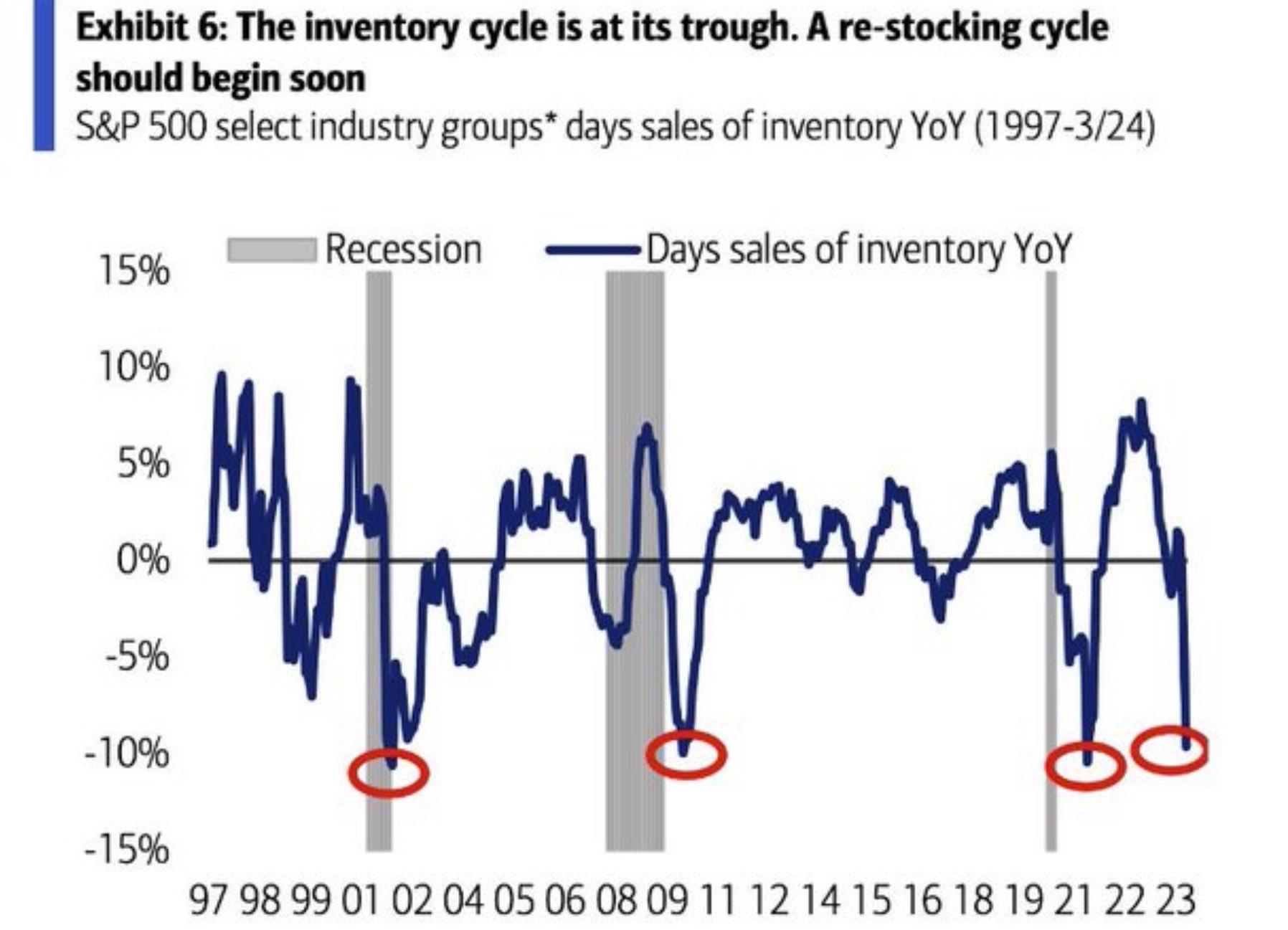

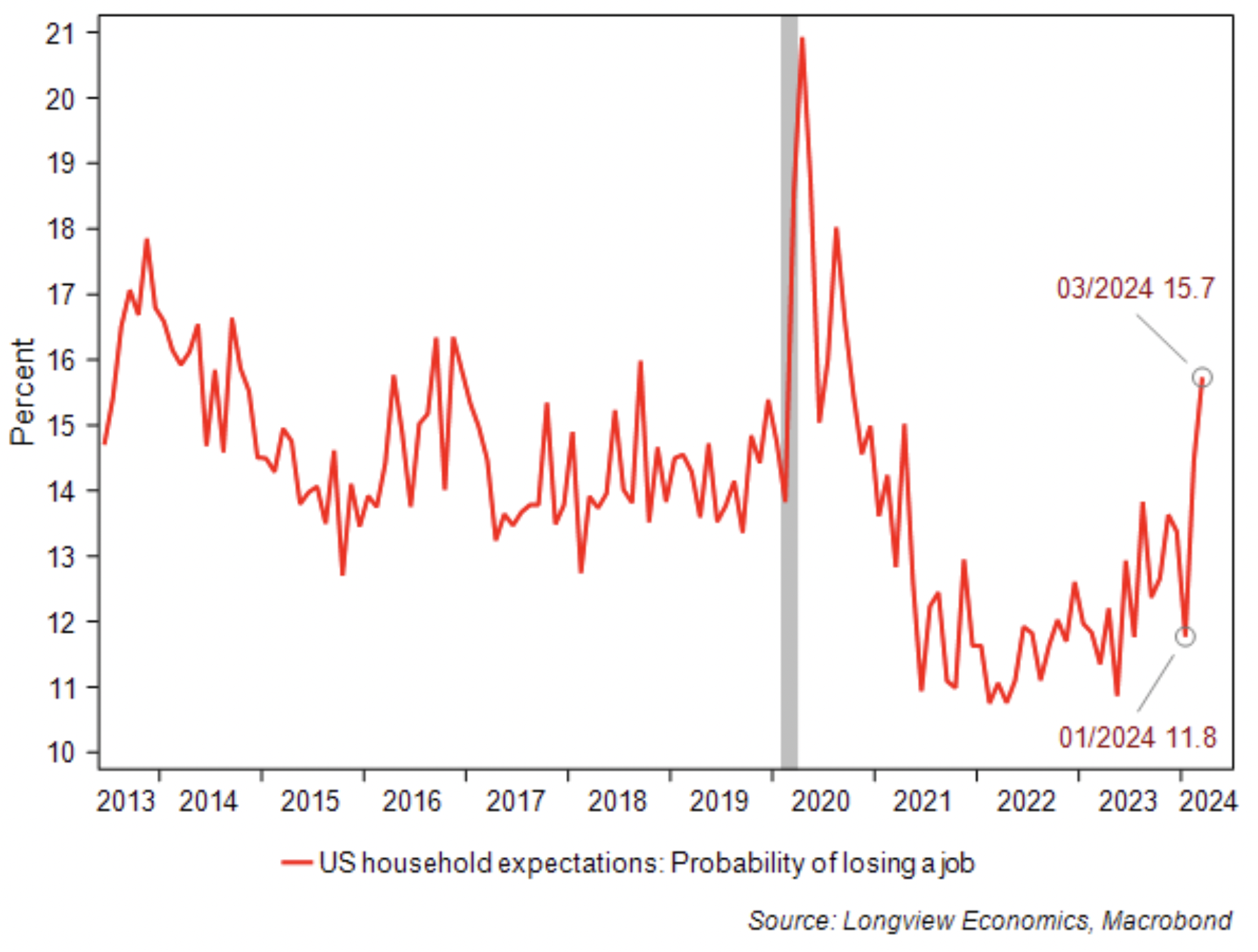

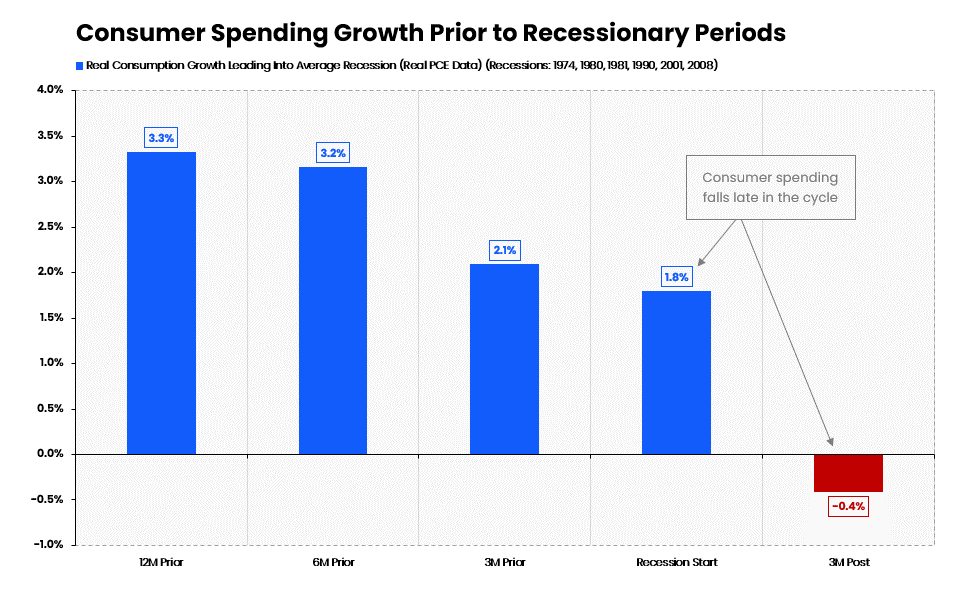

- This measure is falling in line with what has been seen in recent recessions.

Macroeconomics

Snippets on the big picture.

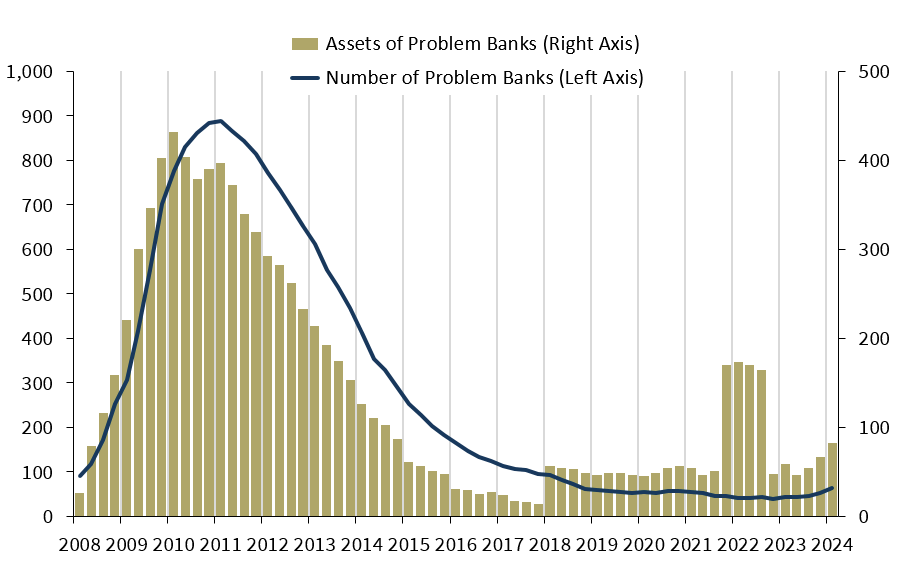

Problem Bank Count Ticking up?

- “The number of banks on the FDIC’s “Problem Bank List” increased from 52 to 63. Total assets held by problem banks rose $15.8 billion to $82.1 billion. Problem banks represent 1.4 percent of total banks, which is within the normal range for non-crisis periods of 1 to 2 percent of all banks.“

- CRE looks to be causing some problems – “The noncurrent rate for non-owner occupied CRE loans of 1.59 percent is now at its highest level since fourth quarter 2013, driven by office portfolios at the largest banks.“

- Source.

Grant’s Speech

- Jim Grant’s speech at Strategas’ 17th annual Macro Conference conference (free, requires sign-up).

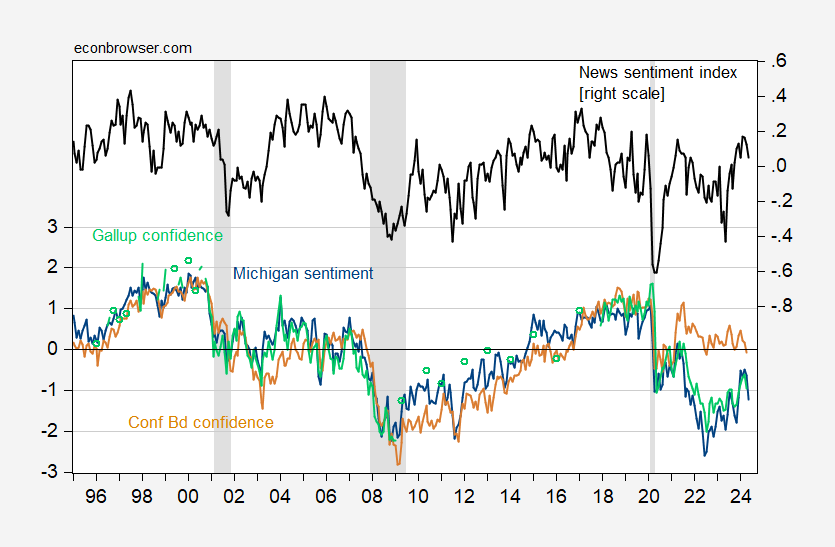

News vs. Consumer Sentiment

- Fairly large divergence.

- Source.

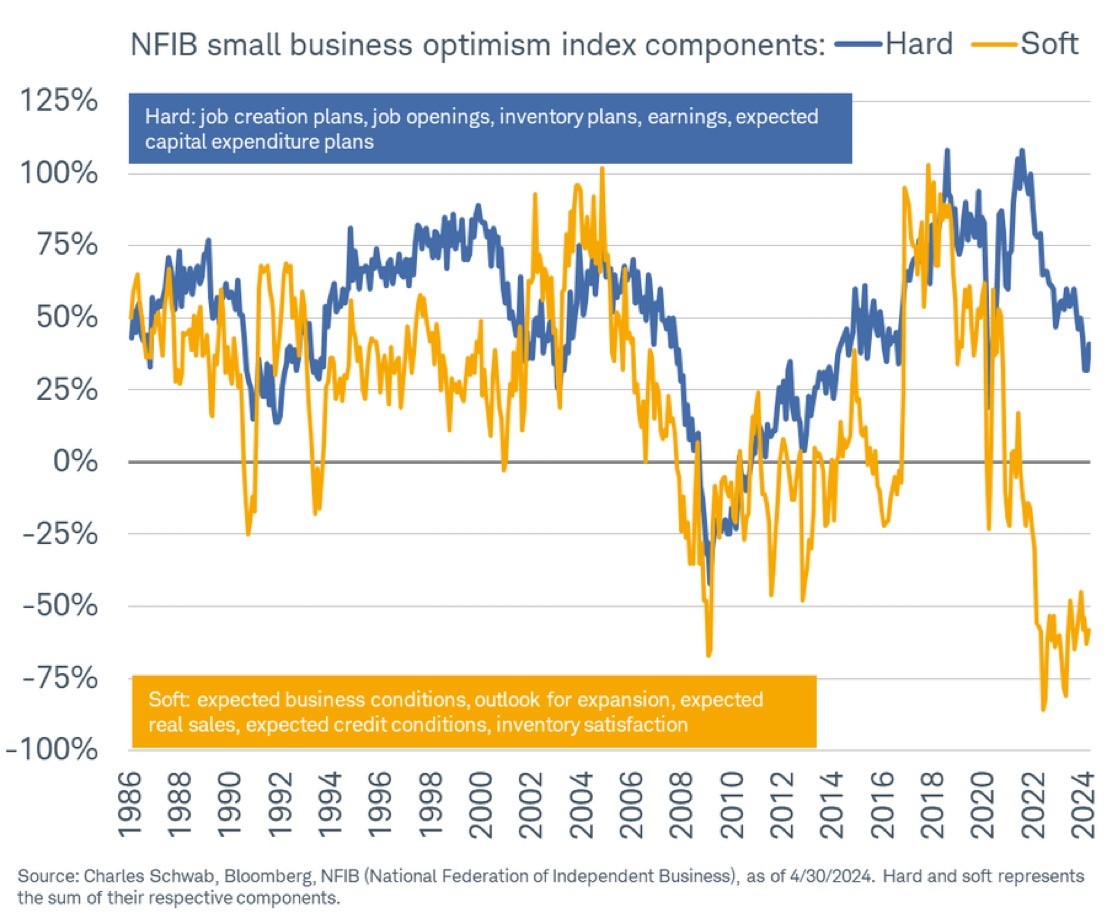

Hard vs. Soft Components

- Soft elements of NFIB small business survey have fallen hard while hard elements have held up.

Changing One’s Mind

- Angus Deaton rethinks.

Inventory Cycle

- Re-stocking coming?

- Source.

Job Insecurity

- Worry about losing one’s job has risen sharply.

- Source.

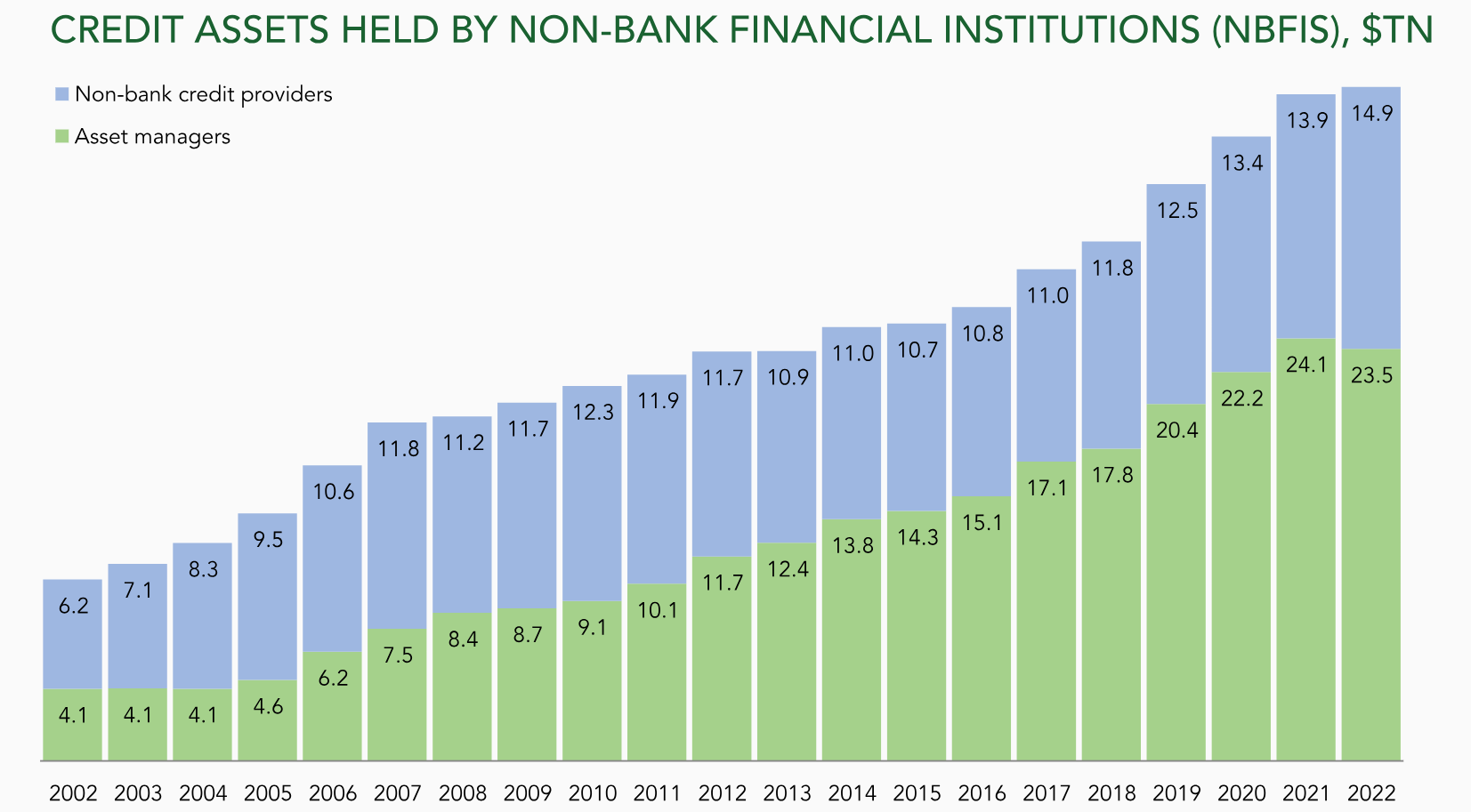

Credit

- The rise of credit outside of the more heavily regulated banking system is something that continues to be a key vulnerability.

- Source.

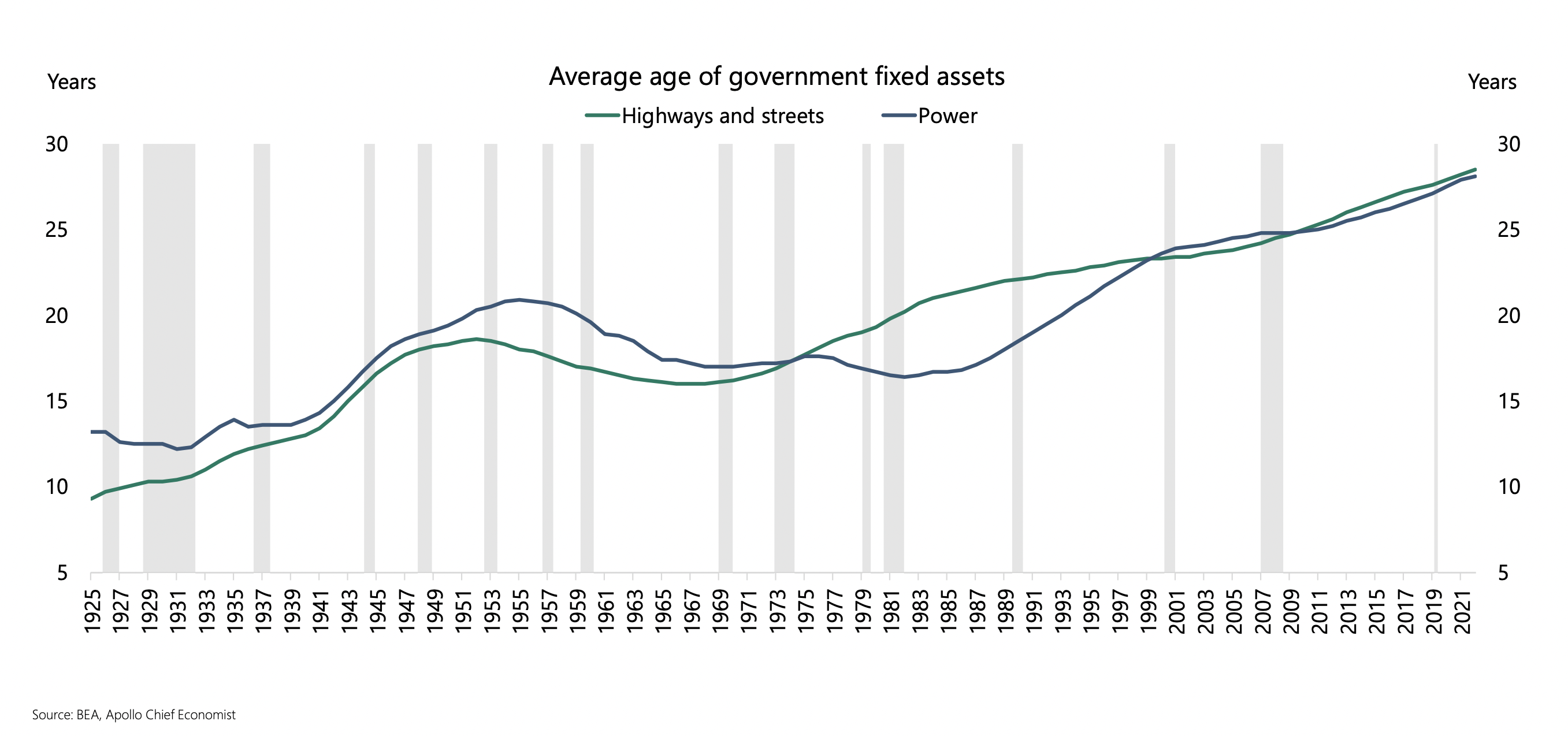

US Infrastructure is Aging

- There is a significant need for new infrastructure.

- Source: Apollo.

Consumer Spending is Late Cycle

- Often discussed, but in fact consumption decline is a late cycle phenomenon.

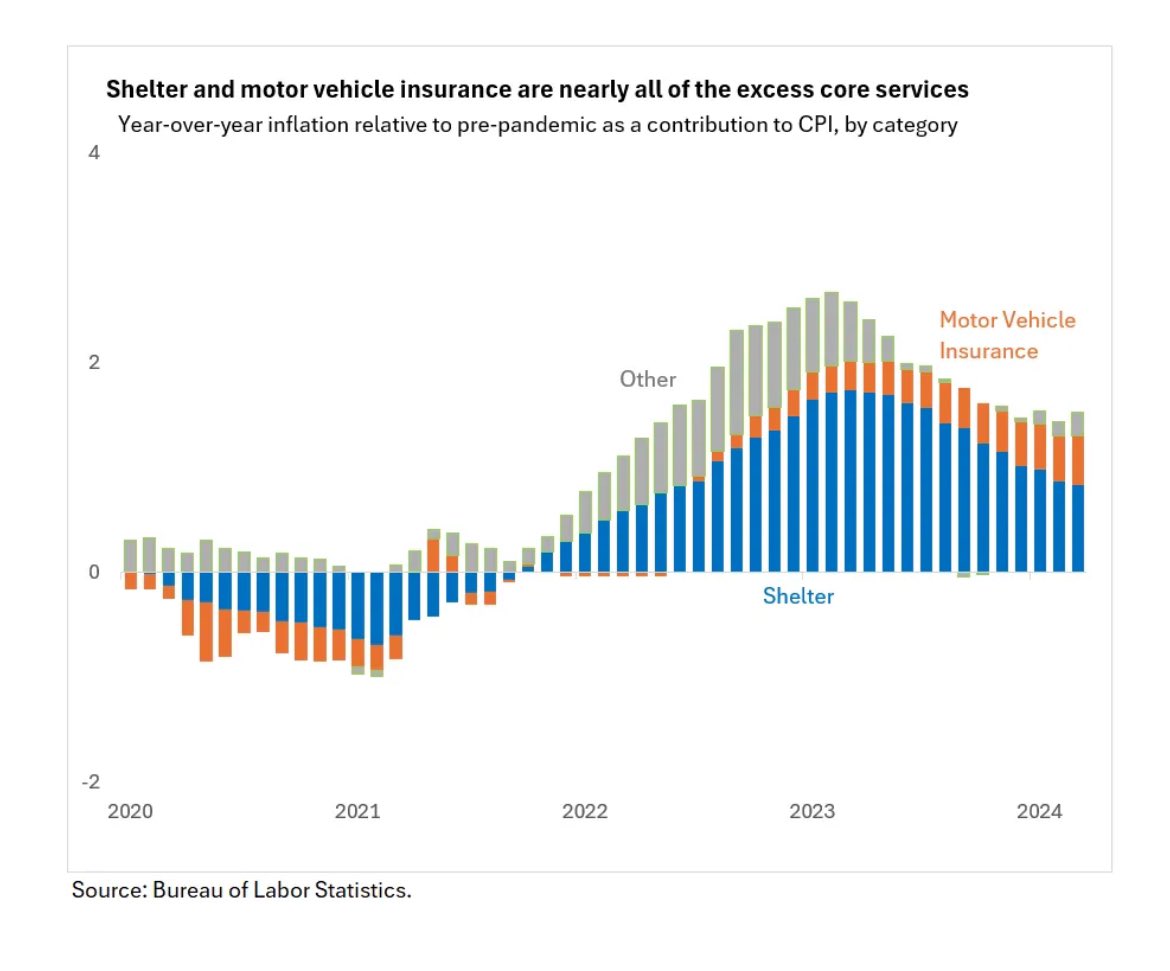

CPI Upside Explained

- CPI stopped going down. Why? It is largely down to two components (Source).

- Auto insurance – though this is surprising as repair cost growth is moderating.

- Shelter – which is a difficult component full of assumptions.

- FT Alphaville has a deeper look – suggesting things aren’t so grim.

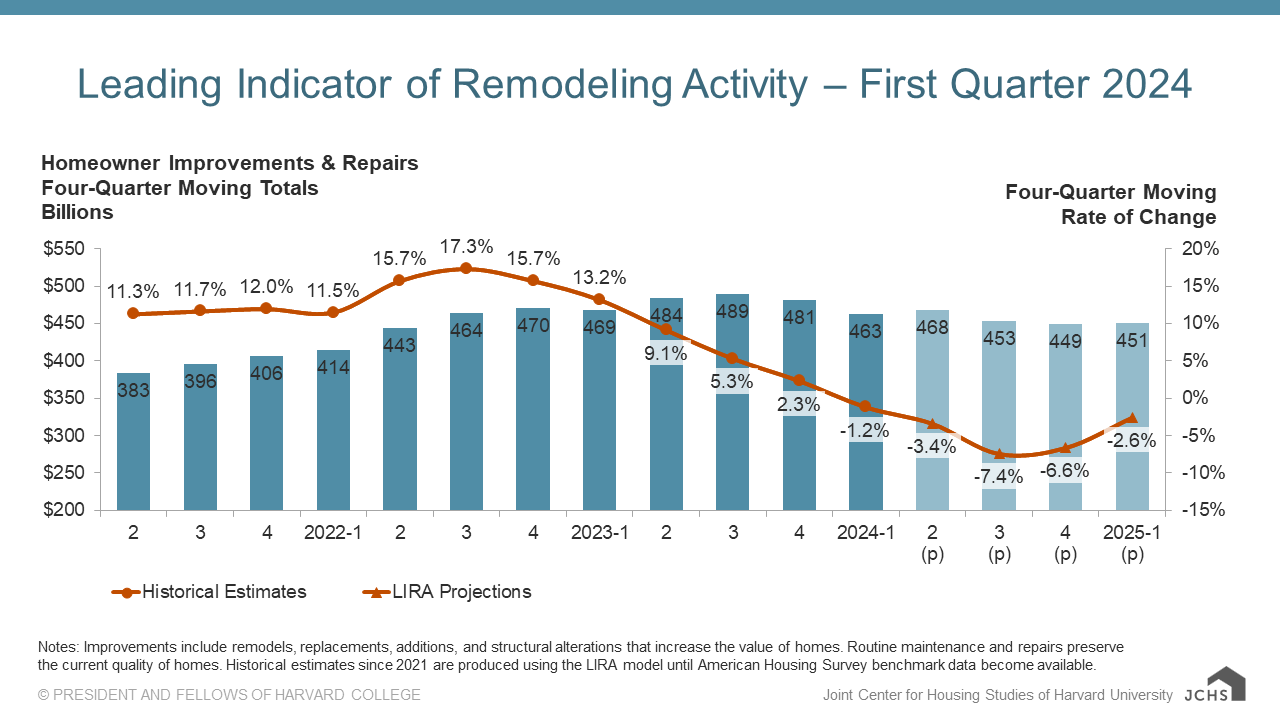

Leading Indicator of Remodeling Activity

- Harvard tracks the short-term outlook for home improvement spend.

- “The indicator, measured as an annual rate-of-change of its components, is designed to project the annual rate of change in spending for the current quarter and subsequent four quarters, and is intended to help identify future turning points in the business cycle of the home improvement and repair industry.“

- Right now a bottom is seen in Q3 2024. The trajectory is a big upgrade on their previous outlook.

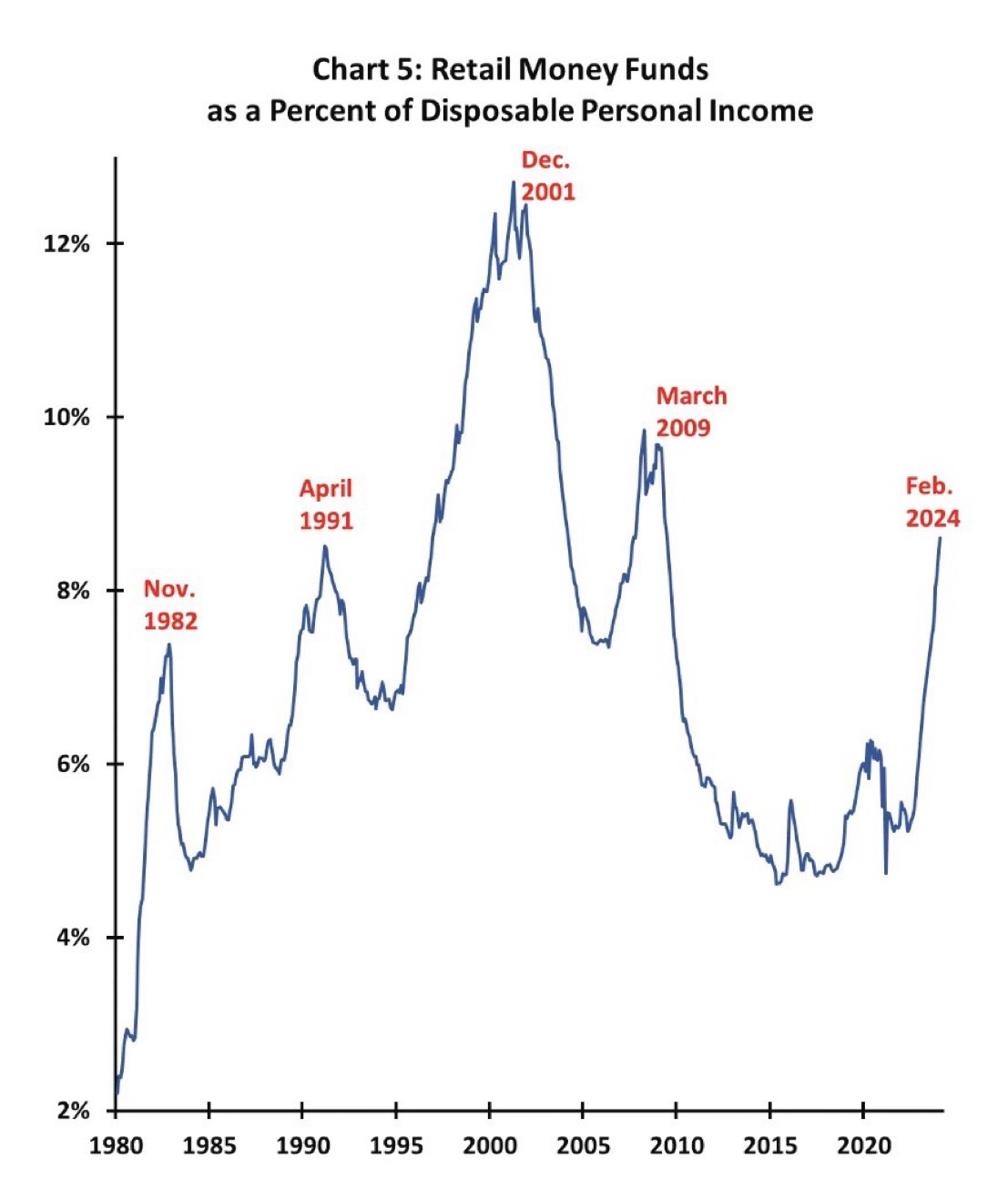

Cash on sidelines

- Plenty of liquidity in MMF as % of disposable income.

- Source.

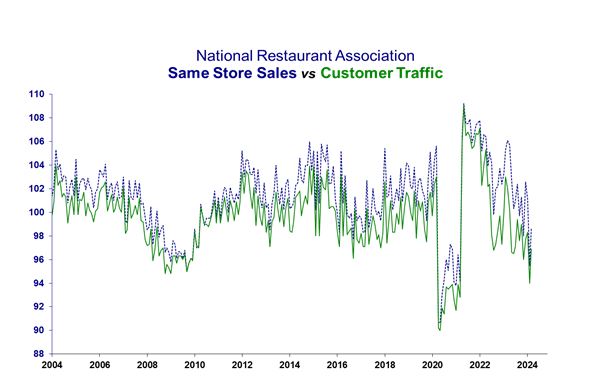

Restaurant Traffic

- Traffic and sales to restaurants in the US are falling.

- Source.

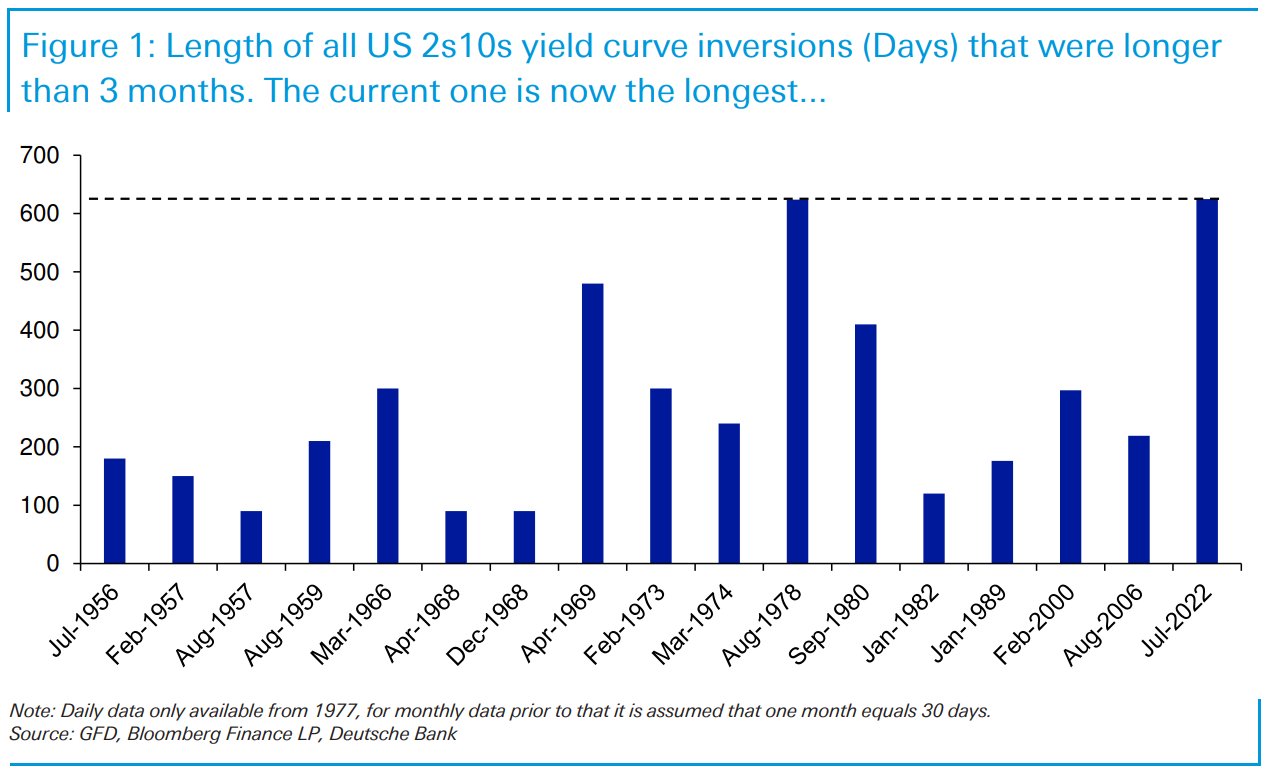

Inverted Curve Record

- The yield curve has been inverted for a record number of days.

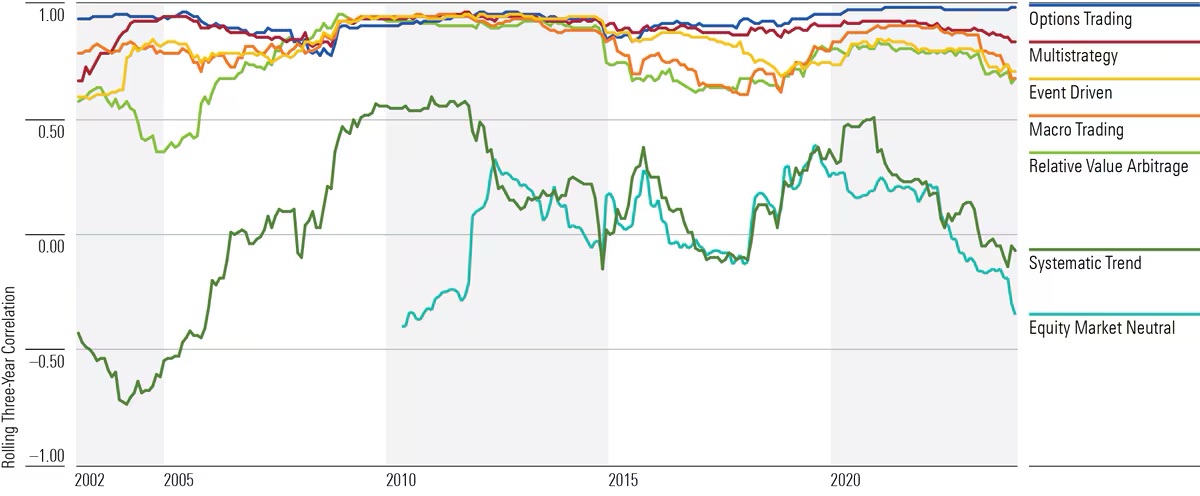

Diversification?

- Morningstar is out with some analysis on diversification of various asset classes.

- Lots of surprising conclusions – for example not all liquid alts are genuine diversifiers.

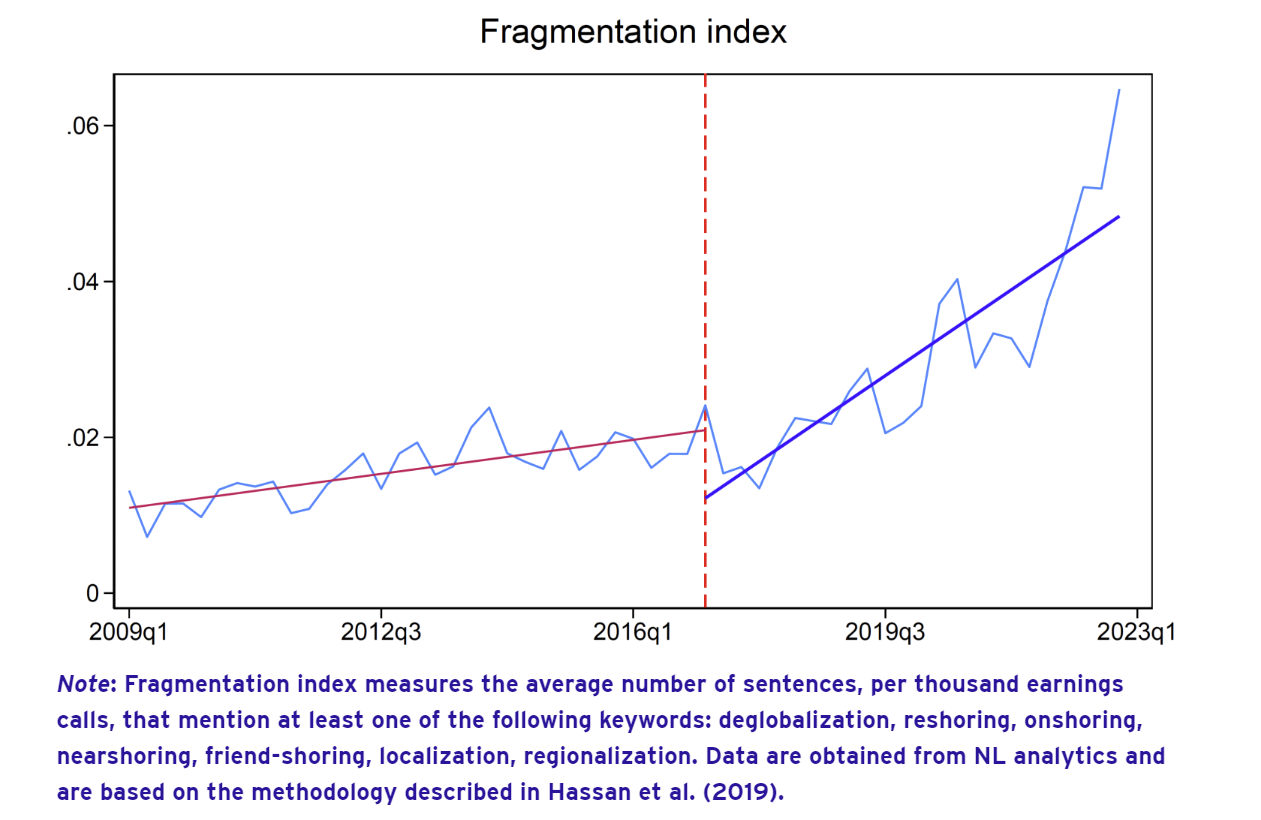

Fragmentation

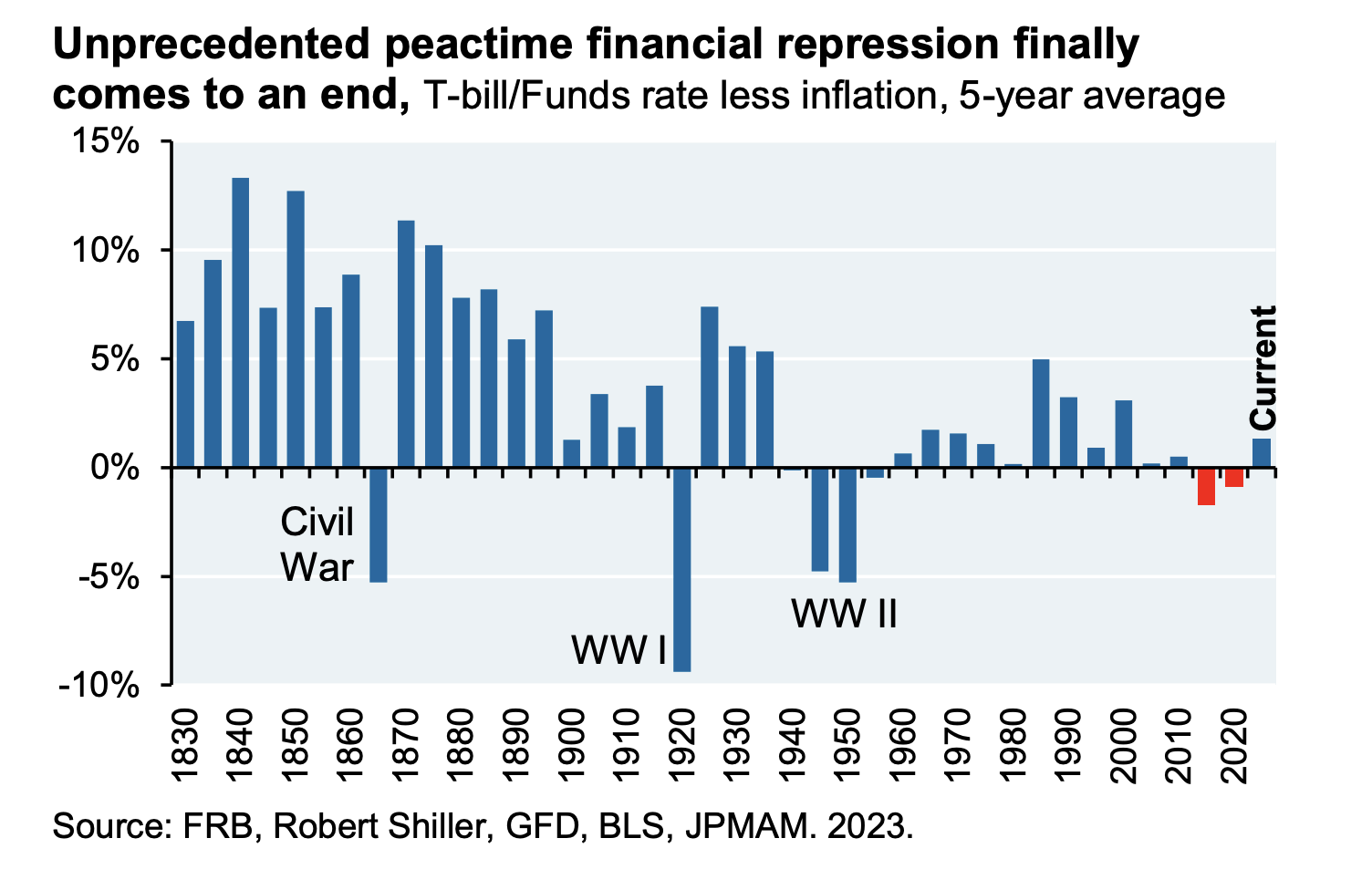

Financial Repression Over

- Financial repression has never before happened during peacetime, and we have just exited this period.

- Source: JPM.

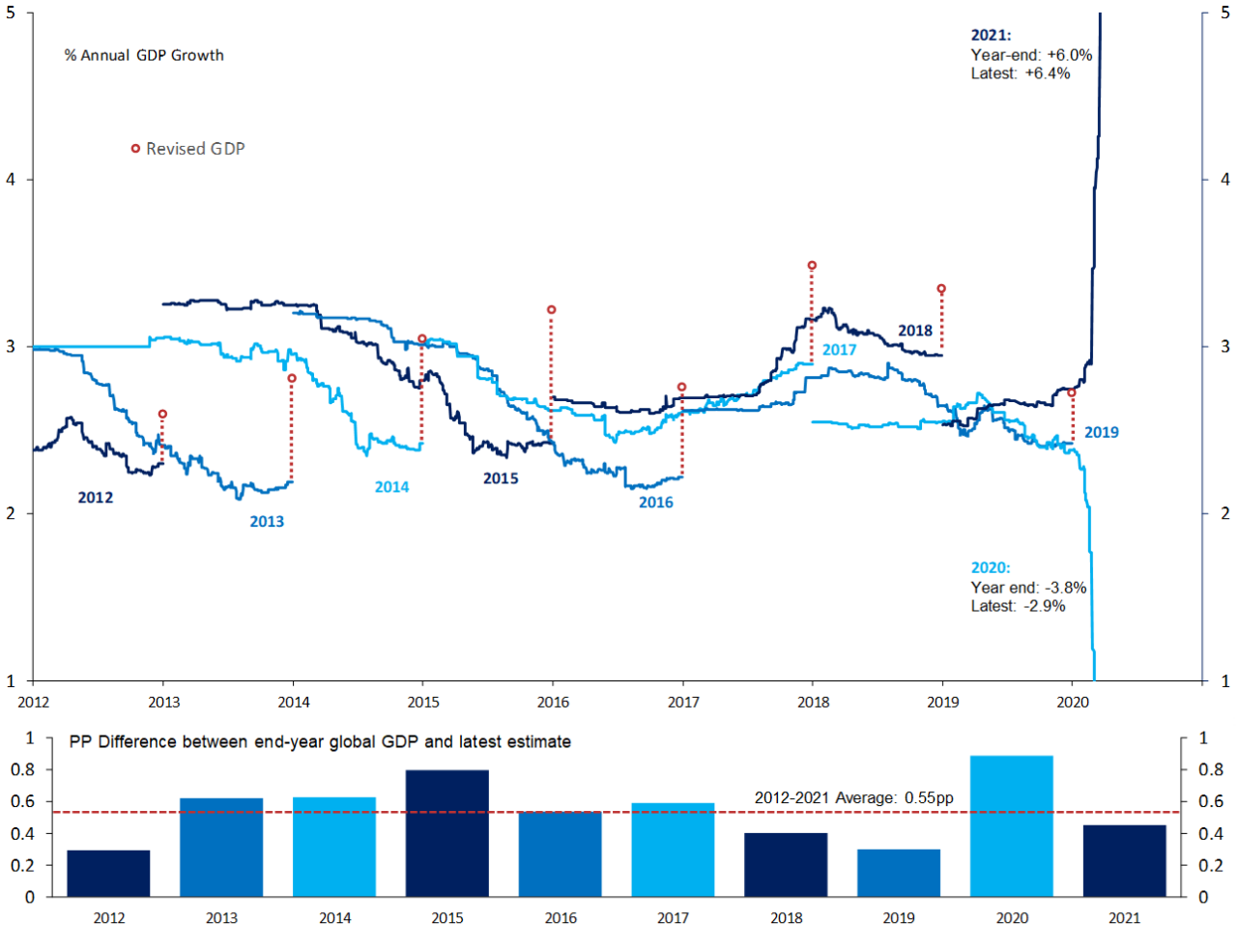

Flash GDP Estimates are Always too Pessimistic

- “As you can see, with the notable exception of 2020 — which was, well, an unusual year — initial estimates of global growth have been consistently too pessimistic, and final revisions have on average pushed up GDP growth by 0.55 percentage points a year in the 12 years to 2021.“

- Source: FT.