homes actively for sale remains on a strong upward trajectory, now 30.6% higher than this time last year. This represents the 79th consecutive week of annual gains in inventory. There were more than 1 million homes for sale last week, the highest inventory level since December 2019.“

- Source.

Trump and the World Economy

- Panel discussion that pre-dates Liberation Day but is nonetheless extremely insightful on the implications of current US trade policy.

- It features:

- Jeffrey Frankel, James W. Harpel Professor of Capital Formation and Growth, Harvard Kennedy School

- Desmond Lachman, Senior Fellow, American Enterprise Institute

- Brad W. Setser, Whitney Shepardson Senior Fellow, Council on Foreign Relations

- Mark Sobel, US Chairman, Official Monetary and Financial Institutions Forum

Buffett on Trade and Tariffs

- Buffett penned an article in 2003 in Forbes magazine about the yawning US trade deficit and what such a persistent deficit would mean going forward.

- He proposed a neat solution.

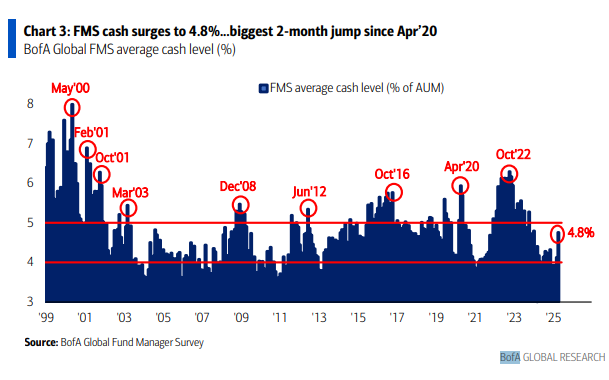

Fund Manager Survey – Cash

- No comment.

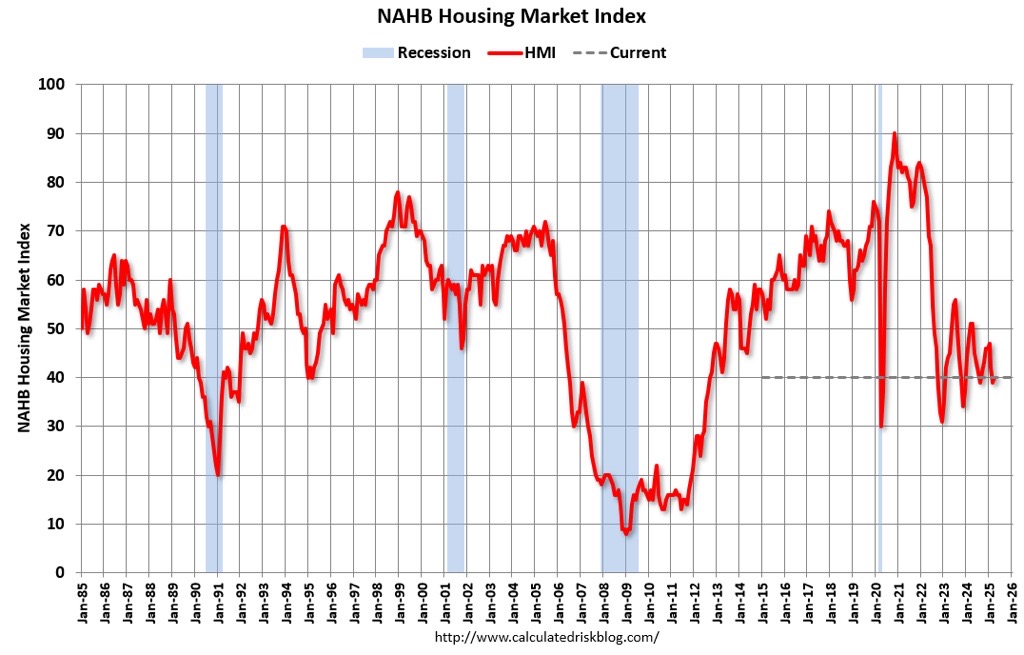

Slow Start to Spring Housing Season

- “Policy uncertainty is having a negative impact on home builders, making it difficult for them to accurately price homes and make critical business decisions,” said NAHB Chief Economist Robert Dietz. “The April HMI data indicates that the tariff cost effect is already taking hold, with the majority of builders reporting cost increases on building materials due to tariffs.”

- When asked about the impact of tariffs on their business, 60% of builders reported their suppliers have already increased or announced increases of material prices due to tariffs. On average, suppliers have increased their prices by 6.3% in response to announced, enacted, or expected tariffs. This means builders estimate a typical cost effect from recent tariff actions at $10,900 per home.

- Source.

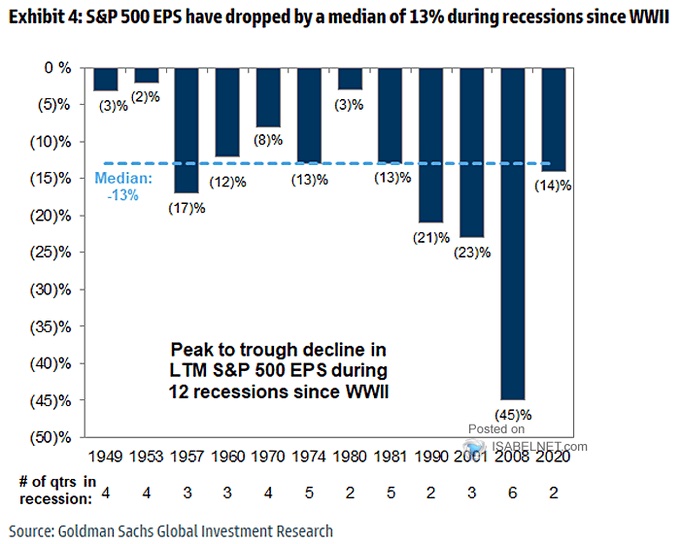

S&P 500 EPS during Recessions

- The median drop is 13%, but it can be a lot worse.

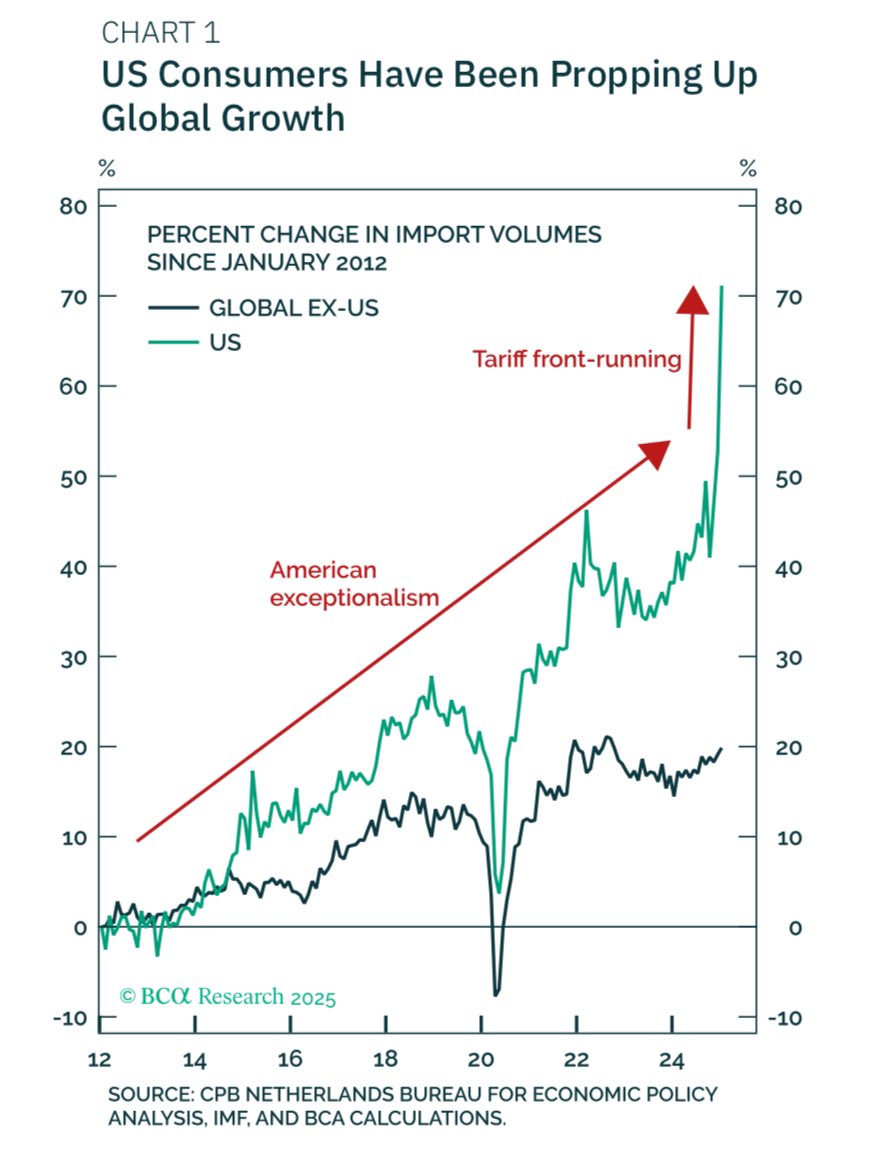

US Consumer

- A key chart – the driver of global demand growth.

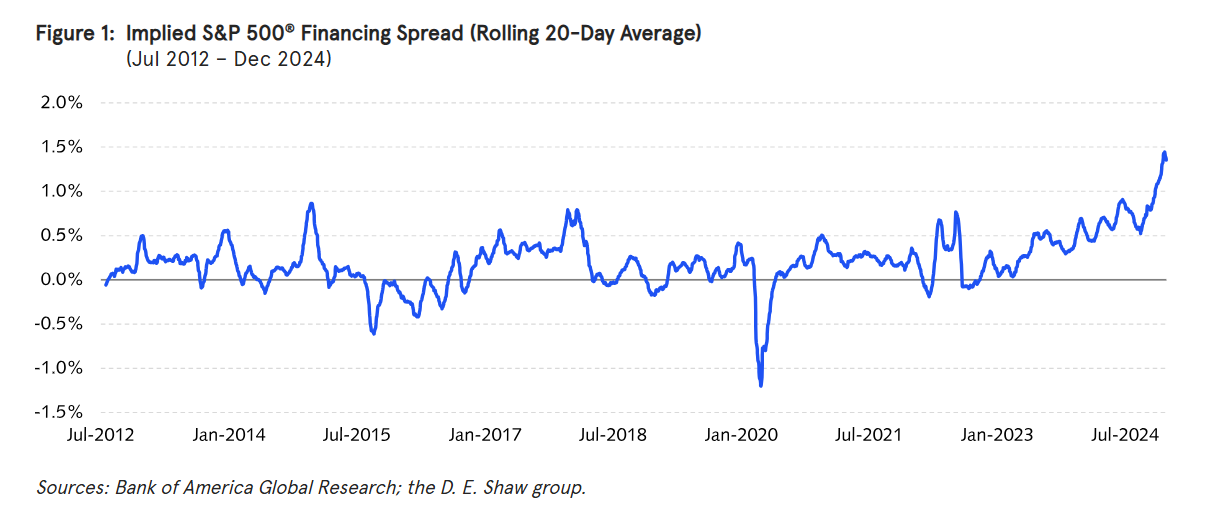

S&P 500 Futures Financing

- The financing rate for equity exposure via futures has been very high.

- The S&P 500® financing spread can’t be directly observed, but it can be estimated by comparing the actual price of futures to the fair value implied by dividend forecasts, interest rates, and spot prices. Figure 1 plots one such estimate since 2012.

- Reasons here.

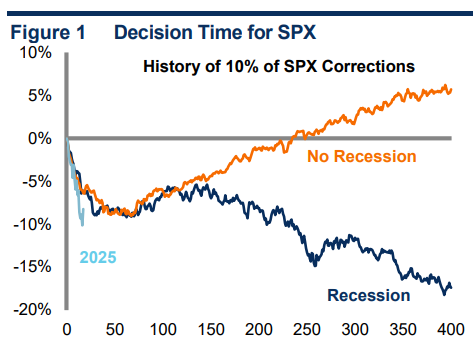

The setup

- Post historic 10% corrections, the setup is usually determined by whether there is a recession or not.

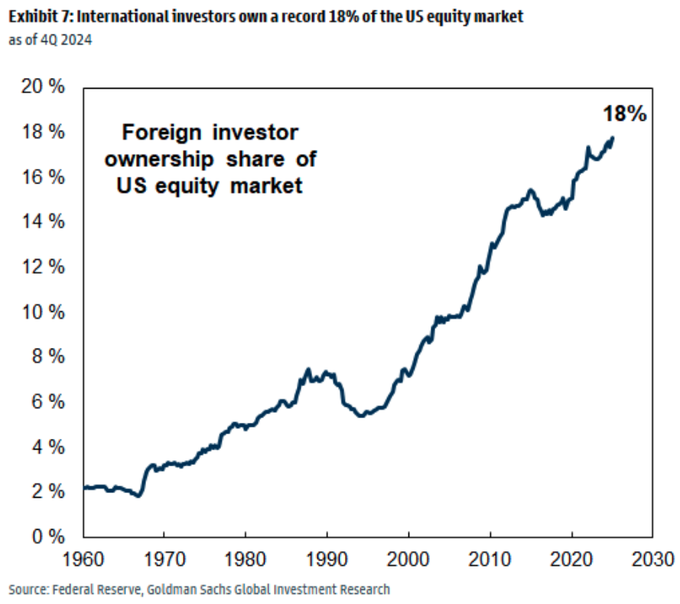

International Ownership of US Stocks

- Currently at a record.

Recession Arguments

- Great interview with BCA’s Chief Global Strategist Peter Berezin where he lays out his view for the economy and market.

- Peter is a bear (sees -30% drop in SPX) and has been calling for a recession since roughly the middle of last year.

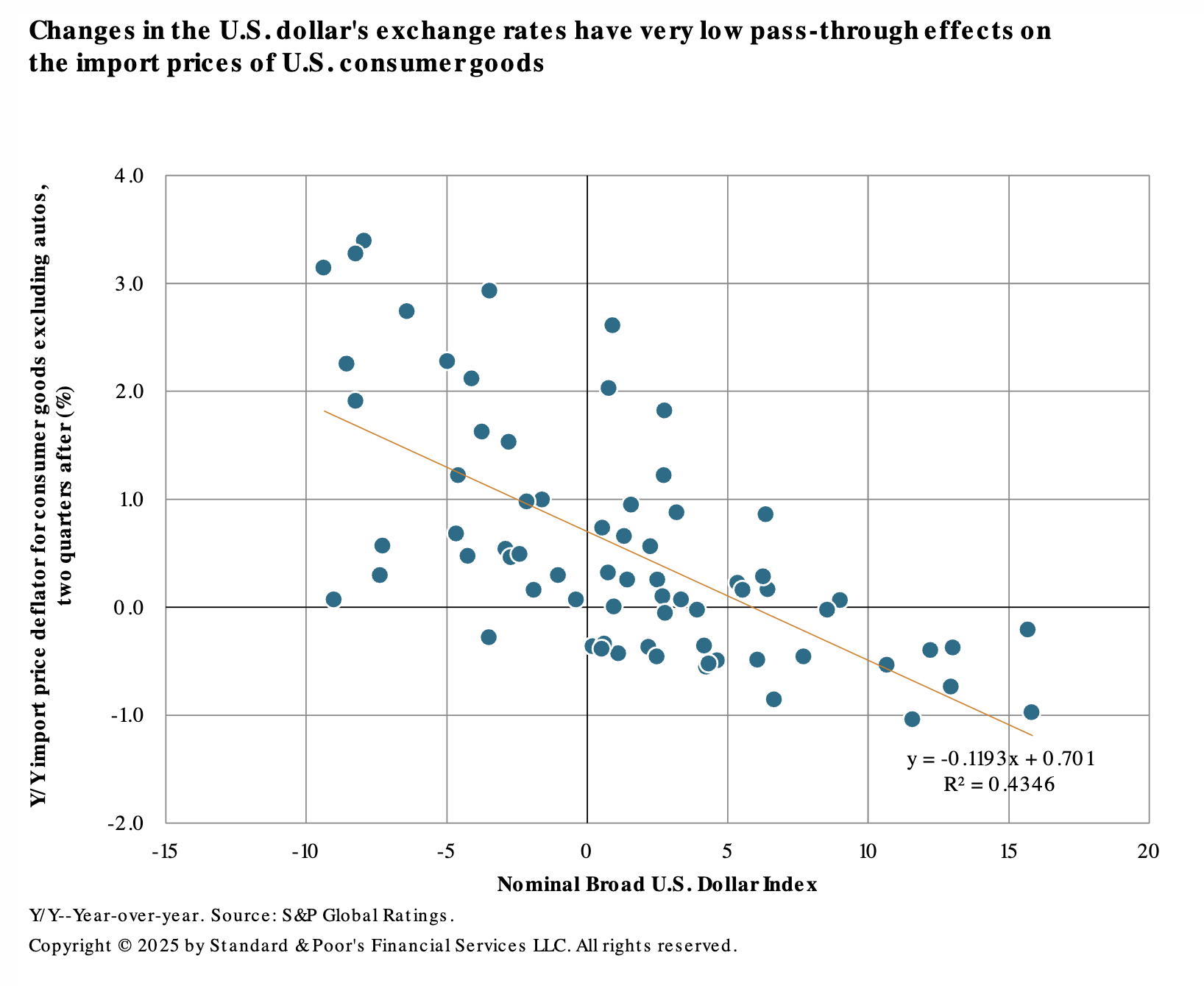

USD and Import Pricing

- The US dollar has a very low pass-through effect to import prices for consumer goods.

- Interesting to think about in the context of tariff environment.

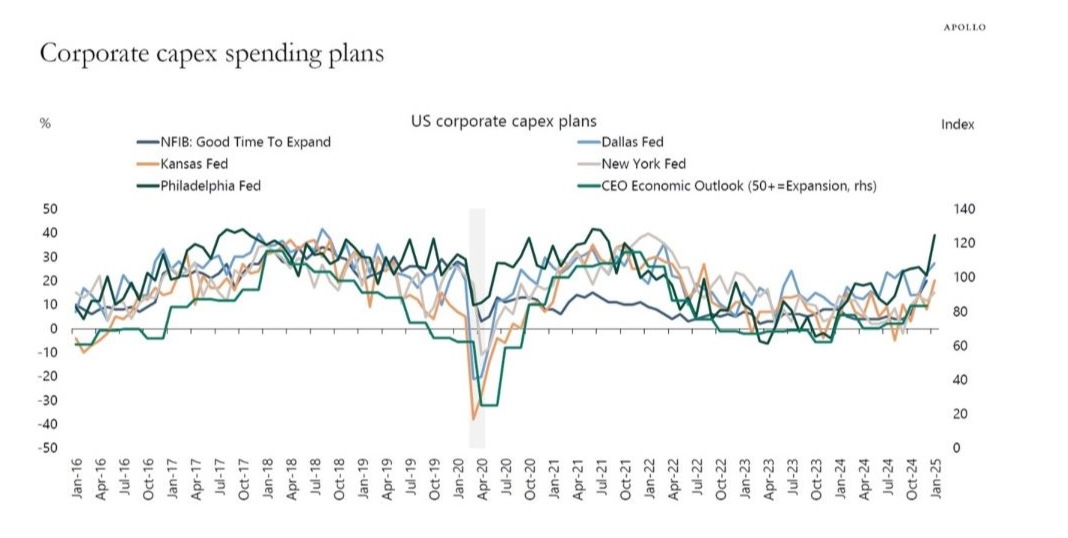

US Capex Plans

- Are turning up across all surveys.

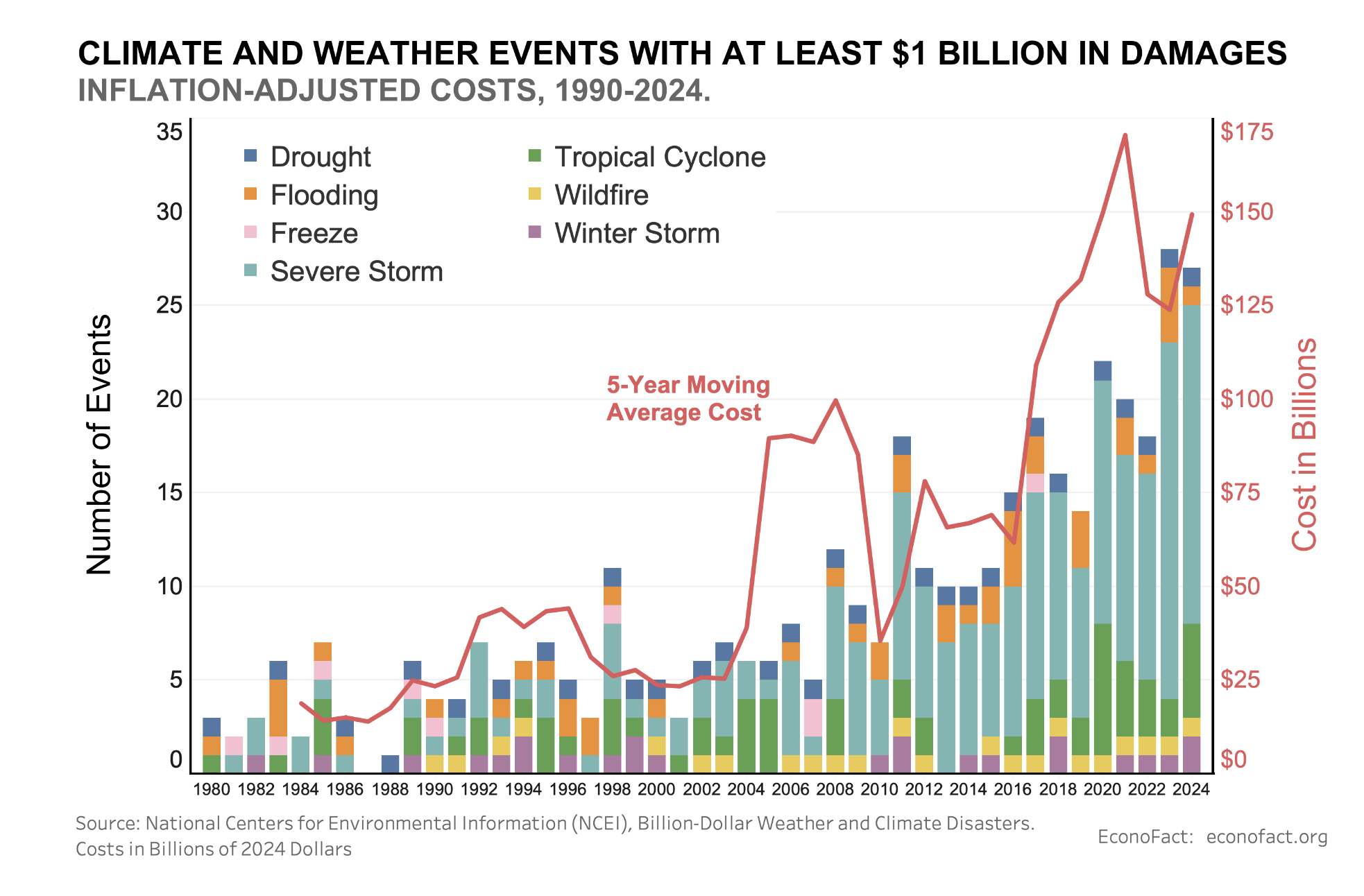

Disasters

- The count and cost of climate and weather events over $1bn in damages keeps rising.

- Source.

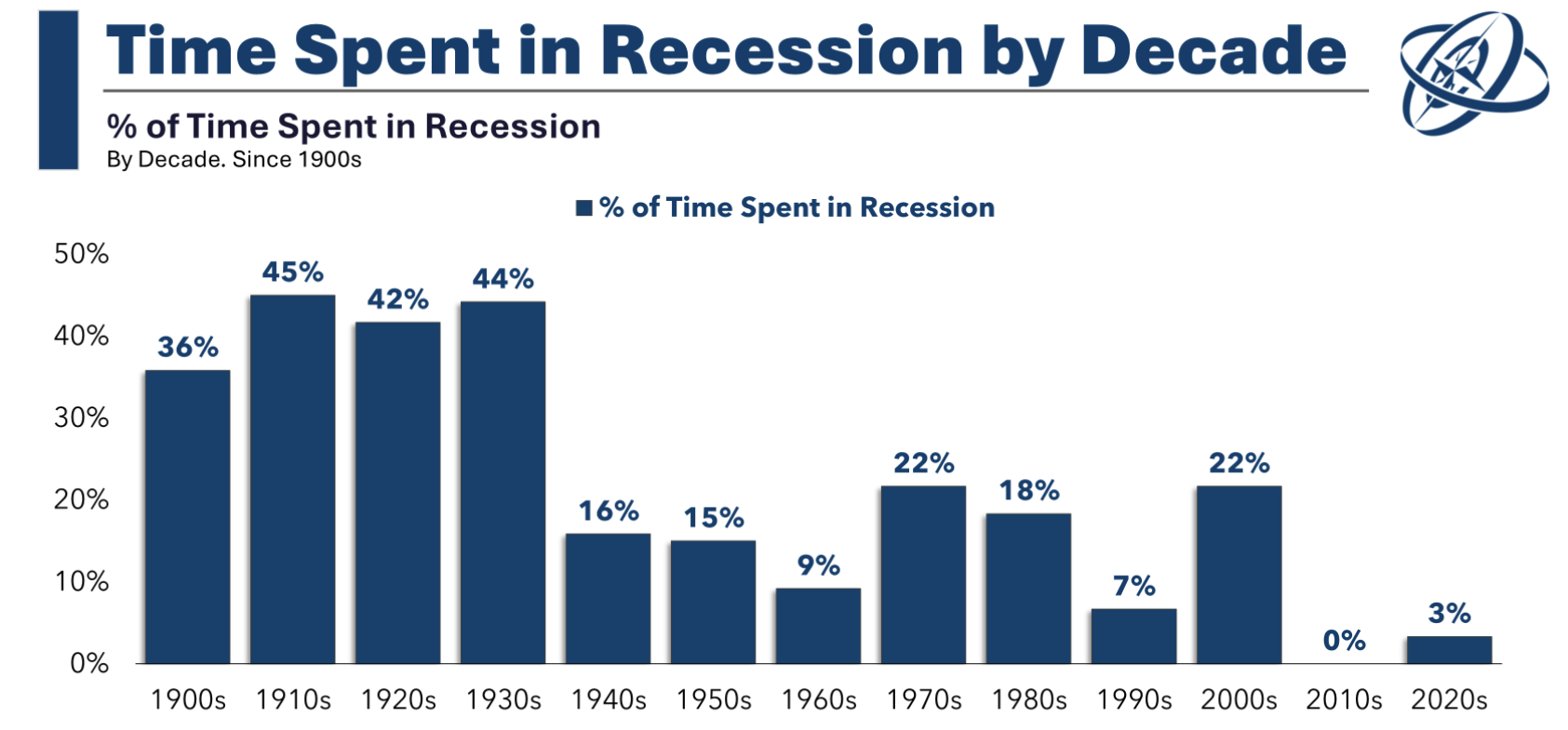

Recessions Gone?

- Economic management has gotten good.

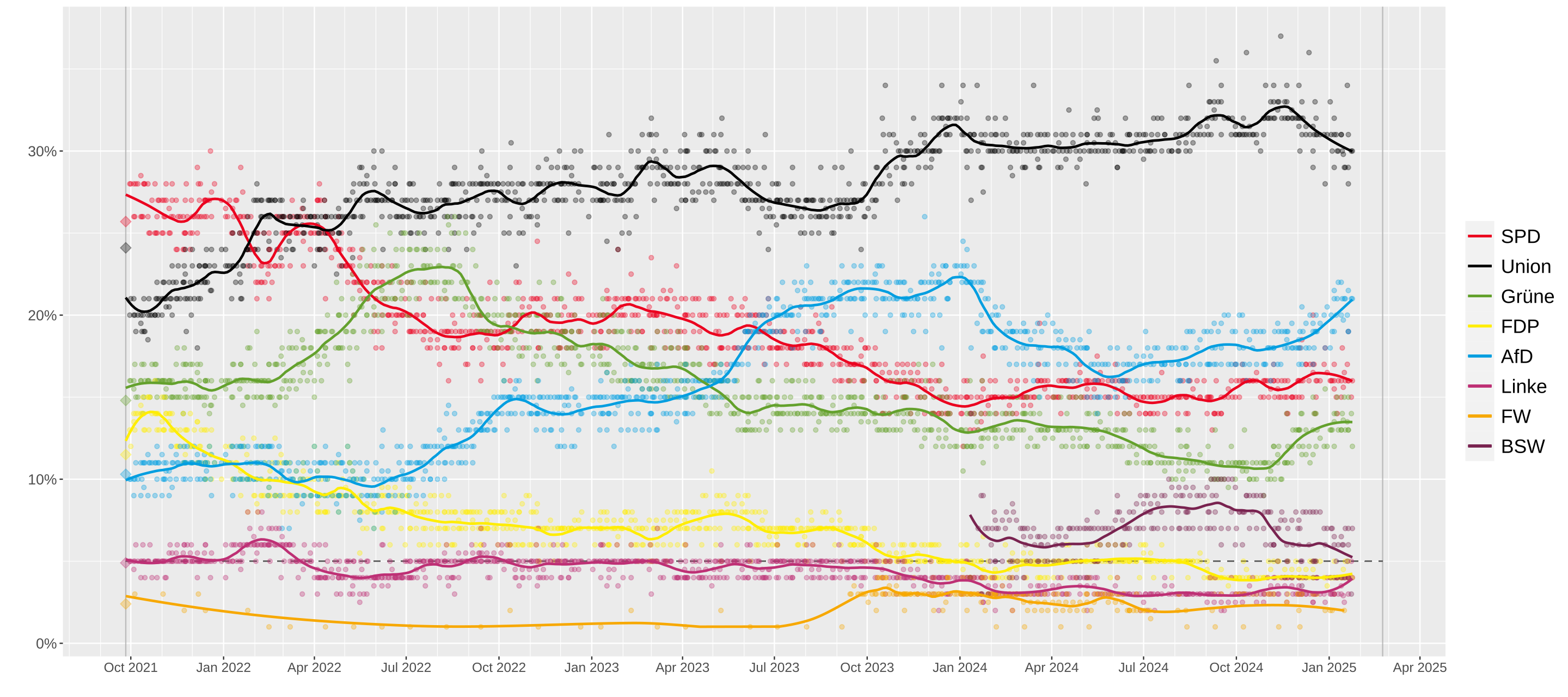

German Opinion Polls

- Elections are just around the corner.

- Source.

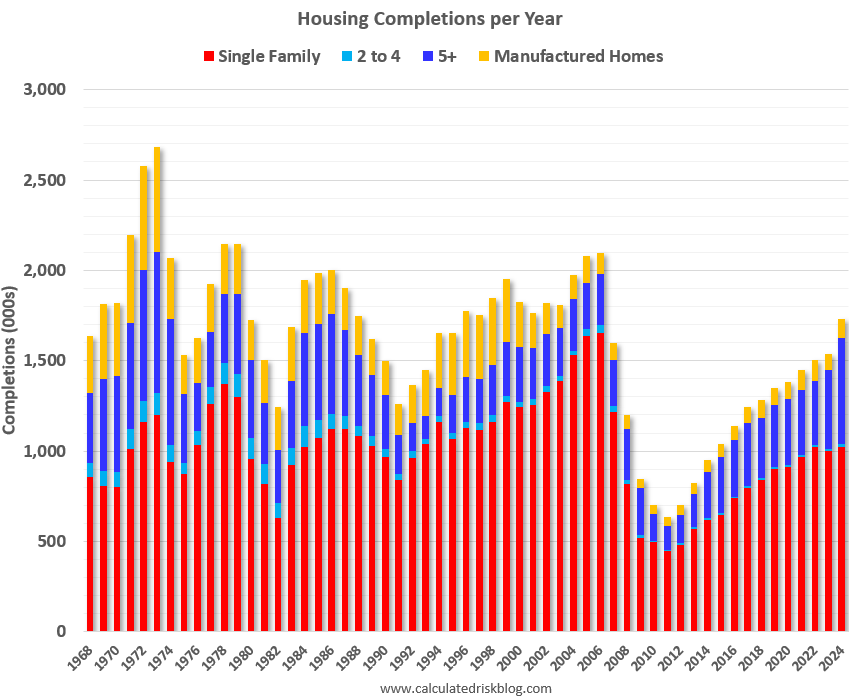

Housing Completions

- Surprisingly, housing completions increased sharply in 2024 to the highest since 2006.

- Source.