- Someone went through every page and listed their 30 most surprising things.

- 26. In the UK, more than half of crimes are estimated to be caused by alcohol consumption.

Macroeconomics

Snippets on the big picture.

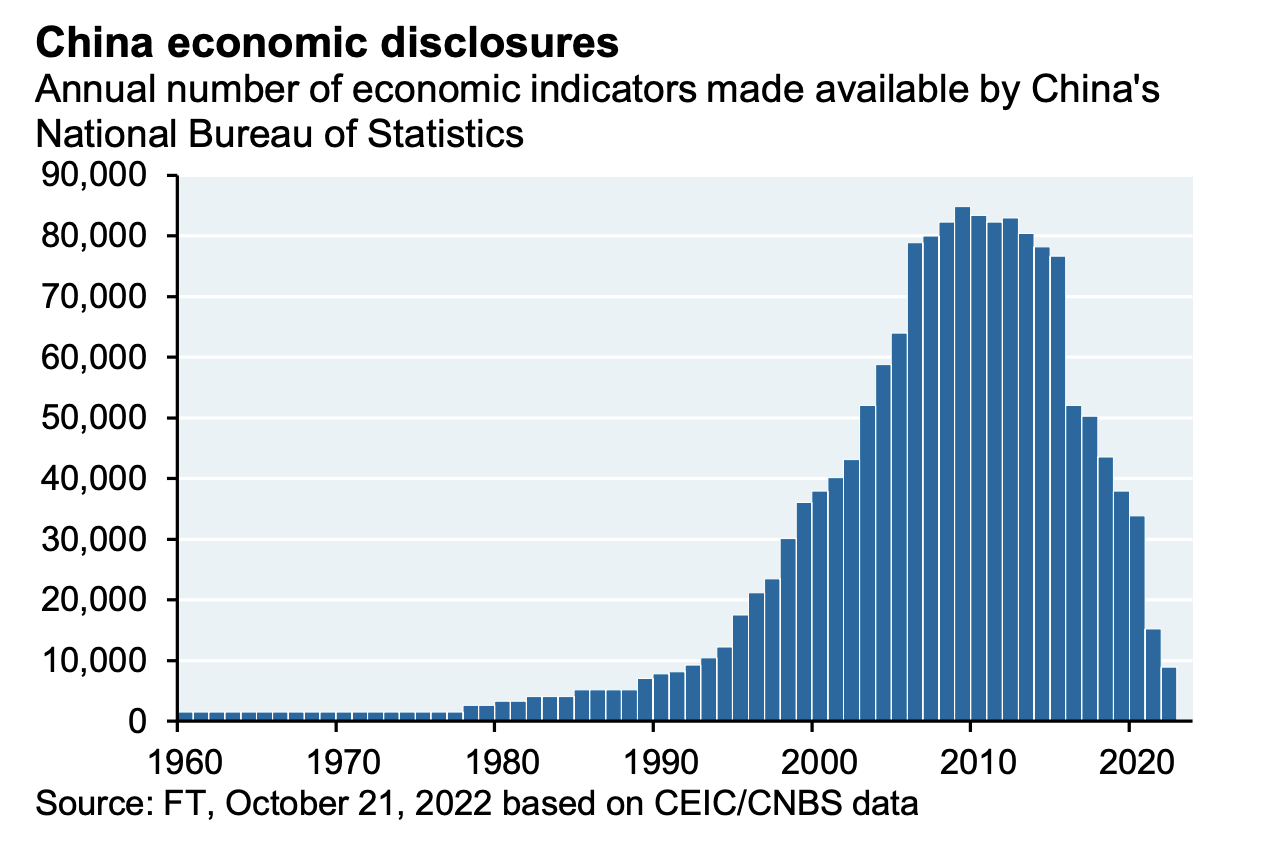

Chinese Economic Disclosures

- The Chinese authorities have substantially decreased the number of economic indicators published.

- Source: JPM.

State Level Data as a Recession Indicator

- “Conveniently, the Philly Fed publishes monthly coincident indicators for each state. Aggregating the 50 signals into a composite index provides a somewhat different view of the US business cycle vs. traditional top-down metrics.“

- The current signal is issuing a warning.

- Source.

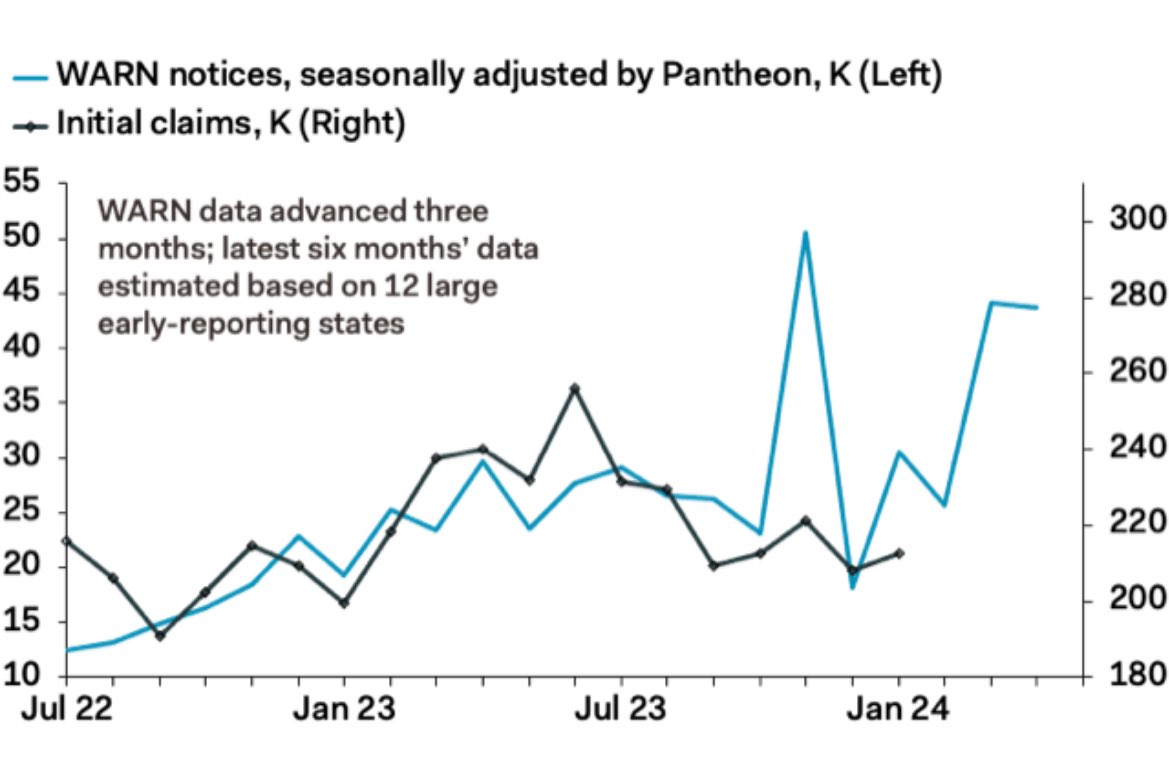

Jobless Claims about to Rise?

- Jobless claims “are still very low by historical standards. We expect that to change soon. The WARN numbers, capturing advance notice of plant closures and mass layoffs, have jumped recently and point to initial claims rising significantly over the next few months ..”

- Source: Pantheon Macro via Carl.

German House Prices

- Residential property prices are down sharply in what was once seen as a sure bet market.

- This is the case across all major cities.

- Source: Apollo.

Where are we in the Cycle?

- Recession? Soft landing? TS Lombard try to answer in this essay.

- The premise is that the COVID-related “cycle” should be dismissed – something we have just about worked off.

Sad State of UK Capital Markets

- The UK is the only major region where the number of liquid companies (defined as having more than $1m of average daily traded value over six months) is down since 2003.

- Source: FT Alphaville.

Job Cuts

- Mentions of job cuts during earnings calls are on the rise.

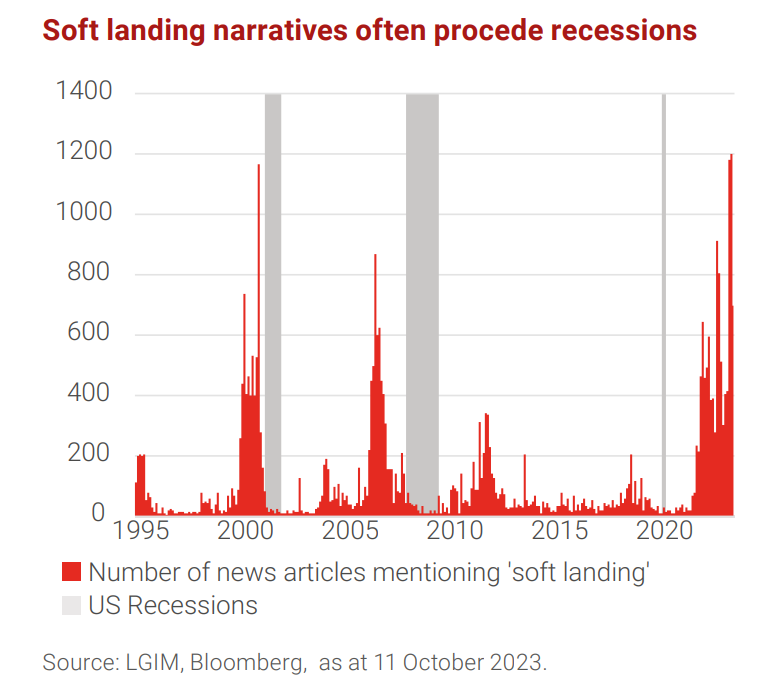

Narratives Before Recession

- Typically the chatter around soft landing peaks just as recessions happen.

- Source: LGIM

Manufacturing Recession

- What might come as a surprise to many, but we are currently tied for the worst global manufacturing recession on record.

- Source: Schwab.

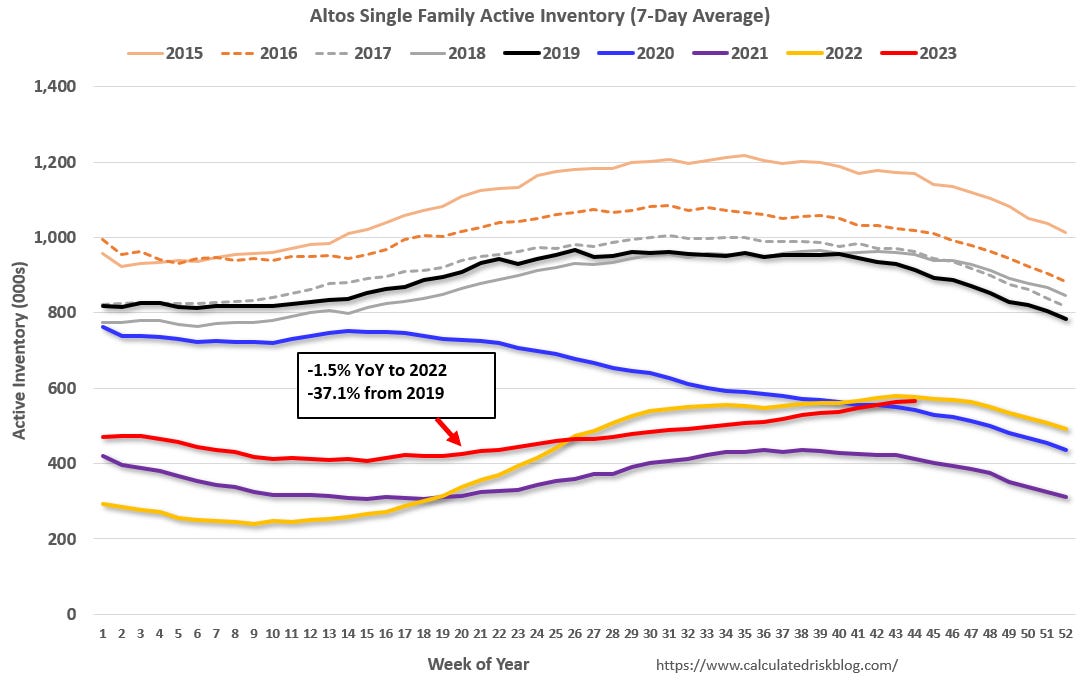

Housing Inventory 2023

- One of the best predictors of house prices is inventories.

- As shown here US housing inventories are rising but still depressed (and very much so vs. 2019).

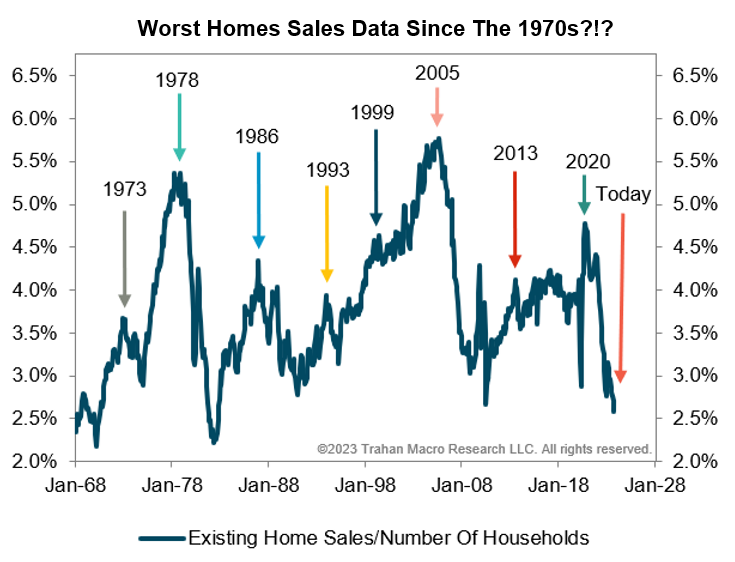

Home Sales Relative to Households

- One way to look at existing home sales is relative to the number of households in the US.

- On this measure today is about as low as it has been since the 1970s.

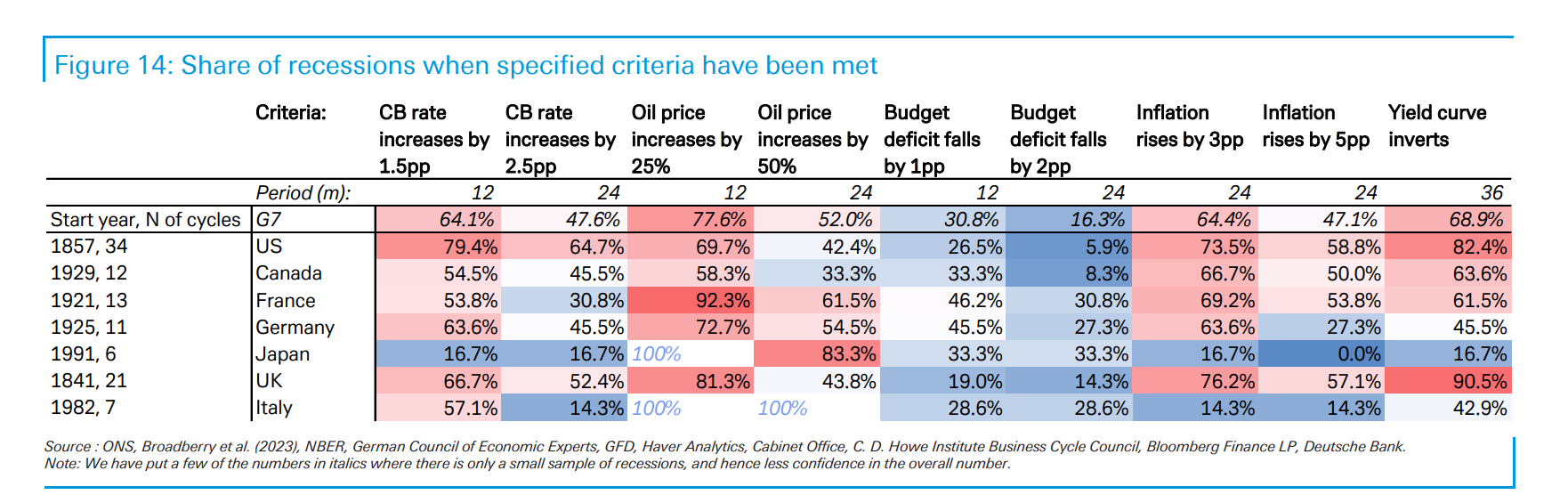

What Causes Recessions

- Useful table studying recessions from this year’s DB Long Term Asset Return Study.

- “79% of US recessions over the last 170 years have seen the central bank policy rate rise at least 1.5pp over a rolling 12-month period within 3 years prior to a recession. It’s 65% if you use 2.5pp of hikes over a rolling 24-month period. So most US recessions are preceded by tighter monetary policy“.

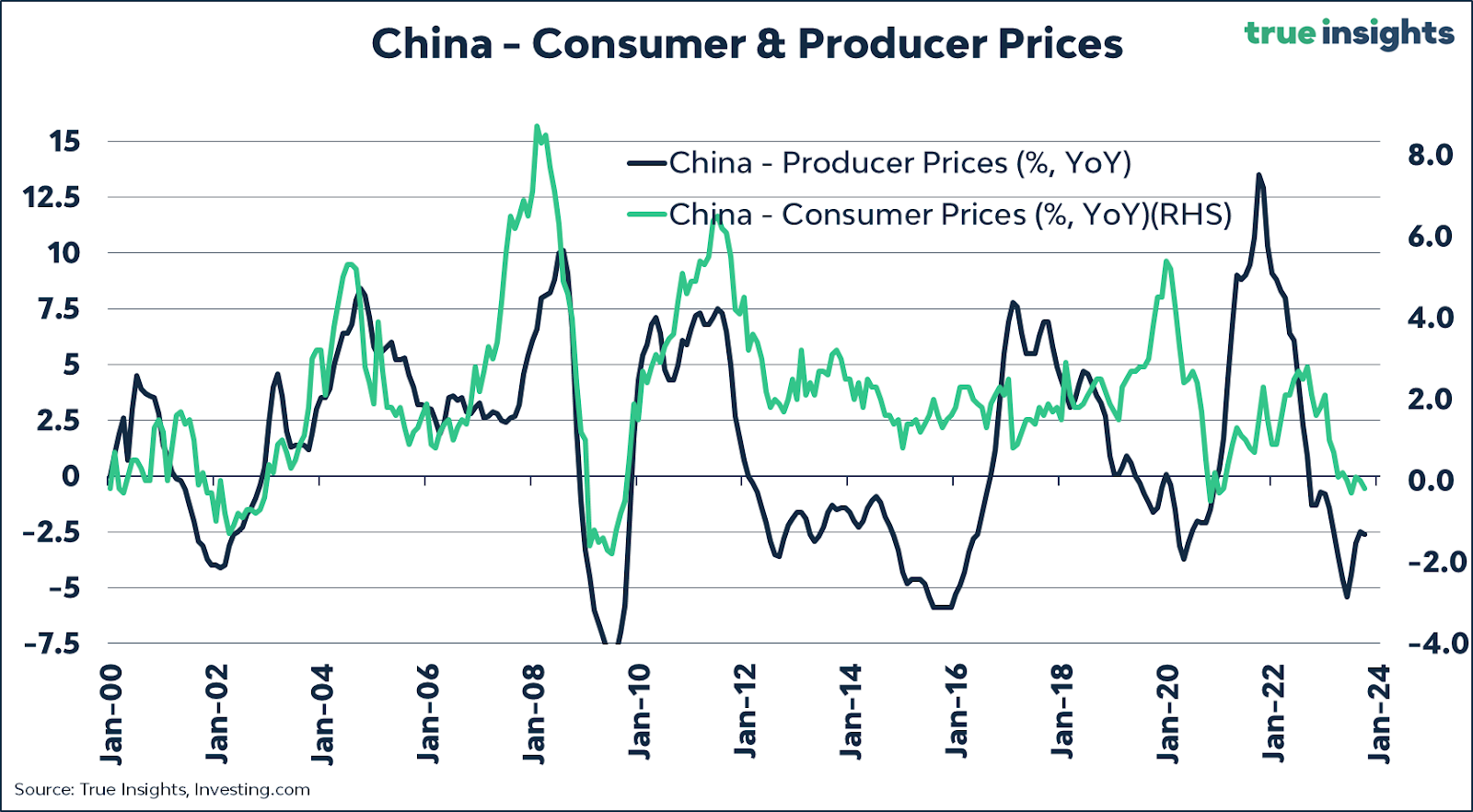

China Deflation

- Probably a big deal.

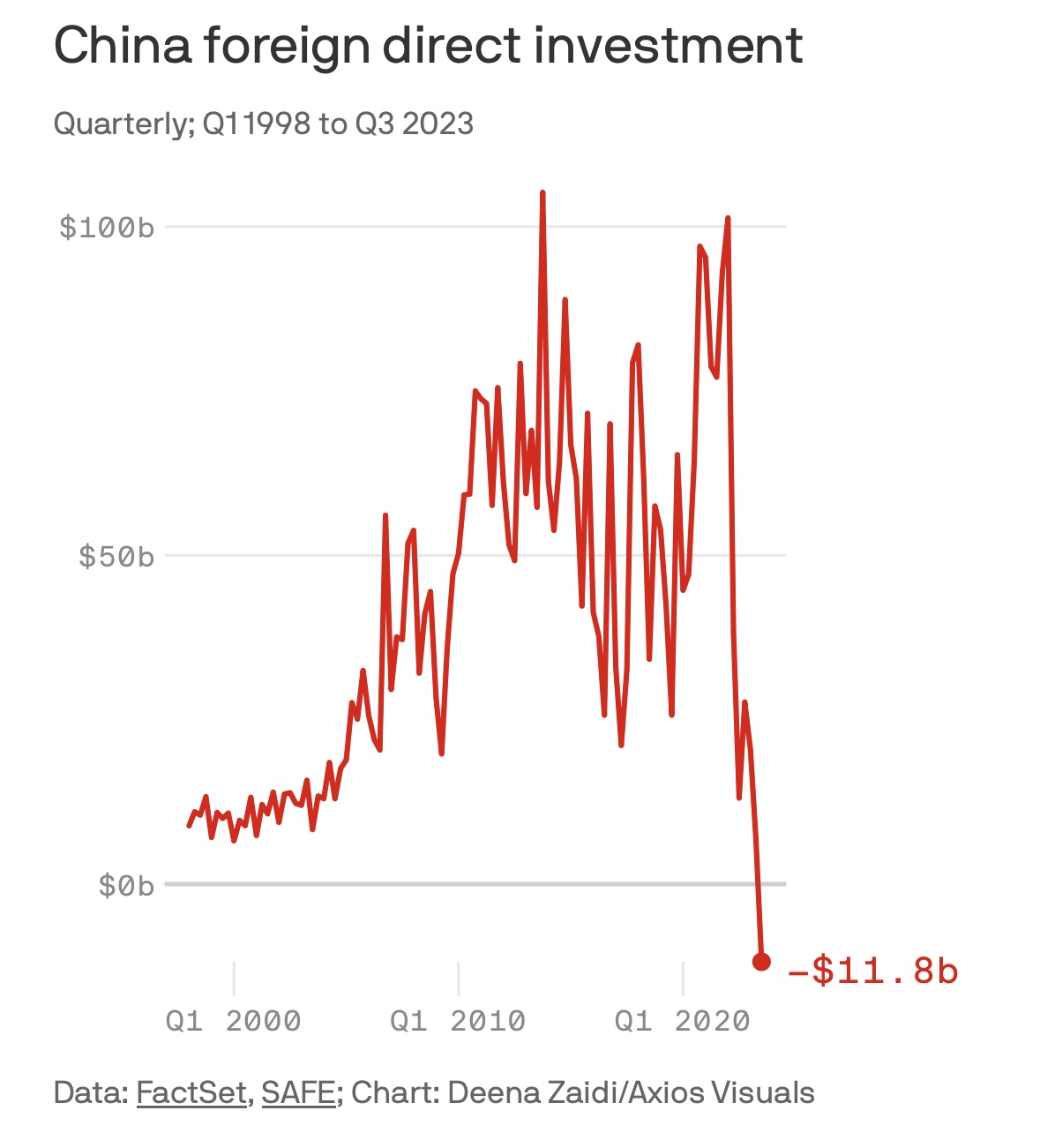

Chinese FDI

- Has gone negative for the first time in many decades.

- Some have pointed out that this is due to retained earnings repatriation out of China and not true investment, but the concern still remains longer term.

- This chart is paired nicely with a very interesting article from the New Yorker – “China’s Age of Malaise”.

- Some fantastic anecdotes “a leak from a Chinese social-media site last year revealed that it blocks no fewer than five hundred and sixty-four nicknames for him, including Caesar, the Last Emperor, and twenty-one variations of Winnie-the-Pooh.”

- Chart source: Axios.

Trucking

- The trucking industry is undergoing another downcycle.

- In a classic capital cycle, weakening demand has met over-expanded supply.

- Bankruptcies have abounded from established trucking firms like Yellow (30,000 employees 100-year-old trucking firm)

- to start-ups that tried to disrupt the less asset-intensive freight brokerage market such as Convoy (once valued at $3.8bn), where it looks like financing (both VC or otherwise) has met cold reality.

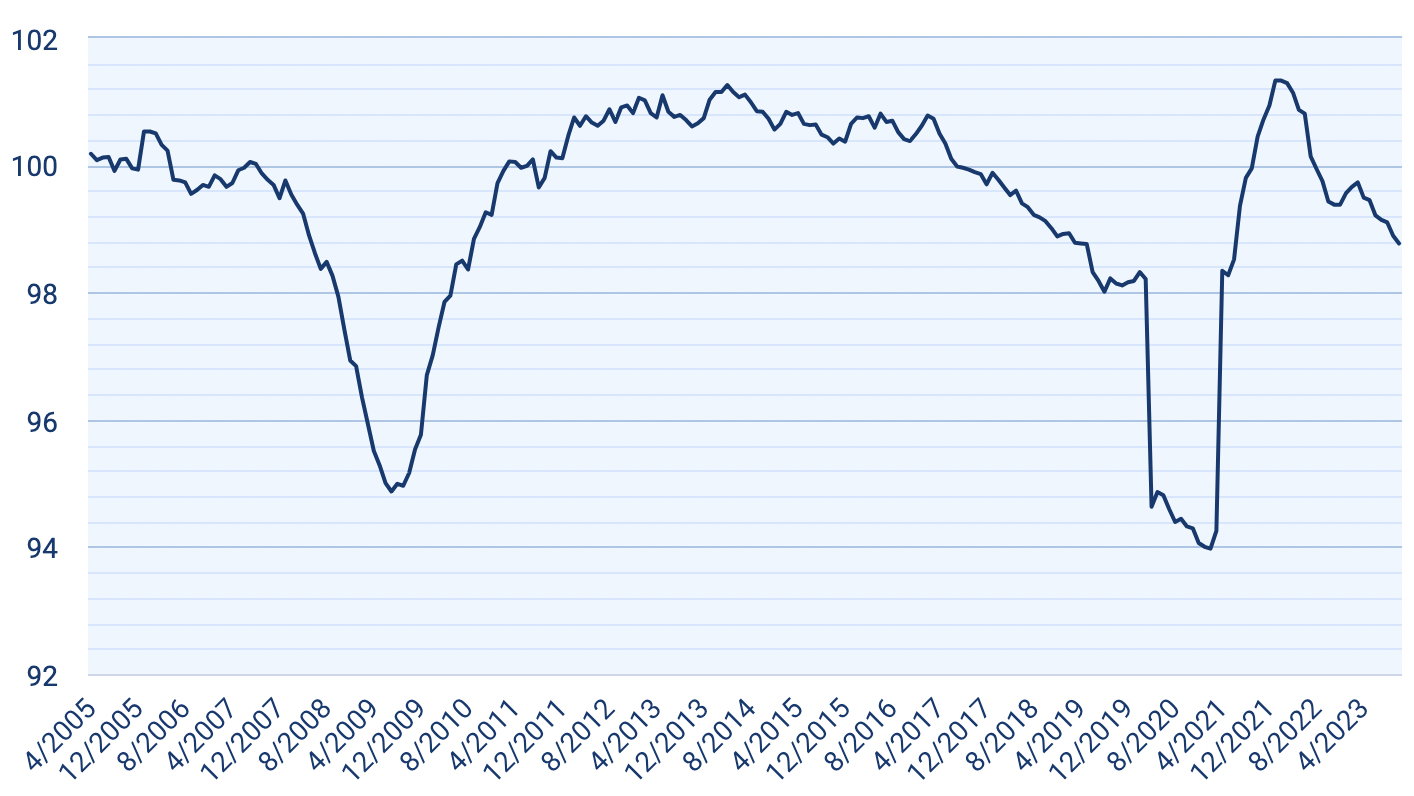

Small Business Employment Index

- SMB job growth keeps falling.

- “The rate of small business job growth has slowed in 17 of the last 20 months, falling from the record high of 101.33 in February 2022 to 98.77 in October 2023.“

- Source: Paychex/IHS

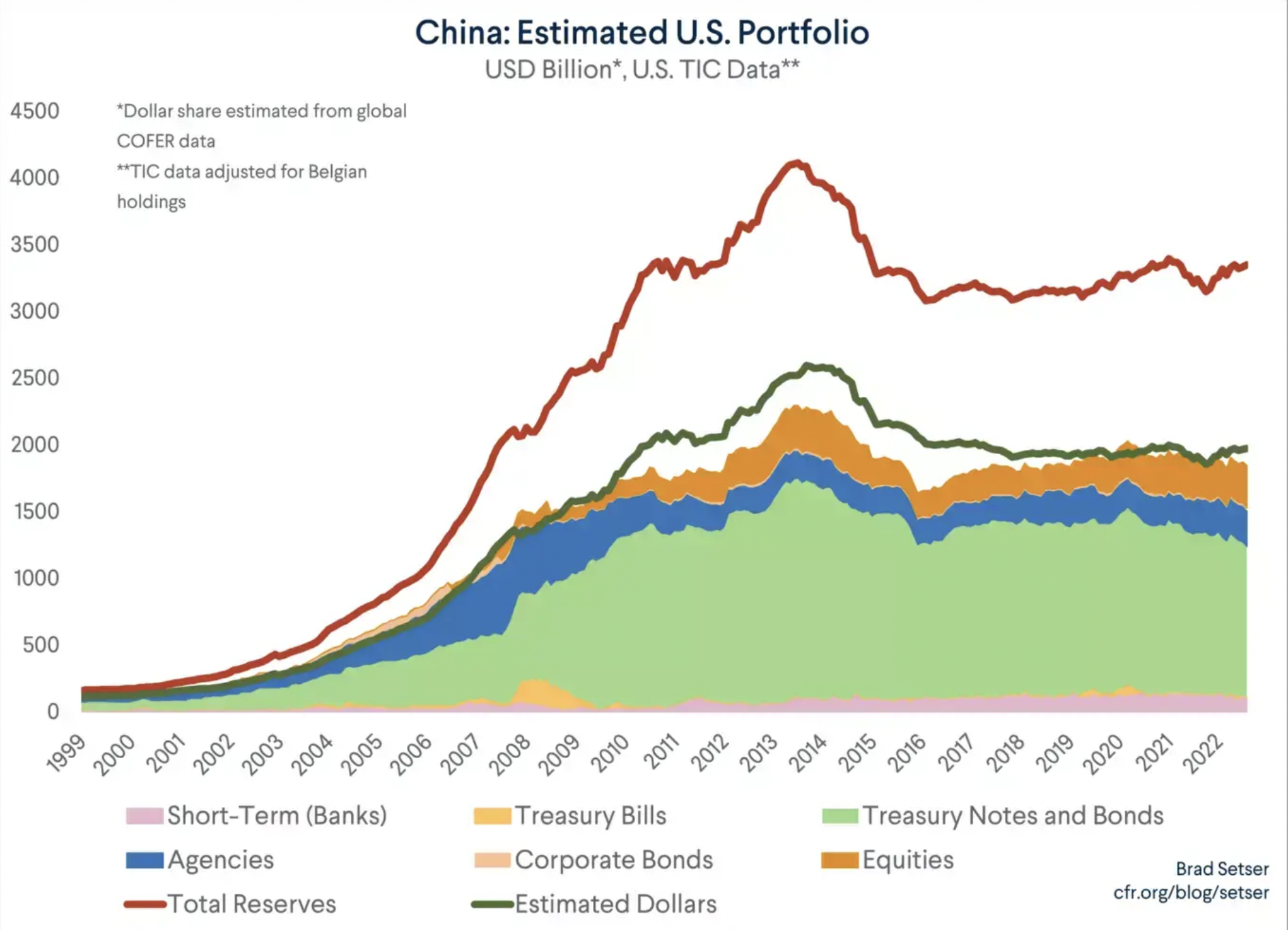

China is not Shifting Away from the Dollar

- The world of foreign exchange reserves is full of false narratives and complex data.

- Here, Brad Setser, uses international banking sleuthing to show that China has not switched its reserves away from dollars.

- “Bottom line: the only interesting evolution in China’s reserves in the past six years has been the shift into Agencies. That has resulted in a small reduction in China’s Treasury holdings – but it also shows that it is a mistake to equate a reduction in China’s Treasury holdings with a reduction in the share of China’s reserves held in U.S. bonds or the U.S. dollar.“

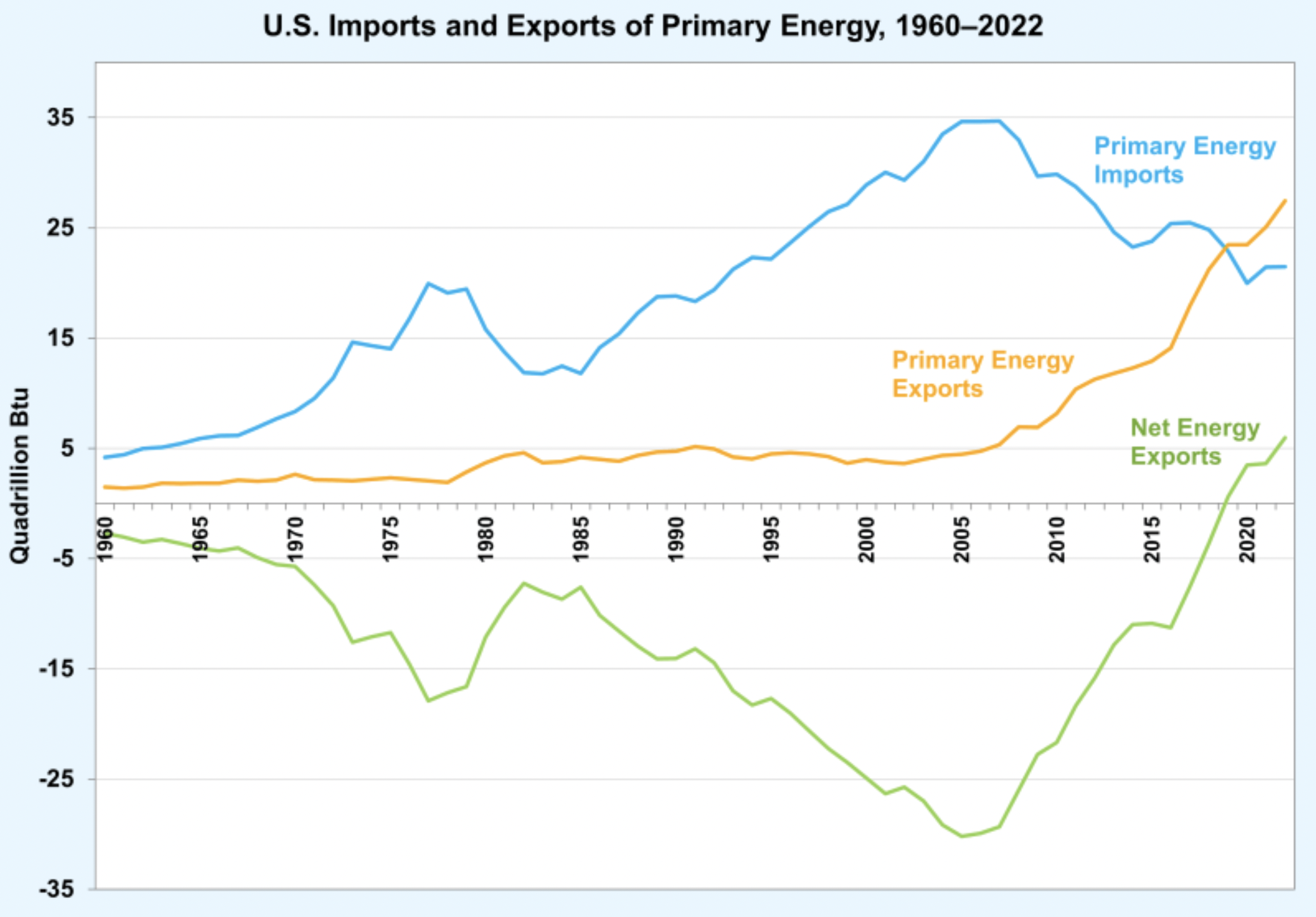

The US is a Primary Net Exporter

- This has increasingly been the case since 2019.

- It can’t be stressed enough how important this is across a wide range of domains.

- Source.

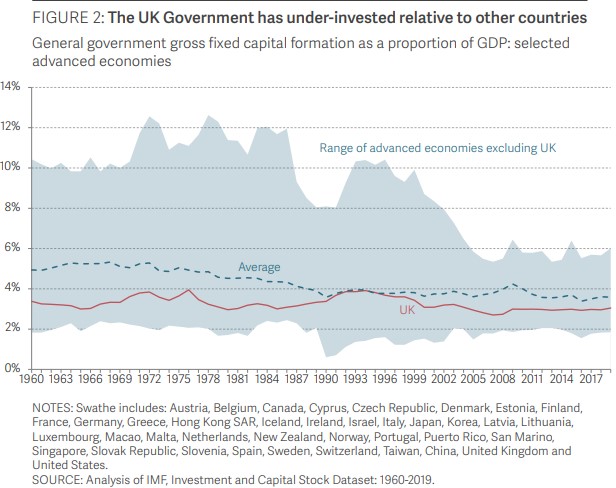

UK Has a Serious Underinvestment Problem

- “Cancelling HS2, and rolling back on net zero, are two vivid examples of a long-term UK problem that has become acute since 2010. The government does not invest enough, and partly as a result the private sector does not invest enough. As this excellent report from the Resolution Foundation’s Felicia Odamtten & James Smith shows, public and private sector investment are complements; the former encourages the latter. This chart from the report shows that UK public investment is consistently below the international average, and that average includes many countries that have underinvested over the last two decades like Germany and the US.“

- High-Speed 2 (HS2), the flagship rail line, as the blog points out, is not about faster transit time between the North and London, but rather helping create more capacity around major northern cities to improve their development. As the chart in the blog shows, outside of London, major UK cities are woefully behind other comparable cities in Europe in terms of productivity. This is something we covered before.

- Full post here.